Banking Products and Finance Activities

Responsible Lending Principles for Individual Customers

No: 46538/99 Date(g): 16/5/2018 | Date(h): 2/9/1439 Status: In-Force Responsible Lending Principles, issued by SAMA under Circular No. (46538/99) dated 02/09/1439H (17/05/2018), Amended by SAMA’s Circular No.( 40694/1) dated 09/09/1439H (24/05/2018).Note: This translation is provided for guidance. The governing text is the Arabic text.

Relevant Laws and Instructions

*These regulations have been replaced by the updated Debt Collection Regulations and Procedures for Individual Customers in accordance with circular No. (106889333), dated 06/09/1446H, corresponding to 05/03/2025G.

Chapter I Definitions

1. The following terms and phrases, wherever mentioned herein, shall have the meaning assigned thereto unless the context requires otherwise:

SAMA: Saudi Central Bank*.

Governor: Governor of Saudi Central Bank (SAMA).

Creditor: Banks and finance companies, supervised by SAMA and licensed to practice one or more activities of finance.

Principles: Responsible Lending Principles for Individual Customers.

Consumer: An individual who obtains or applies for a finance loan or at whom such finance is directed.

Finance Amount: The limit or the total amount made available to the consumer under a finance contract.

Term Cost: The term cost due by the consumer under a finance contract, which may be expressed as a fixed or changed annual percentage of the Finance Amount provided for the consumer.

Variable Term Cost: The term cost specified according to an index or a reference rate which must be explicitly stated in the finance contract; such a cost will change in accordance with the change in such an index.

Total Amount Payable by the Consumer: Finance amount plus all due costs that the consumer must pay as per provisions of finance contract, including term cost, fees, commissions, administrative costs, insurance and any expenses deemed necessary to obtain finance and excluding any expenses that the consumer can avoid, such as costs and fees customer must pay upon his/her violation of any obligations mentioned in the finance contract.

Monthly Credit Obligations: Total amount payable by the consumer, which is calculated on a monthly basis, as per the credit report issued by licensed credit bureaus and the consumer’s disclosure.

Gross Salary: The basic monthly salary (after deducting pension or GOSI contributions) plus all fixed allowances paid to the consumer by the employer on a monthly basis.

Total Monthly Income: The monthly average income of the consumer from any periodical income whether received on a monthly, annual or other periodic basis, including gross salary or any other income (allowances and compensation that are paid periodically, rental income, revenues of other investments, etc.) which can be reasonably verified, calculated as per provisions of Paragraph (17) hereof.

Monthly Disposable Income: The remaining amount of the consumer’s total monthly income for spending, investment or savings after deducting current or expected basic expenses and monthly credit obligations, calculated on a monthly basis.

Deductible Ratio: The ratio of consumer’s monthly credit obligations to total monthly income, calculated as per terms and conditions stated in Chapter IV on Quantitative Principles of Responsible Lending.

Deduction: The act of deducting an amount from the consumer’s gross salary or monthly pension.

* The "Saudi Arabian Monetary Agency" was replaced By the "Saudi Central Bank" in accordance with The Saudi Central Bank Law No. (M/36), dated 11/04/1442H, corresponding to 26/11/2020G.

Chapter II General Provisions

2. The principles herein aim to encourage responsible lending that meets the actual needs of consumers, especially those related to owning housing and assets rather than consumer purposes. The principles also aim to enhance financial inclusion by providing adequate financing for all segments of society, taking into account reasonable deductible ratios that the consumer can afford. In addition, the principles focus on ensuring fairness and competitiveness among creditors to make sure that their procedures and mechanisms are effective and efficient.

3. The principles apply to all creditors and finance activities directed at consumers. These activities encompass all credit products and programs designed for individuals, including, but not limited to, personal finance, vehicle finance, credit cards and real estate finance.

4. The creditor must set appropriate internal controls and procedures to ensure compliance with the principles herein, other relevant laws, regulations, and instructions. It must also pay special attention to documenting information and maintaining documents provided by consumers, thereby gaining an acceptable degree of reliability.

5. If the creditor assigns certain related work to another party or other parties, it must ensure that those parties act in compliance with the principles herein and that they do not contravene the provisions hereof, other relevant laws, regulations and instructions.

6. The creditor must take necessary measures to ensure that the principles herein are fully understood and adhered to by its staff and are shared with its consumers. It must not only focus on the number of financing agreements or the value of finance, but it must also take into account such principles when preparing its incentive programs for its staff. It must ensure that no programs are developed in a way that may lead to irresponsible finance.

7. The creditor must keep sufficient records that show its commitment to the principles herein, other related laws, regulations, and instructions.

Chapter III Qualitative Principles of Responsible Lending

8. The creditor must adopt a clear, transparent and documented scientific method, criteria and procedures to evaluate the creditworthiness of the consumer and his/her ability to repay. These methods, criteria, and procedures must be in accordance with the best practices in this area without prejudice to the principles herein. The board of directors of the creditor must adopt, revise annually, and update when necessary these criteria and procedures. The creditor must apply these procedures and document this application in the finance file before granting finance.

9. Upon the consumer’s consent, the creditor must examine the credit record of the consumer to verify his/her solvency, ability to meet the monthly credit obligations, and his/her credit behavior. The information obtained must be documented in the finance file. The creditor must ask the consumer to disclose, in writing, any other credit obligations he/she has, such as loans from his/her employer, friends or relatives, whether current or expected, and this must be documented in the finance file. Upon granting the finance, the creditor must, in accordance with the provisions of relevant laws, regulations and instructions, register all credit information relating to the finance granted to the consumer with licensed credit bureaus after obtaining his/her consent. The creditor must then update such information throughout the period of dealing with the consumer. The creditor must reject a finance request if it does not obtain the consumer’s consent to all matters stated in this paragraph.

10. The creditor must assess the ability of its consumers to meet monthly credit obligations, especially in cases where consumer's deductible ratios are close to the maximum deduction limits set out herein. The assessment of the ability to meet monthly credit obligations is primarily based on the assessment of the consumer’s monthly disposable income that can be used to meet his/her monthly credit obligations. Basic expenses that vary according to several factors, such as income levels, number of dependents, and residence place, whether the consumer owns such a place, rents it, or otherwise, must be taken into consideration, the creditor should develop appropriate rules in line with best practices to apply comprehensive factors to various categories of consumers. The finance is considered bearable if the consumer’s total monthly credit obligations, upon granting him/her finance, are less than the consumer’s monthly disposable income. This must also be consistent with the deductible ratios stated in Chapter IV on Quantitative Principles of Responsible Lending, Paragraphs (15, 16, and 17) hereof.

11. Based on a credit study and assessment of consumer’s monthly disposable income, the creditor must use financial models and tools to measure the consumer’s ability to meet monthly credit obligations and to what extent such finance suits his/her needs and circumstances. Such models depend on some basics, including identifying and classifying the regular basic expenses of various consumers. Basic expenses cover, as a minimum, the following groups:

a. Food expenses, which are affected by the number of dependents;

b. Housing (rent) and services’ expenses, which depend on whether the consumer is the owner or tenant of the house or otherwise;

c. Wages for domestic worker;

d. Education expenses, which are affected by the number of dependents;

e. Health care expenses, which are affected by the number of dependents;

f. Transportation and communications expenses;

g. Insurance expenses for individuals and their dependents, as the case may be; and

h. Any expected costs or expenses.

In addition to the above-mentioned expenses, existing monthly credit obligations, which can be verified through licensed credit bureaus; finance granted by the consumer’s employer, friends, or relatives; and any other finance that is repaid through installments on a monthly, semi-annual, or other basis must be considered.

12. The creditor must ensure both the efficiency and effectiveness of such financial models and tools, used to measure the consumer’s ability to repay finance. It should benefit from its information and data, as well as legally available general statistics sources. The methodology of such models and tools must include, as a minimum, the following:

a. A mechanism to calculate and analyze total monthly income;

b. A mechanism to calculate and analyze monthly credit obligations; and

c. A mechanism to calculate and analyze basic expenses, including the following:

o A list of basic expense indices compared to verified data;

o The ability of changing basic expenses according to income levels; and

o The ability of changing basic expenses according to the number of dependents.

