Book traversal links for Counter-Fraud Framework

Counter-Fraud Framework

No: 000044021528 Date(g): 11/10/2022 | Date(h): 16/3/1444 Status: In-Force Based on the supervisory and regulatory role of SAMA, and its commitment to enhancing the protection of the banking sector and its customers from financial fraud and fraudulent practices, and pursuant to the powers vested in it under its Law issued by Royal Decree No. (M/36) dated 11/4/1442H, and other related regulations,

We attach the updated version of the Counter Fraud Framework, which aims to improve the level of practices in combating fraud through the implementation of a set of controls that contribute to proactively and effectively enhancing fraud prevention maturity to mitigate fraud risks. Banks operating in the Kingdom are required to comply with its provisions according to the following procedures:

- Conduct an accurate assessment of the current state of fraud prevention measures compared to the Counter Fraud Framework (Gap Assessment); to identify weaknesses within the bank and evaluate the maturity level as defined in the framework, providing SAMA with monthly reports starting from November 30, 2022G.

- Develop a Roadmap to achieve at least the third maturity level for the controls outlined in the framework within nine (9) months from this date, following an accurate assessment of the current state of the bank's environment, and submit it to SAMA no later than November 30, 2022G.

- Obtain the approval of the bank's Board of Directors on the Roadmap and the necessary means of support for its implementation.

- The bank must fully comply with the requirements of the Counter Fraud Framework by no later than June 29, 2023G.

- Prepare a detailed annual report by the Internal Audit Department – with the option to engage consulting firms – outlining the level of compliance with the Counter Fraud Framework requirements, starting from the end of Q4 2023G.

- Submit the Roadmap mentioned in item (2) and the reports referenced in items (1) and (5) to the email address: CRC.compliance@SAMA.GOV.sa.

- The attached Counter Fraud Framework replaces the previous framework issued under Circular No. (41071315) dated 27/12/1441H, effective from June 29, 2023G.

For your information and compliance effective immediately.

1. Introduction

1.1. Introduction to the Framework

The advancement of technology has brought rapid changes in the financial sector. While allowing customers instant access to products and services, this digital transformation has increased their vulnerability to fraud. Small scale incidents impacting individuals have been replaced by large scale cyber-enabled fraud attacks orchestrated by international organised groups. These attacks expose customers to ever more sophisticated threats and it is vital that financial institutions properly safeguard assets and mitigate the risk of customers being exploited. Fraud not only causes emotional harm and financial losses to customers, it can also damage the reputation and financial health of organisations, reducing confidence in the overall financial sector in the Kingdom of Saudi Arabia.

The financial sector recognizes the rate at which fraud risks are evolving and the importance of controls to prevent, detect and respond to suspected fraud. Delivering an effective approach to fraud risk management will help the Kingdom of Saudi Arabia achieve the 2030 Vision aim to build a stable, thriving, and diversified business environment while protecting members of society and making the Kingdom an unattractive place for fraudsters.

The Saudi Central Bank* ("SAMA") has established a Counter-Fraud Framework (“the Framework”) to enable organisations it regulates ("the Member Organisations”) to effectively identify and address risks related to fraud. The objectives of the Framework are as follows:

To create a common approach for addressing fraud risks within the Member Organisations.

To achieve an appropriate maturity level of fraud controls within the Member Organisations.

To ensure fraud risks are properly managed throughout the Member Organisations.

The Framework will be used to periodically assess the maturity level and evaluate the effectiveness of the Counter-Fraud controls at Member Organisations. The Framework is based on SAMA requirements and industry fraud standards.

* The "Saudi Arabian Monetary Agency" was replaced by the "Saudi Central Bank" in accordance with The Saudi Central Bank Law No. (M/36), dated 11/04/1442H, corresponding in 26/11/2020G.

1.2. Definition of Fraud

Fraud is defined as any intentional act that aims to obtain an unlawful benefit or cause loss to another party. This can be caused by exploiting technical or documentary means, relationships or social means, using functional powers, or deliberately neglecting or exploiting weaknesses in systems or standards, directly or indirectly.

To support the definition of fraud, Member Organisations should take note of the non-exhaustive list of fraud types included in the Appendix.

1.3. Scope

The Framework defines Principles and Control Requirements for initiating, implementing, maintaining, monitoring, and improving Counter-Fraud controls within Member Organisations regulated by SAMA. The Principles and Control Requirements span the prevention, detection, and response to fraud, as well as the governance of an organisation’s Counter-Fraud Programme. The Framework should be implemented in conjunction with other SAMA frameworks, in particular SAMA’s Cyber Security Framework (“The Cyber Security Framework”), which should be referred to for specific Cyber Security related requirements.

1.4. Applicability

The Framework is applicable to all Member Organisations operating in Saudi Arabia based on SAMA discretion. Member Organisations required to implement and comply with the Framework will be notified by SAMA.

1.5. Responsibilities

The Framework is mandated by SAMA and will be circulated to Member Organisations for implementation. SAMA is the owner and is responsible for periodically updating the Framework. The Member Organisations are responsible for implementing and complying with the Framework.

1.6. Interpretation

SAMA, as the owner of the Framework, is solely responsible for providing interpretations of the Principles and Control Requirements, if required.

1.7. Target Audience

The Framework is intended for Senior and Executive Management, business owners, members of the Member Organisation’s Counter-Fraud Department and those who are responsible for, and involved in planning, defining, implementing, and reviewing CounterFraud controls across the three lines of defence.

1.8. Review, Updates and Maintenance

SAMA will review the Framework periodically to determine the Framework’s effectiveness, including the effectiveness of the Framework to address emerging fraud threats and risks. If applicable, SAMA will update the Framework based on the outcome of the review.

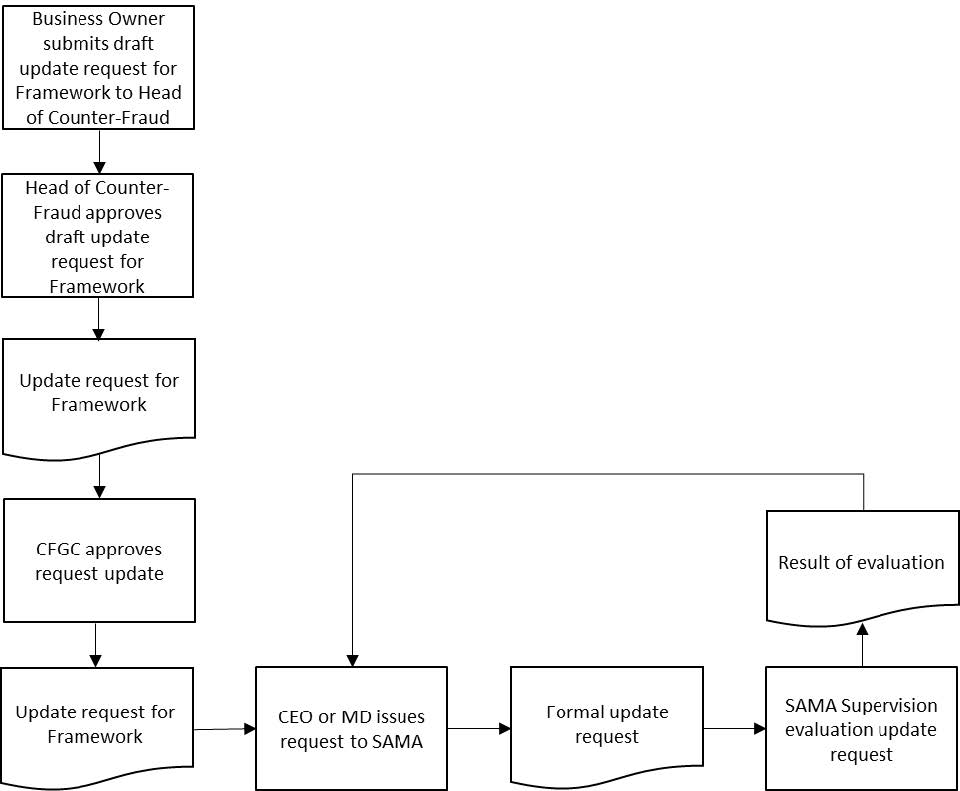

If a Member Organisation considers that an update to the Framework is required, the Member Organisation should formally submit the requested update to SAMA. SAMA will review the requested update, and if applicable, the Framework will be adjusted on the next updated version. The Member Organisation will remain responsible to be compliant with the Framework pending the version update.

Please refer to ‘Appendix C - How to request an Update to the Framework’ for the process of requesting an update to the Framework.

Version control will be implemented for maintaining the Framework. Whenever any changes are made, the preceding version shall be retired and the new version shall be published and communicated to all Member Organisations. For the convenience of the Member Organisations, changes to the Framework shall be clearly indicated.

1.9. Reading Guide

The Framework is structured as follows. Chapter 2 elaborates on the structure of the Framework and provides instructions on how to apply the Framework. Chapters 3 to 6 present the actual Framework, including the Counter-Fraud domains and sub-domains, Principles, and Control Requirements.

