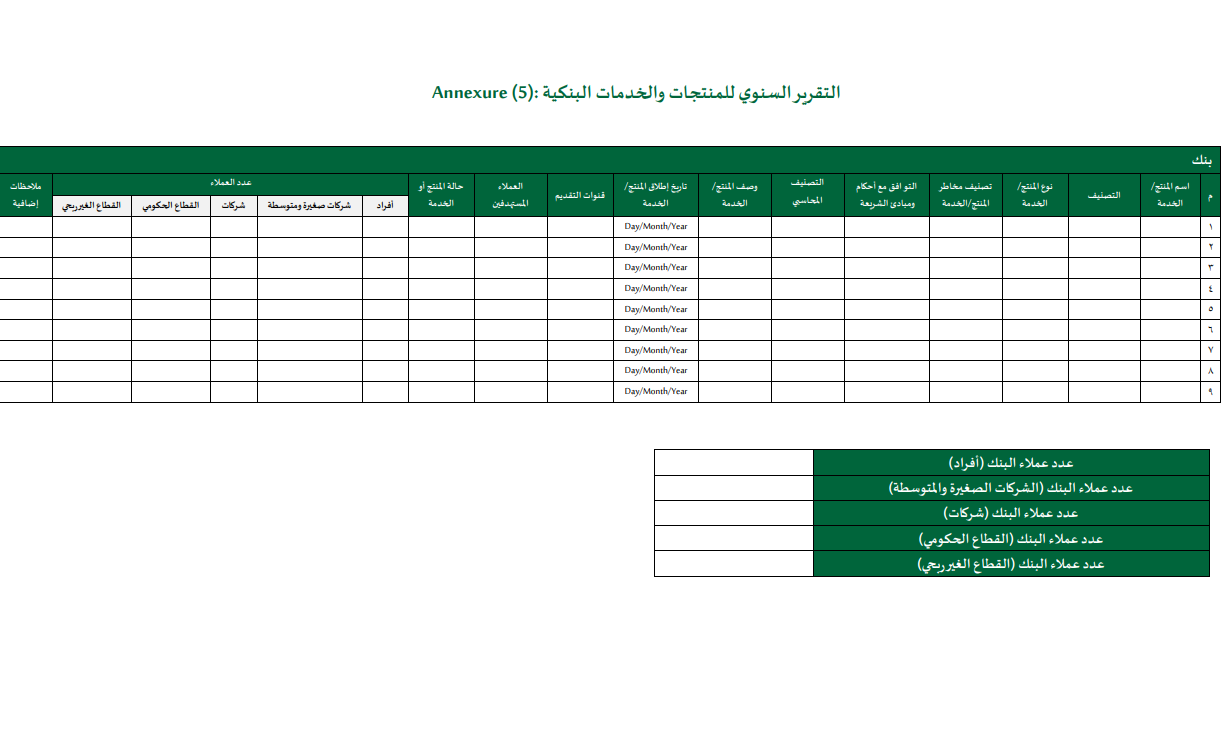

Business Activities and Financial Conduct

Banknotes, Currency, and Cash Movement

Cash Center Operations

Policy for Handling Saudi Banknotes Marked with Security Inks and Compensation

No: 120172/329 Date(g): 12/7/2023 | Date(h): 24/12/1444 Status: In-Force Translated Document

First: Introduction

General framework:

The “Policy for Dealing with and Compensating for Security Marked Banknotes” sets out the rules and controls necessary to organize the mechanism for dealing with and compensating for banknotes marked with security protection inks. The general framework of this policy is summarized in the following main points:

- General controls and specifications for security inks, cash transportation bags and ATM boxes.

- Controls for approving the specifications of cash transportation bags and ATM boxes for service providers.

- Controls for reporting and raising awareness on how to deal with banknotes marked with security inks.

- Controls for receiving seized banknotes.

- Controls for dealing with unseized banknotes.

- Controls for examining and replacing the security-marked banknote.

- Operational cost controls.

- Document retention controls.

Objective:

This policy aims to define the controls and guidelines necessary to organize and control the procedures for handling and replacing Saudi currency banknotes marked with security inks, as well as the general controls and specifications for security inks, cash transport bags and ATM boxes.

Scope:

This policy applies to the Currency Department and all related administrative units, and to dealing with cases of requesting the approval of the specifications of cash transportation bags and ATM boxes, as well as Saudi currency banknotes marked with security inks received by the Central Bank, regardless of whether they are seized or unseized.

Updating and inquiries:

The Currency Department is responsible for updating this policy periodically in coordination with the Center of Excellence, or when there are changes that may impact the policy, as well as responding to any inquiries about it. This policy supersedes any policy or circular related to the content of the policy that was issued prior to the adoption of this policy.

Second: Definitions

Term

Definition

Central Bank Saudi Central Bank. Management Currency management. Marking banknotes Covering some features of Saudi Arabian currency banknotes by self-destructing security ink through self-destruct devices in cash transportation bags or ATM boxes, and the banknotes are considered damaged and unfit for circulation. Seized banknotes Uncirculated banknotes seized subsequent to being marked and identified. Unseized banknotes Banknotes that were circulated among the public after being marked and subsequently seized, but their owner is not identified. Money Carrier Bag A sophisticated bag designed for the secure transportation of money, which facilitates automatic tracking and incorporates a self-destruction mechanism for marking banknotes. Automated teller machine (ATM) boxes Smart boxes are used for the replenishment currency into ATMs and allow for self-destruction by marking the banknotes. The Service Provider the company that imports the cash transportation bags or ATM boxes. The User the organization utilizing the cash bag or ATM box. The Laboratory The laboratory authorized by the authority to test samples of banknotes marked with security inks. The Committee Damaged banknotes compensation committee. DNA Fingerprinting The chemical component in the ink used to mark banknotes and are machine-readable. Third: Policy Content

General Controls and Specifications for Security Inks, Money Bags and ATM Boxes

3.1

Security inks should include the following specifications:

1.1 Have a certificate from an internationally accredited laboratory. 1.2 Must be certified by the Saudi Standards, Metrology, and Quality Organization (SASO). 1.3 It must contain DNA (Taggant). 1.4 Have an integrated Infra-Red (IR) marker. 1.5 Have a dark green color. 1.6 Not being toxic or dangerous to humans. 1.7 Highly stable and impossible to remove with any substance such as: Water, fuel, bleach or cleaning agents. 1.8 Cash Deposit Machines (CDMs), Cash Recyclers (TCRs), self-service machines, and counting and sorting machines should be able to detect and reject counterfeit currency. Cash carriers and ATM boxes must meet the following specifications:

2.1 The materials used in security inkjet technology should not include any materials employed in the production of explosives (according to the requirements of the Ministry of Interior, represented by the Higher Authority for Industrial Security). 2,2 Incorporate a tracking features utilizing satellite or mobile network technology (GPS/GPR Tracking). 2.3 The ability to cover all banknotes with security inks in cash transportation bags and ATM boxes without exception, with a minimum of 20% per banknote once the security inks are activated and dispensed.

Regulations for the approval of specifications for service providers' cash bags and ATM boxes

3.2

- When a service provider applies to the General Directorate of Branches and Cash Centers for a letter of approval regarding the specifications of cash transport cases and ATM boxes, the Directorate must verify the following before granting the approval letter:

1,1 Cash transportation bags and ATM boxes shall use inks in accordance with the specifications for security inks referred to in paragraph (1) of clause (1.3), and cash transportation bags and ATM boxes shall contain the specifications referred to in paragraph (2) of clause (1.3). 1.2 Inform the service provider to bear the operational costs of examining the samples of marked banknotes during the examination. Reporting and Awareness Controls on How to Handle Banknotes Marked with Security Inks

3,3

- The department, in coordination with the Bank Policy Department, must inform the user in a one-time official letter of the following:

1,1 Handing over the seized banknotes to the Central Bank to complete the compensation procedures in accordance with the regulations and procedures approved by the Central Bank. 1.2 Retaining the unseized banknotes, fill out the “Report of a report or seizure of banknotes marked with security inks” form (Annex 3) and send the form with the marked banknotes to the police, and send a copy of the form to the administration. 1.3 Prohibit the circulation of marked banknotes. - The administration must coordinate with the Communication Department to educate the community - in accordance with the approved policies, procedures, and instructions - not to accept marked banknotes, and the need to report any information related to them to the police.

- The administration must take the necessary measures to raise user awareness; to train its employees to identify banknotes marked with security inks and the mechanism for detecting and reporting them.

Controls for Receiving Seized Banknotes

3.4

- Central Bank branches must collect the seized banknotes from the user and hand them over to the administration, and treat them as a cash consignment according to the “Internal and External Cash shipment Policy”.

- The administration must collect the seized banknotes from the user or Central Bank branches and refer them to the committee.

- After submitting an official letter from the user to request compensation for the seized banknotes, the user is required to fill out the “Request for Compensation for Security Marked Banknotes" Form (Annex 1) and the “Declaration of Banknotes for Compensation” form (Annex 2), and the person responsible for receiving the seized banknotes (the cashier) must adhere with the following:

3.1 He shall not receive any controlled banknotes except those of specified number and value. 3.2 Identify the user's name and contact information. 3,3 Receive a copy of the approval letter issued by the Central Bank to the service provider on the conformity of the cash transportation bag or ATM box with the required specifications mentioned in clause (1.3). 3.4 Note the information of manufacturer of the self-destruct device used to mark the seized banknotes and the circumstances under which it was activated. 3.5 Record the serial number of the cash-carrying bag or ATM boxes. 3.6 Request all supporting videos/photos, if any, to be submitted, and a copy of the relevant police report in the event of an attempted takeover. - The seized banknotes shall be presented to the committee to take the necessary measures in accordance with its jurisdiction.

Controls for Dealing with Unseized Banknotes

3.5 - If unseized banknotes are presented to the central bank by:

1,1 The User:

The user is instructed to fill out the form “Banknotes marked with security inks” (Annex 3) and submit the form along with the banknotes to the police, and a copy of the form is sent to the administration.

1.2 Security agencies:

The value of the banknotes should not be reimbursed.

1.3 Individuals:

The value of these banknotes should not be compensated, and they are referred by the administration to the security authorities to ensure that they are not related to a seizure case.

- If unseized banknotes are presented to the central bank by:

Controls for Examining and Replacing Banknotes Marked with Security Inks

3.6

- When the administration receives samples of marked banknotes from the committee for the purpose of examining them, the administration must send the samples to the laboratory to obtain the concentrations of security inks and a detailed report on the results of the examination, and return the samples after completion, and the administration must submit the technical report to the committee.

- The user shall be compensated for banknotes marked with security inks based on the committee's recommendation and the authorization holder's approval of the compensation. Without prejudice to the provisions of this policy, the seized banknotes to be compensated shall be considered as damaged banknotes and compensation shall be subject to the controls contained in the “Damaged Banknotes Compensation Policy".

Operational Cost Controls

3.7

- The Administration shall inform the Service Provider or the User, as the case may be, to bear the cost of examining the samples of the marked banknotes.

- The Administration shall inform the User of the operational costs of replacing the seized banknotes according to the following:

2.1 The value specified in the approval of the authorizing authority for each marked banknote in cases of proven negligence in handling cash transport bags and ATM boxes. 2,2 The cost of transporting the seized banknotes to be compensated in case the user wants the Central Bank to transport them from one of its branches to the main center. Document Retention Controls

8,3

- The original “Request for Compensation for Banknotes Marked with Security Inks” form (Annex 1), “Declaration of Banknotes for which Compensation is requested” form (Annex 2), copies of the rest of the documents, the committee's recommendation for compensation, and the approval of the authority holder thereof shall be retained by the administration for one year in paper form, and then destroyed after being archived in a content management system.

Fourth: References

Reference

Reference Details

Banking Control Law Issued by Royal Decree No. (M/5) dated 22/02/1386 H Mechanism for Compensating Damaged Cash Marked with Security Inks No. (41025174) dated 12/04/1441 H Minister of Finances approval on considering the banknotes marked with private security inks as non-compensable Approval No. (5002) issued on 13/06/1439 H Governor's approval on the circular and compensation No. (43459/80) dated 17/03/1441 H. Damaged Banknote Replacement Policy Version No. 2.0 dated 06/08/1439 H. Criteria and Requirements for Operating a Money Transportation Service No. (53506/198) dated 13/04/1440 H. Fifth: Adjusting the Document

Relevant Department

Related Departments

Advisory Departments

Director of the Department

Currency management

- General Administration of Branches and Cash Centers.