Chapter IV Quantitative Principles of Responsible Lending

This article is amended in accordance to SAMA circular No. (40694/1) dated 09/09/1439.13. Terms for calculating the consumer’s monthly credit obligations must be observed as follows:

a. The monthly credit obligation of a credit card must be equal to the minimum repayment of the credit ceiling for each credit card issued to the consumer.

b. Monthly credit obligations include all credit obligations to creditors and specialized government lending institutions; any other credit obligations, such as loans from employers, friends, or relatives; and other types of finance.

c. Before granting finance with variable term cost and upon calculating the monthly credit obligations of such finance, the creditor must take into account including additional margin in the term cost. The term cost and the additional margin must be considered when documenting the monthly credit obligations for such finance in the consumer’s credit report in the credit bureau in order to avoid risks of changes to term cost.

d. Upon granting finance, the creditor must be responsible when the deductible ratio exceeds the permitted limit hereunder if it is due to a change in the term cost. If this happens, the creditor must reschedule the repayment periods of the finance and must not add a term cost that may lead to exceeding such limits.

e. Monthly credit obligations of finance where all installments are not equal must be calculated based on monthly installments that are fixed at the monthly average level for all installments regardless of whether such finance is payable by equal repayments or requires a final payment.

14. Terms for calculating the total monthly income of the consumer must be observed as follows:

a. Gross salary, as documented by any means by the employer, must be included in such calculation.

b. As for other income, half of the monthly average of the total amount earned by the consumer from any periodical income, whether monthly, annual or other, must be included in such calculation. The other income must include periodically-paid allowances and compensation, rental income, revenues of investments, dividends, etc., which can be reasonably verified via, at least, a two-year bank statement or official documents proving their continuity.

c. Government subsidies, such as those given through the Citizen Account Program or social security, must not be counted as part of the total monthly income of the consumer. However, government subsidies that are documented through contracts with a citizen and that are provided by the Ministry of Housing or the Real Estate Development Fund may be incorporated in the total monthly income of the consumer in real estate finance products.*

15. Deductible ratios for consumers whose total monthly income is SAR 15,000 and less must be subject to the following restrictions:

a. The monthly credit obligations of finance, which are linked only to the monthly deduction of the gross salary of consumer, must not exceed 33.33% of the gross salary for employees and 25% for retired consumers.

b. Monthly credit obligations, excluding monthly credit obligations for real estate finance, must not exceed 45% of the total monthly income of the consumer.

c. Monthly credit obligations of finance must not exceed 55% of the total monthly income of the consumer However, for the consumers who are benefiting from the Ministry of Housing or the Real Estate Development Fund for mortgage products, the monthly obligations of finance must not exceed 65% of the total monthly income.*

16. Deductible ratios for consumers whose total monthly income is more than SAR 15,000 and less than SAR 25,000 must be subject to the following restrictions:

a. The monthly credit obligations of finance, which are linked only to the monthly deduction of the gross salary, must not exceed 33.33% of the gross salary for employees and 25% for retired consumers.

b. Monthly credit obligations, excluding monthly credit obligations for real estate finance must not exceed 45% of the total monthly income of the consumer.

c. Monthly credit obligations of finance must not exceed 65% of the total monthly income of the consumer.

17. Deductible ratios for consumers whose total monthly income is SAR 25,000 and more must be subject to the following restrictions:

a. Monthly credit obligations of finance, which are linked only to the monthly deduction of the gross salary, must not exceed 33.33% of the gross salary for employees and 25% for retired consumers.

b. Credit obligations of finance are subject to the credit policies of the creditor. The creditor must assess the ability of its consumers to meet monthly credit obligations stated herein.

18. Finance term must not exceed (5) years or (60) months from granting such finance, except for real estate finance and credit cards.

19. SAMA may review and amend periodically the ratios in Paragraphs 15, 16, and 17 hereof, taking into account the soundness and stability of the financial system and the forecasts for economic growth.

*Amended in accordance to SAMA circular No. (40694/1) dated 09/09/1439.

Chapter V Publishing and Coming into Force

20. The Principles hereof are issued by a decision of SAMA Governor and published on SAMA website.

21. The provisions of Paragraphs 15, 16 and 17 hereof must be applicable as of the date of circulating such principles.

22. All provisions hereof must come into force as of 01/12/1439H (12/08/2018). The principles herein must be fully observed from that date.

23. The principles herein must supersede any provisions to the contrary.

Regulations for Consumer Financing

No: 351000116619 Date(g): 7/7/2014 | Date(h): 10/9/1435 Status: In-Force These Regulations shall be applicable to Financing Contracts and all related Guarantee Agreements executed by banks licensed and authorized by SAMA. SAMA is the sole authority empowered to apply these Regulations and to take necessary measures as it deems appropriate regarding any violations of these provisions, including imposing punitive charges and or enforcement actions as applicable under the Banking Control Law. These Regulations supersede and replace the Regulations for Consumer Credit of October 2005 issued as circular 33232-MASH/516 dated 23/9/1426 H and its subsequent updates. SAMA may update these Regulations as and when required.

SAMA may, at its discretion, impose a restriction on a Creditor under which its Consumer Financing portfolio may not exceed a specified percentage of its total Financing portfolio.

Definitions

Article 1: Definitions

Each of the following words and phrases, wherever it appears in this Regulation, shall have the meaning following it in this article unless the context indicates otherwise:

Adequate notice: a printed notice to a Borrower that sets forth clearly the pertinent facts so that the Borrower may reasonably be expected to have noticed it and understood its meaning. The notice may be given by Guaranteed Communication Means reasonably assuring receipt by the Borrower.

Advertisement: a commercial message in any medium that promotes, directly or indirectly, a Financing product.

Amount of Financing: the limit or the total amount made available to a Borrower under a Financing Contract.

Annual Percentage Rate or APR: the discount rate at which the present value of all payments and installments that are due from the Borrower, representing the Total Amount Payable by the Borrower, equals the present value of all payments of the Amount of Financing available to the Borrower on the date on which the Financing amount or the first payment thereof is available to the Borrower, calculated in accordance with Annex 1.

Authenticated Communication: Borrower instructions received through a recorded, verifiable and retrievable medium such as paper, electronic or verbal recording.

Borrower: a natural person who, in Financing transactions covered by this Regulation, obtains Financing for purposes outside his trade or profession.

Business Day: a day on which the banks are open for business to the general public.

Calendar Day: any day in a month, including weekends and holidays.

Change in Circumstance: death, disability (partial or total), retirement (mandatory or voluntary), loss of job or bankruptcy of a Borrower*.

Consumer Financing: a Financing granted to a Borrower as follows:

- The Financing is for purposes unconnected with the Borrower’s commercial or professional activity, generally including personal Financing, car Financing, home improvement Financing, and similar products as approved by SAMA.

- Such Financing is granted for the purchase of goods and services for consumption or other needs of the Borrower as identified above, e.g. for the purchase of furniture, consumer durables, automobiles, household items, education, etc.

- Real estate Financing and Finance Leasing are excluded.

- Financing against shares (Margin Lending) is also excluded.

Creditor: a bank licensed and authorized by the Saudi Central Bank.

Default: any breach of the terms and conditions of the Financing Contract and the nonpayment by a Borrower of their monthly installment for 90 Calendar Days from its due date.

Default Notice: a notice from a Creditor to a Borrower under a Financing Contract with the Creditor notifying that he/she is delinquent in payments.

Draw-down: an Amount of Financing drawn by the Borrower under a Financing Contract.

Financing: the right to incur new debt and defer payment, or the right to defer existing debt.

Financing Contract: an agreement by which a Creditor grants, or promises to grant, a Consumer Financing or similar financial accommodation to a Borrower.

