Book traversal links for Attachment 5.1

Attachment 5.1

No: BCS 290 Date(g): 12/6/2006 | Date(h): 16/5/1427 Status: No longer applicable 5.1 Implementation Proposals for the IRB Approach and Minimum Requirements for Internal Rating System (Attachment 5.4) and Risk quantification system (Attachment 5.5)

Purpose

5.1.1 This section sets out the SAMA’s proposals for implementing the IRB Approach, including the minimum qualifying criteria for adoption of the IRB Approach in Saudi Arabia and the manner in which the SAMA intends to exercise national discretions available under the Approach.

5.1.2 The proposals are based on Basel II. SAMA will take into account the banks views and comparable criteria adopted by other supervisors before finalizing these proposals.

Implementation Approach

Availability and choice of approaches

5.1.3 SAMA plans to allow all available IRB Approaches to banks that are capable of meeting the relevant requirements. SAMA aims to make available for adoption by banks the Foundation Approach and the Advanced Approach from 1 January, 2008 and beyond. Exact timing for implementation would be subject to SAMA’s bilateral discussions with banks.

5.1.4 As a general principle, SAMA will not require or mandate any particular bank to adopt the IRB Approach. Banks should conduct their own detailed feasibility study and analysis of the associated costs and benefits in order to decide whether to use this Approach. Nevertheless, for those banks that are building the IRB systems, adopting this Approach will entail significant changes to their existing systems, the collection of extensive data as well as the fulfillment of many other quantitative and qualitative requirements. It would therefore be more practicable for such bank to start with the Foundation Approach rather than going straight to the Advanced Approach. The possibility of moving straight to the Advanced Approach is however not entirely ruled out, if banks concerned can satisfy the more stringent criteria, in particular the ability to measure Loss Given Default (LGD) and Exposures At Default (EAD).

Application / validation procedures

5.1.5 Banks wishing to adopt the IRB Approach should discuss their plans with SAMA and meet the requirements described in Attachment –5.1. Whether they will be able to use the IRB Approach for capital adequacy purposes is subject to the prior approval of SAMA and to their satisfying various qualitative and quantitative requirements relating to internal rating systems and the estimation of Probability of default (PD) Loss Given Default (LGD); Exposure At Default (EAD) and the controls surrounding them. SAMA will conduct on-site validation exercises to ensure that bank internal rating systems and the corresponding risk estimates meet the Basel requirements. It should however be stressed that the primary responsibility for validating and ensuring the quality of bank internal rating systems lies with its management.

5.1.6 In order to allow sufficient time for the SAMA to carry out the necessary validations on their systems, banks should inform SAMA no later than 30 November 2005 of their final plans in writing if they want to use the IRB Approaches. This will be followed by bilateral meetings to discuss the banks Implementation Plans and state of readiness for adopting the IRB Approaches.

5.1.7 In assessing the eligibility of a bank to adopt the IRB Approach, SAMA will adopt the examination processes as outlined in Attachment 5.I. In the case of banks that are branches of foreign banks, SAMA will liaise with the home supervisory authority particularly on the validation arrangements to assess the extent of reliance that it may place on the validation done by the home supervisor. Other aspects will include their Basel II implementation plans, National Discretion, extent of adoption of Saudi portfolios risk characteristic in their internal classification and risk estimates, etc. This approach is consistent with the Basel Concordat and should help keep duplication of supervisory attention to a minimum.

5.1.8 SAMA will provide the banks with more details regarding the application and approval/examination procedures for use of the IRB Approach. Relevant self-assessment questionnaires will also be issued to banks, to assist SAMA in evaluating banks Implementation Plans.

Proposed work programme and implementation timetable

5.1.9 SAMA will discuss with the banks through the Working Groups and bi-laterally concerning their Implementation Plans and strategies relating to the IRB Approach. These guidance rules, cover the proposals on the exercise of national discretions and the minimum qualifying criteria for transition to the IRB Approach.

5.1.10 Regarding the exercise of national discretion, SAMA has provided clear guidance in this document. Banks may seek further clarifications on national discretion items during the Working Groups meetings and on a bi-lateral basis. (Attachment - 5.3.)

5.1.11 Other rules and guidance on the IRB Approach, including the revised capital adequacy returns for users of this Approach will be issued to banks in the future.

