Banking Archive

Minimum Regulatory Requirements

Finalized Guidance Document Concerning the Implementation of Basel III

No: 341000015689 Date(g): 19/12/2012 | Date(h): 6/2/1434 Status: In-Force 1. Overview

SAMA will implement Basel II.5 and Basel III framework commencing as of 1 January 2013 for both i) Standardized Approach and ii) IRB Approaches. Specifically, the Regulatory Capital under Basel III will be an entirely new framework incorporating a more pure and loss absorbent capital structure. However, RWAs under Basel III will be an aggregate of RWA under Basel II and enhancements and modifications to these RWA under Basel II.5 and Basel III frameworks. Refer to attached Basel III Prudential Returns package.

The finalized Guidance Document and Prudential Returns concerning Basel II.5 for both Standardized and IRB Approach have already been circulated through SAMA Circular # BCS 25478 dated 21 October 2012. These Guidance Notes are related exclusively to Basel III concerning both Standardized and IRB Approaches.

As both the Basel II.5 and Basel III Framework are to be implemented concurrently, the following are their major elements with regard to Regulatory Capital and Enhanced Risk Coverage.

For SAMA’s National Discretion items, please refer to Annex # 9.

A.1.1 Refining and Enhancing Regulatory Capital for Basel III

Basel III

The main reasons for the economic and financial crisis, which began in 2007 was that the banks of many countries had 1) insufficient quality of capital 2) limited risk coverage 3) had built up excessive on and off-balance sheet leverage. This was accompanied by a gradual erosion of the level and quality of the capital base and at the same time, many banks were holding insufficient liquidity buffers. The banking system therefore was not able to absorb the resulting systemic trading and credit losses nor could it cope with the re-intermediation of large off-balance sheet exposures that had built up.

Consequently, the Basel III framework is composed of the following major enhancements (1 to 5) which are to be implemented on a staggered approach up to 2019 in accordance with the phase in arrangement describe in Annex #1. In this respect, items 3 (Leverage) and 5 [Liquidity (LCR & NSFR)] are currently being monitored for Saudi banks in accordance with the Phase in arrangements from January 2011 and 2012 respectively.

1. Strengthening the quality of Regulatory Capital

2. Enhanced Risk Coverage

3. Leverage Ratio – refer to SAMA Circular # BCS 5610 dated 13 February 2011

4. Introduction of Capital buffers

5. Introduction of Global Liquidity Standards [Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR)] – refer to SAMA Circular # BCS 28266 dated 19 November 2011

Consequently, these specific guidance and prudential returns are being provided for 1, 2 and 4 through this document which will initiate the monitoring of Basel III capital ratios by 1 January 2013 as per Annex # 1.

Strengthening the Quality of Regulatory Capital

Basel III framework makes critical that banks’ Enhanced risk exposures are backed by a high quality capital base. To this end, the predominant form of Tier 1 capital must be common shares and retained earnings. BCBS principles adopted by SAMA ensure that banks hold a high quality Tier 1 capital that represent "Pure Capital" which is highly "Loss Absorbent" through the following measures:

• Deductions from capital and prudential filters to be generally applied at the level of common equity or its equivalent.

• Subordinated debt of high quality

• Fully discretionary noncumulative dividends or coupons

• Neither a maturity date nor an incentive to redeem.

• Innovative hybrid capital instruments with an incentive to redeem through features such as step-up clauses, currently limited to 15% of the Tier 1 capital base, will be phased out.

• Tier 3 capital instruments to cover market risks are eliminated.

• To improve market discipline, the transparency of the capital base will be improved, with all elements of capital required to be disclosed along with a detailed reconciliation to the reported accounts.

SAMA plans to ensure that its definition of Basel III Regulatory Capital is in compliance with BCBS requirements. This will be accomplished through compliance with requirements as described in Annexes # 2 to 4. Further, SAMA will ensure the Basel III enhancements to Definition of Capital are implemented in a manner that minimizes the disruption to capital instruments that are currently outstanding by Saudi banks.

B.1.2 Enhancing Risk Coverage (Pillar 1) for Basel II.5 and Basel III

1.2.1 Basel II.5 – Enhancing Risk Coverage (Pillar 1)

SAMA implemented Basel II.5 through its Guidance Document and Prudential Return. These introduced further refinements to its Basel II reforms related to capital requirements relating to securitized and resecuritized assets or Risk Weighted Assets for Pillar 1 risks i.e. for Credit and Market risks. Basel II.5 components of Pillar 1, Pillar 2 and Pillar 3 enhancements have been implemented on the basis of the following BCBS documents.

• Enhancement to the Basel II Framework – July 2009

• Revisions to the Basel II Market Risk Framework – December 2010

In specific, these refinements are concerning Securitization and Resecuritization activities in the Banking book and Trading book. These reforms will raise capital requirements for the trading book and complex securitization exposures, which were a major source of losses for many internationally active banks. The enhanced treatment also introduced a stressed value-at- risk (VaR) capital requirement based on a continuous 12-month period of significant financial stress. In addition, the Committee set higher capital requirements for so-called resecuritizations in both the banking and the trading book. Basel III also raised the standard of the Pillar 2 supervisory review process and strengthened Pillar 3 disclosures.

The Committee is also conducting a fundamental review of the trading book. The work on the fundamental review of the trading book currently is incomplete (BCBS document of May 2012).

Consequently, with regard to Market Risk, SAMA will not implement the option to use models for both Basel II.5 or Basel III for the Trading book.

1.2.2 Basel III Framework – Enhanced Risk Coverage

Basel III also introduced measures to strengthen the capital requirements through Enhanced Risk Coverage as given below, which included counterparty credit exposures arising from banks’ derivatives, repo and Securities Financing Activities (SFA). These reforms also included the raising of capital buffers backing these additional exposures, in order to reduce procyclicality and provide additional incentives to move to OTC derivative contracts to central counterparties, thus helping reduce systemic risk across the financial system.

Further, Basel III also provides incentives to strengthen the risk management of counterparty credit exposures. The enhancement to counterparty credit exposures as given below was the main change amongst others to Enhanced Risk Coverage in the Basel III framework:

A. Counterparty Credit Risk

1. Revised metric to better address counterparty credit risk, credit valuation adjustments and wrong-way risks

2. Introduction of Asset Value correlation (AVC) for Financial Institutions

3. Collateralized counterparties and increased margin period of risk

4. Central Counterparties (CCPs)

5. Enhanced counterparty credit risk management requirements

B. Addressing Reliance on external credit ratings and minimizing cliff effects

1. Standardized Inferred rating treatment for long-term exposure

2. Incentive to avoid getting exposures rated

3. Incorporation of IOSCO’s Code of Conduct Fundamentals for Credit Rating Agencies

4. ‘‘Cliff effects’’ arising from guarantees and credit derivatives- ‘‘CRM’’

5. Unsolicited ratings and recognition of ECAI’s

The more specific, Basel III enhancements include the following:

1. Banks will be subject to an additional capital charge for potential mark-to-market losses (i.e. credit valuation adjustment – CVA – risk) associated with a deterioration in the credit worthiness of a counterparty. This charge is applicable both i) under Standardized Approach and ii) IRB Approaches. While the Basel II standard covers the risk of a counterparty default, it does not address such CVA risk, which during the financial crisis was a greater source of losses than those arising from outright defaults. Consequently, an additional Counterparty Credit risk.

2. Under IRB, banks must determine their capital requirement for counterparty credit risk using stressed inputs. This will address concerns about capital charges becoming too low during periods of compressed market volatility and help address procyclicality. The approach, which is similar to what has been introduced for market risk, will also promote more integrated management of market and counterparty credit risk.

3. Basel III Framework has strengthened standards for collateral management and initial margining. Banks with large and illiquid derivative exposures to a counterparty will have to apply longer margining periods as a basis for determining the regulatory capital requirement. Additional standards have been adopted to strengthen collateral risk management practices.

