Automated Teller Machines

Procedures And Controls to Be Observed in Maintaining ATM Machines

We wish to inform you that SAMA receives from time to time reports from Saudi police about the bank's maintenance of ATM machines. In view of the fact that maintenance workers are sometimes caught without having a permit which indicates their identity and the nature of the work they are doing; and since there are instructions and controls adopted by General Security and communicated to SAMA regarding the maintenance of ATM machines; and in our desire to see the ATM machines well maintained and smoothly operating all the time and the maintenance workers are not subject to questioning and arrest by the police, the banks must abide by the following instructions:

- The police operation room must be advised of the location of the ATM machine to be maintained, the day and hour of the maintenance job so that the police patrol in the area will provide needed protection.

- Maintenance workers must carry permits showing their name and photo stamped by the official stamp of their employer to be presented lo security when requested.

- An office must be assigned and operating around the clock with a Saudi employee in charge and its phone number be communicated to the operation room in case of suspicion.

- The maintenance hours must be fixed between 8:00 A.M and 11:00 PM.

- Maintenance companies and establishments must be required to have a special logo attached to their vehicles and worker uniforms so that the maintenance team is clearly identified by the security patrols.

We further wish to remind you of SAMA's circular No.485/BC/36 dated 7/1/1416, with a copy of the Security guide attached thereto, which includes, in several parts, thereof, the procedures and controls which cover all aspects of ATM safety and security as follows:

- The part related to physical security requirements (P 10 and 11)

- The part related to security and safety requirements (P 16, 17, 18, 25 & 26)

- The part related to internal procedures for the transport of cash (P 10 & 11)

- The part related lo establishments security guide (P14)

The above-mentioned parts included the location of ATM machines and the specifications of protection, feeding and alarm that have to be complied with.

Please be informed, advice same to your departments that are involved in feeding and maintaining the ATM machines and acknowledge receipt.

Cash Feeding Requirements for ATMs

Further to SAMA's instructions issued under Circular No. 361000064350 dated 03/05/1436 H regarding to the procedures for reversal of cash transactions in Automated Teller Machines (ATMs), as well as Circular No. 351000009927 dated 22/01/1435 H concerning the reconciliation and replenishment timelines for banks' ATMs, and Circular No. 27027/Akh dated 19/12/1424 H regarding the distribution of cash denominations in ATMs.

We hereby inform you that, in accordance to the Saudi Arabian Monetary Authority Law issued by Royal Decree No. (23) dated 23/05/1377 H, and the Banking Control Law issued by Royal Decree No. (M/5) dated 22/02/1386 H, the following has been decided:

- ATM shall be replenished and extension of the period of reconciliation every ten business days, considering cash flow projections, the characteristics of the location, and associated operational risks.

- The Dispense Logic is determined at the bank's discretion, taking into account the characteristics of the location and the needs of the customers. All ATMs situated within bank branches and transfer centers shall be replenished with a minimum of three cash denominations: five hundred, one hundred, and fifty. This arrangement ensures that customers have the option to withdraw cash in any combination of these three denominations. Outdoor ATMs situated in various locations such as roadways and shopping malls are designed to accept a minimum of two different denominations of currency, ensuring that both denominations can be dispensed to the customer during cash withdrawal transactions. The General Administration of Branches and Cash Centers will conduct a reassessment of the distribution of cash denominations six months following its implementation.

- The responsibility for determining the cash replenishment method of ATM lies with the banks. They have the discretion to decide whether to replace all denomination cassettes simultaneously when the machine requires cash or to replace only the denomination box that has been depleted. The box or cassettes shall be prepared at the cash center and maintained under dual surveillance and monitoring via cameras, subsequent to the bank determination of the requisite accounting mechanisms and procedures.

- Banks must automate ATM replenishment procedures by having an automated system to replenish the ATMs. In the absence of such systems, it is advisable to utilize test cards, which enable the replenishment team to conduct a test withdrawal following each replenishment. This procedure is essential to verify that the appropriate cash denominations have been correctly placed within the ATM. Supervisor cards must be utilized to enable the replenishment team at the cash centers to reconcile ATMs in real time, thereby eliminating the need to wait for reconciliation by the bank's support departments.

- Banks shall rectify discrepancies associated with the reversal of denomination cassettes that arise from the replenishment of ATMs. Additionally, they must manage instances where a customer inadvertently receives funds due to either a technical malfunction or human error. The banks bear the responsibility to substantiate the error in the event the customer disputes their actions.

For your information and action accordingly as of its date. SAMA will undertake field visits to verify compliance with these instructions, and in case of any inquiries in this regard, the Advisor to the Deputy Governor for Financial Sector Development can be contacted.

- ATM shall be replenished and extension of the period of reconciliation every ten business days, considering cash flow projections, the characteristics of the location, and associated operational risks.

Requirements for ATM Cash Feeding with Sixth Issuance Currency and Inclusion of 200 Riyal Denomination

Referring to Circular No. 27027/Akh dated 19/12/1424 H regarding the distribution of cash denominations in ATMs local banks, and Circular No. 30902/227 dated 26/08/1440H regarding cash feeding requirements for ATMs, and based on SAMA’s commitment to enhancing the efficiency and quality of circulating cash, and to meet the needs of ATM users with different cash denominations, SAMA emphasizes to all operating banks the importance of ensuring the proper replenishment and safety of cash in the bank’s ATMs and to adhere to the following:

First: Effective January 1, 2022G, ATMs shall be exclusively replenished by sixth-issue denominations.

Second: The SAR 200 denomination from the sixth issue will be added into all internal ATMs situated within branches and transfer centers. The determination to add this denomination into external ATMs will be made at the bank's discretion, considering the unique attributes of the location and the needs of customers, prior to February 2, 2022G.

The Central Bank emphasizes the importance of adhering to the above, and providing the Cash Supervision Department with the bank's plan to insert the (200) riyal denomination in ATMs via e-mail, within two weeks from its date.

Declined Bank Card Transactions at ATMs

We would like to emphasize the role played by the Saudi banking network in providing advanced banking services to citizens and residents facilitating their access to cash easily and conveniently, which enhanced customers' trust and reliance on the banking sector. The Central Bank appreciates the efforts of Saudi banks in providing these services, whether by issuing cards or installing ATMs and POS terminals. The Central Bank is currently studying the Saudi network fees in order to establish a mutually agreeable resolution for all stakeholders involved.

