7. Policy Requirements

7.1 The Standardized Approach

The Banks must calculate minimum ORC requirements based on the Standardized Approach by multiplying the BIC and the ILM:

ORC = BIC x ILM

Where-

(a) Business Indicator Component (BIC) is calculated as the sum of:

(i) 12% of the Bank’s BI;

(ii) if the Bank’s BI exceeds SAR 4.46 billion, 3% of the amount by which the BI exceeds SAR 4.46 billion; and

(iii) if the Bank’s BI exceeds SAR 133.8 billion, 3% of the amount by which the BI exceeds SAR 133.8 billion;2

BI is elaborated in section 7.2

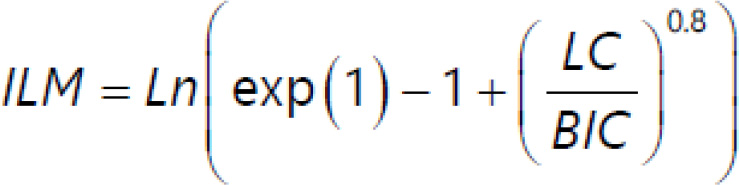

(b) Internal Loss Multiplier (ILM) is calculated as follow:

The explanation of ILM is given in section 7.3

Risk-weighted assets (RWA) for operational risk are equal to 12.5 times ORC.

2 For example, given a BI of SAR 140 billion, BIC = (SAR 140 billion x 12%) + [(SAR 140 billion – SAR 4.46 billion) x 3%] + [(SAR 140 billion – SAR 133.8 billion) x 3%] = (SAR 140 billion x 12%) + (135.54 billion x 3%) + (6.2) x 3%) = SAR 21.05 billion.

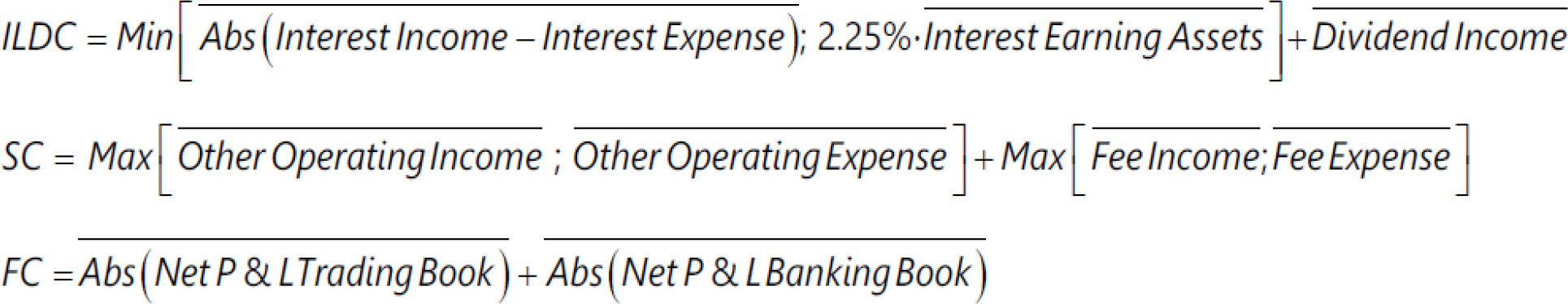

7.2 The Business Indicator

The Business Indicator (BI) comprises of three components: the interest, leases and dividend component (ILDC); the services component (SC), and the financial component (FC). The BI is calculated as follow:

BI = ILDC + SC + FC

ILDC, SC and FC are calculated by the following formula:

Where:

A bar above a term indicates that it is calculated as the average over three years: t, t-1 and t-2.

(Abs) is the absolute value of the terms within the brackets. The absolute value of net items must be calculated first for each financial year, and the average of the past three consecutive financial years must be calculated based on the absolute value of net items for each financial year.

The definitions for each of the components of the BI are provided in Annexure 1.7.3 The Internal Loss Multiplier

7.3.1 A bank’s internal operational risk loss experience affects the calculation of operational risk capital through the Internal Loss Multiplier (ILM). The ILM is defined as below, where the Loss Component (LC) is equal to 15 times average annual operational risk losses incurred over the previous 10 years:

7.3.2 The ILM is equal to one where the Loss Component (LC) and Business Indicator Component (BIC) are equal. Where the LC is greater than the BIC, the ILM is greater than one. That is, a bank with losses that are high relative to its BIC is required to hold higher capital due to the incorporation of internal losses into the calculation methodology. Conversely, where the LC is lower than the BIC, the ILM is less than one. That is, a bank with losses that are low relative to its BIC is required to hold lower capital due to the incorporation of internal losses into the calculation methodology.

7.3.3 The calculation of average losses in the Loss Component must be based on 10 years of high-quality annual loss data. As part of the transition to the standardized approach, banks that do not have 10 years of high-quality loss data may use a minimum of five years of data to calculate the Loss Component, however, the term for transition will require SAMA’s approval. Banks that do not have five years of high-quality loss data must calculate the capital requirement based solely on the BI Component. Further, those Banks that do not have high-quality annual loss data for 5 years are required to approach SAMA to seek approval either to use loss data for the period less than five years or use ILM greater than 1 or as advised by SAMA.

7.3.4 The Banks with a BI less than or equal to SAR 4.46 billion must set the ILM equal to 1 in the calculation of ORC requirement (that is, calculate ORC based solely on the BIC), unless the Bank has obtained the SAMA’s written approval to calculate the ILM in accordance with paragraph 7.3.1 for the calculation of ORC. SAMA will not grant such approval unless the Bank meets all the criteria set out in sections 8 to 12.

7.4 Minimum Standards for the Use of Loss Data Under the Standardized Approach

7.4.1 The Banks with a BI greater than SAR 4.46 billion are required to use loss data as a direct input into the operational risk capital calculations. Banks, which do not meet the loss data standards, as mentioned in section 6 to 10 of this document, are required to hold capital that is at a minimum equal to 100% of the BIC. In such cases, SAMA may require the bank to apply an ILM which is greater than 1. The exclusion of internal loss data due to non-compliance with the loss data standards, and the application of any resulting multipliers, must be publicly disclosed in Pillar 3.

7.4.2 The soundness of data collection and the quality and integrity of the data are crucial to generating capital outcomes aligned with the bank’s operational loss exposure. The qualitative requirements for loss data collection are outlined in sections 8 and 9.