2. Framework Structure and Features

2.1. Structure

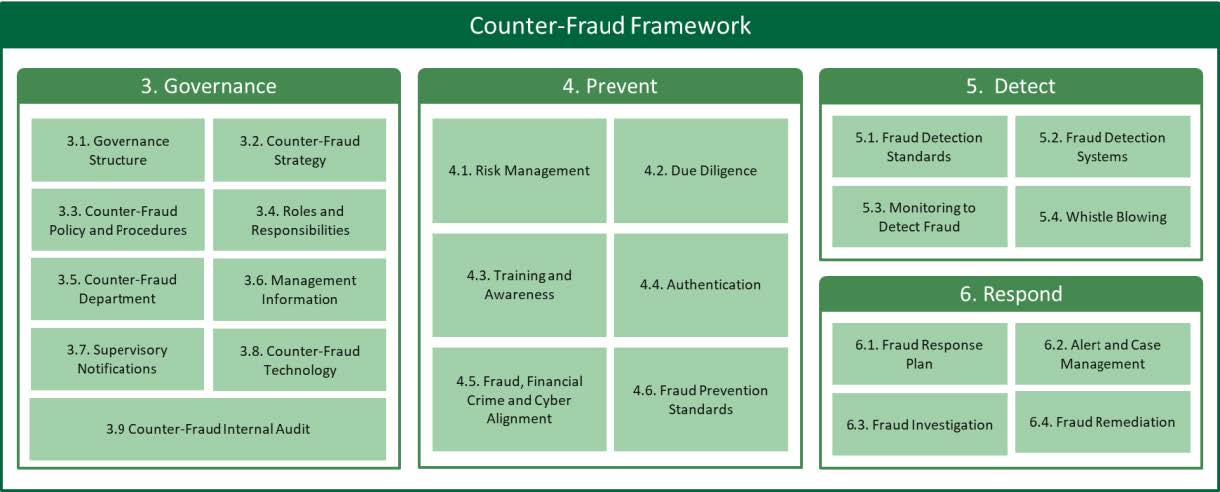

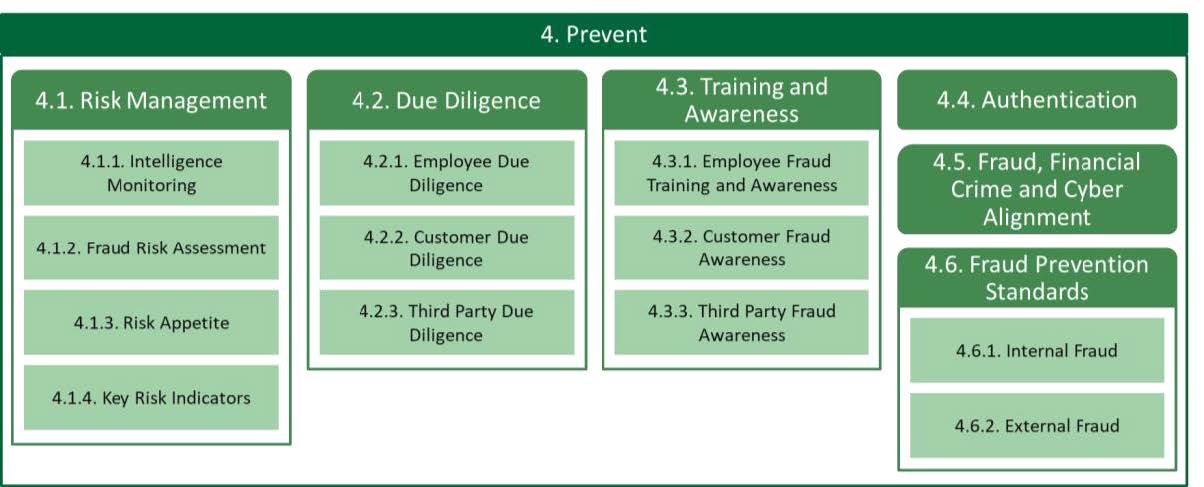

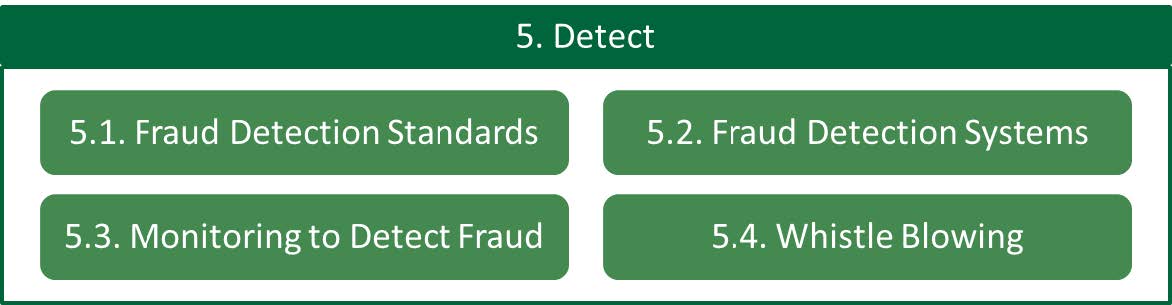

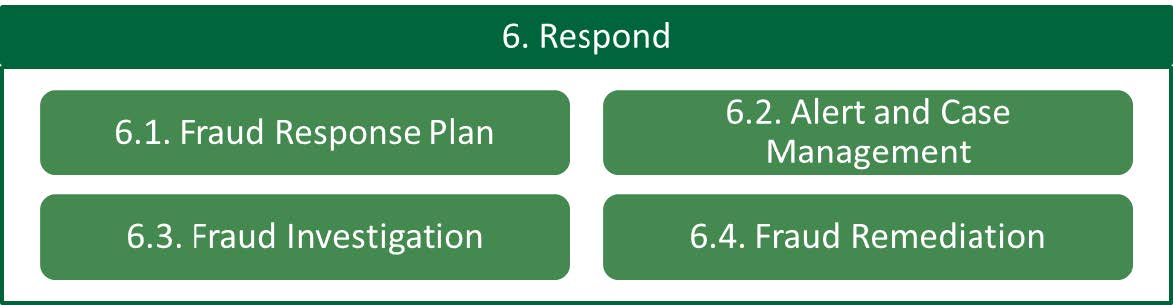

The Framework is structured around four main domains, namely:

Governance

Prevent

Detect

Respond

For each domain, several sub-domains are defined. A sub-domain focuses on a specific Counter-Fraud topic. Where it is helpful to further delineate Control Requirements, a subdomain is split into sub-sectors. Per sub-domain (or sub-section), the Framework states a Principle and related Control Requirements.

A Principle summarises the main set of Counter-Fraud controls related to the sub-domain (or sub-section).

The Control Requirements reflect the mandated Counter-Fraud controls that should be considered by Member Organisations when designing and implementing a Counter-Fraud Programme.

The Framework should be implemented in view of the sub-domains’ Principles along with its associated Control Requirements.

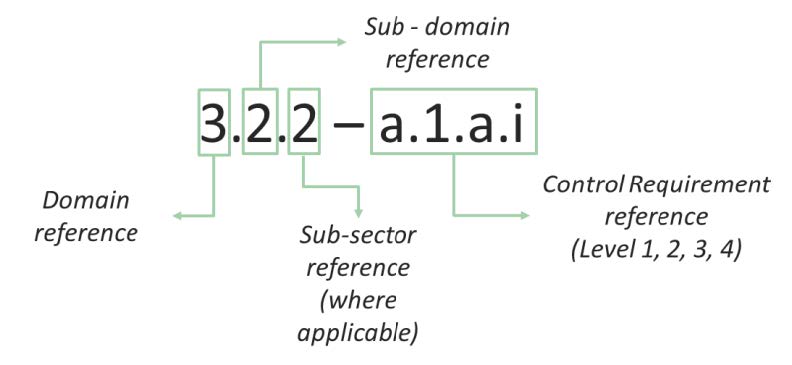

Control Requirements have been uniquely numbered according to the following numbering system throughout the Framework:

Figure 1 - Control Requirements Numbering System

The figure below illustrates the overall structure of the Framework and indicates the Counter-Fraud Framework domains, sub-domains, and sub-sectors, including a reference to the applicable section of the Framework.

Figure 2 - Counter-Fraud Framework Structure

To aid consistency of implementation in Member Organisations, Appendix A contains a glossary of defined terms. Where a defined term is used in the domains and sub-domains in Chapters 3 to 6, it is included in italicised text (e.g., internal fraud, Fraud Risk Assessment, Intelligence Monitoring etc.).