- General Administration of Bank Supervision.

- Communication Department.

- General Department of Legal Affairs.

- Risk and Compliance Department.

- Internal Audit Department.

Dr. Naif bin Abdullah Al-Sharaan

17/03/2023 G

Recommendation of the General Department of Legal Affairs

Signature

Date

Mohammed bin Othman Al-Abduljabbar

18/01/1445 H

Recommendation of the Deputy Governor for Finance and Administrative Affairs

Signature

Date

Abdul Elah bin Abdulaziz Al-Duhaim

11/02/1445 H

Approval of the Governor

Signature

Date

Ayman bin Mohammed al-Siyari

12/02/45 H

List of Releases

Previous Release Date

New Release Date

Original Release Number

New Release Number

Policy for handling and replacing security-marked Saudi Arabian currency banknotes -

12/02/1445 H

-

1,0

Scope of Distribution

Archiving

√ Currency Management

√ General Administration of Branches and Cash Centers.

√ General Directorate of Banking Supervision.

√ Communication Management

√ Central Bank Branches.

√ The original document: To be kept at the Support Services Division.

√ The original document: To be kept at the Center of Excellence.

- General Administration of Branches and Cash Centers.

Annexures

Annexure (1): Form for Requesting Compensation for Banknotes Marked with Security Inks

نموذج طلب تعويض عن الأوراق النقدية الموسومة بالأحبار الأمنية

اسم المستخدم/_________________________________ممثل المستخدم________________________________

رقم الهوية__________________________________________رقم الهاتف___________________________________

رقم الجوال _______________________البريد الإلكتروني_________________ص:ب_________________

الرمز البريدي_______________________ المدينة_______________________

رقم الوكالة وتاريخها ومصدرها_______________________________________________________

ملاحظات: يجب أن تكون الأوراق النقدية الموسومة جافة ومرتبة حسب الفنة، وأن تحتوي كل رزمة على مئة ورقة من الفئة نفسها. مصنع جهاز الإتلاف الذاتي___________________________________________

رقم الحقيبة التسلسلي________________________________

الفئة_______________________________________

عدد الأوراق النقدية______________________________________________________

قيمة المبلغ كتابة____________________________________________________________________________________

أسباب تلف الأوراق النقدية المطلوب التعويض عنها:

• محاولة سرقة • سوء استخدام حقيبة نقل النقود/صندوق أجهزة الصرف الآلي

• أسباب تقنية • أخرى/.....................................

المرفقات المطلوبة:

• تقرير/مشهد من الدفاع المدني- إن وجدت

• تقرير من مزود الخدمة في حال أن التلف ناتج من خلل فني في حقيبة

نقل النقود/صندوق أجهزة الصرف الآل • تقرير/مشهد من الشرطة-إن وجدت

• كل ما يدعم من مقاطع فيديو/صور-إن وجدت • إقرار عن أوراق نقدية مطلوب التعويض عنها

• استلام صورة خطاب الموافقة الصادرة من البنك المركزي لمزود • وكالة

الخدمة على مطابقة حقيبة نقل النقود أو صندوق أجهزة الصرف

الآلي للمواصفات المطلوبة

أرغب في أن يكون تحويل قيمة التعويض المعتمد من صاحب الصلاحية:

للحساب البنكي (رقم آيبان)__________________________________________________________________

لدى مصرف/بنك_________________________________________________________________________

وسيلة أخرى______________________________________________________________________________

أتعهد بتحمل فيمة فحص عيّنات الأوراق النقدية الموسومة بالأحبار الأمنية في المختبر، وقيمة التكاليف التشغيلية لتعويض الأوراق النقدية الموسومة بالأحبار الأمنية. وفق الضوابط التي يضعها البنك المركزي في هذا الشأن.

اسم المستخدم/ الوكيل__________________________________ توقيعه__________________________________

اسم وتوقيع أمين الصرف اسم وتوقيع رئيس العمليات النقدية

________________________________ _____________________________

رقم العملية في النظام الآلي:______________________________________________________________________ الإجراء بالفرع / خزينة المركز بعد اعتماد صاحب الصلاحية لقيمة مبلغ التعويض تم السداد للمستفيد

• التحويل للحساب • أخرى

رقم العملية (الحوالة) الآلية

_________________________________________

اسم أمين الصندوق وتوقيعه ______________________________________________________________

الإجراء في خزينة المركز الرئيسي بعد مرور سنة مالية على اعتماد قيمة المبلغ المعوض لعدم التمكن من التواصل مع المستفيد _______________________________

رقم العملية من النظام الألي ______________________________________________________________________

مستلم النموذج من شعبة العمليات المصرفية ____________________________________________________________

الاسم _______________________________________ التوقيع___________________________________________________

Annexure (2): Declaration of Banknotes to be Compensated

إقرار عن أوراق نقدية مطلوب التعويض عنها

معلومات مندوب المستخدم

الاسم:............................................... رقم الهوية:.....................................

رقم الجوال:........................................ جهة العمل:.....................................................

موقع المراجعة:...................................

تاريخ المراجعة: يوم الموافق / /١٤هـ أتعهد أنا............................................................................................................................. أن بيانات المبلغ النقدي المطلوب التعويض عنه صحيحة حسب الموضح أدناه: مصدر النقد: ..................................................................................................................... ملكية النقد: ................................................................................................... المبلغ التقريبي: ............................................................................................................ الفئات النقدية:............................................................................................................... سبب تلف النقد: ........................................................................................ كما أتعهد بمعرفتي أن تعمد إتلاف العملة السعودية يتم المعاقبة عليها وإذا كانت تحتوي على نقد مزيف فسيتم تطبيق الأنظمة والتعليمات ذات الصلة، وأتعهد بدفع أي تكاليف تشغيلية تفرض وفق تعليمات البنك المركزي. الاسم: ..........................................................................التوقيع,............................................... : خاص بموظفي الخزينة

اسم المسئول: ...............................................................................................................

وظيفة المسئول:.............................................................................................................

التوقيع:................................................................................

Annexure (3): Reporting and Seizure of Banknotes Marked with Security Inks

محضر إبلاغ أوضبط أوراق نقدية موسومة بالأحبار الأمنية

رقم الصادر

/ / 20م

لموافق

/ / 143هـ

التاريخ

ضبط

بلاغ

الحصول على الأوراق النقدية الموسومة عن طريق

أخرى

شخص

مركز الشرطة

الشرطة

محل تجاري

مصرف

بنك

مكان الحصول على الأوراق النقدية الموسومة

الجنسية

البلد

مكان الولادة

العائلة

اسم الجد

اسم الأب

الاسم الأول

مقدم الأوراق النقدية الموسومة

مصدرها

تاريخها

رقمها

نوعها

الهوية

المهنة

التعليم

الحالة الإجتماعية

أنثى

ذكر

الجنس

هاتف

العمل

العنوان

هاتف

السكن

هاتف

الاسم

الكفيل

هاتف

العنوان

وصف الأوراق النقدية الموسومة بالأحبار الامنية

الرقم التسلسلي

العدد

الفئة

نوع العملة (الإصدار)

المبلغ

مستقبل البلاغ

التوقيع

الاسم

الرتبة

الوظيفة

الاسم

البصمة

التوقيع

صورة / لملف القضية.

صورة / للأمن العام / الامن الجنائي / إدارة التحريات والبحث الجنائي - فاكس (0114054216).

صورة / للبنك المركزي السعودي إدارة العملة - Currency@Sama.gov.sa

Providing Small Denominations and Coins

Referring to the instructions of SAMA communicated under Circular No. 341000111354 dated 15/09/1434 H regarding the acceptance and exchange of banknotes and coins by banks operating in the Kingdom to meet public demand.

Accordingly, SAMA emphasizes the need of having sufficient quantities of small denomination banknotes and coins to meet the public's requests for obtaining or exchanging them. This should be made available to everyone at all branches.

For your information and action accordingly, please note that SAMA will conduct field visits to cash centers and bank branches to ensure the availability of various small denominations and coins for individual and corporate customers.

Replacing Damaged Saudi Banknotes

Further to the instructions of SAMA communicated under Circular No. 34734, dated 10/7/1432 H regarding exchanging damaged banknotes from beneficiaries (torn, burned, eroded, incomplete edges or parts, or any of the main features missing due to dirt, adhesive materials, or inappropriate inscriptions, ...).

And based on SAMA's commitment to providing intact banknotes and suitable for circulation, SAMA affirms the acceptance and exchange of various currency denominations after verifying their authenticity with the adoption of the specific mechanism for accepting and compensating damaged currency presented by the public.

1 The replaced banknote must be clearly visible and its area shall not be less than 60% of the size of the original banknote. 2 The two signatures (Minister of Finance and Governor of SAMA) or the two serial numbers must not be missing. 3 If the banknote is not clearly visible due to exposure to fire or other natural factors such as corrosion, the holder must present it to one of the branches of SAMA For your information and action accordingly, and to emphasize to all bank branches, cash centers to circulate intact banknotes and withdraw damaged and invalid cash from circulation, and to coordinate with SAMA's branches to supply it.

Commitment to Employing Citizens in Cash Centers

Further to SAMA Circular No. 341000068320 dated 03/06/1434 H concerning the Compliance with Employing Citizens and the Requirements for Contracting with Recruitment Service Companies, and as stated in clause one, Paragraph (2), which specifies that all positions in branches, remittance centers, and cash centers should be exclusively occupied by Saudis, with the aim of completing the Saudization process by 31/12/2013, it has come to our attention that there are still non-Saudi employees working in cash centers, whether as bank staff or employees of contracted companies, which is a violation to the regulations and exposes banks and companies to severe penalties.

Therefore, we hope you will provide us with proof of compliance with the aforementioned instructions and submit a detailed list of employees working in the bank's cash units and centers, as well as those in exchange companies or centers affiliated with contracted companies, including the following information:

Name Nationality National ID/Residence Number Job Title Name of the Cash Center

Please send the completed form to the Cash Centers and Operations Supervision Department at SAMA within a maximum one week from its date.Techniques to Identify Banknotes

No: 281000041965 Date(g): 4/11/2007 | Date(h): 24/10/1428 Status: In-Force Translated Document

Based on the requirements of Article 4 and Article 5 of The Money Counterfeiting Law 1379H issued by Royal Decree No. (12) dated 21/7/1379H, regarding the establishment of regulations for issuing licenses for currency reproduction in a manner that ensures measures for preventing counterfeiting and protecting it from similar-looking papers and coinages. To ensure the circulation of only genuine currency in the Kingdom of Saudi Arabia, you will find attached the updated regulations for currency reproduction in the Kingdom of Saudi Arabia. We hope that you will act according to them and revoke any previous directives issued in this regard. Applications for obtaining reproduction licenses can be submitted through the central bank's website.

First: General Instructions

- It is prohibited for any natural or legal person to clone, photograph, or use images or designs of any Saudi or foreign currency circulated within the Kingdom for commercial, media, or cultural purposes without obtaining prior authorization from the Saudi Central Bank.

- It is strictly prohibited to use images, replicas, or designs of Saudi and foreign currencies circulated within the Kingdom in the form of paintings, crafts, models, product packaging, or in the shape of money and others.

- Anyone who violates the instructions shall be punished in accordance with the provisions of Money Counterfeiting Law issued by Royal Decree No. (12) dated 02/07/1379 H and according to the Anti-Counterfeiting Law issued by Royal Decree No. 114 dated 26/11/1380 H.

The Anti-Counterfeiting Law issued by Royal Decree No. (114) dated 26/11/1380 H. was replaced by The Penal Code for Forgery Offences, issued by Royal Decree No. (M/11), dated 18/02/1435 H.

Second: Controls for Replicating Foreign Currency Legally Circulated within the Kingdom of Saudi Arabia

- To reproduce images of foreign currency that is legally circulated within the Kingdom of Saudi Arabia for use in printed or electronic (digital) media, an application must be submitted to the Central Bank to obtain a currency reproduction license.