Although the Central Bank had previously issued Circular No. BCT/4593 dated 05/08/1420 H, a copy of which is attached, which stipulates the prohibition of imposing restrictions on the issuance or utilization of Saudi Payments Network cards, it was noticed that certain banks have imposed restrictions on the use of the network, which impacted the network's credibility and led to numerous complaints from customers.

Therefore, we inform you that the bank shall eliminate any restrictions on network usage and remove any current restrictions, noting that as of 05/12/1420 H, the Central Bank will implement a fee of 6.4 riyals for each transaction that is declined beyond the standard rate established by the Central Bank, should the bank fail to comply with the directive to remove the existing restrictions.

Annual Plans to Install ATMs

Referring to the future plans of banks to provide ATM services for customers in all regions of the Kingdom, and the importance of early planning and coordination among the relevant parties in this regard, SAMA will provide the necessary support for banks to implement these plans.

We hope to provide SAMA by the annual plans for installing ATMs in September of each calendar year, along with the plans to benefit from the temporarily suspended site licenses, according to the current requirements among the categories, for review and approval by SAMA.

For inquiries, you can contact specialists in the Currency Supervision Department via email.

Requirements for ATM Receipts Initiative

No: 43067037 Date(g): 6/3/2022 | Date(h): 3/8/1443 Status: In-Force Based on the powers granted to the Saudi Central Bank under its Law issued by Royal Decree No. (M/36) dated 11/4/1442 AH, and the Banking Control Law issued by Royal Decree No. (M/5) dated 22/2/1386 H, and referring to the ATM Service Level Agreement (Version 2) issued under Central Bank Circular No. (41932/227) dated 15/3/1441 H, and in continuation of the efforts made to develop the payment system infrastructure in the Kingdom.

Attached is the Requirements for ATM Receipts Initiative issued by Saudi Payments, which banks are required to implement on ATMs. The initiative aims to reduce customer requests for paper receipts in ATM transactions by standardizing the workflow across all machines to ensure the following:

- Preserving the environment and the overall appearance.

- Standardizing the user experience across all ATMs.

- The importance of maintaining data privacy for cardholders.

- Reducing costs for service providers.

Accordingly, the Central Bank emphasizes that all banks operating in the Kingdom and members of the Saudi Payments Network must comply with the provisions of the attached initiative. Coordination in this regard can be made with specialists at Saudi Payments via email (onboarding@saudipayments.com).

For your information and action accordingly, effective from 30/06/2022 G.

1. Introduction

In line with SAMA’s and Saudi Payments’ vision to make continuous improvements in payment infrastructure of the Kingdom, ATM Receipts initiative aims to minimize Cardholders’ dependency on paper receipts for ATM transactions.

The sole objectives of this initiative are to:

√ Enable cost efficiency for Acquirers

√ Maximize customer data privacy and protection

√ Save environment and go green!

1.1 Purpose of Document

The purpose of this document is to assign rules and requirements related to ATM Receipts to external stakeholders who play significant roles in the success of this change. This document is intended to govern the responsibilities of mada Members from multiple aspects for the purpose of ensuring the quality of the solution.

1.2 Scope of Document

This document covers the rules and requirements for ATM Receipts initiative. It also contains detailed workflows of the new enhancements on ATM screens. This document, however, does not contain certification procedures nor terms and conditions.

1.3 Audience of Document

The intended audience of this document is mada Members who are familiar with the basic guidelines of ATM functionalities, and who must comply with these rules at all times.

2. Overview

ATM Receipts is an enhancement initiative that drives the market to minimize dependency on receipts for the four (4) most commonly performed transactions on ATMs.

This initiative focusses on improving and unifying the screen workflow across all ATMs (off-us and on-us) in an attempt to unify user experience and reduce demand on receipts as a result. However, paper receipts shall still be available and provided to Cardholders whenever requested.

