Disclosure and Reporting Requirements

Pillar 3 Disclosure Requirements Framework

Glossary

1. Introduction

Basel Committee on Banking Supervision issued a document on Basel III: Finalizing post-crisis reforms in December 2017. Which includes the revised disclosure requirements that aims to enhance transparency by setting the minimum requirements for market disclosures of information on the risk management practices and capital adequacy of banks. This will enable market participants to obtain key information on risk exposures, risk management framework, adequacy of regulatory capital of banks, reduces information asymmetry and helps promote comparability of banks' risk profiles within and across jurisdictions. In addition, banks' Pillar 3 disclosure will also facilitate supervisory monitoring while strengthening incentives for banks to implement robust risk management.

Among the key revisions to the Pillar 3 framework include disclosure requirements related to:

a) Credit risk, operational risk, the leverage ratio and credit valuation adjustment (CVA) risk;

b) Risk-weighted assets (RWAs) as calculated by the bank's internal models and according to the standardised approaches;

c) Disclosures related to the revised market risk framework

d) Overview of risk management framework, RWAs and key prudential metrics; and

e) Asset encumbrance; and

f) Capital distribution constraints

This framework is issued by SAMA in exercise of the authority vested in SAMA under the Central Bank Law issued via Royal Decree No. M/36 dated 11/04/1442H, and the Banking Control Law issued 01/01/1386H.

This framework supersedes all circulars/instructions/rules related to Pillar 3 Disclosure Requirements previously issued by SAMA.

2. Scope of Application

2.1 Disclosure requirements are an integral part of the Basel framework. Unless otherwise stated, the Tables and Templates are applicable to all domestic banks both on a consolidated basis, which include all branches and subsidiaries, and on a standalone basis.

2.2 This framework is not applicable to Foreign Banks Branches operating in the kingdom of Saudi Arabia.

2.3 Banks must assess the applicability of the disclosure requirements based on their specific compliance obligations.

3. Implementation Dates

3.1 Disclosure requirements will be effective on 01 January 2023.

3.2 Disclosure requirements are applicable for Pillar 3 reports related to fiscal periods that include or come after the specific calendar implementation date which means that the first set of templates/tables will cover data as at March 31, 2023.

4. Guiding Principles of Banks' Pillar 3 Disclosures

4.1 Banks should ensure compliance with the following guiding principles which aim to provide a firm foundation for achieving transparent, high-quality Pillar 3 risk disclosures that will enable users to better understand and compare a bank's business and its risks:

Principle 1: Disclosures should be clear

4.2 Disclosures should be presented in a form that is understandable to key stakeholders (eg investors, analysts, financial customers and others) and communicated through an accessible medium. Important messages should be highlighted and easy to find. Complex issues should be explained in simple language with important terms defined. Related risk information should be presented together.

Principle 2: Disclosures should be comprehensive

4.3 Disclosures should describe a bank's main activities and all significant risks, supported by relevant underlying data and information. Significant changes in risk exposures between reporting periods should be described, together with the appropriate response by management.

4.4 Disclosures should provide sufficient information in both qualitative and quantitative terms on a bank's processes and procedures for identifying, measuring and managing those risks. The level of detail of such disclosure should be proportionate to a bank's complexity.

4.5 Approaches to disclosure should be sufficiently flexible to reflect how senior management and the board of directors internally assess and manage risks and strategy, helping users to better understand a bank's risk tolerance/appetite.

Principle 3: Disclosures should be meaningful to users

4.6 Disclosures should highlight a bank's most significant current and emerging risks and how those risks are managed, including information that is likely to receive market attention. Where meaningful, linkages must be provided to line items on the balance sheet or the income statement. Disclosures that do not add value to users' understanding or do not communicate useful information should be avoided. Furthermore, information which is no longer meaningful or relevant to users should be removed.

Principle 4: Disclosures should be consistent over time

4.7 Disclosures should be consistent over time to enable key stakeholders to identify trends in a bank's risk profile across all significant aspects of its business. Additions, deletions and other important changes in disclosures from previous reports, including those arising from a bank's specific, regulatory or market developments, should be highlighted and explained.

Principle 5: Disclosures should be comparable across banks

4.8 The level of detail and the format of presentation of disclosures should enable key stakeholders to perform meaningful comparisons of business activities, prudential metrics, risks and risk management between banks and across jurisdictions.

5. Assurance of Pillar 3 Data

5.1 Banks must establish a formal board-approved disclosure policy for Pillar 3 information that sets out the internal controls and procedures for disclosure of such information. The key elements of this policy should be described in the year-end Pillar 3 report or cross-referenced to another location where they are available.

5.2 The board of directors and senior management are responsible for establishing and maintaining an effective internal control structure over the disclosure of financial information, including Pillar 3 disclosures. They must also ensure that appropriate review of the disclosures takes place. The information provided by banks under Pillar 3 must be subject, at a minimum, to the same level of internal review and internal control processes as the information provided by banks for their financial reporting (i.e. the level of assurance must be the same as for information provided within the management discussion and analysis part of the financial report).

5.3 One or more senior officers of a bank must attest in writing that all Pillar 3 disclosures have been prepared in accordance with the board-agreed internal control processes.

6. Reporting Location

6.1 Banks must publish their Pillar 3 report in a standalone document that provides a readily accessible source of prudential measures for users. The Pillar 3 report may be appended to, or form a discrete section of, a bank's financial reporting, but it must be easily identifiable to users. Signposting of disclosure requirements is permitted in certain circumstances, as set out in section 7.2. Banks must also make available on their websites an archive for 10 years retention period of Pillar 3 reports (quarterly, semi-annual and annual) relating to prior reporting periods.

6.2 Banks are required to submit a copy of the disclosures to SAMA via the following email address.

7. Presentation of the Disclosure Requirements

7.1 Templates and tables:

7.1.1 The disclosure requirements are presented either in the form of templates or tables. Templates must be completed with quantitative data in accordance with the definitions provided. Tables generally relate to qualitative requirements, but quantitative information is also required in some instances. Banks may choose the format they prefer when presenting the information requested in tables.

7.1.2 In line with Principle 3 in section 4.6, the information provided in the templates and tables should be meaningful to users. The disclosure requirements in this document that necessitate an assessment from banks are specifically identified. When preparing these individual tables and templates, banks will need to consider carefully how widely the disclosure requirement should apply. If a bank considers that the information requested in a template or table would not be meaningful to users, for example because the exposures and risk-weighted asset (RWA) amounts are deemed immaterial, it may choose not to disclose part or all of the information requested. In such circumstances, however, the bank will be required to explain in a narrative commentary why it considers such information not to be meaningful to users. It should describe the portfolios excluded from the disclosure requirement and the aggregate total RWA those portfolios represent.