- To obtain the license, the instructions and regulations issued by the authorities responsible for the issuance of the foreign currency to be reproduced must be followed.

Third: Controls for Replicating Saudi Currency Legally Circulated within the Kingdom of Saudi Arabia

- To reproduce images of Saudi currency in circulation within the Kingdom of Saudi Arabia in printed or electronic (digital) media, an application must be submitted to the Central Bank to obtain a currency reproduction license.

- To obtain a license to reproduce Saudi currency in circulation inside the Kingdom of Saudi Arabia for use in printed media, the following instructions and controls must be observed:

O Attach the material intended for publication or printing with the request for a currency reproduction license, specifying the technical specifications in terms of shape, color, and size, along with the purpose of publishing the images of the Saudi currency (commercial / media / cultural).

O Do not distort the image of the king in any way (whether by enlarging, shrinking, or changing its coordinates).

O The lack of risk of deceiving the public into thinking it is a genuine currency.

O Images can be of one side of the coin, provided that:

▪ The size of the image should not exceed 75% of the length and width of the original paper, or

▪ The size of the image should not be less than 150% of the length and width of the original document.

O The images can be of both sides of the coin provided that:

▪ The size of the image should not exceed 50% of the length and width of the original paper, or

▪ The size of the image must not be less than 200% of the length and width of the original paper.

▪ Do not display the front side of the banknote against the back side of the same banknote.

O All materials used in the process of producing images from films (negative and positive) and plates must be destroyed immediately after use.

- To obtain a reproduction license Saudi currency Circulated systematically within the Kingdom of Saudi Arabia for use in electronic (digital) means, the following instructions and regulations must be observed:

O Clarify the purpose of using images of the Saudi currency (commercial/media/cultural).

O The image of the king should not be distorted in any way (whether by enlarging, reducing, or altering its coordinates).

O The non-use of images of the Saudi currency in an inappropriate context.

O The resolution should be 72 pixels per inch or less.

O The word "SAMPLE" should be printed diagonally and clearly on the image of the banknote in a different color.

O All materials used in the process of issuing images from digital storage media, such as files and others, must be destroyed or removed immediately after their use is complete.

Instructions to Be Followed When Opening, Relocating or Closing Bank Branches, Instant Remittance Centers and ATMs, Whether Operational or Non-Operational

SAMA has recently observed an increase in violations committed by several banks, where certain measures were taken before obtaining prior approval from SAMA. The most significant of these violations include the following:

- Setting up headquarters for main administrations or operational branches, and then writing to SAMA to obtain approval for the move from the original licensed location to the newly prepared site.

2. Opening offices in different locations for specific purposes and for a limited period, or at exhibitions or festivals.

3. Closing operational branches, converting them into offices, or downsizing banking operations within them.

4. Setting up, installing, or operating ATMs without a license.

5. Relocating or deactivating operational or non-operational ATMs without obtaining approval from SAMA.

6. Engaging in speculative activities and bidding on certain locations that have already been licensed to a bank, thereby depriving the location of banking services.

7. Merging ATM licenses with licenses for active or inactive branches.

8. Failure to follow through with the process of opening branches and machines within the nine-month licensing period, and not providing an explanation when requested for renewal about the reasons that prevented the bank from opening the branch or installing the ATM.

And since the banks' adherence to these procedures constitutes a clear violation to The Banking Control Law in accordance with the current applicable regulations in this regard, we hope that you will inform your relevant specialists about the necessity to follow and adhere to the following instructions:

a) No bank may open new branches, other offices, or ATMs in any region of the Kingdom without first obtaining an official prior license from SAMA.

b) When the bank obtains a license from SAMA to open a branch or install an ATM, it is not permissible to relocating it from one location to another without obtaining written approval from SAMA. This applies whether the branch is operational or non-operational, or whether the ATM machine is operational or non-operational.

c) When the bank obtains approval from SAMA to open a branch at any location, installing an ATM at the branch is covered under the branch's license. There is no need to obtain a separate license for the ATM, however SAMA must be informed about it.

d) The license for an independent ATM (outside branch premises) cannot be merged with any branch, regardless of whether it is operational or non-operational.

e) The duration of the license is nine months from the date of approval issuance, and the bank must follow up to complete the opening within this period. If the opening cannot be completed within this time frame, the bank must inform SAMA of the reasons that led to this before expiry of the license period.

f) The licenses for non-operating branches are extended every six months to provide the bank with the opportunity to prepare the site.

g) The bank must provide SAMA at the end of every six months with a report that includes its position regarding the opening of branches or the installation of ATMs.

c) Every bank must attach the following information when requesting approval to open a branch or install an ATM:

- Feasibility study for opening a branch or installing an ATM.

- A sketch drawing showing the exact location of the desired branch or the ATM.

t) SAMA must be notified of the actual opening date of the branch and the commencement of its operations or the date the ATM becomes operational.

Automated Teller Machines

Procedures And Controls to Be Observed in Maintaining ATM Machines

We wish to inform you that SAMA receives from time to time reports from Saudi police about the bank's maintenance of ATM machines. In view of the fact that maintenance workers are sometimes caught without having a permit which indicates their identity and the nature of the work they are doing; and since there are instructions and controls adopted by General Security and communicated to SAMA regarding the maintenance of ATM machines; and in our desire to see the ATM machines well maintained and smoothly operating all the time and the maintenance workers are not subject to questioning and arrest by the police, the banks must abide by the following instructions:

- The police operation room must be advised of the location of the ATM machine to be maintained, the day and hour of the maintenance job so that the police patrol in the area will provide needed protection.

- Maintenance workers must carry permits showing their name and photo stamped by the official stamp of their employer to be presented lo security when requested.

- An office must be assigned and operating around the clock with a Saudi employee in charge and its phone number be communicated to the operation room in case of suspicion.

- The maintenance hours must be fixed between 8:00 A.M and 11:00 PM.

- Maintenance companies and establishments must be required to have a special logo attached to their vehicles and worker uniforms so that the maintenance team is clearly identified by the security patrols.

We further wish to remind you of SAMA's circular No.485/BC/36 dated 7/1/1416, with a copy of the Security guide attached thereto, which includes, in several parts, thereof, the procedures and controls which cover all aspects of ATM safety and security as follows:

- The part related to physical security requirements (P 10 and 11)

- The part related to security and safety requirements (P 16, 17, 18, 25 & 26)

- The part related to internal procedures for the transport of cash (P 10 & 11)

- The part related lo establishments security guide (P14)

The above-mentioned parts included the location of ATM machines and the specifications of protection, feeding and alarm that have to be complied with.

Please be informed, advice same to your departments that are involved in feeding and maintaining the ATM machines and acknowledge receipt.

Cash Feeding Requirements for ATMs

Further to SAMA's instructions issued under Circular No. 361000064350 dated 03/05/1436 H regarding to the procedures for reversal of cash transactions in Automated Teller Machines (ATMs), as well as Circular No. 351000009927 dated 22/01/1435 H concerning the reconciliation and replenishment timelines for banks' ATMs, and Circular No. 27027/Akh dated 19/12/1424 H regarding the distribution of cash denominations in ATMs.

We hereby inform you that, in accordance to the Saudi Arabian Monetary Authority Law issued by Royal Decree No. (23) dated 23/05/1377 H, and the Banking Control Law issued by Royal Decree No. (M/5) dated 22/02/1386 H, the following has been decided:

- ATM shall be replenished and extension of the period of reconciliation every ten business days, considering cash flow projections, the characteristics of the location, and associated operational risks.

- The Dispense Logic is determined at the bank's discretion, taking into account the characteristics of the location and the needs of the customers. All ATMs situated within bank branches and transfer centers shall be replenished with a minimum of three cash denominations: five hundred, one hundred, and fifty. This arrangement ensures that customers have the option to withdraw cash in any combination of these three denominations. Outdoor ATMs situated in various locations such as roadways and shopping malls are designed to accept a minimum of two different denominations of currency, ensuring that both denominations can be dispensed to the customer during cash withdrawal transactions. The General Administration of Branches and Cash Centers will conduct a reassessment of the distribution of cash denominations six months following its implementation.

- The responsibility for determining the cash replenishment method of ATM lies with the banks. They have the discretion to decide whether to replace all denomination cassettes simultaneously when the machine requires cash or to replace only the denomination box that has been depleted. The box or cassettes shall be prepared at the cash center and maintained under dual surveillance and monitoring via cameras, subsequent to the bank determination of the requisite accounting mechanisms and procedures.

- Banks must automate ATM replenishment procedures by having an automated system to replenish the ATMs. In the absence of such systems, it is advisable to utilize test cards, which enable the replenishment team to conduct a test withdrawal following each replenishment. This procedure is essential to verify that the appropriate cash denominations have been correctly placed within the ATM. Supervisor cards must be utilized to enable the replenishment team at the cash centers to reconcile ATMs in real time, thereby eliminating the need to wait for reconciliation by the bank's support departments.

- Banks shall rectify discrepancies associated with the reversal of denomination cassettes that arise from the replenishment of ATMs. Additionally, they must manage instances where a customer inadvertently receives funds due to either a technical malfunction or human error. The banks bear the responsibility to substantiate the error in the event the customer disputes their actions.

For your information and action accordingly as of its date. SAMA will undertake field visits to verify compliance with these instructions, and in case of any inquiries in this regard, the Advisor to the Deputy Governor for Financial Sector Development can be contacted.

- ATM shall be replenished and extension of the period of reconciliation every ten business days, considering cash flow projections, the characteristics of the location, and associated operational risks.

Requirements for ATM Cash Feeding with Sixth Issuance Currency and Inclusion of 200 Riyal Denomination

Referring to Circular No. 27027/Akh dated 19/12/1424 H regarding the distribution of cash denominations in ATMs local banks, and Circular No. 30902/227 dated 26/08/1440H regarding cash feeding requirements for ATMs, and based on SAMA’s commitment to enhancing the efficiency and quality of circulating cash, and to meet the needs of ATM users with different cash denominations, SAMA emphasizes to all operating banks the importance of ensuring the proper replenishment and safety of cash in the bank’s ATMs and to adhere to the following:

First: Effective January 1, 2022G, ATMs shall be exclusively replenished by sixth-issue denominations.

Second: The SAR 200 denomination from the sixth issue will be added into all internal ATMs situated within branches and transfer centers. The determination to add this denomination into external ATMs will be made at the bank's discretion, considering the unique attributes of the location and the needs of customers, prior to February 2, 2022G.

The Central Bank emphasizes the importance of adhering to the above, and providing the Cash Supervision Department with the bank's plan to insert the (200) riyal denomination in ATMs via e-mail, within two weeks from its date.

Declined Bank Card Transactions at ATMs

We would like to emphasize the role played by the Saudi banking network in providing advanced banking services to citizens and residents facilitating their access to cash easily and conveniently, which enhanced customers' trust and reliance on the banking sector. The Central Bank appreciates the efforts of Saudi banks in providing these services, whether by issuing cards or installing ATMs and POS terminals. The Central Bank is currently studying the Saudi network fees in order to establish a mutually agreeable resolution for all stakeholders involved.

Although the Central Bank had previously issued Circular No. BCT/4593 dated 05/08/1420 H, a copy of which is attached, which stipulates the prohibition of imposing restrictions on the issuance or utilization of Saudi Payments Network cards, it was noticed that certain banks have imposed restrictions on the use of the network, which impacted the network's credibility and led to numerous complaints from customers.

Therefore, we inform you that the bank shall eliminate any restrictions on network usage and remove any current restrictions, noting that as of 05/12/1420 H, the Central Bank will implement a fee of 6.4 riyals for each transaction that is declined beyond the standard rate established by the Central Bank, should the bank fail to comply with the directive to remove the existing restrictions.

Annual Plans to Install ATMs

Referring to the future plans of banks to provide ATM services for customers in all regions of the Kingdom, and the importance of early planning and coordination among the relevant parties in this regard, SAMA will provide the necessary support for banks to implement these plans.

We hope to provide SAMA by the annual plans for installing ATMs in September of each calendar year, along with the plans to benefit from the temporarily suspended site licenses, according to the current requirements among the categories, for review and approval by SAMA.

