Credit Risk Management

Prudential Treatment of Problem Assets

The global financial crisis highlighted the difficulties in identifying and comparing banking data, particularly regarding the quality and types of bank assets and how they are monitored in supervisory reports and disclosures. The Basel Committee on Banking Supervision recognized significant differences in practices among countries.

Therefore, the Committee issued guidelines for managing non-performing assets, particularly non-performing loans and loans subject to forbearance, concerning the scope of evaluation standards and the level of application by banks within the current accounting and regulatory framework. These guidelines will be applied to several topics, including:

- Monitoring and supervision of asset quality to ensure more consistent comparability across countries.

- Internal Rating-Based (IRB) credit classification systems for banks for credit risk management purposes.

- Pillar 3 disclosure regarding asset quality.

- Published data related to asset quality indicators.

Based on the above, SAMA emphasizes the importance of banks adhering to the guidelines for managing non-performing assets issued by the Basel Committee on Banking Supervision.

Rules on Management of Problem Loans

No: 41033343 Date(g): 6/1/2020 | Date(h): 11/5/1441 Status: In-Force In line with SAMA responsibilities to maintain financial stability and contribute to economic development in the Kingdom, and its commitment to fairness in banking transactions,

We would like to inform you that Rules and Guidelines have been issued for the management of Problem Loans granted to Juristic Persons. These Rules and Guidelines aim to support banks in monitoring loans showing signs of distress, organizing procedures for restructuring such loans, and enhancing fair treatment of customers by providing appropriate solutions. Please find attached the following:

- Rules on Management of Problem Loans, which SAMA emphasizes must be adhered to by all banks.

- Guidelines on Management of Problem Loans, to provide guidance on best practices to help banks comply with the aforementioned Rules.

For your information and action accordingly as of 01/07/2020G.

- Rules on Management of Problem Loans, which SAMA emphasizes must be adhered to by all banks.

1. General Requirements

1.1 Introduction

In exercise of the powers vested upon Saudi central Bank* (SAMA) under the charter issued by the Royal Decree no. 23 on 23-05-1377AH (15 December 1957G) and the Banking Control Law promulgated by Royal Decree no. M/5 dated 22/2/1386AH. SAMA is hereby issuing the enclosed Rules on the Management of Problem Loans aimed to develop the practices followed by banks while dealing with loans showing signs of stress along with the loans already specified as non-performing.

These rules should be read in conjunction with SAMA rules on Credit Risk Classification and Provisioning.

Also, SAMA issued the Guidelines on Management of Problem Loans as good practices to support banks in implementing these Rules.

* The "Saudi Arabian Monetary Agency" was replaced By the "Saudi Central Bank" in accordance with The Saudi Central Bank Law No. (M/36), dated 11/04/1442H, corresponding to 26/11/2020G.

1.2 Objective of the Rules

The objectives of these rules are as follows:

i. To ensure banks put in place a conceptual framework which would facilitate rehabilitation of viable borrower, thereby supporting economic activity.

ii. To ensure banks look into aspects of customer conduct and fair treatment whilst dealing with problem loans, especially in instances involving the MSMEs.

iii. To ensure banks have adequate controls over non-performing and problem loan management and restructuring processes, including documented policies and procedures.

1.3 Scope of Implementation

These rules are applicable for all banks licensed under Banking Control Law.

1.4 Definitions

The following terms and phrases, where used in these Rules, should have the corresponding meanings, unless the context requires otherwise:

Problem loans:

Loans that display well-defined weaknesses or signs of potential problems. Problem loans should be classified by the banks in accordance with accounting standards, and consistent with relevant regulations, as one or more of:

a) non-performing;

b) subject to restructuring on account of inability to service contractual payments;

c) IFRS 9 Stages 2; and exhibiting signs of significant credit deterioration or Stage 3;

d) under watch-list, early warning or enhanced monitoring measures; or

e) where concerns exist over the future stability of the borrower or on its ability to meet its financial obligations as they fall due.

Non-performing loans:

As stipulated in BCBS 403 “Guidelines –Prudential treatment of problem assets – definitions of non-performing exposures and forbearance” endorsed by SAMA through circular no. 381000099757 dated 23/09/1438AH.

Watch-list:

Loans that have displayed characteristics of a recent increase in credit risk, and are subject to enhanced monitoring and review by the bank.

Early Warning Signals:

Quantitative or qualitative indicators, based on liquidity, profitability, market, collateral and macroeconomic metrics.

Cooperating borrower:

A borrower which is actively working with a bank to resolve their problem loan.

Viable borrower:

Is that, wherein the loss of any concessions as a result of restructuring, is considered to be lower than the loss borne due to foreclosure.

Viability Assessment:

An assessment of borrower’s ability to generate adequate cash flow in order to service outstanding loans.

Covenant:

A Borrower’s commitment that certain activities will or will not be carried out.

Key performance indicators:

Indicators through which bank management or supervisor can assess the institution’s performance.

Collateral:

Are those, whose value can be considered whilst computing the recoverable amount for workout cases or foreclosed cases, on account of meeting the stipulated conditions laid out in these rules, as would be applicable based on the nature of the collateral.

Failed restructuring:

Any restructuring case where the borrower failed to repay the revised contractual cash flows as agreed upon with the bank and has transitioned into default.

Further to the above, Banks should adopt all requirements relating to i) Restructuring, ii) Identification of forbearance; iii) Identification of financial difficulty; iv) Identification of concession; and v) Stage allocation for forborne loans, as stipulated under SAMA Rules on Credit Risk Classification and Provisioning.

2. Problem Loan Prevention and Identification

2.1 Early Warning Signals

Banks should develop a clear, robust and demonstrable set of policies, procedures, tools, and governance around the establishment of Early Warning Signals (EWS) which are fully integrated into the bank’s risk management system.

The established EWS should be comprehensive and relevant to the specific portfolios of the Banks, and should enable Banks to proactively identify potential difficulties, investigate the drivers of the borrowers stress, and act before the borrower’s financial condition deteriorates to the point of default.

Banks should organize their EWS process in the following three stages:

i. Identification of EWS:

Banks’ EWS should, at a minimum, take into account indicators that point to potential payment difficulties. Individual banks should undertake an internal assessment as to which EWS are suitable for each of their lending portfolios taking into account a combination of the following:

a. Economic environment: Banks should monitor indicators of the overall economic environment, which are relevant for determining the future direction of loan quality, and not only the individual borrower’s ability to pay their obligations but also collateral valuations.

Examples of economic indicators, based on the nature of the respective portfolios, can include GDP growth, Inflation/deflation, and unemployment, as well as indicators that may be specific to certain sectors/portfolios, e.g. commodity or real estate.

b. Financial indicators: Banks should establish a process in order to get frequent interim financial reports (or cash-flow/ turnover details for MSME) from their borrowers (e.g., quarterly for material loans to listed entities and semi-annual for all others), to ensure that EWS are generated in a timely manner.

Examples of financial indicators, based on the nature of the respective portfolios, can include Debt/EBITDA, Capital adequacy, Interest coverage - EBITDA/ interest and principal expenses, Cash flow, Turnover (applicable for MSME).

c. Behavioral indicators: Banks should institute behavioral warning signals to assess the integrity and competency of key stakeholders of the borrower. These indicators will help in the assessment of how a borrower behaves in different situations.