7.1.3 For templates, the format is designated as either fixed or flexible:

a) Where the format of a template is described as fixed, banks must complete the fields in accordance with the instructions given. If a row/column is not considered to be relevant to a bank's activities or the required information would not be meaningful to users (eg immaterial from a quantitative perspective), the bank may delete the specific row/column from the template, but the numbering of the subsequent rows and columns must not be altered. Banks may add extra rows and extra columns to fixed format templates if they wish to provide additional detail to a disclosure requirement by adding sub-rows or columns, but the numbering of prescribed rows and columns in the template must not be altered.

b) Where the format of a template is described as flexible, banks may present the required information either in the format provided in this document or in one that better suits the bank. The format for the presentation of qualitative information in tables is not prescribed. Notwithstanding, banks should comply with the restrictions in presentation, should such restrictions be prescribed in the template (eg Template CCR5 in section 20). In addition, when a customised presentation of the information is used, the bank must provide information comparable with that required in the disclosure requirement (ie at a similar level of granularity as if the template/table were completed as presented in this document).

7.2 Signposting:

7.2.1 Banks may disclose in a document separate from their Pillar 3 report (eg in a bank's annual report or through published regulatory reporting) the templates/tables with a flexible format, and the fixed format templates where the criteria in section 7.2.2 are met. In such circumstances, the bank must signpost clearly in its Pillar 3 report where the disclosure requirements have been published. This signposting in the Pillar 3 report must include:

a) The title and number of the disclosure requirement;

b) The full name of the separate document in which the disclosure requirement has been published;

c) A web link, where relevant; and

d) The page and paragraph number of the separate document where the disclosure requirements can be located.

7.2.2 The disclosure requirements for templates with a fixed format may be disclosed by banks in a separate document other than the Pillar 3 report, provided all of the following criteria are met:

a) The information contained in the signposted document is equivalent in terms of presentation and content to that required in the fixed template and allows users to make meaningful comparison with information provided by banks disclosing the fixed format templates;

b) The information contained in the signposted document is based on the same scope of consolidation as the one used in the disclosure requirement;

c) The disclosure in the signposted document is mandatory; and

d) SAMA is responsible for ensuring the implementation of the Basel standards is subject to legal constraints in its ability to require the reporting of duplicative information.

7.2.3 Banks can only make use of signposting to another document if the level of assurance on the reliability of data in the separate document are equivalent to, or greater than, the internal assurance level required for the Pillar 3 report (see sections on reporting location and assurance above).

8. Frequency and Timing of Disclosures

8.1 The frequencies of disclosure as indicated in the disclosure templates and tables vary between quarterly, semiannual and annual reporting depending upon the nature of the specific disclosure requirement. Annexure 2 summarizes the frequency and timing of disclosures for each table.

8.2 A bank's Pillar 3 report must be published concurrently with its financial report for the corresponding period. If a Pillar 3 disclosure is required to be published for a period when a bank does not produce any financial report (eg semiannual), disclosures must be published as soon as practicable and the time lag must be no longer than the maximum period of 30 days for quarterly disclosures and 60 days for semiannually and annually disclosures from its regular financial reporting period-ends.

9. Retrospective Disclosures, Disclosure of Transitional Metrics and Reporting Periods

9.1 In templates which require the disclosure of data points for current and previous reporting periods, the disclosure of the data point for the previous period is not required when a metric for a new standard is reported for the first time unless this is explicitly stated in the disclosure requirement.

9.2 Unless otherwise specified in the disclosure templates, when a bank is under a transitional regime permitted by the standards, the transitional data should be reported unless the bank already complies with the fully loaded requirements. Banks should clearly state whether the figures disclosed are computed on a transitional or fully-loaded basis. Where applicable, banks under a transitional regime may separately disclose fully-loaded figures in addition to transitional metrics.

9.3 Unless otherwise specified in the disclosure templates, the data required for annual, semiannual and quarterly disclosures should be for the corresponding 12-month, six-month and three-month period, respectively.

10. Proprietary and Confidential Information

10.1 In exceptional cases, where disclosure of certain items required by Pillar 3 may reveal the position of a bank or contravene its legal obligations by making public information that is proprietary or confidential in nature, a bank does not need to disclose those specific items, but must disclose more general information about the subject matter of the requirement instead. It must also explain in the narrative commentary to the disclosure requirement the fact that the specific items of information have not been disclosed and the reasons for this.

11. Qualitative Narrative to Accompany the Disclosure Requirements

11.1 Banks should supplement the quantitative information provided in both fixed and flexible templates with a narrative commentary to explain at least any significant changes between reporting periods and any other issues that management considers to be of interest to market participants. The form taken by this additional narrative is at the bank's discretion.

11.2 Additional voluntary risk disclosures allow banks to present information relevant to their business model that may not be adequately captured by understand and analyse any figures provided. It must also be accompanied by a qualitative discussion. Any additional disclosure must comply with the five guiding principles above.

12. Overview of Risk Management, Key Prudential Metrics and RWA

12.1 The disclosure requirements under this section are:

12.1.1 Template KM1 - Key metrics (at consolidated level)

12.1.2 Template KM2 - Key metrics - total loss-absorbing capacity (TLAC) requirements (at resolution group level)

12.1.3 Table OVA - Bank risk management approach

12.1.4 Template OV1 - Overview of risk-weighted assets (RWA)

12.2 The disclosure requirements related to TLAC are not required to be completed by banks unless otherwise specified by SAMA.

12.3 Template KM1 provides users of Pillar 3 data with a time series set of key prudential metrics covering a bank’s available capital (including buffer requirements and ratios), its RWA, leverage ratio, Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR). As set out in circular No.391000029731 dated 15/03/1439 H, banks are required to publicly disclose whether they are applying a transitional arrangement for the impact of expected credit loss accounting on regulatory capital. If a transitional arrangement is applied, Template KM1 will provide users with information on the impact on the bank’s regulatory capital and leverage ratios compared to the bank’s “fully loaded” capital and leverage ratios had the transitional arrangement not been applied.

12.4 Template KM2 requires global systemically important banks (G-SIBs) to disclose key metrics on TLAC. Template KM2 becomes effective from the TLAC conformance date.

12.5 Table OVA provides information on a bank’s strategy and how senior management and the board of directors assess and manage risks.