For inquiries, you can contact specialists in the Currency Supervision Department via email.

Requirements for ATM Receipts Initiative

No: 43067037 Date(g): 6/3/2022 | Date(h): 3/8/1443 Status: In-Force Based on the powers granted to the Saudi Central Bank under its Law issued by Royal Decree No. (M/36) dated 11/4/1442 AH, and the Banking Control Law issued by Royal Decree No. (M/5) dated 22/2/1386 H, and referring to the ATM Service Level Agreement (Version 2) issued under Central Bank Circular No. (41932/227) dated 15/3/1441 H, and in continuation of the efforts made to develop the payment system infrastructure in the Kingdom.

Attached is the Requirements for ATM Receipts Initiative issued by Saudi Payments, which banks are required to implement on ATMs. The initiative aims to reduce customer requests for paper receipts in ATM transactions by standardizing the workflow across all machines to ensure the following:

- Preserving the environment and the overall appearance.

- Standardizing the user experience across all ATMs.

- The importance of maintaining data privacy for cardholders.

- Reducing costs for service providers.

Accordingly, the Central Bank emphasizes that all banks operating in the Kingdom and members of the Saudi Payments Network must comply with the provisions of the attached initiative. Coordination in this regard can be made with specialists at Saudi Payments via email (onboarding@saudipayments.com).

For your information and action accordingly, effective from 30/06/2022 G.

1. Introduction

In line with SAMA’s and Saudi Payments’ vision to make continuous improvements in payment infrastructure of the Kingdom, ATM Receipts initiative aims to minimize Cardholders’ dependency on paper receipts for ATM transactions.

The sole objectives of this initiative are to:

√ Enable cost efficiency for Acquirers

√ Maximize customer data privacy and protection

√ Save environment and go green!

1.1 Purpose of Document

The purpose of this document is to assign rules and requirements related to ATM Receipts to external stakeholders who play significant roles in the success of this change. This document is intended to govern the responsibilities of mada Members from multiple aspects for the purpose of ensuring the quality of the solution.

1.2 Scope of Document

This document covers the rules and requirements for ATM Receipts initiative. It also contains detailed workflows of the new enhancements on ATM screens. This document, however, does not contain certification procedures nor terms and conditions.

1.3 Audience of Document

The intended audience of this document is mada Members who are familiar with the basic guidelines of ATM functionalities, and who must comply with these rules at all times.

2. Overview

ATM Receipts is an enhancement initiative that drives the market to minimize dependency on receipts for the four (4) most commonly performed transactions on ATMs.

This initiative focusses on improving and unifying the screen workflow across all ATMs (off-us and on-us) in an attempt to unify user experience and reduce demand on receipts as a result. However, paper receipts shall still be available and provided to Cardholders whenever requested.

