Book traversal links for Maturity

Maturity

| No: 44047144 | Date(g): 27/12/2022 | Date(h): 4/6/1444 | Status: In-Force |

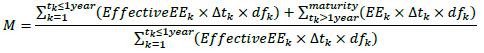

| 7.20. | If the original maturity of the longest-dated contract contained in the set is greater than one year, the formula for effective maturity (M) in 12.42 of the Minimum Capital Requirements for Credit Risk is replaced with formula that follows, where dfK is the risk-free discount factor for future time period tK and the remaining symbols are defined above. Similar to the treatment under corporate exposures, M has a cap of five years.26 | ||

| |||

| 7.21. | For netting sets in which all contracts have an original maturity of less than one year, the formula for effective maturity (M) i in 12.42 of the Minimum Capital Requirements for Credit Risk is unchanged and a floor of one year applies, with the exception of short-term exposures as described in paragraphs in 12.45 to 12.48 of the Minimum Capital Requirements for Credit Risk. | ||

26 Conceptually, M equals the effective credit duration of the counterparty exposure. A bank that uses an internal model to calculate a one-sided credit valuation adjustment (CVA) can use the effective credit duration estimated by such a model in place of the above formula with prior approval of SAMA.