12.6 Template OV1 provides an overview of total RWA forming the denominator of the risk-based capital requirements.

Template KM1: Key metrics (at consolidated group level) Purpose: To provide an overview of a bank’s prudential regulatory metrics. Scope of application: The template is mandatory for all banks. Content: Key prudential metrics related to risk-based capital ratios, leverage ratio and liquidity standards. Banks are required to disclose each metric’s value using the corresponding standard’s specifications for the reporting period-end (designated by T in the template below) as well as the four previous quarter-end figures (T–1 to T–4). All metrics are intended to reflect actual bank values for (T), with the exception of “fully loaded expected credit losses (ECL)” metrics, the leverage ratio (excluding the impact of any applicable temporary exemption of central bank reserves) and metrics designated as “pre-floor” which may not reflect actual values. Frequency: Quarterly. Format: Fixed. If banks wish to add rows to provide additional regulatory or financial metrics, they must provide definitions for these metrics and a full explanation of how the metrics are calculated (including the scope of consolidation and the regulatory capital used if relevant). The additional metrics must not replace the metrics in this disclosure requirement. Accompanying narrative: Banks are expected to supplement the template with a narrative commentary to explain any significant change in each metric’s value compared with previous quarters, including the key drivers of such changes (eg whether the changes are due to changes in the regulatory framework, group structure or business model).

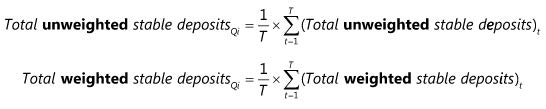

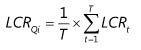

Banks that apply transitional arrangement for ECL are expected to supplement the template with the key elements of the transition they use.a b c d e T T-1 T-2 2-3 T-4 Available capital (amounts) 1 Common Equity Tier 1 (CET1) 1a Fully loaded ECL accounting model 2 Tier 1 2a Fully loaded ECL accounting model Tier 1 3 Total capital 3a Fully loaded ECL accounting model total capital Risk-weighted assets (amounts) 4 Total risk-weighted assets (RWA) 4a Total risk-weighted assets (pre-floor) Risk-based capital ratios as a percentage of RWA 5 CET1 ratio (%) 5a Fully loaded ECL accounting model CET1 (%) 5b CET1 ratio (%) (pre-floor ratio) 6 Tier 1 ratio (%) 6a Fully loaded ECL accounting model Tier 1 ratio (%) 6b Tier 1 ratio (%) (pre-floor ratio) 7 Total capital ratio (%) 7a Fully loaded ECL accounting model total capital ratio (%) 7b Total capital ratio (%) (pre-floor ratio) Additional CET1 buffer requirements as a percentage of RWA 8 Capital conservation buffer requirement (2.5% from 2019) (%) 9 Countercyclical buffer requirement (%) 10 Bank G-SIB and/or D-SIB additional requirements (%) 11 Total of bank CET1 specific buffer requirements (%) (row 8 + row 9 + row 10) 12 CET1 available after meeting the bank’s minimum capital requirements (%) Basel III leverage ratio 13 Total Basel III leverage ratio exposure measure 14 Basel III leverage ratio (%) (including the impact of any applicable temporary exemption of central bank reserves) 14a Fully loaded ECL accounting model Basel III leverage ratio (including the impact of any applicable temporary exemption of central bank reserves) (%) 14b Basel III leverage ratio (%) (excluding the impact of any applicable temporary exemption of central bank reserves) 14c Basel III leverage ratio (%) (including the impact of any applicable temporary exemption of central bank reserves) incorporating mean values for SFT assets 14d Basel III leverage ratio (%) (excluding the impact of any applicable temporary exemption of central bank reserves) incorporating mean values for SFT assets Liquidity Coverage Ratio (LCR) 15 Total high-quality liquid assets (HQLA) 16 Total net cash outflow 17 LCR ratio (%) Net Stable Funding Ratio (NSFR) 18 Total available stable funding 19 Total required stable funding 20 NSFR ratio Instructions Row Number Explanation 4a For pre-floor total RWA, the disclosed amount should exclude any adjustment made to total RWA from the application of the capital floor. 5a, 6a, 7a, 14a For fully loaded ECL ratios (%) in rows 5a, 6a, 7a and 14a, the denominator (RWA, Basel III leverage ratio exposure measure) is also “Fully loaded ECL”, ie as if ECL transitional arrangements were not applied. 5b, 6b, 7b For pre-floor risk based ratios in rows 5b, 6b and 7b, the disclosed ratios should exclude the impact of the capital floor in the calculation of RWA. 12 CET1 available after meeting the bank’s minimum capital requirements (as a percentage of RWA): it may not necessarily be the difference between row 5 and the Basel III minimum CET1 requirement of 4.5% because CET1 capital may be used to meet the bank’s Tier 1 and/or total capital ratio requirements. See instructions to [CC1:68/a]. 13 Total Basel III leverage ratio exposure measure: The amounts may reflect period-end values or averages depending on local implementation. 15 Total HQLA: total adjusted value using simple averages of daily observations over the previous quarter (ie the average calculated over a period of, typically, 90 days). 16 Total net cash outflow: total adjusted value using simple averages of daily observations over the previous quarter (ie the average calculated over a period of, typically, 90 days). Linkages across templates

Amount in [KM1:1/a] is equal to [CC1:29/a]

Amount in [KM1:2/a] is equal to [CC1:45/a]

Amount in [KM1:3/a] is equal to [CC1:59/a]

Amount in [KM1:4/a] is equal to [CC1:60/a] and is equal to [OV1.29/a]

Amount in [KM1:4a/a] is equal to ([OV1.29/a] – [[OV1.28/a])

Amount in [KM1:5/a] is equal to [CC1:61/a]

Amount in [KM1:6/a] is equal to [CC1:62/a]

Amount in [KM1:7/a] is equal to [CC1:63/a]

Amount in [KM1:8/a] is equal to [CC1:65/a]

Amount in [KM1:9/a] is equal to [CC1:66/a]

Amount in [KM1:10/a] is equal to [CC1:67/a]

Amount in [KM1:12/a] is equal to [CC1:68/a]

Amount in [KM1:13/a] is equal to [LR2:24/a] (only if the same calculation basis is used)

Amount in [KM1:14/a] is equal to [LR2:25/a] (only if the same calculation basis is used)

Amount in [KM1:14b/a] is equal to [LR2:25a/a] (only if the same calculation basis is used)

Amount in [KM1:14c/a] is equal to [LR2:31/a]

Amount in [KM1:14d/a] is equal to [LR2:31a/a]

Amount in [KM1:15/a] is equal to [LIQ1:21/b]

Amount in [KM1:16/a] is equal to [LIQ1:22/b]

Amount in [KM1:17/a] is equal to [LIQ1:23/b]

