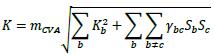

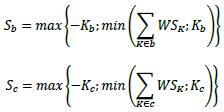

| | Counterparty credit spread buckets, risk factors, sensitivities, risk weights and correlations

|

| 11.63. | Counterparty credit spread risk is not subject to vega risk capital requirements. Buckets for delta risk are set as follows:

|

| | (1) | Buckets 1 to 7 are defined for factors that are not qualified indices as set out in 11.50 of this framework;

|

| | (2) | Bucket 8 is set for the optional treatment of qualified indices. Under the optional treatment, only instruments that reference qualified indices can be assigned to bucket 8, while all single-name and all non-qualified index hedges must be assigned to buckets 1 to 7 for calculations of CVA sensitivities and sensitivities. For any instrument referencing an index assigned to buckets 1 to 7, the look-through approach must be used (i.e., sensitivity of the hedge to each index constituent must be calculated).

|

| | | | Table 5: Buckets for counterparty credit spread delta risk | | Bucket number | Sector | | 1 | a) Sovereigns including central banks, multilateral development banks | | b) Local government, government-backed non-financials, education and public administration | | 2 | Financials including government-backed financials | | 3 | Basic materials, energy, industrials, agriculture, manufacturing, mining and quarrying | | 4 | Consumer goods and services, transportation and storage, administrative and support service activities | | 5 | Technology, telecommunications | | 6 | Health care, utilities, professional and technical activities | | 7 | Other sector | | 8 | Qualified Indices |

|

| 11.64. | For counterparty credit spread delta risk, cross-bucket correlations γbc are set as follows:

|

| | | Table 6: Cross-bucket correlations for counterparty credit spread delta risk | | Bucket | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | 1 | 100% | 10% | 20% | 25% | 20% | 15% | 0% | 45% | | 2 | | 100% | 5% | 15% | 20% | 5% | 0% | 45% | | 3 | | | 100% | 20% | 25% | 5% | 0% | 45% | | 4 | | | | 100% | 25% | 5% | 0% | 45% | | 5 | | | | | 100% | 5% | 0% | 45% | | 6 | | | | | | 100% | 0% | 45% | | 7 | | | | | | | 100% | 0% | | 8 | | | | | | | | 100% |

|

| 11.65. | The counterparty credit spread delta risk factors for a given bucket:

|

| | (1) | The counterparty credit spread delta risk factors are absolute shifts of credit spreads of individual entities (counterparties and reference names for counterparty credit spread hedges) and qualified indices (if the optional treatment is chosen) for the following tenors: 0.5 years, 1 year, 3 years, 5 years and 10 years.

|

| | (2) | For each entity and each tenor point, the sensitivities are measured by shifting the relevant credit spread by 1 basis point (0.0001 in absolute terms) and dividing the resulting change in the aggregate CVA (or the value of CVA hedges) by 0.0001.

|

| | (3) | The risk weights RWk are set as follows the depending on the entity's bucket, where IG, HY, and NR represent “investment grade”, “high yield” and “not rated” as specified for the BA-CVA in 11.16 of this framework. The same risk weight for a given bucket and given credit quality applies to all tenors.

|

| | | | Table 7: Risk weights for counterparty credit spread delta risk | | Bucket | 1 a) | 1 b) | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | IG names | 0.5% | 1.0% | 5.0% | 3.0% | 3.0% | 2.0% | 1.5% | 5.0% | 1.5% | | HY and NR names | 2.0% | 4.0% | 12.0% | 7.0% | 8.5% | 5.5% | 5.0% | 12.0% | 5.0% |

|

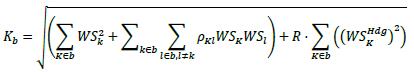

| | (4) | For buckets 1 to 7, the correlation parameter ρkl between two weighted sensitivities WSk and WSi is calculated as follows, where:

|

| | | a) | ρtenor is equal to 100% if the two tenors are the same and 90% otherwise;

|

| | | b) | ρname is equal to 100% if the two names are the same, 90% if the two names are distinct, but legally related and 50% otherwise;

|

| | | c) | ρquality is equal to 100% if the credit quality of the two names is the same (i.e. IG and IG or HY/NR and HY/NR) and 80% otherwise.