Qualifying Criteria for Adoption of IRB Approach

5.1.12 In order for banks to be eligible to use the IRB Approach for capital adequacy purposes, they should comply with a set of minimum qualifying criteria. These requirements generally cover:

(i) The criteria for transition to the IRB Approach; and

(ii) Other requirements relating to the qualitative and quantitative aspects of IRB systems i.e. rating system (Attachment 5.4) and Risk Quantification System (Attachment 5.5).

Criteria for transition to the IRB Approach

Adoption of IRB Approach across the banking group

5.1.13 SAMA would expect banks to adopt the IRB Approach except for immaterial exposures that have been exempted by SAMA. The fundamental principle is that a clear critical mass of bank’s risk-weighted assets (“RWAs”) (as recorded in the banks solo and consolidated capital adequacy returns) would have to be on the IRB Approach before the bank could transition to that Approach for capital adequacy purposes. In this regard, the amount of immaterial exposures that can be exempt from the requirements of the IRB Approach is subject to a maximum limit of 15% of a bank’s risk-weighted assets. Exempt exposures will apply the Standardized Approach.

5.1.14A Given the data limitations associated with SL exposures, a bank may remain on the supervisory slotting criteria approach for one or more of the PF, OF, IPRE or HVCRE sub-classes, and move to the foundation or advanced approach for other sub-classes within the corporate asset class.

(Refer para 262, International Convergence of Capital Measurement and Capital Standards – June 2006)

5.1.14 SAMA current proposal is that the ultimate level of IRB coverage should be at least 85% of a bank’s RWA’s, a bank may be allowed to transition before reaching this level of coverage if it can satisfy the criteria for adopting phased rollout (see paragraphs 5.1.16 to 5.1.18 below).

5.1.15 Prescribing a minimum level of IRB coverage means that some banks might not qualify to adopt IRB immediately (i.e. on 1 January 2008) but might have to wait until they have achieved the requisite level of coverage. This, SAMA believes, is preferable to a situation in which banks are approved to use IRB when in fact a very significant proportion of their RWAs are not actually on IRB. Given that use of IRB-type systems in Saudi Arabia are not well established, a certain degree of caution is considered prudent, and SAMA does not expect banks to rush to adopting IRB when they are not fully ready.

Consequently, banks planning to use the IRB Approach should conduct a well thought out and a comprehensive feasibility study.

5.1.16 Phased rollout and transition period

A bank may be allowed to adopt a phased rollout of the IRB Approach across its banking group within a transition period of up to three years subject to SAMA being satisfied with its final Implementation Plans. The implementation plan should specify, among other things, the extent and timing for rolling out the IRB Approach across significant asset classes (or sub-classes in the case of retail) and business units over time. The plan should be precise and realistic, and must be approved with SAMA. Further, when a bank adopts the IRB Approach for an asset class within a particular business unit (or in the case of retail exposures for an individual sub-class), it must apply the IRB Approach to all exposures within that asset class (or sub-class) in that unit.

5.1.17 Banks adopting phased rollout should have achieved a certain level of IRB coverage (say, at least 85% of their RWAs) before they could be allowed to use the Approach for capital calculation. By the end of the transition period, all of their non-exempt exposures should have been migrated to the IRB Approach.

5.1.18 Banks adopting the foundation or advanced approaches are required to calculate their capital requirement using these approaches, as well as the 1988 Accord for the time period specified in paragraphs 45 to 49, International Convergence of Capital Measurement and Capital Standards – June 2006

(Refer para 263, International Convergence of Capital Measurement and Capital Standards – June 2006)

Under these transitional arrangements banks are required to have a minimum of two years of data at the implementation of this Framework. This requirement will increase by one year for each of three years of transition.

(Refer para 265, International Convergence of Capital Measurement and Capital Standards – June 2006)

Parallel run and capital floor

5.1.19 There will be a parallel run of Basel II – IRB Approach only.

5.1.20 Banks planning to use the IRB Approach will be subject to a single capital floor for the first three years after they have adopted the IRB Approach for capital adequacy purposes. They should calculate the difference between: (i) the floor as defined in paragraphs 5.1.21 and 5.1.22 below; and (ii) the amount as calculated according to paragraph 5.1.23 below. If the floor amount is larger, Banks are required to add 12.5 times the difference to RWAs. See Example-I for a simple illustration of how the floor works.

