5.2 Identifying the Workout Options

5.2.1 Purpose of Workout

Under a best-case workout scenario, the bank and the viable (or marginally viable) borrower will agree on the restructuring strategy aiming to return the defaulted borrower to a fully performing status in the shortest feasible time frame. This requires matching the borrower's sustainable repayment capacity with the correct restructuring option(s). There is no one standard (“one size fits all") approach and instead, the Workout Unit must choose from a variety of options to tailor a restructuring plan that meets the needs of specific borrower.

For the bank to consider approving a restructuring plan, the borrower must meet two essential pre-conditions: (i) borrower's projected cash flows must be sufficient to repay all or a substantial portion of its past due to obligations within a reasonable time frame: and (ii) borrower must display cooperative behavior.

Not all borrowers will be able to repay their obligations in full. However, this does not mean they should automatically be subject to legal action. Banks are advised to invoke out of court settlements for borrowers willing to cooperate with the restructuring process and are able to demonstrate that the economic loss as a result of any foreseeable restructuring is likely to be lower than seeking foreclosure. Instead, the bank should proceed with restructuring whenever it can reasonably document that the revised terms (which may include conditional loan forgiveness) will result in a greater recovery value for the bank than a legal procedure (bankruptcy or foreclosure).

In a syndicated or multi-bank scenario, wherein minority banks don't agree to a restructured/ work out solution, dissenting banks may utilize the guidelines laid down in the Bankruptcy law.

5.2.2 Workout Options

At the initial segmentation stage, the loan-to-value and viability parameters are generally used to help identify potentially viable borrowers (Refer to Chapter 3). This group of borrowers is then subject to in-depth financial analysis and business viability assessment, which narrows the number of candidates for potential restructuring even further. At this stage, the Workout Unit should have a fully informed view as to the nature and causes of the borrower's difficulties. Based on this understanding, the Workout Unit should work with the borrower on developing a realistic repayment plan designed around the borrower's projected sustainable cash flows and/or the liquidation of assets within acceptable timeframes. Understanding and knowing when to use each of the options discussed below provides a Workout Unit with the flexibility necessary to tailor appropriate restructuring proposals.

Consider personal guarantees, conversion of loans from owner(s) to equity or other subordinated form, capital increase, additional collateral, sale of excess assets, achievement of certain levels of financial indicators.