Amount in [KM1:18/a] is equal to [LIQ2:14/e]

Amount in [KM1:19/a] is equal to [LIQ2:33/e]

Amount in [KM1:20/a] is equal to [LIQ2:34/e]Template KM2: Key metrics - TLAC requirements (at resolution group level) Purpose: Provide summary information about total loss-absorbing capacity (TLAC) available, and TLAC requirements applied, at resolution group level under the single point of entry and multiple point of entry (MPE) approaches. Scope of application: The template is mandatory for all resolution groups of G-SIBs. Content: Key prudential metrics related to TLAC. Banks are required to disclose the figure as of the end of the reporting period (designated by T in the template below) as well as the previous four quarter-ends (designed by T-1 to T-4 in the template below). When the banking group includes more than one resolution group (MPE approach), this template is to be reproduced for each resolution group. Frequency: Quarterly. Format: Fixed. Accompanying narrative: Banks are expected to supplement the template with a narrative commentary to explain any significant change over the reporting period and the key drivers of such changes. a b c d e T T-1 T-2 2-3 T-4 Resolution group 1 1 Total Loss Absorbing Capacity (TLAC) available 1a Fully loaded ECL accounting model TLAC available 2 Total RWA at the level of the resolution group 3 TLAC as a percentage of RWA (row1/row2) (%) 3a Fully loaded ECL accounting model TLAC as a percentage of fully loaded ECL accounting model RWA (%) 4 Leverage exposure measure at the level of the resolution group 5 TLAC as a percentage of leverage exposure measure (row1/row4) (%) 5a Fully loaded ECL accounting model TLAC as a percentage of fully loaded ECL accounting model leverage ratio exposure measure (%) 6a Does the subordination exemption in the antepenultimate paragraph of Section 11 of the FSB TLAC Term Sheet apply? 6b Does the subordination exemption in the penultimate paragraph of Section 11 of the FSB TLAC Term Sheet apply? 6c If the capped subordination exemption applies, the amount of funding issued that ranks pari passu with Excluded Liabilities and that is recognised as external TLAC, divided by funding issued that ranks pari passu with Excluded Liabilities and that would be recognised as external TLAC if no cap was applied (%) Linkages across templates

Amount in [KM2:1/a] is equal to [resolution group-level TLAC1:22/a]

Amount in [KM2:2/a] is equal to [resolution group-level TLAC1:23/a]

Aggregate amounts in [KM2:2/a] across all resolution groups will not necessarily equal or directly correspond to amount in [KM1:4/a]

Amount in [KM2:3/a] is equal to [resolution group-level TLAC1:25/a]

Amount in [KM2:4/a] is equal to [resolution group-level TLAC1:24/a]

Amount in [KM2:5/a] is equal to [resolution group-level TLAC1:26/a][KM2:6a/a] refers to the uncapped exemption in Section 11 of the FSB TLAC Term Sheet in which all liabilities excluded from TLAC specified in Section 10 are statutorily excluded from the scope of the bail-in tool and therefore cannot legally be written down or converted to equity in a bail-in resolution. Possible answers for [KM2:6a/a]: [Yes], [No].

[KM2:6b/a] refers to the capped exemption in Section 11 of the FSB TLAC Term Sheet where SAMA may, under exceptional circumstances specified in the applicable resolution law, exclude or partially exclude from bail-in all of the liabilities excluded from TLAC specified in Section 10, and where the relevant authorities have permitted liabilities that would otherwise be eligible to count as external TLAC but which rank alongside those excluded liabilities in the insolvency creditor hierarchy to contribute a quantum equivalent of up to 2.5% RWA (from 2019) or 3.5% RWA (from 2022. Possible answers for [KM2:6b/a]: [Yes], [No].

Amount in [KM2:6c/a] is equal to [resolution group-level TLAC1:14 divided by TLAC1:13]. This only needs to be completed if the answer to [KM2:6b] is [Yes]. Table OVA: Bank risk management approach Purpose: Description of the bank's strategy and how senior management and the board of directors assess and manage risks, enabling users to gain a clear understanding of the bank's risk tolerance/appetite in relation to its main activities and all significant risks. Scope of application: The template is mandatory for all banks. Content: Qualitative information. Frequency: Annual Format: Flexible Banks must describe their risk management objectives and policies, in particular: (a) How the business model determines and interacts with the overall risk profile (eg the key risks related to the business model and how each of these risks is reflected and described in the risk disclosures) and how the risk profile of the bank interacts with the risk tolerance approved by the board. (b) The risk governance structure: responsibilities attributed throughout the bank (eg oversight and delegation of authority; breakdown of responsibilities by type of risk, business unit etc); relationships between the structures involved in risk management processes (eg board of directors, executive management, separate risk committee, risk management structure, compliance function, internal audit function). (c) Channels to communicate, decline and enforce the risk culture within the bank (eg code of conduct; manuals containing operating limits or procedures to treat violations or breaches of risk thresholds; procedures to raise and share risk issues between business lines and risk functions). (d) The scope and main features of risk measurement systems. (e) Description of the process of risk information reporting provided to the board and senior management, in particular the scope and main content of reporting on risk exposure. (f) Qualitative information on stress testing (eg portfolios subject to stress testing, scenarios adopted and methodologies used, and use of stress testing in risk management). (g) The strategies and processes to manage, hedge and mitigate risks that arise from the bank's business model and the processes for monitoring the continuing effectiveness of hedges and mitigants. Template OV1: Overview of RWA Purpose: To provide an overview of total RWA forming the denominator of the risk-based capital requirements. Further breakdowns of RWA are presented in subsequent parts. Scope of application: The template is mandatory for all banks. Content: RWA and capital requirements under Pillar 1. Pillar 2 requirements should not be included. Frequency: Quarterly. Format: Fixed. Accompanying narrative: Banks are expected to identify and explain the drivers behind differences in reporting periods T and T-1 where these differences are significant.