Examples of these indicators are: regular and consistent attempts at delaying financial reporting requirements; reluctance or unwillingness to respond to various communications, any attempt at deception or misrepresentation of facts, excessive delays in responding to a request for no valid reason.

d. Third-party indicators: Banks should organize a reliable screening process for information provided by third parties (e.g. rating agencies, General Authority of Zakat and Tax, press, and courts) to identify signs that could lead to a borrower’s inability to service its outstanding liabilities.

Example of these indicators are: Default at other financial institutions / any negative information, insolvency proceedings for major supplier or customer, downgrade in external rating assigned and trends with respect to external ratings.

e. Operational indicators: Banks should establish a process where any changes in the borrower’s operations are flagged as soon as they occur.

Examples of these indicators, based on the nature of the portfolio can include, frequent changes of suppliers, frequent changes of senior management, qualified audit reports, change of the ownership, major organizational change, management and shareholder contentiousness.

Banks should establish a comprehensive set of EWS that provide banks with an opportunity to act before the borrower’s financial condition deteriorates to the point of default, and enable them to proactively identify and flag other loans that have similar characteristics, i.e. multiple loan facilities extended to the same borrower, or borrowers in same sector that may be affected by the overall economic environment, or loans with similar type of collateral.

ii. Corrective action:

Banks should have a proper written procedures to be followed in case any of the established EWS is triggered. The response procedure should clearly identify the roles and responsibilities of all the sections responsible for taking action on the triggered EWS, specific timelines for actions along with, identification of the cause and severity of the EWS.

iii. Monitoring:

Banks should have a robust monitoring mechanism for following up on the triggered EWS, in order to ensure that the corrective action plan has been executed to pre-empt potential payment difficulties of the borrowers. The level and timing of the monitoring process should reflect the risk level of the borrower.

3. Non-performing loans (NPL) Strategy

3.1 Developing the NPL Strategy

i. Banks should develop and implement an NPL strategy that is approved by the Board of Directors or its delegated authority.

ii. The NPL strategy should layout in a clear, concise manner the bank’s approach and objectives, and establish annual quantitative targets over a realistic but sufficiently ambitious timeframe, divided into short, medium and long-term horizons. It should serve as a roadmap for guiding the allocation of internal resources (human capital, information systems, and funding) and the design of proper controls (policies and procedures) to monitor interim performance and take corrective actions to ensure that the overall goals are met.

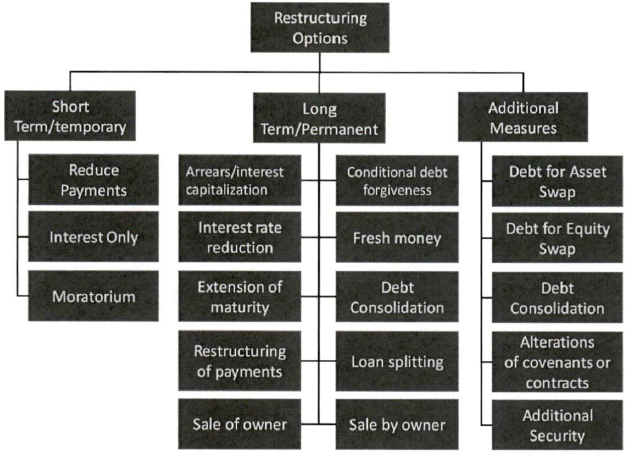

iii. The NPL strategy should consider all available options to deal with problem loans, where banks review the feasibility of such options and their respective financial impact. These include hold/restructuring strategies, active portfolio reductions through either sales and/or writing off provisioned NPLs that are deemed unrecoverable, taking collateral onto the balance sheet, legal options and out-of-court options.

iv. Banks should follow the principle of proportionality and materiality, while designing the NPL strategy, where adequate resources should be exhausted on specific segments of NPLs during the resolution process, including MSME’s.

3.2 Implementing the NPL Strategy

i. Banks should ensure that the components of the NPL strategy are communicated to relevant stakeholders across the bank, and proper monitoring protocols are established, together with performance indicators.

ii. The NPL strategy should be backed by an operational plan detailing how the NPL strategy will be implemented. This should include clearly defining and documenting the roles, responsibilities, formal reporting lines and individual (or team) goals and incentives geared towards reaching the targets in the NPL strategy.

iii. Banks should put in place mechanisms for a regular review of the strategy and monitoring of its operational plan effectiveness and its integration into the bank’s risk management framework.

4. Structuring the Workout Unit

i. Banks should establish a dedicated Workout Department/Section/or Unit to manage all workout related cases in order to effectively manage NPL resolution process. The Workout Department/Section/or Unit should be independent of the Business/Loan Originating Units to avoid any potential conflicts of interest.

ii. Banks should ensure that. Workout Unit is properly staffed with resources having the required skill sets to manage workout situations, strong analytical, legal, financial analysis skills, and proper understanding of the workout process.

4.1 Performance Management

i. Banks should establish proper and well-defined performance matrices for Workout Unit staff that should not be based solely on the reduction in the volume of nonperforming loans; An appraisal system and compensation structures tailored for the NPL Workout Unit should be implemented and in alignment with the overall NPL strategy, operational plan and the bank’s code of conduct.

ii. In addition to quantitative elements linked to the bank’s NPL targets and milestones (with a strong focus on the effectiveness of workout activities), the appraisal system should include qualitative measurements such as; level of negotiations competency, technical abilities relating to the analysis of the financial information and data received, structuring of proposals, quality of recommendations, and monitoring of restructured cases.

iii. The importance of the respective weight given to indicators within the overall performance measurement framework should be proportionate to the severity of the NPL issues faced by the bank.

5. Approaching Restructuring Cases

5.1 Viability of Restructuring

Banks should implement a well-defined restructuring policy aligned with the concept of viability that recognizes in a timely manner those borrowers who are non-viable. The policy should ensure that only viable restructuring solutions are considered, which should contribute to reducing the borrower’s balance of credit facilities.

Long-term restructuring measures should only be considered viable where the following conditions are met:

i. The bank can demonstrate, based on reasonable documented financial information, that the borrower can realistically afford the restructuring solution.

ii. Outstanding arrears are addressed as part of the restructured terms. That does not necessarily mean full repayment, and should not conflict with the potential reduction in the borrower’s balance in the medium to long-term that could be required to align with the borrower’s loan service capacity.

iii. In cases, where there have been previous restructuring solutions granted in respect of a loan, the bank should ensure that additional internal controls and early warning signals are implemented, so that the subsequent restructuring treatment meets the viability criteria. These controls should include, at a minimum, approval of a designated Senior Management Committee.

Short-term restructuring measures should only be considered viable where the following conditions are met:

i. The bank can demonstrate, based on reasonable documented financial information, that the borrower can realistically afford the restructuring solution.

ii. Short-term measures are to be applied temporarily where the bank has satisfied itself and is able to attest, based on reasonable financial information, that the borrower demonstrates the ability to repay the original or agreed modified amount on a full principal and interest basis commencing from the end of the short-term temporary arrangement.

iii. The solution approved is not perceived to lead to multiple consecutive restructuring measures in the future.

The bank’s assessment of viability should be based on the financial characteristics of the borrower and the restructuring measure to be granted at that time.

Whilst evaluating borrower’s viability, due consideration need be made, that any increase in pricing (for instance, over and above driven by risk-based pricing principles) with respect to the borrower’s outstanding facilities, does not make the resultant installments, unserviceable.

Banks should undertake the viability assessment irrespective of the source of restructuring, for instance, borrowers using restructuring clauses embedded in a contract, bilateral negotiation of restructuring between a borrower and the banks, public restructuring scheme extended to all borrowers in a specific situation.

