Rules and Circulars

All Circulars

ATM

Finding Damaged Boxes for ATM Replenishment

Referring to the telegram of the Undersecretary of the Emirate of Riyadh Province No. 113337 dated 08/10/1437 H, which includes the reports of the security patrols regarding the sighting of special boxes feeding ATMs in front of the ATMs of some banks. And that after removing the boxes, it was found that they were damaged and deliberately thrown away by the feeding team, which causes an increase in security measures and costs time and effort for the security authorities to search and find out the reasons that led to this.

Accordingly, please adhere to the procedures issued in SAMA Circular No. 361000064350 dated 03/05/1436 H regarding the importance of banks taking all precautionary measures while feeding ATMs, including the obligation to fill feeding boxes and keep them under double supervision within cash centers, with an emphasis on following up the performance of companies contracting to transfer funds and feed ATMs, by doubling supervision and control.

Targeted Operating Ratios for Bank ATMs

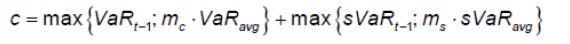

Referring to SAMA Circular No. 341000110148 dated 10/9/1434H regarding the issuance of the Service Level Agreement for Automated Teller Machines (ATM SLA), the contents of which were implemented as of the beginning of 2014. SAMA commends the role played by banks during the previous period, which included strategic and operational changes that contributed to raising the level of service and overcoming challenges to achieve the operational ratios targeted in the agreement.

We would also like to inform you that SAMA has studied the current market situation - and the changes and data that have occurred on it - and redetermined the target operating ratios, as it was decided that the operating ratio for the period from the fourth quarter of 2014 until the end of the first half of 2016 will be as follows:

Year

2014

2015

2016

Period

Fourth Quarter

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

First Quarter

Second Quarter

Target Ratio

95.50%

95.75%

96.00%

96.25%

Accordingly, SAMA will update the document according to the ratios set above and recalculate the operating ratios for banks and the banking sector and implement them, starting from the fourth quarter of 2014.

High ATM Footfall During Seasons and Fast Cash Depletion

You know the great demand in all regions and cities of the Kingdom to use ATMs during seasons and holidays, which may cause r cash to run out quickly or malfunction of some devices, and due to the need of citizens and pilgrims to shop and obtain cash from ATMs during the Hajj season and Eid days, which requires supporting and strengthening the bank's ATMs network and points of sale, especially in the holy sites in both Makkah Al-Mukarramah and Al Madinah Al-Munawarah to achieve a high operating rate that keeps pace with the expected increase and avoid machine breakdown or running out of cash.

Therefore, we hope to take the necessary measures to achieve the following:

First: Supporting the bank's ATM network and technical equipment in terms of the capacity to handle transactions and the speed of processing, especially during peak times. Second: Providing qualified and necessary human support to ensure the proper functioning of systems around the clock and providing the operating team at SAMA with their names, working hours and phone numbers. Third: Analysis of the results of operations by specialists in the bank in real time in order to detect any failure that may occur and address it immediately.

Fourth: The need for sufficient cash in ATMs and the speed of feeding them with cash, especially during the Eid holiday period, to meet the needs of citizens and residents during the period of closing bank branches. Extending the Time Frame for Maintaining Bank's ATMs Security Camera Recordings

This section is currently available only in Arabic, please click here to read the Arabic version.Compliance with the Circulars Issued by SAMA

Recently, it has been noted the recurrence of the problem of cash retracted, where this case occurs when cash is not withdrawn from the ATM after it has been withdrawn, and a circular was previously issued recommending not sending an automatic reversal of operations in this case and doing them manually after ensuring that the customer did not receive the cash or part of it, and stressing the importance of processing these operations manually to protect the rights of customers, and based on SAMA's keenness to continue the conduct of operations in the Saudi network in the best possible way and to preserve the rights of customers and banks alike, so we would like to note that all banks linked to the network must abide by all agreements and circulars issued by SAMA in previous periods and apply them to any updates in the banking systems in order to avoid any problems resulting from non-compliance with the application of these circulars when moving to the new system (SPAN2), so we hope that everyone will adhere to the above and in case of any inquiries you can contact the banking technology department.

Retention of CCTV Footage from ATMs

This circular is currently available only in Arabic, please click here to read the Arabic version.Reducing the Rate of Declined Card Transactions

In reference to SAMA's circular No. BCB/813 dated 01/12/1420H regarding declined bank card transactions at ATMs and the continuous follow-up by SAMA of the performance of bank customers on the ATMs of other banks.

I inform you that after studying and analyzing the rejected transactions on banks' ATMs for the past years and with the aim of providing distinguished services to citizens that reflect the reality of the banking system in the Kingdom and its development, SAMA will reduce the acceptable rate of rejection as of 01/06/2012. SAMA hopes that banks will work to improve performance and reduce the rate of declined transactions of the bank's cards on their devices as well as on other banks' devices, in accordance with the instructions of SAMA in this regard.

ATM Feeding

This section is currently available only in Arabic, please click here to read the Arabic version.ATM Fraud

Recently, SAMA has noticed instances of ATM fraud in some neighboring countries. This involves downloading certain programs and files to instruct the cash dispensing unit of the machine to dispense cash from the feeding boxes, without affecting customer accounts.

SAMA urges all banks operating in the Kingdom to exercise caution regarding these operations and to implement necessary precautionary measures to monitor any unauthorized access or use of ATM machines. It is essential to activate all appropriate procedures for protecting the machines, ensure the functionality of security systems and surveillance cameras, mitigate the damages and risks associated with electronic hacking, and take necessary actions to communicate with equipment suppliers while training staff responsible for monitoring ATMs.

We hope that you will adhere to these guidelines and inform SAMA immediately if any similar incidents occur, God forbid, as well as to report on the measures to be applies to limit hacking operations on ATMs urgently within a week from its date.

Place Advertising Stickers on ATMs that Offer Early Repayment of Borrowers' Debts - 2014

Referring to SAMA’s Circular No. 27780/MAT/13135 dated 27/5/1431H, which refers to SAMA’s Circular No. 51224/MAT/995 dated 30/10/1430H regarding the phenomenon of individuals and offices placing promotional stickers on ATMs offering early settlement of borrowers’ debts with banks, assisting them in obtaining new loans, and advertising installment sales. Such practices constitute a violation of Article 2 of the Banking Control Law issued under Royal Decree No. M/5 dated 22/6/1386H. Banks are required to implement procedures to prevent the placement of promotional stickers on ATMs, raise awareness among customers regarding the violations and risks of this phenomenon, and instruct branch managers, staff, and relevant department employees not to cooperate with any individual or office in any way or assist anyone engaging in these practices. They must report any individual or entity involved in such activities to SAMA. It is emphasized that any violation or concealment by any official or employee will result in penalties in accordance with the provisions of the Banking Control Law and the Anti-Money Laundering Law.

In light of the continued occurrence of this phenomenon, we stress the necessity for banks to implement measures to prevent the placement of promotional stickers on ATMs, raise awareness among employees about the violations and risks associated with this phenomenon, intensify awareness campaigns for customers about the dangers of dealing with individuals engaging in these activities, and emphasize that these practices violate the Banking Control Law and the Anti-Money Laundering Law. Violators will be penalized in accordance with the provisions of these laws.

Please act accordingly and provide feedback on the actions taken within two weeks from the date of this notice.