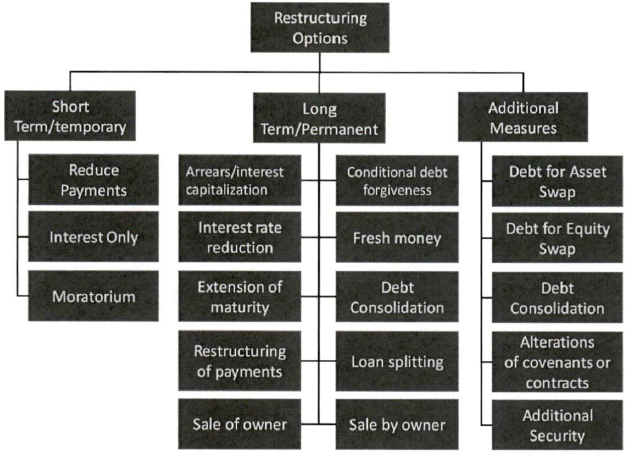

Borrower Type Workout Measure Description Viable Normal reprogramming Future cash flows sufficient for repayment of loan until a sustainable level of cash flow reached within the stipulated period (Actual timeline dependent on the profile of the borrower and tenor of the loan). Consider personal guarantees, conversion of loans from owner(s) to equity or other subordinated form, capital increase, additional collateral, sale of excess assets, achievement of certain levels of financial indicators. Marginal Extended repayment period Extended period of reprogramming (rescheduling) needed to reach a sustainable level of cash flow, i.e., with final payment in equal installments or balloon or bullet payment. Loan Splitting Loan is split into two parts: the first, representing the amount that can be repaid from sustainable cash flow) is repaid in equal installments (principal and interest) with a specified maturity date; the remaining portion is considered to be excess loan (which can be subordinated), which may be split into several parts/tranches. These may be non-interest bearing with interest payable either at maturity or from the proceeds of specific asset sales. Conditional Loan Forgiveness To be used to encourage owners to make an additional financial contribution to the company and to ensure that their interests are harmonized with those of the bank, particularly in those cases when the net present value of the company (taking into consideration all collateral and potential cash flow) is lower than the total loan. Bank may choose to: i. Partial write-off in the framework of the owner's cash equity contribution, particularly in all cases where the owner(s) have not guaranteed the loan; ii. Partial write-off in the framework of a cash capital increase from a third-party investor where they have not assumed the role of the guarantor; iii. Partial write-off in the case of a particularly successful business restructuring that materially deviates from the operating plan that served as the basis for the restructuring; iv. Partial write-off in those cases when the above-average engagement of the owner(s) (i.e. successful sale of excess assets) guarantees a higher level of repayment to the bank(s). Loans can also be written off if the collateral has no economic value, and such action ensures the continuation of the borrower's operations and the bank has confidence in the management or if the cause for the problems came from objective external factors. Loan to Equity Swaps Appropriate for medium-sized companies where the company can be sold, has established products/services, material know-how; or significant market share, etc. However, such measures should be in-line with the requirements stipulated by Banking Control Law (Issued by SAMA) under Article 10 subsection 2 and 4. Loan to Asset Swaps Can be an effective tool particularly in the case of stranded real estate projects provided that the real estate is in good condition and can be economically viable managed in the future. The transaction must not be legally disputable, considering the provisions of the bankruptcy and enforcement legislation. It may also be used for other real estate cases, equity stakes, and securities with determinable market value. Short Term restructuring Restructuring agreements with a one-year maturity may be appropriate in those cases such as micro and small borrowers, where the bank feels closer monitoring or increased pressure to perform is necessary. Loan Sale Sale of the loan is reasonable under the following conditions: • The bank does not have sufficient capacity to effectively manage the borrower; • The buyer has a positive reference; and • The buyer is a major specialist in the area of resolving non-performing loans. Non-Viable Borrowers Collateral Liquidation by owner MSME owners have strong attachments to their property. They may fail to carry out the sale within the agreed-upon time frame or have unrealistic expectations regarding the value of the property. It is recommended that the bank set short deadlines; obtain a notarized power of attorney allowing it to activate the sale procedures; and have sufficient human resources within the real estate market to expedite the sales process. Execution or Insolvency To be used when the borrower is not viable or non-cooperative, and no feasible restructuring solution can be put in place. The below figure presents the various options broken into three broad categories: (i) short term measures most appropriately used in early-stage arrears to stabilize the situation and give the borrower and the bank time to develop a longer-term strategy; (ii) longer-term/ permanent solutions, which will result in the reduction of the loan: and (iii) additional measures, which do not directly lead to repayment but strengthen the bank's collection efforts.

5.2.3 Short Term Restructuring Measures:

Short-term measures do not lead, in and of themselves, to the repayment of a borrower's obligations. Instead they are designed to provide: (i) temporary relief in response to a clearly identified short term disruption in a borrower's cash flow (e.g., event out of the borrower's control, like a sudden fall in demand due to external circumstances); or (ii) time for the creditor(s) to assess the situation and determine an appropriate course of action. They are most appropriate to use when there is a reasonable expectation that the borrower's sustainable cash flow will be strong enough to allow the resumption of its existing payment schedule at the end of the restructuring period. Evidence of such an event should be demonstrated in a formal manner (and not speculatively) via written documentation with defined evidence showing that the borrower's income will recover in the short-term or on the basis of the bank concluding that a long-term restructuring solution was not possible due to a temporary financial uncertainty of a general or borrower-specific nature. As these options envision that the borrower will be able to bring defaulted amounts of interest and/or principal current at the end of the restructuring period, they should not exceed a tenor of 24 months (12 months in the case of real estate or construction projects) and must be used in combination with longer-term solutions such as an extension of maturity, revision in terms and additional security.

