Appendices

Appendix A – Defined Terms

The following are considered defined terms for the purpose of this Framework.

Defined Term Definition Access Management The process of granting authorised users the right to use

a service, while preventing access to non-authorised

users.Anomalous Session Log-in sessions to mobile or online services that have

different log-in parameters to those previously used by

the customer, e.g., Device ID or location; or when the IP

address is flagged as a risk.Anomaly Detection Finding patterns in data that depart significantly from the

expected behaviour. Fraud anomaly detection can be

implemented as an intelligence tool using unsupervised

Machine Learning algorithms.Artificial Intelligence The use of computer systems to perform tasks typically

requiring human knowledge and logical capabilities,

often in problem solving scenarios.Black Box System A complex system where the internal rules and

mechanisms are not visible to or understood by the

system owner.Blacklist A list of untrustworthy or high risk individuals or entities

that should be excluded and avoided. Also known as

block-list.Case Management System A system used to manage alerts and fraud incidents from

an initial report, through investigation, resolution and

remediation where required.Code of Conduct A defined set of expectations which outline principles,

values, and behaviours that an organisation considers

important to its operations and success.Contractor An individual or organisation under contract for the

provision of services to an organisation.Counter-Fraud Culture The shared values, beliefs, knowledge, attitudes and

understanding about fraud risk within an organisation. In

a strong Counter-Fraud culture people proactively

identify, discuss, and take responsibility for fraud risks.Counter-Fraud

GovernanceA set of responsibilities and practices exercised by the

Board, Executive and Senior Management with the goal

of providing strategic direction for countering fraud,

ensuring that Counter-Fraud objectives are achieved, ascertaining that fraud risks are managed appropriately

and verifying that the enterprise's resources are used

responsibly.Counter-Fraud

Governance Committee

(CFGC)An established group of individuals tasked with providing

oversight and direction, and ensuring that the

organisation’s combined Counter-Fraud capabilities are

functioning appropriately and efficiently.Counter-Fraud Maturity The extent to which an organisation’s resources are

effectively implemented for the purpose of countering

fraud in comparison to global accepted standards and

best practice.Counter-Fraud Policy A set of criteria for the provision of Counter-Fraud

activities. It sets the commitment and objectives for

Counter-Fraud and documents responsibilities.Counter-Fraud

ProgrammeA collection of policies, processes, guidelines, risk

management approaches, actions, training, best

practices, assurance, and technologies that are used to

protect the Member Organisation and its customers

against internal and external fraud threats.Counter-Fraud Strategy A high-level plan, consisting of projects and initiatives, to

mitigate fraud risks while complying with legal, statutory,

contractual, and internally prescribed requirements.Counter-Fraud

DepartmentA dedicated department or team established for the

purpose of managing the implementation of the

organisation’s Counter-Fraud objectives.Critical services Services provided by a third party where a failure or

disruption in the provision of services could leave the

Member Organisation unable to serve its customers or

meet its regulatory obligations.Cyber Security Cyber security is defined as the collection of tools,

policies, security concepts, security safeguards,

guidelines, risk management approaches, actions,

training, best practices, assurance, and technologies that

can be used to protect the Member Organisation's

information assets against internal and external threats.Due Diligence The investigation of an employee, customer or third

party to confirm facts and that it is as presented.Emergency Stop A self-service capability for customers to immediately

freeze their account and block further transactions if they

suspect their account has been compromisedEmployee Employees encompass members of the Board of

Directors and its committees, Executives, permanent and

contract employees, consultants, and employees working

through a third partyEntity Resolution A process to identify data records in a single data source

or across multiple data sources that refer to the same

real-world entity and to link the records together.External Fraud A fraudulent event conducted by any persons on the

‘outside’ of the organisation i.e., not employed by the

organisation.Financial Crime Criminal activities to provide economic benefit including

money laundering; terrorist financing; bribery and

corruption; and market abuse and insider dealing.Fraud Any act that aims to obtain an unlawful benefit or cause

loss to another party. This can be caused by exploiting

technical or documentary means, relationships or social

means, using functional powers, or deliberately

neglecting or exploiting weaknesses in systems or

standards, directly or indirectly.Fraud case An individual occurrence of fraud recognised by an

organisation.Fraud Landscape/Threat

LandscapeFraud threats, trends, and developments in the political,

economic, social, technological, or legal environment.Fraud Response Plan A plan which details the actions to be undertaken when a