Gross Salary basic monthly salary (less GOSI and pensions contributions) plus all fixed allowances paid to Borrower by the employer on a monthly basis.

Guarantee Agreement: an ancillary agreement concluded by a Guarantor and guaranteeing or promising to guarantee the fulfillment of any form of Financing granted to a Borrower.

Guaranteed Communication Means: registered mail, hand delivery, and any recorded, verifiable and retrievable electronic medium.

Guarantor: a natural person who guarantees or promises to guarantee the fulfillment of any Financing granted to a Borrower.

Initial Disclosure: the information required to be provided to the Borrower by a Creditor upon opening a Consumer Financing account in accordance with Section 5 of these Regulations.

Licensed Credit Bureau: a credit information company licensed by SAMA to collect and maintain credit information on consumers and provide the same to members upon request.

Optional Feature: features and services which are not part of the standard features or services of the Financing Contract product, requiring payment of additional fees and/or Term Cost by the Borrower.

Outsourcing: an arrangement under which a third party (i.e. a service provider) undertakes to provide a Creditor with a service previously carried out by the Creditor itself or a new service to be launched by the Creditor. Outsourcing can be to a service provider in Saudi Arabia or overseas and the service provider may be a unit of the same Creditor (e.g. head office or an overseas branch), an affiliated company of the Creditor's group or an independent third party, and is subject to the requirement to fully comply with SAMA Rules on Outsourcing issued vide 34720/BCS/424 dated 17/7/1429H Correspondent to 20/7/2008.

Refinancing: repayment of an existing Financing from the proceeds of a new Financing granted to the Borrower.

Repayments or Deductions: deductions from the Gross Salary or monthly pension entitlement of a Borrower towards repayment of Financing. Only deductions for Real Estate Financing repayments and divorce settlements are excluded.

SAMA: the Saudi Central bank**.

Satisfactorily Resolved: resolution of the dispute in accordance with the procedures and timeframes for resolving disputes.

Secured Financing: a Financing that is collateralized by assignment of rights to property including a security interest in personal property or real estate taken by the Creditor as collateral. A Financing may be secured by pledge of cash (deposits), tangible goods or other collateral.

Term Cost: the term cost due and payable by the Borrower under the Financing Contract; this must be expressed as a fixed annual percentage of the Amount of Financing obtained by the Borrower.

Term to Maturity: the period from initial disbursement to the date on which the final repayment of the relevant Financing is due.

Total Cost of Financing: all costs payable by the Borrower under a Financing Contract other than the Amount of Financing, including Term Cost, fees, commissions, administrative services fees, insurance, and any charges required to obtain Financing, but excluding any expenses the Borrower can avoid, such as costs or fees due and payable by the Borrower as a result of the Borrower's breach of any obligations contained in the Financing Contract.

Total Amount Payable by the Borrower: the Amount of Financing plus the Total Cost of Financing.

*The definition of "Change in Circumstance" has been amended in accordance with Circular No (381000095088) dated 10/09/1438H. The amended definition is currently available only in Arabic.

** The "Saudi Arabian Monetary Agency" was replaced By the "Saudi Central Bank" in accordance with The Saudi Central Bank Law No. (M/36), dated 11/04/1442H, corresponding in 26/11/2020G.

Section One Scope of Application

Article 2: Application of the Regulations

- These Regulations apply to all kinds of Consumer Financing.

- These Regulations do not apply to lease or real estate Financing or margin lending.

Article 3: Meaning of Consumer Financing and Amount of Financing

- For the purposes of these Regulations, Consumer Financing is granted under a Financing Contract in case of any of the following:

- The repayment of a debt owed by a person (the Borrower) to another (the Creditor) is deferred; or

- a person (Borrower) incurs a deferred debt to another (Creditor).

- For the purpose of complying with Article 14(1), the Creditor must calculate the Amount of Financing based on the Borrower's Gross Salary or monthly pension entitlement (as the case may be) when the application for Financing is submitted.

- For the purposes of these Regulations, Consumer Financing is granted under a Financing Contract in case of any of the following:

Section Two Financing Contracts and Guarantee Agreements

Article 4: Financing Contracts and Guarantee Agreements

- A Financing Contract or Guarantee Agreement must be in the form of-

- a written contract document signed by the Borrower or Guarantor and the Creditor; or

- a written contract document signed by the Creditor and constituting an offer to the Borrower that is accepted in writing by the Borrower.

- All Financing Contracts, application forms, Guarantee Agreements, repayment schedules, Borrower acknowledgement letter and other documentation related to Consumer Financing must be in Arabic and if the Borrower requests that documentation be prepared in English, the documentation shall be prepared in both languages. The Creditor must provide copies thereof to the Borrower. In the event of a divergence between the Arabic and the English text of any such document, the Arabic text prevails.

- Each contracting party must receive a copy of the Financing Contract or Guarantee Agreement (as the case may be).

- A Financing Contract or Guarantee Agreement must be in the form of-

Article 5: Necessary content of Financing Contracts or Guarantee Agreements

1- The Creditors must provide a synopsis for each Financing Contract to the Borrower that contains, in clear and succinct language, basic information about the Financing, including the Total Cost of Financing. The receipt of this synopsis by the Borrower must be documented and included in the Financing file.

2- The Financing Contract must include at least the following information:

(a) names of the parties to the Financing Contract, the national identity number or Iqama number of the Borrower as applicable, official addresses, means of contact including telephone and mobile numbers and e-mails, if available;

(b) type of Financing;

(c) Term to Maturity;

(d) Amount of Financing;

(e) conditions for drawing down the Amount of Financing, if any;

(f) description of the calculation method for determining Term Cost to enable the Borrower to understand the Term Cost and to distribute the cost over the Term to Maturity;

(g) Term Cost and the conditions governing the application of the Term Cost and any index or reference rate applicable to the Term Cost;

(h) Annual Percentage Rate (APR);

(i) Total Cost of Financing and the Total Amount Payable by the Borrower, calculated at the time of entering into the Financing Contract; stating the assumptions made in order to calculate that amount;

(j) instalment amounts payable by the Borrower, number of instalments, due dates of instalments, and method of distribution over the remaining amounts;

(k) charges, commissions and costs of administrative services;

(l) payment periods of charges or amount that must be paid without paying the Amount of Financing; and related payment conditions;

(m) consequences of delayed repayment of instalments;

(n) where applicable, notarial fees;

(o) collateral and required insurance;

(p) procedures for exercising the right of withdrawal, if any, its conditions and resulting financial obligations;

(q) procedures for early repayment and indemnifying the Creditor, if applicable, and the method for determining such indemnity;

(r) procedures for dealing with collateral if its value decreases, if applicable;

(s) procedures for exercising the right of termination of the Financing Contract;

(t) Borrower's consent to filing his/her information in credit bureau records; and

(u) any other data or information stipulated by the Agency.

Article 6: Amendment of the Financing Contract

Any amendment (including any addition to) of a Financing Contract by the Creditor after it has been signed by the Borrower is invalid unless the Borrower has agreed in writing.

Article 7: Copy of Financing Contract and Guarantee Agreement for Borrower and Guarantor as applicable

If a Financing Contract or Guarantee Agreement needed to be signed by the Borrower or Guarantor and returned to the Creditor, the Creditor must give each of the Borrower or Guarantor, as applicable, a signed copy they may keep, not later than 10 Calendar Days after the Financing Contract or Guarantee Agreement has been entered into.

Article 8: Annual Percentage Rate (APR)

- The APR must include all mandatory charges or costs under a Consumer Financing as shown in the relevant advertising notices or materials.

- The Financing Contract must stipulate the use of the declining balance method in distributing the Term Cost over the maturity period, which means that the Term Cost is allocated pro-rata to installments based on the remaining balance of the Amount of Financing at the beginning of the period for which an installment is due.

- The Term Cost is fixed.

Article 9: Fees and Charges

All fees, costs and administrative services charges to be recovered from the Borrower by the Creditor must not exceed the equivalent of (1%) of the Amount of Financing or (5,000) five thousand Saudi riyals, whichever is lower.