When minimum capital requirements in column (c) do not correspond to 8% of RWA in column (a), banks must explain the adjustments made. If the bank uses the internal model method (IMM) for its equity exposures under the market-based approach, it must provide annually a description of the main characteristics of its internal model.a b c RWA Minimum capital requirements T T-1 T 1 Credit risk (excluding counterparty credit risk) 2 Of which: standardised approach (SA) 3 Of which: foundation internal ratings-based (F-IRB) approach 4 Of which: supervisory slotting approach 5 Of which: advanced internal ratings-based (A-IRB) approach 6 Counterparty credit risk (CCR) 7 Of which: standardised approach for counterparty credit risk 8 Of which: IMM 9 Of which: other CCR 10 Credit valuation adjustment (CVA) 11 Equity positions under the simple risk weight approach and the internal model method during the five-year linear phase-in period 12 Equity investments in funds - look-through approach 13 Equity investments in funds - mandate-based approach 14 Equity investments in funds - fall-back approach 15 Settlement risk 16 Securitisation exposures in banking book 17 Of which: securitisation IRB approach

(SEC-IRBA)18 Of which: securitisation external ratings-based approach

(SEC-ERBA), including internal assessment approach (IAA)19 Of which: securitisation standardised approach (SEC-SA) 20 Market risk 21 Of which: standardised approach (SA) 22 Of which: internal model approach (IMA) 23 Capital charge for switch between trading book and banking book 24 Operational risk 25 Amounts below the thresholds for deduction (subject to 250% risk weight) 26 Output floor applied 27 Floor adjustment (before application of transitional cap) 28 Floor adjustment (after application of transitional cap) 29 Total (1 + 6 + 10 + 11 + 12 + 13 + 14 + 15 + 16 + 20 + 23 + 24 + 25 + 28) Definitions and instructions

RWA: risk-weighted assets according to the Basel framework and as reported in accordance with the subsequent parts of this standard. Where the regulatory framework does not refer to RWA but directly to capital charges (eg for market risk and operational risk), banks should indicate the derived RWA number (ie by multiplying capital charge by 12.5).

RWA (T-1): risk-weighted assets as reported in the previous Pillar 3 report (ie at the end of the previous quarter). Minimum capital requirement T: Pillar 1 capital requirements at the reporting date. This will normally be RWA * 8% but may differ if a floor is applicable or adjustments (such as scaling factors) are applied at jurisdiction level. Row number Explanation 1 Credit risk (excluding counterparty credit risk): RWA and capital requirements according to the credit risk standard of the Basel framework (SCRE), with the exceptions of RWA and capital requirements related to: (i) counterparty credit risk (reported in row 6); (ii) equity positions (reported in row 11 to 14); (iii) settlement risk (reported in row 15); (iv) securitisation positions subject to the securitisation regulatory framework, including securitisation exposures in the banking book (reported in row 16); and (v) amounts below the thresholds for deduction (reported in row 25). 2 Of which: standardised approach: RWA and capital requirements according to the standardised approach to credit risk (as specified in SCRE5 to SCRE9). 3 and 5 Of which: (foundation/advanced) internal rating based approaches: RWA and capital requirements according to the F-IRB approach and/or A-IRB approach (as specified in SCRE10 to SCRE16 with the exception of SCRE13). 4 Of which: supervisory slotting approach: RWA and capital requirements according to the supervisory slotting approach (as specified in SCRE13). 6 to 9 Counterparty credit risk: RWA and capital charges according to the counterparty credit risk chapters of the Basel framework (SCCR3 to SCCR10). 10 Credit valuation adjustment: RWA and capital charge requirements according to SCCR11. 11 Equity positions under the simple risk weight approach and internal models method: the amounts in row 11 correspond to RWA where the bank applies the simple risk weight approach or the internal model method, which remain available during the five-year linear phase-in arrangement as specified in SCRE17.2. Equity positions under the PD/LGD approach during the five-year linear phase-in arrangement should be reported in row 3. Where the regulatory treatment of equities is in accordance with the standardised approach, the corresponding RWA are reported in Template CR4 and included in row 2 of this template. 12 Equity investments in funds - look-through approach: RWA and capital requirements calculated in accordance with SCRE24. 13 Equity investments in funds - mandate-based approach: RWA and capital requirements calculated in accordance with SCRE24. 14 Equity investments in funds - fall-back approach: RWA and capital requirements calculated in accordance with SCRE24. 15 Settlement risk: the amounts correspond to the requirements in SCRE25. 16 to 19 Securitisation exposures in banking book: the amounts correspond to capital requirements applicable to the securitisation exposures in the banking book. The RWA amounts must be derived from the capital requirements (which include the impact of the cap in accordance with SCRE18.50 to SCRE18.55, and do not systematically correspond to the RWA reported in Templates SEC3 and SEC4, which are before application of the cap). 20 Market risk: the amounts reported in row 20 correspond to the RWA and capital requirements in the market risk standard (MAR), with the exception of amounts that relate to CVA risk (as specified in SCCR11 and reported in row 10). They also include capital charges for securitisation positions booked in the trading book but exclude the counterparty credit risk capital charges (reported in row 6 of this template). The RWA for market risk correspond to the capital charge times 12.5. 21 Of which: standardised approach: RWA and capital requirements according to the market risk standardised approach, including capital requirements for securitisation positions booked in the trading book. 22 Of which: Internal Models Approach: RWA and capital requirements according to the market risk IMA. 23 Capital charge for switch between trading book and banking book: outstanding accumulated capital surcharge imposed on the bank in accordance with Basel Framework “Risk-based capital requirements” (Boundary between the banking book and trading book) 25.14 and 25.15, when the total capital charge (across banking book and trading book) of a bank is reduced as a result of the instruments being switched between the trading book and the banking book at the bank's discretion and after their original designation. The outstanding accumulated capital surcharge takes into account any adjustment due to run-off as the positions mature or expire, in a manner agreed with SAMA. 24 Operational risk: the amounts corresponding to the minimum capital requirements for operational risk as specified in the operational risk standard (SOPE). 25 Amounts below the thresholds for deduction (subject to 250% risk weight): the amounts correspond to items subject to a 250% risk weight according to SACAP4.4. They include significant investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation and below the threshold for deduction, after application of the 250% risk weight. 26 Output floor applied: the output floor (expressed as a percentage) applied by the bank in its computation of the floor adjustment value in rows 27 and 28. 27 Floor adjustment (before the application of transitional cap): the impact of the output floor before the application of the transitional cap, based on the output floor applied in row 26, in terms of the increase in RWA. 28 Floor adjustment (after the application of transitional cap): the impact of the output floor after the application of the transitional cap, based on the output floor applied in row 26, in terms of the increase in RWA. The figure disclosed in this row takes into account the transitional cap (if any) applied by SAMA, which will limit the increase in RWA to 25% of the bank's RWA before the application of the output floor. 29 The bank's total RWA. Linkages across templates

Amount in [OV1:2/a] is equal to [CR4:12/e]

Amount in [OV1:3/a] and [OV1:5/a] is equal to the sum of [CR6: Total (all portfolios)/i]

Amount in [OV1:6/a] is equal to the sum of CCR1:6/f+CCR8:1/b+CCR8:11/b]

Amount in [OV1:16/c] is equal to the sum of [SEC3:1/n + SEC3:1/o + SEC3:1/p + SEC3:1/q] + [SEC4:1/n + SEC4:1/o + SEC4:1/p + SEC4:1/q]

Amount in [OV1:21/c] is equal to [MR1:12/a]

Amount in [OV1:22/c] is equal to [MR2:12]13. Comparison of Modelled and Standardised RWA

13.1 This chapter covers disclosures on RWA calculated according to the full standardised approach as compared to the actual RWA at the risk level, and for credit risk at asset class and sub-asset class levels. The disclosure requirements related in this section are not required to be completed by banks unless SAMA approve the bank to use the IRB and/or IMA approach.