5.2 Code of Conduct

Banks should develop a written Code of Conduct for managing problem loans, the Code of Conduct should define a robust problem loan resolution process to ensure that viable borrowers are provided a chance for reaching a workout solution, rather than invoking outright enforcement actions.

The Code of Conduct should be based broadly on but not limited to following:

i. Communication with the borrower: Banks should establish a written procedure around initiating communication with the borrowers along with the content, format, and medium of communication that is aligned with relevant Laws and Regulations, in the event that a borrower fails to pay in part or in full the installments as per the agreed repayment schedule.

ii. Information-gathering: Banks should establish a written procedure with proper timelines to collect adequate, complete and accurate information on the borrower’s financial condition from all available sources, in addition to standardized submissions such as quarterly/year-end financial statements, business/ operating plans obtained/submitted by the borrowers.

iii. Financial assessment of the borrower: Banks should ensure that proper analysis is performed on the information gathered relating to the borrower, in order to assess the borrower’s current repayment capacity, the borrower’s credit record, and the borrower’s future repayment capacity over the proposed workout period. Banks should ensure that reasonable efforts are made to cooperate with the borrower throughout the assessment process with the objective of reaching a mutual agreement on an appropriate workout solution.

iv. Proposal of resolution/solutions: Based on the assessment performed for the borrowers, banks should provide borrowers who are classified as cooperating a proposal for one or more alternative restructuring solutions, or if none of such solutions is agreed upon, one or more resolution and closure solutions, without this being considered as a new service to the borrower.

In presenting the proposed solution or alternative solutions, banks should be open to comments and queries on the part of borrowers, providing them with standardized - to the extent possible - and comprehensive information to help them understand the proposed solution or, in the case where there is more than one proposed solution, the differences across the proposed alternatives.

v. An objection-handling process: Banks should establish a clear and objective process for handling objections raised by the borrowers, and the process should be communicated to the borrowers. The process should highlight the appropriate forums for appeals and the timeframe for their closure.

Banks should develop standardized forms to be used by borrowers in case they want to raise an appeal. The forms should specify the list of information and required documents necessary to review the appeal, along with timelines for the submission and review of appeals.

vi. Workout fee: Banks should establish clear policy and procedure relating to charging fee for workout solution reached with borrowers. Banks should ensure that the policy and practice provide for impact analysis of the fee on borrower cash-flows, i.e. that increased cost is not going to further deteriorate the financial condition of the borrower. The rationale for charged fees should be clearly documented and transparency must be ensured through proper and clear communication with the borrower on fees charged by the banks.

The Code of Conduct should be reflected in all pertinent internal documentation with reference to problem loan resolution and be effectively implemented.

6. Workout Plan

i. Banks should develop a workout plan agreed between the viable borrower and the bank in order to return the non-performing borrower to a fully performing status in the shortest feasible time-frame, matching the borrower’s sustainable repayment capacity with the correct restructuring option(s).

ii. The workout plan needs to be approved by a designated Management Committee based upon the bank’s delegation of authority matrix.

iii. Banks should establish and document a policy with clear and objective time-bound criteria for the mandatory transfer of loans from Loan Originating Units to the Workout Unit along with the specification of relevant approvals required for such transfers.

iv. The policy should include details on areas where proper collaboration is required between the Workout Unit and Loan Originating Units especially in scenarios where the borrowers are showing signs of stress but still being managed by the Loan Originating Units.

6.1 Negotiating and Documenting Workout Plan

Banks should develop a process for negotiating and documenting the workout plan with a viable borrower. The process should cover the following components:

i. Developing the negotiating strategy:

Banks should have a proper process to manage the negotiations with viable borrowers on the potential workout solutions, the process should cover the following:

a) Identify minimum information required to objectively assess the borrower’s capacity to repay the proposed restructured solution.

b) Assess the strengths and weaknesses of both the bank’s and the borrower’s positions and then develop a negotiating strategy to obtain objectives of a successful restructuring for a viable borrower.

c) Where deemed essential, encourage less sophisticated borrowers to seek the advice of counsel or financial advisor to ensure they fully understand the terms and conditions of the proposed restructured solution.

d) Develop covenants appropriate to the level of complexity and size of the transaction, and comprehensiveness of the information available.

ii. Communicating with the borrower during the workout process:

Communication with borrowers should be as per the procedures outlined in the bank’s code of conduct. This should include; timelines for responding to borrower’s requests/complaints, identify who within the bank is responsible/authorized to issue various types of communications to the borrowers, documenting process for all communications to/from the borrowers, signing/acknowledgement protocols with timelines, approval requirements for all workout proposals, templates to be used for communication with the borrowers.

iii. Resolution of disputes:

Banks should follow the objection handling process for managing disputes with the borrowers in cases where the bank and the borrower fail to reach an agreement. This should include providing the borrower with prompt and easy access to filing an appeal, along with all necessary information to review the appeal, and a timeline for its closure, it should also be ensured that the dispute is being reviewed independently of the individual or team against whom the appeal has been filled.

6.2 Monitoring the Workout Plan

i. Banks should develop proper policies and procedures for establishing a monitoring mechanism over restructured loans in order to ensure the borrowers continued ability to meet their obligations. Banks monitoring mechanism should analyze the cause of any failed restructuring, and the analysis should be used for improving the workout solutions provided to borrowers.

ii. Banks should define proper and adequate key performance indicators (including workout effectiveness) comparable with their portfolios and should be monitored on a periodic basis along-with regular detailed reporting to the executive management.

7. Collateral

Banks should ensure proper collateral management and apply the following requirements throughout the credit process irrespective of the performance on the loan.

7.1 Governance

i. Banks should develop policies and procedures in order to ensure proper management of collateral obtained to mitigate the risk of loss associated with the potential default of the borrowers. Collateral policies and procedures should be approved by the Board of Directors or its delegated authority and should be reviewed at least every three years or more frequently if the bank deems is necessary based on the changes in the relevant regulatory requirements or business practices. Collateral policies and procedures should be fully aligned with the bank’s risk appetite statement (RAS).

ii. Consistent with SAMA’s requirements on valuation of real-estate collateral, banks should institute an appropriate governance process with respect to valuers and their performance standards. Banks should monitor and review the valuations performed by internal or external valuers on a regular basis, as well as develop and implement a robust internal quality assurance of such valuations.

iii. The internal audit function of banks should regularly review the consistency and quality of the collateral policies and procedures, the independence of the valuers selection process and the appropriateness of the valuations carried out by valuers.

7.2 Types of Collateral and Guarantees

Banks should clearly document in collateral policies and procedures the types of collateral they accept and the process in respect of the appropriate amount of each type of collateral relative to the loan amount. Banks should classify the collaterals they accept as follows:

i. Financial collateral - cash (money in bank accounts), securities (both debt and equity) and credit claims (sums owed to banks).

ii. Immovable collateral - immovable object, an item of property that cannot be moved without destroying or altering it - a property that is fixed to the earth, such as land or a house.

iii. Receivables - also referred to as accounts receivable, are debts owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

iv. Other physical collateral - physical collateral other than immovable property.

v. Treating lease exposures as collateral - exposure arising from leasing transactions as collateralized by the type of property leased.

vi. Other funded credit Protection - cash on deposit with, or cash assimilated instruments held by, a third party bank should come under this category.

vii. Guarantee- is a promise from a bank, corporate, any other entity or individual, that the liabilities of a borrower will be met in the event of failure to fulfil contractual obligations.