Article 10: Right of Termination or Withdrawal

- The Borrower may, by giving written notice to the Creditor within 10 Calendar Days from the date of execution of a Financing Contract, terminate the Financing Contract, unless

- Draw-down of any part of the Amount of Financing has occurred; or

- A credit card or other means of obtaining Financing provided to the Borrower by the Creditor has been used to acquire goods or services for which Financing is to be advanced under the Financing Contract.

- In the event of termination under Article 10(1), the Creditor may not charge or claim any Term Cost and or fees from the Borrower unless the conditions under Article 10(1)(a) or (b) above have been met.

Clarifications in accordance with Circular No. (381000095091) dated 10/09/1438H.This part is currently available only in Arabic. Please Click here to read the Arabic version.

- The Borrower may, by giving written notice to the Creditor within 10 Calendar Days from the date of execution of a Financing Contract, terminate the Financing Contract, unless

Article 11: Early payments

- A Creditor must accept any payment under a Financing Contract before its due date as partial payment if it is equivalent to one full installment or multiples thereof.

- A Creditor must credit each payment made under a Financing Contract to the Borrower's account promptly after receipt of such payment.

- The Borrower may prepay, at any time, the remaining Amount of Financing without incurring any Term Cost for the remaining period. The Creditor is entitled to compensation from the Borrower for the following:

- The cost of re-investment, which may not exceed the Term Cost for the three months following the payment, calculated on the basis of a declining balance; and

- The expenses the Creditor pays to a third party as a consequence of the Financing Contract for the remaining period of the Consumer Financing if such expenses are unrecoverable, and provided that such expenses are properly recorded in the Borrower's Financing file.

- The Creditor must notify the Borrower in writing of all such fees payable by the Borrower as referenced under Art. 11(3)(a)and (b) above. The Creditor must give that notification by Guaranteed Communication Means within 10 Business Days after the first to occur of:

- receipt by the Creditor of a notice from the Borrower of the intended prepayment; or

- receipt by the Creditor of the prepayment,

Article 12: Balance Transfer

- Creditors must quickly facilitate the transfer of balance(s) to other Creditors in the Consumer Financing accounts of their Borrowers. Creditors must not unreasonably withhold their consent to a balance transfer request they receive.

- Creditors may not unreasonably withhold the issuance of a balance statement or certificate of outstanding liabilities requested by the Borrower; these must be issued within 7 Business Days from the date of request.

Article 13: Assignment of Rights

- If the Creditor assigns rights under a Financing Contract or the Financing Contract itself to a third party or issues securities against rights under the Financing Contract, the Borrower may use against the assignee any defense that would have been available to him against the original Creditor.

- The Creditor must receive a no-objection letter from SAMA before he can assign a Consumer Financing or a portfolio of Consumer Financings to another party.

Article 14: Maximum Credit Limit and Maximum Term to Maturity

- Before granting a new Consumer Financing or increasing the limit of any Consumer Financing and without prejudice to the requirements of any applicable law or regulation, a Creditor must ensure that the total monthly Repayments or Deductions recovered from a Borrower under his Consumer Financing obligations to all Creditors do not exceed 33.33% of the Borrower's Gross Salary during the period in which those Repayments or Deductions are made. For retired Borrowers, the deduction limit is 25% of their monthly pension.

- The Creditor must first obtain the Borrower's prior approval and then obtain and examine the credit record of the Borrower from one or more of the Licensed Credit Bureaus, to confirm the Borrower's compliance with the requirement under Article 14(1), his solvency, repayment capacity and credit conduct. The confirmation of such prior approval by the Borrower must be documented in the Borrower's Financing file.

- The Creditor must, upon the approval of the Borrower, register the Borrower's credit information with one or more of the Licensed Credit Bureaus in accordance with the relevant laws, regulations and instructions. Such information shall be updated throughout the period of dealing with the Borrower.

- The Creditor must decline a Financing request if he does not obtain the approval of the Borrower as referred to in Article 14(2) and 14(3) above.

- Creditors must ensure that the maximum Term to Maturity of a Consumer Financing does not exceed 5 years from the date of initial disbursement.

- *In the event of a Change in Circumstance of the Borrower, Creditors may reschedule the repayment terms of the Consumer Financing (provided no new Financing is being granted and without any change to the Term Cost under the original Financing Contract) in accordance their credit policies. Creditors must provide SAMA with a half-yearly report of all Consumer Financings that have been rescheduled.

- In calculating the maximum deductions of one third (33.33%) for Borrowers and one fourth (25%) for pensioners, Creditors must include all Consumer Financing Repayments or Deductions, including the minimum monthly payment required for all credit cards issued to the Borrower.

*Article 14(6) has been amended in accordance to Circular No (381000095088) dated 10/09/1438H. The amended article is currently available only in Arabic.

Section Three Obligations and Accountability

Article 15: General Requirements and Obligations of Creditors and Borrowers

- Consumer Financing granted on the basis of any security other than the deduction of salary or pension payments (e.g. against lien of deposits or assignment of other regular earnings or pledge of collateral) is not subject to the provisions under Article 14(1).

- A Creditor must carry out proper risk management procedures such as the use of credit scoring models for the granting or renewal of all Consumer Financings and must assign appropriate credit limits to its Borrowers.

- Prior to granting a new Consumer Financing, a Creditor must have received a Borrower request through Authenticated Communication or the execution of a Financing Contract. A Creditor may not increase the Financing limit of its Borrower without receiving a request through Authenticated Communication from its Borrower seeking such an increase. Each such increase/amendment in the Financing Contract requires execution of a new Financing Contract.

- Creditors are required to obtain knowledge of the purpose of the Consumer Financing from the Borrower and document that. This confirmation must be a part of a written acknowledgment by the Borrower clearly stating that he has fully understood the terms and conditions and confirms the execution of the respective Financing Contract.

- Creditors are only allowed to refinance Consumer Financing accounts of those Borrowers who have repaid at least 20% of their original Amount of Financing under their Consumer Financing account.

- Creditors refinancing the Consumer Financing accounts of their Borrowers must fully comply with the disclosure requirements under Section 5, Additionally, the Borrower must be provided with a break-down of the refinanced amount, clearly identifying the refinanced amount that will credited to his/her account, net of all identified fees and charges and the settlement of the original outstanding balance prior to a Refinancing.

- Borrowers opting for early retirement are required to ensure that their pension payments continue to be routed to the Creditor in the event of outstanding balances under their Consumer Financing account. A Creditor may require a suitable undertaking from the Borrower affirming the foregoing arrangement.

- Additional features or services requiring additional payment of fees and charges which are optional to the primary product features of the Consumer Financing may not be added on or embedded into the Consumer Financing account and must be clearly represented as an Optional Feature. A Borrower must have indicated his/her desire to obtain such services by Authenticated Communication before their inclusion in the account. Creditors must also clearly disclose all fees and charges for these services to the Borrower within their offer for such Optional Features.

- A Creditor must promptly advise its Borrowers of the following amendments and or changes in their Financing Contract by giving them at least 30 Calendar Days prior written notice:

(a) any increase of the annual fees and/or handling fees charged to the Borrower;

(b) an increase in recurring fees or charges

(c) any new fees or charges.

(d) any other changes.

- The Borrower may terminate the relevant Financing Contract with the Creditor if he/she does not agree to such amendment, change or modification by notifying the Creditor of his/her desire to terminate the Financing Contract within ten (10) Calendar Days after his/her receipt through Authenticated Communication of the notification of the aforementioned changes, subject to full settlement of all outstanding balances on the Consumer Financing account. The aforementioned notice must advise Borrowers of the 10 Calendar Day termination period.

- A Creditor engaging in Outsourcing any component of its Consumer Financing Business must comply with the Rules on Outsourcing issued by SAMA.