|

ρkl = ρtenor ∙ ρname ∙ ρquality

|

| | (5) | For bucket 8, the correlation parameter ρkl between two weighted sensitivities WSk and WSi is calculated as follows, where

|

| | | a) | ρtenor is equal to 100% if the two tenors are the same and 90% otherwise;

|

| | | b) | ρname is equal to 100% if the two indices are the same and of the same series, 90% if the two indices are the same, but of distinct series, and 80% otherwise;

|

| | | c) | ρquality is equal to 100% if the credit quality of the two indices is the same (ie IG and IG or HY and HY) and 80% otherwise.

|

ρkl = ρtenor ∙ ρname ∙ ρquality

|

| | Reference credit spread buckets, risk factors, sensitivities, risk weights and correlations

|

| 11.66. | Reference credit spread risk is subject to both delta and vega risk capital requirements. Buckets for delta and vega risks are set as follows, where IG, HY and NR represent “investment grade”, “high yield” and “not rated” as specified for the BA-CVA in 11.16 of this framework:

|

| | | Table 8: Buckets for reference credit spread risk | | Bucket number | Credit quality | Sector | | 1 | IG | Sovereigns including central banks, multilateral development banks | | 2 | Local government, government-backed non-financials, education and public administration | | 3 | Financials including government-backed financials | | 4 | Basic materials, energy, industrials, agriculture, manufacturing, mining and quarrying | | 5 | Consumer goods and services, transportation and storage, administrative and support service activities | | 6 | Technology, telecommunications | | 7 | Health care, utilities, professional and technical activities | | 8 | (HY) and NR | Sovereigns including central banks, multilateral development banks | | 9 | Local government, government-backed non-financials, education and public administration | | 10 | Financials including government-backed financials | | 11 | Basic materials, energy, industrials, agriculture, manufacturing, mining and quarrying | | 12 | Consumer goods and services, transportation and storage, administrative and support service activities | | 13 | Technology, telecommunications | | 14 | Health care, utilities, professional and technical activities | | 15 | (Not applicable) | Other sector | | 16 | IG | Qualified Indices | | 17 | HY | Qualified Indices |

|

| 11.67. | For reference credit spread delta and Vega risks, cross-bucket correlations γbc are set as follows:

|

| | (1) | The cross-bucket correlations γbc between buckets of the same credit quality (ie either IG or HY/NR) are set as follows:

|

| | | | Table 9: Cross-bucket correlations for reference credit spread risk | | Bucket | 1/8 | 2/9 | 3/10 | 4/11 | 5/12 | 6/13 | 7/14 | 15 | 16 | 17 | | 1/8 | 100% | 75% | 10% | 20% | 25% | 20% | 15% | 0% | 45% | 45% | | 2/9 | | 100% | 5% | 15% | 20% | 15% | 10% | 0% | 45% | 45% | | 3/10 | | | 100% | 5% | 15% | 20% | 5% | 0% | 45% | 45% | | 4/11 | | | | 100% | 20% | 25% | 5% | 0% | 45% | 45% | | 5/12 | | | | | 100% | 25% | 5% | 0% | 45% | 45% | | 6/13 | | | | | | 100% | 5% | 0% | 45% | 45% | | 7/14 | | | | | | | 100% | 0% | 45% | 45% | | 15 | | | | | | | | 100% | 0% | 0% | | 16 | | | | | | | | | 100% | 75% | | 17 | | | | | | | | | | 100% |

|

| | (2) | For cross-bucket correlations γbc between buckets 1 to 14 of different credit quality (i.e. IG and HY/NR), the correlations γbc specified in 11.67 of this framework (1) are divided by 2.

|

| 11.68. | Reference credit spread delta risk factors for a given bucket:

|

| | (1) | The single reference credit spread delta risk factor is a simultaneous absolute shift of the credit spreads of all tenors for all reference names in the bucket.

|

| | (2) | The sensitivity to reference credit spread delta risk is measured by simultaneously shifting the credit spreads of all tenors for all reference names in the bucket by 1 basis point (0.0001 in absolute terms) and dividing the resulting change in the aggregate CVA (or the value of CVA hedges) by 0.0001.

|

| | (3) | The risk weights RWk are set as follows depending on the reference name's bucket:

|

| | | | Table 10: Risk weights for reference credit spread delta risk | | IG bucket | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | Risk weigh | 0.5% | 1.0% | 5.0% | 3.0% | 3.0% | 2.0% | 1.5% | 2.0% | 4.0% | | HY/NR bucket | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | | | Risk weight | 12.0% | 7.0% | 8.5% | 5.5% | 5.0% | 12.0% | 1.5% | 5.0% |

|

| 11.69. | Reference credit spread vega risk factors for a given bucket:

|

| | (1) | The single reference credit spread Vega risk factor is a simultaneous relative shift of the volatilities of credit spreads of all tenors for all reference names in the bucket.