7.3 General Requirements for Collateral

Banks should ensure that the following requirements are incorporated with respect to the management of collaterals accepted by them:

i. Banks should properly document the collateral arrangements and have in place clear and robust procedures that ensure that any legal conditions required for declaring the default of a borrower and timely collection/ liquidation of collateral are observed.

ii. Banks should fulfil any contractual and statutory requirements in respect of, and take all steps necessary to ensure, the enforceability of the collateral arrangements under the law applicable to their interest in the collateral. In connection therewith, banks should conduct sufficient legal review confirming the enforceability of the collateral arrangements in all areas of operations, for example, foreign branches and subsidiaries. They should re-conduct such review as necessary to ensure continuing enforceability.

iii. The collateral policies and procedures should ensure mitigation of risks arising from the use of collateral, including risks of failed or reduced credit protection, valuation risks, risks associated with the termination of the credit protection, concentration risk arising from the use of collateral and the interaction with the bank's overall risk profile.

iv. The financing agreements should include detailed descriptions of the collateral as well as detailed specifications of the manner and frequency of revaluation.

v. Banks should calculate the market and the forced sale values (incorporating haircuts) of the collateral at a minimum frequency to enable it to form an objective view of borrower or workout viability; such valuations should incorporate the cost and time to realise, maintain and sell the collateral in the event of foreclosure.

vi. Where the collateral is held by a third party, banks should take reasonable steps to ensure that the third party segregates the collateral from its own assets.

vii. While conducting valuation and revaluation, banks should take into account any deterioration or obsolescence of the collateral.

viii. Banks should have the right to physically inspect the collateral. They should also have in place policies and procedures addressing their exercise of the right to physical inspection.

ix. When applicable, the collateral taken as protection should be adequately insured against the risk of damage the risk of damage.

7.4 Specific Requirements for Each Type of Collateral and Guarantees

A) Financial collateral

Under all approaches and methods, financial collateral should qualify as eligible collateral where all the following requirements are met:

i. The credit quality of the borrower and the value of the collateral should not have a material positive correlation. Where the value of the collateral is reduced significantly, this should not alone imply a significant deterioration of the credit quality of the borrower. Where the credit quality of the borrower becomes critical, this should not alone imply a significant reduction in the value of the collateral.

Securities issued by the borrower, or any related group entity, should not qualify as eligible collateral. Notwithstanding the aforementioned, a borrower's own issues of covered bonds qualify as eligible collateral, when they are posted as collateral for a repurchase transaction, provided that they comply with the condition set out in this paragraph.

ii. Banks should ensure that sufficient resources are devoted to the orderly operation of margin agreements with OTC derivatives and securities-financing counterparties, as measured by the timeliness and accuracy of their outgoing margin calls and response time to incoming margin calls.

B) Immovable property

i. Banks should clearly document the types of residential and commercial immovable property they accept in their lending policies.

ii. Immovable collateral should be classified in the following categories based on the underlying nature and behaviour:

a) Investment properties;

b) Owner-occupied properties;

c) Development properties;

d) Properties normally valued on the basis of trading potential.

C) Receivables

Receivables should qualify as eligible collateral, where all the following requirements are met:

i. Banks should have in place a sound process for determining the credit risk associated with the receivables, such a process should include analyses of a borrower's business and industry and the types of customers with whom that borrower does business. Where the bank relies on its borrowers to ascertain the credit risk of the customers, the bank should review the borrowers' credit practices to ascertain their soundness and credibility;

ii. The difference between the amount of the loan and the value of the receivables should reflect all appropriate factors, including the cost of collection, concentration within the receivables pool pledged by an individual borrower, and potential concentration risk within the bank's total loans beyond that controlled by the bank's general methodology.

iii. Banks should maintain a continuous monitoring process appropriate to the receivables. They should also review, on a regular basis, compliance with loan covenants, environmental restrictions, and other legal requirements;

iv. Receivables pledged by a borrower should be diversified and not be unduly correlated with that borrower. Where there is a material positive correlation, banks should take into account the attendant risks in the setting of margins for the collateral pool as a whole;

v. Banks should not use receivables from subsidiaries and affiliates of a borrower, including employees, as eligible credit protection:

vi. Banks should have in place a documented process for collecting receivable payments in distressed situations. Banks should have in place the requisite facilities for collection even when they normally rely on their borrowers for collections.

D) Other physical collateral

Physical collateral other than immovable property should qualify as eligible collateral, when the conditions specified as general requirements for collateral are met.

E) Treating lease exposures as collateralized

Banks should treat exposures arising from leasing transactions as collateralized by the type of property leased, where all the following conditions are met:

i. The conditions set out for the type of asset/property leased to qualify as eligible collateral are met;

ii. The lessor has in place robust risk management with respect to the use to which the leased asset is put, its location, its age and the planned duration of its use, including appropriate monitoring of its value;

iii. Where this has not already been ascertained in calculating the Loss Given Default level, the difference between the value of the unamortized amount and the market value of the security is not so large as to overstate the credit risk mitigation attributed to the leased assets.

F) Other funded credit protection

Cash on deposit with, or cash assimilated instruments held by, a third-party institution should be eligible, where all the following conditions are met:

i. The borrower's claim against the third party institution is openly pledged or assigned to the lending bank and such pledge or assignment is legally effective and enforceable and is unconditional and irrevocable;

ii. The third party institution is notified of the pledge or assignment;

iii. As a result of the notification, the third party institution is able to make payments solely to the lending bank, or to other parties only with the lending bank's prior consent.

G) Guarantees

Credit protection deriving from a guarantee should qualify as eligible unfunded credit protection where all the following conditions are met:

i. The credit protection is direct and explicitly document the obligation assumed by the protection provider;

ii. The extent of the credit protection is clearly defined and incontrovertible;

iii. The credit protection contract does not contain any clause, the fulfillment of which is outside the direct control of the bank, that would:

a) allow the protection provider to cancel the protection unilaterally;

b) increase the effective cost of protection as a result of a deterioration in the credit quality of the protected loan;

c) prevent the protection provider from being obliged to pay out in a timely manner in the event that the original borrower fails to make any payments due, or when the leasing contract has expired for the purposes of recognizing the guaranteed residual value;

d) allow the maturity of the credit protection to be reduced by the protection provider.

iv. The credit protection contract is legally effective and enforceable, at the time of the conclusion of the credit agreement and thereafter i.e. over the life of the exposure;

v. The credit protection covers all types of payments the borrower is expected to make in respect of the claim. Where certain types of payment are excluded from the credit protection, the lending bank has to adjust, the value of credit protection to reflect the limited coverage;

vi. On the qualifying default of or non-payment by the borrower, the lending bank has the right to pursue, in a timely manner, the protection provider for any monies due under the claim in respect of which the protection is provided and the payment by the protection provider should not be subject to the lending bank first having to pursue the borrower. 7.5 Valuation Frequency

i. Banks should clearly document in collateral policies and procedures the frequency of collateral valuations. The policies and procedures should also provide for the following:

a) Banks monitor the value of each type of collateral on a defined frequent basis.

b) More frequent valuations where the market is subject to significant negative changes and/or where there are signs of a significant decline in the value of an individual collateral.

c) Defined criteria for determining that a significant decline in collateral value has taken place. These will include quantitative thresholds for each type of collateral established, based on the observed empirical data and qualitative bank experience, taking into consideration relevant factors such as market price trends or the opinion of independent valuers.

d) Revaluation of collateral for restructuring cases should be done only where necessary, and should be done in accordance with the requirements of these rules.

ii. Banks should have appropriate IT processes and systems in place to flag outdated valuations and to trigger valuation reports.