13.2 The disclosure requirements under this section are:

13.2.1 Template CMS1 - Comparison of modelled and standardised RWA at risk level

13.2.2 Template CMS2 - Comparison of modelled and standardised RWA for credit risk at asset class level

13.3 Template CMS1 provides the disclosure of RWA calculated according to the full standardised approach as compared to actual RWA at risk level. Template CMS2 further elaborates on the comparison between RWA computed under the standardised and the internally modelled approaches by focusing on RWA for credit risk at asset class and sub-asset class levels.

Template CMS1 – Comparison of modelled and standardised RWA at risk level Purpose: To compare full standardised risk-weighted assets (RWA) against modelled RWA for banks which have received SAMA’s approval to use internal models in accordance with the Basel framework. The disclosure also provides the full standardised RWA amount that is the base of the output floor as defined in Basel Framework “Risk-based capital requirements” (calculation of minimum risk-based capital requirements) as specified in the Output floor to be issued by SAMA. Scope of application: The template is mandatory for all banks using internal models. Content: RWA. Frequency: Quarterly. Format: Fixed. Accompanying narrative: Banks are expected to explain the main drivers of difference (eg asset class or sub-asset class of a particular risk category, key assumptions underlying parameter estimations, national implementation differences) between the internally modelled RWA disclosed that are used to calculate their capital ratios and RWA disclosed under the full standardised approach that would be used should the banks not be allowed to use internal models. Explanation should be specific and, where appropriate, might be supplemented with quantitative information. In particular, if the RWA for securitisation exposures in the banking book are a main driver of the difference, banks are expected to explain the extent to which they are using each of the three potential approaches (SEC-ERBA, SEC-SA and 1,250% risk weight) for calculating SA RWA for securitisation exposures. a b c d RWA RWA for modelled approaches banks which have received SAMA approval to use internal model RWA for portfolios where standardised approaches are used Total Actual RWA (a + b) (ie RWA which banks report as current requirements) RWA calculated using full standardised approach (ie RWA used in capital floor computation) 1 Credit risk (excluding counterparty credit risk) 2 Counterparty credit risk 3 Credit valuation adjustment 4 Securitisation exposures in the banking book 5 Market risk 6 Operational risk 7 Residual RWA 8 Tota Definitions and instructions

Rows:

Credit risk (excluding counterparty credit risk, credit valuation adjustments and securitisation exposures in the banking book)

(row 1):

Definition of standardised approach: The standardised approach for credit risk. When calculating the degree of credit risk mitigation, banks must use the simple approach or the comprehensive approach with standard supervisory haircuts. This also includes failed trades and non-delivery-versus-payment transactions as set out in SCRE25.

The prohibition on the use of the IRB approach for equity exposures will be subject to a five-year linear phase-in arrangement as specified in SCRE17.2. During the phase-in period, the risk weight for equity exposures used to calculate the RWA reported in column (a) will be the greater of: (i) the risk weight as calculated under the IRB approach, and (ii) the risk weight set for the linear phase-in arrangement under the standardised approach for credit risk

RWA for modelled approaches that banks have SAMA approval to use (cell 1/a): For exposures where the RWA is not computed based on the standardised approach described above (ie subject to the credit risk IRB approaches (Foundation Internal Ratings-Based (F-IRB), Advanced Internal Ratings-Based (AIRB) and supervisory slotting approaches of the credit risk framework). The row excludes all positions subject to SCRE18 to SCRE23, including securitisation exposures in the banking book (which are reported in row 4) and capital requirements relating to a counterparty credit risk charge, which are reported in row 2.

RWA for portfolios where standardised approaches are used (cell 1/b): RWA which result from applying the above-described standardised approach.

RWA for portfolios where standardised approaches are used (cell 1/b): RWA which result from applying the above-described standardised approach.

Total actual RWA (cell 1/c): The sum of cells 1/a and 1/b.

RWA calculated using full standardised approach (cell 1/d): RWA as would result from applying the above-described standardised approach to all exposures giving rise to the RWA reported in cell 1/c.

Counterparty credit risk (row 2):

Definition of standardised approach: To calculate the exposure for derivatives, banks must use the standardised approach for measuring counterparty credit risk (SA-CCR). The exposure amounts must then be multiplied by the relevant borrower risk weight using the standardised approach for credit risk to calculate RWA under the standardised approach for credit risk.

RWA for modelled approaches that banks have SAMA approval to use (cell 2/a): For exposures where the RWA is not computed based on the standardised approach described above.

RWA for portfolios where standardised approaches are used (cell 2/b): RWA which result from applying the above-described standardised approach.

Total actual RWA (cell 2/c): The sum of cells 2/a and 2/b.

RWA calculated using full standardised approach (cell 2/d): RWA as would result from applying the above-described standardised approach to all exposures giving rise to the RWA reported in cell 2/c.

Credit valuation adjustment (row 3):

Definition of standardised approach: The standardised approach for CVA (SA-CVA), the basic approach (BA-CVA) or 100% of a bank’s counterparty credit risk capital requirements (depending on which approach the bank uses for CVA risk).

Total actual RWA (cell 3/c) and RWA calculated using full standardised approach (cell 3/d): RWA according to the standardised approach described above.

Securitisation exposures in the banking book (row 4):

Definition of standardised approach: The external ratings-based approach (SEC-ERBA), the standardised approach (SEC-SA) or a risk weight of 1,250%.

RWA for modelled approaches that banks have SAMA approval to use (cell 4/a): For exposures where the RWA is computed based on the SEC-IRBA or SEC-IAA.

RWA for portfolios where standardised approaches are used (cell 4/b): RWA which result from applying the above-described standardised approach.

Total actual RWA (cell 4/c): The sum of cells 4/a and 4/b.

RWA calculated using full standardised approach (cell 4/d): RWA as would result from applying the above-described standardised approach to all exposures giving rise to the RWA reported in cell 4/c.

Market risk (row 5):

Definition of standardised approach: The standardised approach for market risk. The SEC-ERBA, SEC-SA or a risk weight of 1,250% must also be used when determining the default risk charge component for securitisations held in the trading book.