fraud is suspected or has been detected. This will include

reporting protocols, team responsibilities and

information logging.Fraud Risk Appetite The level of fraud risk that an organisation is willing to

accept or tolerate in pursuit of its objectives.Fraud Risk Assessment A process aimed at addressing the organisation’s

vulnerability to fraud. This will include identification of

fraud risks, assessment of the likelihood that fraud risks

will occur and the resulting impact, determination of the

appropriate response, and review of the control

framework.Fraud Risk Management The ongoing process of identifying, analysing, monitoring,

and responding to fraud risks to which the organisation

and its customers are exposed.Fraud Scenario Analysis The testing of devised fraud scenarios for the purpose of

assessing the current capability of fraud systems within

the organisation.Fraud Threat Any circumstance or event with the potential to result in

a fraud event occurring.Fraud Typology A categorisation of a fraud event based on its

methodology and common themes with other fraud

events.Geofencing Restricting access to online or mobile services based

upon the user's geographical location.Incident A fraud case or series of associated cases. Inherent Risk The fraud risks posed to the organisation’s business

operations or its customers if there were no controls

present.Intelligence Monitoring The process of continually reviewing and gathering

intelligence on new and emerging fraud threats and

typologies from a comprehensive range of sources.Internal Fraud Fraud committed by or with the assistance of people

employed by the organisation.Key Risk Indicators (KRIs) A measure used to indicate the probability an activity or

organisation will exceed its defined risk appetite. KRIs are

used by organisations to provide an early signal of

increasing risk exposures in various areas of the

enterprise.Keyword Analysis Codifying rules to match key words on a look-up table to

those within key fields of a fraud case record. Complexity

can be added to rules such as requiring the words to be

in a particular order or high-risk terms that have often

indicated fraud.Machine Learning The use of computer systems that have the capability to

learn and adapt without explicit instruction through the

use of algorithms or models to analyse and build on

patterns and trends in data.Management Information Information collated and then presented, often in the

form of a report or statement, to management or

decision makers for the purpose of identifying trends,

solving issues and/or forecasting the future.Member Organisation All financial institutions or financial services providers

regulated by SAMA.Model Validation Analysis to assess whether the outputs of a system are

performing as expected.Mule accounts Accounts set-up (often via remote or online channels) to

receive fraudulently obtained funds and launder the

proceeds of crime.Multi-Factor

AuthenticationAuthentication using two or more factors to achieve

authentication. Factors include something you know

(e.g., password/PIN), something you have (e.g.,

cryptographic identification device, token), or something

you are (e.g., biometric).Near Misses Potential fraud incidents that are detected and

remediated prior to the fraud incident resulting in a

monetary loss.Policy Breach The failure to comply with or disregard of policy

requirements.Precision and Recall

TestingMetrics to evaluate the effectiveness of models.

Precision: The ability of a classification model to identify

only the relevant data points.

Recall: The ability of a model to find all the relevant cases

within a data set.Predictive Analytics The use of statistics and modelling techniques to

determine future outcomes or performance.RACI Matrix Illustrates who is Responsible, Accountable, Consulted

and Informed within an organisational framework.Residual Risk The remaining risk after management has implemented a

risk response.Risk A measure of the extent to which an organisation is

threatened by a potential circumstance or event, and

typically a function of: (i) the adverse impacts that would

arise if the circumstance or event occurs; and (ii) the

likelihood of occurrence.Risk Factors Different categories of risk that organisations must

consider considered when performing a Fraud Risk

AssessmentRules Rules used in fraud prevention and detection systems use

correlation, statistics, and logical comparison of data to

identify a pattern based on insights gained from previous

known fraud incidents.Scams Where an individual is tricked into making or authorising

a payment to a criminal’s account. Scammers typically

use social engineering and can impersonate banks,

investment opportunities, utility companies and

government bodies using emails, phone calls and SMS

that appear genuine.Sectorial Anti-Fraud

CommitteeA committee governed by SAMA to combat fraud

involving Member Organisations operating in the

Kingdom (e.g., Banking Anti-Fraud Committee).Senior Management The highest level of management in an organisation (the

level below the Board) and their direct reports.Service Level Agreement

(SLA)The specific responsibilities for delivery, typically an

agreement on timeliness or quality, for example relating

to management of fraud alerts.Static Data Data with low change frequency (e.g., name, email

address, mobile phone number, signatory rights,

specimen signatures, power-of-attorney).The Cyber Security

FrameworkSAMA's Cyber Security Framework. Third Party A separate unrelated entity that provides an organisation