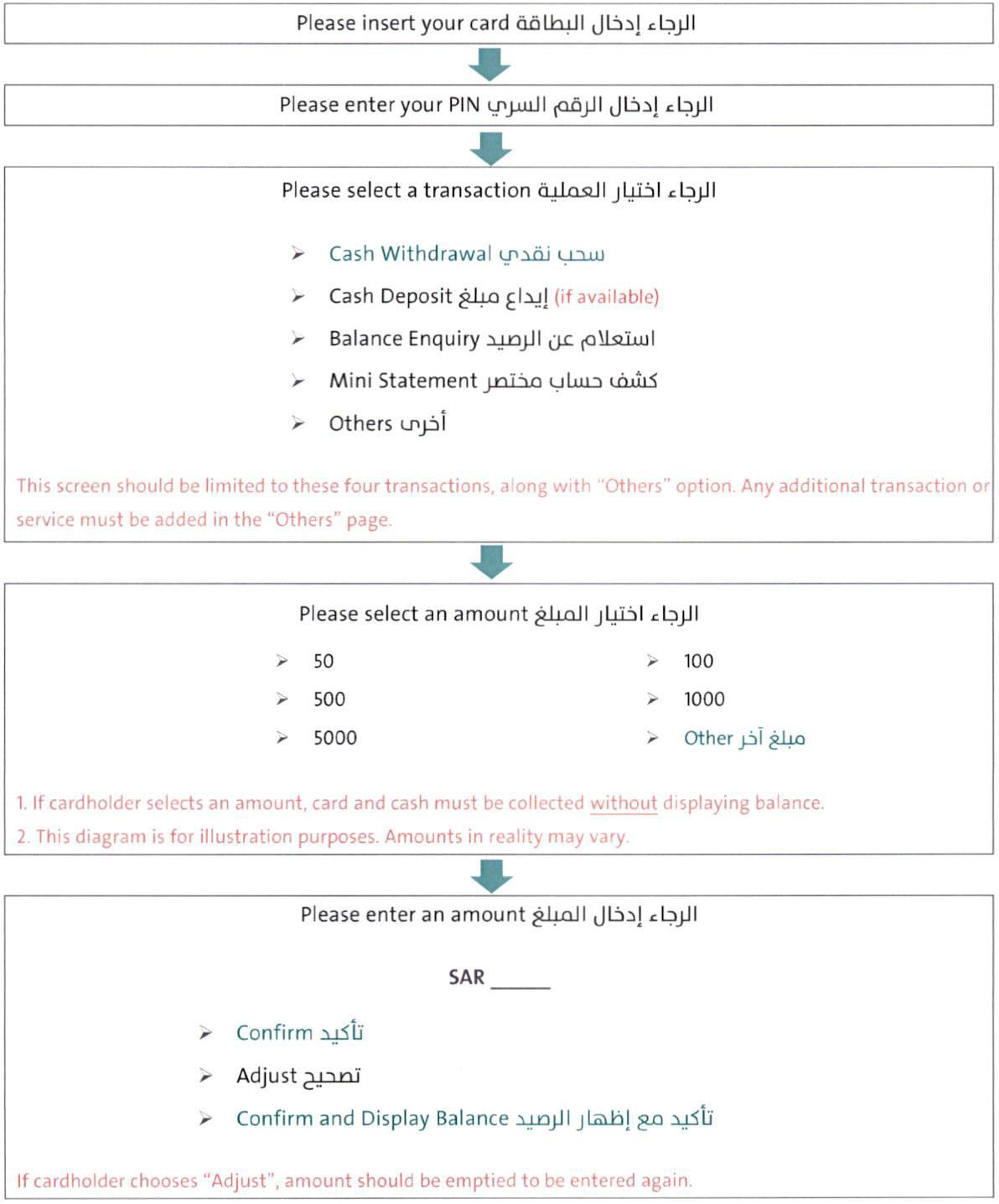

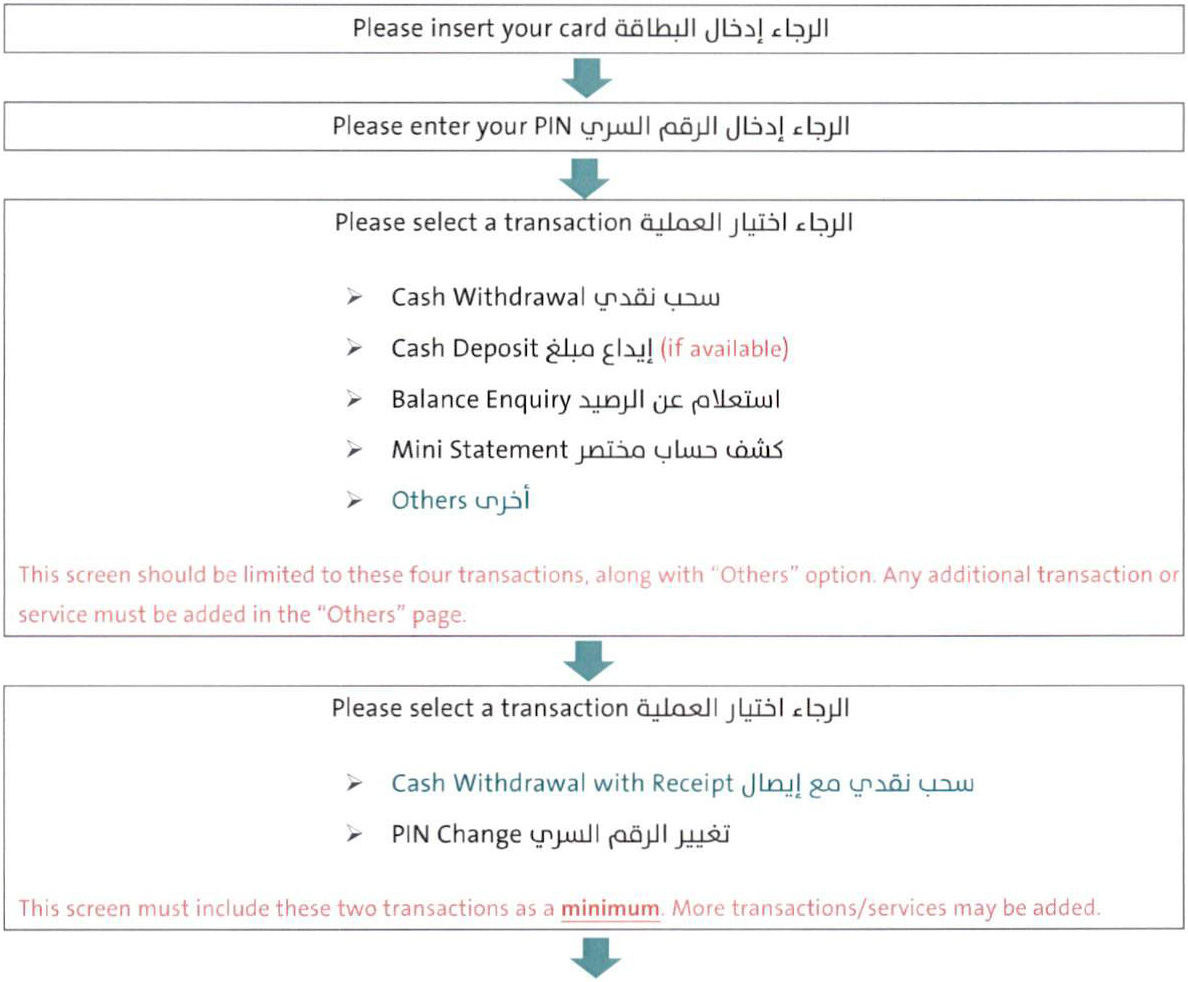

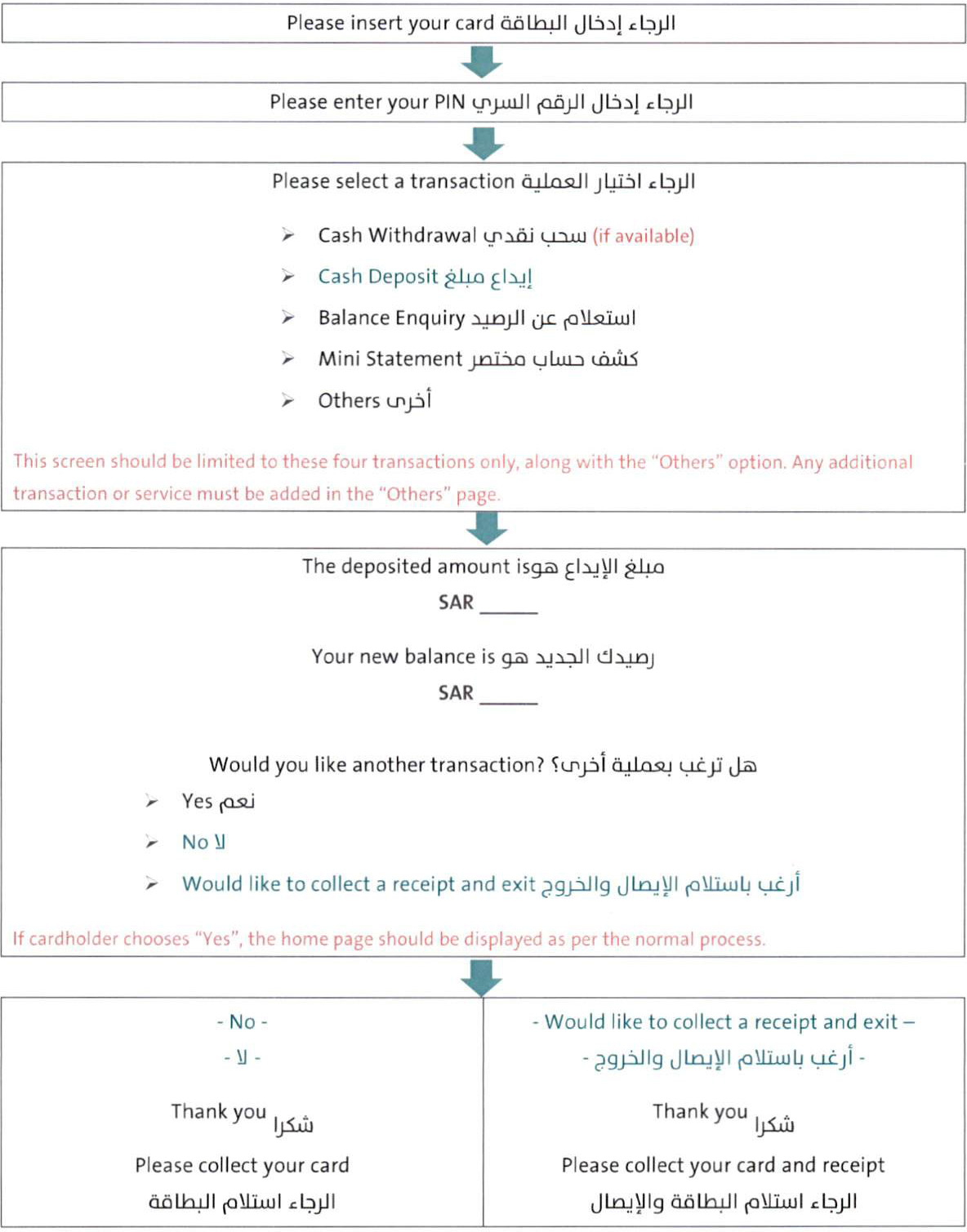

Currently, the Home page on ATMs-after inserting the card and entering the PIN-displays the four major transactions (Cash Withdrawal, Balance Inquiry, Mini Statement, and Cash Deposit if available). As part of this initiative, the Home page will be limited to whatever is available of those four transactions and must be fixed and unified across all ATMs (including on-us and off-us). In addition to the four transactions, the Home page also provides an 'Others’ option which opens up to any other transaction(s) and/or service(s) (i.e. PIN Change, Transfer...etc.).