4. Basel III Framework also includes the additional systemic risk arising from the interconnectedness of banks and other financial institutions through the derivatives markets. In this regard, the Basel III Framework supports the efforts of the Committee on Payments and Settlement Systems (CPSS) and the International Organization of Securities Commissions (IOSCO) to establish strong standards for financial market infrastructures, including central counterparties. These standards have now been finalized through the BCBS Finalized Document entitled "Capital Requirements for Banks Exposures to Central Counterparties" of July 2012.The capitalization of bank exposures to central counterparties (CCPs) is based in part on the compliance of the CCP with such standards. A bank’s collateral and mark-to-market exposures to CCPs meeting these enhanced principles will be subject to a low risk weight, proposed at 2%; and default fund exposures to CCPs will be subject to risk-sensitive capital requirements. These criteria, together with strengthened capital requirements for bilateral OTC derivative exposures, will create strong incentives for banks to move exposures to such CCPs. Moreover, to address systemic risk within the financial sector, the Committee also is raising the risk weights through IRB Approaches only on exposures to financial institutions relative to the non-financial corporate sector, as financial exposures are more highly correlated than non-financial ones.

5. The Committee is raising counterparty credit risk management standards in a number of areas, including for the treatment of wrong-way risk, i.e. cases where the exposure increases when the credit quality of the counterparty deteriorates. It also issued final additional guidance for the sound backtesting of counterparty credit exposures. Finally, the Committee assessed a number of measures to mitigate the reliance on external ratings of the Basel II framework. The measures include requirements for banks to perform their own internal assessments of externally rated securitization exposures, the elimination of certain “cliff effects” associated with credit risk mitigation practices, and the incorporation of key elements of the IOSCO Code of Conduct Fundamentals for Credit Rating Agencies into the Committee’s eligibility criteria for the use of external ratings in the capital framework. The Committee also is conducting a more fundamental review of the securitization framework, including its reliance on external ratings.

A. Regulatory Capital Under Basel III

2. Definition of Regulatory Capital for Basel III

2.1 A Summary of Components of Capital

Total regulatory capital will consist of the sum of the following elements:

• Tier 1 Capital (going-concern capital)

a. Common Equity Tier 1Capital

b. Additional Tier 1Capital

• Tier 2 Capital

For each of the three categories above (Tier-1-a, Tier-1-b and Tier-2 capital) there are sets of criteria that instruments are required to meet before inclusion in the relevant category. (Refer to attachment # 2 to 4).

Limits and minima

All elements above are net of the associated regulatory adjustments and are subject to the following restrictions (see also Annex 1):

• Common Equity Tier 1 must be at least 4.5% of risk-weighted assets at all times.

• Tier 1 Capital must be at least 6.0% of risk-weighted assets at all times.

• Total Capital (Tier 1 Capital plus Tier 2 Capital) must be at least 8.0% of risk weighted assets at all times.

2.2 Details on Components of Regulatory Capital

2.2.1 Common Equity Tier 1

Common Equity Tier 1 capital consists of the sum of the following elements:

• Common shares issued by the bank that meet the criteria for classification as common shares for regulatory purposes (or the equivalent for non-joint stock companies);

• Stock surplus (share premium) resulting from the issue of instruments included Common Equity Tier 1;

• Retained earnings;

• Accumulated other comprehensive income and other disclosed reserves;

(There is no adjustment applied to remove from Common Equity Tier 1 unrealized gains or losses recognized on the balance sheet. Unrealized losses are subject to the transitional arrangements set out in paragraph 94 (c) and (d) Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems, 2011.)

• Common shares issued by consolidated subsidiaries of the bank and held by third parties (i.e. minority interest) that meet the criteria for inclusion in Common Equity Tier 1 capital.

• Retained earnings and other comprehensive income include interim profit or loss.

• Dividends are removed from Common Equity Tier 1 in accordance with applicable accounting standards. The treatment of minority interest and the regulatory adjustments applied in the calculation of Common Equity Tier 1 are addressed in separate sections.

Common shares issued by the bank

For an instrument to be included in Common Equity Tier 1 capital it must meet all of the criteria that an outlined in Annex-2. The vast majority of internationally active banks are structured as joint stock companies. (Joint stock companies are defined as companies that have issued common shares, irrespective of whether these shares are held privately or publically. These will represent the vast majority of internally active banks)1 and for these banks the criteria must be met solely with common shares.

In the rare cases where banks need to issue non-voting common shares as part of Common Equity Tier 1, they must be identical to voting common shares of the issuing bank in all respects except the absence of voting rights.

• Common shares issued by consolidated subsidiaries are described in section 3 of this document.

Regulatory adjustments applied in the calculation of Common Equity Tier 1 are described in section 4 of this document.

• Common shares issued by consolidated subsidiaries are described in section 3 of this document.

2.2.2. Additional Tier 1 capital

• A minimum set of criteria for an instrument issued by the bank to meet or to exceed in order for its to be included in additional Tier-1 Capital and described in Annex # 3.

Additional Tier 1 capital consists of the sum of the following elements:

• Instruments issued by the bank that meet the criteria for inclusion in Additional Tier 1 capital (and are not included in Common Equity Tier 1); Refer to paragraph 87-89, A global regulatory framework for more resilient banks and banking systems – revised version (rev June 2011)

• Stock surplus (share premium) resulting from the issue of instruments included in Additional Tier 1 capital;

• Instruments issued by consolidated subsidiaries of the bank and held by third parties that meet the criteria for inclusion in Additional Tier 1 capital and are not included in Common Equity Tier 1. Refer to section 3 for the relevant criteria; and

• Regulatory adjustments applied in the calculation of Additional Tier 1 Capital are addressed in section 4 of this document.

• Tier-1 Capital instruments issued by consolidated subsidiaries are described in section 3 of this document.

2.2.3. Tier 2 Capital

The objective of Tier 2 is to provide loss absorption on a gone-concern basis. Based on this objective, the following out the minimum set of criteria for an instrument to meet or exceed in order for it to be included in Tier 2 capital. (Annex 4)

• For details on the qualifying criteria for Tier 2 capital, please refer to annex # 4.

Tier 2 capital consists of the sum of the following elements:

• Instruments issued by the bank that meet the criteria for inclusion in Tier 2 capital (and are not included in Tier 1 capital);

• Stock surplus (share premium) resulting from the issue of instruments included in Tier 2 capital;

• Instruments issued by consolidated subsidiaries of the bank and held by third parties that meet the criteria for inclusion in Tier 2 capital and are not included in Tier 1 capital are described in section 3.

• Certain loan loss provisions

• Regulatory adjustments applied in the calculation of Tier 2 Capital.

The treatment of regulatory adjustments applied in the calculation of Tier 2 Capital are addressed in section 4.

Stock surplus (share premium) resulting from the issue of instruments included in Tier 2 capital;

Stock surplus (i.e. share premium) that is not eligible for inclusion in Tier 1, will only be permitted to be included in Tier 2 capital if the shares giving rise to the stock surplus are permitted to be included in Tier 2 capital.

General provisions/general loan-loss reserves (for banks using the Standardized Approach for credit risk)

Provisions or loan-loss reserves held against future, presently unidentified losses are freely available to meet losses which subsequently materialize and therefore qualify for inclusion within Tier 2. Provisions ascribed to identified deterioration of particular assets or known liabilities, whether individual or grouped, should be excluded. Furthermore, general provisions/general loan-loss reserves eligible for inclusion in Tier 2 will be limited to a maximum of 1.25 percentage points of credit risk-weighted risk assets calculated under the Standardized approach.

Excess of total eligible provisions under the Internal Ratings-based Approach

Where the total expected loss amount is less than total eligible provisions, as explained in paragraphs 380 to 383 of the June 2006 Comprehensive version of Basel II, banks may recognize the difference in Tier 2 capital up to a maximum of 0.6% of credit risk weighted assets calculated under the IRB approach. SAMA may apply a lower limit than 0.6% which will be communicated to banks.

3. Minority Interest (i.e. Non-Controlling Interest) and Other Capital Issued Out of Consolidated Subsidiaries that is Held by Third Parties

Note: Minority Interests arise on the full consolidation of majority held subsidiaries.