The Formation of a Committee to Study the Implementation of an Appropriate Mechanism That Would Limit the Theft of ATMs

Referring to the letter from His Royal Highness the Crown Prince, Deputy Prime Minister, and Minister of Interior No. 22380 dated 30/3/1433 H, which refers to His Royal Highness's letter No. 2290/2/5/1 dated 12/1/1432 H, regarding the approval to form a committee comprising Public Security, the Ministry of Municipal and Rural Affairs, and the Central Bank to study the appropriate mechanism to limit the recurrence of ATM uprooting and theft and the preventive security measures that ensure the detection of any attempt before the theft occurs. The committee has reached a number of security measures to limit the recurrence of this phenomenon, and His Royal Highness has expressed a desire to implement the following recommendations:

Take into account the geographical characteristics of the ATM location to ensure easy access to the device without hindering rapid intervention in emergencies. Avoid areas prone to heavy fog or sandstorms. If the ATM is located in a fuel station, the station’s total area must be no less than 3,000 m² for stations within cities and 4,000 m² for stations outside cities, including all associated facilities.

Ensure the provision of a digital CCTV system for monitoring and recording at all ATMs with a minimum recording resolution of 4 frames per second. The recordings must be retained for a period of one year. The system should include (external camera to monitor activity in front of the ATM, covering the area around the user and their vehicle, internal camera to clearly capture the features of the ATM user, camera for the ATM feeding room to monitor activities within the area used for feeding the ATM). Each ATM must be equipped with an independent recording unit. Additionally, a cooling and ventilation system should be provided to ensure the efficiency and continuity of the recording process. There should be also a mechanism for remote monitoring of all external ATM recording systems, operating 24/7, with the capability to download recordings remotely.

Installing a satellite tracking chip inside the device's safe that enables it to locate the device if it is uprooted.

Provide a theft and fire detection and alarm system to detect tampering attempts, which includes a vibration and frequency detector and an infrared sensor connected to the theft detection and alarm system for back-fed devices.

Provide the following structural requirements:

a) Make a reinforced concrete base buried in the ground with a depth of at least (50) cm and dimensions that exceed the dimensions of the ATM by at least (25) cm on all sides to install the ATM.

b) The device is fixed to the concrete base by four nails with a thickness of (25) mm and a depth of at least (30) cm inside the concrete base, taking into account that the nail has a hooked end that is fixed to the rebar of the concrete base to make it difficult to remove it.

c) Construct two reinforced concrete columns adjacent to the ATM from the right and left with a thickness of at least five inches. These columns are laminated with steel on the outside and buried in the concrete base at a depth of not less than (30 cm) cm and fixed with base reinforcement, and a third steel belt is placed transversely above the outer surface of the ATM. This belt is made of steel skewers with a thickness of at least three inches, welded and anchored to the rebar of the concrete base at a depth of at least (30) centimeters.

d) For ATMs that are located in their own independent rooms (Lobby ATM), only the upper part that the customer needs (screen - card insertion slot - keyboard - cash output slot) should be visible, and it is sufficient to install the device with four nails with a thickness of (16) mm and a depth of not less than (10) cm, and that room is independent and sealed with a tight door that opens with secret numbers, and the door should not be from the back or side of the building, but rather next to the ATM, and the ATM is fed from the back inside the independent room, which must be sealed with a secure door that opens with secret numbers. The door is not from the back or side of the building, but rather next to the ATM, and the ATM is fed from the back from inside the independent room, all sides of which must be made of cement bricks and no gypsum board or wood is used, and all security precautions are available, including surveillance cameras, a burglar alarm, a backup generator, and concealment of all electrical wiring. These rooms become an alternative to the rooms in which the ATM is fully visible, with the exception of ATMs in the central area of the Two Holy Mosques and airport lounges.

e) For ATMs located in closed shopping malls, it is sufficient to place them in a safe place under the eyes of the security guards of the complex and fix them with four nails with a thickness of (16) mm and a depth of at least (10) centimeters.

f) Hide all connections and cables inside metal conduits.

g) Providing all ATMs with sufficient lighting around the clock.

h) Linking ATMs to banks' operations rooms to receive any alarms that may arise.

i) When feeding and maintaining ATMs, the following should be followed:

- Feeding and maintenance shall be during official working hours and on holidays from 9:00 a.m. to 5:00 p.m. Feeding and maintenance shall not be at fixed and known times.

- The bank's security guards must be present at the time of feeding or maintenance.

- Notify the Ministry of Interior's security operations room.

For your information and take the necessary measures to comply with the above and inform us.

Post Advertisements on ATMs for Services Offered by Individuals and Offices for Early Repayment of Borrowers' Debts - 2010

This section is currently available only in Arabic, please click here to read the Arabic version.Post Advertisements on ATMs for Services Offered by Individuals and Offices for Early Repayment of Borrowers' Debts - 2009

Recently, there has been an observed increase in the practice of attaching promotional brochures to ATMs by individuals and offices. These brochures advertise services such as early repayment of borrowers' debts, assistance in obtaining new loans, and installment plans for goods and prepaid communication cards with varying interest rates.

These practices are in violation of Article 2 of the Banking Control Law issued by Royal Decree No. M/5 dated 22/6/1386H, which states: "No person, natural or juristic, unlicensed in accordance with the provisions of this Law, shall carry on basically any of the banking business." The Implementation Rules for Banking Control Law further clarify these activities and specify penalties for violations under paragraph 1 of Article 23 of the same law, which states: "Imprisonment for a term not exceeding two years and to a fine not exceeding SAR 5,000 for every day the offense continues or to either of these penalties for any person who contravenes the provisions of paragraph 1 of Article 2 ."

Since the Banking Control Law provides the regulatory framework under which banks operate and are subject to supervision and oversight, the activities conducted by individuals and office owners are in violation of this law. These activities have negative implications for national security and the economy, directly affecting public interest, conflicting with the operations of banks, and impacting their interests. Additionally, their practices may involve money laundering activities, especially since they are unlicensed and not subject to any supervision, oversight, or regulation. Their actions may also lead to breaches of banking confidentiality.

Therefore, we request the implementation of the following measures:

- Implement measures to ensure that promotional stickers are not placed on ATMs.

- Educate customers about the illegality and risks associated with this practice.

- Direct branch managers, staff, and employees in relevant departments to refrain from cooperating with individuals or office owners in any way or assisting anyone in carrying out these activities. They must report any individuals or entities engaging in such practices to the Central Bank. Additionally, emphasize that any violation, assistance, or concealment by any official or employee will result in penalties in accordance with the Banking Control Law and the Anti-Money Laundering Law.

We request a report on the actions taken within two weeks from the date of this circular.

Follow Up on ATM Maintenance Specifically During Holidays and Paydays

This section is currently available only in Arabic, please click here to read the Arabic version.Provision of Standard Banking Services Through Tellers

Due to the increasing number of complaints received by SAMA from customers with banks represented in the refusal to provide banking services available at ATMs through the tellers' windows, including the non-acceptance of the implementation of withdrawals and cash deposits in small amounts or the payment of utility bills.

SAMA would like to reiterate to all banks the need to fully comply with the instructions of SAMA issued regarding the acceptance of the implementation of cash withdrawals and deposits, regardless of their amounts, and the acceptance of payment of public utility bills through the teller windows in all branches of the bank, while continuing the bank's policy towards encouraging and educating customers on the use of banking technologies, including ATMs, to carry out the banking operations referred to above, noting the importance of banks following up on the performance of the work of ATMs and their maintenance. Continuously.

SAMA will ensure the compliance of the branches with these instructions and apply the fines stipulated in the Banking Control Law against the violating branches.