5.1.21 The capital floor is based on application of the current Accord. It is derived by applying an adjustment factor to the following amount: (i) 8% of the RWAs; (ii) plus Tier 1 and Tier 2 capital deductions; and (iii) less the amount of general provisions that may be recognized in Tier 2 capital. The adjustment factor for banks using the IRB Approach, whether Foundation or Advanced, for the First year is 95%. The adjustment factor for the Second Year is 90%, and for the Third year is 80%. Such adjustment factors will apply to banks adopting the IRB Approaches during the transition period, i.e. 3 years following the initial period. The timeframe for application of the capital floor and adjustment factors proposed here is different from that in paragraph 46 of the Basel II document. SAMA considers that these rules will ensure a level-playing field for banks that adopt the IRB Approach in different years within the transition period.

5.1.22 For banks using the IRB Approach and AMA approach for operational risk, the floor will be based on calculations using the rules of the Standardized Approach for credit risk. The adjustment factor for banks using the IRB Approaches are given below;

Application of Adjustment Factors

1st year of Implementation 2nd year of Implementation 3rd year of Implementation Basis of Comparison Foundation Approach 95% 90% 80% Current Accord Advanced IRB and or operation risk 90% 80% 70% Standardized Approach 5.1.23 In the years in which the floor applies, banks should also calculate: (i) 8% of total RWAs as calculated under Basel II; (ii) less the difference between total provisions and expected loss amount as described in Section III.G in the Basel II document; and (iii) plus other Tier 1 and Tier 2 capital deductions. Where a bank uses the Standardized Approach for credit risk for any portion of its exposures, it also needs to exclude general provisions that may be recognized in Tier 2 capital for that portion from the amount calculated according to the first sentence of this paragraph.

5.1.24 Should problems emerge during the three-year period of applying the capital floors, SAMA will take appropriate measures to address them, and, in particular, will be prepared to keep the floors in place beyond the third year if necessary.

Transition arrangements

5.1.25 The Basel Committee recommends that some minimum requirements for: (i) corporate, sovereign and bank exposures under the Foundation Approach; (ii) retail exposures; and (iii) the PD/LGD Approach to equity can be relaxed during the transition period, subject to national discretion1.

SAMA recognizes that bank wishing to adopt the IRB Approach may need an extended period of time to develop/enhance their internal rating systems to come into line with the Basel requirements and to start building up the required data for estimation of PD/LGD/EAD. Therefore, SAMA proposes to apply the transition requirement of a minimum of two years of data at the time of adopting the foundation IRB Approach.

The table below sets out SAMA’s arrangements:

Item Requirement Transition Arrangement Requirement Observation period for PD for corporate, bank, sovereign and retail exposures At least 2 years 2 years of data during the transition- same as normal requirement LGD/EAD for corporate, bank and sovereign exposures At least 7 years No transition period Reduction LGD and EADs for retail exposure At least 5 years No transition period Reduction 5.1.27 As a 2 year data observation period may not be enough to capture default data during a full credit cycle, SAMA expects banks to exercise conservatism in the assignment of borrower ratings and estimation of risk characteristics. Banks would need to demonstrate and document their methodology and work in this area.

5.1.28 SAMA will incorporate the above proposals in its final implementation document after taking into account the bank’s comments and any further discussions with the bank and after reviewing each bank’s final Implementation Plans.

Qualitative and quantitative requirements on IRB systems

General

5.1.29 The IRB Approach to the measurement of credit risk relies on banks’ internally generated inputs to the calculation of capital. To minimize variation in the way in which the IRB Approach is carried out and to ensure significant comparability across banks, SAMA considers it necessary to establish minimum qualifying criteria regarding the comprehensiveness and integrity of the internal rating systems of banks adopting the IRB Approach, including the ability for those systems to produce reasonably accurate and consistent estimates of risk i.e. PD’s LGD’s and EAD’s. SAMA will employ these criteria for assessing their eligibility to use the IRB Approach.

5.1.30 The minimum IRB requirements focus on a bank’s ability to rank order and quantify risk in a consistent, reliable and valid manner. The qualitative aspects of an internal rating system, such as rating system design and operations, corporate governance and oversight, and use of internal ratings, are detailed in the “Minimum Requirements for Internal Rating Systems under IRB Approach” Attachment-5.4. Other quantitative aspects covering risk quantification requirements and validation of internal estimates are prescribed in the “Minimum Requirements for Risk Quantification under IRB Approach” (Attachment-5.3). Apart from meeting the relevant minimum requirements, banks’ overall credit risk management practices should also be consistent with the guidelines and sound practices issued by SAMA.