3.1 Common Shares Issued by Consolidated Subsidiaries

Minority interest arising from the issue of common shares by a fully consolidated subsidiary of the bank may receive recognition in Common Equity Tier 1 only if (1) the instrument giving rise to the minority interest would, if issued by the bank, meet all of the criteria for classification as common shares for regulatory capital purposes; and (2) the subsidiary that issued the instrument is itself a bank (for the purposes of this paragraph, any institution that is subject to the same minimum prudential standards and level of supervision as a bank may be considered to be a bank.) & (Minority interest in a subsidiary that is a bank is strictly excluded from the parent bank’s common equity if the parent bank or affiliate has entered into any arrangements to fund directly or indirectly minority investment in the subsidiary whether through an SPV or through another vehicle or arrangement. The treatment outlined above, thus, is strictly available where all minority investments in the bank subsidiary solely represent genuine third party common equity contributions to the subsidiary).

The amount of minority interest meeting the criteria above that will be recognized in consolidated Common Equity Tier 1 will be calculated as follows:

• Total minority interest meeting the two criteria above minus the amount of the surplus Common Equity Tier 1 of the subsidiary attributable to the minority shareholders.

• Surplus Common Equity Tier 1 of the subsidiary is calculated as the Common Equity Tier 1 of the subsidiary minus the lower of: (1) the minimum Common Equity Tier 1 requirement of the subsidiary plus the capital conservation buffer (i.e. 7.0% of risk weighted assets) and (2) the portion of the consolidated minimum Common Equity Tier 1 requirement plus the capital conservation buffer (i.e. 7.0% of consolidated risk weighted assets) that relates to the subsidiary.

• The amount of the surplus Common Equity Tier 1 that is attributable to the minority shareholders is calculated by multiplying the surplus Common Equity Tier 1 by the percentage of Common Equity Tier 1 that is held by minority shareholders.

Refer to para 62 A global regulatory framework for more resilient bank.

3.2 Tier 1 Qualifying Capital Issued by Consolidated Subsidiaries

Tier 1 capital instruments issued by a fully consolidated subsidiary of the bank to third party investors including amounts under paragraph 62 of the BCBS document of June 2011 may receive recognition in Tier 1 capital only if the instruments would, if issued by the bank, meet all of the criteria for classification as Tier 1 capital. The amount of this capital that will be recognized in Tier 1 will be calculated as follows:

• Total Tier 1 of the subsidiary issued to third parties minus the amount of the surplus Tier 1 of the subsidiary attributable to the third party investors.

• Surplus Tier 1 of the subsidiary is calculated as the Tier 1 of the subsidiary minus the lower of: (1) the minimum Tier 1 requirement of the subsidiary plus the capital conservation buffer (ie 8.5% of risk weighted assets) and (2) the portion of the consolidated minimum Tier 1 requirement plus the capital conservation buffer (ie 8.5% of consolidated risk weighted assets) that relates to the subsidiary.

• The amount of the surplus Tier 1 that is attributable to the third party investors is calculated by multiplying the surplus Tier 1 by the percentage of Tier 1 that is held by third party investors.

The amount of this Tier 1 capital that will be recognized in Additional Tier 1 will exclude amounts recognized in Common Equity Tier 1 Capital under paragraph 62 of BCBS document of June 2011.

3.3 Tier 1 and Tier 2 Qualifying Capital Issued by Consolidated Subsidiaries

Total capital instruments (ie Tier 1 and Tier 2 capital instruments) issued by a fully consolidated subsidiary of the bank to third party investors (including amounts under paragraph 3.1 and 3.2) may receive recognition in Total Capital only if the instruments would, if issued by the bank, meet all of the criteria for classification as Tier 1 or Tier 2 capital. The amount of this capital that will be recognized in consolidated Total Capital will be calculated as follows:

• Total capital instruments of the subsidiary issued to third parties minus the amount of the surplus Total Capital of the subsidiary attributable to the third party investors.

• Surplus Total Capital of the subsidiary is calculated as the Total Capital of the subsidiary minus the lower of: (1) the minimum Total Capital requirement of the subsidiary plus the capital conservation buffer (i.e. 10.5% of risk weighted assets) and (2) the portion of the consolidated minimum Total Capital requirement plus the capital conservation buffer (i.e. 10.5% of consolidated risk weighted assets) that relates to the subsidiary.

• The amount of the surplus Total Capital that is attributable to the third party investors is calculated by multiplying the surplus Total Capital by the percentage of Total Capital that is held by third party investors.

The amount of this Total Capital that will be recognized in Tier 2 will exclude amounts recognized in Common Equity Tier 1 under paragraph 3.1 and amounts recognized in Additional Tier 1 under paragraph 3.2.

Paragraphs 64-65: A global regulatory framework for more resilient banks and banking systems – revised version (rev June 2011).

Where capital has been issued to third parties out of a special purpose vehicle (SPV), none of this capital can be included in Common Equity Tier 1. However, such capital can be included in consolidated Additional Tier 1 or Tier 2 and treated as if the bank itself had issued the capital directly to the third parties only if it meets all the relevant entry criteria and the only asset of the SPV is its investment in the capital of the bank in a form that meets or exceeds all the relevant entry criteria (as required by criterion 14 for Additional Tier 1 and criterion 9 for Tier 2). In cases where the capital has been issued to third parties through an SPV via a fully consolidated subsidiary of the bank, such capital may, subject to the requirements of this paragraph, be treated as if the subsidiary itself had issued it directly to the third parties and may be included in the bank’s consolidated Additional Tier 1 or Tier 2 in accordance with the treatment outlined in paragraphs 63 and 64 of the BCBS document of June 2011.

4. Regulatory Adjustments or "Filter"

4.1

This section sets out the regulatory adjustments to be applied to regulatory capital. In most cases these adjustments are applied in the calculation of Common Equity Tier 1.

4.1.1 Goodwill and Other Intangibles (Except Mortgage Servicing Rights)

Goodwill and all other intangibles must be deducted in the calculation of Common Equity Tier 1, including any goodwill included in the valuation of significant investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation. With the exception of mortgage servicing rights, the full amount is to be deducted net of any associated deferred tax liability which would be extinguished if the intangible assets become impaired or derecognized under the relevant accounting standards. The amount to be deducted in respect of mortgage servicing rights is set out in the threshold deductions section below.

Subject to prior supervisory approval, banks that report under local GAAP may use the IFRS definition of intangible assets to determine which assets are classified as intangible and are thus required to be deducted.

4.1.2 Deferred Tax Assets

Deferred tax assets (DTAs) that rely on future profitability of the bank to be realized are to be deducted in the calculation of Common Equity Tier 1. Deferred tax assets may be netted with associated deferred tax liabilities (DTLs) only if the DTAs and DTLs relate to taxes levied by the same taxation authority and offsetting is permitted by the relevant taxation authority. Where these DTAs relate to temporary differences (e.g. allowance for credit losses) the amount to be deducted is set out in the “threshold deductions” section below. All other such assets, e.g. those relating to operating losses, such as the carry forward of unused tax losses, or unused tax credits, are to be deducted in full net of deferred tax liabilities as described above. The DTLs permitted to be netted against DTAs must exclude amounts that have been netted against the deduction of goodwill, intangibles and defined benefit pension assets, and must be allocated on a pro rata basis between DTAs subject to the threshold deduction treatment and DTAs that are to be deducted in full.

An over installment of tax or, in some jurisdictions, current year tax losses carried back to prior years may give rise to a claim or receivable from the government or local tax authority. Such amounts are typically classified as current tax assets for accounting purposes. The recovery of such a claim or receivable would not rely on the future profitability of the bank and would be assigned the relevant sovereign risk weighting.

4.1.3 Cash Flow Hedge Reserves

The amount of the cash flow hedge reserves that relates to the hedging of items that are not fair valued on the balance sheet (including projected cash flows) should be derecognized in the calculation of Common Equity Tier 1. This means that positive amounts should be deducted and negative amounts should be added back.