- A Creditor is required to implement a clearly defined Code of Conduct for employees engaged in roles involving sales and marketing of Consumer Financing products and follow-up and collection of impaired and delinquent Consumer Financing Accounts. (Creditors are also required to be in compliance with SAMA circular MAT/8211 dated 1/4/1431H.) A Creditor must provide those employees with a copy of the Code of Conduct and obtain their acknowledgement of receipt. The Code of Conduct must prohibit the following:

(a) Any contact with neighbours, relatives, colleagues or friends of the defaulting Borrower for the purpose of requesting or conveying information on the solvency of the Borrower or Guarantor.

(b) Any communications (verbal or written) to the Borrower or Guarantor conveying incorrect information on the consequence of defaulting on their obligations to the Creditor.

(c) Unauthorized repossession of the pledged collateral without judicial proceedings or the specific consent of the Borrower.

(d) Communicating with the defaulting Borrower using envelopes tagged with inscriptions identifying contents as containing debt collection information.

(e) Any breach of confidentiality of Borrower information, conflict of interest and breach of ethical values.

- Creditors are required to have structured training programs for all new staff and Consumer Financing product knowledge programs for staff involved in marketing and sales and customer service for Consumer Financing products.

- A Creditor must issue procedural rules to handle Borrower complaints relating to Consumer Financings and to ensure that Borrowers are made aware of the procedure and contact details of the complaint handling unit/department.

- If a Borrowers' application for any Financing facility is declined, the Creditor must provide the Borrower with a written reason for the rejection through Guaranteed Communication Means.

- Upon full and final repayment of the Consumer Financing by the Borrower, the Creditor is required to issue a no liability or clearance letter within 7 Business Days from the date of full and final settlement und update his record with a Licensed Credit Bureau.

Article 16: Non Performance of Financing Contract and Guarantee Agreements

- A Creditor may only proceed to enforcement against a Guarantor if the Borrower is in Default and has failed to comply with a Default Notice for a period of not less than 30 Calendar Days from the date of receipt.

- Creditors, their representatives, and any other assignees of the Creditor's rights under the Financing Contract or Guarantee Agreement may not take disproportionate, excessive or unreasonable measures to recover amounts due to them in the event of non-performance of aforementioned agreements

- A Creditor may demand immediate repayment in the event of Default only through a Default Notice requesting the Borrower, or where applicable, the Guarantor to comply with his/her obligations under the Agreement within 30 Calendar Days from the date of the issuance of notice.

- A Default Notice is not required in the event of any of the following:

(a) Fraudulent activities by the Borrower or Guarantor, which must be proven by the Creditor;

(b) Steps taken by the Borrower to sell or attempt to sell financed goods to which the Creditor has retained title or pledged collateral without due authorization of the Creditor.

- A Creditor may suspend Draw-downs under a Financing Contract in the event of a failure by either the Borrower or the Guarantor to abide by its terms and conditions in a Default. However the Creditor is required to give notice of its intent to suspend Draw-downs to the Borrower and the Guarantor (if any) without delay.

- A Creditor is required to provide without delay and upon request of the Borrower, a detailed statement of account incorporating all applicable fees, Term Cost and charges including any administrative charges, free of charge in the event of a Default or prepayment of the Consumer Financing.

- A Creditor may not bring an action for the enforcement of security over goods pledged as collateral without first obtaining approval from the Committee for Settlement of Banking Disputes if:

(a) the Borrower has repaid 75% of the Amount of Financing; and

(b) the Borrower has not provided his/her consent to the Creditor (whether in the Finance documentation or otherwise) to enforce that security.

Section Four Advertising

Article 17: Advertising Consumer Financing Products

- The Creditor must indicate in all product advertisements its name, logo, any identifying representation and contact details.

- The advertisement must disclose, in a manner that is clear to the Borrower, the name and Annual Percentage Rate of the advertised product and shall not include other rates such as the Term Cost.

- The Creditor may not do any of the following:

(a) Provide an advertisement that includes a false offer or statement or claim expressed in terms that would directly or indirectly deceive or mislead the Borrower.

(b) Provide an advertisement that includes the unlawful use of a logo, a distinctive mark, or a counterfeit mark.

- SAMA may require any Creditor who does not abide by the provisions of this Article to withdraw the advertisement within one Business Day of notice SAMA from to that effect.

- Furthermore, SAMA may take other punitive actions as required.

Section Five Rules of Information Disclosure

Article 18: General disclosure

A Creditor is required to provide the Borrower in writing with the Initial Disclosure information stated in Article 21 below. The Initial Disclosure must be made in clear and easy-to-read language duly highlighting terms and conditions which may affect the Borrower's rights and obligations, and the Creditor must use any format specified by SAMA from time for that purpose. Furthermore, the specific terms contained under Article 21 (1) (b) and (c) and information on the Total Cost of Financing must be included in the Initial Disclosure statement.

Article 19: Manner of Disclosure

- For the purpose of these Regulations, a Creditor must provide the Borrower with a written disclosure statement that provides the information required by these Regulations to be disclosed.

- A disclosure statement may be part of a Financing Contract or an application for a Consumer Financing or may be an annex to the foregoing documents.

- The Creditor is required to obtain written acknowledgement from the Borrower confirming he/she has received and read the Initial Disclosure statement.

- Information disclosed in a disclosure statement may be based on a reasonable assumption or estimate and such information must be clearly identified to the Borrower as an assumption or estimate.

- A disclosure statement, or consent in relation to a disclosure statement, must be in plain, clear and concise language. It must be presented in a manner that is logical and likely to bring to the Borrower's attention the information required by these Regulations to be disclosed.

- If the Borrower consents by Authenticated Communication, the disclosure statement may be provided by electronic means in an electronic form that the Borrower can retrieve and retain.

- A disclosure statement is deemed to be provided to the Borrower:

(a) on the day recorded as the time of sending by the Creditor's server, if provided by electronic means, and the Borrower has consented to receive it by electronic means.

(b) on the day recorded as the time of sending by a fax machine, if provided by fax and the Borrower has consented to receive it by fax;

(c) ten Calendar Days after the postmark date, if provided by registered mail; or

(d) when it is received, in any other case.

Article 20: Timing of Initial Disclosure

A Creditor that proposes to enter into a Financing Contract with a Borrower must provide the Borrower with the Initial Disclosure statement required by these Regulations prior to or upon entering into the Financing Contract by the Borrower and the Creditor.

Article 21: Initial Disclosure – Content

- A Creditor that enters into a Financing Contract with a Borrower must provide the Borrower with an Initial Disclosure statement that includes the following information:

(a) The initial limit of the Financing, if it is known at the time the disclosure is made;

(b) The APR and the annual Term Cost;

(c) The nature and amounts of any recurring non-Term Cost charges;

(d) The minimum payment during each payment period and the method for determining it;

(e) Each period for which a statement of account is to be provided;

(f) The date on and after which Term Cost accrues;

(g) The particulars of all charges and administrative fees that may be imposed;

(h) information about any Optional Feature in relation to the Financing Contract that the Borrower accepts in writing, the charges for each Optional Feature and the conditions under which the Borrower may cancel that feature;

(i) the manner in which the Term Cost is calculated; and

(j) information on all applicable charges including reporting of Default cases to a Licensed Credit Bureau or appropriate Regulatory Authorities as per SAMA's approval.

- If the initial limit of the Financing is not known when the Initial Disclosure statement is made, the Creditor must disclose it in:

(a) The first statement of account provided to the Borrower; or

(b) In a separate statement that the Borrower receives on or before the date on which the Borrower receives that first statement of account.

- If a Financing Contract is amended, the Creditor must, in writing and within 30 Calendar Days or more before the amendment takes effect, disclose to the Borrower and Guarantor (if any), any changes to the agreement pertaining to items referred to under Article 21(1) except changes to the following:

(a) A decrease in charges other than Term Cost or Default charges;

(b) A change concerning information about any Optional Feature in relation to the Financing Contract.

- An amendment referred to in Article 21(3) must be disclosed in the first statement that is provided to the Borrower after the amendment is made.