2.2. Principle-Based

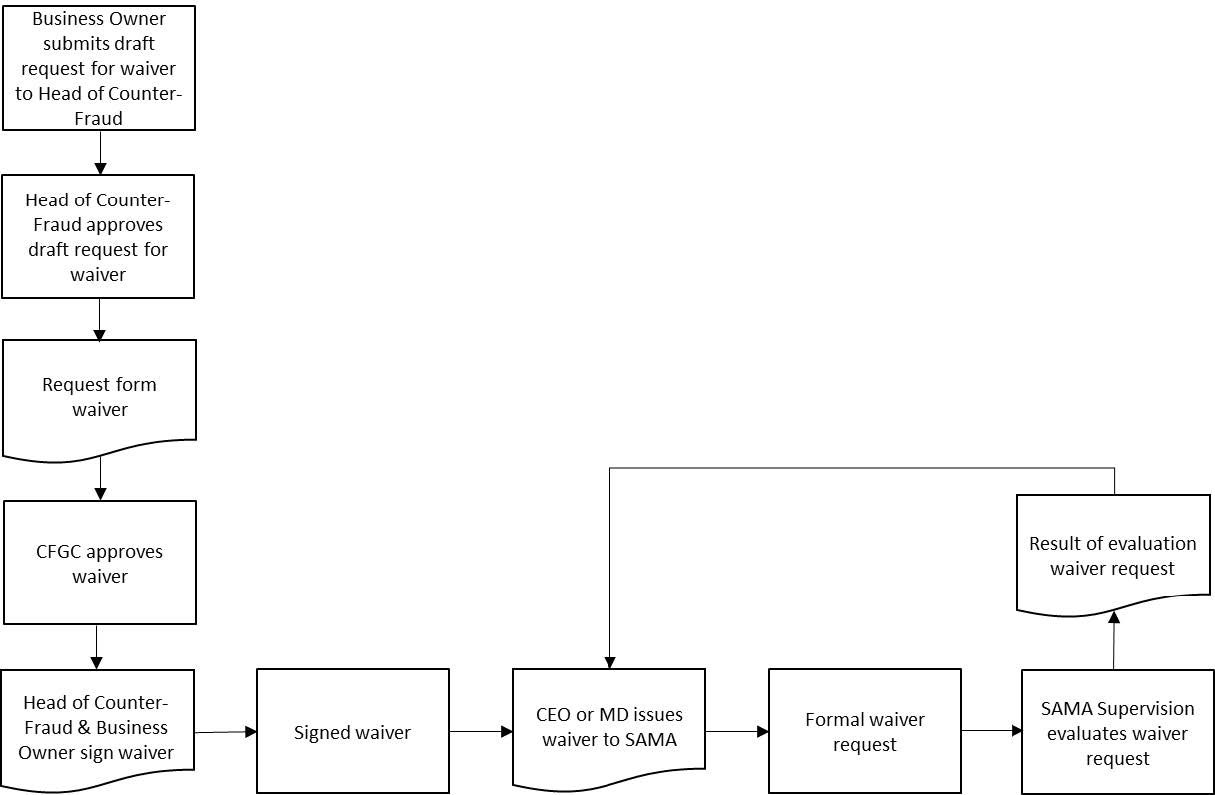

The Framework is principle-based, supported by a specific set of Control Requirements, allowing Member Organisations to adopt a risk-based approach within the applicable laws of the KSA. This means that it prescribes key Counter-Fraud principles to be embedded and achieved by the Member Organisations. The list of mandated Control Requirements provides additional direction and should be considered by Member Organisations. When a certain Control Requirement cannot be implemented, the Member Organisation should follow an exception process involving the consideration of compensating controls proportionate to business operations, pursuing an internal risk acceptance and finally requesting a formal waiver from SAMA. Approval of waiver requests will be at the discretion of SAMA. Please refer to Appendix E for details for the - How to request a Waiver from the Framework - process.

2.3. Self-Assessment, Review and Audit

The implementation of the Framework at the Member Organisations will be subject to a periodic self-assessment. The self-assessment will be performed by the Member Organisations based on a questionnaire. The self-assessments will be reviewed and audited by SAMA to determine the level of compliance with the Framework and the Counter-Fraud maturity level of the Member Organisations. Please refer to '2.4 Counter-Fraud Maturity Model' for more details about the Counter-Fraud Maturity Model.

2.4. Counter-Fraud Maturity Model

The Counter-Fraud maturity level will be measured with the help of a predefined maturity model. The Counter-Fraud Maturity Model distinguishes 6 maturity levels (0, 1, 2, 3, 4 and 5), which are summarised in the table below. In order to achieve levels 3, 4 or 5, Member Organisations should first meet all criteria of the preceding maturity levels.

Maturity Level Definition and Criteria Explanation 0

Non-existent- No documentation.

- There is no awareness or attention for certain Counter-Fraud controls.

- Counter-Fraud controls are not in place. There may be no awareness of the particular risk area or no current plans to implement such Counter-

Fraud controls.

1

Ad-hoc- Counter-Fraud controls are not or partially defined.

- Counter-Fraud controls are performed in an inconsistent way.

- Counter-Fraud controls are not fully defined.

- Counter-Fraud control design and execution varies by department or owner.

- Counter-Fraud control design may only partially mitigate the identified risk and execution may be inconsistent.

2

Repeatable but

informal- The execution of the Counter-Fraud controls is based on an informal and unwritten, though standardised, practice.

- Repeatable Counter-Fraud controls are in place. However, the control objectives and design are not formally defined or approved.

- There is limited consideration for a structured review or testing of a control.

3

Structured and

formalised- Counter-Fraud controls are defined, approved, and implemented in a structured and formalised way.

- Fraud detection system capability is implemented and embedded.

- The implementation of Counter-Fraud controls can be demonstrated.

- Reporting is in place to monitor Counter-Fraud control performance.

- Counter-Fraud policies, standards and procedures are established

- Counter-Fraud controls are implemented and embedded.

- Fraud detection system capability is in place to prevent and proactively detect fraud across all products and channels.

- Compliance with Counter-Fraud documentation (i.e., policies, standards, and procedures) is monitored, preferably using a governance, risk, and compliance tool (GRC).

- Key Performance Indicators are defined and reported to monitor the implementation of controls.

4

Managed and

measurable- The effectiveness of Counter-Fraud controls is periodically assessed and improved when necessary.

- This periodic measurement, evaluations and opportunities for improvement are documented.

- Effectiveness of implemented Counter- Fraud controls is measured and periodically evaluated.

- Key Risk Indicators and trend reporting are used to monitor position against risk appetite and give an early warning of potential emerging issues.

- Results of measurement and evaluation are used to identify opportunities for improvement of the Counter-Fraud controls.

5

Adaptive- Counter-Fraud controls are subject to a continuous improvement plan.

- The enterprise-wide Counter-Fraud Programme focuses on continuous compliance, effectiveness, and improvement of the Counter-Fraud controls.

- Counter-Fraud controls are integrated with enterprise risk management framework and practices.

Table 1 - Counter-Fraud Maturity Model

The objective of the Framework is to create an effective approach for addressing and managing Counter-Fraud risks within the financial sector. To achieve an appropriate CounterFraud maturity level, the Member Organisations should at least operate at maturity level 3 or higher as explained below.2.4.1. Maturity Level 3

To achieve level 3 maturity, a Member Organisation should define, approve, and implement Counter-Fraud controls in line with the Control Requirements of this Framework. This includes the implementation of fraud detection system capability to prevent and proactively detect fraud.

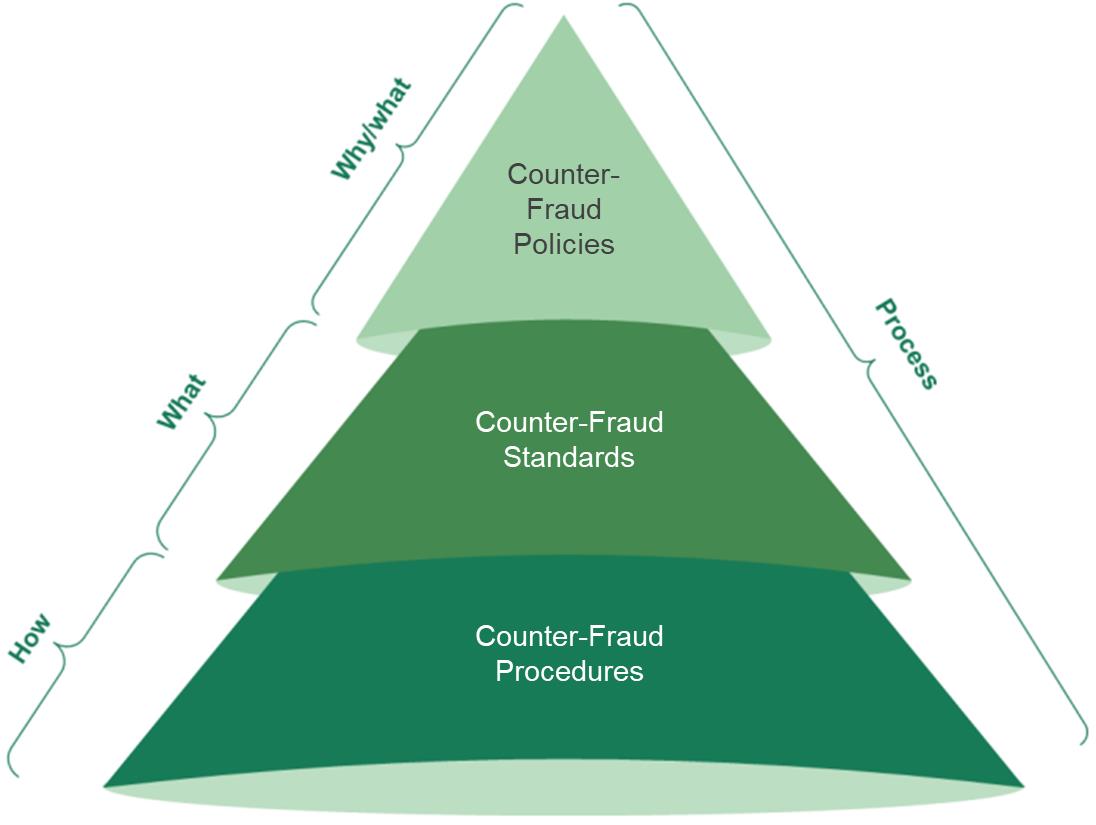

In addition, a Member Organisation should monitor compliance with the Counter-Fraud documentation. The Counter-Fraud documentation should clearly indicate "why", "what" and "how" Counter-Fraud controls should be implemented. The Counter-Fraud documentation consists of Counter-Fraud policies, standards, and procedures.

Figure 3 - Counter-Fraud Documentation Pyramid

The Counter-Fraud Policy should be endorsed and mandated by the Board of the Member Organisation and state "why" countering fraud and protecting customers is important to the Member Organisation. The policy should highlight the overall scope of the Counter-Fraud

Programme, key Counter-Fraud responsibilities and “what” Counter-Fraud principles and objectives should be established.

Based on the Counter-Fraud Policy, Counter-Fraud standards should be developed. These standards define "what" Counter-Fraud controls should be implemented, such as, Due Diligence, authentication, prevention, and detection etc. The standards support and reinforce the Counter-Fraud Policy and are to be considered as Counter-Fraud baselines.

The step-by-step tasks and activities that should be performed by staff of the Member Organisation are detailed in the Counter-Fraud procedures. These procedures prescribe "how" the Counter-Fraud controls, tasks and activities have to be executed in the operating environment.

The actual progress of the implementation, performance and compliance of the Counter-Fraud controls should be periodically monitored using Key Performance Indicators (KPIs).

2.4.2. Maturity Level 4

To achieve maturity level 4, Member Organisations should periodically measure and evaluate the effectiveness of the Counter-Fraud controls implemented to achieve maturity level 3. In order to measure and evaluate whether the Counter-Fraud controls are effective, Key Risk Indicators (KRIs) should be defined. A KRI indicates the norm for effectiveness measurement and should define thresholds to determine whether the actual result of measurement is below, on, or above the targeted norm. KRIs are used to monitor a potential increase in fraud risk exposure and allow actions to be taken to mitigate the risk before an increase in fraud cases occurs.