Requests to Reserve Television Filming of ATMs

This section is currently available only in Arabic, please click here to read the Arabic version.Distribution of Cash Denominations at Local Bank ATMs

In the Central Bank's effort to enhance the efficiency of cash usage, meet the local market’s needs for different denominations of banknotes, and ensure a balanced distribution of these denominations to facilitate commercial transactions based on ATM locations, withdrawal rates, and feeding periods, and based on the significant role played by local banks in providing cash through ATMs. And since the Central Bank has observed a rising demand for the 50 Riyal denomination based on direct withdrawals from its branches, indicating public need. Consequently, it is crucial for banks to ensure the availability of various denominations according to the preferences of citizens and residents.

Therefore, the Central Bank urges banks to study ATM withdrawal patterns and adjust denominations to align with those patterns, especially by adding the 50 Riyal denomination in ATMs with lower withdrawal rates. Banks are also requested to provide these denominations to customers at their branches and to cooperate in this regard within their available resources. Distribution models (1, 2) attached may serve as guidance. Additionally, banks are requested to inform the Treasury and Issuance Department at the Central Bank of any changes made, as deemed necessary to meet beneficiaries' needs. This will allow us to collectively monitor how effectively we respond to the preferences of ATM service users.

Distribution of Banknotes in Local Bank ATMs

In line with the role played by local banks in providing cash through ATMs, and in SAMA's commitment to enhancing the efficiency of cash utilization and meeting the local market's demand for various denominations of banknotes, as well as ensuring a balanced distribution of these denominations to facilitate commercial transactions based on the locations of ATMs, their actual withdrawal rates, and their replenishment schedules, SAMA has conducted a study to redistribute banknote denominations for ATM withdrawals in a manner that meets the needs of both beneficiaries and banks.

The study concluded that the distribution of banknote denominations should be as follows:

First: Banknote denominations for withdrawal transactions should be distributed according to the attached distribution table (Type A) for no less than 10% of the bank's total ATMs. This is intended to cover ATMs with withdrawal rates of less than SAR 2,500 per transaction on a monthly basis.

Second: According to the (Type A) distribution, withdrawals should be in multiples of SAR 50, with a maximum withdrawal limit of SAR 2,500 per transaction, as indicated by the ATM's operational metrics.

Third: Cash denominations should be distributed according to distribution table (Type B) in the rest of the ATMs according to the bank's assessment, provided that withdrawals should be in multiples of 100 riyals and that the maximum limit for each withdrawal should not exceed 5,000 riyals according to the ATM's operational metrics.

Fourth: Banks issuing Saudi Network cards should consider amending the ATM rules to comply with the distribution of (Type A) categories while granting authorization to the host bank for the disbursement process.

Fifth: Banks shall take into account, in the manner they deem appropriate, the selection of what distinguishes (Type A) devices from (Type B) devices.Therefore, SAMA hopes that all banks, before adopting the above proposal, will provide us with their views by having a representative of the bank attend the meeting of SAMA's Treasury and Issuance Department, which will be held on Sunday 27/06/1424H corresponding to 24/08/2003G at SAMA's head office building.

Type A

Amount

200

100

50

Number of Notes Per Transaction

50

0

0

1

1

100

0

0

2

2

150

0

0

3

3

200

0

4

4

250

0

0

5

5

300

0

0

6

6

350

0

0

7

7

400

0

0

8

8

450

0

0

9

9

500

0

1

8

9

550

0

1

9

10

600

0

2

8

10

650

0

2

9

11

700

0

3

8

11

750

0

3

9

12

800

0

4

8

12

850

0

4

9

13

900

0

5

8

13

950

0

5

9

14

1000

2

4

4

10

1050

3

3

3

9

1100

3

3

4

10

1150

3

3

5

11

1200

3

4

4

11

1250

3

4

5

12

1300

4

3

4

11

1350

4

4

3

11

1400

4

4

4

12

1450

5

3

3

11

1500

5

4

2

11

1550

5

4

3

12

1600

5

4

4

13

1650

5

4

5

14

1700

5

4

6

15

1750

5

5

5

15

1800

5

5

6

16

1850

6

4

5

15

1900

7

4

2

13

1950

7

4

3

14

2000

7

4

4

15

2050

7

5

3

15

2100

8

4

2

14

2150

8

4

3

15

2200

8

4

4

16

2250

8

5

3

16

2300

8

7

0

15

2350

8

7

1

16

2400

8

7

2

17

2450

8

7

3

18

2500

8

7

4

19

Average

3.5

3.36

4.78

Max Number of Notes

19

Average Number of Notes

11.64

Type B

Amount

500

200

100

Number of Notes Per

Transaction

100

0

0

1

1

200

0

1

0

1

300

0

1

1

2

400

0

1

2

3

500

0

1

3

4

600

0

1

4

5

700

0

1

5

6

800

0

1

6

7

900

0

1

7

8

1000

0

3

4

7

1100

0

3

5

8

1200

0

3

6

9

1300

0

3

7

10

1400

1

2

5

8

1500

2

1

3

6

1600

2

1

4

7

1700

2

1

5

8

1800

2

2

4

8

1900

2

2

5

9

2000

2

2

6

10

2100

2

3

5

10

2200

2

3

6

11

2300

3

2

4

9

240

3

2

5

10

2500

3

3

4

10

2600

4

2

2

8

2700

5

0

2

7

2800

5

0

3

8

2900

5

1

2

8

3000

5

1

3

9

3100

5

2

2

9

3200

6

0

2

8

3300

6

1

1

8

3400

6

1

2

9

3500

6

2

1

9

3600

6

2

2

10

3700

6

3

1

10

3800

6

3

2

11

3900

7

1

2

10

4000

7

1

3

11

4100

7

2

2

11

4200

8

0

2

10

4300

8

1

1

10

4400

8

1

2

11

4500

8

1

3

12

4600

9

0

1

10

4700

9

1

0

10

4800

9

1

1

11

4900

9

1

2

12

5000

9

2

1

12

Average

3.9

1.48

3.04

Max Number of Notes

12

Average Number of Notes

8.42

Current

Amount

500

200

100

Number of Notes Per Transaction

100

0

0

1

1

200

0

0

2

2

300

0

1

1

2

400

0

1

2

3

500

0

2

1

3

600

0

2

2

4

700

0

3

1

4

800

0

3

2

5

900

0

4

1

5

1000

1

2

1

4

1100

1

2

2

5

1200

1

3

1

5

1300

1

3

2

6

1400

1

4

1

6

1500

1

4

2

7

1600

1

5

1

7

1700

1

5

2

8

1800

1

6

1

8

1900

1

6

2

9

2000

2

4

2

8

2100

2

5

1

8

2200

2

5

2

9

2300

2

6

1

9

2400

2

6

2

10

2500

2

7

1

10

2600

2

7

2

11

2700

2

8

1

11

2800

2

8

2

12

2900

2

9

1

12

3000

3

7

1

11

3100

3

7

2

12

3200

3

8

1

12

3300

3

8

2

13

3400

3

9

1

13

3500

3

9

2

14

3600

3

10

1

14

3700

3

10

2

15

3800

3

11

1

15

3900

3

11

2

16

4000

4

9

2

15

4100

4

10

1

15

4200

4

10

2

16

4300

4

11

1

16

4400

4

11

2

17

4500

4

12

1

17

4600

4

12

2

18

4700

4

13

1

18

4800

4

13

2

19

4900

4

14

1

19

5000

5

12

1

18

Average

2.1

6.76

1.48

Max Number of Notes

19

Average Number of Notes

10.34

Debit Cards, Phone and Online Banking Fraud Prevention

Referring to previous Central Bank directives, the latest of which is Circular No. (19109/BCT/166 dated 21/10/1422H), regarding The Need to Limit Fraud and Manipulation with ATM Cards, Phone Banking, and Online Banking Services, and to ensure banks fulfill their responsibilities in providing these services. Banks are required to educate their customers about the associated risks and have robust monitoring systems and policies to prevent such incidents.