7.6 Specific Requirements for Valuers

Banks valuation process should be carried out by valuers who possess the necessary qualifications, ability and experience to execute a valuation and who are independent of the credit decision process.

Banks should ensure compliance with SAMA circular no. 371000061185 dated 28/05/1437AH on "Obligations of Real Estate Appraisal Clients Subject to SAMA Supervision" and the revision made to the said circular through circular no. 65768/99 dated 25/10/1439AH along with all relevant regulatory requirements in that regard.

8. Regulatory Reporting Requirements

Banks are required to submit to SAMA on a quarterly basis all Restructuring Cases (Responses should only cover restructuring cases of “Problem loans” as defined in section 1.4 of these Rules) and Associated Fees as per the templates provided by SAMA. The reports should be submitted within 30 days of quarter end.

9. Effective Date

These Rules should come into force with effect from the 1st of July 2020.

Guidelines on Management of Problem Loans

No: 41033343 Date(g): 6/1/2020 | Date(h): 11/5/1441 Status: In-Force 1. Introduction

1.1 Purpose of Document

The purpose of this document is to support the Saudi banking sector in their ongoing efforts to accelerate the resolution of non-performing loans (NPLs) associated with large corporates, micro, small and medium-sized enterprise sector. This document seeks to reflect the local and international best practices on dealing with problem loans, these guidelines also seek to take into account the specifics of Kingdom of Saudi Arabia's (KSA) economic and banking sector structure and the extensive experience accumulated by KSA banks in dealing with their corporate borrowers, as well as KSA's existing legal, regulatory and institutional framework for resolution and does not identify the possible obstacles to efficient and timely problem loan management that might still exist in this broader framework, or to propose potential improvements which would be outside the banks’ sphere of control.

Bank loans can become “problem loan" because of problems with the borrower’s financial health, or inadequate processes within banks to restructure viable borrowers, or both. In ascertaining how to deal with a problem loan, it is important to distinguish between a borrower's “ability to pay” and “willingness to pay,” Making this distinction is not always easy and requires effort. These guidelines should guide banks staff in dealing with problem loans including non-performing loans (NPLs) extended to corporate and Micro, Small and Medium Enterprises (MSMEs). It deals with both ad-hoc and systemic financial distress and delves into how borrower problems may have arisen in the first place. It provides guidance to banks staff responsible for handling individual problem loans and to senior managers responsible for organizing portfolio-wide asset resolution.

1.2 Scope of Implementation

These guidelines are applicable as better practices for all banks licensed under Banking Control Law, including Foreign Bank Branches. These guidelines should be read in conjunction with Mandatory Rules on the Management of Problem Loans and Rules on Credit Risk Classification and Provisioning issued by Saudi Central Bank* (SAMA).

Whenever the requirements specified under these guidelines differ from existing laws, regulations and circulars issued by SAMA or other government organizations, the later shall take precedence over these guidelines

* The "Saudi Arabian Monetary Agency" was replaced By the "Saudi Central Bank" in accordance with The Saudi Central Bank Law No. (M/36), dated 11/04/1442H, corresponding to 26/11/2020G.

2. Problem Loan Prevention & Identification

2.1 Early Warning Signals as a Tool for Preventing NPLs

One of the keys to maintaining acceptable levels of Non-Performing Loans lies in the ability to identify potential payment difficulties of a borrower as early as possible. SAMA views instituting an effective framework within regulated entities as a mandatory requirement. The sooner the problem is identified, the easier it will be to remedy it. Early warning signals (EWS), fully integrated into the bank's risk management system, is a crucial tool to identify and manage upcoming problems with a borrower’s ability to service his loan.

The purpose of the EWS is therefore twofold:

i. To produce an early signal of potential payment difficulties of the borrower; and

ii. To allow the opportunity to develop a corrective action plan at a very early stage.

iii. When the borrower exhibits early warning signs, the bank should proactively identify the driver and assess whether the borrower’ case should continue to be handled by the business / commercial unit or if the Workout Unit (whether involved in a shadow capacity at first or have full control of the case) should be involved.

Banks should ensure that proper training is provided to the business units on how to manage accounts with early signs of stress.

2.2 Scope of EWS Process

The EWS process is organized in three stages: identification, action, and monitoring. Each of these stages is described in detail in the following sections. The timeline for implementing actions included in each of these stages is explained in section 2.3.

# Area Description 1 Signal Identification • Responsibility for establishing parameters for signals and monitoring resides in a separate unit or function within risk management, middle or back office. • Upon identification of a signal, notification is sent to the respective relationship manager and his team leader that action is required to close the EWS breach. 2 Action

• Relationship Manager contacts the borrower and identifies the source and magnitude of a potential payment difficulty. • After analysis and in consultation with risk management, a corrective action plan is put in place. • A loan is added to the watch list prepared on the basis of EWS for the purposes of further monitoring. 3 Monitoring • Risk management approval required to remove the loan from watch list prepared on the basis of EWS. • A loan can remain on watch list for a time period specified by the bank. After that period, loan must be either returned to originating unit or transferred to Workout Unit. • While on the watch list, a loan should be classified with a lower risk rating compared to the one prior to moving to the watch list. 2.3 Stages of EWS Process

1. Identification:

Early warning signs are indicators that point to potential payment difficulties. These indicators could be alienated into five broad categories:

i. Economic environment,

ii. Financial indicators,

iii. Behavioral indicators,

iv. Third-party indicators, and

v. Operational indicators.

The main aim of this list is to produce a comprehensive set of signals that provides the bank an opportunity to act before the borrower’s financial condition deteriorates to the point of default. Each of these categories has been explained below from sections “i to v”.

It is the responsibility of the unit/section assigned for managing EWS process to interpret the signals received from a borrower and determine whether that borrower should be included in the watch list (prepared on the basis of EWS) for further corrective action.

In most cases, such a decision will involve the identification of groups of signals that validate one another. Taken alone, individual indicators can be too ambiguous/inconclusive to predict financial distress, but when a holistic approach is adopted the unit/ section responsible for managing EWS, may decide that the combination of certain signs anticipates serious financial distress.

Determining what combination of signs, that will trigger the scenario to classify the borrower as watch list, requires adequate knowledge of the industry and will involve some subjective judgment as well. In most cases, the specialized unit will have to identify very subtle warning signs that reinforce others in arriving at a judgment. These subtle signs might be based also on personal contacts between the bank and the borrower, especially in the context of medium-size enterprises.

For example, a trigger for the transfer to the watch list could be a signal received from only one substantial indicator, such as Debt/ Earnings before interest, taxes, depreciation and amortization (EBITDA) to be above 5 (the aforementioned example has been included for clarity purposes only and; should not be viewed as SAMA’s interpretation of the given financial ratio). However, the transfer may also be triggered by the combination of less significant indicators, e.g., an increase in the general unemployment rate, increase in days of receivables outstanding, or frequent changes of suppliers. In addition, signals received from at least two less significant indicators could trigger a deeper review of the borrower’s financial health.

The bank may expand the list of substantial indicators based on the findings from the analysis of the historical data and backtesting results. For the purpose of simple EWS approach (using one or multiple indicators with specific thresholds), the bank should define trigger points for creating signals based on good practice and analysis of historical data. In case of availability, a differentiation between the thresholds for different economic sectors would be a good practice. The bank should apply a prudent approach when selecting specific thresholds for particular indicators.