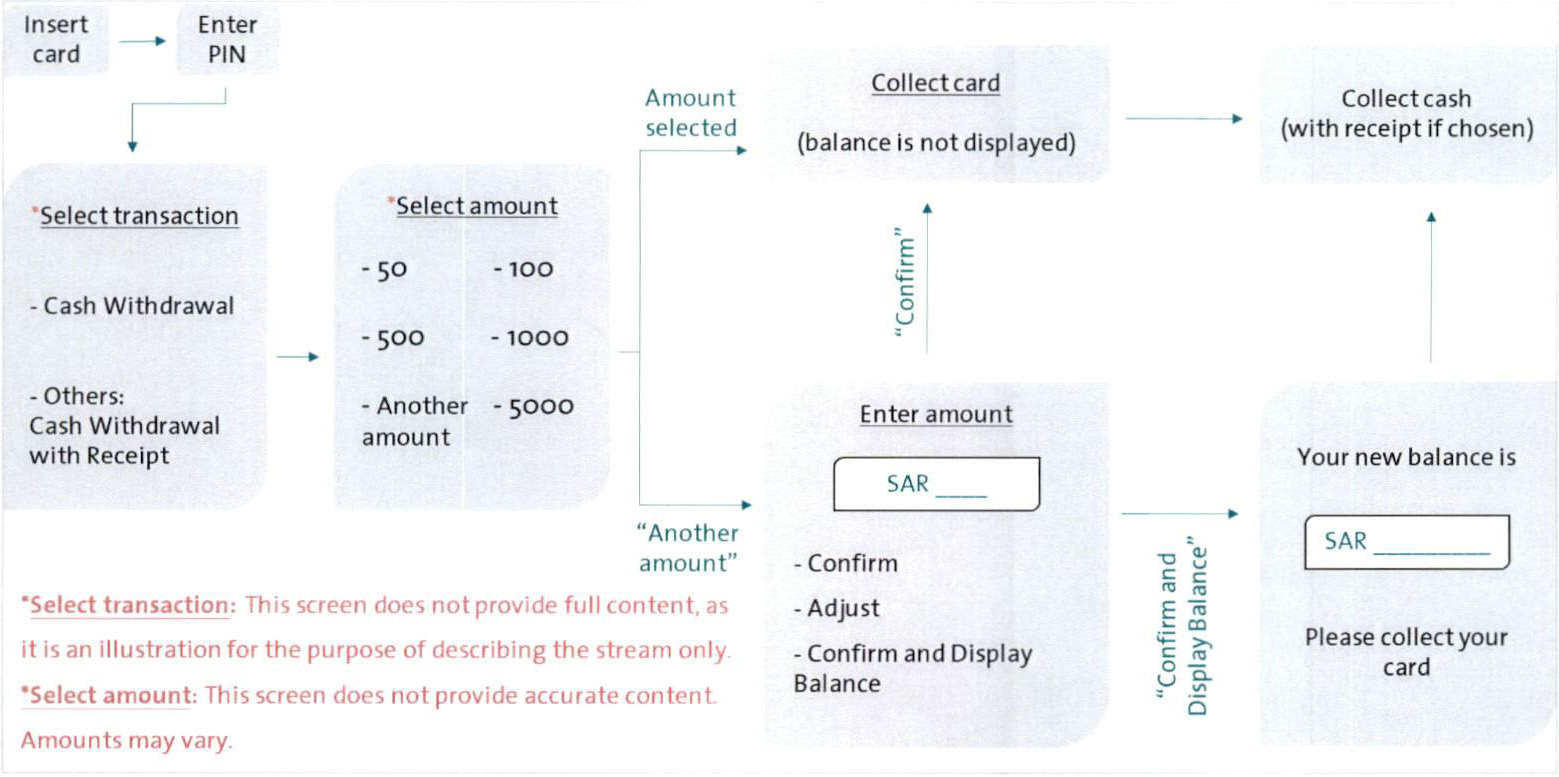

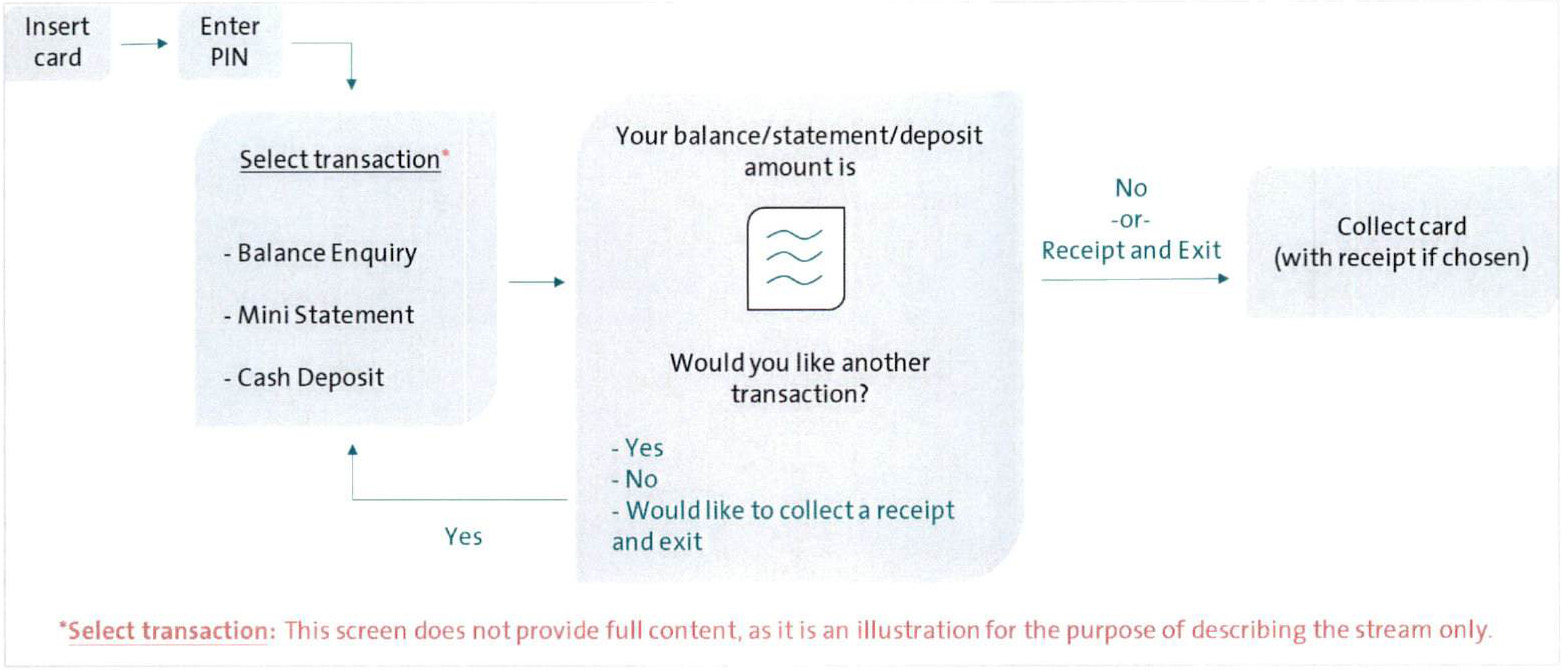

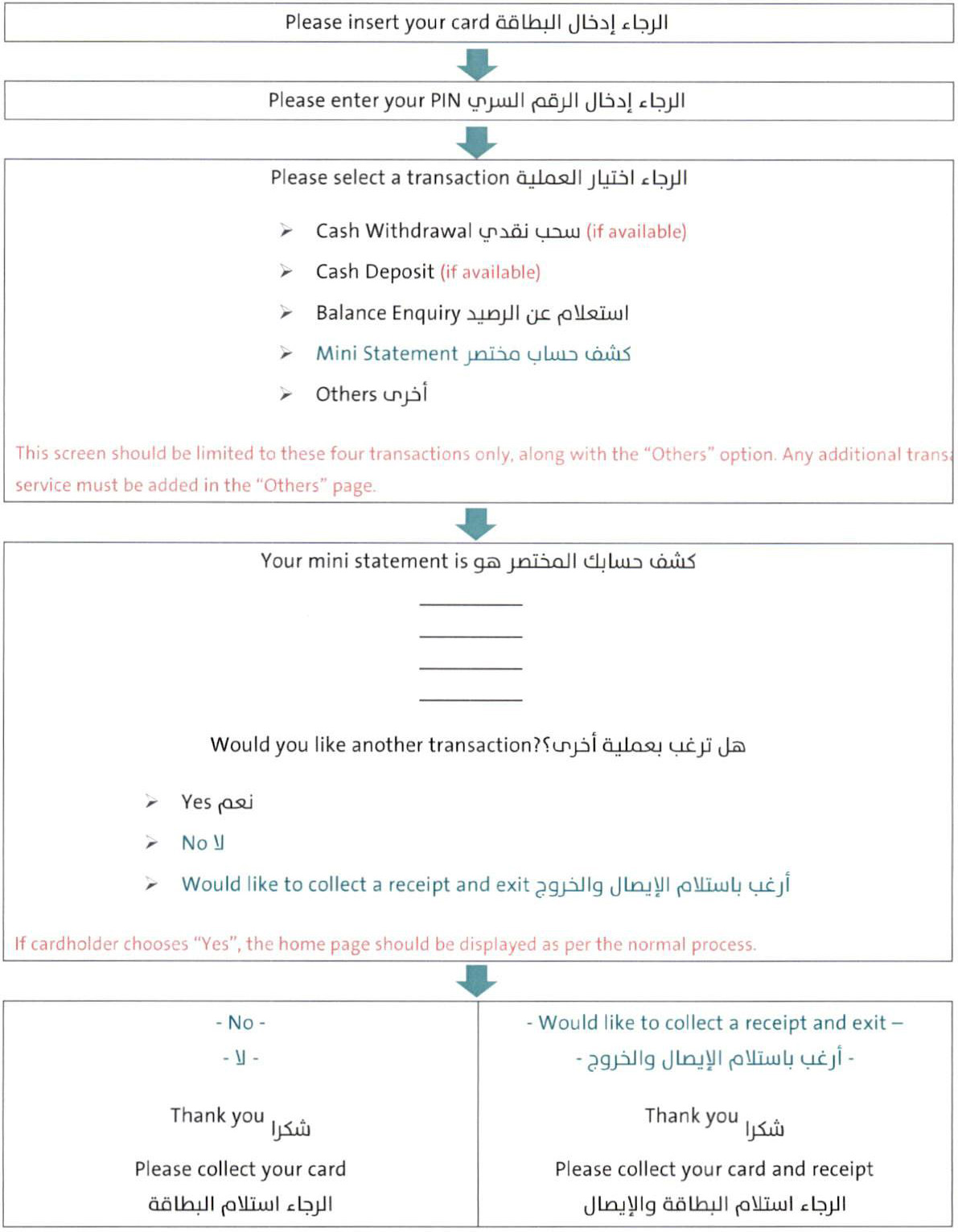

The new enhancement on ATM screen flow runs into two streams: (1) Cash Withdrawal transaction stream, and (2) *Non-cash transactions stream. Each of which has its own mechanism to achieve the same goal of receipt reduction.

*Non-cash transactions include (1) Balance Enquiry, (2) Mini Statement, and (3) Cash Deposit -which is currently available for on-us only.

3. New ATM Screen Workflows

3.1 Cash Withdrawal Transaction Stream

Since Cash Withdrawal is the top transaction in terms of initiation and receipt requests, there will be two separate transactions for Cash Withdrawal:

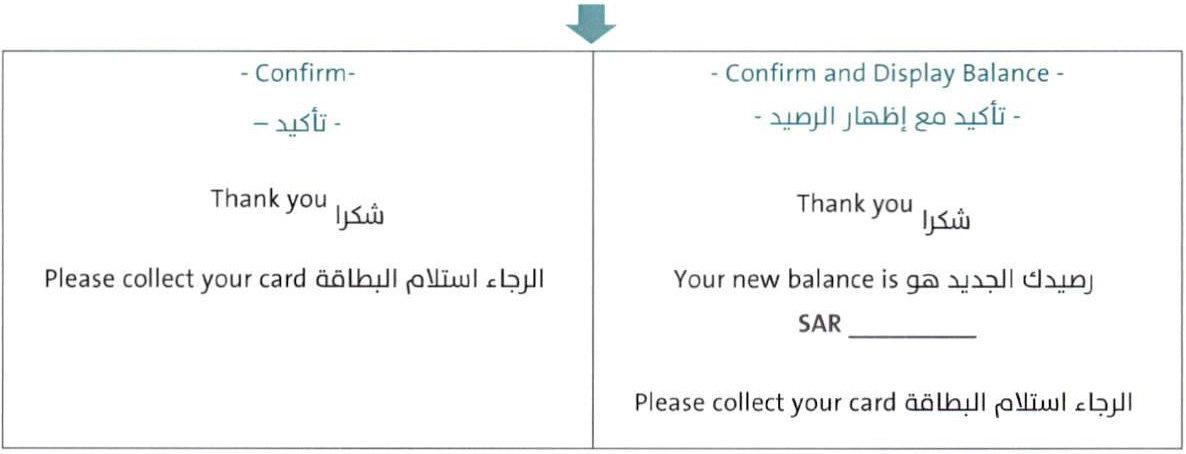

(1) The first transaction is “Cash Withdrawal" which is presented within the Home page on the ATM. This transaction should not provide a receipt upon completion.

(2) The second transaction is "Cash Withdrawal with Receipt” which will be added inside the 'Others' page from the Home page. This transaction should provide a receipt upon completion.

More importantly, after choosing either of the two transactions, if Cardholder selects one of the listed amounts on the screen, card and cash should be collected immediately and without displaying the account balance. However, in case Cardholder chooses "Another amount” and manually enters the amount, an option to "Confirm and Display Balance” will be given to the Cardholder in addition to the default option(s). The new workflow for Cash withdrawal transactions will be as follows:

A detailed workflow for the Cash Withdrawal transactions stream can be found in the Appendix.