Given the Central Bank's observation of an increasing use of these services by bank customers, the following instructions are issued to banks providing such services and similar ones:

First: A specific annual budget should be allocated for a comprehensive and continuous program aimed at raising awareness among the bank’s customers (especially senior citizens). This program should include information related to the following:

- Emphasize the importance of protecting the card and PIN, avoiding writing it on the card or keeping it in the wallet, and stressing the customer's responsibility in this regard.

- Enable the customer to choose their own PIN and raise their awareness to avoid selecting easy numbers or numbers related to birth dates, phone numbers, or national ID cards.

- Provide clear steps for the customer to follow in case of card loss, theft, or damage.

These details can be communicated to the customer through various methods chosen by the bank, including:

- General instructions on how to use the card and the importance of safeguarding it and the PIN, sent with the card to new customers.

- Displaying brief messages and tips to customers when using ATMs.

- Distributing brochures and leaflets to customers or through various media channels.

- Through monthly account statements or direct communication, whether by phone or through branch employees.

Second: Regularly review and update monitoring systems and procedures as needed. These procedures must include advising bank customers to choose a different PIN for telephone banking services than the one used for ATMs, point-of-sale devices, and internet banking. Customers should also be reminded not to disclose their PIN.

Third: Implement the necessary technical measures to ensure that the full account number (or ATM card number) does not appear on ATM receipts provided to customers when conducting transactions.

Fourth: In general, the bank’s management is responsible for reviewing fraud cases, whether they result in financial losses or other non-financial damages, and reporting them to the Central Bank. These cases may indicate larger-scale fraudulent activities.

It is worth noting that the Central Bank issues such directives to protect the bank and its customers. The bank must make every effort to resolve all disputes with its customers without delay. Failure to comply with any of the Central Bank’s instructions or similar directives will result in the bank being held accountable.

We request the implementation of all these measures and adherence to them. Please confirm receipt of this circular.

Providing the Agency with the Required Statistics of Financial Transactions Conducted Via Automated Teller Machines (ATMs)

As you well know, since the operation of SPAN on 20-5-1990, SPAN has been witnessing steady development, in terms of daily operations, ATM expansion and card holders, which clearly indicates the success and importance of these services.

In our desire to see all the banks respond adequately to this expansion, we hope you provide us continuously at the end of each month with the necessary statistics in accordance with our circular No. BC/223 dated 16-5-1409 (26-12-1988), showing a general picture of the financial operations executed by ATMs.

We also hope that you make sure the bank ATM network is compatible with SPAN specifications for the purpose of expanding the client services and realize the benefit of all parties concerned.

Reaffirming to Banks that All their ATMs Must Be Fully Stocked with Cash at All Times, Including on Thursdays and Fridays

As you well know, the banks have established ATM to serve the clients and avail them with the opportunity of withdrawing from their accounts at any time and place. This was supported by the creation of SPAN jointly by SAMA and the banks, which enabled all clients to use any ATM belonging to a bank member of SPAN anywhere in the Kingdom. This is certainly a good step in serving the clients which fulfills their need for cash at any time and place, specially when the banks are closed. It also plays an effective role in reducing the rush on banks.

In view of the importance of keeping the clients assured that cash is always available at ATMs, and since it was noticed by SAMA that this is not always the case, and to avoid unpleasant consequences, we call on all banks to double their efforts to keep the machines adequately supplied with cash at all times, including Thursdays and Fridays, and always operative. The present situation may require the banks to continuously check on these machines and feed them with cash.

Please be informed and act accordingly.

ATMs

Reference the authorization by SAMA of some banks to use in branch and off-site ATMs, we hope you observe the following:

- ATMs should be operative for 24 hours daily.

- Daily withdrawal should not exceed SR 5,000 in cash and 10,000 in traveler checks or the equivalent of SR 10,000 in foreign currencies at ATMs in sea and airports.

- Daily withdrawal in cash and traveler checks should not exceed SR 10,000 per person in 24 hours

- Only checks, not cash, can be deposited at ATMs by the card holder.

- Total cash withdrawal, in the event of multiple credit cards, should not exceed SR 5,000 from one single account.

- ATMs should not be used to transfer funds from one account to the other unless both are for one person.

- The installation of off-site ATMs requires the prior approval of Saudi Central Bank.

- Banks must provide Banking Control with monthly statistics as per attached form.

Bank Name : _______________________________________________________________________________________________

Department Concerned ___________________________________________________________________________________

ATM Yearly Statistics

Report date : _______________________________________________________________________________________________

I. A C C O U N T S

I.1 ANNUAL FORECAST :

(To be submitted annually for the next five (5) years)

1988

1989

1990

1991

1992

TOTAL ACCOUNTS

TOATAL ATM

CARDS

TOTAL ATMs

TOTAL TRANSACTIONS

Bank Name : ____________________________________________________________________________________________________________________________

Department Concerned ______________________________________________________________________________________________________________

ATM Monthly Statistics

for the (Gregorian) month of _________________________________________________________________________________________________________

Report date : _________________________________________________________________________________________________________________________

I.2 CUSTOMERS STATISTICS

TOTAL ACCOUNTS

TOTAL ATM

CARDS

RERCENT OF TOTAL ACCOUNTS

TOTAL ACTIVE

CARDS

PERCENT OF

TOTAL CARDS

II. A T M ' s

II. 1 CURRENT DIRECTORY BY LOCATION (INSTALLED OR PLANNED)

ITEM NO.

LOCATION

ATM IDENTIFIER

ATM

TYPE (*)

ATM MODEL

SERVICE

HOURS

INST'N DATE

TRANS PER MONTH

Note: * ATM TYPEs are - In branch, thru the wall

- In branch, special lobby

- In branch, standalone

- off-site thru the wall

- off-site special lobby

- drive-up

III. TRANSACTIONS

III.1. ATM TRANSACTIONS PROCESSED

TRANSACTIONS

THIS MONTH

PREVIOUS MONTH

ANNUAL FORECAST

TOTAL

WITHDRAWALS

BALANCE ENQ.

OTHERS

III. 2 PERFORMANCE DATA

- Last month's average transactions:

- per ATM _______________________________________________________________________________________________________________________

- per CARD ______________________________________________________________________________________________________________________

- Maximum transactions at an ATM last month _____________________________________________________________________________________

- Average Cost per ATM last month _________________________________________________________________________________________________

- Average Cost per transaction last month __________________________________________________________________________________________

- Average total transaction time (from card insertion till completion) last month __________________________________________________

- Average system response time last month ________________________________________________________________________________________

- Average amount in withdrawal transactions last month __________________________________________________________________________

- Absolute average uptime last month _____________________________________________________________________________________________

- Total number of problems acted upon at network control last month ___________________________________________________________

- Peak time : from _______________ HRS to ___________________________ HRS.

Replenish ATMs by Licensed Security Companies for Money Transportation

Based on the keenness and interest of SAMA to encourage everything that would develop the banking sector and the services it provides, and given the possibility of providing the service of feeding ATMs by licensed local security companies, and the desire of local banks to enter and participate in this service by filling cash containers and assigning security companies to transport these containers from the bank and enter them into ATMs at the bank's responsibility regarding the cash they contain, as well as the contents of ATMs From inks, customer receipt papers, ATM tape paper and cards held inside the machine, SAMA does not mind that, provided that the bank follows up and provides its service providers with them and verifies the application of the instructions of SAMA, and considers the bank the first and last responsible towards SAMA in the application and implementation of those instructions to reach the greatest degree of security, and in a way that preserves the rights of the bank with the providers of this service and provides the best services to customers benefiting from banking services, in accordance with the standards and controls The following procedural, regulatory and technical procedures:

First: - Approval of SAMA

Banks are obliged to submit to SAMA draft agreements for the implementation of this service with the concerned companies and attach them the detailed procedures for feeding ATMs, before starting to contract with service providers for study and approval by SAMA.

