Book traversal links for 28. Liquidity

28. Liquidity

| No: 44047144 | Date(g): 27/12/2022 | Date(h): 4/6/1444 | Status: In-Force |

| 28.1 | The disclosure requirements set out in this chapter are: | |||

| 28.1.1 | Table LIQA - Liquidity risk management | |||

| 28.1.2 | Template LIQ1 - Liquidity coverage ratio (LCR) | |||

| 28.1.3 | Template LIQ2 - Net stable funding ratio (NSFR) | |||

| 28.2 | Table LIQA provides information on a bank's liquidity risk management framework which it considers relevant to its business model and liquidity risk profile, organisation and functions involved in liquidity risk management. Template LIQ1 presents a breakdown of a bank's cash outflows and cash inflows, as well as its available high-quality liquid assets under its LCR. Template LIQ2 provides details of a bank's NSFR and selected details of its NSFR components. | |||

| Table LIQA - Liquidity risk management | |

| Purpose: Enable users of Pillar 3 data to make an informed judgment about the soundness of a bank's liquidity risk management framework and liquidity position. | |

| Scope of application: The table is mandatory for all banks. | |

| Content: Qualitative and quantitative information. | |

| Frequency: Annual. | |

| Format: Flexible. Banks may choose the relevant information to be provided depending upon their business models and liquidity risk profiles, organisation and functions involved in liquidity risk management. | |

Below are examples of elements that banks may choose to describe, where relevant: | |

| Qualitative disclosures | |

| (a) | Governance of liquidity risk management, including: risk tolerance; structure and responsibilities for liquidity risk management; internal liquidity reporting; and communication of liquidity risk strategy, policies and practices across business lines and with the board of directors. |

| (b) | Funding strategy, including policies on diversification in the sources and tenor of funding, and whether the funding strategy is centralised or decentralised. |

| (c) | Liquidity risk mitigation techniques. |

| (d) | An explanation of how stress testing is used. |

| (e) | An outline of the bank's contingency funding plans. |

| Quantitative disclosures | |

| (f) | Customised measurement tools or metrics that assess the structure of the bank's balance sheet or that project cash flows and future liquidity positions, taking into account off-balance sheet risks which are specific to that bank. |

| (g) | Concentration limits on collateral pools and sources of funding (both products and counterparties). |

| (h) | Liquidity exposures and funding needs at the level of individual legal entities, foreign branches and subsidiaries, taking into account legal, regulatory and operational limitations on the transferability of liquidity. |

| (i) | Balance sheet and off-balance sheet items broken down into maturity buckets and the resultant liquidity gaps. |

Template LIQ1: Liquidity Coverage Ratio (LCR) | |||

| Purpose: Present the breakdown of a bank's cash outflows and cash inflows, as well as its available high-quality liquid assets (HQLA), as measured and defined according to the LCR standard. | |||

| Scope of application: The template is mandatory for all banks. | |||

| Content: Data must be presented as simple averages of daily observations over the previous quarter (ie the average calculated over a period of, typically, 90 days) in the local currency. | |||

| Frequency: Quarterly. | |||

| Format: Fixed. | |||

| Accompanying narrative: Banks must publish the number of data points used in calculating the average figures in the template. In addition, a bank should provide sufficient qualitative discussion to facilitate users' understanding of its LCR calculation. For example, where significant to the LCR, banks could discuss: | |||

| |||

| a | b | ||

| Total unweighted value (average) | Total weighted value (average) | ||

| High-quality liquid assets | |||

| 1 | Total HQLA | ||

| Cash outflows | |||

| 2 | Retail deposits and deposits from small business customers, of which: | ||

| 3 | Stable deposits | ||

| 4 | Less stable deposits | ||

| 5 | Unsecured wholesale funding, of which: | ||

| 6 | Operational deposits (all counterparties) and deposits in networks of cooperative banks | ||