- If a Creditor offers to defer or skip a payment or installment under a Financing Contract, the Creditor must, with the offer, disclose in a prominent manner whether Term Cost will continue to accrue during any period covered by the offer if the offer is accepted. Creditors must ensure compliance with Article 14(5), i.e. the maximum Term to Maturity may not exceed 5 years.

Section Six Dealing with Borrowers

Article 22: Rules for dealing with Borrowers

- A Creditor must deliver at least on a quarterly basis to each Borrower a statement of his/her Consumer Financing transaction amounts in writing or through electronic medium (such as e-statement) as agreed with the Borrower in advance. The account statement should fully disclose the following information:

(a) The dates on which the statement period begins and ends.

(b) The opening and closing balances (indicating the amount owed by the Borrower at the beginning and at the end of the statement period).

(c) Particulars of each Draw-down during the statement period.

(d) The amount of the Term Cost charge debited to the Borrowers account during the statement period and when the Term Cost was debited.

(e) Particulars of any fees and charges debited to the Borrower's account during the statement period.

(f) Payments to or from the account.

(g) Particulars of each amount paid by the Borrower to the Creditor, or credited to the Borrower, during the statement period.

(h) Particulars of any amount transferred to or from the account to which the statement relates or to or from any other account maintained under or for the purposes of the Financing Contract.

(i) If a minimum amount is payable by the Borrower under the Financing Contract, a statement of the amount and the date by which it is due.

- The address for notification of account statement errors: The address or telephone number to be used for notification of account statement errors or any other enquiries that a Borrower may have on the account statement.

- The time period allowed to the Borrower to verify the accuracy of transactions as annotated in the account statement after which the account statement is binding: This period shall not be less than 30 Calendar Days as of the date of sending the statement via Guaranteed Communication Means

- The Saudi Riyal shall be used as a basis for calculating all transactions and charges of Consumer Financing, and it shall be used in all disclosures of monetary values for Consumer Financing accounts denominated in Saudi Riyal. For Consumer Financing accounts denominated in currencies other than Saudi Riyal, the basis for calculation will be their respective currency of account.

- If the Creditor wants to change the charges related to the Consumer Financing account or the method of paying due amounts, it must notify the Borrower of such change within a period of at least 60 Calendar Days prior to its application. The notice shall be mailed or delivered by Guaranteed Communication Means to the address on record of the Borrower.

- The Borrower is required to keep the Creditor's records updated with his/her latest address and to immediately notify the Creditor of any change in his/her contact details in writing or by Authenticated Communication. Failure to provide this information will release the Creditor from any liabilities and obligations under Article 22.5 above.

Section Seven Dispute Resolution

Article 23: Rules for Dispute Resolution

- The term “account statement error/dispute” means any transaction posted to the Borrower's Consumer Financing account, resulting in an error in the overall balance. Account statement errors shall include the following:

(a) Failure by the Creditor to properly credit a payment or any other amount deposited in the Borrower's account.

(b) Accounting error made by the Creditor, so that a charge would be lower or higher than it should be including the imposition of fees or charges that are not in accordance with the terms and the agreement in force.

(c) The Creditor's failure to deliver, by Guaranteed Communication Means, an account statement to the Borrower’s address on record.

(d) Any other errors not covered above.

- The term “notice of account statement error”/dispute means a written notification given by a Borrower to the Creditor, using the contact information as included within the said account statement or other information supplied by the Creditor, and it must meet the following requirements:

(a) It must be received by the Creditor no later than 30 Calendar Days after the Creditor had mailed or delivered by Guaranteed Communication Means the first account statement which contains the alleged account statement error.

(b) The notice shall enable the Creditor to identify the Borrower's name and account number, and indicate, to the extent possible, the Borrower's reasons for believing that an account statement error exists, the nature of such error, the transaction details including posting date and amount related to the error.

- The Creditor must address account statement errors/disputes as follows:

(a) The Creditor must mail or deliver by Guaranteed Communication Means a written response to the Borrower within 30 Calendar Days of receiving the notice of account statement error/dispute advising the Borrower of the likely timeframe of resolution of the error/dispute and requesting any additional available information or documentation.

(b) The Creditor shall conduct the necessary investigation and comply with the appropriate dispute resolution procedures (as communicated to the Borrower) within 60 Calendar Days, but in no case later than 90 Calendar Days from the date of receipt of the notice of account statement error/dispute.

- If the account statement error/dispute has not been Satisfactorily Resolved, the Borrower shall not be obliged to pay the portion of the required payment that the Borrower believes is related to the disputed amount, including Term Cost or any other charges. The Creditor may not try to collect any amount, Term Cost or other charges related to the account statement error/dispute until the dispute is Satisfactorily Resolved.

- The Creditor must not make or threaten to make an improper report about the Borrower's credit standing, or report that an amount or account is delinquent prior to the error/dispute being Satisfactorily Resolved, because the Borrower did not pay the disputed amount or relevant Term Cost or other charges during the error/dispute resolution process in any event, not earlier than 90 Calendar Days from the date of the notice of account statement error/dispute.

- If the Creditor determines that an account statement error has occurred as stated by the Borrower, it must correct the error and pay back any disputed amount and relevant Term Cost and other charges debited on the Borrower's account and deliver by Guaranteed Communication means a correction notice to the Borrower.

- If the Creditor determines that a different account statement error other than the one identified in the Borrower’s notice has occurred, the Creditor must mail or deliver by Guaranteed Communication Means to the Borrower the Creditor's reasons for believing that a different account statement error has occurred and the reasons for the belief that the error alleged by the Borrower is incorrect. The Creditor shall correct the error and credit the Borrower’s account with the correct amount in accordance with procedures in force.

- If the Creditor determines that no account statement error has occurred, it must mail or deliver by Guaranteed Communication Means to the Borrower an explanation of the reasons of believing that the error alleged by the Borrower is incorrect and provide the Borrower with copies of any documented evidence if he/she so requests.

- If the Creditor believes that a Borrower is liable for all or part of the disputed amount and relevant Term Cost and other charges, it must:

(a) Notify the Borrower in writing of the date when payment is due and the portion of the disputed amount and relevant Term Cost and other charges for which the Borrower is liable.

(b) Report to a Licensed Credit Bureau that an account or amount is delinquent because the amount due has remained unpaid after the due date provided for in the terms and conditions of the relevant Financing Contract.

- Without prejudice to applicable law and regulation, a Creditor that has fully complied with the requirements of this section shall not have further responsibilities under this section if the Borrower insists on his/her claim.

- The Committee for Settlement of Banking Disputes is the final authority in resolving any unresolved disputes between the Borrower and the Creditor.

- These Regulations are issued in Arabic and English. In the event of a conflict between the two versions of these Regulations, the Arabic version prevails.

Annex 1 Calculation of the Annual Percentage Rate

This annex has been updated by circular No (45025707) dated 17/04/1445H (corresponding to 01/11/2023). Please refer to Rules Governing Calculation of Annual Percentage Rate (APR) to read the updated version.The Annual Percentage Rate (APR) is the discount rate at which the present value of all payments and installments that are due from the Borrower, representing the Total Amount Payable by the Borrower, equals the present value of all payments of the Amount of Financing available to the Borrower on the date on which the Financing amount or the first payment thereof is available to the Borrower, in accordance with the following equation:

where:

m is the number of the last payment to be received by the Borrower

d is the number of a payment to be received by the Borrower

Cd is the amount of payment (d) to be received by the Borrower

Sd is the period between the date of the first payment to be received by the Borrower and the date of each subsequent payment to the Borrower, expressed in years and fractions of year, therefore S1=0.

n is the number of the last repayment or payment of charges due on the Borrower

p is the number of a repayment or a payment of charges due on the Borrower

Bp is the amount of repayment or payment of charges (p) due on the Borrower

tp is the period between the date of the first payment to be received by the Borrower and the date of each repayment or payment of charges due on the Borrower, expressed in years and fractions of year

X is the Annual Percentage Rate (APR)

- For the purpose of calculating APR, periods between dates shall be based on a year of 12 equal months.