Second: Regulatory Procedural Standards and Controls:

- Implementing the provisions of SAMA Circular No. 8187/MT/336 dated 7/6/1419 H, which includes circulars on the controls of money transfer, and No. 17989/MT/778 dated 17/11/1420 H, to which the executive regulations governing the practice of the activity of transferring funds and precious metals are attached.

- The transport of cash containers shall be carried out by armored vehicles in accordance with the technical specifications set forth in the Security Safety Manual issued pursuant to SAMA Circular No. 485/MA/36 dated 7/1/1416H (the part on the procedures for transporting cash for commercial banks and transport companies).

- Implementing the instructions of SAMA notified pursuant to Circular No. 6898/MT/287 dated 4/5/1420 H on the procedures and controls to be followed when carrying out the maintenance of ATMs.

- Comply with the provisions of SAMA Circular No. 12327/MT/550 dated 26/8/1419 H, which stipulates the need to coordinate and inform the security authorities when transferring funds.

- Banks must ensure that the cash containers are sealed before handing them over to the company, exclusively for legal liability, so that a metal or plastic strip is placed with a special number that is closed by those responsible for packing cash containers and is opened only by those responsible for cash containers in banks, after making sure that the metal or plastic strip number matches and then opened by them.

Third: Technical Standards and Controls:

- Banks must ensure that the concerned companies pay attention to the level of service provided through ATMs, and provide the necessary training to those in charge of feeding and maintaining ATMs, whether through banks or ATM suppliers.

- Banks should oblige these companies to quickly deliver packed and also used cash containers, strips of inventoried machines and retained cards to banks, in order to speed up the matching process, pay the existing increases, and speed up the return of the issued retained cards according to the procedures regulating this in the Saudi Payment Network Guides.

- The banks shall be responsible for the application by the concerned companies of the controls and procedures for feeding the ATMs notified to all banks under the following SAMA circulars No. 19886/MT/214 dated 01/08/1414 H, No. 2193/MT/102 dated 13/02/1419 H, and No. 11843/MT/588 dated 24/9/1415 H, provided that banks are responsible for informing companies of any developments received from SAMA on these controls and procedures.

- The bank shall monitor the performance of its ATMs and the principal to fill them with cash containers for these companies and ensure the availability of cash and all the contents of ATMs such as inks, customer receipt papers and ATM tape paper.

- Banks should be responsible for managing cash in ATMs and determining the amounts required for each ATM by analyzing the number and amounts of transactions in each ATM.

- Obliging banks to place the new denominations of banknotes in implementation of SAMA's circular No. 18765 / QA / 817 dated 02/12/1420 H to provide the denomination of two hundred riyals in all ATMs of all local banks.

- The money transfer company has the right, in the narrowest limits, to keep a number of cash containers in the event that they cannot be replaced within the specified time, provided that the conditions for retention and the number of containers are included in the draft agreements submitted to SAMA.

The Need to Limit Fraud and Manipulation with ATM Cards, Phone Banking, and Online Banking Services

SAMA has recently received some fraud cases related to ATM cards issued by banks operating in the Kingdom, and after considering these cases, it was noted that most banks do not focus on some security aspects related to the information of these cards and ATMs, which facilitated the occurrence of these fraudulent operations. Therefore, SAMA stresses the need to adhere to the security aspects of operations and cards, as well as the ATMs recorded in the Saudi Payment Network guides, and out of SAMA's keenness not to spread the phenomenon of fraud in bank cards in order to preserve the rights of customers and banks alike, it is necessary to adhere to the following:

First: Not allowing ATM cardholders to exceed the maximum daily withdrawal limit (5000 riyals), whether through ATMs or other banks' devices, correcting the status of any card that allows withdrawals to exceed this limit, and not submitting requests to SAMA to exceed this limit for any category of customers, whatever the reasons.

Second: Follow the security safety means related to concealing the electrical current wires of the ATMs in a tight manner to prevent users from accessing and seeing them, and making the necessary technical procedures in the bank's ATM system to prevent the reversal of the operations carried out by the ATMs after the power outage of the ATM used.

Third: In the event that two or more devices are installed in close proximity, users cannot see others while entering passwords when performing operations on these devices, and security and control tools such as cameras are provided at ATM sites.

Fourth: Ensure that the inventory of the contents of the ATMs is carried out in the presence of at least two people, and the bank must follow up the team in charge of this through inventory forms and ATM reports and make the necessary adjustments resulting from the inventory, whether on the accounts of the bank's customers or customers of other banks directly.

Fifth: Making the necessary technical measures to prevent the full number of the exchange card from appearing in the receipt given to the cardholder after conducting automated teller operations to avoid the use of customer card numbers by other people.

Sixth: Working to raise awareness among the bank's customers of the importance of maintaining the ATM card password and not writing it.

For your information, adopt and abide by it.

ATM Instructions

No: 46010824 Date(g): 23/8/2024 | Date(h): 18/2/1446 Status: In-Force Translated Document

Based on the powers granted to SAMA under its Law issued by Royal Decree No. (M/36) dated 11/04/1442H, and the Banking Control Law issued by Royal Decree No. (M/5) dated 22/02/1386H, and in line with SAMA's efforts to establish a regulatory and supervisory framework for ATM licensing.

Attached are the ATM Instructions, which aim to encourage the geographical distribution of the ATM network to ensure coverage in all areas, in addition to establishing a supervisory framework for the licensing and license cancellation of ATMs.

For your information and action accordingly as of this date. Please note that these instructions replace SAMA's previous instructions regarding the licensing and license cancellation of ATMs as outlined in earlier circulars.

1. Introduction

SAMA issued these instructions within the framework of exercising its powers granted under the Saudi Central Bank Law issued by Royal Decree No. (M/36) dated 11/04/1442H, and the Banking Control Law issued by Royal Decree No. (M/5) dated 22/02/1386H. These instructions specify the procedures governing ATMs located outside the branches of banks. The objectives of these instructions are as follows:

1.1 Encouraging the geographical distribution of the ATM network and ensuring its coverage across all regions.

1.2 Establishing a supervisory framework for the licensing and cancellation of licenses for ATMs.

2. Scope of Application

These instructions apply to all local banks, and branches of foreign banks licensed within the Kingdom of Saudi Arabia, with the exception of ATMs associated with branch licenses.

3. Definitions

The following terms and phrases, whenever they occur in these instructions, shall have the meanings assigned thereto unless the context requires otherwise:

Term Definition SAMA Saudi Central Bank.

Instructions Instructions for ATMs Located Outside Bank Branches.

Bank The bank licensed to conduct banking activities in the Kingdom in accordance with the provisions of the Banking Control Law.

Branches Comprehensive branches that provide a full range of banking services, as well as other branch models that offer basic banking services, including account openings, cash deposits, cash withdrawals, money transfers, and others.

ATMs associated with branch licenses ATMs located within the bank branch premises, subject to its license, providing cash withdrawals and/or cash deposits, as well as other services such as balance inquiries, mini-statements, bill payments, money transfers, and others.

ATMs ATMs located outside the bank branch premises, operating under separate licenses independent of the branch licenses, providing cash withdrawals, as well as other services such as balance inquiries, mini-statements, bill payments, money transfers, and others.

Cash Acceptance Machines Cash Acceptance Machines located outside the bank branch premises, operating under separate licenses independent of the branch licenses, and providing cash deposit services exclusively for certain corporate bank customers.