2.4.3. Maturity Level 5

Maturity level 5 focuses on the continuous improvement of Counter-Fraud controls. Continuous improvement is achieved through continuously analysing the goals and achievements of Counter-Fraud governance and identifying structural improvements. Counter-Fraud controls should be integrated with enterprise risk management practices and supported with automated real-time monitoring to assess control effectiveness. Business process owners should be accountable for monitoring the compliance of the Counter-Fraud controls, measuring the effectiveness of the Counter-Fraud controls, and incorporating the Counter-Fraud controls within the enterprise risk management framework.

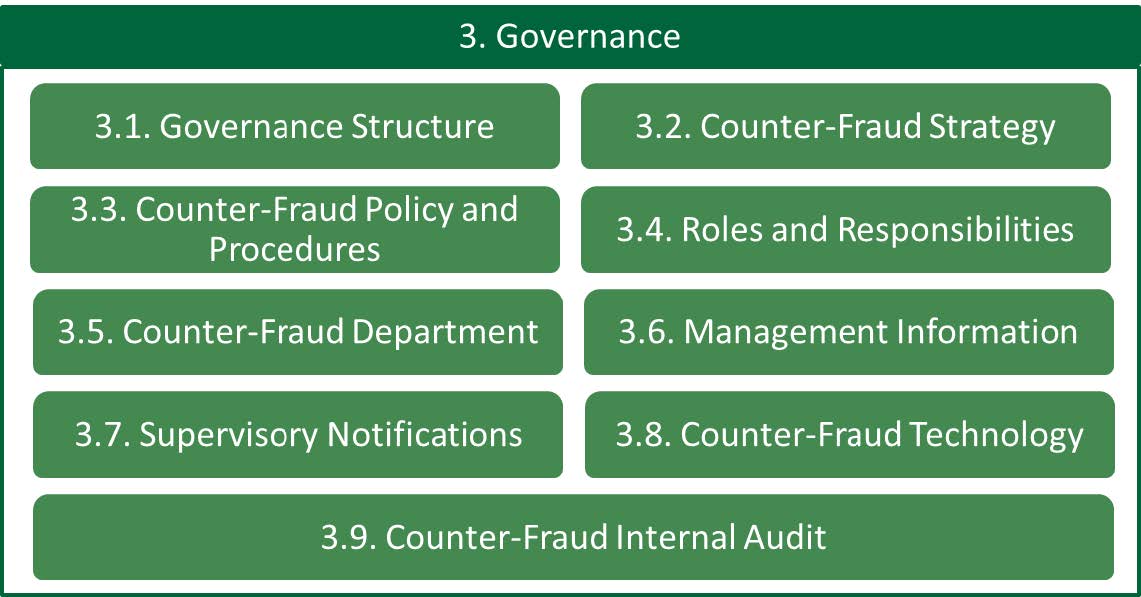

3. Governance

The Board and Executive Leadership of the Member Organisation is ultimately responsible for creation of a Counter-Fraud Programme; providing leadership and direction; and projecting a Counter-Fraud culture inside and outside the organisation. The programme should include a Counter-Fraud Strategy to define organisational objectives, a Counter-Fraud Policy outlining responsibilities and mandatory requirements, and a Governance Structure with associated internal and external reporting aligned to the organisation's size and complexity to monitor and oversee fraud risk management.

Figure 4 - Governance Domain3.1. Governance Structure

Principle

Member Organisations should establish and maintain a Counter-Fraud Governance Structure owned by Senior Management with responsibility for oversight and control of all aspects of the organisational Counter-Fraud Programme.

Control Requirements

a. Member Organisations should establish and maintain a dedicated Counter-Fraud Governance Committee (CFGC).

b. The CFGC should be headed by a member of the Executive Committee (e.g., CEO, CRO or equivalent).

c. The following positions at a minimum should be represented in the CFGC:

1. Head of Counter-Fraud/Senior Manager accountable for the Counter-Fraud Programme.

2. Chief Risk Officer.

3. Chief Operating Officer.

4. Head of Digital.

5. Heads of relevant business departments or product owners (e.g., General Manager of Retail/Corporate).

6. Senior Managers from all departments involved in fraud risk management (e.g., Operational Risk Management, Cyber Security, Counter-Fraud Department, Analytics, Compliance).

7. Internal Audit should attend as an “observer”.

d. A CFGC charter should be developed, approved, and reflect the following:

1. Committee objectives.

2. Authority and accountability of the committee.

3. Roles and responsibilities.

4. Minimum number and role of meeting participants required to meet quorum.

5. Meeting frequency (minimum on a quarterly basis).

6. Escalation process for fraud issues or incidents to Board level.

7. Documentation and retention of meeting minutes and decisions.

e. The CFGC should at a minimum be responsible for:

1. Approving, supporting, communicating, and monitoring:

a. Counter-Fraud Strategy.

b. Counter-Fraud Policy.

c. Fraud Risk Management Framework that should include at a minimum:

i. Intelligence Monitoring process.

ii. Fraud Risk Assessment.

iii. Fraud Risk Appetite

iv. KRIs for fraud.

d. Management Information

2. Providing leadership, direction, and oversight of the Member Organisation’s Counter-Fraud Programme.

f. Member Organisations should appoint an appropriately qualified and experienced Head of Counter-Fraud as accountable for the Counter-Fraud Programme at Senior Management level (see control requirement 3.5.e).

g. Member Organisations should establish a documented and approved process for Counter-Fraud budget and spending prioritisation which should align with fraud strategic objectives.

h. The overall Counter-Fraud budget should be monitored, reviewed periodically, and adjusted accordingly by the CFGC to meet the Counter-Fraud and business needs.

i. Member Organisations should define roles and responsibilities of Senior Management and Counter-Fraud Department employees using a responsibility assignment matrix, also known as RACI. The RACI Matrix should outline who is responsible and accountable for Counter-Fraud processes and controls, as well as who should be consulted or informed.

3.2. Counter-Fraud Strategy

Principle

Member Organisations should define, approve, implement and maintain a Counter-Fraud Strategy aligning to the overall strategic objectives of the organisation that identifies short and long-term Counter-Fraud initiatives and communicates a plan of action to achieve them.

Control Requirements

a. Counter-Fraud Strategy should be defined, approved, implemented and maintained.

b. Counter-Fraud strategic initiatives should be translated into a defined roadmap including but not limited to, consideration of:

1. Timescales to deliver initiatives.

2. The owner responsible for delivering the initiative.

3. How the initiatives will close the gaps between current and target environments.

4. The integration of initiatives into a coherent Counter-Fraud Strategy that aligns with the business strategy.

5. Dependencies, overlaps, synergies and impacts among projects, and prioritisation.

c. Counter-Fraud Strategy should be aligned with:

1. The Member Organisation’s overall business strategic objectives.

2. Broader strategies that may influence fraud risks and controls, e.g., Cyber Security, IT, Financial Crime (Anti-Money Laundering (AML) & Customer Due Diligence (CDD)).

3. Legal and regulatory compliance requirements of the Member Organisation and any other applicable laws in the Kingdom of Saudi Arabia (KSA).

d. Counter-Fraud Strategy should at a minimum address:

1. The current state maturity of the Member Organisation, including the most significant fraud related challenges faced.

2. The people, process, and technology requirements to deliver the strategy and proactively manage fraud within risk appetite.

3. The future direction of the Member Organisation’s Counter-Fraud Programme, and the initiatives required to successfully migrate to the desired future state.

4. Known changes to the fraud landscape (e.g., the increasing digitalisation of financial services products, new external threats, new regulation, or guidance).

e. A Member Organisation should review and when required update its Counter-Fraud Strategy on a periodic basis or whenever there is a material change:

1. Internally (e.g., the Member Organisation’s business model, operational environment, or business strategy).

2. Externally (e.g., the fraud landscape or applicable laws and regulations).

3.3. Counter-Fraud Policy and Procedures

Principle

Member Organisations should define, approve, communicate, and implement a Counter-Fraud Policy to set the commitment and objectives for Counter-Fraud and provide requirements to relevant stakeholders; and associated procedures to outline the step-by-step tasks and activities that should be performed by employees.

Control Requirements

a. Counter-Fraud Policy and procedures should be defined, approved, communicated and implemented.

b. Counter-Fraud Policy and procedures should take into consideration the risks identified in the Fraud Risk Assessment, the evolving fraud landscape and the Member Organisation’s business model and operations, and should be periodically reviewed to ensure the identified risks are managed effectively.

c. Counter-Fraud Policy should be readily accessible to all employees, contractors and relevant third parties, including all branches and majority-owned subsidiaries.

d. Counter-Fraud Policy should require Member Organisations to follow all applicable Counter-Fraud laws and regulations, and payment operator requirements.

e. Counter-Fraud Policy should include at a minimum, the following:

1. A defined owner of appropriate seniority and role (e.g., Head of Counter-Fraud).

2. The Member Organisation’s overall fraud objectives and scope.

3. A statement of the Board’s intent, supporting the fraud objectives.

4. Core requirements to provide a consistent, proportionate, and effective approach to the management of fraud risk.

5. Responsibilities for key stakeholders and relevant third parties who play a role in fraud governance, prevention, detection, or response across the three lines of defence (e.g., Senior Management, Compliance, Internal Audit).

6. Escalation and reporting requirements in the event of a policy breach.

f. Counter-Fraud procedures should outline the step-by-step tasks and activities that should be performed by employees in the operating environment for Counter-Fraud process and control operation (e.g., product risk assessment, alert handling, investigations).

g. For Member Organisations with a headquarters in the KSA, the Counter-Fraud Policy should apply across all international branches and subsidiaries. If the law of another jurisdiction prohibits compliance, an exemption should be documented and approved.

3.4. Roles and Responsibilities

Principle

Member Organisations should define, approve and implement Counter-Fraud roles and responsibilities across the three lines of defence and all relevant stakeholders should have an adequate level of understanding of the expectations related to their role.