Specific short-term measures to consider include:

i. Reduced payments - the company’s cash flow is sufficient to service interest and make partial principal repayments.

ii. Interest-only - the company's cash flow can only service its interest payments, and no principal repayments are made during a determined period of time.

iii. Moratorium - an agreement allowing the borrower to suspend payments of principal and/or interest for a clearly defined period. This technique is most commonly used at the beginning stages of a workout process (especially with multi-bank borrowers) to allow the bank and other creditors time to assess the viability of the business and develop a plan for moving forward. Another appropriate use is in response to natural disaster, which has temporarily interrupted the company's cash flow.

The contractual terms for any restructuring solution should ensure that the bank has the right to review the agreed restructuring measures if the situation of the borrower improves and more favorable conditions for the bank (ranging from the restructuring to the original contractual conditions) could, therefore, be enforced. The bank should also consider including strict consequences in the contractual terms for borrowers who fail to comply with the restructuring agreement (e.g. additional security).

5.2.4 Long Term/Permanent Restructuring

Longer-term/permanent options are designed to permanently reduce the borrower’s loan. Most borrowers will require a combination of options to ensure repayment. In all cases, the bank must be able to demonstrate (based on reasonable documented financial information) that the borrower's projected cash flow will be sufficient to meet the restructured payment terms.

Specific options that may be considered include:

i. Interest and Arrears capitalization - adds past due payments and/or accrued interest arrears to the outstanding principal balance for repayment under a sustainable revised repayment program. Workout Unit should always attempt to have the borrower bring past due payments and interest current at the time a loan is rescheduled. Capitalization, intended to be used selectively, is likely to be more widespread when borrowers have been in default for an extended period. This measure should be applied only once, and in an amount that does not exceed a pre-defined size relative to the overall principle as defined in the bank's Remedial/restructuring policy. The bank should also formally confirm that the borrower understands and accepts the capitalization conditions.

ii. Interest rate reduction - involves the permanent (or temporary) reduction of the interest rate (fixed or variable) to a fair and sustainable rate. This option could be considered when the evolution of interest rates has resulted in the borrower receiving finance at an exorbitant cost, compared with prevailing market conditions. However, banks should ensure that lower interest rate is sufficient to cover the relevant credit risk.

iii. Extension of maturity - extension of the maturity of the loan (i.e., of the last contractual loan installment date) allows a reduction in installment amounts by spreading the repayments over a longer period

iv. Rescheduled Payments - the existing contractual payment schedule is adjusted to a new sustainable repayment program based on a realistic assessment of the borrower's cash flows, both current and forecasted. This is usually used in combination with an extension of maturity. In addition to normal rescheduling, additional repayment options include:

a. Partial repayment - a payment is made against the credit facility (e.g., from a sale of assets) that is lower than the outstanding balance. This option is used to substantially reduce the loan at risk and to enable a sustainable repayment program for the remaining outstanding amount. This option is generally preferable, from the bank's standpoint to the balloon, bullet or step-up options described below.

b. Balloon or bullet payments - are used in the case of more marginal borrowers whose sustainable cash flow is insufficient to fully repay the loan within the rescheduled tenor. A balloon payment is a final installment substantially larger than the regularly scheduled installments. Bullet loans carry no regular installment payments. They are payable in full at the maturity date and frequently contain provisions allowing the capitalization of interest throughout the life of the loan.