- For the purpose of calculating APR, the Total Amount Payable by the Borrower shall be determined, including all unavoidable costs and fees with the exception of charges and fees payable by the Borrower as a result of non-compliance with any of his commitments laid down in the Financing Contract.

- The calculation of the APR must be based on the assumption that the Financing Contract will remain valid for the agreed period and that the Creditor and the Borrower will fulfil their obligations under the terms specified in the Financing Contract.

- If the Financing Contract contains clauses allowing variations in the charges contained in the APR but unquantifiable at the time of calculation, the APR shall be calculated on the assumption that the charges will remain fixed at the initial level and will remain applicable until the end of the Financing Contract.

- The Annual Percentage Rate must be calculated and expressed in percentage points with minimum two basis points and the portion of a basis point being rounded to one full point.

Rules Governing Calculation of Annual Percentage Rate (APR)

No: 45025707 Date(g): 31/10/2023 | Date(h): 17/4/1445 Status: In-Force Chapter I: General Provisions

Article 1: Definitions

The following terms and phrases, where used in these Rules, shall have the corresponding meanings unless the context requires otherwise:

Central Bank: The Saudi Central Bank.

Rules: Rules Governing the Calculation of the Annual Percentage Rate (APR).

Finance Providers: Banks, and Finance Companies Licensed to engage in retail lending.

Borrower: a person receiving finance.

Financing Agreement: an agreement whereby financing is granted for the activities listed in the Laws and Regulations.

Amount of Finance: the ceiling or the total amounts made available to the borrower under a finance agreement.

Annual Percentage Rate (APR): The discount rate at which the present value of payments and installments that are due from the borrower representing the total amount payable by the borrower equals the present value of all payments of the amount of financing available to the borrower on the date on which the financing amount or the first payment thereof is available to the borrower.

Total Amount Payable by the Borrower: the sum of principal loan amount and the total cost of finance.

Total Cost of Finance: All the costs to be paid by the borrower under a financing agreement other than the amount of Finance, including term cost, fees, commissions, administrative services fees, insurance, and any charges required to obtain finance excluding any expenses the borrower can avoid such as costs or fees payable by the borrower due to his breach of any of his obligations contained in the financing agreement.

Article 2: Scope of Implementation

1. These Rules shall be applicable on all finance providers engaging in retail lending 2. The Rules shall be read in conjunction with the related Laws and Regulations, including but not limited to the following: - Finance Companies Control Law and its Implementing Regulation. - Rules Regulating Consumer Microfinance Companies. - The Rules on Disclosure of Interest Rates on Financing and Saving Products. - The Regulations for Consumer Financing. - SAMA's Circular No. 381000095091 issued on 10/9/1438H to clarify Article (10) and Article (21) and the APR Calculation Mechanism in the Regulation for Consumer Financing. Article 3: General Provisions

1. The objective of these Rules is to standardize the Annual Percentage Rate (APR) calculation for different types of retail lending, ensuring transparency in the finance offers and comparability to enable retail consumers to make informed decisions.

2. The APR for financing transactions shall be determined in accordance with the instructions and APR Calculator implemented through these Rules for the following:

a. Advertising and promotional materials.

b. Finance offering stage.

c. Financing contract.

d. Periodic statements provided to customers.

e. Any other disclosure of APR.

Chapter II: APR Calculator

Article 4: SAMA APR Calculator

Finance providers shall utilize the Excel based calculator issued by SAMA for the purpose of implementing the Rules.

Article 5: Implementation and Update of the APR Calculator

- Finance providers shall update the relevant policies and procedures to comply with the requirements included in the Rules.

- Finance providers are responsible for implementing adequate internal controls and audit mechanisms to safeguard the integrity of the APR Calculator deployed. In case where the APR Calculator is automated, finance providers should verify the results obtained using the automated tool by comparing those results to the figures obtained by using Excel based APR Calculator provided by SAMA.

- Finance providers shall also ensure that the APR Calculator made available to customers through their websites is updated to align with the Rules requirements and the enclosed Calculator.

Chapter III: APR Calculation Requirements

Article 6: APR Calculation Method

The APR should be calculated based on the net present value method using the following formula:

Where:

- m is the last payment of the amount of finance to be received by the borrower. - d is the payment to be received by the borrower from the amount of finance. - Cd is the payment value of (d) to be received by the borrower from the amount of finance. - Sd is the period between the date on which the amount of finance or the first payment is available to the borrower and the date of payment (d), calculated in years and parts of the year, and so that this period of first payment received by the borrower from the amount of finance is zero (s1=0) - n is the last payment payable by the borrower. - p is the payment payable by the borrower. - Bp is the payment value (p) payable by the borrower - Tp the period between the date on which the amount of finance or the first payment is available to the borrower and the date of the payment (p) to be received from the borrower, calculated in years and parts of the year. - X is the Annual Percentage Rate. Article 7: Cost of Finance

1. For calculating the APR, finance providers shall specify the total amount payable by the borrower.

2. Finance providers shall include the cost elements in the total cost of finance as specified below:

a. All types of costs that the borrower has to pay in order to access the credit.

b. All costs shall be accounted for regardless of whether they are payable to the finance provider or a third party or payable directly or indirectly by the borrower or whether they give access to financial or non-financial services.

c. Term cost, commissions arising from the credit agreement, credit brokerage fees payable by the borrower, administrative fees / or loan processing fee, insurance related costs, valuation costs, cost of ancillary services, and taxes including VAT, etc.

d. Cost of ancillary services or supplementary services to the financing agreement, shall be included in the total cost of finance where the ancillary service is mandatory to obtain the finance or to obtain the finance on the terms and conditions marketed by the finance provider.

Article 8: Costs Excluded from APR Calculations

The total cost of finance shall not include:

a. Any amount charged in lieu of early repayment or settlement and changes in the terms and conditions of the financing agreement. b. Fees and charges incurred as a result of failure to comply with the terms of the agreement i.e., late payment charges in the form of penalties, charges for collection, etc. c. Other costs not paid in connection with the financing agreement (e.g. vehicle registration fees). Article 9: General Requirements

Finance providers must consider the following while calculating the APR:

- The periods between the date on which the amount of finance or the first payment is available to the borrower and the date of each payment received or payable by the borrower shall be calculated on the basis of 365 days a year.

- The APR shall be calculated on the assumption that the amount of finance is valid for the term agreed upon and the parties’ adherence to their obligations according to the conditions stipulated in the financing agreement.

- The APR must be calculated and expressed in percentage points with a minimum of two basis points, rounding half basis points to the nearest full basis points.

- In case the finance agreement contains a clause allowing variations in term cost and fees contained in the APR (e.g. floating) which is not quantifiable at the time of financing, the APR must be calculated on the assumption that the term cost and other charges remain fixed in relation to the initial term cost applied and will remain applicable until the end of the financing agreement.

Article 10: Specific Requirements for Credit Cards Products

Finance providers while calculating the APR for credit cards shall assume the following:

- The amount of finance is provided for a period of 1 year starting from the date of the initial drawdown or card allotment/approval date, and that the final payment made by the borrower clears the principal payment, term cost and other charges, if any.

- The principal payments and term cost are repaid by the borrower in 12 equal monthly payments, commencing 1 month after the date of the initial drawdown.

- If the ceiling of the credit card has not been determined, that ceiling shall assumed to be SAR 10,000 when calculating the advertised APR.

- At the pre-contractual stage, the amount of finance shall be equal to the financing limit or credit card limit requested by the customer or offered to the customer.

- At the contractual stage, the amount of finance shall be equal to the financing limit or credit card limit based on the agreement concluded with the borrower.

Chapter IV: Concluding Provisions

Article 11

The internal audit function shall review the APR calculation process at least annually. Any control deficiencies highlighted by the internal auditor shall be addressed by management in a timely and effective manner.

Article 12

These Rules shall enter into force (90) days after the date of their publication on SAMA’s official Website.