Control Requirements

a. Member Organisations should define, approve and implement Counter-Fraud roles and responsibilities for all relevant stakeholders and ensure they have been communicated and understood.

b. The Board should be accountable for:

1. The establishment of a Counter-Fraud Programme.

2. Setting the tone from the top to establish a Counter-Fraud culture through a Code of Conduct (or equivalent).

3. Ensuring that a robust Fraud Risk Management framework is established and maintained to manage fraud risks.

4. Ensuring that sufficient budget for Counter-Fraud is allocated, utilised, and monitored.

5. Approving the CFGC charter.

6. Endorsing (after being approved by the CFGC):

a. The roles and responsibilities of Senior Management accountable for the Counter-Fraud Programme.

b. The Counter-Fraud Strategy.

c. The Counter-Fraud Policy.

d. The output of the Fraud Risk Assessment.

e. Fraud Risk Appetite.

c. The Head of Counter-Fraud should be accountable for:

1. Developing, implementing, and maintaining:

a. Counter-Fraud Strategy.

b. Counter-Fraud Policy.

c. Fraud Risk Assessment.

d. Fraud Risk Appetite.

e. KRIs for fraud.

2. Reinforcing and maintaining the tone from the top to deliver a culture of compliance with the Code of Conduct.

3. Developing a risk-based Counter-Fraud Programme that addresses people, process, and technology, including adequate systems to prevent, detect and respond to fraud.

4. Ensuring that detailed Counter-Fraud standards and procedures are established, approved, and implemented.

5. Ensuring that Counter-Fraud systems and controls remain effective in light of evolving threats identified through Intelligence Monitoring.

6. Periodically informing CFGC on the latest developments on Counter-Fraud strategic initiatives and implementation status.

7. Establishing a Counter-Fraud Department that is adequately resourced and has responsibility for the requirements outlined in sub-domain 3.5.

8. Collating and overseeing organisation-wide Management Information reporting produced in relation to Counter-Fraud risks and performance.

9. Promptly notifying SAMA of new fraud typologies and significant fraud incidents in line with the Supervisory Notification requirements included in sub-domain 3.7.

10. Taking action when a notification is received of any significant fraud incidents, investigations or breaches of Counter-Fraud policy or standards, and reporting to the Board or CFGC as required.

11. Defining the organisation’s ongoing fraud awareness programme in coordination with relevant departments (e.g., operations, Communications, Human Resources (HR)).

d. At a minimum, Senior Management should be accountable for:

1. Ensuring that employees are compliant with the Code of Conduct and CounterFraud policies, standards, and procedures.

2. Ensuring that employees receive training in line with the requirements of the fraud training and awareness programme.

3. Developing and reviewing regular Management Information reporting to monitor Counter-Fraud risks and performance.

4. Notifying the CFGC where escalation is required (e.g., adverse internal findings relating to Counter-fraud controls or fraud risk appetite is exceeded).

5. Managing fraud losses through processes and controls in own area of accountability within the organisation’s agreed Fraud Risk Appetite.

6. Maintaining appropriate systems and controls to prevent, detect and respond to fraud.

e. Manager(s) accountable for fraud operations (e.g., managing fraud alerts, responding to reported fraud and dealing with fraud cases) should be responsible for:

1. Ensuring that all suspected fraud, including system alerts and manual employee and customer referrals are adequately prioritised, investigated and the outcome is appropriately recorded.

2. Taking immediate steps to prevent further exposure and corrective action(s) when a fraud is identified.

3. Notifying relevant external parties (e.g., law enforcement).

f. The Internal Audit function should be responsible for:

1. The identification of a comprehensive set of auditable areas for fraud risk.

2. Assessment and prioritisation of fraud risks during audit planning.

3. Performing fraud audits and producing independent objective reports.

g. All Member Organisation employees should be responsible for:

1. Complying with applicable Counter-Fraud policies, standards, and procedures.

2. Reporting any suspicions of fraud in a timely manner.

h. Member Organisations should ensure that suspected or actual cases of internal fraud are investigated by individuals of appropriate seniority (e.g., if the fraud involves a manager, an individual of higher seniority should take responsibility for the oversight and approval of the investigation); and independence (e.g., internal audit or an equivalent control function should conduct the investigation with the investigators free from potential conflicts of interest).

i. Member Organisations should periodically review the roles and responsibilities of employees with fraud related responsibilities to ensure they reflect best practice, address trending fraud typologies and are aligned with the fraud landscape and business model.

j. Member Organisations should develop a formal Counter-Fraud succession plan in coordination with the HR Department taking into consideration the reliance on key Counter-Fraud employees having critical roles and responsibilities.

3.5. Counter-Fraud Department

Principle

Member Organisations should establish and maintain a Counter-Fraud Department that has responsibility for the day-to-day operation of the Counter-Fraud Programme.

Control Requirements

a. Member Organisations should establish and maintain a Counter-Fraud Department that has responsibility for the day-to-day operation of the Counter-Fraud Programme, including at a minimum:

1. Monitoring and overseeing compliance with Counter-Fraud policies, standards, and procedures.

2. Designing and implementing organisation wide required counter-fraud controls covering people, process and technology dimensions.

3. Performing an in-depth organisation wide Fraud Risk Assessment.

4. Analysis of Counter-Fraud data and intelligence to proactively identify fraud trends.

5. Sharing Counter-Fraud Intelligence with SAMA and other organisations in the sector.

6. Proactively and reactively tuning Counter-Fraud systems.

7. Monitoring of Counter-Fraud Operations.

8. Performing comprehensive fraud investigations, identifying root causes of fraud incidents and documenting corrective actions.

9. Monitoring Fraud Risk Appetite measures and actively engaging a crisis management task force if the defined limit is breached with an impact on customers (see control requirement 4.1.3.d).

10. Ensuring alignment of Counter-Fraud capabilities with Cyber Security and Financial Crime.

11. Periodic reporting to senior management covering at minimum:

a. Fraud Risk Assessment results.

b. Fraud typologies identified.

c. Fraud Risk Appetite measures and performance against thresholds and limits.

d. Operational and customer fraud losses.

b. Member Organisations should assess the most appropriate reporting line for the CounterFraud Department based on organisational structure; decision making authority; visibility to the Executive Committee/Board; and Senior Management accountability and responsibilities.

c. Member Organisations should evaluate the staffing requirements of the Counter-Fraud Department on a periodic basis and in response to material changes to the business, operational and fraud landscape or the Member Organisation Fraud Risk Assessment.

d. Evaluation of staffing requirements should consider both the capacity (number of resources) and the capability (skills and experience) required.

e. The Head of Counter-Fraud should have skills and experience at a minimum consisting of:

1. An in-depth understanding of fraud risks in the financial sector.

2. Strong knowledge of digital fraud threats and common typologies, along with emerging trends impacting financial sector organisations and their customers.

3. Designing and implementing technology and controls based on use-cases to mitigate fraud risks and threats.

4. The use of data and analytics to proactively prevent fraud and protect customers.

f. The Counter-Fraud Department should at a minimum include employees with skills and experience in:

1. Fraud risks and typologies related to the products offered by the organisation (e.g., experience in payment fraud; scams; and social engineering).

2. Fraud risks and typologies related to the delivery channels offered by the organisation, in particular digital channels such as online and mobile.

3. Counter-Fraud data analytics to enable the analysis of large volumes of transactions and proactive identification of fraud threats.

4. Counter-Fraud technology to ensure systems are operating effectively with scenarios relevant to the risks faced by the Member Organisation.

5. The analysis of intelligence and data to identify fraud trends and the root cause of fraud incidents.

6. Fraud investigations, from initial notification of a potential incident to closure and corrective actions.

7. Reporting and production of Management Information to monitor organisational fraud performance.

g. Member Organisations should consider fraud qualifications for roles in the Counter-Fraud Department.

h. Member Organisations should establish a training plan and provide periodic training to develop and maintain the competency of the employees in the Counter-Fraud Department.

i. Where third party services or resources (e.g., contractors or Managed Services) are used to fulfil responsibilities of the Counter-Fraud Department, Member Organisations should ensure the resource is appropriately vetted and monitored.

3.6. Management Information

Principle

Member Organisations should define, approve and implement a process for the reporting of Management Information to enable Senior Management to monitor Counter-Fraud risks and performance.

Control Requirements

a. Member Organisations should define, approve and implement a process for the reporting of Management Information to monitor Counter-Fraud risks and performance.

b. Fraud Management Information should be reported to Senior Management and the CFGC on a periodic basis and on an ad hoc basis as required (e.g., if a new or unusual typology is identified).

c. Member Organisations should coordinate the collation of fraud Management Information to ensure a holistic picture can be reported of all fraud impacting the organisation or its customers.

d. Member Organisations should identify appropriate Management Information to adequately inform Senior Management of Counter-Fraud risks and performance. At a minimum this should include:

1. Fraud Risk Assessment results.

2. Fraud Risk Appetite measures and performance against thresholds and limits.

3. Volume of fraud alerts notified by:

a. Customers

b. Employees

c. Fraud systems

4. Volume and trends of Fraud cases handled, split by product and typology.

5. New typologies identified.

6. Value of near misses or potential frauds that were detected and prevented.

7. Case value of fraud handled (the total value of the fraud case, including actual and potential losses).

8. Fraud losses, split by product, payment type (where applicable) and typology, including:

a. Customer losses

b. Operational losses.

9. Value of customer refunds following fraud.

3.7. Supervisory Notifications

Principle

Member Organisations should immediately notify SAMA of new fraud typologies and significant fraud incidents to mitigate the risk of the fraud impacting additional customers, other organisations, or the financial sector in the KSA.

Control Requirements

a. Member Organisations should notify SAMA General Department of Cyber Risk Control immediately of the following:

1. Any new fraudulent typology whether it resulted in financial loss or not (e.g., type of fraud not previously observed or new scam attempt detected).