Drive-Thru ATM ATMs located outside the bank branch premises, operating under separate licenses independent of the branch licenses, and providing cash withdrawal services as well as other banking services through vehicle-mounted ATMs.

Shumul A Geographic Information System managed by SAMA, allowing member banks to input the locations of their ATMs along with their full data.

4. ATM Licensing

It is required to meet the following conditions for granting a license for new ATMs:

4.1 The bank must submit all its applications for ATM licenses through SAMANet.

4.2 The bank applying for a new ATM license must attach the following documents with its application:

4.2.1 The location coordinates in decimal degree format as follows: (Longitude 46.454109, Latitude 25.353898).

4.2.2 A copy of the signed contract between the bank and the property owner/tenant.

4.2.3 Clear photographs of the site from all directions (at least four photographs), with the following considerations:

4.2.3.1 Photograph quality.

4.2.3.2 The necessity of photographing from all angles of the site.

4.2.3.3 Provide a photograph of the entire site.

4.3 Any other documents requested by SAMA.

4.4 In case of applying for a license for a drive-thru ATM, the bank must attach a copy of the building permit or the approved architectural plans from the municipality or the local authority within whose jurisdiction the device is located.

4.5 The bank's application, once submitted, is subject to review by SAMA for approval.

4.6 The license is valid for a period of nine months, starting from the issuance of SAMA's approval, and can be extended for an additional three months with the approval of SAMA, upon a request submitted by the bank through SamaNet, outlining the reasons for the extension.

4.7 After obtaining the approval, the bank must add the ATM location and all of its details to the "Shumul" system.

4.8 The bank must notify SAMA through SAMANet of the activation of the ATM, within five business days of its activation.

4.9 The bank must comply with the Financial Sector Security and Safety Guide for the Kingdom, issued in 1441H, and any updates thereto, for all existing and new ATM locations.

4.10 The bank must provide SAMA with the annual plans for the installation and deactivation of ATMs in October of each year. The plans should include the strategy for presence in the holy sites during the Hajj and Umrah seasons, whether for permanent or temporary locations.

5. ATM Cancellation

5.1 Request for ATM Cancellation

5.1.1 The bank must submit requests for the cancellation of ATM licenses by completing the ATM Cancellation Request Form (Appendix 1) and sending it to SAMA. 5.1.2 The bank must provide the following in the cancellation request:

5.2.1.1 The current site details, including a copy of the license showing its number and date.

5.2.1.2 Attach the justification for the cancellation request.

5.2.1.3 Photographs of the site where the device is to be canceled.

5.2.1.4 Identify the area where the device to be canceled is located (Appendix 1).

5.2 Review of Cancellation Request

The request will be reviewed based on the specified cancellation requirements, which include:

5.2.1 The accessibility of ATMs in the area mentioned in the request.

5.2.2 The ratio of the bank's current ATMs to its customers.

5.2.3 The reason for the cancellation.

5.2.4 The distance between the ATM to be cancelled and other ATMs of the bank.

5.2.5 ATM usage rate.

If the ATM mentioned in the request meets the specified requirements for cancellation, SAMA will provide its non-objection to the bank for deactivating the ATM. Based on SAMA's non-objection to the cancellation request, the bank must remove all the ATM data, including the license number, date, and site coordinates, from the "Shumul" system within three working days. The bank must also remove the cancelled ATM from the site and disconnect all associated devices.

6. Replacement of ATM

To obtain the approval of SAMA for the cancellation of an ATM that does not meet the cancellation requirements, the bank must provide a replacement ATM in the same area within a specified distance, in accordance with the following requirements for ATM replacement:

6.1 The bank's commitment to installing a replacement ATM in the same governorate and within a specified distance (Appendix 2).

6.2 The bank must notify SAMA upon the installation and activation of the replacement ATM within the specified time frame.

6.3 If the bank is unable to adhere to the specified timeframes, SAMA will not accept any further cancellation requests until the bank fulfills its obligation to install a replacement ATM.

7. Communication with Customers

The bank must adhere to the following:

7.1 Update the details of ATM locations on their websites (internet and mobile devices).

7.2 Place an identification card on the ATM that includes the ATM number and contact information in both Arabic and English for customers.

7.3 Each ATM must clearly display all types of accepted cards.

8. Reporting Requirements

The bank must submit the following data to SAMA, using the required forms (Appendix 3).

8.1 The data on the "Shumul" system must reflect the actual status of the ATMs at all times.

8.2 Submitting monthly reports on newly installed, cancelled, and replaced ATMs (within five days after the end of each month). 9. Implementation of the Instructions

These instructions shall be effective from the date of their issuance.

10. Appendices

10.1 Appendix 1: ATM Cancellation Request Form

10.2 Appendix 2:

10.2.1 Criteria for the Defined Distance for Replacing ATMs*

Area Distance Criteria Area 1 Within a 5 km radius Area 2 Area 3 Within a 10 km radius Area 4 Area 5 Within a 15 km radius 2.2.10 Area Classification

Area Population range Area 1 A population of more than one million Area 2 More than half a million to one million population Area 3 More than 100,000 to half a million population Area 4 From 20,000 to 100,000 population Area 5 Less than 20,000 population * It is subject to the exceptional approval of SAMA.

10.3 Appendix (3): Reporting Requirements

Cash Transfer

Cash Transfer between Local Banks and Licensed Money Exchangers

Based on the letters of His Excellency the Minister of Finance No. 1/S/9687 and No. 1/S/9690 dated 1/11/1427 H based on the circular of His Royal Highness the Minister of Interior No. 19/46391/SH2 dated 14/8/1426 H regarding the Customs Authority taking the necessary steps to start applying the provisions of the manual Procedures for the disclosure of cash and precious metals on departure and arrival to and from the Kingdom to implement the provisions of Article 14 of the Implementing Regulations of the Anti-Money Laundering Law issued by Royal Decree No. (M/39) dated 25/6/1424 H. SAMA is directed to take measures to regulate the entry and exit of cash into and out of the Kingdom in general, which is carried out by banks and licensed money changers through border crossings in particular, in accordance with the articles of the Anti-Money Laundering Law and its Implementing Regulations and the requirements of the recommendations issued by the Financial Action Task Force (FATF), especially the Special Recommendation IX.

In order to achieve this, SAMA wishes to take the following regulatory steps:

- Local banks operating in the Kingdom and licensed exchange shops have the right to import and export cash and convertible financial instruments in Saudi currency or other foreign currencies through border crossings.

- Banks and exchange shops are obligated to notify customs officials at border crossings of the amounts of cash and convertible financial instruments that they carry and wish to enter or exit the Kingdom to apply the principle of disclosure, as well as for representatives of SAMA to conduct inspection and ensure the safety of cash from counterfeiting.

- This regulation applies to all parties involved in the transportation process, including banks, licensed money changers and their direct and indirect employees, shipping companies, parcel and cargo transportation companies, companies specialized in transporting cash (private security companies), postal transportation, etc.

- Negotiable and transferable means of payment that are similar in their characteristics to money, such as checks, including Travelers Cheques, Draft Cheques, etc. are considered as part of the funds subject to the application of the law.

- SAMA's branches and representatives at border points, as well as banks and exchange houses, must record and maintain data and information (information center) related to the movement of cash and transferable financial instruments across borders. This data should be utilized as much as possible for monitoring and conducting studies.

- Banks and exchange houses must establish regulatory procedures for the transportation of cash and transferable financial instruments both incoming to and outgoing from their premises. These procedures must include the following:

(A) Complete the procedures for buying or selling cash currencies and transferable financial instruments through standard banking practices before initiating the transportation process.