5.1.31 The overarching principle behind the requirements is that an IRB compliant rating system should provide for a meaningful assessment of borrower and transaction characteristics, a meaningful differentiation of credit risk, and reasonably accurate and consistent quantitative estimates of risk. Banks using the IRB approach would need to be able to measure the key statistical drivers of credit risk. They should have in place a process that enables them to collect, store and utilize loss statistics over time in a reliable manner.

5.1.32 The proposed requirements are broadly consistent with the Basel standards. Highlighted below are some specific areas of the requirements.

Use of internal ratings

5.1.33 In order to facilitate banks to transition to IRB over time, SAMA would be flexible in applying the “use” test to a Basel II - compliant internal rating system. Banks would need to demonstrate that such a system has been used for three years prior to qualification.

If the internal rating systems of a bank which is owned by a foreign banking group, have been developed and used at the group level for some time, there may be scope for reducing the three year requirement on a case-by-case basis, depending on the level of group support (e.g. in terms of resources and training) provided to the local bank. This, however, will not absolve local management from the responsibility to understand and ensure the effective operation of the IRB systems at the bank level.

Assessment of capital adequacy using stress tests

5.1.34 For the purpose of assessment of capital adequacy using stress tests, it is proposed that stressed scenario chosen by bank should resemble an economic recession and other economic down turns experiences in KSA.

Definition of default

5.1.35 The proposed definition of default is consistent with SAMA’s regulatory definition set at 90 days. Further, there is the setting of a materiality threshold to an obligor’s credit obligations in determining whether a default is considered to have occurred with regard to the obligor after any portion of the obligor’s credit obligations has been past due for more than 90 days. The purpose of applying materiality to the definition of default is to avoid counting as defaulted obligors those that are in past due only for technical reasons. SAMA’s preliminary intention is to apply the materiality level on a conservative basis i.e. 5% or more of the obligor’s outstanding credit obligations, and banks may set a lower threshold if they choose not to apply the threshold based on their individual circumstances.

5.1.36 The second element is the application of the default definition on a “banking group” or consolidated basis. In other words, once an obligor has defaulted on any credit obligation to the banking group, all of its facilities within the group are considered to be in default. SAMA proposes that a banking group should cover all entities within the group that are subject to full consolidation.

5.1.37 The third element relates to the use of different default triggers in the definition. If a bank owned by a foreign banking group wants to use a different default trigger set by its home supervisor for particular exposures (e.g. 180 days for exposures to retail or public sector entities), the banks should be able to satisfy the SAMA that such a difference in the definition of default will not result in any material impact on the default / loss estimates generated.

Internal validation of IRB Approach

5.1.38 With regard to banks’ internal validation of the IRB Approach, SAMA considers that it should be an integral part of a banks rating system architecture to provide reasonable assurances about its rating system. Banks adopting the IRB Approach should have a robust system in place to validate the accuracy and consistency of their rating systems, processes and the estimation of all relevant risk components. They should demonstrate to SAMA that their internal validation process enables them to assess the performance of internal rating and risk estimation systems consistently and meaningfully. It is proposed that the internal validation process should include review of rating system developments, ongoing analysis, and comparison of predicted estimates to actual outcomes i.e. back-testing.

Way Forward

5.1.39 Given that implementation of the IRB Approach is a challenging task and demands significant time and resources, banks planning to use the IRB Approach on 1 January 2008 and beyond should have already completed in sufficient depth their detailed project evaluations, and their implementation plans be well advanced. They should be prepared to provide the SAMA with the full details of their implementation plan and demonstrate how they are monitoring the progress of their Implementation Plans.

5.1.40 SAMA, in the meantime, will carry on with the work of finalizing its relevant guidance (including the risk-weighting framework), the revised capital adequacy return and completion instructions as well as the approval / validation procedures for the IRB Approach for consulting with the banks during 2006.