2. Where an external person has committed or attempted to commit a significant fraud against it.

3. Where an employee of a Member Organisation has committed a significant internal fraud against one of its customers or may be guilty of serious misconduct concerning honesty or integrity related to the organisation's regulatory obligations.

4. Where Wholesale Payment Endpoint Security Fraud is suspected or identified.

5. Where a significant irregularity is identified in the organisation's accounting records that may be indicative of fraud.

b. When assessing whether a fraud is considered significant to meet the notification requirements above, Member Organisations should consider at a minimum:

1. The value of any monetary loss or potential monetary loss to the organisation or its customers (the value should consider an individual fraud incident or total losses from connected incidents).

2. The number of customers impacted.

3. Reputational damage to the organisation and the wider financial sector.

4. Whether any regulation has been breached.

5. Whether the incident reflects weaknesses in the organisation's Counter-Fraud controls.

6. If the incident has the potential to impact other Member Organisations.

c. Member Organisations should use the standard reporting template in Appendix G to notify SAMA.

d. At a minimum, Member Organisations should include the origin of the incident; the methods used; related parties (internal and external); corrective actions; and losses, if any, in the notification to SAMA. Where all required information is not available at the time of notification, any gaps should be supplied to SAMA promptly as the investigation progresses.

3.8. Counter-Fraud Technology

Principle

Member Organisations should define, approve and implement a strategy for the sourcing or development and implementation of counter-fraud systems and technology to manage the fraud risks they are exposed to.

Control Requirements

a. Member Organisations should define, approve and implement a strategy for the sourcing or development of Counter-Fraud systems and technology to prevent, detect and respond to fraud.

b. Member Organisations should implement Counter-Fraud systems and technology and verify that they are operating as intended.

c. The output of the Fraud Risk Assessment should inform the technology required, and systems should be proportionate to the risk appetite of the organisation.

d. Whether a fraud system is sourced from a vendor or developed in-house, Member Organisations should consider the below requirements at a minimum:

1. The Counter-Fraud Department are engaged in the design and implementation of the system with oversight from the CFGC.

2. The rationale for scenarios developed and thresholds applied is documented.

3. The system and rules are designed or can be customised to align to the products, services, and fraud risks of the organisation.

4. New rules can be implemented on a timely basis to target prevention and detection of new or emerging typologies identified through Intelligence Monitoring.

5. Awareness of rules to prevent and detect potential internal fraud is limited to a restricted, documented set of roles which does not include employees or third parties responsible for the operation of processes and controls being monitored (e.g., branch/customer facing staff or operational payments teams).

6. Configuration changes should follow the System Change Management Principles and Control Requirements in SAMA’s Information Technology Governance Framework (“The IT Governance Framework”).

7. The organisation can explain and outline the fraud threats that scenarios are designed to monitor and mitigate.

8. Where Machine Learning or Artificial Intelligence are used the system should not be 'black box' and should be capable of being audited (e.g., the organisation should have the capability to test what the algorithms are designed to do and whether they are correctly implemented).

9. Business Continuity and IT Disaster Recovery Plans are in place aligned to the requirements of the SAMA Business Continuity Management Framework.

3.9. Counter-Fraud Internal Audits

Principle

Member Organisations should conduct audits in accordance with generally accepted auditing standards and relevant SAMA framework(s) to verify that the fraud control design is adequately implemented and operating as intended.

Control Requirements

a. Member Organisations should ensure that Counter-Fraud audits are performed independently and according to generally accepted auditing standards and relevant SAMA frameworks.

b. Member Organisations should establish an audit cycle that determines the frequency of Counter-Fraud audits.

c. Member Organisations should develop a formal Counter-Fraud audit plan addressing people, process and technology components.

d. The frequency of Counter-Fraud audit should be aligned with the output of the Fraud Risk Assessment and consider the criticality and risk of the Counter-Fraud system, control or process.

e. The Internal Audit function of Member Organisations should complete periodic validation of the implementation of Counter-Fraud related corrective actions, including those resulting from SAMA instruction.

f. Member Organisations should ensure that the Counter-Fraud auditors have the requisite level of competencies and skills to effectively assess and evaluate the adequacy of Counter-Fraud policies, procedures, processes and controls implemented.

g. Counter-Fraud audit reports, at a minimum, should:

1. Include the findings, recommendations, management's response with defined action plan, and responsible party and limitations in scope with respect to the Counter-Fraud audits.

2. Be signed, dated and distributed according to the format defined.

3. Be submitted to the audit committee on periodical basis.

h. A follow-up process for audit observations should be established to track and monitor Counter-Fraud audit observations.

4. Prevent

An effective Counter-Fraud Programme includes fraud prevention processes and controls to facilitate the identification of threats and mitigate the risk of fraud occurring. These processes and controls are proactive and have the objective of stopping a fraudster acting before they can cause harm to the organisation or its customers.

Figure 5 - Prevent Domain

4.1 Risk Management

Principle

A Fraud Risk Management Framework should be defined, approved and implemented, and should be aligned with the Member Organisation’s enterprise risk management process.

Control Requirements

a. The Fraud Risk Management Framework should be defined, approved and implemented.

b. The effectiveness of the Fraud Risk Management Framework should be measured and periodically evaluated using Key Performance Indicators, including at a minimum the volume and value of fraud cases.

c. The Fraud Risk Management Framework should be aligned with the Member Organisation’s enterprise risk management process.

d. The Fraud Risk Management Framework should address at a minimum:

1. Intelligence Monitoring.

2. Fraud Risk Assessment.

3. Fraud Risk Appetite.

4. Key Risk Indicators (KRIs).

e. Fraud risk management activities should involve, but not be limited to, the following stakeholders:

1. Business owners and users.

2. Operational Risk.

3. Counter-Fraud Department.

4. Cyber and IT departments.

5. HR.

6. Digital Department.

4.1.1 Intelligence Monitoring

Principle

Member Organisations should draw on a variety of internal and external data sources to identify and monitor emerging fraud threats.

Control Requirements

a. The fraud Intelligence Monitoring process should be defined, approved, and implemented.

b. When defining the Intelligence Monitoring process, Member Organisations should consider the SAMA Cyber Threat Intelligence Principles.

c. The effectiveness of fraud Intelligence Monitoring should be subject to periodic evaluation to assess whether the sources used are comprehensive and the intelligence collated is aiding the prevention of fraud.

d. The Intelligence Monitoring process should include:

1. Scanning, collation, analysis, assessment and dissemination of information on existing and emerging threats.

2. Capturing relevant details on identified threats, such as modus operandi, actors, motivation, the origin of attacks (e.g., organised crime group, jurisdiction) and type of threats.

3. Taking action to act on existing and emerging threats.

4. Sharing relevant intelligence with internal and external stakeholders (e.g., Cyber, Business Operations or SAMA).

e. Intelligence Monitoring activities should draw on a range of information sources to develop a holistic understanding of the Member Organisation’s fraud landscape. At a minimum, these should include:

1. Internal Audit reports, fraud investigation output and Fraud Scenario Analysis covering attempted and actual fraud to identify trending fraud tactics, techniques, and procedures (TTPs).

2. New and emerging fraud typologies identified by fraud detection systems, fraud investigators or the Counter-Fraud Department.

3. Insights from support functions (e.g., Internal Audit, Compliance, Cyber Security Event and Incident Management).

4. Reliable and relevant external sources on fraud trends both locally and globally, (e.g., government agencies, fraud forums and events, Counter-Fraud system vendors, open-source information, and subscription sources).

f. Member Organisations should, to the extent not prohibited by law or contractual terms, collaborate in sharing Counter-Fraud information including emerging fraud typologies, fraud threat intelligence on the groups who may be perpetrating fraud, TTPs and market trends with Saudi Central Bank and other organisations in the sector.

g. Member Organisations should share log-in information for confirmed fraud cases (e.g., mobile or Device ID, IP address) through the Sectorial Anti-Fraud Committee.

h. Member Organisations should perform analysis of log-in information shared by other Member Organisations to assess the level of exposure for their own customers and record the actions completed on an analysis log sheet which may be subject to independent review.

4.1.2 Fraud Risk Assessment

Principle

Member Organisations should conduct a Fraud Risk Assessment to identify fraud risks to which they or their customers are subject and assess the effectiveness of controls in place to mitigate the risks.

Control Requirements

a. A Member Organisation should conduct an enterprise-wide Fraud Risk Assessment as part of its Counter-Fraud Programme.

b. The Fraud Risk Assessment should be based on a documented Fraud Risk Assessment Methodology.

c. At a minimum, the Fraud Risk Assessment Methodology should include:

1. Identification of the inherent risk of fraud the Member Organisation and its customers are exposed to.

2. An assessment of the likelihood of the inherent risks occurring and the impact on the Member Organisation and its customers if the inherent risks were to occur.

3. Testing of the effectiveness of the controls in place to prevent, detect and respond to the inherent risks identified.

4. Determination of the residual risk of fraud that the Member Organisation remains exposed to following testing of implemented controls.

5. The development of action plans to address residual risk that is outside of risk appetite or could lead to a breach of regulations.

6. The ongoing monitoring of action plans to validate that the risk is brought within appetite.

d. Risks identified in the Fraud Risk Assessment should be recorded in a formal centralised register.

e. Actions to address gaps identified in the Fraud Risk Assessment should be documented in a treatment plan and reviewed for adequacy and effectiveness to reduce risks.

f. The outcome of the Fraud Risk Assessment should be formally approved by the relevant business owner.

g. When assessing fraud risks, Member Organisations should consider:

1. Both frauds committed by persons outside the organisation (external fraud) and frauds committed by or with the assistance of people employed by the organisation (internal fraud).

2. The output of Intelligence Monitoring and threat assessments.

3. Fraud incidents and loss events.

4. The modelling of potential threats to the organisation through Fraud Scenario Analysis.

5. Product risk - Products and services offered and how they could be used to commit fraud.

6. Customer risk - The customer base of the organisation, including, but not limited to the type of customer (e.g., Retail customer, corporate or regulated entity); the number of customers; the level of fraud awareness; and vulnerability to fraud.