Criteria for the inclusion in the watch list should be applied at the individual level or at a portfolio level. For example, if real estate prices fall by more than 5 percent on an annual basis, for the group of loans that have real estate as collateral a review should be performed to determine if the collateral value is adequate in the light of price adjustment or not. Collateral evaluation should be done in accordance with SAMA Guidelines. In cases the collateral is no longer sufficient, a bank should take corrective action to improve collateral coverage.

An additional factor that should be considered in managing EWS is the concept of materiality. For this reason, a bank may define a level of average loan size in the NPL portfolio, determine that all loans above this indicator are material, and require more attention from the bank. The main principle behind this concept is to give a higher level of attention, scrutiny, and resources to specified cases.

i. Economic environment:

Indicators of the overall economic environment are very important for the early identification of potential deterioration of the loan portfolio. Their importance stems from the fact that they can point to the likely economic downturn. As such, they are a powerful determinant of the future direction of loan quality (as per international practices, real gross domestic product (GDP) growth is the main driver of nonperforming loan ratios) influencing not only the individual borrower's ability to pay his obligations but also collateral valuations.

Table 1 below provides major indicators that should be monitored to identify potential loan servicing difficulties early on. Data sources for these indicators should be a combination of the bank’s internal economic forecasts and (particularly, in case of smaller banks) forecasts of respected forecasting banks in the country or abroad. Indicators of economic environment are especially relevant for predicting the future payment ability of individual entrepreneurs and family business owners. Given the broad nature of these indicators, they should be monitored continuously using information collected on a monthly or quarterly basis. When a downturn is signaled, a more thorough review of those segments of the portfolio that are most likely to be affected should be undertaken.

Table 1: List of Potential Economic Environment Indicators

Indicator Description Economic sentiment indicators (early indicator on monthly basis) or GDP growth Economic growth directly influences borrowers’ (company and individuals) ability to generate cash flows and service their loans. Major changes in economic sentiment indicators and consequently growth forecasts should serve as a key flag for certain loan groups (retail, real estate, agriculture, hospitality sector, etc.). In most cases, oil prices, government spending, and inflation along with GDP growth has a good correlation with the prices of real estate. In a forecasted economic contraction, horizontal adjustments to real estate valuations (all assets classes) should be made. Inflation/deflation Above-average inflation or deflation may change consumer behavior and collateral values. Unemployment For MSME, an increased unemployment rate indicates a potential adjustment in the purchasing power of households, thus influencing businesses’ ability to generate cash flows to service their outstanding liabilities. Non-elastic consumption components (e.g., food, medicine) will be less sensitive to this indicator than elastic ones (e.g., hotels, restaurants, purchase of secondary residence and vacationing).

Note: The above has been outlined for illustrative purposes only,

ii. Financial indicators:

Financial indicators (Table 2) are a good source of information about the companies that issue financial reports. However, it is not sufficient to rely only on annual financial reports. To ensure that warning signals are generated in a timely manner, the bank may require more frequent interim financial reporting (e.g., quarterly for material loans and semi-annual for all others).

Data sources for financial indicators may be either company financial statements received directly from the borrower. For example, an increase in debt/EBITDA ratio could be due to (i) an increasing loan level, or (ii) a decrease of EBITDA. In the first case, appropriate corrective action could be the pledge of additional collateral. In the second case, it could be a short term or permanent phenomena and corrective actions could range from light restructuring to a more comprehensive restructuring of the obligations as part of the workout process. Financial indicators should be monitored continuously based on quarterly financial statements for material loans and on a semi-annual basis for others.

Table 2: List of Potential Financial Indicators

Indicator Description Debt/EBITDA The prudent ratio should be used for most companies with somewhat higher threshold possible for sectors with historically higher ratios. Capital adequacy Negative equity, insufficient proportion of equity, or rapid decline over a certain period of time. Interest coverage - EBITDA/ interest and principal expenses This ratio should be above a defined threshold. Cash flow Large decline during reporting period, or negative EBITDA. Turnover (applicable for MSME) A decrease in turnover, loss of substantial customer, expiry of patent. Changes in working capital Lengthening of days in sales outstanding and days in inventory. Increase in credit loan to customers Lengthening of days in receivables outstanding. Sales can be increased at the expense of deteriorating quality of customers.

Note: The above has been outlined for illustrative purposes only.

For the MSME portfolio, wherein the quality of financial statements is weak it may be feasible to develop financial ratios based on cash flow statements, Banks are therefore advised to require the respective borrower to disclose details of all its bank accounts maintained, so as to enable capturing the state of liquidity. However, the privacy of the borrowers has to be ensured and written consent needs to be taken in order to access their personal information.

iii. Behavioral indicators:

This group of indicators (Table 3) includes signals about potential problems with collateral adequacy or behavioral problems. Most of these signals should be monitored at a minimum on a quarterly basis with more frequent monitoring of occupancy rates and real estate indexes during downturns.

Table 3: List of potential behavioral indicators:

Indicator Description Loan to value (LTV) LTV > 100 % indicates that the value of the collateral is less than the loan amount outstanding. Reasons for this could be that collateral has become obsolescent or economic conditions have caused a rapid decrease in value. To be prudent, the ratio should be below 80 %, to provide adequate cushion to cover the substantial cost associated with collateral enforcement. Downgrade in internal credit risk category An annual review of borrower's credit profile reveals shortcomings. Breaches of contractual commitments Breach of covenants (financial or non-financial) in the loan agreement with bank or other financial institutions. Real estate indexes The bank should monitor real estate indexes in adequate-granularity. Depending on the collateral type (commercial or individual real estate) the bank needs to establish reliable, timely, and accurate tracking of changes in respective values. Decline larger than 5 percent on annual basis (y/y) should create a flag for all loans that have similar collateral. At this stage, the bank should review if LTV with the new collateral value is adequate. Credit card loans Delay in settling credit card loans or increasing reliance on provided credit line (particularly for partnerships and individual entrepreneurs).

Note: The above has been outlined for illustrative purposes only.

iv. Third-party indicators:

The bank should organize a reliable screening process for information provided by third parties (e.g. rating agencies, tax authorities, press, and courts) to identify signs that could lead to a borrower’s inability to service its outstanding liabilities. These should be monitored on a daily basis so that they can be acted on immediately upon receipt of the information.

Table 4: List of potential third party information indicators

Indicator Description Default / any negative information SIMAH Report / Negative press coverage, reputational problems, doubtful ownership. and involvement in financial scandals. SIMAH Report / Media Insolvency proceedings for major supplier or customer May have a negative impact on the borrower Information from courts and other judicial institutions. External rating assigned and trends Any rating downgrade would have been an indicator deteriorating in the borrower profile Rating Agencies

Note: The above has been outlined for illustrative purposes only.

v. Operational indicators:

In order to capture potential changes in the company’s operations, close monitoring of frequent changes in management and suppliers should be arranged.

Indicator Description Frequent changes in senior management Often rotation of senior management, particularly Chief Executive Officer (CEO), Chief Financial Officer (CFO), Chief Risk Officer (CRO), could indicate internal problems in the company. Annual report and discussion with the company. Qualified audit reports At times, auditors raise concerns about the quality of financial statements by providing modified opinions such as qualification, adverse and even some times disclaimer. Annual report Change of the ownership Changes in ownership or major shareholders (stakeholders or shareholders). Public registries and media. Major organizational change Restructuring of organizational structure (e.g., subsidiaries, branches, new entities, etc.). Public registries and media. Management and shareholder contentiousness Issues arising from the management and from the shareholders which would result in serious disputes. Public registries and media.