|

| | (2) | The sensitivity to the reference credit spread vega risk factor is measured by simultaneously shifting the volatilities of credit spreads of all tenors for all reference names in the bucket by 1% relative to their current values and dividing the resulting change in the aggregate CVA (or the value of CVA hedges) by 0.01.

|

| | (3) | Risk weights for reference credit spread volatilities ??? are set to 100%.

|

| | Equity buckets, risk factors, sensitivities, risk weights and correlations

|

| 11.70. | For equity delta and vega risks, buckets are set as follow, where:

|

| | (1) | Market capitalization (“market cap”) is defined as the sum of the market capitalizations of the same legal entity or group of legal entities across all stock markets globally. The reference to “group of legal entities” covers cases where the listed entity is a parent company of a group of legal entities. Under no circumstances should the sum of the market capitalizations of multiple related listed entities be used to determine whether a listed entity is “large market cap” or “small market cap”.

|

| | (2) | “Large market cap” is defined as a market capitalization equal to or greater than USD 2 billion and “small market cap” is defined as a market capitalization of less than USD 2 billion.

|

| | (3) | The advanced economies are Canada, the United States, Mexico, the euro area, the non-euro area western European countries (the United Kingdom, Norway, Sweden, Denmark and Switzerland), Japan, Oceania (Australia and New Zealand), Singapore and Hong Kong SAR.

|

| | (4) | To assign a risk exposure to a sector, banks must rely on a classification that is commonly used in the market for grouping issuers by industry sector. The bank must assign each issuer to one of the sector buckets in the table above and it must assign all issuers from the same industry to the same sector. Risk positions from any issuer that a bank cannot assign to a sector in this fashion must be assigned to the “other sector” (i.e. bucket 11). For multinational multi-sector equity issuers, the allocation to a particular bucket must be done according to the most material region and sector in which the issuer operates.

|

| | | Table 11: Buckets for equity risk | | Bucket number | Size | Region | Sector | | 1 | Large | Emerging market economies | Consumer goods and services, transportation and storage, administrative and support service activities, healthcare, utilities | | 2 | Telecommunications, industrials | | 3 | Basic materials, energy, agriculture, manufacturing, mining and quarrying | | 4 | Financials including government-backed financials, real estate activities, technology | | 5 | Advanced economies | Consumer goods and services, transportation and storage, administrative and support service activities, healthcare, utilities | | 6 | Telecommunications, industrials | | 7 | Basic materials, energy, agriculture, manufacturing, mining and quarrying | | 8 | Financials including government-backed financials, real estate activities, technology | | 9 | Small | Emerging market economies | All sectors described under bucket numbers 1, 2, 3, and 4 | | 10 | Advanced economies | All sectors described under bucket numbers 5, 6, 7, and 8 | | 11 | (Not applicable) | Other sector | | 12 | Large cap, advanced economies | Qualified Indices | | 13 | Other | Qualified Indices |

|

| 11.71. | For equity delta and vega risks, cross-bucket correlation γbc is set at 15% for all cross-bucket pairs that fall within bucket numbers 1 to 10. The cross-bucket correlation between buckets 12 and 13 is set at 75% and the cross bucket correlation between buckets 12 or 13 and any of the buckets 1-10 is 45%. γbc is set at 0% for all cross-bucket pairs that include bucket 11.

|

| 11.72. | Equity delta risk factors for a given bucket:

|

| | (1) | The single equity delta risk factor is a simultaneous relative shift of equity spot prices for all reference names in the bucket.

|

| | (2) | The sensitivity to the equity delta risk factors is measured by simultaneously shifting the equity spot prices for all reference names in the bucket by 1% relative to their current values and dividing the resulting change in the aggregate CVA (or the value of CVA hedges) by 0.01.

|

| | (3) | Risk weights RWk are set as follows depending on the reference name's bucket:

|

| | | | Table 12: Risk weights for equity delta risk | | Bucket number | Risk weight | | 1 | 55% | | 2 | 60% | | 3 | 45% | | 4 | 55% | | 5 | 30% | | 6 | 35% | | 7 | 40% | | 8 | 50% | | 9 | 70% | | 10 | 50% | | 11 | 70% | | 12 | 15% | | 13 | 25% |

|

| 11.73. | Equity Vega risk factors for a given bucket:

|

| | (1) | The single equity vega risk factor is a simultaneous relative shift of the volatilities for all reference names in the bucket.