7. Delivery channel risk - Channels that a customer can use to contact the Member Organisation or access their products and services, with particular consideration of the risks of remote interaction as digitalisation of products increases.

8. Transaction risk - The methods of conducting transactions, receiving funds, or transferring value.

9. Jurisdiction risk - The additional risks where products and services can be used in a foreign country.

10. Third Party Risk - The use of third parties to deliver services to the organisation or its customers.

11. Wholesale Payment Endpoint Security Risk - End-to-end wholesale payments risks, including communication (Member Organisation to other Member Organisation, Member Organisation to system); systems (Workstation terminal); people; and processes.

h. Member Organisations should ensure that the Fraud Risk Assessment fully considers cyber enabled fraud, including the interaction with the member organisation's Cyber Security risk management model.

i. The Fraud Risk Assessment should be performed at a minimum on an annual basis.

j. Member Organisations should additionally update their Fraud Risk Assessment for changes in the internal or external fraud risk environment. These changes include, but are not limited to:

1. A new gap or weakness identified in the control environment.

2. New regulatory requirements.

3. New products and services.

4. New channels to market and new digital platforms.

5. New business acquisitions.

6. Sale or disposals of parts of the Member Organisation's business.

7. Changes in the internal environment (e.g., organisational structure).

8. New information obtained in fraud Intelligence Monitoring.

4.1.3 Risk Appetite

Principle

Member Organisations should define, approve, and apply their Fraud Risk Appetite when designing and implementing Counter-Fraud systems and controls.

Control Requirements

a. The Fraud Risk Appetite of the Member Organisation should be defined to state the level of fraud risk the Member Organisation is willing to tolerate.

b. The Member Organisation Fraud Risk Appetite should be based on the outcome of the Fraud Risk Assessment and aligned to the overall risk appetite of the organisation.

c. When defining Fraud Risk Appetite, Member Organisations should put in place measures with associated thresholds and limits that address the impact on both:

1. The Member Organisation (e.g., fraud losses, reputational damage); and

2. Its customers (e.g., customer losses, number of fraud victims, inconvenience).

d. In the event that a Fraud Risk Appetite limit is breached with an impact on customers, a Member Organisation should escalate to Senior Management and initiate a crisis management process that should:

1. Involve the CEO and other Senior Managers in the Member Organisation.

2. Require meetings on at least a weekly basis until the issue is resolved and the measure returns to a level within appetite.

e. Fraud Risk Appetite should be reviewed on at least an annual basis and be formally endorsed by the Board.

f. Fraud Risk Appetite should be monitored and updated for material changes to the Member Organisation’s business model.

4.1.4 Key Risk Indicators

Principle

Member Organisations should define, approve, and monitor KRIs to measure and evaluate position against agreed Fraud Risk Appetite and provide an early indication of increasing fraud risk exposure.

Control Requirements

a. The KRIs defined by the Member Organisation should be based on a documented methodology which should require:

1. KRIs to monitor exposure against the risks identified in the Fraud Risk Assessment.

2. KRIs to consider risks to the organisation (e.g., fraud losses, reputational impact, operational management of fraud alerts) and its customers (e.g., customer losses).

3. KRIs to be approved by the CFGC or wider Risk Committee which governs the Counter-Fraud Programme in line with the requirements included in sub-domain 3.1.

4. All KRIs to have a documented owner who is responsible for monitoring the KRI and taking early action if risk exposure exceeds Fraud Risk Appetite.

5. KRIs to be periodically reported to Senior Management and relevant stakeholders (minimum on a quarterly basis).

6. KRIs to be reviewed and updated at a minimum on an annual basis and more frequently in response to material changes to the fraud landscape or the Member Organisation Fraud Risk Assessment.

b. KRIs should be forward looking and provide an early indication of increasing fraud risk exposure rather than simply measuring fraud volumes or losses (e.g., controls rated as ineffective in control testing; failure of employees to complete mandatory fraud training; or fraud alerts not reviewed within defined service level agreements).

c. When developing KRIs, Member Organisations should define thresholds that allow them to determine whether the actual result of measurement is below, on, or above the targeted risk appetite position.

d. Member Organisations should ensure that metrics associated with KRIs are complete, accurate and generated on a timely basis.

4.2 Due Diligence

Principle

Member Organisations should define, approve and implement standards for assessing the fraud risk associated with employees, customers and third parties to prevent the establishment of relationships outside risk appetite and manage fraud risks throughout the duration of the relationship.

Control Requirements

a. Due Diligence standards should be defined, communicated, and implemented.

b. Due Diligence standards should be approved by individuals of appropriate responsibility (e.g., Employee Due Diligence in HR).

c. Due Diligence standards should consider employees, customers and third parties.

d. Due Diligence standards should be aligned to the risks identified in the Fraud Risk Assessment.

e. Member Organisations should review and update Due Diligence standards on a periodic basis and in response to material changes to the fraud landscape, the Member Organisation Fraud Risk Assessment, customer groups serviced by the Member Organisation or changes to the products or services it offers.

f. The effectiveness of the fraud Due Diligence standards should be measured and periodically evaluated.

g. Due Diligence standards should include:

1. The Due Diligence checks and requirements that should be conducted to provide an informed understanding of fraud risk.

2. When Due Diligence should be conducted.

3. The role(s) responsible for conducting and approving Due Diligence.

4. Red flags or warning signs which may indicate increased fraud risk and result in the requirement for escalation or further checks to be completed.

5. Red flags or warning signs which indicate an employee, customer or third party is outside risk appetite and the relationship should be declined or exited.

6. Steps to be taken to exit relationships outside risk appetite.

4.2.1 Employee Due Diligence

Principle

Member Organisations should ensure background checks are conducted on employees, including contractors, to reduce the exposure to internal fraud risks and reputational damage resulting from the actions of staff of the Member Organisation.

Control Requirements

a. Employee Due Diligence measures should reflect the risks of internal fraud impacting the Member Organisation.

b. Employee Due Diligence should have the objective of establishing the identity, integrity, and verifying the credentials of the employee, enabling the Member Organisation to determine whether they are suitable for the position.

c. Employee Due Diligence should consist of screening and background checks on the employee, including but not limited to:

1. Confirmation of identity.

2. Criminal background checks.

3. Conflict of interest checks.

4. Verification of qualifications claimed.

5. Previous employment checks.

d. Employee Due Diligence should be:

1. Conducted as part of the hiring process.

2. Reassessed when an existing employee moves to a new role.

3. Reperformed periodically on a risk-based approach (e.g., re-performance of screening for criminal or fraudulent behaviour to validate that employees remain suitable for the position).

e. Member Organisations should assess roles which represent a high risk of fraud and document any enhanced checks required.

f. The outcome of Employee Due Diligence checks should be retained in line with the Member Organisation’s record management policies for personal information.

4.2.2 Customer Due Diligence

Principle

Member Organisations should establish controls to capture and validate the identity of customers to reduce the exposure to external fraud losses.

Control Requirements

a. When establishing a new customer relationship, Member Organisations should check and verify the identity of the customer to reasonably ensure that it is not exposed to fraud risk.

b. Customer Due Diligence should align with the Member Organisation’s policies on Anti Money Laundering (AML) and Countering Terrorist Financing (CTF).

c. Customer Due Diligence should be conducted as a part of the onboarding process and at appropriate times in the ongoing relationship with the customer (e.g., addition of new credit product).

d. Customer Due Diligence should be enhanced with additional checks for higher risk customers or in response to a perceived increased fraud threat (e.g., if impersonation is suspected or there is a concern on the validity or legitimacy of documents provided to prove identity or evidence financial history).

e. Where a customer relationship is initiated on a remote basis (e.g., online), Member Organisations should assess the risk of impersonation and the set-up of mule accounts, implementing appropriate controls to mitigate the risk, including but not limited to:

1. Ensuring a phone number or National ID/Iqama is linked to one customer application only. In the event an exception is identified (e.g., dependent family member), additional due diligence checks should be conducted to validate the authenticity of the application and monitoring use cases should be developed.

2. Authentication of the account opening request via the National Single Sign-On portal using Biometric based authentication (e.g., facial identification from national trusted party).

3. Verification that the ownership of the phone number is registered to the same user through a trusted party (i.e., the name of the account applicant and national ID match).

4. Including a one-time-password mechanism (OTP) explaining that a new account is being opened as a form of verification. The OTP must be sent to the verified phone number.

5. Notification of the completion of account opening should be sent to verified phone number that is registered for the account as well as to the phone number that is registered in the national single sign-on portal.

6. Requiring the use of a registered National Address.

7. Where a physical card is to be provided, this should be:

a. Sent to the registered National Address of the customer only; or

b. Collected from an ATM with the customer verified using biometric authentication.

8. Following initial set up, restrictions should be placed on the account (e.g., reduced transaction value limit) until such time as the Member Organisation validates that the customer is genuine (e.g., use of biometric authentication mechanism through facial identification from national trusted party periodically, physical presence in a branch or kiosk supported by biometrics, regular pattern of account activity over a period of time).

9. Developing comprehensive use cases to proactively identify potential mule accounts and implementing monitoring of the use cases through detection software (e.g., value of incoming funds, high transaction frequency, transaction patterns that do not fit expected behaviours, sudden increase in activity following dormancy).

10. Measuring and periodically evaluating the effectiveness of controls to mitigate the risk of impersonation and set-up of mule accounts.

4.2.3 Third Party Due Diligence

Principle

Member Organisations should ensure proportionate Due Diligence is conducted on third parties to develop an understanding of fraud risk associated with business relationships and ensure third parties are appropriately managed to mitigate the risk.