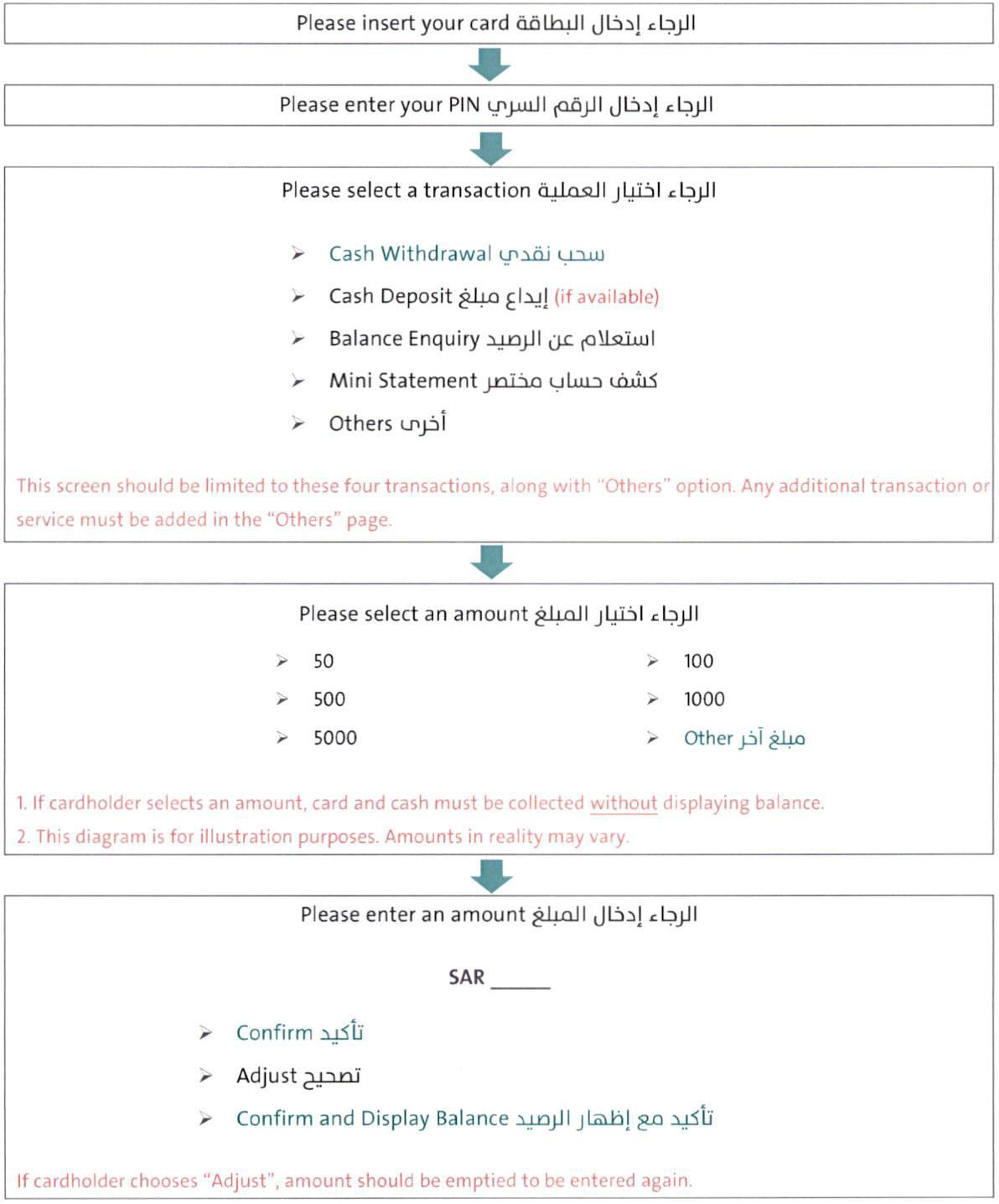

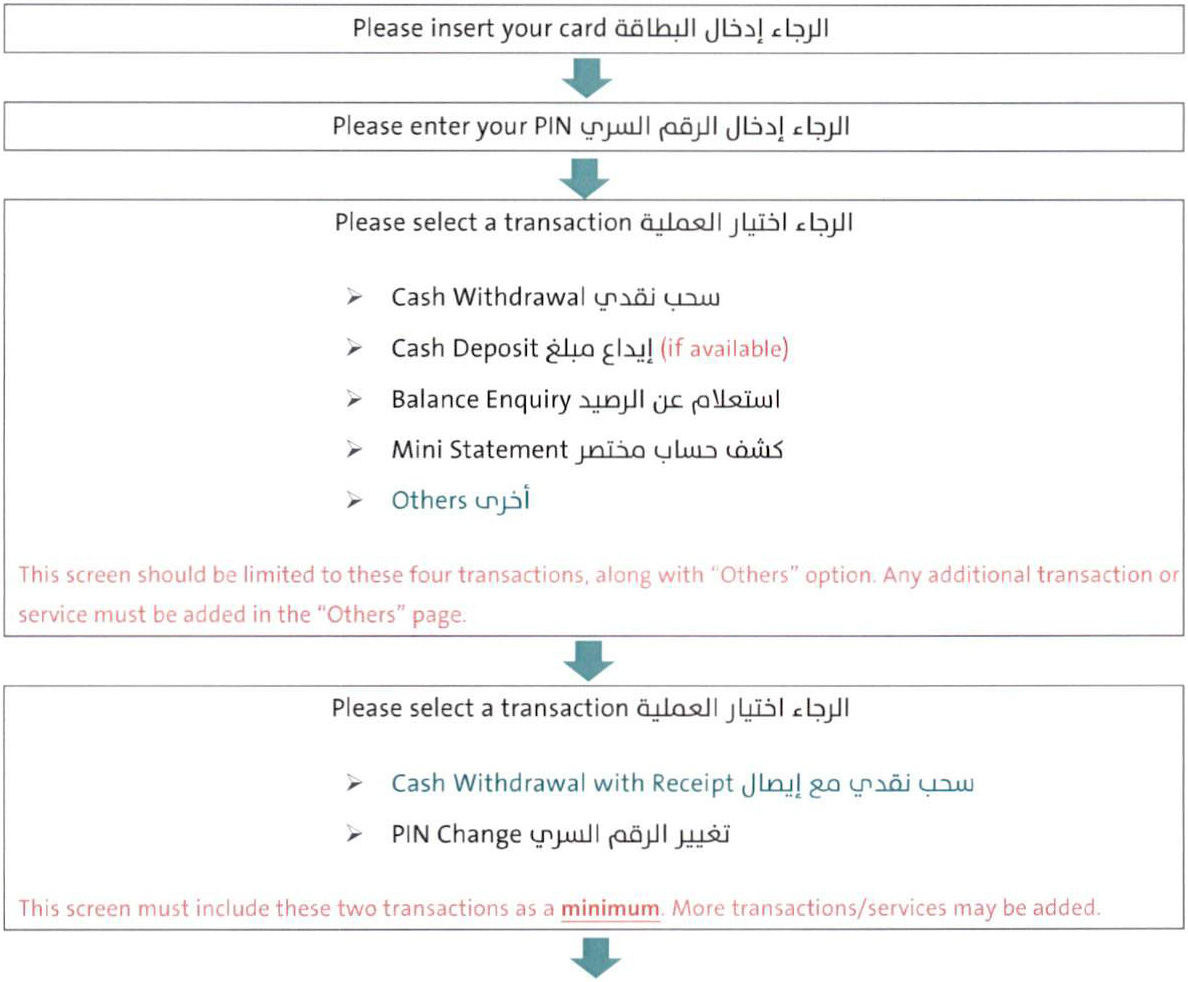

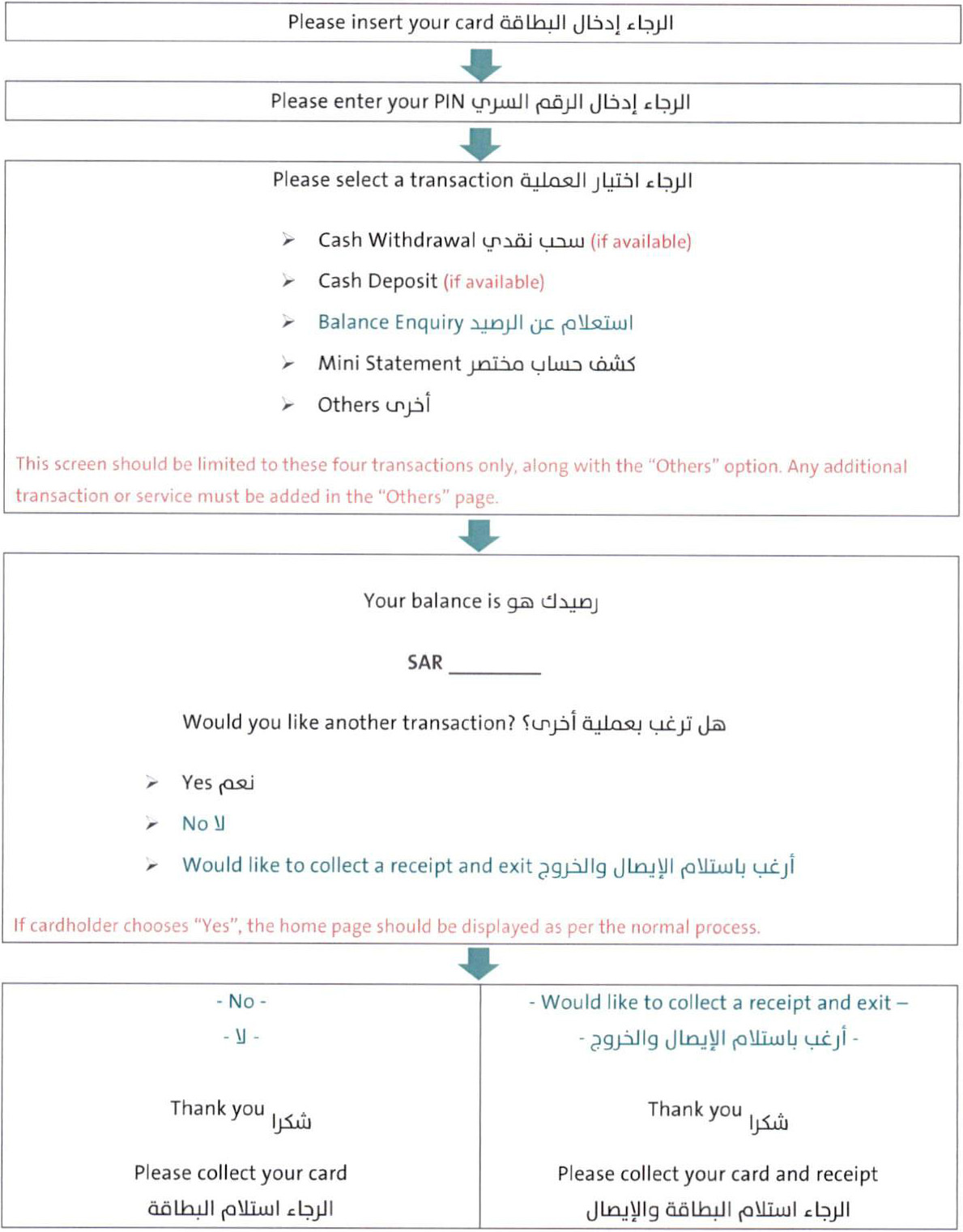

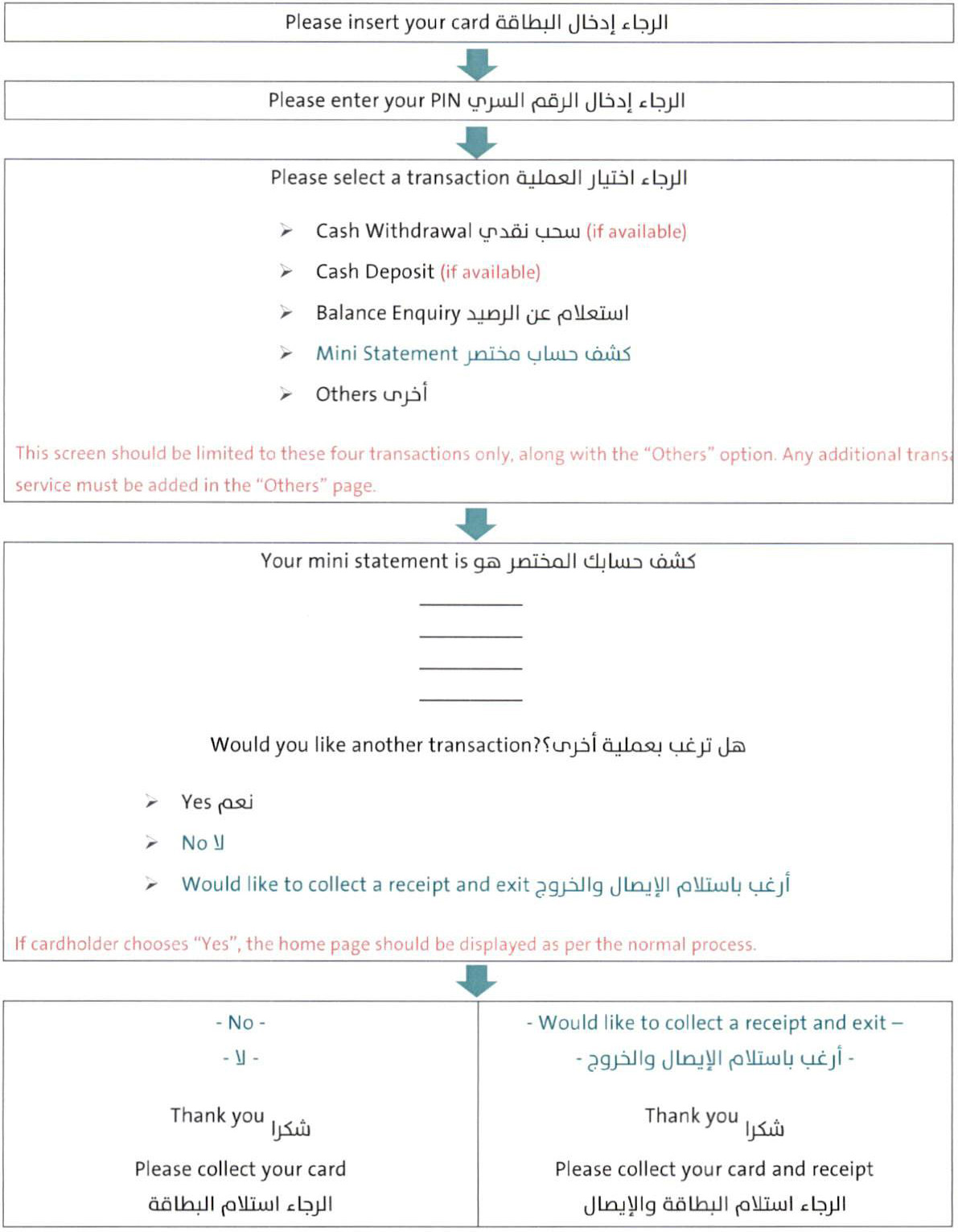

Currently, the Home page on ATMs-after inserting the card and entering the PIN-displays the four major transactions (Cash Withdrawal, Balance Inquiry, Mini Statement, and Cash Deposit if available). As part of this initiative, the Home page will be limited to whatever is available of those four transactions and must be fixed and unified across all ATMs (including on-us and off-us). In addition to the four transactions, the Home page also provides an 'Others’ option which opens up to any other transaction(s) and/or service(s) (i.e. PIN Change, Transfer...etc.).

The new enhancement on ATM screen flow runs into two streams: (1) Cash Withdrawal transaction stream, and (2) *Non-cash transactions stream. Each of which has its own mechanism to achieve the same goal of receipt reduction.

*Non-cash transactions include (1) Balance Enquiry, (2) Mini Statement, and (3) Cash Deposit -which is currently available for on-us only.