This treatment specifically identifies the element of the cash flow hedge reserve that is to be derecognized for prudential purposes. It removes the element that gives rise to artificial volatility in common equity, as in this case the reserve only reflects one half of the picture (the fair value of the derivative, but not the changes in fair value of the hedged future cash flow).

4.1.4 Shortfall of the Stock of Provisions to Expected Losses

The deduction from capital in respect of a shortfall of the stock of provisions to expected losses under the IRB approach should be made in the calculation of Common Equity Tier 1. The full amount is to be deducted and should not be reduced by any tax effects that could be expected to occur if provisions were to rise to the level of expected losses.

Gain on sale related to securitization transactions

Derecognize in the calculation of Common Equity Tier 1 any increase in equity capital resulting from a securitization transaction, such as that associated with expected future margin income (FMI) resulting in a gain-on- sale.

Cumulative gains and losses due to changes in own credit risk on fair valued financial liabilities

Derecognize in the calculation of Common Equity Tier 1, all unrealized gains and losses that have resulted from changes in the fair value of liabilities that are due to changes in the bank’s own credit risk.

In addition, with regard to derivative liabilities, derecognize all accounting valuation adjustments arising from the bank's own credit risk. The offsetting between valuation adjustments arising from the bank's own credit risk and those arising from its counterparties' credit risk is not allowed.

(BIS has issued its final guidelines (July 2012) titled “Regulatory treatment of valuation adjustments to derivative liabilities - final rule issued by the Basel Committee”. Banks are advised to refer to the aforementioned, these would be regarded as binding by SAMA with respect to capital computation / capital adequacy under Basel III guidelines.

4.1.5 Defined Benefit Pension Fund Assets and Liabilities

Defined benefit pension fund liabilities, as included on the balance sheet, must be fully recognized in the calculation of Common Equity Tier 1 (ie Common Equity Tier 1 cannot be increased through derecognizing these liabilities). For each defined benefit pension fund that is an asset on the balance sheet, the asset should be deducted in the calculation of Common Equity Tier 1 net of any associated deferred tax liability which would be extinguished if the asset should become impaired or derecognized under the relevant accounting standards. Assets in the fund to which the bank has unrestricted and unfettered access can, with supervisory approval, offset the deduction. Such offsetting assets should be given the risk weight they would receive if they were owned directly by the bank.

This treatment addresses the concern that assets arising from pension funds may not be capable of being withdrawn and used for the protection of depositors and other creditors of a bank. The concern is that their only value stems from a reduction in future payments into the fund. The treatment allows for banks to reduce the deduction of the asset if they can address these concerns and show that the assets can be easily and promptly withdrawn from the fund.

4.1.6 Investments in Own Shares (Treasury Stock)

All of a bank’s investments in its own common shares, whether held directly or indirectly, will be deducted in the calculation of Common Equity Tier 1 (unless already derecognized under the relevant accounting standards). In addition, any own stock which the bank could be contractually obliged to purchase should be deducted in the calculation of Common Equity Tier 1. The treatment described will apply irrespective of the location of the exposure in the banking book or the trading book. In addition:

• Gross long positions may be deducted net of short positions in the same underlying exposure only if the short positions involve no counterparty risk.

• Banks should look through holdings of index securities to deduct exposures to own shares. However, gross long positions in own shares resulting from holdings of index securities may be netted against short position in own shares resulting from short positions in the same underlying index. In such cases the short positions may involve counterparty risk (which will be subject to the relevant counterparty credit risk charge).

This deduction is necessary to avoid the double counting of a bank’s own capital. Certain accounting regimes do not permit the recognition of treasury stock and so this deduction is only relevant where recognition on the balance sheet is permitted. The treatment seeks to remove the double counting that arises from direct holdings, indirect holdings via index funds and potential future holdings as a result of contractual obligations to purchase own shares.

Following the same approach outlined above, banks must deduct investments in their own Additional Tier 1 in the calculation of their Additional Tier 1 capital and must deduct investments in their own Tier 2 in the calculation of their Tier 2 capital.

4.1.7 Reciprocal Cross Holdings in the Capital of Banking, Financial and Insurance Entities

Reciprocal cross holdings of capital that are designed to artificially inflate the capital position of banks will be deducted in full. Banks must apply a “corresponding deduction approach” to such investments in the capital of other banks, other financial institutions and insurance entities. This means the deduction should be applied to the same component of capital for which the capital would qualify if it was issued by the bank itself.

4.2

Investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation and where the bank does not own more than 10% of the issued common share capital of the entity.

The regulatory adjustment described in this section applies to investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation and where the bank does not own more than 10% of the issued common share capital of the entity. In addition:

• Investments include direct, indirect1 and synthetic holdings of capital instruments. For example, banks should look through holdings of index securities to determine their underlying holdings of capital.2

• Holdings in both the banking book and trading book are to be included. Capital includes common stock and all other types of cash and synthetic capital instruments (e.g. subordinated debt). It is the net long position that is to be included (i.e. the gross long position net of short positions in the same underlying exposure where the maturity of the short position either matches the maturity of the long position or has a residual maturity of at least one year).

• Underwriting positions held for five working days or less can be excluded. Underwriting positions held for longer than five working days must be included.

• If the capital instrument of the entity in which the bank has invested does not meet the criteria for Common Equity Tier 1, Additional Tier 1, or Tier 2 capital of the bank, the capital is to be considered common shares for the purposes of this regulatory adjustment.3

Amounts below the threshold, which are not deducted, will continue to be risk weighted. Thus, instruments in the trading book will be treated as per the market risk rules and instruments in the banking book should be treated as per the internal ratings-based approach or the standardized approach (as applicable). For the application of risk weighting the amount of the holdings must be allocated on a pro rata basis between those below and those above the threshold.

1 Indirect holdings are exposures or parts of exposures that, if a direct holding loses its value, will result in a loss to the bank substantially equivalent to the loss in value of the direct holding.

2 If banks find it operationally burdensome to look through and monitor their exact exposure to the capital of other financial institutions as a result of their holdings of index securities, SAMA may permit banks, subject to prior supervisory approval, to use a conservative estimate.

3 If the investment is issued out of a regulated financial entity and not included in regulatory capital in the relevant sector of the financial entity, it is not required to be deducted.4.2.1

If the total of all holdings listed above in aggregate exceed 10% of the bank’s common equity (after applying all other regulatory adjustments in full listed prior to this one) then the amount above 10% is required to be deducted, applying a corresponding deduction approach. This means the deduction should be applied to the same component of capital for which the capital would qualify if it was issued by the bank itself. Accordingly, the amount to be deducted from common equity should be calculated as the total of all holdings which in aggregate exceed 10% of the bank’s common equity (as per above) multiplied by the common equity holdings as a percentage of the total capital holdings. This would result in a common equity deduction which corresponds to the proportion of total capital holdings held in common equity. Similarly, the amount to be deducted from Additional Tier 1 capital should be calculated as the total of all holdings which in aggregate exceed 10% of the bank’s common equity (as per above) multiplied by the Additional Tier 1 capital holdings as a percentage of the total capital holdings. The amount to be deducted from Tier 2 capital should be calculated as the total of all holdings which in aggregate exceed 10% of the bank’s common equity (as per above) multiplied by the Tier 2 capital holdings as a percentage of the total capital holdings.

If, under the corresponding deduction approach, a bank is required to make a deduction from a particular tier of capital and it does not have enough of that tier of capital to satisfy that deduction, the shortfall will be deducted from the next higher tier of capital (eg if a bank does not have enough Additional Tier 1 capital to satisfy the deduction, the shortfall will be deducted from Common Equity Tier 1).

4.3 Significant investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation 1

The regulatory adjustment described in this section applies to investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation where the bank owns more than 10% of the issued common share capital of the issuing entity or where the entity is an affiliate2 of the bank. In addition:

• Investments include direct, indirect and synthetic holdings of capital instruments. For example, banks should look through holdings of index securities to determine their underlying holdings of capital.3

• Holdings in both the banking book and trading book are to be included. Capital includes common stock and all other types of cash and synthetic capital instruments (e.g. subordinated debt). It is the net long position that is to be included (i.e. the gross long position net of short positions in the same underlying exposure where the maturity of the short position either matches the maturity of the long position or has a residual maturity of at least one year).