with a service. This may include suppliers, technology

providers (e.g., Absher, Nafath), outsourcers,

intermediaries, brokers, introducers, and agents.Threat Intelligence Threat intelligence is evidence-based knowledge,

including context, mechanisms, indicators, implications,

and actionable advice, about an existing or emerging

menace or hazard to assets that can be used to inform

decisions regarding the subject's response to that

menace or hazard.Trend Analysis The process of collecting and reviewing information to

identify patterns and predict future trends.Trusted Device A trusted device is a device that the customer owns,

controls access to, and uses often.Violation Any act, or concealment of acts, of fraud, corruption,

collusion, coercion, unlawful conduct, misconduct,

financial mismanagement, accounting irregularities,

conflict of interest, wrongful conduct, illegal or unethical

practices or other violations of any applicable laws and

instructions.Whistle Blowing Policy SAMA Whistle Blowing Policy for Financial

Institutions.Wholesale Payment

Endpoint SecurityMeasures taken with respect to endpoint hardware,

software, physical access, logical access, organisation and

processes at a point in place and time at which payment

instruction information is exchanged between two

parties in the ecosystem.Appendix B – Fraud Types that May Impact a Member Organisation and Its Customers.

The following is a non-exhaustive list of fraud types that should be considered by a Member Organisation when relevant to its products.

- Social engineering (e.g., capture of customer credentials; investment scams; purchase scams; invoice scams; advance fee scams).

- Account takeover (e.g., gaining access to a customer product or device to control assets or transact).

- Impersonation (e.g., obtaining personal information to use for own benefit; assuming the identity of another to access products; impersonating a government body to obtain customer information).

- Internal fraud (e.g., misappropriation of assets; procurement fraud; theft of assets or cash; theft of intellectual property; falsification of information; unauthorised passing of information to third parties; false expense claims; abuse of authority; collusion; use of organisation assets for own gain; diversion of funds).

- Accounting fraud (e.g., concealment; false invoicing; payroll fraud; improper revenue recognition; overstatement of assets; understatement of liabilities; customer overbilling; treasury and investment fraud).

- Application fraud (e.g., failing to disclose information; falsification of information; providing false documents).

- Wholesale Payment Endpoint Security fraud.

- Banking and payment products: Credit/Debit card fraud; Online or mobile app payment fraud; Cheque fraud; ATM fraud; Mule fraud.

- Credit and lending products: Mortgage fraud; Loan fraud.

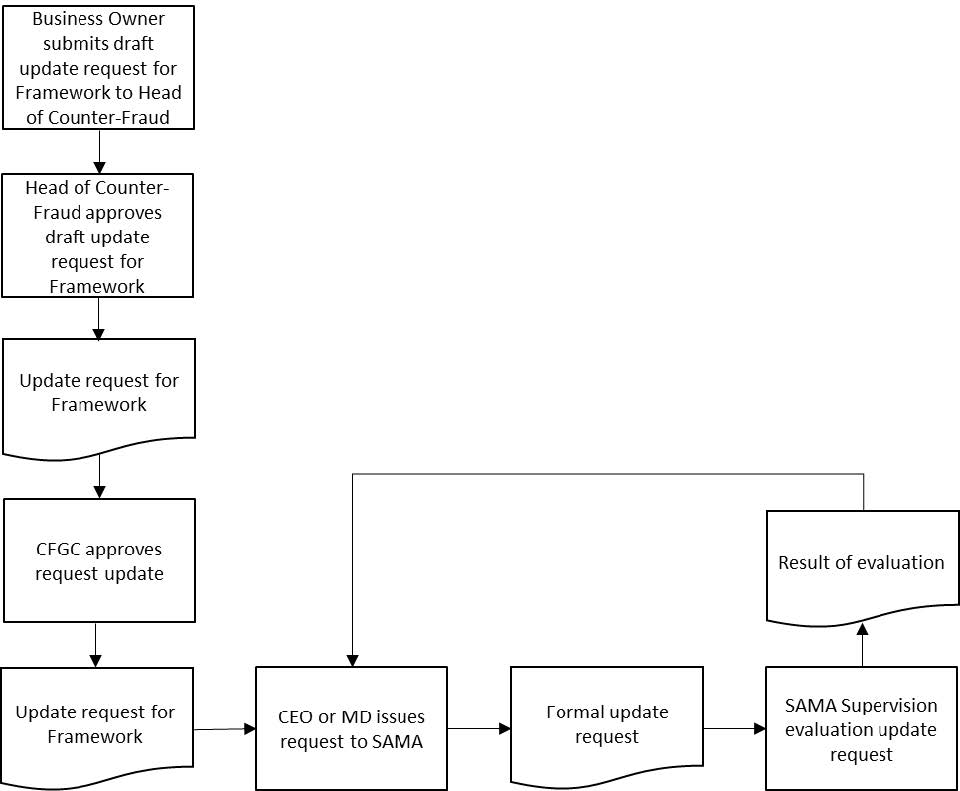

Appendix C – How to Request an Update to the Framework

- Below is an illustration of the process for requesting an update to the Framework.