(B) Agree in advance on purchase or sale prices and identify the counterpart involved in the banking transaction (cash purchase or sale) on the other side to finalize the transaction. Avoid engaging in bargaining or bidding for cash in the markets.

(C) Agree on how to arrange and prepare the funds in a manner suitable for both parties, facilitating their transportation, counting, and verification of authenticity.

(D) Ensure strict adherence to security procedures for transporting cash and transferable financial instruments, applying the instructions outlined in the Security Safety Manual as a minimum standard, and utilizing modern and appropriate transportation methods.

(E) Identify the entities involved in buying or selling and verify the legitimacy of their operations, ensuring they possess the required licenses for conducting banking activities.

(F) Restrict the process of sending, receiving, and transporting funds within the Kingdom to Saudi employees only.

(G) Local banks and exchange houses are responsible for verifying the authenticity of the cash and transferable financial instruments they sell or purchase, ensuring the legitimacy of their sources and uses. Furthermore, external entities involved in transactions must share in this responsibility.

Dealing with SAMA Branches

Further to SAMA Circular No. 50481/MT/23865 dated 22/10/1432 H, regarding the reluctance of some branches of banks and cash centers in some cities of the Kingdom to deal with the branches of SAMA near them in the operations of cash deposits and withdrawals, and to deal directly with cash centers affiliated to the Bank in other regions, and in view of the consequent increase in the cost and risks associated with the process of transferring cash to other regions, and to the shortage or increase in the different denominations of cash in regions in the Kingdom without another.

Accordingly, SAMA reaffirms the importance of adhering to the instructions issued in this regard, and that each bank reviews its cash management controls, takes all necessary measures to ensure that cash is not transferred from one region to another, and commits to conducting cash deposits and withdrawals through the nearest branch of SAMA.

Dealing With SAMA Branches

Reference to SAMA's circular No. BCI/15864 dated 10/07/1432 H and No. BCI/15865 dated 10/07/1432 H and other instructions issued regarding the controls and procedures for dealing with cash in its various categories, and in view of the reluctance of some bank branches and cash centers in some cities of the Kingdom to deal with the branches of SAMA near them in deposits and withdrawals and to deal directly with cash centers belonging to the bank in other areas far from it, which led to a shortage or increase in the various denominations of cash in some areas of the Kingdom but not others.

In view of the consequent increase in the cost and risks associated with the process of transferring cash to branches far from SAMA branch near the bank's branch, SAMA stresses the importance of adhering to the instructions issued in this regard and that each bank (exchanger) reviews its cash management controls and makes appropriate amendments to them in order to limit the transfer of cash and the commitment to conduct deposits and withdrawals through the nearest branch of SAMA and ensure the provision of automated equipment and adequate human resources for counting and examination. Cash sorting in all cash centers and bank branches.

We hope to instruct the competent department to verify this and inform us of the implementation within a month from its date.

Adherence to Regulations and Instructions on Cash Movement and Security Safety

Further to SAMA Circular No. 381000101035 dated 09/10/1438 H regarding contracting with cash transfer companies and using high-specification security bags, and SAMA Circular No. 361000156181 dated 25/12/1436 H concerning the necessity of adhering with the regulations and instructions related to the movement of money and the security safety manual, as well as SAMA Circular No. 15475/MAT/306 dated 12/04/1428 H regarding the regulation of cash transfer between local banks and licensed money exchangers, and SAMA Circular No. 49302/M AT/940 dated 22/12/1428 H which includes the Law of transporting money, precious metals, and negotiable instruments issued by Royal Decree No. M/81 dated 1428/10/18 H.

Therefore, SAMA emphasizes the necessity to review and comply with the provisions of these regulations and instructions issued in this regard, and what is stated in the security safety manual and the specific requirements for vehicles used for transporting cash and items of value exceeding 200,000 Riyals. Anyone found to be transporting money or receiving transferred cash in an irregular manner will be subject to legal penalties.

Cash Transfer between Local Banks and Licensed Money Exchangers According to Rule (16) from the Anti-Money Laundering Law

In reference to SAMA Circular No. 15475/M AT/306 dated 12/04/1428 H, regarding the necessary actions for the General Authority of Customs to begin implementing the procedures outlined in the disclosure guide for cash and precious metals upon departure and arrival from and to the Kingdom, in accordance with Article (14) of the Anti-Money Laundering Law issued by Royal Decree No. M/39 dated 25/06/1424 H, and the requirements outlined by SAMA regarding the regulation of the process for licensed banks and money changers to transport cash in and out of the Kingdom generally through border crossings. Also referring to SAMA Circular No. 341000074807 dated 15/06/1434 H regarding amendments to the Anti-Money Laundering Law issued by Royal Decree No. M/31 dated 11/05/1433 H and its implementing regulations.

SAMA wishes to confirm the regulatory requirements included in the aforementioned circular and we would like to inform you that Article Fourteen of the Anti-Money Laundering Law issued by Royal Decree No. M/39 dated 25/06/1424 H has been amended to become Article Sixteen in the amended Anti-Money Laundering Law issued by Royal Decree No. M/31 dated 11/05/1433 H, and a paragraph regarding "negotiable financial instruments" has been added, and the term "disclosure" has been replaced with "declaration." Therefore, we hope you will comply and take the necessary actions to align internal instructions and procedures with the amendments included in Article Sixteen of the Anti-Money Laundering Law and its implementing regulations.

Penalties Re. the violation of the Law of Transporting Money, Precious Metals, and Negotiable Instruments

No: 381000063640 Date(g): 12/3/2017 | Date(h): 14/6/1438 Translated Document

Referring to the letter from the Assistant Director of Public Security for Security Affairs No. 3/3472/3 dated 10/5/1438H, which references the recommendations in the report of the committee formed by Public Security and SAMA regarding addressing violations related to the transportation of cash, precious metals, and valuable documents. The report also outlines a mechanism for handling violations by banks against cash transportation companies by reporting such violations to the operations rooms to enable field enforcement units to address them.

Accordingly, please inform the Operations Rooms of the Security Patrols about any violations committed by cash transportation companies or institutions within the bank. Upon the patrol's arrival to address the report, an original and two copies of the notification (report) should be handed over, specifying the time of the report and the time the patrol addressed the situation. This will enable the Security Patrols to document the case and initiate legal and regulatory procedures in accordance with the Law of Transporting Money, Precious Metals, and Valuable Documents, using the attached form.

Adherence with the Regulations and Instructions Related to the Movement of Money and the Security Safety Manual

Following SAMA's circular No. 15475/M A T/306 dated 12/04/1428H regarding the regulation of cash transportation movement for local banks and money exchangers, and SAMA's circular No. 49302/M A T/940 dated 22/12/1428H, which includes the regulations for the transportation of cash and precious metals issued by Royal Decision No. M/81 dated 18/10/1428H, as well as SAMA's circular No. 3202/M A T/52 dated 03/02/1424H, which includes the security safety guidelines.

Whereas SAMA has observed a lack of compliance by some exchange companies and institutions with the regulations and instructions issued regarding the movement of funds and the aforementioned security safety guidelines, SAMA emphasizes the necessity of adhering to these regulations and instructions. Those found to be transporting funds in an irregular manner or receiving cash amounts transported irregularly from other exchange companies and institutions will be subject to the legal penalties stipulated in the Banking Control Law issued by Royal Decree No. M/5 dated 22/02/1386H.