3. New ATM Screen Workflows

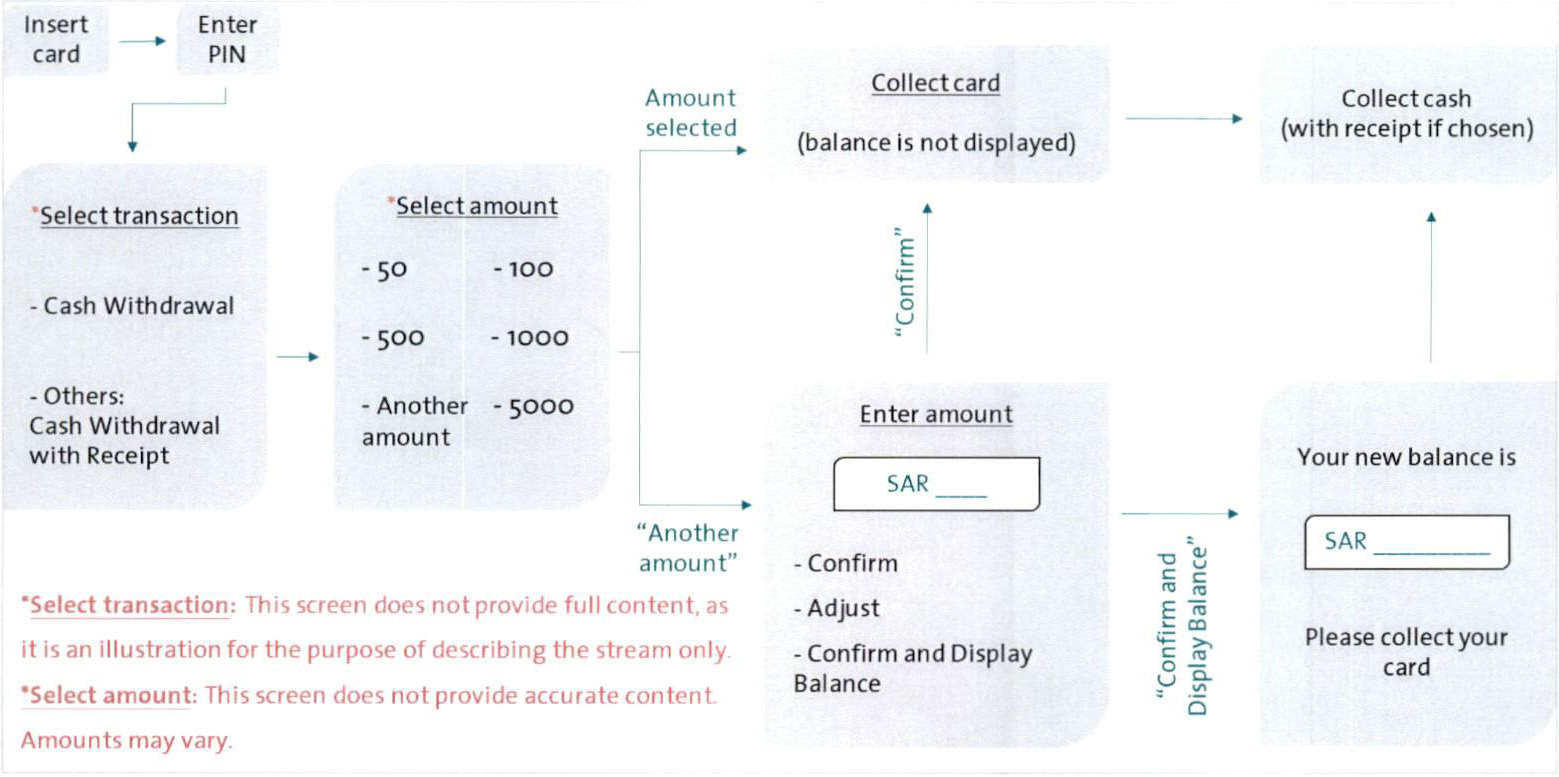

3.1 Cash Withdrawal Transaction Stream

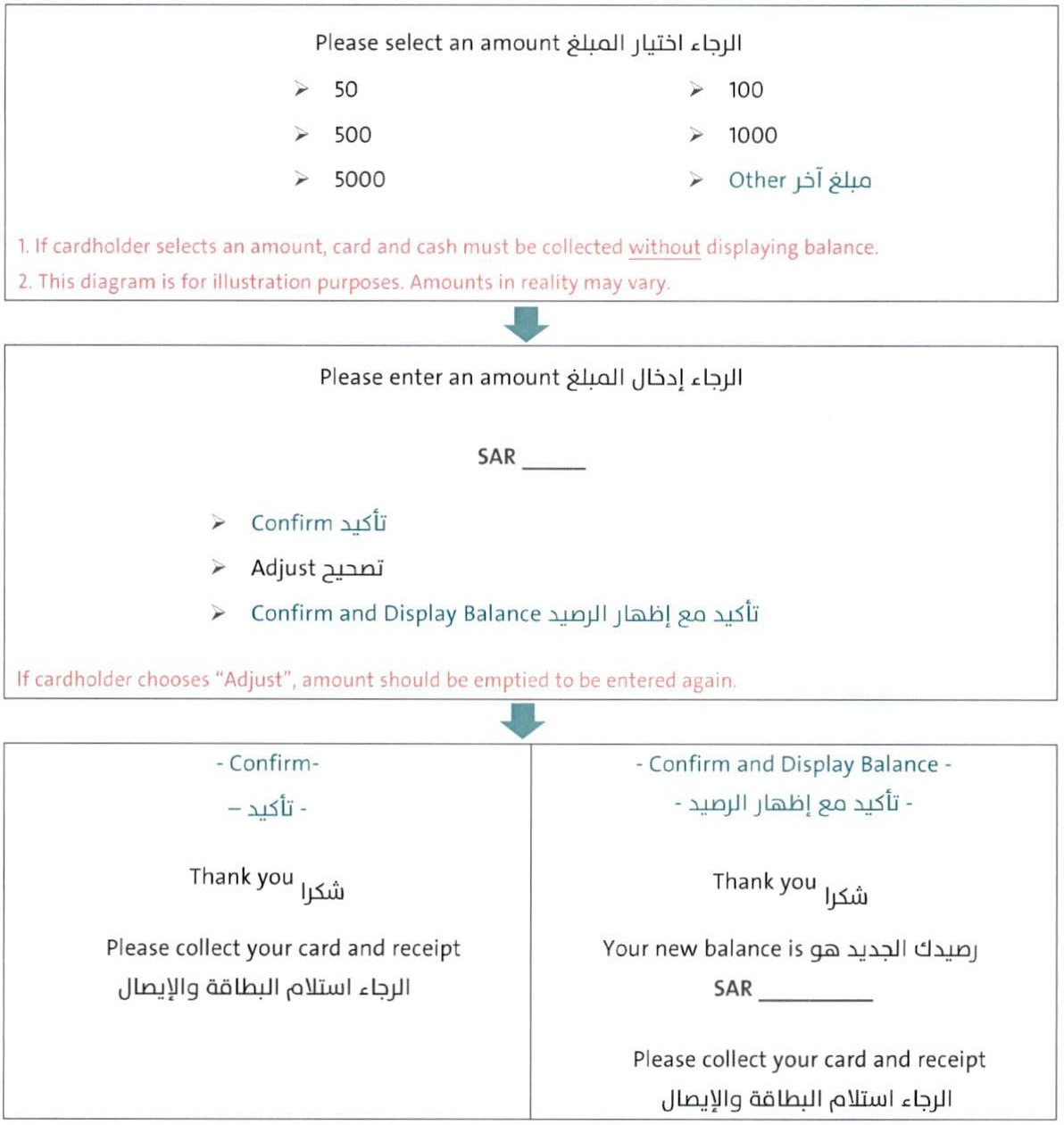

Since Cash Withdrawal is the top transaction in terms of initiation and receipt requests, there will be two separate transactions for Cash Withdrawal:

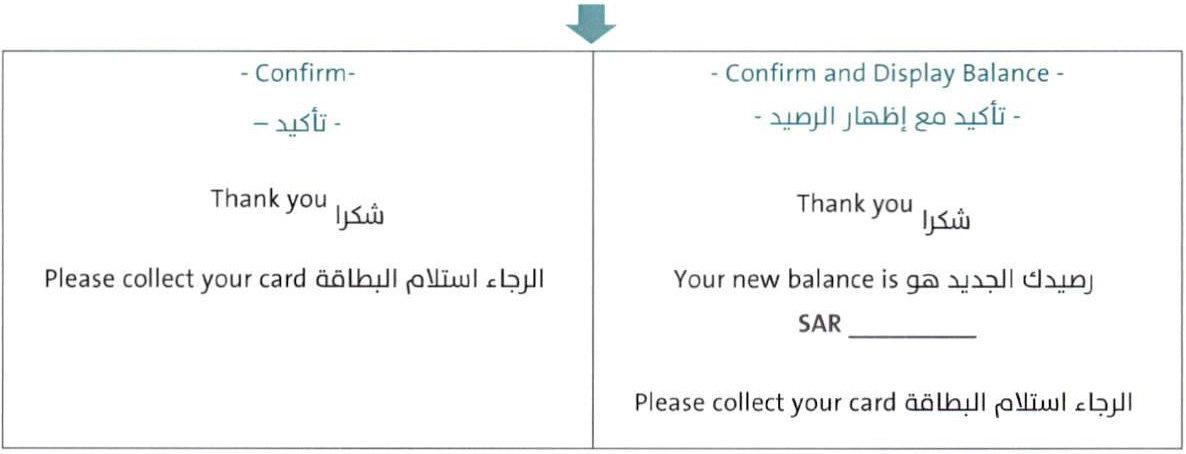

(1) The first transaction is “Cash Withdrawal" which is presented within the Home page on the ATM. This transaction should not provide a receipt upon completion.

(2) The second transaction is "Cash Withdrawal with Receipt” which will be added inside the 'Others' page from the Home page. This transaction should provide a receipt upon completion.

More importantly, after choosing either of the two transactions, if Cardholder selects one of the listed amounts on the screen, card and cash should be collected immediately and without displaying the account balance. However, in case Cardholder chooses "Another amount” and manually enters the amount, an option to "Confirm and Display Balance” will be given to the Cardholder in addition to the default option(s). The new workflow for Cash withdrawal transactions will be as follows:

A detailed workflow for the Cash Withdrawal transactions stream can be found in the Appendix.

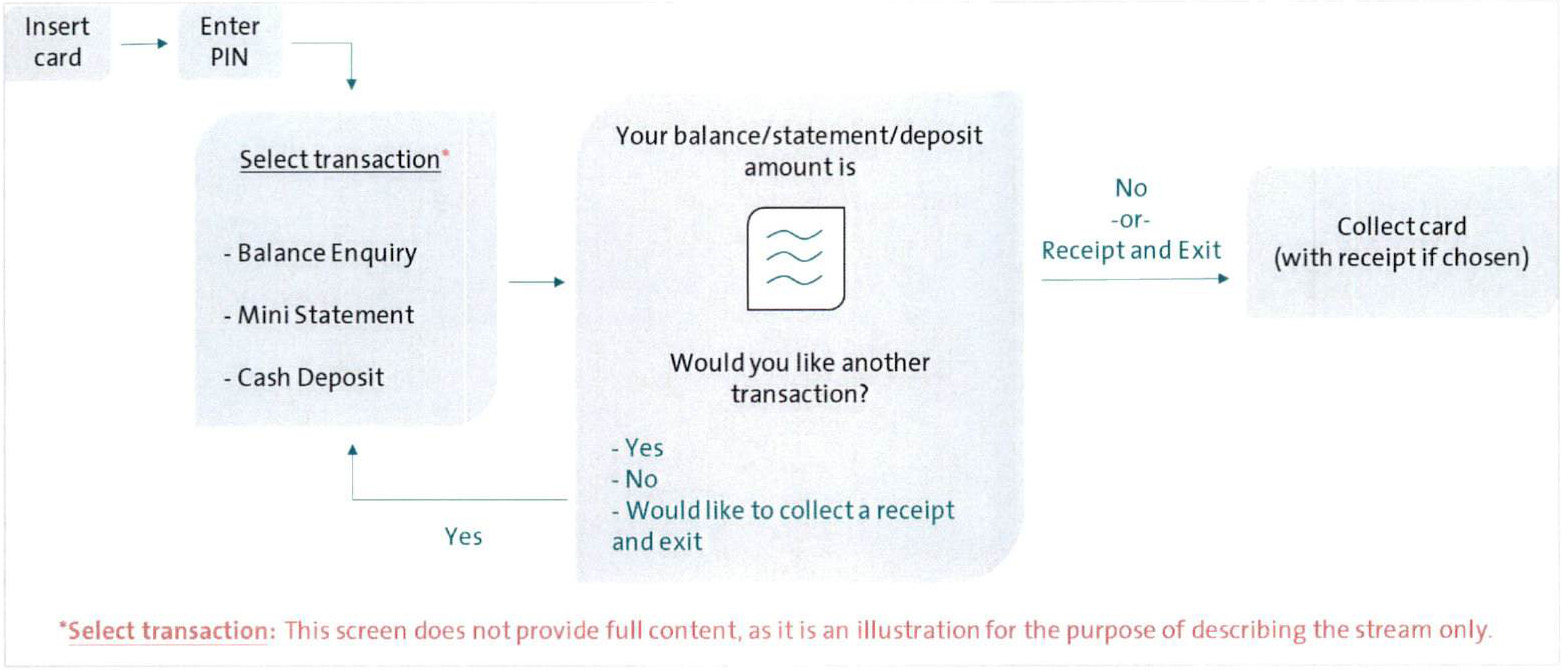

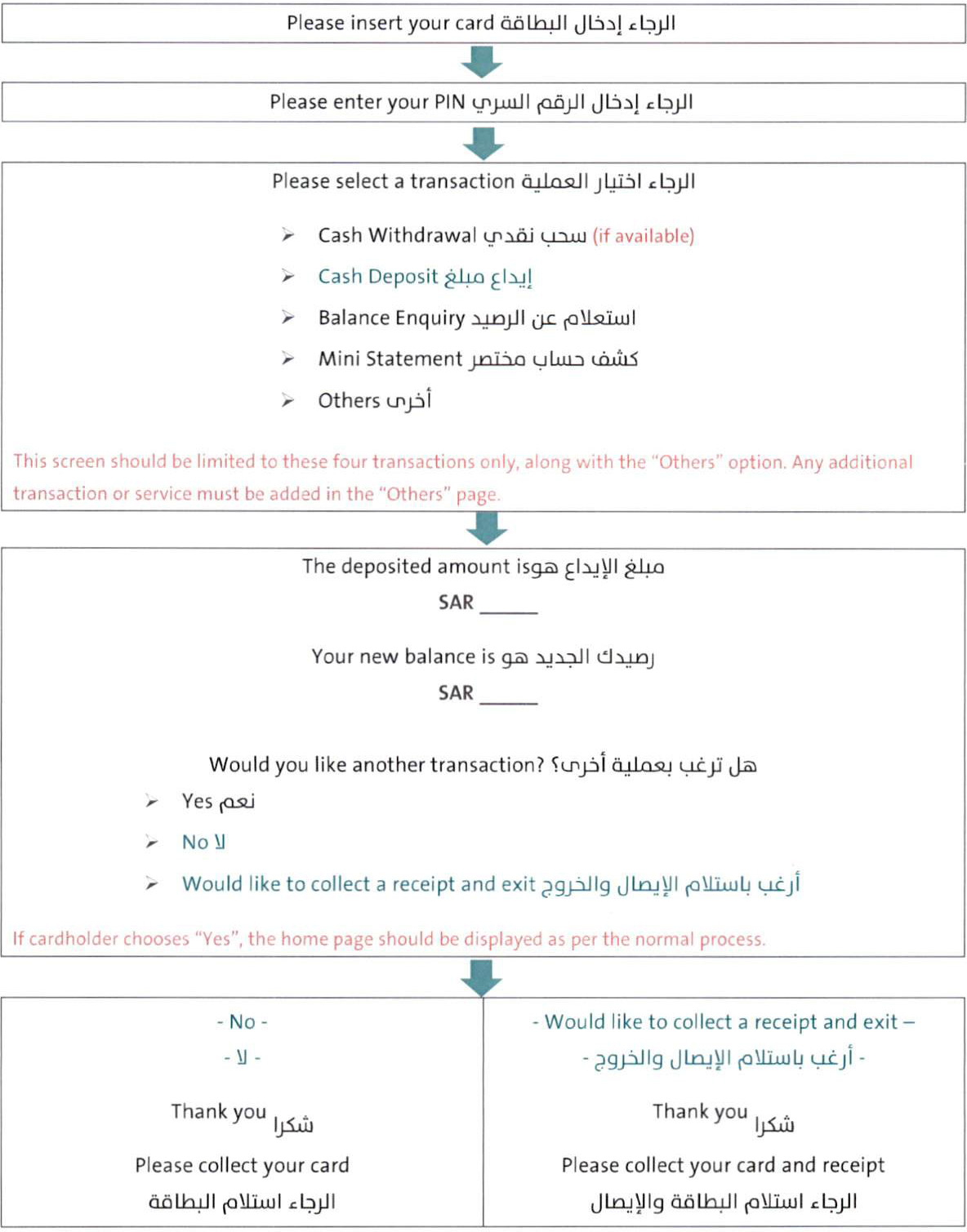

3.2 Non-Cash Transactions Stream

As mentioned earlier, non-cash transactions include Balance Enquiry, Mini Statement, and Cash Deposit. There will be two changes (or additions) to enhance the screen flow and reduce receipt demand for this stream:

First, upon choosing Balance Enquiry or Mini Statement, the account balance or mini statement, respectively, will be shown on the screen. And upon choosing Cash Deposit, the deposited amount as well as the new balance will be shown on the screen.