• Underwriting positions held for five working days or less can be excluded. Underwriting positions held for longer than five working days must be included.

• If the capital instrument of the entity in which the bank has invested does not meet the criteria for Common Equity Tier 1, Additional Tier 1, or Tier 2 capital of the bank, the capital is to be considered common shares for the purposes of this regulatory adjustment.4

• National discretion applies to allow banks, with prior supervisory approval, to exclude temporarily certain investments where these have been made in the context of resolving or providing financial assistance to reorganize a distressed institution. (If necessary and relevant, please refer to SAMA for further guidance.)

All investments included above that are not common shares must be fully deducted following a corresponding deduction approach. This means the deduction should be applied to the same tier of capital for which the capital would qualify if it was issued by the bank itself. If the bank is required to make a deduction from a particular tier of capital and it does not have enough of that tier of capital to satisfy that deduction, the shortfall will be deducted from the next higher tier of capital (e.g. if a bank does not have enough Additional Tier 1 capital to satisfy the deduction, the shortfall will be deducted from Common Equity Tier 1).

Investments included above that are common shares will be subject to the threshold treatment described in the next section.

1 Investments in entities that are outside of the scope of regulatory consolidation refers to investments in entities that have not been consolidated at all or have not been consolidated in such a way as to result in their assets being included in the calculation of consolidated risk-weighted assets of the group.

2 An affiliate of a bank is defined as a company that controls, or is controlled by, or is under common control with, the bank. Control of a company is defined as (1) ownership, control, or holding with power to vote 20% or more of a class of voting securities of the company; or (2) consolidation of the company for financial reporting purposes.

3 If banks find it operationally burdensome to look through and monitor their exact exposure to the capital of other financial institutions as a result of their holdings of index securities, SAMA may permit banks to use a conservative estimate.

4 If the investment is issued out of a regulated financial entity and not included in regulatory capital in the relevant sector of the financial entity, it is not required to be deducted.4.4 Threshold Deductions

Instead of a full deduction, the following items may each receive limited recognition when calculating Common Equity Tier 1, with recognition capped at 10% of the bank’s common equity (after the application of all regulatory adjustments set out in paragraphs 4.1.1 to 4.3):

• Significant investments in the common shares of unconsolidated financial institutions (banks, insurance and other financial entities) as referred to in paragraph 4.3 of this document; (Refer to paragraph 87,89, A global regulatory framework for more resilient bank and banking systems – revised version (rev June 2011)

• Mortgage servicing rights (MSRs); and

• DTAs that arise from temporary differences.

On 1 January 2013, a bank must deduct the amount by which the aggregate of the three items above exceeds 15% of its common equity component of Tier 1 (calculated prior to the deduction of these items but after application of all other regulatory adjustments applied in the calculation of Common Equity Tier 1). The items included in the 15% aggregate limit are subject to full disclosure. As of 1 January 2018, the calculation of the 15% limit will be subject to the following treatment: the amount of the three items that remains recognized after the application of all regulatory adjustments must not exceed 15% of the Common Equity Tier 1 capital, calculated after all regulatory adjustments. See Annex 2 for an example.

The amount of the three items that are not deducted in the calculation of Common Equity Tier 1 will be risk weighted at 250%. (Refer to Prudential Return)

4.10 Former Deductions from Capital

90. The following items, which under Basel II were deducted 50% from Tier 1 and 50% from Tier 2 (or had the option of being deducted or risk weighted), will receive a 1250% risk weight: (Refer to Prudential Return)

• Certain Securitization and Resecuritization exposures;

• Certain equity exposures under the PD/LGD approach;

• Non-payment/delivery on non-DvP and non-PvP transactions; and

• Significant investments in commercial entities.

5. Transitional Arrangements

The transitional arrangements for implementing the new standards will help to ensure that there is minimal disruption in banking sector, and that it can meet the higher capital standards through reasonable earnings retention and capital raising, while still supporting lending to the economy. The transitional arrangements include:

5.1 Minimum Capital Adequacy Ratio – Please Also Refer to Annex-1

National implementation by member countries will begin on 1 January 2013. Member countries must translate the rules into national laws and regulations before this date. As of 1 January 2013, banks will be required to meet the following new minimum requirements in relation to risk-weighted assets (RWAs):

– 3.5% Common Equity Tier 1/RWAs;

– 4.5% Tier 1 capital/RWAs, and

– 8.0% total capital/RWAs.

5.2 Phasing in of the Minimum Common Equity Tier 1 and Tier 1 Requirements

The minimum Common Equity Tier 1 and Tier 1 requirements will be phased in between 1 January 2013 and 1 January 2015. On 1 January 2013, the minimum Common Equity Tier 1 requirement will rise from the current 2% level to 3.5%. The Tier 1 capital requirement will rise from 4% to 4.5%. On 1 January 2014, banks will have to meet a 4% minimum Common Equity Tier 1 requirement and a Tier 1 requirement of 5.5%. On 1 January 2015, banks will have to meet the 4.5% Common Equity Tier 1 and the 6% Tier 1 requirements. The total capital requirement remains at the existing level of 8.0% and so does not need to be phased in. The difference between the total capital requirement of 8.0% and the Tier 1 requirement can be met with Tier 2 and higher forms of capital.

5.3 15% Limit for Significant Investment

The regulatory adjustments (ie deductions and prudential filters), including amounts above the aggregate 15% limit for significant investments in financial institutions, mortgage servicing rights, and deferred tax assets from temporary differences, would be fully deducted from Common Equity Tier 1 by 1 January 2018.

5.4 Phasing in Regulatory Adjustment

In particular, the regulatory adjustments will begin at 20% of the required adjustments to Common Equity Tier 1 on 1 January 2014, 40% on 1 January 2015, 60% on 1 January 2016, 80% on 1 January 2017, and reach 100% on 1 January 2018. During this transition period, the remainder not deducted from Common Equity Tier 1 will continue to be subject to existing national treatments (Follow up). The same transition approach will apply to deductions from Additional Tier 1 and Tier 2 capital. Specifically, the regulatory adjustments to Additional Tier 1 and Tier 2 capital will begin at 20% of the required deductions on 1 January 2014, 40% on 1 January 2015, 60% on 1 January 2016, 80% on 1 January 2017, and reach 100% on 1 January 2018. During this transition period, the remainder not deducted from capital will continue to be subject to existing national treatments. (Follow up)

5.5 The Treatment of Capital Issued Out of Subsidiaries and Held by Third Parties

The treatment of capital issued out of subsidiaries and held by third parties (eg minority interest) will also be phased in. Where such capital is eligible for inclusion in one of the three components of capital according to paragraphs 63 to 65 of the BCBS document of June 2011, it can be included from 1 January 2013. Where such capital is not eligible for inclusion in one of the three components of capital but is included under the existing national treatment, 20% of this amount should be excluded from the relevant component of capital on 1 January 2014, 40% on 1 January 2015, 60% on 1 January 2016, 80% on 1 January 2017, and reach 100% on 1 January 2018.

5.6 Grand Fathering

Existing public sector capital injections will be grandfathered until 1 January 2018.

5.7 Capital Instruments that No Longer Qualify as Non-Common Equity Tier 1 Capital

Capital instruments that no longer qualify as non-common equity Tier 1 capital or Tier 2 capital will be phased out beginning 1 January 2013. Fixing the base at the nominal amount of such instruments outstanding on 1 January 2013, their recognition will be capped at 90% from 1 January 2013, with the cap reducing by 10 percentage points in each subsequent year. This cap will be applied to Additional Tier 1 and Tier 2 separately and refers to the total amount of instruments outstanding that no longer meet the relevant entry criteria. To the extent an instrument is redeemed, or its recognition in capital is amortized, after 1 January 2013, the nominal amount serving as the base is not reduced. In addition, instruments with an incentive to be redeemed will be treated as follows:

– For an instrument that has a call and a step-up prior to 1 January 2013 (or another incentive to be redeemed), if the instrument is not called at its effective maturity date and on a forward-looking basis will meet the new criteria for inclusion in Tier 1 or Tier 2, it will continue to be recognized in that tier of capital.