Cash Collection Service for Bank Customers

Pursuant to SAMA Circular No. 5922/MAT/62 dated 8/4/1421H regarding the Replenishment of ATMs by Licensed Security Companies for Money Transportation, and given SAMA’s observation that this service has positively contributed to enhancing the performance of the banking sector and enabling it to focus on its core responsibilities, SAMA encourages initiatives that aim to develop and improve this sector and its services to customers. SAMA has sensed that there is a new service that can be offered in the Saudi banking sector, which is for banks to collect cash and transport it from their customers' premises on their behalf to deposit it in their accounts by commissioning licensed security companies.

SAMA has no objection to providing this service because of its role in increasing services in the banking sector and preserving the processes of transferring cash from the customer to the branch, provided that the requirements that will provide this service in a good and safe manner are applied:

- The transfer must be carried out by licensed security companies.

- Coordination with the customer so that the cash is transferred from his premises carefully, taking precautions during the transfer process.

- Cash must be transported in armored cars in accordance with the technical specifications outlined in the Security Safety Manual issued by SAMA Circular No. 485/MA/36 dated 7/1/1416H.

- Adherence to SAMA Circular No. 12337/CT/550 dated 26/8/1419 H, which stipulates the need to coordinate and inform the security authorities when transferring money.

- The transfer process must take place from the beginning of work until ten o'clock at night.

- The cash counting process must take place at the bank's headquarters under bilateral supervision with the necessary means of protection or monitoring through closed-circuit television (CCTV).

Banknotes

The New Method of Counting and Sorting of Print Banknote Allows the PBS to Destroy the Defect Banknotes During the Counting and Sorting Process Causing a Loss of One Pack 100 Banknotes

This section is currently available only in Arabic, please click here to read the Arabic version.Acceptance of all Cash Deposits Through Branches

SAMA noted frequent complaints from the public about the refusal of tellers inside the branches to accept cash deposits from customers, setting a minimum limit for accepting them, and directing them to deposit cash through cash deposit machines.

Accordingly, SAMA stresses the commitment of all branches of the bank to accept cash deposits regardless of their amounts directly through the branches and to grant customers the freedom to choose the appropriate deposit method for them.

Instructions for Handling Banknotes of Different Denominations

Due to instances where some banks deposit banknotes to SAMA that are composed of two parts from different notes of the same denomination, each part bearing a different serial number and glued together to create the impression of a single valid banknote for compensation purposes,

SAMA emphasizes the importance for banks to thoroughly audit their daily deposits and ensure their validity. In the event of discovering a banknote composed of parts from two different notes, the following actions must be taken:

- Stamp it with a "Not Eligible for Compensation" mark.

- Send it to SAMA, as it is not eligible for compensation.

If a banknote with two different serial numbers is deposited with the Central Bank branches, it will be confiscated by the Central Bank, and the necessary regulatory actions will be taken.

Safety of Cash in Circulation

Referring to SAMA's Circular No. 42406/MAT/547 dated 07/09/1429H, and Circular No. 42/N/Th dated 20/01/1412H, regarding the emphasis on the necessity of maintaining the integrity of circulating banknotes and the importance of inspecting and sorting banknotes before disbursing them to customers or when feeding ATMs, we inform you that SAMA has observed that some banks are disbursing banknotes to customers and feeding ATMs with torn or damaged banknotes.

Therefore, we emphasize the need to give sufficient attention to the integrity of the circulating banknotes in branches, cash centers, and ATMs affiliated with the bank. Supervisors and bank officials are required to oversee, monitor, and follow up on the process of feeding ATM cassettes in collaboration with cash-in-transit companies, ensuring that this responsibility is not solely entrusted to these companies. Banks and financial institutions must also ensure the use of modern machines capable of sorting sound banknotes from others. Banknotes should be in an acceptable condition in general appearance, not worn out or dilapidated, and their general appearance should be clean. The main colors of the banknotes should be clearly visible, free from adhesive tapes, with all edges and parts intact, and should not be torn or have holes. Additionally, the banknotes should be free from defacing writings or stamps.

SAMA will verify the extent of compliance by banks and financial institutions with these instructions, regulations, and procedures, and appropriate penalties will be imposed on any non-compliant entity

Compliance with Instructions for Handling and Delivering Cash

Referring to SAMA's Circular No. 381000092716 dated 03/09/1438H regarding adherence to the guidelines in the Security and Safety Manual when cash-in-transit teams carry out transportation operations from customer locations and bank branches to cash centers, and in light of certain inquiries regarding the responsibilities of the cash counting team at customer premises.

We would like to clarify that there is no objection to having an independent team of Saudi nationals handle the counting and preparation of cash at the customer’s premises, followed by a separate independent team conducting the cash transportation. There must be a clear separation of duties and responsibilities between the cash counting team and the cash transportation team. Additionally, the cash amounts must be received in special containers equipped with automated tracking and self-destruction ink systems to minimize the risk of robbery or theft.

Applying the Maximum Financial Penalty for Each Counterfeit Banknote Received from Banks to SAMA

Referring to SAMA’s Circular No. 2887/MAT/101 dated 21/2/1420H, which supplements previous circulars urging banks to exercise due diligence and care when receiving banknotes from their customers to detect counterfeit notes before depositing them in their vaults and subsequently delivering them to SAMA. The circular included SAMA’s decision to impose a financial penalty on banks delivering counterfeit banknotes to SAMA, amounting to ten times the value of the counterfeit note, in addition to its confiscation.

In continuation of the financial penalties imposed under SAMA’s punitive decisions in this regard, SAMA reaffirms the enforcement of the maximum financial penalty stipulated in Paragraph 5 of Article 23 of the Banking Control Law, amounting to SAR 5,000 for each counterfeit banknote delivered to SAMA, regardless of the denomination. SAMA urges all banks to exert greater care and attention in examining banknotes and ensuring their authenticity before delivering them to SAMA.

Replacement Mutilated Banknotes

Referring to SAMA’s observation of some circulating banknotes being tampered with, whereby certain security features are deliberately removed and then presented to banks for replacement with new banknotes, this practice contributes significantly to the waste of economic resources and shows a lack of respect for the national currency, which represents a symbol of the state.

Therefore, please direct anyone requesting the replacement of banknotes that have been defaced or tampered with regarding their security features to SAMA branches located across the Kingdom. Additionally, ensure that all staff members involved in receiving banknotes are well-trained and familiar with the main security features of Saudi currency, such as the 3D security thread, the 3D special ink feature, the shiny silver stripe, and other security features highlighted in the publications issued by SAMA when launching its banknote editions or available on SAMA’s website through the following links:

Security Features of the Fifth Edition

Security Features of the Sixth EditionAcceptance and Exchange of Banknotes and Coins

Referring to SAMA Circular No. 34736/BCI/15864, dated 1432 H and Circular No. 34734/BCI/15865 dated 10/071432 H, which includes reference to previous circulars issued by SAMA regarding banknotes and coins, and the receipt of damaged ones.

Circular Number Date Circular Number Date 1) M/A/155 23/08/1400H 5) 406/M A/290 21/07/1412H 2) 10023/M/A/192 13/07/1405H 6) 400/M A/241 21/10/1413H 3) 1419/M/A/40 04/02/1407H 7) 23782/M A/251 14/09/1414H 4) 42/N/Z 20/01/1412H 8) 1941/BCI/95 05/02/1418H Due to the commencement of the "Take the Change" campaign launched by the Ministry of Commerce and Industry in coordination with SAMA to provide coins to customers, and to indicate that fines will be imposed on violating stores starting from 10/10/1434H, and in order to continue the coordination and cooperation between SAMA and the banks in this matter, we would like to emphasize the responsibility of banks to comply with the instructions given in previous circulars. We would also like to assure that small denominations of banknotes and coins are available in sufficient quantities at SAMA branches, and there is no reason for banks not to provide them to customers.