Second, at the end of either of the three transactions, a receipt will not be automatically printed. However, an option to "collect a receipt and exit’’ will be given to the Cardholder in addition to the default option(s) - if chosen, the process should be ended and the card should be collected along with the receipt. The new workflow for the non-cash transactions will be as follows:

A detailed workflow for the non-cash transactions stream can be found in the Appendix.

4. Appendix

4.1 Workflows for Cash Withdrawal Transactions Stream

4.1.1 Workflow for Cash Withdrawal (without Receipt)

4.1.2 Workflow for Cash Withdrawal with Receipt

4.2 Workflows for Non-Cash Transactions Stream

4.2.1 Workflow for Balance Enquiry

4.2.2 Workflow for Mini Statement

4.2.3 Workflow for Cash Deposit

Adoption of ATM's Electronic Journals

Referring to the discussions held in the Banking Operations Managers Committee (BOOC) regarding the request to cancel the use of paper journals from ATMs and to adopt electronic journals.

We inform you that SAMA has no objection to the adoption of the outputs of the Electronic Data Capture (EDC) for banks wishing to do so when addressing customer claims and complaints, as well as for reconciling and settling ATM transactions instead of using paper journals. It should be noted that in the event of customer claims or complaints and if the bank is unable to obtain a copy of the transaction from either the electronic or paper journal, the bank will bear any resulting responsibilities.

Immediate Response to Any Sudden Power or Communication Disruption in ATMs

Referring to what SAMA recently observed regarding the weak response of some banks to reports of malfunctions related to sudden power or communication disruption in ATMs, and the cash remaining inside the machines for long periods.

Accordingly, SAMA stresses to all banks to respond immediately to any of these cases, and to work on the safety of cash and not to leave it in ATMs for more than 24 hours in the event that it is not possible to resolve problems related to electricity, communications and technical malfunctions.

We also hope that you will inform the relevant departments and your affiliated entities to implement this, act accordingly and include it in your internal procedures as of this date.

SAMA will verify the extent of compliance with these instructions.

Time Out Cash Retract on ATMs

Referring to the Time out-Cash retract in Automated Teller Machines (ATMs), which returns the amount to the ATM in case it is not collected.

We inform you that, due to the emergence of several negative aspects in this feature, banks are required to stop the service as of 1/1/2015.

Maintenance and Feeding of ATMs

Referring to SAMA Circular No. 4567/BCI/123 dated 27/02/1429 H, supplementary to Circular No. 6898/BCI/287 dated 1420 H regarding the procedures and controls to be observed in maintaining ATM machines, including the requirement for ATM maintenance workers to carry permits showing their names and photos, stamped with the official stamp of their organization, and for the companies and institutions performing maintenance to display a specific logo on their vehicles and uniforms. SAMA has observed, during its monitoring of certain ATMs belonging to banks and based on reports from security agencies to SAMA, that some maintenance and feeding workers are using private vehicles and wearing inappropriate clothing that does not comply with the regulations.

Therefore, we hope to confirm adherence to the instructions mentioned in the above circular and inform the contracted companies to comply accordingly. SAMA will monitor compliance with these instructions and apply regulations against any violating banks.

Safety of Cash in ATMs

Based on SAMA's keenness and role in ensuring the safety of cash in circulation and the banks' responsibility for cash in ATMs, SAMA emphasizes to all local banks the necessity of paying sufficient attention to the safety of cash in the ATMs under the bank's jurisdiction, and adhering to the following:

First: Provision of necessary money counting and inspection machines at cash centers, and periodic assurance of the efficiency of these machines and the correctness of their setup (programming).

Second: Compliance With SAMA circular No. 23782/BC/251 dated 14/09/1414 H, and No. 422/M/T and the date 8/11/1413 H, and circular No. 400/B/C/241 and date 21/10/1413 H regarding the inspection of cash and ensuring its safety and quality before feeding it into ATMs.

Third: Increasing bank tellers' awareness of banknotes and their embedded security features, and providing all necessary equipment to verify the safety of the banknotes that are dealt with.

Fourth: ATMs should be fed under dual control and surveillance cameras with TV recording features, with the recorded material retained for at least six months for future reference if needed.

Fifth: Supervision, monitoring, and follow-up by bank officials on the process of feeding ATMs by cash transport companies, and not leaving this to companies only.

SAMA emphasizes the importance of adhering to what has been mentioned above.

ATM Maintenance Procedures

Further to SAMA Circular No. 6898 /BCI/ 287, dated 04/05/1420 H, which outlines the procedures and controls to be observed in maintaining ATM machine, including the requirement for maintenance workers to carry permits with their names and photos stamped with their organization's official stamp, and for maintenance companies and establishments to display a specific logo on their vehicles and uniforms. SAMA has observed, during its monitoring of certain ATM machines belonging to banks and through reports from security agencies, that maintenance and feeding workers have been using their private vehicles and some have not adhered to the regulations.

Therefore, please ensure strict adherence to the instructions outlined in the aforementioned circular and inform your contracted companies of the necessity to comply with these requirements. SAMA will continue to monitor compliance with these instructions and apply regulatory measures against non-compliant banks.

Extension of the Period for Making Inventories of ATMs and Feeding them With Cash

Referring to SAMA Circular No. 2193/BCI/102 dated 13/2/1419 H, which includes internal controls on ATMs and POSs on a daily basis, whether these ATM's are outside the branches or inside them, according to the instructions issued in this regard in the rules and procedures of the Saudi Payments Network (SPAN Business Book) circulated by Circular No. 341000076614 dated 20/6/1434 H. Based on the request submitted by the Bank Operating Officers Committee (BOOC) regarding the extension of the current ATM audit period, and considering the technological advancements in systems and ATMs that support their monitoring and remote access to withdrawal transaction documents, SAMA has decided to extend the scheduled period for making inventory and feeding of ATMs as follows:

• Banks must immediately feed the ATM's when the cash in the ATM reaches 20% of the total cash across all denominations.

• When there are complaints or claims from customers that require the bank to conduct a physical inventory, the bank must do so immediately regardless of the bank's schedule in normal cases.

To review and act accordingly and inform SAMA of what has been done in this regard within a month from its date.

ATM Service Level Agreement (Second Edition)

Based on the Saudi Arabian Monetary Authority Law issued by Royal Decree No. 23 dated 23/05/1377 H and the Banking Control Law issued by Royal Decree No. M/5 dated 22/02/1386 H, and with reference to Central Bank Circular No. 341000110148 dated 10/09/1434 H on issuing and signing the ATM Service Level Agreement.

We attach to you the ATM Service Level Agreement (second version) approved by the Central Bank, which aims to enhance and elevate the qualiy of ATM services recognizing their significance as a critical electronic channel for facilitating a wide array of banking services. Consequently, the revised agreement will be applied to all ATM services starting from January 1, 2021G. It is imperative to comply with this agreement and any subsequent updates. Therefore, we kindly request that it be signed and returned to the Central Bank within a maximum timeframe of two weeks from the date of receipt.

Note that the bank must send monthly reports in line with the new mechanisms and clauses in the agreement (second version) as of 01/04/2020 G, while continuing to send the current agreement reports as usual until the beginning of the full implementation of the new agreement at the beginning of 2021 G.

Instructions on Forms for Straps of Banknote Stacks of Sixth Edition

No: 42065141 Date(g): 25/4/2021 | Date(h): 14/9/1442 Status: In-Force Translated Document

Referring to the third edition of the instructions for the models of cards for tying the denominations of the sixth series of banknotes, communicated under Circular No. 42018358 dated 22/03/1442 H, and to the issuance of the 200-riyal denomination for circulation on 13/09/1442 H, in order to ensure consistency in the color of the banknote tying cards among banks, and SAMA's branches with the current and previous issues.

Attached is the fourth edition of the instructions for the models of cards for tying the denominations of the sixth series of banknotes, which includes the addition of the card model for tying the 200-riyal denomination, replacing the third edition referenced above.

Please take note and implement this within three months from the date of this notice.

1. General Instructions

1-1 Approve the printing of tying cards for the sixth series of banknotes according to the designs and colour specifications outlined in these instructions.

1-2 These cards must be used for tying the denominations of the sixth series when supplying them to SAMA branches.

2. Requirements to be Included in the Cards

A. The bank's name and logo at the top of the card.

B. The names and signatures of the first and second employees at the bottom of the card.

C. The number of notes and denomination in the center of the card, with the denomination in a larger font size.

D. The issue of the currency in the corner of the card.

3. Colors of the Cards

Distinguish each denomination by printing it in specific colors as follows:

Denomination

Color Value (RGB)

Color Model (RGB)

Color Model (CMYK)

Blue

Green

Red

K

Y

M

C

500 Riyals

230

195

157

10%

0%

15%

32%

100 Riyals

77

77

253

1%

70%

70%

0%

50 Riyals

80

208

146

18%

62%

0%

30%

10 Riyals

131

177

244

4%

46%

27%

0%

5 Riyals

255

204

255

0%

0%

20%

0%

5 Riyals (Polymer)

169

93

211

17%

20%

56%

0%

20 Riyals

202

108

133

21 %

0%

47%

34%

200 Riyals

166

166

166

35%

0%

0%

0%

4. Card Models

No: 42065141 Date(g): 25/4/2021 | Date(h): 14/9/1442 Status: In-Force Translated Document

Attached are the card models for compliance.

Attachments

Compliance with Employing Citizens and the Requirements for Contracting with Recruitment Service Companies

Reference to SAMA Circular No. 1712/BC/88 dated 6/2/1416 H and No. 3851/BC/124 dated 2/4/1410 H and other circulars regarding the implementation of Saudization in jobs within banks, and in continuation of the efforts made by SAMA and the banks in localizing jobs and qualifying Saudis to fill them, and due to the importance of intensifying efforts to achieve the desired goals in line with general directions, SAMA emphasizes the necessity of adhering to the following:

First) Citizens Employment

- The goal is to localize all jobs, of various types and levels, including top leadership and supervisory positions, and not to limit Saudization to certain jobs only. Employment contracts with non-Saudi employees should be considered only if a qualified Saudi candidate is not available at the time, while taking into consideration the stipulations stated in The Labor Law issued by the Royal Decree No. M/51 dated 23/8/1426 H In this regard.

- Appointment and employment in all positions at branches, remittance centers, and cash centers are restricted to Saudis only, without specifying the type of job. Efforts should be made to completely replace non-Saudi employees with Saudi employees by a maximum date of 31/12/2013 G. It is allowed to hire one non-Saudi employee at remittance centers if the bank or money exchange deems the presence of such an employee necessary, provided that their role is limited to assisting and serving customers without having access to the bank's data and automated systems, or conducting banking operations, or opening customer accounts*.

- The appointment to all positions involving financial transactions, the transfer of money, and related roles, as well as positions related to information security and those concerning the combating of money laundering and the financing of terrorism, is restricted to Saudi nationals only across all departments of the bank, exchange offices, branches, and affiliated remittance centers.

- Develop programs and specific timelines for the Saudization of all jobs and provide them to SAMA within three months from this date. Work on recruiting, training, and qualifying national cadres to replace non-Saudis in these positions within a specified period.

- Prohibition of direct and indirect dealings with any entities or individuals working as marketers of banking services within the Kingdom on behalf of foreign banks or financial entities and banning the presence of representatives of such entities within the bank, exchange office, or any of its branches or affiliated centers.

- Develop plans and schedules for training and qualifying Saudis in accordance with the aforementioned instructions and provide them to SAMA within two months from this date.

Second) Adherence to the requirements of contracting with employment service companies

- Selecting companies specialized in providing employment, support services, and verifying the integrity of the contracts concluded with them, as well as ensuring their compliance with and fulfillment of the requirements of SAMA and relevant authorities.

- Ensuring that all employees are working legally and that their job roles correspond to the tasks assigned to them, as well as matching what is recorded in their work permits and residence permits.