RWA for modelled approaches that banks have SAMA approval to use (cell 5/a): For exposures where the RWA is not computed based on the standardised approach described above.

RWA for portfolios where standardised approaches are used (cell 5/b): RWA which result from applying the above-described standardised approach.

Total actual RWA (cell 5/c): The sum of cells 5/a and 5/b.

RWA calculated using full standardised approach (cell 5/d): RWA as would result from applying the above-described standardised approach to all exposures giving rise to the RWA reported in cell 5/c.

Operational risk (row 6):

Definition of standardised approach: The standardised approach for operational risk.

Total actual RWA (cell 6/c) and RWA calculated using full standardised approach (cell 6/d): RWA according to the revised standardised approach for operational risk.

Residual RWA (row 7):

Total actual RWA (cell 7/c) and RWA calculated using full standardised approach (cell 7/d): RWA not captured within rows 1 to 6 (ie the RWA arising from equity investments in funds (rows 12 to 14 in Template OV1), settlement risk (row 15 in Template OV1), capital charge for switch between trading book and banking book (row 23 in Template OV1) and amounts below the thresholds for deduction (row 25 in Template OV1)).

Total (row 8):

RWA for modelled approaches that banks have SAMA approval to use (cell 8/a): The total sum of cells 1/a, 2/a, 4/a and 5/a.

RWA for portfolios where standardised approaches are used (cell 8/b): The total sum of cells 1/b, 2/b, 3/b, 4/b, 5/b, 6/b and 7/b.

Total actual RWA (cell 8/c): The bank’s total RWA before the output floor adjustment. The total sum of cells 1/c, 2/c, 3/c, 4/c, 5/c, 6/c and 7/c.

RWA calculated using full standardised approach (cell 8/d): The bank’s RWA that are the base of the output floor, as specified in the Output floor to be issued by SAMA (ie amount before multiplication by 72.5%). The total sum of cells 1/d, 2/d, 3/d, 4/d, 5/d, 6/d and 7/d. Disclosed numbers in rows 1 to 7 are calculated purely for comparison purposes and do not represent requirements under the Basel framework.

Linkages across templates

[CMS1: 1/c] is equal to [OV1:1/a]

[CMS1: 2/c] is equal to [OV1:6/a]

[CMS1:3/c] is equal to [OV1:10/a]

[CMS1: 4/c] is equal to [OV1:16/a]

[CMS1: 5/c] is equal to [OV1:20/a]

[CMS1:5/d] is equal to [MR2:12/a] multiplied by 12.5

[CMS1:6/c] is equal to [OV1:24/a]Template CMS2 – Comparison of modelled and standardised RWA for credit risk at asset class level Purpose: To compare risk-weighted assets (RWA) calculated according to the standardised approach (SA) for credit risk at the asset class level against the corresponding RWA figure calculated using the approaches (including both the standardised and IRB approach for credit risk and the supervisory slotting approach) that banks have SAMA approval to use in accordance with the Basel framework for credit risk. Scope of application: The template is mandatory for all banks using internal models for credit risk. Similar to row 1 of Template CMS1, it excludes counterparty credit risk, credit valuation adjustments and securitisation exposures in the banking book. Content: RWA. Frequency: Semiannual. Format: Fixed. The columns are fixed, but the portfolio breakdowns in the rows will be set by SAMA to reflect the exposure classes required under national implementation of IRB and SA. Banks are encouraged to add rows to show where significant differences occur. Accompanying narrative: Banks are expected to explain the main drivers of differences between the internally modelled amounts disclosed that are used to calculate their capital ratios and amounts disclosed should the banks apply the standardised approach. Where differences are attributable to mapping between IRB and SA, banks are encouraged to provide explanation and estimated materiality. a b c d RWA RWA for modelled approaches that banks have SAMA approval to use RWA for column (a) if re-computed using the standardised approach Total Actual RWA (ie RWA which banks report as current requirements) RWA calculated using full standardised approach (ie RWA used in the base of the output floor) 1 Sovereign Of which: categorised as MDB/PSE in SA 2 Banks and other financial institutions 3 Equity1 4 Purchased receivables 5 Corporates Of which: F-IRB is applied Of which: A-IRB is applied 6 Retail Of which: qualifying revolving retail Of which: other retail Of which: retail residential mortgages 7 Specialised lending Of which: income-producing real estate and high volatility commercial real estate 8 Others 9 Total Definitions and instructions

Columns:

RWA for modelled approaches that banks have SAMA approval to use (column (a)): Represents the portion of RWA according to the IRB approach for credit risk as specified in SCRE10 to SCRE16.

Corresponding standardised approach RWA for column (a) (column (b)): RWA equivalent as derived under the standardised approach.

Total actual RWA (column (c)): Represents the sum of the RWA for modelled approaches that banks have SAMA approval to use and the RWA under standardised approaches.

RWA calculated using full standardised approach (column (d)): Total RWA assuming the full standardised approach applied at asset class level.

Disclosed numbers for each asset class are calculated purely for comparison purposes and do not represent requirements under the Basel framework.Linkages across templates

[CMS2:9/a] is equal to [CMS1:1/a]

[CMS2:9/c] is equal to [CMS1:1/c]

[CMS2:9/d] is equal to [CMS1:1/d]

1 The prohibition on the use of the IRB approach for equity exposures will be subject to a five-year linear phase-in arrangement as specified in SCRE17.2. During the phase-in period, the risk weight for equity exposures (to be reported in column (a)) will be the greater of: (i) the risk weight as calculated under the IRB approach, and (ii) the risk weight set for the linear phase-in arrangement under the standardised approach for credit risk. Column (b) should reflect the corresponding RWA for these exposures based on the phased-in standardised approach. After the phase-in period, columns (a) and (b) for equity exposures should both be empty.

14. Composition of Capital and TLAC

14.1 The disclosures described in this chapter cover the composition of regulatory capital, the main features of regulatory capital instruments and, for global systemically important banks, the composition of total loss-absorbing capacity and the creditor hierarchies of material subgroups and resolution entities. The disclosure requirements related to TLAC only, are not required to be completed by banks unless otherwise specified by SAMA.