| 7 | Non-operational deposits (all counterparties) | ||

| 8 | Unsecured debt | ||

| 9 | Secured wholesale funding | ||

| 10 | Additional requirements, of which: | ||

| 11 | Outflows related to derivative exposures and other collateral requirements | ||

| 12 | Outflows related to loss of funding on debt products | ||

| 13 | Credit and liquidity facilities | ||

| 14 | Other contractual funding obligations | ||

| 15 | Other contingent funding obligations | ||

| 16 | TOTAL CASH OUTFLOWS | ||

| Cash inflows | |||

| 17 | Secured lending (eg reverse repos) | ||

| 18 | Inflows from fully performing exposures | ||

| 19 | Other cash inflows | ||

| 20 | TOTAL CASH INFLOWS | ||

| Total adjusted value | |||

| 21 | Total HQLA | ||

| 22 | Total net cash outflows | ||

| 23 | Liquidity Coverage Ratio (%) | ||

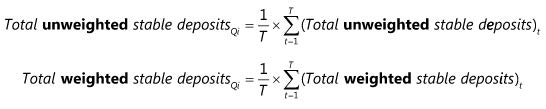

| General explanations Figures entered in the template must be averages of the observations of individual line items over the financial reporting period (ie the average of components and the average LCR over the most recent three months of daily positions, irrespective of the financial reporting schedule). The averages are calculated after the application of any haircuts, inflow and outflow rates and caps, where applicable. For example: | ||

| ||

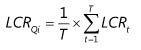

| where T equals the number of observations in period Qi. Weighted figures of HQLA (row 1, third column) must be calculated after the application of the respective haircuts but before the application of any caps on Level 2B and Level 2 assets. Unweighted inflows and outflows (rows 2-8, 11-15 and 17-20, second column) must be calculated as outstanding balances. Weighted inflows and outflows (rows 2-20, third column) must be calculated after the application of the inflow and outflow rates. Adjusted figures of HQLA (row 21, third column) must be calculated after the application of both (i) haircuts and (ii) any applicable caps (ie cap on Level 2B and Level 2 assets). Adjusted figures of net cash outflows (row 22, third column) must be calculated after the application of both (i) inflow and outflow rates and (ii) any applicable cap (ie cap on inflows). The LCR (row 23) must be calculated as the average of observations of the LCR: | ||

| ||

| Not all reported figures will sum exactly, particularly in the denominator of the LCR. For example, "total net cash outflows" (row 22) may not be exactly equal to "total cash outflows" minus "total cash inflows" (row 16 minus row 20) if the cap on inflows is binding. Similarly, the disclosed LCR may not be equal to an LCR computed on the basis on the average values of the set of line items disclosed in the template. | ||

Definitions and instructions: Columns Unweighted values must be calculated as outstanding balances maturing or callable within 30 days (for inflows and outflows). Weighted values must be calculated after the application of respective haircuts (for HQLA) or inflow and outflow rates (for inflows and outflows). Adjusted values must be calculated after the application of both (i) haircuts and inflow and outflow rates and (ii) any applicable caps (ie cap on Level 2B and Level 2 assets for HQLA and cap on inflows). | ||

| Row number | Explanation | Relevant paragraph(s) of SLCR, refer to Illustrative Summary of the Amended LCR for the Factors of each item. |

| 1 | Sum of all eligible HQLA, as defined in the standard, before the application of any limits, excluding assets that do not meet the operational requirements, and including, where applicable, assets qualifying under alternative liquidity approaches. | SLCR28 to SLCR48, SLCR55, SLCR58 to SLCR62, SLCR57 |

| 2 | Retail deposits and deposits from small business customers are the sum of stable deposits, less stable deposits and any other funding sourced from (i) natural persons and/or (ii) small business customers (as defined by SCRE10.18 and SCRE10.19). | SLCR73 to SLCR84, SLCR89 to SLCR92 |

| 3 | Stable deposits include deposits placed with a bank by a natural person and unsecured wholesale funding provided by small business customers, defined as "stable" in the standard. | SLCR73 to SLCR78, SLCR89 to SLCR90 |