|

| | (2) | The sensitivity to equity vega risk factors are measured by simultaneously shifting the volatilities for all reference names in the bucket by 1% relative to their current values and dividing the resulting change in the aggregate CVA (or the value of CVA hedges) by 0.01.

|

| | (3) | The risk weights for equity volatilities RWk are set to 78% for large market capitalization buckets and to 100% for other buckets.

|

| | Commodity buckets, risk factors, sensitivities, risk weights and correlations

|

| 11.74. | For commodity delta and vega risks, buckets are set as follows:

|

| | | Table 13: Buckets for commodity risk | | Bucket number | Commodity group | Examples | | 1 | Energy – Solid combustibles | coal, charcoal, wood pellets, nuclear fuel (such as uranium) | | 2 | Energy – Liquid combustibles | crude oil (such as Light-sweet, heavy, WTI and Brent); biofuels (such as bioethanol and biodiesel); petrochemicals (such as propane, ethane, gasoline, methanol and butane); refined fuels (such as jet fuel, kerosene, gasoil, fuel oil, naptha, heating oil and diesel) | | 3 | Energy – Electricity and carbon trading | electricity (such as spot, day-ahead, peak and off-peak); carbon emissions trading (such as certified emissions reductions, in delivery month EUA, RGGI CO2 allowance and renewable energy certificates) | | 4 | Freight | dry-bulk route (such as capesize, panamex, handysize and supramax); liquid-bulk/gas shipping route (such as suezmax, aframax and very large crude carriers) | | 5 | Metals – nonprecious | base metal (such as aluminum, copper, lead, nickel, tin and zinc); steel raw materials (such as steel billet, steel wire, steel coil, steel scrap and steel rebar, iron ore, tungsten, vanadium, titanium and tantalum); minor metals (such as cobalt, manganese, molybdenum) | | 6 | Gaseous combustibles | natural gas; liquefied natural gas | | 7 | Precious metals (including gold) | gold; silver; platinum; palladium | | 8 | Grains & oilseed | corn; wheat; soybean (such as soybean seed, soybean oil and soybean meal); oats; palm oil; canola; barley; rapeseed (such as rapeseed seed, rapeseed oil, and rapeseed meal); red bean, sorghum; coconut oil; olive oil; peanut oil; sunflower oil; rice | | 9 | Livestock & dairy | cattle (such live and feeder); poultry; lamb; fish; shrimp; dairy (such as milk, whey, eggs, butter and cheese) | | 10 | Softs and other agriculturals | cocoa; coffee (such as arabica and robusta); tea; citrus and orange juice; potatoes; sugar; cotton; wool; lumber and pulp; rubber | | 11 | Other commodity | industrial minerals (such as potash, fertilizer and phosphate rocks), rare earths; terephthalic acid; flat glass |

|

| 11.75. | For commodity delta and vega risks, cross-bucket correlation γbc is set at 20% for all cross-bucket pairs that fall within bucket numbers 1 to 10. γbc is set at 0% for all cross-bucket pairs that include bucket 11.

|

| 11.76. | Commodity delta risk factors for a given bucket:

|

| | (1) | The single commodity delta risk factor is a simultaneous relative shift of commodity spot prices for all commodities in the bucket.

|

| | (2) | The sensitivities to commodity delta risk factors are measured by shifting the spot prices of all commodities in the bucket by 1% relative to their current values and dividing the resulting change in the aggregate CVA (or the value of CVA hedges) by 0.01.

|

| | (3) | The risk weights RWk are set as follows depending on the reference name's bucket:

|

| | | | Table 14: Risk weights for commodity delta risk | | Bucket | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | RW | 30% | 35% | 60% | 80% | 40% | 45% | 20% | 35% | 25% | 35% | 50% |

|

| 11.77. | Commodity vega risk factors for a given bucket:

|

| | (1) | The single commodity vega risk factor is a simultaneous relative shift of the volatilities for all commodities in the bucket.

|

| | (2) | The sensitivity to commodity vega risk factors is measured by simultaneously shifting the volatilities for all commodities in the bucket by 1% relative to their current values and dividing the resulting change in the aggregate CVA (or the value of CVA hedges) by 0.01.

|

| | (3) | Risk weights for commodity volatilities RWk are set to 100%.

|