14.2 The disclosure requirements set out in this chapter are:

14.2.1 Table CCA - Main features of regulatory capital instruments and of other total loss-absorbing capacity (TLAC) - eligible instruments

14.2.2 Template CC1 - Composition of regulatory capital

14.2.3 Template CC2 - Reconciliation of regulatory capital to balance sheet

14.2.4 Template TLAC1 - TLAC composition for global systemically important banks (G-SIBs) (at resolution group level)

14.2.5 Template TLAC2 - Material subgroup entity - creditor ranking at legal entity level

14.2.6 Template TLAC3 - Resolution entity - creditor ranking at legal entity level

14.3 The following table and templates must be completed by all banks:

14.3.1 Table CCA details the main features of a bank's regulatory capital instruments and other TLAC-eligible instruments, where applicable. This table should be posted on a bank's website, with the web link referenced in the bank's Pillar 3 report to facilitate users' access to the required disclosure. Table CCA represents the minimum level of disclosure that banks are required to report in respect of each regulatory capital instrument and, where applicable, other TLAC-eligible instruments issued.2

14.3.2 Template CC1 details the composition of a bank's regulatory capital.

14.3.3 Template CC2 provides users of Pillar 3 data with a reconciliation between the scope of a bank's accounting consolidation, as per published financial statements, and the scope of its regulatory consolidation.

14.4 The following additional templates must be completed by banks which have been designated as G-SIBs:

14.4.1 Template TLAC1 provides details of the TLAC positions of G-SIB resolution groups. This disclosure requirement applies to all G-SIBs at the resolution group level. For single point of entry G-SIBs, there is only one resolution group. This means that they only need to complete Template TLAC1 once to report their TLAC positions.

14.4.2 Templates TLAC2 and TLAC3 present information on creditor rankings at the legal entity level for material subgroup entities (ie entities that are part of a material subgroup) which have issued internal TLAC to one or more resolution entities, and also for resolution entities. These templates provide information on the amount and residual maturity of TLAC and on the instruments issued by resolution entities and material subgroup entities that rank pari passu with, or junior to, TLAC instruments.

14.5 Templates TLAC1, TLAC2 and TLAC3 become effective from the TLAC conformance date.

14.6 Through the following three-step approach, all banks are required to show the link between the balance sheet in their published financial statements and the numbers disclosed in Template CC1:

14.6.1 Step 1: Disclose the reported balance sheet under the regulatory scope of consolidation in Template CC2. If the scopes of regulatory consolidation and accounting consolidation are identical for a particular banking group, banks should state in Template CC2 that there is no difference and move on to Step 2. Where the accounting and regulatory scopes of consolidation differ, banks are required to disclose the list of those legal entities that are included within the accounting scope of consolidation, but excluded from the regulatory scope of consolidation or, alternatively, any legal entities included in the regulatory consolidation that are not included in the accounting scope of consolidation. This will enable users of Pillar 3 data to consider any risks posed by unconsolidated subsidiaries. If some entities are included in both the regulatory and accounting scopes of consolidation, but the method of consolidation differs between these two scopes, banks are required to list the relevant legal entities separately and explain the differences in the consolidation methods. For each legal entity that is required to be disclosed in this requirement, a bank must also disclose the total assets and equity on the entity's balance sheet and a description of the entity's principal activities.

14.6.2 Step 2: Expand the lines of the balance sheet under the regulatory scope of consolidation in Template CC2 to display all of the components that are used in Template CC1. It should be noted that banks will only need to expand elements of the balance sheet to the extent necessary to determine the components that are used in Template CC1 (eg if all of the paid-in capital of the bank meets the requirements to be included in Common Equity Tier 1 (CET1) capital, the bank would not need to expand this line). The level of disclosure should be proportionate to the complexity of the bank's balance sheet and its capital structure.

14.6.3 Step 3: Map each of the components that are disclosed in Template CC2 in Step 2 to the composition of capital disclosure set out in Template CC1.

Table CCA - Main features of regulatory capital instruments and of other TLAC-eligible instruments Purpose: Provide a description of the main features of a bank's regulatory capital instruments and other TLAC-eligible instruments, as applicable, that are recognised as part of its capital base / TLAC resources. Scope of application: The template is mandatory for all banks. In addition to completing the template for all regulatory capital instruments, G-SIB resolution entities should complete the template (including lines 3a and 34a) for all other TLAC-eligible instruments that are recognised as external TLAC resources by the resolution entities, starting from the TLAC conformance date. Internal TLAC instruments and other senior debt instruments are not covered in this template. Content: Quantitative and qualitative information as required. Frequency: Table CCA should be posted on a bank's website. It should be updated whenever the bank issues or repays a capital instrument (or other TLAC-eligible instrument where applicable), and whenever there is a redemption, conversion/writedown or other material change in the nature of an existing instrument. Updates should, at a minimum, be made semiannually. Banks should include the web link in each Pillar 3 report to the issuances made over the previous period. Format: Flexible. Accompanying information: Banks are required to make available on their websites the full terms and conditions of all instruments included in regulatory capital and TLAC. a Quantitative / qualitative information 1 Issuer 2 Unique identifier (eg Committee on Uniform Security Identification Procedures (CUSIP), International Securities Identification Number (ISIN) or Bloomberg identifier for private placement) 3 Governing law(s) of the instrument 3a Means by which enforceability requirement of Section 13 of the TLAC Term Sheet is achieved (for other TLAC-eligible instruments governed by foreign law) 4 Transitional Basel III rules 5 Post-transitional Basel III rules 6 Eligible at solo/group/group and solo 7 Instrument type (refer to SACAP) 8 Amount recognised in regulatory capital (currency in millions, as of most recent reporting date) 9 Par value of instrument 10 Accounting classification 11 Original date of issuance 12 Perpetual or dated 13 Original maturity date 14 Issuer call subject to prior SAMA approval 15 Optional call date, contingent call dates and redemption amount 16 Subsequent call dates, if applicable Coupons / dividends 17 Fixed or floating dividend/coupon 18 Coupon rate and any related index 19 Existence of a dividend stopper 20 Fully discretionary, partially discretionary or mandatory 21 Existence of step-up or other incentive to redeem 22 Non-cumulative or cumulative 23 Convertible or non-convertible 24 If convertible, conversion trigger(s) 25 If convertible, fully or partially 26 If convertible, conversion rate 27 If convertible, mandatory or optional conversion 28 If convertible, specify instrument type convertible into 29 If convertible, specify issuer of instrument it converts into 30 Writedown feature 31 If writedown, writedown trigger(s) 32 If writedown, full or partial 33 If writedown, permanent or temporary 34 If temporary write-down, description of writeup mechanism 34a Type of subordination 35 Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument in the insolvency creditor hierarchy of the legal entity concerned). 36 Non-compliant transitioned features 37 If yes, specify non-compliant features Instructions

Banks are required to complete the template for each outstanding regulatory capital instrument and, in the case of G-SIBs, TLAC-eligible instruments (banks should insert "NA" if the question is not applicable).