Third) Assign the Human Resources Department to develop a plan for the localization of jobs, to train and qualify their occupants, and to begin its implementation. Also, assign the Compliance Department to monitor and oversee its implementation according to the above requirements and to prepare reports at the end of each quarter on the progress of job localization and training until the end of the period.

*According to Circular No. (21755/41) dated 6/4/1440 H, SAMA emphasizes the restriction of all currency exchange business roles (category (A, B)) to Saudis and the necessity of training Saudi employees and enrolling them in suitable training programs that match the nature of their work. Currency exchange institutions and companies must take the necessary measures to ensure full compliance, provided that the time period for Saudization of jobs does not exceed a maximum of January 29, 2020 G. Note that SAMA will take all regulatory measures against exchange institutions and companies that do not adhere to this directive.

According to Circular No. (18910/41) dated 21/03/1440 H, the categories that are treated equivalent to Saudis must be counted in the Saudization rates, in accordance with what is issued by the Ministry of Labor and Social Development and disclosed in the data submitted to SAMA.

Contract with Cash Transfer Companies and Using High-Specification Security Bags

Referring to the letter from His Royal Highness the Crown Prince, Deputy Prime Minister, and Minister of Interior, "may God protect him," No. 225703 dated 28/08/1438 H, regarding the recommendations from the Crime Research Center to require large companies and commercial establishments to contract with cash transfer companies and to use high-specification security bags, and to SAMA Circular No. 371000093183 dated 22/08/1437 H based on the letter from His Royal Highness the Crown Prince, Deputy Prime Minister, and Minister of Interior, "may God protect him," No. 126563 dated 14/05/1437 H, regarding the approval of the results of the security committee formed by the General Security, the Ministry of Finance, and SAMA to review and update the necessary standards and conditions and impose strict and precise controls for conducting the activity of transporting cash, precious metals, and valuable documents to require all companies operating in this field to comply with them. This includes the adoption of using containers for transporting cash, which enable automated tracking and self-destruction of cash if diverted from the proposed route, instead of the current fabric containers.

Therefore, compliance with the instructions mentioned above is required, and cash should only be transported for large companies and commercial establishments through licensed cash transfer companies, using security bags approved by SAMA. Please note that SAMA will conduct field visits to ensure the implementation of these recommendations and impose penalties against violators.

Prohibition on Dealing with Representatives of Private Security Companies and Cash Transport Companies that are non-Saudis

Due to the availability of information regarding certain representatives of private security companies and cash transport companies from non-Saudis negotiating with local banks when seeking to provide security services or cash transport.

SAMA emphasizes to all banks the importance of not engaging or negotiating with any non-Saudi representative of these companies and institutions. They must also inform the relevant authority in the region about the company or institution employing the non-Saudi representative to take the necessary legal actions against them. Furthermore, SAMA reiterates the importance of full compliance with its issued directives regarding compliance with The Law of Private Security Services and its Implementing Regulations, as well as The Law of Transporting Cash, Precious Metals, and Valuable Documents and its Implementing Regulations.

Recommendations for the Cash Transfer System

Referring to the telegram from His Royal Highness the Crown Prince, Deputy Prime Minister, and Minister of Interior (may God protect him), No. 126563, dated 14/05/1437H, which includes the approval of the results of the security committee formed by (Public Security - Ministry of Finance - and SAMA) to review and update the necessary standards and conditions, and to impose strict and precise regulations for practicing the activity of transporting cash, precious metals, and negotiable instruments, requiring all companies operating in this field to comply with them.

Based on this, the committee concluded with a number of recommendations concerning banks and cash transport companies, as follows:

- Require banks to enhance oversight of the performance of contracted companies inside cash centers, adhere to specific procedures and mechanisms for receiving and delivering cash, and impose necessary penalties on violating banks.

- Separate the tasks and responsibilities related to cash transportation from those related to replenishing ATMs:

- Companies must adhere to the regulations and guidelines for the transport vehicle crew involved in cash transportation, consisting of three members (driver, guard, and companion). The guard and companion should be equipped with the necessary firearms.

- When using a transport vehicle for ATM replenishment, the two-person replenishment team (supervisor and replenisher) should never accompany the armored vehicle crew. Instead, they should travel in a civilian vehicle displaying the company logo, following the armored vehicle’s route. This setup will result in a five-person ATM replenishment team (three inside the armored vehicle and two in the civilian vehicle).

- Cash replenishment boxes for ATMs must be filled, secured inside specialized containers, and sealed by an independent team from the cash transport company. This process should be under dual supervision and monitored by CCTV inside cash centers. The ATM replenishment team’s role should be limited to transporting the secured containers and replenishing ATMs according to a preassigned route provided at the start of the workday.

- A separate team (from the bank or the company) at the cash center should be responsible for counting and reconciling the returned cash from ATMs according to the readings from the ATM counters and the bank’s system.

- Companies must adhere to the regulations and guidelines for the transport vehicle crew involved in cash transportation, consisting of three members (driver, guard, and companion). The guard and companion should be equipped with the necessary firearms.

- Implement the use of high-standard cash transport containers as practiced in developed countries, which enable automatic tracking and self-destruction of the cash if the proposed route is altered, replacing the current fabric containers.

- Leverage credit information from the Credit Information Company (SIMAH) to review the credit history of individuals applying for jobs at cash transport companies and other legitimate sources to assess the suitability of employees in this field.

- Provide SAMA with the procedures and mechanisms followed by the bank to monitor the performance of companies contracted for cash transport and ATM replenishment. This includes doubling supervision and monitoring the movement of cash transport vehicles, precious metals, and negotiable instruments, as well as tracking the time allocated for cash transport and ATM replenishment to and from the bank premises. Additionally, review the rotation of employees in cash centers, cash transport, and ATM replenishment, and work on improving training programs to enhance the performance and efficiency of employees in both the contracted companies and banks.

Therefore, we request that you proceed with the swift implementation of the above-mentioned recommendations and provide us with an update within two weeks from this date. It is worth noting that arrangements are currently being made to allow licensed cash transport companies to establish their own cash processing units to serve the ATMs of all the banks they contract with, following the necessary approvals from SAMA and the Ministry of Interior. These units will be governed by unified security standards, procedures, and requirements. The license for operating such cash processing units will be granted for a maximum of three years, renewable, with the aim of improving service levels and preparing local companies to manage and operate unified cash centers, which will be established by SAMA.

- Require banks to enhance oversight of the performance of contracted companies inside cash centers, adhere to specific procedures and mechanisms for receiving and delivering cash, and impose necessary penalties on violating banks.

Mechanism for the Entry and Exit of Saudi and Foreign Currency via King Fahd Causeway

No: 371000035276 Date(g): 3/1/2016 | Date(h): 24/3/1437 Status: In-Force Translated Document

Referring to the agreement with the Customs Authority regarding the mechanism related to handling the entry and exit of Saudi and foreign currency through the King Fahd Causeway customs, please adhere to and implement the following directives:

First: Mechanism for the Entry and Exit of Saudi Currency through King Fahd Causeway Customs

The current mechanism for handling Saudi currency, as agreed upon between the General Customs Authority and SAMA in the coordination and cooperation record dated 10/4/1435H, shall continue. According to this mechanism, customs employees at King Fahd Causeway are responsible for sealing the Saudi currency transported through the customs for banks and exchange companies, and then sending it to SAMA branch in Dammam for inspection, as follows:

- A financial declaration form for the cash amounts (entry) is filled out electronically using the automated financial declaration system. The form indicates the number of containers or packages received, the sequence of their seal numbers, and the total amount sent.

- The financial declaration form is faxed from the King Fahd Causeway customs to SAMA branch in Dammam, and a copy is handed over to the bank representative or the exchange company.

- Upon deposit at SAMA branch, the number of packages and the customs seal numbers provided in the letter of King Fahd Causeway customs is verified by the Treasury Division at SAMA branch in Dammam. The cash packages are then reviewed and accepted under counting and are set aside with the customs letter until they are counted and verified for accuracy.

- King Fahd Causeway customs will be notified by SAMA branch in Dammam in the event of any unusual discrepancy, such as a mismatch between the declared amount and the received funds, concerns about the currency's condition, the failure of the funds to arrive as per the customs letter sent by fax to SAMA branch, or delays in delivering the funds to SAMA.

Additionally, King Fahd Causeway customs will receive a letter from SAMA branch when local banks request to export financial amounts abroad after sealing them in a container or package, detailing the amount and seal numbers. A copy of this letter will be faxed simultaneously to King Fahd Causeway customs and the bank representative.

- A financial declaration form for the cash amounts (entry) is filled out electronically using the automated financial declaration system. The form indicates the number of containers or packages received, the sequence of their seal numbers, and the total amount sent.

Second: Mechanism for the Entry and Exit of Foreign Currency through King Fahd Causeway

After completing the approved immediate clearance procedures at King Fahd Causeway Customs, the following steps are taken:

- The Gulf vehicles transporting foreign currency are sealed with a metal seal by the customs officer.

- A letter is signed by King Fahd Causeway Customs addressed to SAMA branch in Dammam, with a copy sent to the benefiting bank or exchange company.

- The vehicles are allowed to depart to the cash centers of banks and exchange offices. If the vehicle is armored, approval from the General Customs Authority is required, as its entry is restricted.

- In the case of discovering counterfeit currency, SAMA branch in Dammam is notified, which in turn informs King Fahd Causeway Customs and returns the counterfeit amounts to the customs for necessary legal procedures.

- SAMA branch in Dammam is notified, and it will officially inform King Fahd Causeway Customs in case of any unusual violation, such as a discrepancy between the declared and received amounts, the condition of the currency, failure of the amounts to arrive as indicated in the customs letter sent by fax to SAMA, delays in receiving the amounts, or any other reasons.

- The Gulf vehicles transporting foreign currency are sealed with a metal seal by the customs officer.

Third: Regulations for the Entry of Gulf Cash Transport Vehicles into Saudi Arabia

- Gulf vehicles transporting foreign currency into the Kingdom must comply with the technical specifications for the armoring of cash transport vehicles as outlined in the implementing regulations issued by Ministerial Decision No. (4814) dated 09/10/1433H. These specifications pertain to the Transporting Cash, Precious Metals, and Negotiable Instruments Law, issued under Royal Decree No. (81/M) dated 18/10/1428H.

- Entities importing Saudi and foreign currencies (banks/exchange offices) are required to deploy an armed security escort vehicle to accompany the Gulf vehicle transporting foreign currency. The security vehicle must belong to an entity licensed to operate in transporting cash, precious metals, and negotiable instruments, and should be stationed outside the customs area awaiting the foreign currency transport vehicles for escort.

- Gulf vehicles transporting foreign currency into the Kingdom must comply with the technical specifications for the armoring of cash transport vehicles as outlined in the implementing regulations issued by Ministerial Decision No. (4814) dated 09/10/1433H. These specifications pertain to the Transporting Cash, Precious Metals, and Negotiable Instruments Law, issued under Royal Decree No. (81/M) dated 18/10/1428H.

Cash Transfers must be Coordinated with Security Authorities Well Enough in Advance

Further to SAMA's circular No. 5922/BCI/62 dated 08/04/1421H, which includes specific guidelines for feeding ATMs, particularly the paragraph concerning the necessity of coordination and notification of security authorities during the cash transfer, we inform you that SAMA has received a letter from its branch in Buraidah containing observations from the Qassim Region Police on the reporting process. These reports are being received upon the arrival of the feeding officials at the ATMs, which disrupts the work of the security authorities and results in delays in the security agencies carrying out their duties.

Therefore, we hope to inform and ensure coordination with the security authorities for transportation operations in a timely manner so that the security authorities can perform their duties as required in various regions and governorates of the Kingdom.

Internal Controls on ATMs and POSs

In Reference to our previous circulars No. BC/588 dated 24-9-1415, No. BC/353 dated 10-7-1415 and No. BC 214 dated 1-8-1414, regarding internal controls presently applied on ATMs and POSs and the procedures and problems connected therewith; and

In view of the increase of complaints by some people who insist that they are not receiving the money they ask for from ATM; and

In view of the importance of this matter in enhancing public confidence in the banking sector in general and the ATM and POS services in particular,

SAMA would like to emphasize the following:

Banks must conduct a daily inventory of all ATMs, whether inside or outside branch premises.