These options are generally only be used/considered in exceptional circumstances, and when the bank can duly document future cash flow availability to meet the payment. Bullet loans are frequently used in conjunction with loan splitting. In this case, the unsustainable portion of the loan represented by the bullet loan should be fully provisioned and written off in accordance with bank policy.

c. Step-up payments - should be used when the bank can ensure and demonstrate that there is a good reason to expect that the borrower's future cash flow will be sufficient to meet increases (step-up) in payments.

v. Sale by owner/assisted sale - this option is used when the borrower agrees to voluntarily dispose of the secured assets to partially or fully repay the loan. It is usually combined with the partial repayment option or conditional loan forgiveness. The borrower must be monitored closely to ensure that the sale is conducted in a timely manner and the agreement should contain a covenant allowing the borrower to conduct the sale if the borrower fails to do so within the specified timeframe.

vi. Conditional loan forgiveness - involves the bank forfeiting the right to legally recover part or the whole of the amount of an outstanding loan upon the borrower's performance of certain conditions. This measure may be used when the bank agrees to a “reduced payment in full and final settlement", whereby the bank agrees to forgive all the remaining loan if the borrower repays the reduced amount of the principal balance within an agreed timeframe. This option should be used to encourage owners to make an additional financial contribution to the company and to ensure that their interests are aligned with the banks. It is particularly appropriate in those cases where the net present value of the borrower's projected repayment capacity (taking into consideration all the collateral and potential cash flow) is lower than the total loan. In these cases the bank may consider:

a) Partial write-off in return for a cash equity contribution from an owner(s), particularly in those cases where the owner(s) have not guaranteed the loan.

b) Partial write-off in the framework of a cash capital increase from a third- party investor where they have not assumed the role of guarantor.

c) Partial write-off in the case of a particularly successful business restructuring that materially deviates from the operating plan that served as the basis for the restructuring.

d) Partial write-off in those cases when the above-average engagement of the owner(s) (i.e. successful sale of excess assets) guarantees a higher level of repayment to the bank(s).

e) Loan can also be written off if: (i) the collateral has no economic value, and such action ensures the continuation of the company's operations; (ii) it is evident that the owner has invested his entire property in the business and has lost it; (iii) the borrower possesses significant “know-how", and the bank has confidence in the management; or, (iv) the problems were caused by objective external factors.

Banks should apply loan forgiveness options carefully since the possibility of forgiveness can give rise to moral hazard, weaken the payment discipline, and encourage “strategic defaults". Therefore, banks should define specific forgiveness policies and procedures to ensure strong controls are in place.

vii. Fresh money - providing new financing arrangements to support the recovery of a distressed borrower is usually not a standalone viable restructuring solution but should be combined with other measures addressing existing arrears. It should only be applied in exceptional cases and requires a thorough assessment of the borrower's ability to repay. For loans with significant amount, independent sector experts should be used to validate the viability of proposed business plans and cash flow projections.

The Banks are recommended to have strict policies prohibiting lending new monies or allowing roll-overs. There are, however, three specific situations where it may be warranted. They are: (i) the need for fresh money to be used for working capital to restart the business; (ii) advances required to protect the bank's collateral position; or, (iii) small advances to prevent large contingent exposures (guarantees) from being called.

viii. Loan splitting - is used to address collateral and cash flow shortfalls. In this option, the loan is split into two parts: (i) the portion representing the amount that can be repaid from sustainable cash flow is repaid in equal installments of principal and interest; and (ii) the remaining portion represents “excess loan" (which can be subordinated). This portion can be used in combination with payments from the sale of specific assets or bullet payments at the maturity.

5.2.5 Additional Measures

Additional measures are not considered to be viable stand-alone restructuring options as they do not result in an immediate reduction in the loan. However, when combined with one or more of the previously identified options, they can provide incentives for repayment or strengthen the bank's overall position.

i. Loan-to-asset swap - transfers a loan, or portion of a loan, into “other assets owned" where the ultimate collection of the original loan requires the sale of the asset. This technique is generally used in conjunction with conditional loan forgiveness or partial loan repayment and maturity extension options. The management and sale of real estate properties also requires specialized expertise to ensure that the bank maximizes its returns from these assets.