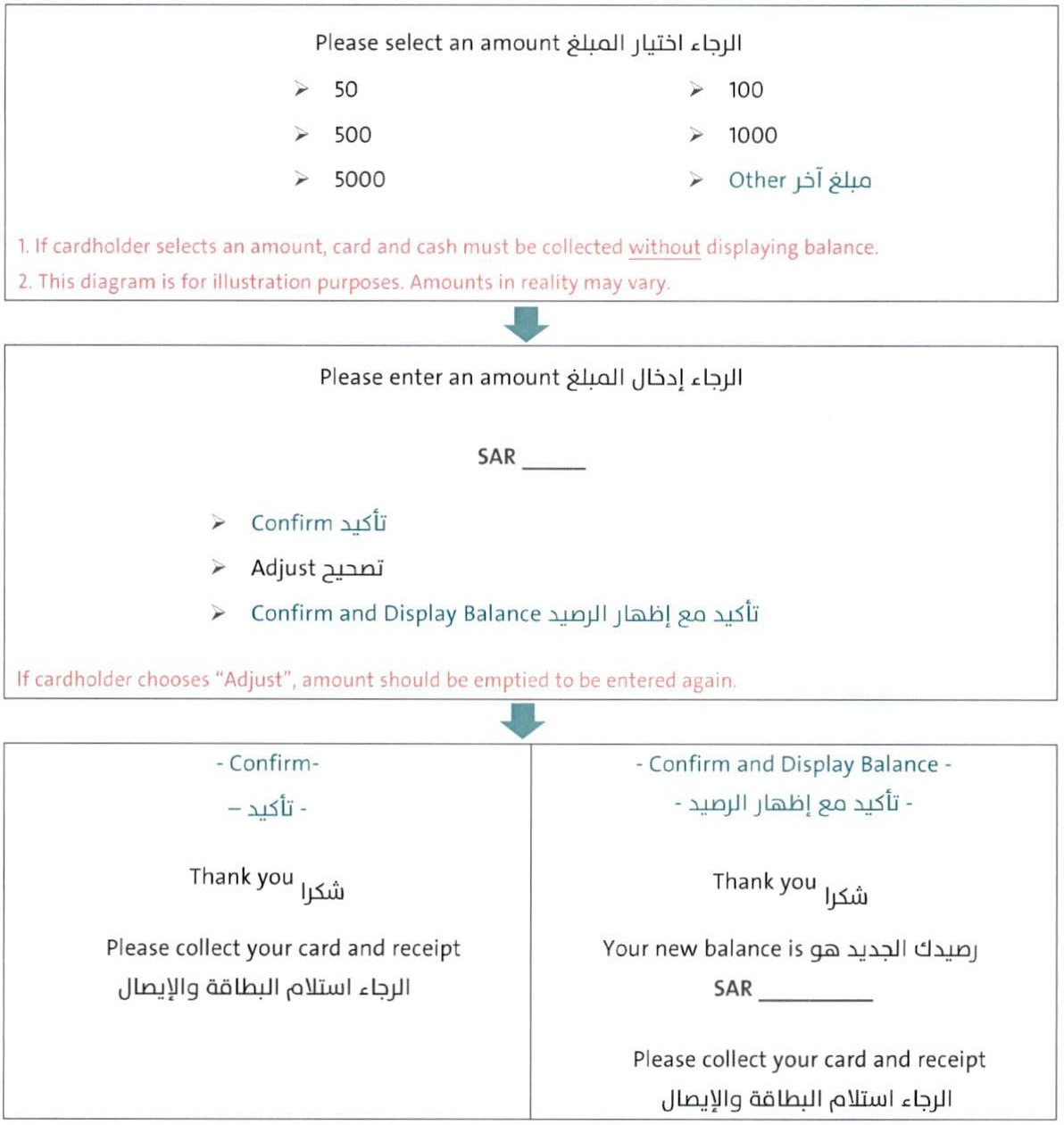

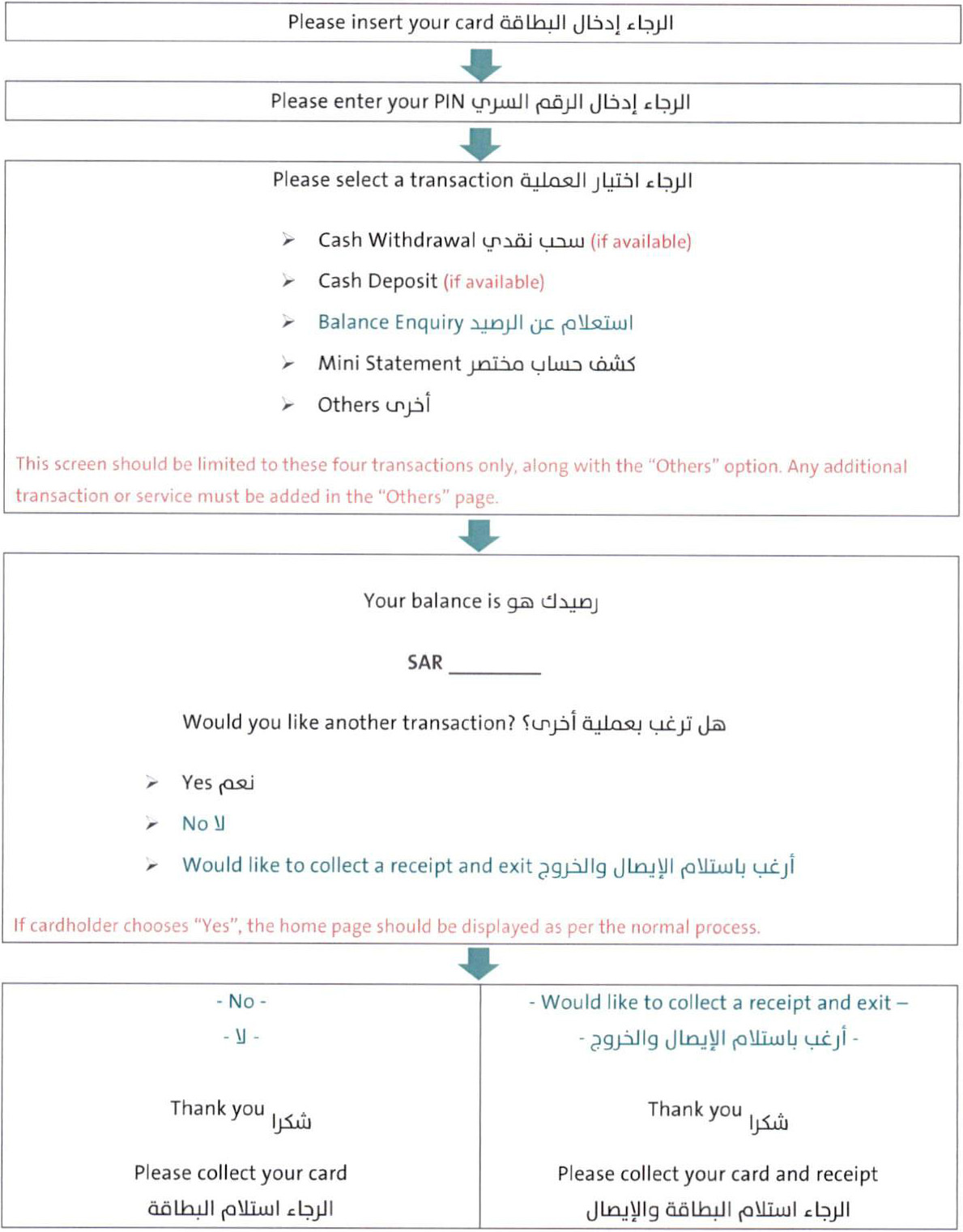

3.2 Non-Cash Transactions Stream

As mentioned earlier, non-cash transactions include Balance Enquiry, Mini Statement, and Cash Deposit. There will be two changes (or additions) to enhance the screen flow and reduce receipt demand for this stream:

First, upon choosing Balance Enquiry or Mini Statement, the account balance or mini statement, respectively, will be shown on the screen. And upon choosing Cash Deposit, the deposited amount as well as the new balance will be shown on the screen.

Second, at the end of either of the three transactions, a receipt will not be automatically printed. However, an option to "collect a receipt and exit’’ will be given to the Cardholder in addition to the default option(s) - if chosen, the process should be ended and the card should be collected along with the receipt. The new workflow for the non-cash transactions will be as follows:

A detailed workflow for the non-cash transactions stream can be found in the Appendix.

4. Appendix

4.1 Workflows for Cash Withdrawal Transactions Stream

4.1.1 Workflow for Cash Withdrawal (without Receipt)

4.1.2 Workflow for Cash Withdrawal with Receipt

4.2 Workflows for Non-Cash Transactions Stream

4.2.1 Workflow for Balance Enquiry

4.2.2 Workflow for Mini Statement

4.2.3 Workflow for Cash Deposit

Adoption of ATM's Electronic Journals

Referring to the discussions held in the Banking Operations Managers Committee (BOOC) regarding the request to cancel the use of paper journals from ATMs and to adopt electronic journals.