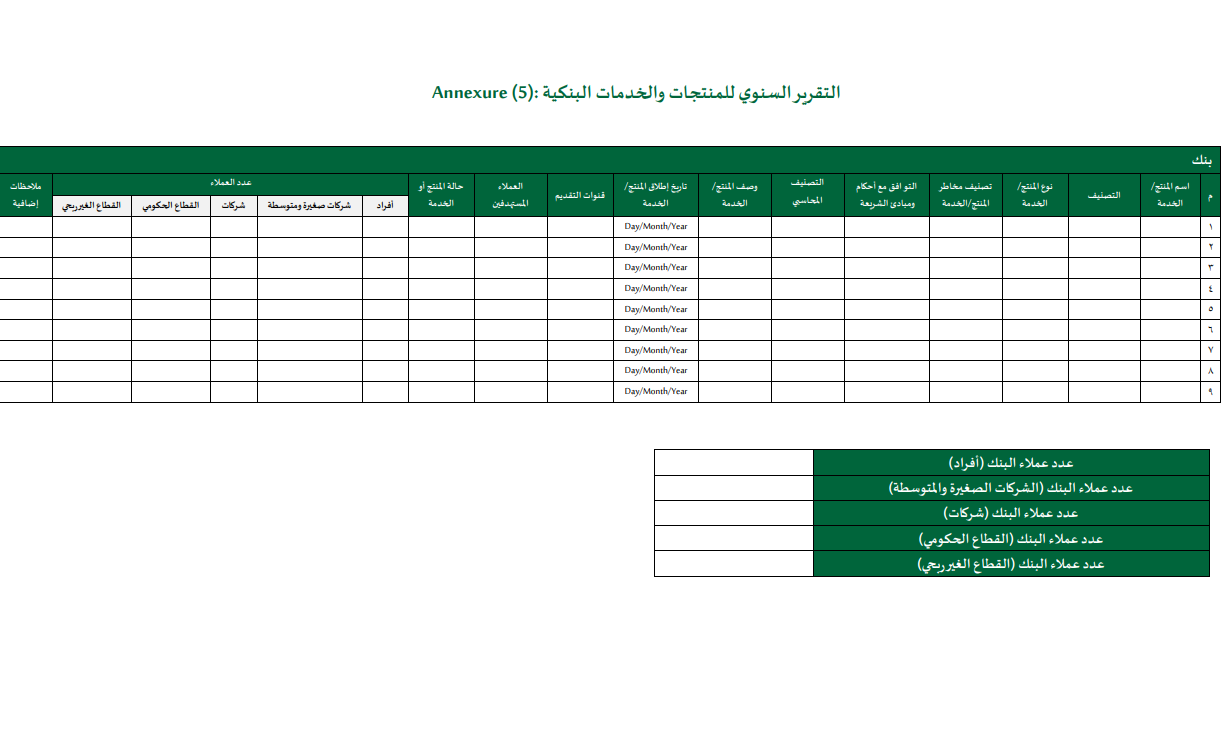

New Banking Products and Services Regulation

No: 45032226 Date(g): 30/11/2023 | Date(h): 16/5/1445 Status: In-Force This regulation was issued under circular No. (391000006163), dated 18/01/1439H, corresponding to 08/10/2017G, and updated by Circular No. (45032226), dated 16/05/1445H, corresponding to 30/11/2023G.Based on the powers granted to SAMA according to Saudi Central Bank Law issued by Royal Decree No. (M/36) dated 11/04/1442 H and related regulations. And referring to SAMA Circular No. (391000006163) dated 18/01/1439 H regarding SAMA's New Banking Products and Services Guidelines, and in continuation of what SAMA issued in this regard.

Attached is the first update of the above-mentioned guidelines, which seeks to achieve several objectives, most notably promoting sound practices in managing the risks associated with products and services, clarifying the roles and responsibilities of the board of directors and senior management in the governance, development and oversight of banking products and services. In addition to improving the mechanism for receiving and processing bank notifications to introduce new banking products and services, clarifying the products and services that require no written objection or notification to SAMA (provided that the requirements in the instructions are met), and creating a unified model for introducing new banking products and services. These instructions will replace the previous instructions.

For your information and action accordingly as of March 1, 2024 G.

1. Introduction

Banks frequently introduce new products and services and/or modify existing products and services in normal course of business. These new or modified products and services could expose the banks or the financial system as a whole to new risks or could amplify existing risks. Therefore, the risks posed by the introduction and/or modification of products and services must be identified, assessed, monitored and managed appropriately by the banks.

New Banking Products and Services Guidelines were issued by SAMA in 2017; due to changes in the financial system and regulatory framework, SAMA decided to update these guidelines. The key objectives of this regulation is to promote sound risk management practices and/or manage risks associated with banking products and services. The banks must adhere to this regulation as minimum set of regulatory requirements.

2. Objective

This Regulation sets out SAMA’s requirements with regard to banks’ offering of new products and services and regulatory requirements of notifying SAMA prior offering a new product or service, and the required supporting documents to be submitted. In addition, the regulation aim to improve the time-to-market for banks to introduce new product and service, and promoting sound risk management practices in managing and controlling risks associated with banking products and services.

3. Scope of Application

This Regulation shall be applicable to all licensed banks in Saudi Arabia under the Banking Control Law.

4. Definitions

4.1 Product or Service

A product or service are what the banks offer to their customers within the scope of banking business as defined in the Banking Control Law.

4.2 New Product or Service

A new product or service is one that a bank offers for the first time in Saudi Arabia notwithstanding the fact that a bank, its parent bank, branches or subsidiaries in a foreign jurisdiction may have offered similar product and service outside of Saudi Arabia, or a variation to an existing product offered by bank in Saudi Arabia or a combination of product or service with another existing or new product or service, that results in a material change(1) to the structure, features or risk profile of the existing product or service.

(1) Material changes or modifications may include, for example, significant changes to key terms related to payout, rights and obligations of the counterparties/customers, the changes in nature of assets underlying the product or service, changes result in new or additional risk exposure to the bank or the customer.

4.3 Existing Product or Service

An existing product or service, which a bank had offered, and continue to offer, until the bank decides to discontinue or make material modifications to the product or service.

5. Board of Directors and Senior Management Responsibilities

5.1 Board of Directors (The Board)

5.1.1 The Board has an oversight responsibility (2) to ensure that senior management develop and implement the detailed internal policies and procedures for offering of new products and services.

5.1.2 The Board is responsible for ensuring that product and service risks are well managed, and the needs and rights of consumers are appropriately addressed.

5.1.3 The Board must review whether the offering of products and services by the bank remains consistent with the risk appetite approved by the board and internal policies and procedures for offering of new products and services.

5.1.4 The Board must review and revise the bank’s risk appetite when the offering of products and services by the bank is no longer consistent with the approved risk appetite. Any changes to the risk appetite must be justified and documented with detailed risk assessment, taking into consideration the risk management capabilities and risk bearing capacity of the bank. The Board must also ensure that internal policies and procedures are updated by senior management accordingly following changes in risk appetite.

(2) The management function responsible for overseeing the operations of Foreign Bank Branch (FBB) are to ensure that policies an d procedures for new products and services are consistent with the requirement of this regulation, and effectively implemented in its operations.

5.2 Senior Management

5.2.1 Senior management are responsible for the design, implementation, and compliance of the bank’s new products and services with the Board approved internal policies and procedures for offering of new products and services.

5.2.2 Senior management must ensure that offering of any new or existing products and services must fall within the scope of banking business as defined in the Banking Control Law.

5.2.3 Senior management must ensure that that risks arising from new products and services are well understood and aligned to the bank’s risk appetite and tolerance level.

5.2.4 Senior management has to determine whether the change to any product or service is considered to be a material change (3).

5.2.5 Senior management must periodically review the appropriateness of the products and services internal policies and procedures and whether they continue to meet the objectives as set out in this regulation, and must propose to the Board that the policies and procedures be amended if this is no longer the case.

5.2.6 Senior management must identify and mitigate potential negative effects on the bank's reputation either actual or perceived.