ii. Loan-to-equity swap - transfers the loan, or portion of the loan, into an investment. Generally used to strengthen the capital structure of large highly indebted corporate borrowers, it is seldom appropriate for MSME borrowers due to limited access to equity markets and difficulties in determining the fair value of illiquid securities. Like the loan-to-asset swap above, this option may also require the bank to allocate additional resources for managing the new investment. However, such measures should be in-line with the requirements stipulated by Banking Control Law (Issued by SAMA) under Article 10 subsection 2 and 4.

iii. Loan Consolidation - more common for small loans, entails the combination of multiple loans into a single loan or a limited number of loans. This solution should be combined with other restructuring measures addressing existing arrears. This option is particularly beneficial in situations, where combining collateral and secured cash flows provides greater overall security coverage for the entire loan than individually.

iv. Other alterations of contract/covenants - when entering a restructuring agreement, it is generally necessary to revise or modify existing contracts/covenants to meet the borrower’s current financial circumstances. Examples might include revising ratios such as minimum working capital or providing additional time for a borrower to sell excess assets.

Additional security - additional liens on unencumbered assets (e.g., pledge on a cash deposit, assignment of receivables, or a new/additional mortgage on immovable property) are generally obtained as additional security from a borrower to compensate for the higher risk loan or cure existing defaults in loan-to-value ratio covenants.

5.2.6 Utilizing New Information

If new information is obtained after deciding on the resolving approach, the bank must re-examine and refresh it. For example, if it turns out that the borrower had been misleading it with certain material information, the approach and the measures must be more conservative. On the other hand, if the borrower puts forward or presents a repayment proposal during the measures, which would considerably improve the bank's position, the bank may mitigate the measures subject to fulfillment of certain conditions or eliminate them completely. This means that there is a certain flexibility of restructuring measures for the company.

Banks generally have a choice of choosing to restructure a loan, sell the loan (note sale), or liquidate the underlying collateral either by sale by owner or legal procedures (e.g. enforcement or insolvency). These guidelines require banks to compare the value of the proposed restructuring option against the other alternatives. The analysis will be confined to comparing the value of the proposed restructuring against enforcement and bankruptcy. Choosing the optimal option, i.e., the solution that returns the highest value to the bank is not always clear-cut.

Evaluating alternative strategies based on NPV analysis

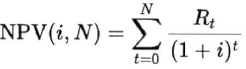

Using a simple Net Present Value (NPV) analysis is recommended in order to provide more quantitative justification for the decision.

The general formula to calculate net present value is:

Where i = interest rate per period

N = total number of periods

Rt= net cash flow per period t

t = period in which cash flow occurs

Net present value (NPV) is the sum of the present values (PV) of a stream of payments over a period of time. It is based on the concept of time value of money - money received in the future is less valuable than money received today. To determine NPV, the net cash flow (cash payments of principal, interest, and fees less the bank’s out-of-pocket costs for legal fees, consultants, etc.) received annually is calculated. Each of these amounts or future values (FV) is then discounted to the present by using an appropriate market-based discount rate. Alternatively, the Banks may also use original effective interest rate used for computation of provisioning under International Financial Reporting Standard (IFRS) 9 guidelines.

The sum of the PVs equals the NPV. Because of its simplicity, NPV is a useful tool to evaluate which of the possible workout options results in the maximum recovery to the bank.

For NPV analysis, the bank's standard risk-adjusted discount rate should be considered. NPV from various options should be considered including below considerations in each option:

i. Restructuring: evaluation based on estimated cash-flows for a period under negotiation for new tenor of contract. The factors to be considered are interest rate of the new term, any other expenses involved in restructuring and business plan or internal estimations of the bank.

ii. Enforcement (including legal): the parameters to be considered includes current value of the property, suitable haircuts to be applied, litigation charges and additional time to be taken to conclude these proceedings.

iii. Insolvency: cost of insolvency procedure, length of time to conclude insolvency proceedings and estimated value to be recovered.