We inform you that SAMA has no objection to the adoption of the outputs of the Electronic Data Capture (EDC) for banks wishing to do so when addressing customer claims and complaints, as well as for reconciling and settling ATM transactions instead of using paper journals. It should be noted that in the event of customer claims or complaints and if the bank is unable to obtain a copy of the transaction from either the electronic or paper journal, the bank will bear any resulting responsibilities.

Immediate Response to Any Sudden Power or Communication Disruption in ATMs

Referring to what SAMA recently observed regarding the weak response of some banks to reports of malfunctions related to sudden power or communication disruption in ATMs, and the cash remaining inside the machines for long periods.

Accordingly, SAMA stresses to all banks to respond immediately to any of these cases, and to work on the safety of cash and not to leave it in ATMs for more than 24 hours in the event that it is not possible to resolve problems related to electricity, communications and technical malfunctions.

We also hope that you will inform the relevant departments and your affiliated entities to implement this, act accordingly and include it in your internal procedures as of this date.

SAMA will verify the extent of compliance with these instructions.

Time Out Cash Retract on ATMs

Referring to the Time out-Cash retract in Automated Teller Machines (ATMs), which returns the amount to the ATM in case it is not collected.

We inform you that, due to the emergence of several negative aspects in this feature, banks are required to stop the service as of 1/1/2015.

Maintenance and Feeding of ATMs

Referring to SAMA Circular No. 4567/BCI/123 dated 27/02/1429 H, supplementary to Circular No. 6898/BCI/287 dated 1420 H regarding the procedures and controls to be observed in maintaining ATM machines, including the requirement for ATM maintenance workers to carry permits showing their names and photos, stamped with the official stamp of their organization, and for the companies and institutions performing maintenance to display a specific logo on their vehicles and uniforms. SAMA has observed, during its monitoring of certain ATMs belonging to banks and based on reports from security agencies to SAMA, that some maintenance and feeding workers are using private vehicles and wearing inappropriate clothing that does not comply with the regulations.

Therefore, we hope to confirm adherence to the instructions mentioned in the above circular and inform the contracted companies to comply accordingly. SAMA will monitor compliance with these instructions and apply regulations against any violating banks.

Safety of Cash in ATMs

Based on SAMA's keenness and role in ensuring the safety of cash in circulation and the banks' responsibility for cash in ATMs, SAMA emphasizes to all local banks the necessity of paying sufficient attention to the safety of cash in the ATMs under the bank's jurisdiction, and adhering to the following:

First: Provision of necessary money counting and inspection machines at cash centers, and periodic assurance of the efficiency of these machines and the correctness of their setup (programming).

Second: Compliance With SAMA circular No. 23782/BC/251 dated 14/09/1414 H, and No. 422/M/T and the date 8/11/1413 H, and circular No. 400/B/C/241 and date 21/10/1413 H regarding the inspection of cash and ensuring its safety and quality before feeding it into ATMs.

Third: Increasing bank tellers' awareness of banknotes and their embedded security features, and providing all necessary equipment to verify the safety of the banknotes that are dealt with.

Fourth: ATMs should be fed under dual control and surveillance cameras with TV recording features, with the recorded material retained for at least six months for future reference if needed.

Fifth: Supervision, monitoring, and follow-up by bank officials on the process of feeding ATMs by cash transport companies, and not leaving this to companies only.

SAMA emphasizes the importance of adhering to what has been mentioned above.

ATM Maintenance Procedures

Further to SAMA Circular No. 6898 /BCI/ 287, dated 04/05/1420 H, which outlines the procedures and controls to be observed in maintaining ATM machine, including the requirement for maintenance workers to carry permits with their names and photos stamped with their organization's official stamp, and for maintenance companies and establishments to display a specific logo on their vehicles and uniforms. SAMA has observed, during its monitoring of certain ATM machines belonging to banks and through reports from security agencies, that maintenance and feeding workers have been using their private vehicles and some have not adhered to the regulations.

Therefore, please ensure strict adherence to the instructions outlined in the aforementioned circular and inform your contracted companies of the necessity to comply with these requirements. SAMA will continue to monitor compliance with these instructions and apply regulatory measures against non-compliant banks.

Extension of the Period for Making Inventories of ATMs and Feeding them With Cash

Referring to SAMA Circular No. 2193/BCI/102 dated 13/2/1419 H, which includes internal controls on ATMs and POSs on a daily basis, whether these ATM's are outside the branches or inside them, according to the instructions issued in this regard in the rules and procedures of the Saudi Payments Network (SPAN Business Book) circulated by Circular No. 341000076614 dated 20/6/1434 H. Based on the request submitted by the Bank Operating Officers Committee (BOOC) regarding the extension of the current ATM audit period, and considering the technological advancements in systems and ATMs that support their monitoring and remote access to withdrawal transaction documents, SAMA has decided to extend the scheduled period for making inventory and feeding of ATMs as follows:

• Banks must immediately feed the ATM's when the cash in the ATM reaches 20% of the total cash across all denominations.

• When there are complaints or claims from customers that require the bank to conduct a physical inventory, the bank must do so immediately regardless of the bank's schedule in normal cases.

To review and act accordingly and inform SAMA of what has been done in this regard within a month from its date.

ATM Service Level Agreement (Second Edition)

Based on the Saudi Arabian Monetary Authority Law issued by Royal Decree No. 23 dated 23/05/1377 H and the Banking Control Law issued by Royal Decree No. M/5 dated 22/02/1386 H, and with reference to Central Bank Circular No. 341000110148 dated 10/09/1434 H on issuing and signing the ATM Service Level Agreement.

We attach to you the ATM Service Level Agreement (second version) approved by the Central Bank, which aims to enhance and elevate the qualiy of ATM services recognizing their significance as a critical electronic channel for facilitating a wide array of banking services. Consequently, the revised agreement will be applied to all ATM services starting from January 1, 2021G. It is imperative to comply with this agreement and any subsequent updates. Therefore, we kindly request that it be signed and returned to the Central Bank within a maximum timeframe of two weeks from the date of receipt.

Note that the bank must send monthly reports in line with the new mechanisms and clauses in the agreement (second version) as of 01/04/2020 G, while continuing to send the current agreement reports as usual until the beginning of the full implementation of the new agreement at the beginning of 2021 G.