| | Full version of the BA-CVA (hedges are recognized)

|

| 11.17. | As set out in 11.13(1) the full version of the BA-CVA recognizes the effect of counterparty credit spread hedges. Only transactions used for the purpose of mitigating the counterparty credit spread component of CVA risk, and managed as such, can be eligible hedges.

|

| 11.18. | Only single-name credit default swaps (CDS), single-name contingent CDS and index CDS can be eligible CVA hedges.

|

| 11.19. | Eligible single-name credit instruments must:

|

| | (1) | reference the counterparty directly; or

|

| | (2) | reference an entity legally related to the counterparty; where legally related refers to cases where the reference name and the counterparty are either a parent and its subsidiary or two subsidiaries of a common parent; or

|

| | (3) | reference an entity that belongs to the same sector and region as the counterparty.

|

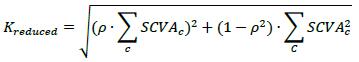

| 11.20. | Banks that intend to use the full version of BA-CVA must calculate the reduced version (Kreduced) as well. Under the full version, capital requirement for CVA risk DSBA-CVA × Kfull is calculated as follows, where DSBA-CVA = 0.65, and β= 0.25 is the SAMA supervisory parameter that is used to provide a floor that limits the extent to which hedging can reduce the capital requirements for CVA risk:

|

Kfull = β ∙ Kreduced + (1 - β) ∙ Khedged

|

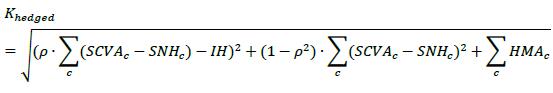

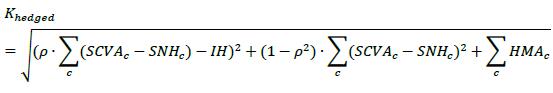

| 11.21. | The part of capital requirements that recognizes eligible hedges (Khedged) is calculated formulas follows (where the summations are taken over all counterparties c that are within scope of the CVA charge), where:

|

| | (1) | Both the stand-alone CVA capital (SCVAc) and the correlation parameter (ρ) are defined in exactly the same way as for the reduced form calculation BA-CVA.

|

| | (2) | SNHc is a quantity that gives recognition to the reduction in CVA risk of the counterparty c arising from the bank's use of single-name hedges of credit spread risk. See 11.23 for its calculation.

|

| | (3) | IH is a quantity that gives recognition to the reduction in CVA risk across all counterparties arising from the bank's use of index hedges. See 11.24 for its calculation.

|

| | (4) | HMAc is a quantity characterizing hedging misalignment, which is designed to limit the extent to which indirect hedges can reduce capital requirements given that they will not fully offset movements in a counterparty's credit spread. That is, with indirect hedges present Khedged cannot reach zero. See 11.25 for its calculation.

|

| | |  |

| 11.22. | The formula for Khedged in 11.21 comprises three main terms as below:

|

| | (1) | The first term (ρ • ∑c(SCVAc - SNHc) - IH)2 aggregates the systematic components of CVA risk arising from the bank's counterparties, the single name hedges and the index hedges.

|

| | (2) | The second term (1- ρ2) • ∑c(SCVAc - SNHc)2 aggregates the idiosyncratic components of CVA risk arising from the bank's counterparties and the single-name hedges.

|

| | (3) | The third term ∑cHMAc aggregates the components of indirect hedges that are not aligned with counterparties' credit spreads.

|

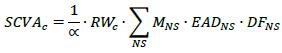

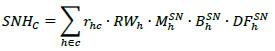

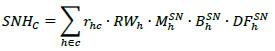

| 11.23. | The quantity SNHc is calculated as follows (where the summation is across all single name hedges h that the bank has taken out to hedge the CVA risk of counterparty c), where:

|

| | (1) | rhc is the supervisory prescribed correlation between the credit spread of counterparty c and the credit spread of a single-name hedge h of counterparty c. The value of rhc is set out the table 2 of 11.26. It is set at 100% if the hedge directly reference the counterparty c, and set at lower values if it does not.

|

| | (2) | MhSN is the remaining maturity of single-name hedge h.

|

| | (3) | BhSN is the notional of single-name hedge h. For single-name contingent credit default swaps (CDS), the notional is determined by the current market value of the reference portfolio or instrument.

|

| | (4) | DFhSN is the supervisory discount factor calculated as  . .

|

| | (5) | RWh is the supervisory risk weight of single-name hedge h that reflects the volatility of the credit spread of the reference name of the hedging instrument. These risk weights are based on a combination of sector and credit quality of the reference name of the hedging instrument as prescribed in Table 1 of 11.16.

|

| | |  |

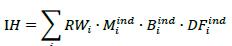

| 11.24. | The quantity IH is calculated as follows (where the summation is across all index hedges i that the bank has taken out to hedge CVA risk), where:

|

| | (1) | Miind is the remaining maturity of index hedge i.

|

| | (2) | Biind is the notional of the index hedge i.

|

| | (3) | DFiind is the supervisory discount factor calculated as

|

| | (4) | RWi is the supervisory risk weight of the index hedge i. RWi is taken from the Table 1 of 11.16 based on the sector and credit quality of the index constituents and adjusted as follows:

|

| | | (a) | For an index where all index constituents belong to the same sector and are of the same credit quality, the relevant value in the Table 1 of 11.16 is multiplied by 0.7 to account for diversification of idiosyncratic risk within the index.

|

| | | (b) | For an index spanning multiple sectors or with a mixture of investment grade constituents and other constituents, the name-weighted average of the risk weights from the Table 1 of 11.16 should be calculated and then multiplied by 0.7.

|

| | | |  |

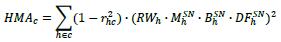

| 11.25. | The quantity HMAc is calculated as follows(where the summation is across all single name hedges h that have been taken out to hedge the CVA risk of counterparty c), where rhc, MhSN, BhSN, DFhSN and RWh have the same definitions as set out in 11.23.

|

| |  |

| 11.26. | The supervisory prescribed correlations rhc between the credit spread of counterparty c and the credit spread of its single-name hedge h are set in Table 2 as follows:

|

| | | Table 2: Correlations between credit spread of counterparty and single-name hedge | | Single-name hedge h of counterparty c | Value of rhc | | references counterparty c directly | 100% | | has legal relation with counterparty c | 80% | | shares sector and region with counterparty c | 50% |

|