| 4 | Less stable deposits include deposits placed with a bank by a natural person and unsecured wholesale funding provided by small business customers, not defined as "stable" in the standard. | SLCR73 and SLCR74, SLCR79 to SLCR81, SLCR89 to SLCR90 |

| 5 | Unsecured wholesale funding is defined as those liabilities and general obligations from customers other than natural persons and small business customers that are not collateralised. | SLCR93 to SLCR111 |

| 6 | Operational deposits include deposits from bank clients with a substantive dependency on the bank where deposits are required for certain activities (ie clearing, custody or cash management activities). Deposits in institutional networks of cooperative banks include deposits of member institutions with the central institution or specialised central service providers. | SLCR93 to SLCR106 |

| 7 | Non-operational deposits are all other unsecured wholesale deposits, both insured and uninsured | SLCR107 to SLCR109 |

| 8 | Unsecured debt includes all notes, bonds and other debt securities issued by the bank, regardless of the holder, unless the bond is sold exclusively in the retail market and held in retail accounts. | SLCR110 |

| 9 | Secured wholesale funding is defined as all collateralised liabilities and general obligations. | SLCR112 to SLCR114 |

| 10 | Additional requirements include other off-balance sheet liabilities or obligations | SLCR112 and SLCR Attachment#2 row 228 to 238. |

| 11 | Outflows related to derivative exposures and other collateral requirements include expected contractual derivatives cash flows on a net basis. These outflows also include increased liquidity needs related to: downgrade triggers embedded in financing transactions, derivative and other contracts; the potential for valuation changes on posted collateral securing derivatives and other transactions; excess non-segregated collateral held at the bank that could contractually be called at any time; contractually required collateral on transactions for which the counterparty has not yet demanded that the collateral be posted; contracts that allow collateral substitution to non-HQLA assets; and market valuation changes on derivatives or other transactions. | SLCR112 to SLCR Attachment#2 row 221 |

| 12 | Outflows related to loss of funding on secured debt products include loss of funding on: asset-backed securities, covered bonds and other structured financing instruments; and asset-backed commercial paper, conduits, securities investment vehicles and other such financing facilities. | SLCR Attachment#2 row 222 and 223. |

| 13 | Credit and liquidity facilities include drawdowns on committed (contractually irrevocable) or conditionally revocable credit and liquidity facilities. The currently undrawn portion of these facilities is calculated net of any eligible HQLA if the HQLA have already been posted as collateral to secure the facilities or that are contractually obliged to be posted when the counterparty draws down the facility. | SLCR page 64 to SLCR Attachment#2 row 228 to 238. |

| 14 | Other contractual funding obligations include contractual obligations to extend funds within a 30-day period and other contractual cash outflows not previously captured under the standard. | SLCR Attachment#2 row 240, 241, and 265. |

| 15 | Other contingent funding obligations, as defined in the standard. | SLCR Attachment#2 page 69 to 71. |

| 16 | Total cash outflows: sum of rows 2-15. | |

| 17 | Secured lending includes all maturing reverse repurchase and securities borrowing agreements. | SLCR Attachment#2 a) page 71 to 72. |

| 18 | Inflows from fully performing exposures include both secured and unsecured loans or other payments that are fully performing and contractually due within 30 calendar days from retail and small business customers, other wholesale customers, operational deposits and deposits held at the centralised institution in a cooperative banking network. | SLCR Attachment#2 row 301, 303, 306, and 307. |

| 19 | Other cash inflows include derivatives cash inflows and other contractual cash inflows. | SLCR Attachment#2 row 316, to 317. |

| 20 | Total cash inflows: sum of rows 17-19 | |

| 21 | Total HQLA (after the application of any cap on Level 2B and Level 2 assets). | SLCR28 to SLCR46, SLCR47 to SLCR annex 1(4), SLCR49 to SLCR54 |

| 22 | Total net cash outflows (after the application of any cap on cash inflows). | SLCR69 |