- Detail information supported by pros and cons about the suggested update.

- The request should first be approved by the Head of Counter-Fraud before submitting to the Counter-Fraud Governance Committee (CFGC).

- The request should be approved by Member Organisation's CFGC.

- The request should be sent formally in writing to the manager 'General Department of Cyber Risk Control' via the Member Organisation's CEO or managing director.

- 'General Department of Cyber Risk Control' will evaluate the request and inform the Member Organization.

- The current Framework remains applicable while the requested update is being considered, processed and if applicable is approved and processed.

Appendix D – Framework Update Request Form

Request to Update the Counter-Fraud Framework

A submission to the manager of SAMA General Department of Cyber Risk Control.

SAMA will consider requests from a member organisation (MO) to update its Counter-Fraud Framework based on the information submitted using the form below. A separate form must be completed for each requested update. Please note that all required fields must be properly filled in before SAMA will begin the review process

Requestor Information

REQUESTOR'S SIGNATURE*

xREQUESTOR'S POSITION* DATE* REQUESTOR'S NAME*

MEMBER ORGANISATION OF REQUESTOR*

FRAMEWORK SECTION*:

PURPOSE OF REQUESTED UPDATE (including detailed information on its pros and cons)*:

PROPOSAL*:

Approvals

1. MO’s HEAD OF COUNTER-FRAUD APPROVAL*

DATE*

2. MO’S COUNTER-FRAUD GOVERNANCE COMMITTEE

APPROVAL*

APPROVER’S POSITION*

DATE*

3. SAMA DECISION

SAMA APPROVAL

DATE

* Denotes required fields

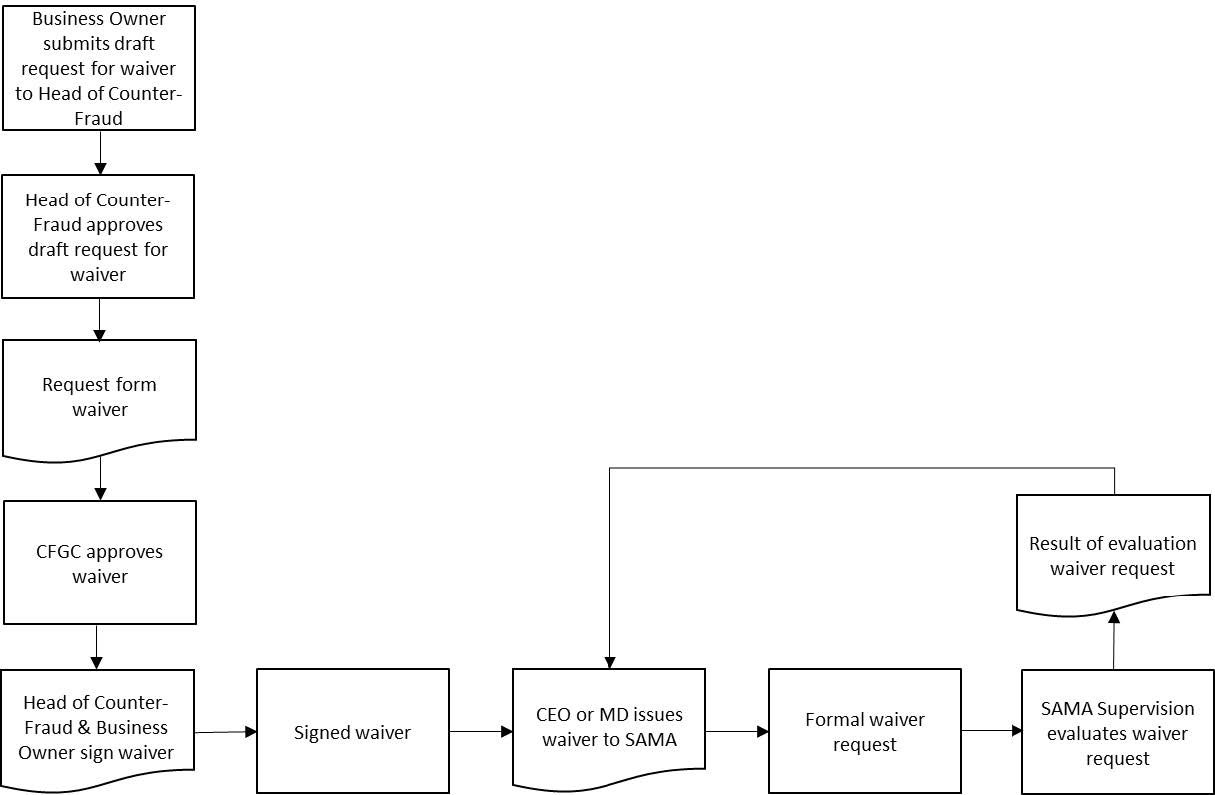

Appendix E – How to Request a Waiver from the Framework

Below is an illustration of the process for requesting a waiver from the Framework.

- Detail description about the reasons that the member organisation could not meet the required control.

- Detail description about the available or suggested compensating controls.

- The waiver request should first be approved by the Head of Counter-Fraud before submitting to the Counter-Fraud Governance Committee (CFGC).

- The waiver request should be approved by the members of Member Organisation’s Counter-Fraud Governance Committee.

- The waiver request should be signed by the Head of Counter-Fraud and relevant (business) owner.

- The waiver request should be formally issued in writing to the manager of ‘General Department of Cyber Risk Control’ via the Member Organisation’s CEO or managing director.