– For an instrument that has a call and a step-up on or after 1 January 2013 (or another incentive to be redeemed), if the instrument is not called at its effective maturity date and on a forward looking basis will meet the new criteria for inclusion in Tier 1 or Tier 2, it will continue to be recognized in that tier of capital. Prior to the effective maturity date, the instrument would be considered an “instrument that no longer qualifies as Additional Tier 1 or Tier 2” and will therefore be phased out from 1 January 2013.

– For an instrument that has a call and a step-up between 12 September 2010 and 1 January 2013 (or another incentive to be redeemed), if the instrument is not called at its effective maturity date and on a forward looking basis does not meet the new criteria for inclusion in Tier 1 or Tier 2, it will be fully derecognized in that tier of regulatory capital from 1 January 2013.

– For an instrument that has a call and a step-up on or after 1 January 2013 (or another incentive to be redeemed), if the instrument is not called at its effective maturity date and on a forward looking basis does not meet the new criteria for inclusion in Tier 1 or Tier 2, it will be derecognized in that tier of regulatory capital from the effective maturity date. Prior to the effective maturity date, the instrument would be considered an “instrument that no longer qualifies as Additional Tier 1 or Tier 2” and will therefore be phased out from 1 January 2013.

– For an instrument that had a call and a step-up on or prior to 12 September 2010 (or another incentive to be redeemed), if the instrument was not called at its effective maturity date and on a forward looking basis does not meet the new criteria for inclusion in Tier 1 or Tier 2, it will be considered an “instrument that no longer qualifies as Additional Tier 1 or Tier 2” and will therefore be phased out from 1 January 2013.

Capital instruments that do not meet the criteria for inclusion in Common Equity Tier 1 will be excluded from Common Equity Tier 1 as of 1 January 2013. However, instruments meeting the following three conditions will be phased out over the same horizon described in paragraph 94(g): (1) they are issued by a non-joint stock company1; (2) they are treated as equity under the prevailing accounting standards; and (3) they receive unlimited recognition as part of Tier 1 capital under current national banking law.

Only those instruments issued before 12 September 2010 qualify for the above transition arrangements.

NOTE: Banks should also refer to SAMA Circular entitled "Elements of the Reforms to Raise the Quality of Regulatory Capital – Loss Absorbency at the Point of Non- Viability issued through SAMA Circular # BCS 5611 dated 13 February 2011.

1 Non-joint stock companies were not addressed in the Basel Committee’s 1998 agreement on instruments eligible for inclusion in Tier 1 capital as they do not issue voting common shares.

B. Pillar 1 Requirements

Enhancement Risk Under Basel III Framework

6. Enhanced Risk Coverage

In addition to raising the quality and level of the capital base, the Basel III framework recognized the need to ensure that all material risks are captured in the capital framework. Failure to capture major on- and off-balance sheet risks, as well as derivative related exposures, was a key factor that amplified the crisis. This section outlines enhancement to Risk Coverage under the Basel III framework as given below.

A. Counterparty Credit Risk

• Revised metric to better address counterparty credit risk, credit valuation adjustments and wrong-way risks

• Introduction of Asset Value correlation (AVC) for Financial Institutions

• Collateralized counterparties and increased margin period of risk

• Central Counterparties (CCPs)

• Enhanced counterparty credit risk management requirements

B. Addressing Reliance on external credit ratings and minimizing cliff effects

• Standardized Inferred rating treatment for long-term exposure

• Incentive to avoid getting exposures rated

• Incorporation of IOSCO’s Code of Conduct Fundamentals for Credit Rating Agencies

• ‘’Cliff effects’’ arising from guarantees and credit derivatives- ‘’CRM’’

• Unsolicited ratings and recognition of ECAI’s

6.1 Counterparty Credit Risk

As mentioned, Counterparty Credit Risk under Basel II only measured Default Risk which could be calculated by using the following 3 methods, where SAMA adopted the # 3 Current Exposure Method.

1. Internal Model Method

2. Standardized Approach

3. Current Exposure Method (CEM)

In this regard, SAMA had permitted only the Current Exposures Method under Basel II. For Basel III purposes as in Basel II banks are to use the more simple CEM.

Further, Basel III introduced the concept of Current Value Adjustment (CVA) as an additional Counterparty Risk, which again can be determined by using the Internal Model Method (IMM) or the Standardized Method.

It should also be emphasized that Basel III introduced incremental risk or additional risk through the concept of the Credit Value Adjustment which measure the counterparty risk prior to default. Consequently, total risk is an aggregate of these two.

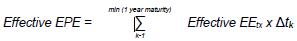

The main revision to Internal Models Method to measure default risk exposure is to using the Effective EPE with stressed parameters.

In this regard, the Default risk capital charge is the greater of:

• Portfolio level capital charge based on effective EPE (not including CVA charge using current market data) and the portfolio level capital charge based on effective EPE under stress calibration.

B. Credit Value Adjustment

Capitalization of the risk of CVA losses

The major element of CVA include the following:

• Applies to IMM and non IMM banks

• Huge mark-to-market losses incurred during financial crisis

• BCBS introduced a ‘’bond equivalent of the counterparty exposure’’ approach which aims to better capture CVA losses

• In addition to default risk, additional capital charge introduced for CCR for OTC derivatives

• Transactions with SFTs and CCPs excluded from CVA capital charge unless these are material, where the materiality threshold for SFT’s will be defined by SAMA and if warranted, bank will be advised accordingly.

• Banks with IMM approval and Specific Interest Rate Risk VaR model approval for bonds will use ‘’Advanced CVA risk capital charge’’

• All other banks will calculate CVA capital charge based on ‘’Standardized CVA risk capital charge’’ methodology

• Under Basel II, Banks in KSA are mandated by SAMA to use ‘’CEM’’ methodology for both Standardized & IRB Approach. However, for Basel III they can utilize IMM as well.

• Under the Standardized Approach, Banks would be required to develop enhanced system’s capability to apply this formula

• Maturity: Mi is the notional weighted average maturity (FAQ- For CVA purposes, the 5-year cap of the effective maturity will not be applied). This applies to all transactions with the counterparty, not only to index CDS- Maturity will be capped at the longest contractual remaining maturity in the netting set.

A. Counterparty credit risk using Internal Models

This section is only applicable for those banks that have been given regulatory approval by SAMA to use the IMM Approach to calculate counterparty credit risk. Alternatively, Banks should use Standardized Approach 6.1.B on page 30. Also, for further clarifications, please refer to SAMA Circular # BCS 24331 dated 4 September 2012 entitled "Basel III Definition of Capital FAQs (p.7).

6.1.A Internal Model Method (IMM)

Default Risk Exposures Calculation

Internal Model (EPE)

25(i). To determine the default risk capital charge for counterparty credit risk as defined in paragraph 105, banks must use the greater of the portfolio-level capital charge (not including the CVA charge in paragraphs 97-104) based on Effective EPE using current market data and the portfolio-level capital charge based on Effective EPE using a stress calibration. The stress calibration should be a single consistent stress calibration for the whole portfolio of counterparties. The greater of Effective EPE using current market data and the stress calibration should not be applied on a counterparty by counterparty basis, but on a total portfolio level.

61. When the Effective EPE model is calibrated using historic market data, the bank must employ current market data to compute current exposures and at least three years of historical data must be used to estimate parameters of the model. Alternatively, market implied data may be used to estimate parameters of the model. In all cases, the data must be updated quarterly or more frequently if market conditions warrant. To calculate the Effective EPE using a stress calibration, the bank must also calibrate Effective EPE using three years of data that include a period of stress to the credit default spreads of a bank’s counterparties or calibrate Effective EPE using market implied data from a suitable period of stress. The following process will be used to assess the adequacy of the stress calibration:

• The bank must demonstrate, at least quarterly, that the stress period coincides with a period of increased CDS or other credit spreads – such as loan or corporate bond spreads – for a representative selection of the bank’s counterparties with traded credit spreads. In situations where the bank does not have adequate credit spread data for a counterparty, the bank should map each counterparty to specific credit spread data based on region, internal rating and business types.