| 23 | Liquidity Coverage Ratio (after the application of any cap on Level 2B and Level 2 assets and caps on cash inflows). | SLCR22 |

| Template LIQ2: Net Stable Funding Ratio (NSFR) | ||

| Purpose: Provide details of a bank's NSFR and selected details of its NSFR components. | ||

| Scope of application: The template is mandatory for all banks. | ||

| Content: Data must be presented as quarter-end observations in the local currency. | ||

| Frequency: Semiannual (but including two data sets covering the latest and the previous quarter-ends). | ||

| Format: Fixed. | ||

| Accompanying narrative: Banks should provide a sufficient qualitative discussion on the NSFR to facilitate an understanding of the results and the accompanying data. For example, where significant, banks could discuss: | ||

| (a) | drivers of their NSFR results and the reasons for intra-period changes as well as the changes over time (eg changes in strategies, funding structure, circumstances); and | |

| (b) | composition of the bank's interdependent assets and liabilities (as defined in SNSF8) and to what extent these transactions are interrelated. | |

| a | b | c | d | e | ||

| (In currency amount) | Unweighted value by residual maturity | Weighted value | ||||

| No maturity | < 6 months | 6 months to < 1 year | ≥ 1 year | |||

| Available stable funding (ASF) item | ||||||

| 1 | Capital: | |||||

| 2 | Regulatory capital | |||||

| 3 | Other capital instruments | |||||

| 4 | Retail deposits and deposits from small business customers: | |||||

| 5 | Stable deposits | |||||

| 6 | Less stable deposits | |||||

| 7 | Wholesale funding: | |||||

| 8 | Operational deposits | |||||

| 9 | Other wholesale funding | |||||

| 10 | Liabilities with matching interdependent assets | |||||

| 11 | Other liabilities: | |||||

| 12 | NSFR derivative liabilities | |||||

| 13 | All other liabilities and equity not included in the above categories | |||||

| 14 | Total ASF | |||||

| Required stable funding (RSF) item | ||||||

| 15 | Total NSFR high-quality liquid assets (HQLA) | |||||

| 16 | Deposits held at other financial institutions for operational purposes | |||||

| 17 | Performing loans and securities: | |||||

| 18 | Performing loans to financial institutions secured by Level 1 HQLA | |||||

| 19 | Performing loans to financial institutions secured by non-Level 1 HQLA and unsecured performing loans to financial institutions | |||||

| 20 | Performing loans to non-financial corporate clients, loans to retail and small business customers, and loans to sovereigns, central banks and PSEs, of which: | |||||

| 21 | With a risk weight of less than or equal to 35% under the Basel II standardised approach for credit risk | |||||

| 22 | Performing residential mortgages, of which: | |||||

| 23 | With a risk weight of less than or equal to 35% under the Basel II standardised approach for credit risk | |||||

| 24 | Securities that are not in default and do not qualify as HQLA, including exchange-traded equities | |||||

| 25 | Assets with matching interdependent liabilities | |||||

| 26 | Other assets: | |||||

| 27 | Physical traded commodities, including gold | |||||

| 28 | Assets posted as initial margin for derivative contracts and contributions to default funds of central counterparties | |||||

| 29 | NSFR derivative assets | |||||

| 30 | NSFR derivative liabilities before deduction of variation margin posted | |||||

| 31 | All other assets not included in the above categories | |||||

| 32 | Off-balance sheet items | |||||

| 33 | Total RSF | |||||

| 34 | Net Stable Funding Ratio (%) | |||||

| General instructions for completion of the NSFR disclosure template Rows in the template are set and compulsory for all banks. Key points to note about the common template are: | ||

| ||

| Items to be reported in the "no maturity" time bucket do not have a stated maturity. These may include, but are not limited to, items such as capital with perpetual maturity, non-maturity deposits, short positions, open maturity positions, non-HQLA equities and physical traded commodities. | ||

| Explanation of each row of the common disclosure template | ||

| Row number | Explanation | Relevant paragraph(s) of SNSF |

| 1 | Capital is the sum of rows 2 and 3. | |

| 2 | Regulatory capital before the application of capital deductions, as defined in SACAP2.1. Capital instruments reported should meet all requirements outlined in SACAP2 and should only include amounts after transitional arrangements in SACAP5 have expired under fully implemented Basel III standards (ie as in 2022). | SNSF6: |

| - Receiving a 100% ASF (a). - Receiving a 50% ASF (d). - Receiving a 0% ASF (a). | ||

| 3 | Total amount of any capital instruments not included in row 2. | SNSF6: |

| - Receiving a 100% ASF (b). - Receiving a 50% ASF (d). - Receiving a 0% ASF (a). | ||

| 4 | Retail deposits and deposits from small business customers, as defined in the SLCR73-82 and SLCR89-92, are the sum of row 5 and 6. | |

| 5 | Stable deposits comprise "stable" (as defined in SLCR75 to SLCR78) non-maturity (demand) deposits and/or term deposits provided by retail and small business customers. | SNSF6: |

| - Receiving a100% ASF (c). - Receiving a 95% ASF. | ||

| 6 | Less stable deposits comprise "less stable" (as defined in SLCR79 to SLCR81) non-maturity (demand) deposits and/or term deposits provided by retail and small business customers. | SNSF6: |

| - Receiving a 100% ASF (c). - Receiving a 90% ASF. | ||

| 7 | Wholesale funding is the sum of rows 8 and 9. | |

| 8 | Operational deposits: as defined in SLCR93 to SLCR104, including deposits in institutional networks of cooperative banks. | SNSF6: |

| - Receiving a 100% ASF (c). - Receiving a 50% ASF (b). - Receiving a 0% ASF (a). - Including footnote 17. | ||

| 9 | Other wholesale funding includes funding (secured and unsecured) provided by non-financial corporate customer, sovereigns, public sector entities (PSEs), multilateral and national development banks, central banks and financial institutions. | SNSF6: |

| - Receiving a 100% ASF (c). - Receiving a 50% ASF (a). - Receiving a 50% ASF (c). - Receiving a 50% ASF (d). - Receiving a 0% ASF (a). | ||

| 10 | Liabilities with matching interdependent assets. | SNSF8 |

| 11 | Other liabilities are the sum of rows 12 and 13. | |

| 12 | In the unweighted cells, report NSFR derivatives liabilities as calculated according to NSFR paragraphs 19 and 20. There is no need to differentiate by maturities. [The weighted value under NSFR derivative liabilities is cross-hatched given that it will be zero after the 0% ASF is applied.] | SNSF5(A), SNSF6: |

| - Receiving a 0% ASF (c). | ||

| 13 | All other liabilities and equity not included in above categories. | SNSF6: |

| - Receiving a 0% ASF (a). - Receiving a 0% ASF (b). - Receiving a 0% ASF (d). | ||

| 14 | Total available stable funding (ASF) is the sum of all weighted values in rows 1, 4, 7, 10 and 11. | |

| 15 | Total HQLA as defined in SLCR45, SLCR50] to SLCR54, SLCR55, SLCR63, SLCR65, SLCR58, SLCR62, SLCR67, (encumbered and unencumbered), without regard to LCR operational requirements and LCR caps on Level 2 and Level 2B assets that might otherwise limit the ability of some HQLA to be included as eligible in calculation of the LCR: ncumbered assets including assets backing securities or covered bonds. (b)Unencumbered means free of legal, regulatory, contractual or other restrictions on the ability of the bank to liquidate, sell, transfer or assign the asset. | SNSF Footnote 9, SNSF7: |

| - Assigned a 0% ASF (a). - Assigned a 0% ASF (b). - Assigned a 5% ASF. - Assigned a 15% ASF (a). - Assigned a 50% ASF (a). - Assigned a 50% ASF (b). - Assigned a 85% ASF (a). - Assigned a 100% ASF (a). | ||

| 16 | Deposits held at other financial institutions for operational purposes as defined in SLCR93 to SLCR104. | SNSF7: |

| - Assigned a 50% ASF (d). | ||

| 17 | Performing loans and securities are the sum of rows 18, 19, 20, 22 and 24. | |

| 18 | Performing loans to financial institutions secured by Level 1 HQLA, as defined in the SLCR50(c) to SLCR50(e). | SNSF7: |

| - Assigned a 10% ASF. - Assigned a 50% ASF (c). - Assigned a 100% ASF (c). | ||

| 19 | Performing loans to financial institutions secured by non-Level 1 HQLA and unsecured performing loans to financial institutions. | SNSF7: |

| - Assigned a 50% ASF (b). - Assigned a 50% ASF (c). - Assigned a 100% ASF (c). | ||

| 20 | Performing loans to non-financial corporate clients, loans to retail and small business customers, and loans to sovereigns, central banks and PSEs. | SNSF7: |

| - Assigned a 0% ASF (c). - Assigned a 50% ASF (d). - Assigned a 65% ASF (b). - Assigned a 85% ASF (b). - Assigned a 65% ASF (a). | ||

| 21 | Performing loans to non-financial corporate clients, loans to retail and small business customers, and loans to sovereigns, central banks and PSEs with risk weight of less than or equal to 35% under the Standardised Approach. | SNSF7: |

| - Assigned a 0% ASF (c). - Assigned a 50% ASF (d). - Assigned a 65% ASF (b). - Assigned a 100% ASF (a). | ||

| 22 | Performing residential mortgages. | SNSF7: |

| - Assigned a 50% ASF (e). - Assigned a 65% ASF (a). - Assigned a 85% ASF (b). - Assigned a 100% ASF (a). | ||

| 23 | Performing residential mortgages with risk weight of less than or equal to 35% under the Standardised Approach. | SNSF7: |

| - Assigned a 50% ASF (e). - Assigned a 65% ASF (a). - Assigned a 100% ASF (a). | ||

| 24 | Securities that are not in default and do not qualify as HQLA including exchange-traded equities. | SNSF7: |

| - Assigned a 50% ASF (e). - Assigned a 85% ASF (c). - Assigned a 100% ASF (a). | ||

| 25 | Assets with matching interdependent liabilities. | SNSF8 |

| 26 | Other assets are the sum of rows 27-31. | |

| 27 | Physical traded commodities, including gold. | SNSF7: |

| - Assigned a 85% ASF (d) | ||

| 28 | Cash, securities or other assets posted as initial margin for derivative contracts and contributions to default funds of central counterparties. | SNSF7: |

| - Assigned a 50% ASF (a) | ||

| 29 | In the unweighted cell, report NSFR derivative assets, as calculated according to SNSF5 (B) “Calculation of derivative asset amounts”. There is no need to differentiate by maturities. In the weighted cell, if NSFR derivative assets are greater than NSFR derivative liabilities, (as calculated according to SNSF5 (A) “Calculation of derivative liability amounts”, report the positive difference between NSFR derivative assets and NSFR derivative liabilities. | SNSF5 (B) “Calculation of derivative asset amounts” and SNSF7: |

| - Assigned a 100% ASF (b). | ||

| 30 | In the unweighted cell, report derivative liabilities as calculated according to SNSF5 (A) “Calculation of derivative liability amounts”, ie before deducting variation margin posted. There is no need to differentiate by maturities. In the weighted cell, report 20% of derivatives liabilities' unweighted value (subject to 100% RSF). | SNSF5 (A) “Calculation of derivative liability amounts” and SNSF7: |

| - Assigned a 100% ASF (d). | ||

| 31 | All other assets not included in the above categories. | SNSF7: |

| - Assigned a 0% ASF (d). - Assigned a 100% ASF (c). | ||

| 32 | Off-balance sheet items. | SNSF9 |

| 33 | Total RSF is the sum of all weighted value in rows 15, 16, 17, 25, 26 and 32. | |

| 34 | Net Stable Funding Ratio (%), as stated SNSF | SNSF4 |