1 There are no transition arrangements for the Advanced IRB Approach and the Market based Approach to qualify.

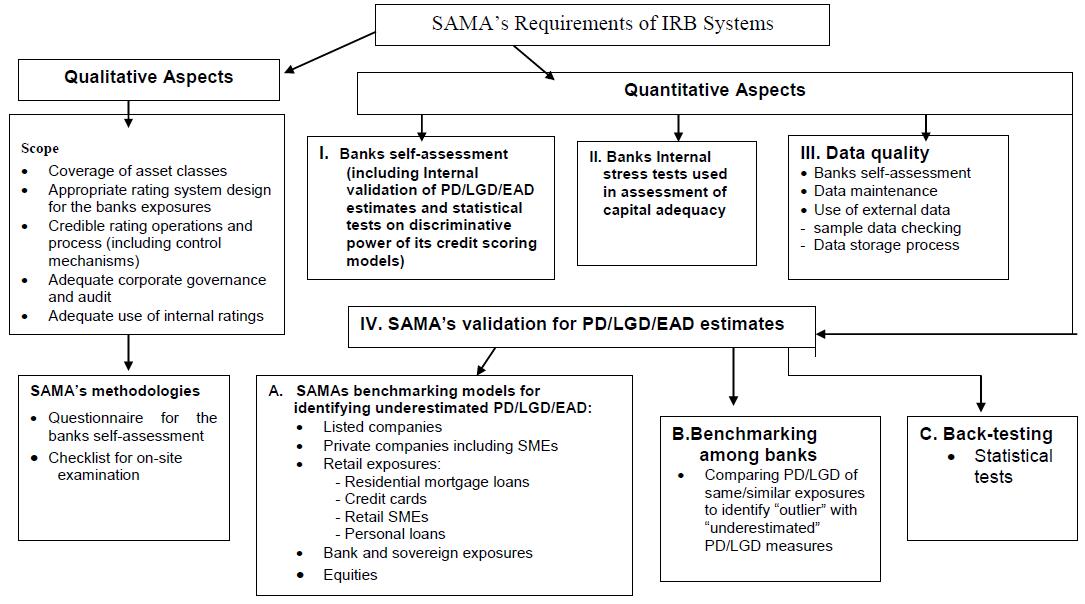

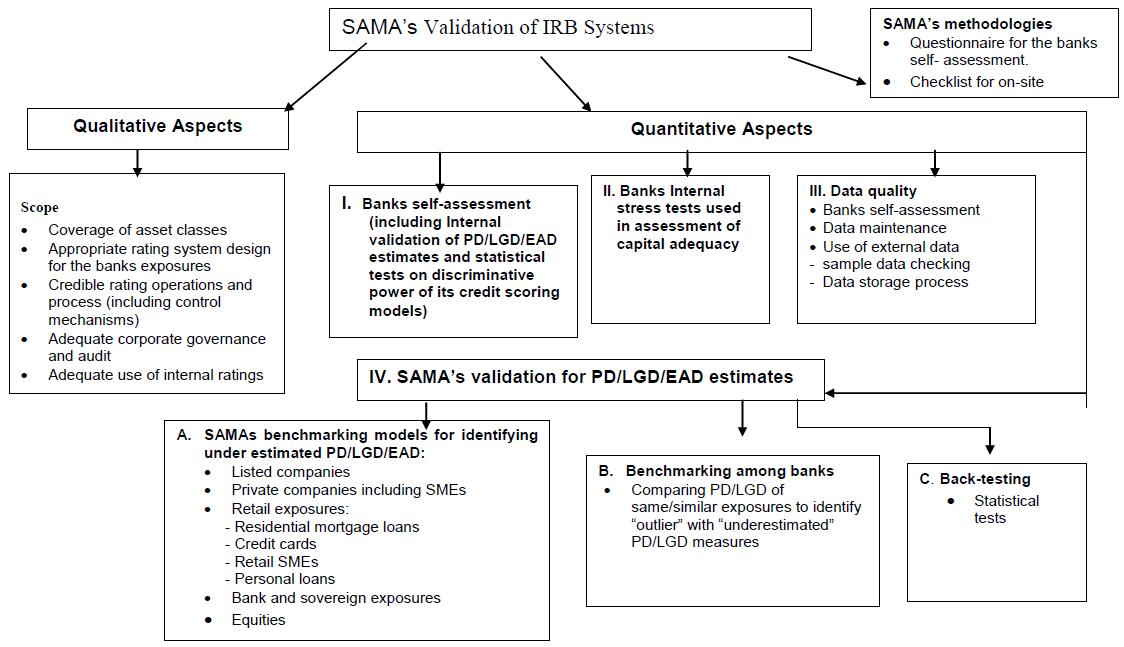

Appendix– 5.1

FIGURE - 1

Book traversal links for Attachment 5.1

2974