• The exposure model for all counterparties must use data, either historic or implied, that include the data from the stressed credit period, and must use such data in a manner consistent with the method used for the calibration of the Effective EPE model to current data.

• To evaluate the effectiveness of its stress calibration for Effective EPE, the bank must create several benchmark portfolios that are vulnerable to the same main risk factors to which the bank is exposed. The exposure to these benchmark portfolios shall be calculated using (a) current positions at current market prices, stressed volatilities, stressed correlations and other relevant stressed exposure model inputs from the 3-year stress period and (b) current positions at end of stress period market prices, stressed volatilities, stressed correlations and other relevant stressed exposure model inputs from the 3-year stress period. Supervisors may adjust the stress calibration if the exposures of these benchmark portfolios deviate substantially.

Calculation of Credit Value Adjustment (CVA)

The Concept

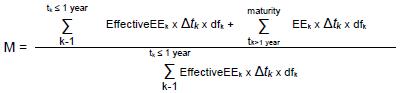

Credit Value Adjustments (CVA) under Basel III is an incremental credit risk capital charge prior to default. Under Basel II and Basel II.5 counterparty credit risk methodology only calculated capital requirements for default risk. However, Basel III brings in the capital charge with regard to the deterioration of a counterparty risk prior to default. Consequently, the CVA is in addition or as an incremental risk to default risk. SAMA's methodology uses the Current Exposure Method (CEM) for Default Risk which is one of the four methods prescribed under Basel II Annex # 41. Consequently, capital requirements for counterparty risk is the aggregate of CEM and CVA calculations.

Specific Aspects of CVA under IMM Approach

Capitalization of the risk of CVA losses

99. To implement the bond equivalent approach, the following new section VIII will be added to Annex 4 of the Basel II framework.1 The new paragraphs (97 to 105) are to be inserted after paragraph 96 in Annex 4.1

VIII. Treatment of mark-to-market counterparty risk losses (CVA capital charge)

- CVA Risk Capital Charge

97. In addition to the default risk capital requirements for counterparty credit risk determined based on the standardized or internal ratings- based (IRB) approaches for credit risk, a bank must add a capital charge to cover the risk of mark-to-market losses on the expected counterparty risk (such losses being known as credit value adjustments, CVA) to OTC derivatives. The CVA capital charge will be calculated in the manner set forth below depending on the bank’s approved method of calculating capital charges for counterparty credit risk and specific interest rate risk. A bank is not required to include in this capital charge (i) transactions with a central counterparty (CCP); and (ii) securities financing transactions (SFT), unless their supervisor determines that the bank’s CVA loss exposures arising from SFT transactions are material.

A. Banks with IMM approval and Specific Interest Rate Risk VaR model2 approval for bonds: Advanced CVA risk capital charge

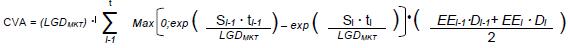

98. Banks with IMM approval for counterparty credit risk and approval to use the market risk internal models approach for the specific interest-rate risk of bonds must calculate this additional capital charge by modeling the impact of changes in the counterparties’ credit spreads on the CVAs of all OTC derivative counterparties, together with eligible CVA hedges according to new paragraphs 102 and 103, using the bank’s VaR model for bonds. This VaR model is restricted to changes in the counterparties’ credit spreads and does not model the sensitivity of CVA to changes in other market factors, such as changes in the value of the reference asset, commodity, currency or interest rate of a derivative. Regardless of the accounting valuation method a bank uses for determining CVA, the CVA capital charge calculation must be based on the following formula for the CVA of each counterparty:

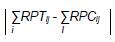

Where:

• ti is the time of the i-th revaluation time bucket, starting from t0=0.

• tT is the longest contractual maturity across the netting sets with the counterparty.

• si is the credit spread of the counterparty at tenor ti, used to calculate the CVA of the counterparty. Whenever the CDS spread of the counterparty is available, this must be used. Whenever such a CDS spread is not available, the bank must use a proxy spread that is appropriate based on the rating, industry and region of the counterparty.

• LGDMKT is the loss given default of the counterparty and should be based on the spread of a market instrument of the counterparty (or where a counterparty instrument is not available, based on the proxy spread that is appropriate based on the rating, industry and region of the counterparty). It should be noted that this LGDMKT, which inputs into the calculation of the CVA risk capital charge, is different from the LGD that is determined for the IRB and CCR default risk charge, as this LGDMKT is a market assessment rather than an internal estimate.

• The first factor within the sum represents an approximation of the market implied marginal probability of a default occurring between times ti-1 and ti. Market implied default probability (also known as risk neutral probability) represents the market price of buying protection against a default and is in general different from the real-world likelihood of a default.

• EEi is the expected exposure to the counterparty at revaluation time ti, as defined in paragraph 30 (regulatory expected exposure), where exposures of different netting sets for such counterparty are added, and where the longest maturity of each netting set is given by the longest contractual maturity inside the netting set. For banks using the short cut method (paragraph 41 of Annex 4)1 for margined trades, the paragraph 99 should be applied.

• Di is the default risk-free discount factor at time ti, where D0 = 1.

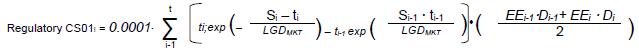

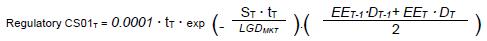

99. The formula in paragraph 98 must be the basis for all inputs into the bank’s approved VaR model for bonds when calculating the CVA risk capital charge for a counterparty. For example, if this approved VaR model is based on full repricing, then the formula must be used directly. If the bank’s approved VaR model is based on credit spread sensitivities for specific tenors, the bank must base each credit spread sensitivity on the following formula:3

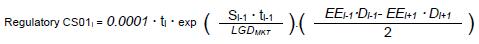

If the bank’s approved VaR model uses credit spread sensitivities to parallel shifts in credit spreads (Regulatory CS01), then the bank must use the following formula:4

If the bank’s approved VaR model uses second-order sensitivities to shifts in credit spreads (spread gamma), the gammas must be calculated based on the formula in paragraph 98.

Banks using the short cut method for collateralized OTC derivatives (paragraph 41 in Appendix 4), must compute the CVA risk capital charge according to paragraph 98, by assuming a constant EE (expected exposure) profile, where EE is set equal to the effective expected positive exposure of the shortcut method for a maturity equal to the maximum of (i) half of the longest maturity occurring in the netting set and (ii) the notional weighted average maturity of all transactions inside the netting set.

Banks with IMM approval for the majority of their businesses, but which use CEM (Current Exposure Method) or SM (Standardized Method) for certain smaller portfolios, and which have approval to use the market risk internal models approach for the specific interest rate risk of bonds, will include these non-IMM netting sets into the CVA risk capital charge, according to paragraph 98, unless the national supervisor decides that paragraph 104 should apply for these portfolios. Non-IMM netting sets are included into the advanced CVA risk capital charge by assuming a constant EE profile, where EE is set equal to the EAD as computed under CEM or SM for a maturity equal to the maximum of (i) half of the longest maturity occurring in the netting set and (ii) the notional weighted average maturity of all transactions inside the netting set. The same approach applies where the IMM model does not produce an expected exposure profile.

For exposures to certain counterparties, the bank's approved market risk VaR model may not reflect the risk of credit spread changes appropriately, because the bank's market risk VaR model does not appropriately reflect the specific risk of debt instruments issued by the counterparty. For such exposures, the bank is not allowed to use the advanced CVA risk charge. Instead, for these exposures the bank must determine the CVA risk charge by application of the standardized method in paragraph 104. Only exposures to counterparties for which the bank has supervisory approval for modeling the specific risk of debt instruments are to be included into the advanced CVA risk charge.