- ‘General Department of Cyber Risk Control’ will evaluate the waiver request and inform the Member Organisation.

The current Framework remains applicable while the requested waiver is being evaluated and processed, until the moment of granting the waiver.

Appendix F – Framework Waiver Request Form

Request for Waiver from the SAMA Counter-Fraud Framework

A submission to the manager of 'General Department of Cyber Risk Control’

SAMA will consider requests for waiver from a member organisation (MO) from its Counter-Fraud Framework based on the information submitted using the form below. A separate form must be completed for each requested waiver. Please note that all required fields must be properly filled in before SAMA will begin the review process.

Requestor Information

REQUESTOR'S SIGNATURE*

xREQUESTOR'S POSITION* DATE* REQUESTOR'S NAME*

MEMBER ORGANISATION OF REQUESTOR*

FRAMEWORK CONTROL*:

DETAILED DESCRIPTION OF WHY CONTROL CANNOT BE IMPLEMENTED*:

DETAILED DESCRIPTION OF AVAILABLE OR SUGGESTED COMPENSATING CONTROLS*:

Approvals

1. MO’s HEAD OF COUNTER-FRAUD APPROVAL*

DATE*

2. MO’S COUNTER-FRAUD GOVERNANCE COMMITTEE

APPROVAL*

APPROVER’S POSITION*

DATE*

3.SAMA DECISION

SAMA APPROVAL

DATE**

* Denotes required fields

** The validity of this waiver is one year. It is the Member Organisations responsibility to ensure renewal of this waiver.

Appendix G – Supervisor Notification Form

Fraud Supervisory Notification

A submission to the manager of SAMA General Department of Cyber Risk Control.

SAMA requires immediate notification of new fraud typologies and significant fraud incidents to mitigate the risk of the fraud impacting additional customers, other organisations, or the financial sector in the KSA. This form should be used to provide the notification. Please note that all required information must be provided, however it is understood that not all information may be available at the time of notification. Where information is not available at the time of notification, any gaps should be supplied to SAMA promptly as the investigation progresses.

Notifier Information

NOTIFIER’S SIGNATURE*

NOTIFIER’S POSITION*

DATE*

NOTIFIER’S NAME*

MEMBER ORGANISATION OF NOTIFIER*

FRAUD NOTIFICATION TYPE*

DATE OF INCIDENT*

☐ New typology ☐ Significant internal fraud ☐ Significant external fraud ☐ Significant accounting irregularity ☐ Wholesale Payment Endpoint Security Fraud ORIGIN OF THE INCIDENT*:

METHODS USED*:

RELATED PARTIES (INTERNAL AND EXTERNAL)*:

OUTCOME (INCLUDING LOSSES WHERE APPLICABLE)*:

CORRECTIVE ACTIONS*:

ADDITIONAL INFORMATION:

* Denotes required fields