Book traversal links for 5.2.2 Workout Options

5.2.2 Workout Options

| No: 41033343 | Date(g): 6/1/2020 | Date(h): 11/5/1441 | Status: In-Force |

At the initial segmentation stage, the loan-to-value and viability parameters are generally used to help identify potentially viable borrowers (Refer to Chapter 3). This group of borrowers is then subject to in-depth financial analysis and business viability assessment, which narrows the number of candidates for potential restructuring even further. At this stage, the Workout Unit should have a fully informed view as to the nature and causes of the borrower's difficulties. Based on this understanding, the Workout Unit should work with the borrower on developing a realistic repayment plan designed around the borrower's projected sustainable cash flows and/or the liquidation of assets within acceptable timeframes. Understanding and knowing when to use each of the options discussed below provides a Workout Unit with the flexibility necessary to tailor appropriate restructuring proposals.

Consider personal guarantees, conversion of loans from owner(s) to equity or other subordinated form, capital increase, additional collateral, sale of excess assets, achievement of certain levels of financial indicators.

| Borrower Type | Workout Measure | Description | |

| Viable | Normal reprogramming | Future cash flows sufficient for repayment of loan until a sustainable level of cash flow reached within the stipulated period (Actual timeline dependent on the profile of the borrower and tenor of the loan). | |

| Consider personal guarantees, conversion of loans from owner(s) to equity or other subordinated form, capital increase, additional collateral, sale of excess assets, achievement of certain levels of financial indicators. | |||

| Marginal | Extended repayment period | Extended period of reprogramming (rescheduling) needed to reach a sustainable level of cash flow, i.e., with final payment in equal installments or balloon or bullet payment. | |

| Loan Splitting | Loan is split into two parts: the first, representing the amount that can be repaid from sustainable cash flow) is repaid in equal installments (principal and interest) with a specified maturity date; the remaining portion is considered to be excess loan (which can be subordinated), which may be split into several parts/tranches. These may be non-interest bearing with interest payable either at maturity or from the proceeds of specific asset sales. | ||

| Conditional Loan Forgiveness | To be used to encourage owners to make an additional financial contribution to the company and to ensure that their interests are harmonized with those of the bank, particularly in those cases when the net present value of the company (taking into consideration all collateral and potential cash flow) is lower than the total loan. Bank may choose to: | ||

| i. | Partial write-off in the framework of the owner's cash equity contribution, particularly in all cases where the owner(s) have not guaranteed the loan; | ||

| ii. | Partial write-off in the framework of a cash capital increase from a third-party investor where they have not assumed the role of the guarantor; | ||

| iii. | Partial write-off in the case of a particularly successful business restructuring that materially deviates from the operating plan that served as the basis for the restructuring; | ||

| iv. | Partial write-off in those cases when the above-average engagement of the owner(s) (i.e. successful sale of excess assets) guarantees a higher level of repayment to the bank(s). | ||

| Loans can also be written off if the collateral has no economic value, and such action ensures the continuation of the borrower's operations and the bank has confidence in the management or if the cause for the problems came from objective external factors. | |||

| Loan to Equity Swaps | Appropriate for medium-sized companies where the company can be sold, has established products/services, material know-how; or significant market share, etc. However, such measures should be in-line with the requirements stipulated by Banking Control Law (Issued by SAMA) under Article 10 subsection 2 and 4. | ||

| Loan to Asset Swaps | Can be an effective tool particularly in the case of stranded real estate projects provided that the real estate is in good condition and can be economically viable managed in the future. The transaction must not be legally disputable, considering the provisions of the bankruptcy and enforcement legislation. It may also be used for other real estate cases, equity stakes, and securities with determinable market value. | ||

| Short Term restructuring | Restructuring agreements with a one-year maturity may be appropriate in those cases such as micro and small borrowers, where the bank feels closer monitoring or increased pressure to perform is necessary. | ||

| Loan Sale | Sale of the loan is reasonable under the following conditions: | ||

| • | The bank does not have sufficient capacity to effectively manage the borrower; | ||

| • | The buyer has a positive reference; and | ||

| • | The buyer is a major specialist in the area of resolving non-performing loans. | ||

| Non-Viable Borrowers | Collateral Liquidation by owner | MSME owners have strong attachments to their property. They may fail to carry out the sale within the agreed-upon time frame or have unrealistic expectations regarding the value of the property. It is recommended that the bank set short deadlines; obtain a notarized power of attorney allowing it to activate the sale procedures; and have sufficient human resources within the real estate market to expedite the sales process. | |

| Execution or Insolvency | To be used when the borrower is not viable or non-cooperative, and no feasible restructuring solution can be put in place. | ||

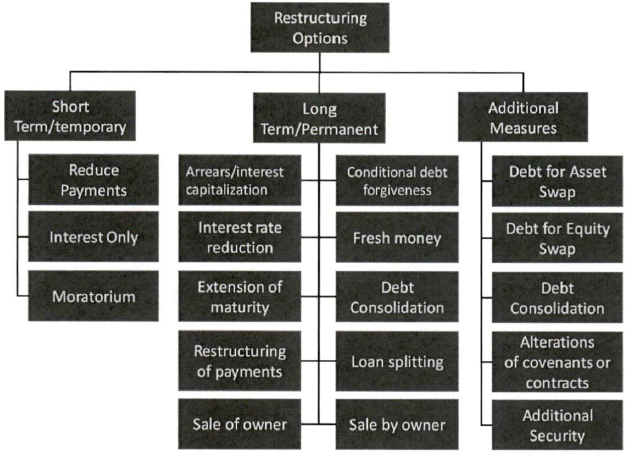

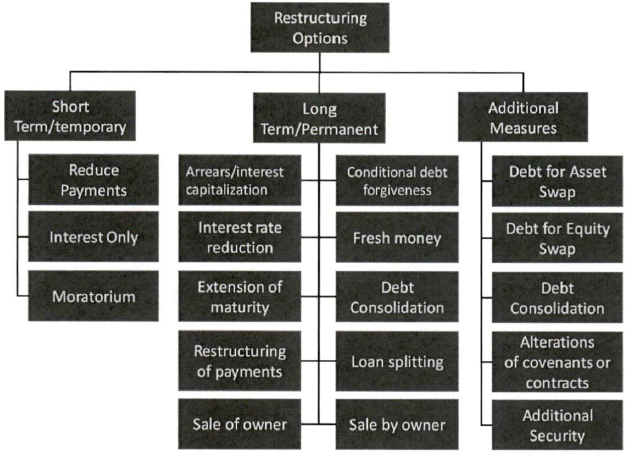

The below figure presents the various options broken into three broad categories: (i) short term measures most appropriately used in early-stage arrears to stabilize the situation and give the borrower and the bank time to develop a longer-term strategy; (ii) longer-term/ permanent solutions, which will result in the reduction of the loan: and (iii) additional measures, which do not directly lead to repayment but strengthen the bank's collection efforts.