It is important to note that the proposed categories and indicators presented above are not exhaustive. Each bank should work to create a solid internal database of these and other indicators, which should be, utilized for EWS purposes. The indicators from the database should be backtested in order to find out the indicators with the highest signaling power. For this purpose, indicators should be tested at different stages of an economic cycle.

Note: The above has been outlined for illustrative purposes only.

2. Corrective Action:

Once an early warning signal is identified, based on the criteria explained above, the unit responsible for managing EWS, needs to flag the potentially problematic loan to the relationship officer / respective portfolio manager in charge of the borrower's relationship.

The cause and severity of the EWS is assessed and based on the assessment the borrowers can be categorized as ‘watch list'. Following are the two potential scenarios:

• Loans remain performing while on the watch list and will be brought back to regular loans after some time, and

• The credit quality of the loan continues to deteriorate and it is transferred to the bank’s Workout Unit (Remedial / Restructuring etc.).

Once the borrower is classified as watch list, the bank should decide, document and implement appropriate corrective actions (within the specified timeframe) in order to mitigate further worsening of loan's credit quality.

Corrective action might include:

i. Securing additional collateral or guarantee (if considered necessary).

ii. Performing more regular site visits.

iii. More frequent updates to the credit committee.

iv. Assessment of financial projections and forecast loan service capacity.

3. Monitoring:

Once increased credit risk is identified, it is crucial for the bank to follow up on the signal received as soon as possible, and develop a corrective action plan to pre-empt potential payment difficulties. The intensification of communication with the borrower is of utmost importance. The action plan may be as simple as collecting missing information such as an insurance policy or as complex as initiating discussions on a multi-bank restructuring of the borrower's obligations.

While the borrower remains on the watch list, bank’s primary contact with the borrower remains the business officer/portfolio manager, although the head of business as well as risk management, are expected to take a more active involvement in the decision and action process for larger, more complex loans. While on the watch list, the borrower should be classified in a lower rating than “ordinary” borrowers.

All loans in the bank's portfolio should be subject to the EWS described above. This applies to performing loans that never defaulted, but to restructured loans as well.

A. Timeline

For EWS to be effective, clear deadlines for actions should be in place, and consistently enforced (see an indicative timeline in Table below). The level and timing of the monitoring process should reflect the risk level of the loan. Large loans should be monitored closely and by the Risk department and respective Credit committees or any higher management committees.

Banks should also establish the criteria to monitor large corporate loans and at the same time importance to be provided to smaller loans, and the same should be followed by designated staff within the bank, with the results reported to the management.

Indicator Responsibility Workout (once the trigger identified) Description Any triggers identified / or any Signal received Relationship Manager (RM) / Portfolio Manager (PM). Max 1 working day. RM / PM starts analyzing the borrower details to investigate further. Follow up with the borrower and report with analysis Relationship Officer / Portfolio Manager. Max 3 working days for a material loan and 5 working days for others. RM / PM contacts borrower determines reasons, and provide analysis. Decision on further actions Relationship Manager & Head of Business; EWS manager. Max 6 working days for material loan and 10 working days for others. Decision for a loan to be: (i) put on watch list and potential request for corrective action; (ii) left without action or mitigating measures; and (iii) transferred to Workout Unit. Review of watch list Relationship Manager & Head of Business, EWS manager and Credit Committee. Every fortnightly for material loans and 1 month for others, the list is reviewed and amended, if needed. Risk manager/EWS manager (in consultation with Head of Business) monitors the performance of the borrower and agreed mitigation measures. If needed, based on the recommendation of Credit Committee or any other delegated committee takes decision to transfer to Workout Unit. Final decision Head of Business /Risk manager, EWS manager. Banks as per their internal policy can specify the maximum time a borrower can remain on watch list. Borrower can be on watch list only on a temporary basis. Banks should assess as how much time should be specified for which the borrower remains in watch list, once the specified time is completed a final decision should be taken, i.e., loan either removed from watch list (if problems are resolved), or transferred to Workout Unit. B. Establishing criteria for transfer to Workout Unit:

Banks shall establish and document a policy with clear and objective time-bound criteria for the mandatory transfer of loans from Loan Originating Units to the Workout Unit along with the specification of relevant approvals required for such transfers. The policy should include details on areas where proper collaboration is required between the Workout Unit and Loan Originating Units especially in scenarios where the borrowers are showing signs of stress but still being managed by the Loan Originating Units.

While corrective actions should be taken as soon as a problem is identified, if the problem cannot be solved within a reasonably short period, the loan should be transferred to the Workout Unit (WU) for more intensive oversight and resolution. Allowing past-due loans to remain within the originating unit for a long time perpetuates the problem, leads to increased NPL levels within the bank, and ultimately results in a lower collection/recovery rate.

C. Following are generally the key indicators for transferring to Workout Unit (not all-inclusive):

i. Days past due (DPD) based on internal thresholds and considering the nature of the borrower should be included as a mandatory trigger (For further guidance on this refer to SAMA rules on Credit Risk Classification and Provisioning).

ii. Debt to EBITDA ≥ Internally set threshold dependent on the nature and industry of the borrower (not applicable to an MSME, in cases wherein reliable financial information is not available),

iii. Net loss during any consecutive twelve-month period ≥Internally set threshold dependent on the nature and industry of the borrower,

iv. A loan classification of “Watch list ” if syndication is involved and/or reputational/legal issues are at stake;

v. Length of time on watch list (e.g., more than twelve months), or at least two unsuccessful prior restructurings;

vi. An indication of an imminent major default or materially adverse event, including government intervention or nationalization, notice of termination of operating license or concession, significant external rating downgrade of borrower or guarantor, sudden plant closure, etc.;

vii. Litigation, arbitration, mediation, or other dispute resolution mechanism involving or affecting the banks; or

viii. Evidence or strong suspicion of corruption or illegal activity involving the borrower or the borrower's other stakeholders.

Note: Banks are encouraged to develop customized indicators for the MSME sector.

The decision to transfer a loan to the Workout Unit should be based on a refined judgment that the loan will not be repaid in time, in full and urgent action is needed in view of the borrower’s deteriorating situation. The above-mentioned criteria can give a clear signal that: (i) loan-level is unsustainable; (ii) equity of a company has been severely depleted; or (iii) previous restructurings were not successful, and more drastic measures should be applied.

Exceptions to this policy should be rare, well documented in writing, and require the approval of the Board of Directors or any other bank's board designated committee.

Note: Banks should define clear and objective criteria in its internal documentation, for handing over a borrower to the workout and legal support unit, as well as the criteria for returning the borrower back to the commercial unit for regular management. The commercial unit and the workout and legal support unit must he completely separated in terms of functional, organizational and personnel issues.

The work out unit should seek to restructure the loan and maximize banks recovery for borrowers considered as viable. Borrower's viability needs to be evaluated in light of comparing the losses that may transpire in case of restructuring versus foreclosure.

However, on the other hand, foreclosure proceedings may be initiated, if the bank after due process concludes that the case is ineligible for restructuring consideration either because of financial or qualitative issues.

2.4 EWS Structure and Institutional Arrangements

Structure of EWS within the Bank

To ensure the independence of the process, and achieve a holistic approach to credit risk monitoring, and prevent conflicts of interest, the unit responsible for managing EWS should operate outside of the loan originating unit. Best practice indicates that the responsibilities to manage the EWS process should be assigned within the credit risk management department and fully incorporated into the bank's regular risk management processes.

Since an effective EWS requires an operational IT system that draws all information available about a particular borrower, EWS benefit from being part of the bank's internal credit rating system that already contains information about the borrower, the bank should allocate enough staff and financial resources to keep the system operational and effective.

The operation of the EWS should be governed by written policies and procedures, including time thresholds for required actions, approved by the Board of Directors of the bank. They should be subject to annual review and reapproved by the Senior Management Committee to incorporate:

i. Required changes identified during previous operational periods;

ii. Regulatory amendments; and

iii. Additionally, independent quality assurance (e.g., review of the process by an external expert or the Internal Audit function) should be considered.

Reporting:

All actions during the EWS process should be recorded in the IT system to provide a written record of decisions and actions taken. At a minimum, the system should record:

i. Time the action was taken;

ii. Name and department of those participating/approving the actions;

iii. The reasons for actions taken; and

iv. The decision of the appropriate approval authority, if applicable.

The watch list should include, at a minimum, the following information:

i. Details of the loan;

ii. Is it part of a group or related party;

iii. Material or non-material loan;

iv. Date added to the list;

v. Reviews taken (including timestamps) and outcomes,

vi. Mitigation measures; and

vii. Reasons for inclusion in the watch list.

The watch list (or at least material loans on it) should be presented monthly to a designated management committee (Executive Committee or Risk Committee) only or in parallel with the credit committee for information purposes and potential action. For major cases, the bank's Management Board must be included in the decision-making process. The Board should also receive monthly:

a) A detailed list of material loans for information: and

b) Aggregate figures for the loans on the watch list. Information about the borrower/group in potential payment difficulties must be disseminated widely and promptly within the banking group, including branches and subsidiaries. (For details on samples of EWS refer to Appendix 1).

3. Non-performing Loans (NPLs) Strategy

The bank's goal in the resolution process should be to reduce non-performing assets as early as possible, in order to:

i. Free up coinage and capital for new lending;

ii. Reduce the bank's losses, and return assets to earning status, if possible;

iii. Generate good habits and a payment culture among borrowers; and

iv. Help maintain a commercial relationship with the borrower by conducting a responsible resolution process. To ensure that the goal is met, each bank should have a comprehensive, written strategy for management of the overall NPL portfolio, supported by time-bound action plans for each significant asset class. The bank must also put in place and maintain adequate institutional arrangements for implementing the strategy.

3.1 Developing the NPL Strategy

The NPL reduction strategy should layout in a clear, concise manner the bank's approach and objectives (i.e., maximizing recoveries, minimizing losses) as well as establish, at a minimum, annual NPL reduction targets over a realistic but sufficiently ambitious timeframe (minimum 3 years). It also serves as a roadmap for guiding the internal organizational structure, the allocation of internal resources (human capital, information systems, and funding) and the design of proper controls (policies and procedures) to monitor interim performance and take corrective actions to ensure that the overall reduction goals are met.

The strategy development process is divided into the following two components:

1. Assessment; and

2. Design.

1. Assessment

In order to prepare the NPL strategy, Banks should conduct a comprehensive assessment of their internal operating environment, external climate for resolution, and the impact of various resolution strategies on the bank's capital structure.

i. Internal Self-Assessment

The purpose of this self-assessment is to provide management with a full understanding of the severity of the problems together with the steps that are to be taken into consideration to correct the situation. Specific details are noted below:

a) Internal Operating Assessment:

A thorough and realistic self-assessment should be required and performed to determine the severity of the situation and the paces that need to be taken internally to address it, there are a number of key internal aspects that influence the bank's need and ability to optimize its management of, and thus reduce, NPLs and foreclosed assets (where relevant).

b) Scale and drivers of the NPL issue:

- Size and evolution of its NPL portfolios on an appropriate level of granularity, which requires appropriate portfolio segmentation:

- The drivers of NPL in-flows and outflows, by portfolio where relevant;

- Other potential correlations and causations.

c) Outcomes of NPL actions taken in the past:

- Types and nature of actions implemented, including restructuring measures;

- The success of the implementation of those activities and related drivers, including the effectiveness of restructuring treatments.

d) Operational capacities:

Processes, tools, data quality, IT/automation, staff/expertise, decision-making, internal policies, and any other relevant area for the implementation of the strategy) for the different process steps involved, including but not limited to:

- early warning and detection/recognition of NPLs;

- restructuring;

- provisioning;

- collateral valuations;

- recovery/legal process/foreclosure;

- management of foreclosed assets (if relevant);

- reporting and monitoring of NPLs and the effectiveness of NPL workout solutions.

For each of the process steps involved, including those listed above, banks should perform a thorough self-assessment to determine strengths, significant gaps and any areas of improvement required for them to reach their NPL reduction targets. The resulting internal report should be prepared and the same to be maintained for the record purpose.

Banks should monitor and reassess or update relevant aspects of the self-assessment at least annually and regularly seek independent expert views on these aspects, if necessary.

ii. Portfolio Segmentation

Purpose and principles of portfolio segmentation

Segmentation is the process of dividing a large heterogeneous group of Nonperforming loans into smaller more homogeneous parts. It is the essential first step in developing a cost-effective and efficient approach to NPL resolution. Grouping borrowers with similar characteristics allow the bank to develop more focused resolution strategies for each group. Using basic indicators of viability and collateral values, the portfolio can be broken down at an early stage by proposed broad resolution strategies (hold/restructure, dispose, or legal enforcement). Identifying broad asset classes at an early stage of workout is also helpful for efficient set up of Workout Unit, including allocation of staffing and specialized expertise for a more in-depth analysis of borrower’s viability and design of final workout plan.

The segmentation, including initial viability assessment, should be done immediately after the non-performing loan is transferred to the Workout Unit, and before the loan is assigned to a specific workout officer. The exercise is normally performed by a dedicated team in the Workout Unit.

In order to deal with the stock of NPLs, the bank should follow the principles of proportionality and materiality. Proportionality means that adequate resources should be spent on specific segments of NPLs during the resolution process, taking into account the substantial internal costs of the workout process borne by the bank. Materiality means that more attention should be allocated to larger loans compared to smaller loans during the resolution process. These principles should guide the allocation of financial, time and human (in terms of numbers and seniority) resources in WU.

A well-developed management information system containing accurate data is an essential pre-condition for conducting effective segmentation. The exercise is expected to be performed on the basis of information already contained in the loan file when it is transferred from the originating unit to the WU.

Two-Stage segmentation process

It is recommended that the basic segmentation of the bank's NPL portfolio is done in the following two stages. The main objective is to select a smaller pool of loans relating to potentially viable borrowers, which warrant the additional (substantial in case of material loans) follow-up effort from WU, including in-depth viability analysis and re-evaluation of collateral, in order to design an appropriate workout plan.

Stage one - Segmentation by nature of business, past-due buckets, loan balance, and status of legal procedure

The bank's portfolio, segmentation can be conducted by taking multiple borrowers’ characteristics into consideration. Segmentations should have a useful purpose, meaning that different segments should generally trigger different treatments by the NPL WUs or dedicated teams within those units. Following is the list of potential segmentation criteria that can be utilized by banks:

i. Nature of the business: Micro, Small and medium-sized enterprises (MSMEs), including sole traders/ partnerships and Corporates: (by asset class or sector).