Control Requirements

a. Third Party Due Diligence should consist of checks and vetting procedures on a risk-based approach to allow an assessment of the fraud risks presented by the relationship.

b. Third Party Due Diligence should be conducted prior to entering into a commitment for a new relationship

c. Third Party Due Diligence should be reviewed periodically or following a trigger which indicates increased fraud risk (e.g., concerns on the conduct of a third party or its employees; or negative media articles).

d. Third Party Due Diligence should be enhanced for:

1. Higher risk third parties or their representatives

2. Third parties providing critical services to the Member Organisation.

e. Enhanced Third Party Due Diligence checks should include additional steps to assess the fraud risks presented by the relationship (e.g., additional vetting or assessing the third party approach to managing the risk of fraud).

f. Where a Member Organisation outsources services to a third party organisation, that third party should comply with the Member Organisation’s Counter-Fraud Policy or apply an equivalent approach.

4.3 Training and Awareness

Principle

A fraud awareness programme should be defined, approved, and conducted for employees, customers and third parties of the Member Organisation.

Control Requirements

a. The fraud awareness programme should be defined, approved, and conducted to promote awareness of fraud risks, provide education on preventing, detecting, and responding to potential fraud and create a positive Counter-Fraud culture.

b. The fraud awareness programme should include coverage of:

1. Employees of the Member Organisation.

2. Customers of the Member Organisation.

3. Third parties who hold relationships with the Member Organisation.

c. The fraud awareness programme should consist of training, education and awareness materials directly linked to risks and threats identified in the Fraud Risk Assessment.

d. The fraud awareness programme should:

1. Outline the nature, scale and scope of training and education to be delivered.

2. Be tailored to the different target groups.

3. Be delivered via multiple channels.

e. The activities of the fraud awareness programme should be conducted periodically and throughout the year.

f. Member Organisations should ensure that the programme is updated at least annually to account for changes in the fraud threat landscape or in response to new fraud threats identified in Intelligence Monitoring.

g. Where a new or emerging fraud typology may impact the Member Organisation and its customers, Member Organisations should take immediate action to make employees, customers and relevant third parties aware of the threat and preventive measures to be taken (where applicable).

h. Member Organisations should monitor and evaluate the effectiveness of the fraud awareness programme and implement improvements where required.

4.3.1 Employee Fraud Training and Awareness

Principle

Member Organisations should define and deliver an employee fraud training and awareness programme to enable employees to identify fraud and report it promptly.

Control Requirements

a. Counter-Fraud training should enable employees to develop a clear understanding of the Member Organisation's Counter-Fraud policies and procedures and their personal responsibilities in relation to fraud prevention and detection.

b. Training should be provided to all employees at, or shortly after, onboarding and be refreshed at regular intervals.

c. The Member Organisation's fraud training and awareness programme should be risk based, including the requirement for certain employees to be provided with specialised training depending upon the fraud risk associated with their role (e.g., managers with positions of authority, customer facing staff in branches, employees operating CounterFraud controls and fraud investigators).

d. Counter-Fraud training should include a knowledge check to assess whether the employee has understood the content. Employees who do not pass the knowledge check should be required to repeat the training and pass rates should be monitored, with action taken if there are repeated failures (e.g., re-training via another delivery method or removal of authority to operate a Counter-Fraud control until successful).

e. The Board of Directors and Senior Management at Member Organisations should be provided with fraud training tailored to the seniority of the role (e.g., fraud awareness, setting an appropriate culture and governance).

f. Formally delivered training should be augmented by ongoing employee education activity to maintain the general fraud awareness of employees (e.g., issuing reminders and circulars on potential indicators of fraud and common fraud typologies).

g. Member Organisations should maintain records of fraud training delivered to employees and awareness activity conducted.

h. Member Organisations should have a documented process to manage employees who are non-compliant with the training requirements for their role.

4.3.2 Customer Fraud Awareness

Principle

Member Organisations should define and conduct a customer fraud awareness programme of activity to increase customer understanding of fraud risks; help customers to recognise and resist fraud attempts; and inform them how to report fraud.

Control Requirements

a. Customer fraud awareness activity should deliver relevant and timely education to customers and promote fraud awareness.

b. The activity delivered through the customer fraud awareness programme should include, at a minimum:

1. Information on the fraud threats and scams customers may be exposed to.

2. Customer responsibilities about countering fraud.

3. How customers can prevent themselves from becoming victims.

4. How to report to the Member Organisation if the customer believes they have been a victim of fraud.

c. Customer fraud awareness activity should be tailored to the current fraud trends impacting the Member Organisation and its sector, including but not limited to the fraud typologies observed and the point of compromise which led to the fraud (e.g., SMS, email, social media).

d. Customer fraud awareness activity should cover the duration of the customer lifecycle (e.g., onboarding, changes to product holdings, transactions and settlements).

e. Member Organisations should deliver customer awareness materials through all communication channels offered to the customer (e.g., website, mobile app, email, post, and SMS).

f. Member Organisations should provide additional education on fraud protection to customers who may be vulnerable to or have been the victim of a scam (e.g., support on the phone or additional materials via email or post).

4.3.3 Third Party Fraud Awareness

Principle

Member Organisations should define and deliver a proportionate fraud awareness programme to third parties outlining expectations in respect of Counter-Fraud activity and prompt reporting of suspicious activity.

Control Requirements

a. Third party fraud awareness requirements should be documented and agreed in contractual arrangements where applicable.

b. Member Organisations should provide risk-based fraud awareness materials to third parties at the outset of a relationship and refresh periodically as required.

c. Third party fraud awareness requirements should as a minimum include:

1. The creation of a positive Counter-Fraud culture.

2. Third party roles and responsibilities regarding fraud.

3. Tailored messaging aligned to the fraud risks of the services provided by the third party.

4. Reporting mechanisms available to the third party.

4.4. Authentication

Principle

Member Organisations should define, approve, implement and maintain a standard for the authentication of customer, employee and third party credentials and instructions to ensure information is protected and unauthorised access or actions are prevented. This should be risk-based and utilise multi-factor authentication.

Control Requirements

a. A Member Organisation should define, approve, implement and maintain an authentication standard with input from both the Counter-Fraud Department and Cyber Security Team.

b. A Member Organisation's authentication standard should consider the risks identified in its Fraud Risk Assessment and Cyber Security Risk Assessment.

c. The authentication standard should consider both customer access to products and services, and employee and third party access to Member Organisation systems.

d. When defining the authentication standard, Member Organisations should take note of the following Control Requirements outlined in The Cyber Security Framework:

1. 3.3.5 Identity and access management

2. 3.3.13 Electronic Banking Services

e. A Member Organisation's authentication standard should cover both digital (e.g., online services and mobile app) and non-digital (e.g., phone, ATM and branch) channels.

f. Member Organisations should adopt a risk-based approach to authentication with higher risk instructions or activity subject to multi-factor authentication before they are acted upon.

g. Multi-factor authentication conducted by Member Organisations for identification or transaction verification should not solely consist of One Time Passwords (OTPs) sent via SMS. Member Organisations should implement additional factors, including but not limited to:

1. Approval of transactions through Mobile App (e.g., sending a push notification to mobile app on a trusted device).

2. Device characteristics (e.g., trusted/known mobile device).

3. Geolocation (e.g., verifying location, IP address or checking mobile network).

4. Behavioural profile (e.g., variations to usual transaction volume, value, frequency and/or currency).

5. Biometric behavioural profile (e.g., identification of changes in the way a customer or employee uses a browser or device).

h. Where an OTP is sent via SMS, the purpose, amount and merchant name should be clearly defined in line with SAMA approved notification templates.

i. OTPs sent via SMS should be in the language selected by the customer on the account (e.g., Arabic, English).

j. Member Organisations should define high-risk instructions or activity in the authentication standard which should include, but not be limited to:

1. Registration process for online or mobile app product access.

2. Activating a token on a new or additional device.

3. Adding a credit/debit card to a digital wallet on a mobile device.

4. Reset of security credentials following failed attempts to access phone, online or remote facilities.

5. Logging in to digital products from a previously unknown device or location.

6. Payments to an e-wallet or digital wallet.

7. High risk transaction, withdrawals, or transfer of funds (e.g., exceeding pre-defined limits/thresholds, transfers large relative to overall balance or remittance/international transfers).

8. Adding or modifying beneficiaries.

9. Change of account holder details (e.g., address or contact details).

10. Change of language used on the account (e.g., Arabic to English).

11. Reset of password or PIN.

12. Issue and activation of a new debit/credit card.

13. Reactivation of dormant accounts or blocked services.

14. A combination of activity(s) which may be indicative of fraud or account takeover (e.g., aggregated risk score following failed log-in attempts, buying gift cards, use of new device or new geolocation).

k. Member Organisations should require a third authentication factor (e.g., a phone call to the number on the account requiring verification of secure information, a physical visit to a branch, generating a token with a temporary password linked to a device, OTP) to validate an instruction when:

1. A user log-in attempt to mobile and online services is detected as an anomalous session (e.g., a device ID or location is different from previously known log-in parameters, or the IP address is flagged as a risk).

2. A transaction is instructed from a non-trusted device to a newly added beneficiary.

3. An abnormal transfer rate (e.g., five transfers per hour for a retail customer) is exceeded.

l. Member Organisations should restrict activity where an anomalous session is identified to low level transactions until the organisation is able to authenticate the request originates from the genuine customer and can make the device trusted.

1. Low level transactions should be defined by the Member Organisation in Fraud prevention standards (see 4.6).

4.5. Fraud, Financial Crime and Cyber Alignment

Principle

Member Organisations should ensure that Cyber Security, Counter-Fraud and Financial Crime Team operational capabilities are aligned to deter fraud.

Control Requirements

a. Member Organisations should define and implement a process for the alignment of the Counter-Fraud, Cyber Security and Financial Crime Team operational capabilities which should include at a minimum:

1. Defining clear roles and responsibilities between the Counter-Fraud Department, Financial Crime and Cyber Security teams.

2. Cross training between the Counter-Fraud Department, Financial Crime and Cyber Security Teams.

3. The establishment of multi-disciplinary contacts between Cyber, Financial Crime and Counter-Fraud Departments to regularly share knowledge.