100. The CVA risk capital charge consists of both general and specific credit spread risks, including Stressed VaR but excluding IRC (incremental risk charge). The VaR figure should be determined in accordance with the quantitative standards described in paragraph 718(Lxxvi). It is thus determined as the sum of (i) the non-stressed VaR component and (ii) the stressed VaR component.

i. When calculating the non-stressed VaR, current parameter calibrations for expected exposure must be used.

ii. When calculating the stressed VaR future counterparty EE profiles (according to the stressed exposure parameter calibrations as defined in paragraph 61 of Annex 4)1 must be used. The period of stress for the credit spread parameters should be the most severe one-year stress period contained within the three year stress period used for the exposure parameters.5

101. This additional CVA risk capital charge is the standalone market risk charge, calculated on the set of CVAs (as specified in paragraph 98) for all OTC derivatives counterparties, collateralized and uncollateralized, together with eligible CVA hedges. Within this standalone CVA risk capital charge, no offset against other instruments on the bank’s balance sheet will be permitted (except as otherwise expressly provided herein).

102. Only hedges used for the purpose of mitigating CVA risk, and managed as such, are eligible to be included in the VaR model used to calculate the above CVA capital charge or in the standardized CVA risk capital charge set forth in paragraph 104. For example, if a credit default swap (CDS) referencing an issuer is in the bank’s inventory and that issuer also happens to be an OTC counterparty but the CDS is not managed as a hedge of CVA, then such a CDS is not eligible to offset the CVA within the standalone VaR calculation of the CVA risk capital charge.

103. The only eligible hedges that can be included in the calculation of the CVA risk capital charge under paragraphs 98 or 104 are single-name CDSs, single-name contingent CDSs, other equivalent hedging instruments referencing the counterparty directly, and index CDSs. In case of index CDSs, the following restrictions apply:

• The basis between any individual counterparty spread and the spreads of index CDS hedges must be reflected in the VaR. This requirement also applies to cases where a proxy is used for the spread of a counterparty, since idiosyncratic basis still needs to be reflected in such situations. For all counterparties with no available spread, the bank must use reasonable basis time series out of a representative bucket of similar names for which a spread is available.

• If the basis is not reflected to the satisfaction of the supervisor, then the bank must reflect only 50% of the notional amount of index hedges in the VaR. Other types of counterparty risk hedges must not be reflected within the calculation of the CVA capital charge, and these other hedges must be treated as any other instrument in the bank’s inventory for regulatory capital purposes. Tranched or nthto-default CDSs are not eligible CVA hedges. Eligible hedges that are included in the CVA capital charge must be removed from the bank’s market risk capital charge calculation.

1 Annex 5 of this document.

2 “VaR model” refers to the internal model approach to market risk.

3 This derivation assumes positive marginal default probabilities before and after time bucket ti and is valid for i<T. For the final time bucket i=T, the corresponding formula is:

4 This derivation assumes positive marginal default probabilities.

5 Note that the three-times multiplier inherent in the calculation of a bond VaR and a stressed VaR will apply to these calculations.6.1.B Counterparty Credit Risk (Under the Standardized Approach)

The total capital requirements for counterparty credit risk under the Standardized Approach is also an aggregate of the 1) Default risk under SAMA Basel III calculated using the Current Exposure Method and the Incremental Risk under Basel III called the Credit Value Adjustment.

For further clarifications, please refer to SAMA Circular # BCS 24331 dated 4 September 2012 entitled "Basel III Definition of Capital FAQs (p.7).

Consequently, Bank using the Standardized Approach will calculate the Default Risk using the CEM as prescribed also under Basel II, and the CVA under the Standardized Approach as given below under Basel III.

Standardized CVA risk capital charge

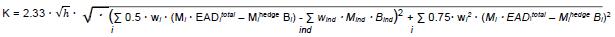

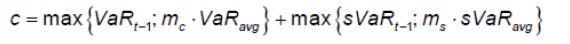

104. When a bank does not have the required approvals to use paragraph 98 to calculate a CVA capital charge for its counterparties, the bank must calculate a portfolio capital charge using the following formula:

Where:

• h is the one-year risk horizon (in units of a year), h = 1.

• wi is the weight applicable to counterparty ‘i’. Counterparty ‘i’ must be mapped to one of the seven weights wi based on its external rating, as shown in the table of this paragraph below. When a counterparty does not have an external rating, the bank must, subject to supervisory approval, map the internal rating of the counterparty to one of the external ratings.

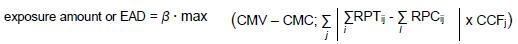

• EADtotali EAD is the exposure at default of counterparty ‘i’ (summed across its netting sets), including the effect of collateral as per the existing IMM, SM or CEM rules as applicable to the calculation of counterparty risk capital charges for such counterparty by the bank. For non-IMM banks the exposure should be discounted by applying the factor (1-exp(-0.05*Mi))/(0.05*Mi). For IMM banks, no such discount should be applied as the discount factor is already included in Mi.

• Bi is the notional of purchased single name CDS hedges (summed if more than one position) referencing counterparty ‘i’, and used to hedge CVA risk. This notional amount should be discounted by applying the factor (1-exp(-0.05*Mihedge))/(0.05* Mihedge).

• Bind is the full notional of one or more index CDS of purchased protection, used to hedge CVA risk. This notional amount should be discounted by applying the factor (1-exp(-0.05*Mind))/(0.05* Mind).

• wind is the weight applicable to index hedges. The bank must map indices to one of the seven weights wi based on the average spread of index ‘ind’.

• Mi is the effective maturity of the transactions with counterparty ‘i’. For IMM banks, Mi is to be calculated as per Annex 4,1 paragraph 38 of the Basel Accord. For non-IMM banks, Mi is the notional weighted average maturity as referred to in the third bullet point of para 320. However, for this purpose, Mi should not be capped at 5 years.

• Mihedge is the maturity of the hedge instrument with notional Bi (the quantities Mihedge Bi are to be summed if these are several positions).

• Mind is the maturity of the index hedge ‘ind’. In case of more than one index hedge position, it is the notional weighted average maturity.

For any counterparty that is also a constituent of an index on which a CDS is used for hedging counterparty credit risk, the notional amount attributable to that single name (as per its reference entity weight) may, with supervisory approval, be subtracted from the index CDS notional amount and treated as a single name hedge (Bi) of the individual counterparty with maturity based on the maturity of the index.

The weights are given in this table, and are based on the external rating of the counterparty:2

Rating Weight Wi AAA 0.7% AA 0.7% A 0.8% BBB 1.0% BB 2.0% B 3.0% CCC 10.0% 1 Annex 5 of this document.

2 The notations follow the methodology used by one institution, Standard & Poor’s. The use of Standard & Poor’s credit ratings is an example only; those of some other approved external credit assessment institutions could be used on an equivalent basis. The ratings used throughout this document, therefore, do not express any preferences or determinations on external assessment institutions by the Committee.6.1.C Further Details on CCR and CVA Aggregation

105. Calculation of the aggregate CCR and CVA risk capital charges for 6.1.A IMM and 6.1.b (Standardized Approach)

As a summary, total counterparty exposure is an aggregate of 1) Default Rate calculated either through IMM, CEM or Standardized Approach and 2) Credit Value Adjustment which again can be calculated as per the IMM or Standardized Approach or CEM.

This paragraph deals with the aggregation of the default risk capital charge and the CVA risk capital charge for potential mark-to-market losses. Note that outstanding EAD referred to in the default risk capital charges below is net of incurred CVA losses according to [new paragraph after Para 9 in Annex 4],1 which affects all items “i” below. In this paragraph, “IMM capital charge” refers to the default risk capital charge for CCR based on the RWAs obtained when multiplying the outstanding EAD of each counterparty under the IMM approach by the applicable credit risk weight (under the Standardized or IRB approach), and summing across counterparties. Equally, Current Exposures Method “(CEM) capital charge” or “SM capital charge” refer to the default risk capital charges where outstanding EADs for all counterparties in the portfolio are determined based on CEM or SM, respectively.

A. Banks with IMM approval and market-risk internal-models approval for the specific interest-rate risk of bonds The total CCR capital charge for such a bank is determined as the sum of the following components: