8- Standardised Approach: Default Risk Capital Requirement

Main Concepts of Default Risk Capital Requirements

8.1 The default risk capital (DRC) requirement is intended to capture jump-to-default (JTD) risk that may not be captured by credit spread shocks under the sensitivities- based method. DRC requirements provide some limited hedging recognition. In this chapter offsetting refers to the netting of exposures to the same obligor (where a short exposure may be subtracted in full from a long exposure) and hedging refers to the application of a partial hedge benefit from the short exposures (where the risk of long and short exposures in distinct obligors do not fully offset due to basis or correlation risks).

Instruments Subject to the Default Risk Capital Requirement

8.2 The DRC requirement must be calculated for instruments subject to default risk:

(1) Non-securitisation portfolios

(2) Securitisation portfolio (non-correlation trading portfolio, or non-CTP)

(3) Securitisation (correlation trading portfolio, or CTP)

Overview of Drc Requirement Calculation

8.3 The following step-by-step approach must be followed for each risk class subject to default risk. The specific definition of gross JTD risk, net JTD risk, bucket, risk weight and the method for aggregation of DRC requirement across buckets are separately set out per each risk class in subsections in [8.9] to [8.26].

(1) The gross JTD risk of each exposure is computed separately.

(2) With respect to the same obligator, the JTD amounts of long and short exposures are offset (where permissible) to produce net long and/or net short exposure amounts per distinct obligor.

(3) Net JTD risk positions are then allocated to buckets.

(4) Within a bucket, a hedge benefit ratio is calculated using net long and short JTD risk positions. This acts as a discount factor that reduces the amount of net short positions to be netted against net long positions within a bucket. A prescribed risk weight is applied to the net positions which are then aggregated.

(5) Bucket level DRC requirements are aggregated as a simple sum across buckets to give the overall DRC requirement.

8.4 No diversification benefit is recognised between the DRC requirements for:

(1) non-securitisations;

(2) securitisations (non-CTP) ; and

(3) securitisations (CTP).

8.5 For traded non-securitisation credit and equity derivatives, JTD risk positions by individual constituent issuer legal entity should be determined by applying a look- through approach.

The JTD equivalent is defined as the difference between the value of the security or product assuming that each single name referenced by the security or product, separately from the others, defaults (with zero recovery) and the value of the security or product assuming that none of the names referenced by the security or product default.

8.6 For the CTP, the capital requirement calculation includes the default risk for non securitisation hedges. These hedges must be removed from the calculation of default risk non-securitisation.

8.7 Claims on sovereigns, public sector entities and multilateral development banks would be subject to a zero default risk weight in line with paragraphs 7.1 through 7.11 in the SAMA Minimum Capital Requirements for Credit Risk framework. SAMA apply a non-zero risk weight to securities issued by certain foreign governments, including to securities denominated in a currency other than that of the issuing government.

8.8 For claims on an equity investment in a fund that is subject to the treatment specified in [7.36](3) (ie treated as an unrated “other sector” equity), the equity investment in the fund shall be treated as an unrated equity instrument. Where the mandate of that fund allows the fund to invest in primarily high-yield or distressed names, banks shall apply the maximum risk weight per Table 2 in [8.24] that is achievable under the fund’s mandate (by calculating the effective average risk weight of the fund when assuming that the fund invests first in defaulted instruments to the maximum possible extent allowed under its mandate, and then in CCC-rated names to the maximum possible extent, and then B-rated, and then BB-rated). Neither offsetting nor diversification between these generated exposures and other exposures is allowed.

Default Risk Capital Requirement for Non-Securitisations

Gross jump-to-default risk positions (gross JTD)

8.9 The gross JTD risk position is computed exposure by exposure. For instance, if a bank has a long position on a bond issued by Apple, and another short position on a bond issued by Apple, it must compute two separate JTD exposures.

8.10 For the purpose of DRC requirements, the determination of the long/short direction of positions must be on the basis of long or short with respect to whether the credit exposure results in a loss or gain in the case of a default.

(1) Specifically, a long exposure is defined as a credit exposure that results in a loss in the case of a default.

(2) For derivative contracts, the long/short direction is also determined by whether the contract will result in a loss in the case of a default (ie long or short position is not determined by whether the option or credit default swap (CDS), is bought or sold). Thus, for the purpose of DRC requirements, a sold put option on a bond is a long credit exposure, since a default results in a loss to the seller of the option.

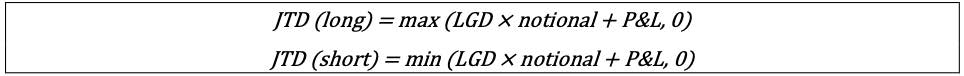

8.11 The gross JTD is a function of the loss given default (LGD), notional amount (or face value) and the cumulative profit and loss (P&L) already realised on the position, where:

(1) notional is the bond-equivalent notional amount (or face value) of the position; and

(2) P&L is the cumulative mark-to-market loss (or gain) already taken on the exposure. P&L is equal to the market value minus the notional amount, where the market value is the current market value of the position.

8.12 For calculating the gross JTD, LGD is set as follows:

(1) Equity instruments and non-senior debt instruments are assigned an LGD of 100%.

(2) Senior debt instruments are assigned an LGD of 75%.

(3) Covered bonds, as defined within [7.51], are assigned an LGD of 25%.

(4) When the price of the instrument is not linked to the recovery rate of the defaulter (eg a foreign exchange-credit hybrid option where the cash flows are swap of cash flows, long EUR coupons and short USD coupons with a knockout feature that ends cash flows on an event of default of a particular obligor), there should be no multiplication of the notional by the LGD.

8.13 In calculating the JTD as set out in [8.11], the notional amount of an instrument that gives rise to a long (short) exposure is recorded as a positive (negative) value, while the P&L loss (gain) is recorded as a negative (positive) value. If the contractual or legal terms of the derivative allow for the unwinding of the instrument with no exposure to default risk, then the JTD is equal to zero.

8.14 The notional amount is used to determine the loss of principal at default, and the mark-to-market loss is used to determine the net loss so as to not double-count the mark-to-market loss already recorded in the market value of the position.

(1) For all instruments, the notional amount is the notional amount of the instrument relative to which the loss of principal is determined. Examples are as follows:

(a) For a bond, the notional amount is the face value.

(b) For credit derivatives, the notional amount of a CDS contract or a put option on a bond is the notional amount of the derivative contract.

(c) In the case of a call option on a bond, the notional amount to be used in the JTD calculation is zero (since, in the event of default, the call option will not be exercised). In this case, a JTD would extinguish the call option’s value and this loss would be captured through the mark- to-market P&L term in the JTD calculation.

(2) Table 1 illustrates examples of the notional amounts and market values for a long credit position with a mark-to-market loss to be used in the JTD calculation, where:

(a) the bond-equivalent market value is an intermediate step in determining the P&L for derivative instruments;

(b) the mark-to-market value of CDS or an option takes an absolute value; and

(c) the strike amount of the bond option is expressed in terms of the bond price (not the yield).

Examples of components for a long credit position in the JTD calculation Table 1 Instrument Notional Bond-equivalent market value P&L Bond Face value of bond Market value of bond Market value - face value CDS Notional of CDS Notional of CDS -| mark- to-market (MtM) value of CDS | -| MtM value of CDS | Sold put option on a bond Notional of option Strike amount -| MtM value of option | (Strike -| MtM value of option |) - Notional Bought call option on a bond 0 MtM value of option MtM value of option P&L = bond-equivalent market value - notional.

With this representation of the P&L for a sold put option, a lower strike results in a lower JTD loss.

The convertible bonds are not treated the same way as vanilla bonds in computing the DRC requirement Banks should also consider the P&L of the equity optionality embedded within a convertible bond when computing its DRC requirement. A convertible bond can be decomposed into a vanilla bond and a long equity option. Hence, treating the convertible bond as a vanilla bond will potentially underestimate the JTD risk of the instrument.

8.15 To account for defaults within the one-year capital horizon, the JTD for all exposures of maturity less than one year and their hedges are scaled by a fraction of a year. No scaling is applied to the JTD for exposures of one year or greater.35 For example, the JTD for a position with a six month maturity would be weighted by one-half, while the JTD for a position with a one year maturity would have no scaling applied to the JTD.

8.16 Cash equity positions (ie stocks) are assigned to a maturity of either more than one year or three months, at banks’ discretion.

[8.16] states that for the standardised approach DRC requirement, cash equity positions may be attributed a maturity of three months or a maturity of more than one year, at firms’ discretion. Such restrictions do not exist in [13] for the internal models approach, which allows banks discretion to apply a 60-day liquidity horizon for equity sub-portfolios. Furthermore, [8.15] states “... the JTD for all exposures of maturity less than one year and their hedges are scaled by a fraction of a year”. Given the above- mentioned paragraphs, for purposes of the standardised approach DRC requirement, the bank is not permitted to assign cash equities and equity derivatives such as index futures any maturity between three months and one year on a sub-portfolio basis in order to avoid broken hedges As required by [8.16], cash equity positions are assigned a maturity of either more than one year or three months. There is no discretion permitted to assign cash equity positions to any maturity between three months and one year. In determining the offsetting criterion, [8.17] specifies that the maturity of the derivatives contract be considered, not the maturity of the underlying instrument. [8.18] further states that the maturity weighting applied to the JTD for any product with maturity of less than three months is floored at three months. To illustrate how the standardised approach DRC requirement should be calculated with a simple hypothetical portfolio, consider equity index futures with one month to maturity and a negative market value of EUR 10 million (–EUR 10 million, maturity 1M), hedged with the underlying equity positions with a positive market value of EUR 10 million (+EUR 10 million). Both positions in the example should be considered having a three-month maturity. Based on [8.15], which requires maturity scaling, defined as a fraction of the year, of positions and their hedge, the JTD for the above trading portfolio would be calculated as follows: 1/4*10 – 1/4*10 = 0.

8.17 For derivative exposures, the maturity of the derivative contract is considered in determining the offsetting criterion, not the maturity of the underlying instrument.

8.18 The maturity weighting applied to the JTD for any sort of product with a maturity of less than three months (such as short term lending) is floored at a weighting factor of one-fourth or, equivalently, three months (that means that the positions having shorter-than-three months remaining maturity would be regarded as having a remaining maturity of three months for the purpose of the DRC requirement).

In the case where a total return swap (TRS) with a maturity of one month is hedged by the underlying equity, and if there were sufficient legal terms on the TRS such that there is no settlement risk at swap maturity as the swap is terminated based on the executed price of the stock/bond hedge and any unwind of the TRS can be delayed (beyond the swap maturity date) in the event of hedge disruption until the stock/bond can be liquidated. The net JTD for such a position would be zero. If the contractual/legal terms of the derivative allow for the unwinding of both legs of the position at the time of expiry of the first to mature with no exposure to default risk of the underlying credit beyond that point, then the JTD for the maturity-mismatched position is equal to zero.

Net jump-to-default risk positions (net JTD)

8.19 Exposures to the same obligator may be offset as follows:

(1) The gross JTD risk positions of long and short exposures to the same obligor may be offset where the short exposure has the same or lower seniority relative to the long exposure. For example, a short exposure in an equity may offset a long exposure in a bond, but a short exposure in a bond cannot offset a long exposure in the equity.

(2) For the purposes of determining whether a guaranteed bond is an exposure to the underlying obligor or an exposure to the guarantor, the credit risk mitigation requirements set out in paragraphs 9.70 and 9.72 of the SAMA Minimum Capital Requirements for Credit Risk.

(3) Exposures of different maturities that meet this offsetting criterion may be offset as follows.

(a) Exposures with maturities longer than the capital horizon (one year) may be fully offset.

(b) An exposure to an obligor comprising a mix of long and short exposures with a maturity less than the capital horizon (equal to one year) must be weighted by the ratio of the exposure’s maturity relative to the capital horizon. For example, with the one-year capital horizon, a three-month short exposure would be weighted so that its benefit against long exposures of longer-than- one-year maturity would be reduced to one quarter of the exposure size.36

8.20 In the case of long and short offsetting exposures where both have a maturity under one year, the scaling can be applied to both the long and short exposures.

8.21 Finally, the offsetting may result in net long JTD risk positions and net short JTD risk positions. The net long and net short JTD risk positions are aggregated separately as described below.

Calculation of default risk capital requirement for non-securitisation

8.22 For the default risk of non-securitisations, three buckets are defined as:

(1) corporates;

(2) sovereigns; and

(3) local governments and municipalities.

8.23 In order to recognise hedging relationship between net long and net short positions within a bucket, a hedge benefit ratio is computed as follows.

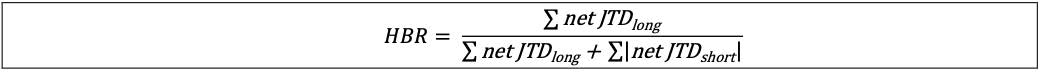

(1) A simple sum of the net long JTD risk positions (not risk-weighted) must be calculated, where the summation is across the credit quality categories (ie rating bands). The aggregated amount is used in the numerator and denominator of the expression of the hedge benefit ratio (HBR) below.

(2) A simple sum of the net (not risk-weighted) short JTD risk positions must be calculated, where the summation is across the credit quality categories (ie rating bands). The aggregated amount is used in the denominator of the expression of the HBR below.

(3) The HBR is the ratio of net long JTD risk positions to the sum of net long JTD and absolute value of net short JTD risk positions:

8.24 For calculating the weighted net JTD, default risk weights are set depending on the credit quality categories (ie rating bands) for all three buckets (ie irrespective of the type of counterparty), as set out in Table 2:

Default risk weights for non-securitisations by credit quality category Table 2 Credit quality category Default risk weight AAA 0.5% AA 2% A 3% BBB 6% BB 15% B 30% CCC 50% Unrated 15% Defaulted 100%

8.25

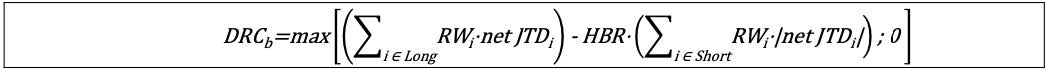

The capital requirement for each bucket is to be calculated as the combination of the sum of the risk-weighted long net JTD, the HBR, and the sum of the risk- weighted short net JTD, where the summation for each long net JTD and short net JTD is across the credit quality categories (ie rating bands). In the following formula, DRC stands for DRC requirement; and i refers to an instrument belonging to bucket b.

8.26 No hedging is recognised between different buckets - the total DRC requirement for non- securitisations must be calculated as a simple sum of the bucket level capital requirements.

35 Note that this paragraph refers to the scaling of gross JTD (ie not net JTD).

36 SAMA Minimum Capital Requirements for Credit Risk.Default Risk Capital Requirement for Securitisations (Non-CTP)

Gross jump-to-default risk positions (gross JTD)

8.27 For the computation of gross JTD on securitisations, the same approach must be followed as for default risk (non-securitisations), except that an LGD ratio is not applied to the exposure. Because the LGD is already included in the default risk weights for securitisations to be applied to the securitisation exposure (see below), to avoid double counting of LGD the JTD for securitisations is simply the market value of the securitisation exposure (ie the JTD for tranche positions is their market value).

8.28 For the purposes of offsetting and hedging recognition for securitisations (non-CTP), positions in underlying names or a non-tranched index position may be decomposed proportionately into the equivalent replicating tranches that span the entire tranche structure. When underlying names are treated in this way, they must be removed from the non-securitisation default risk treatment.

Net jump-to-default risk positions (net JTD)

8.29 For default risk of securitisations (non-CTP), offsetting is limited to a specific securitisation exposure (ie tranches with the same underlying asset pool). This means that:

(1) no offsetting is permitted between securitisation exposures with different underlying securitised portfolio (ie underlying asset pools), even if the attachment and detachment points are the same; and

(2) no offsetting is permitted between securitisation exposures arising from different tranches with the same securitised portfolio.

8.30 Securitisation exposures that are otherwise identical except for maturity may be offset. The same offsetting rules for non-securitisations including scaling down positions of less than one year as set out in [8.15] through [8.18] apply to JTD risk positions for securitisations (non- CTP). Offsetting within a specific securitisation exposure is allowed as follows.

(1) Securitisation exposures that can be perfectly replicated through decomposition may be offset. Specifically, if a collection of long securitisation exposures can be replicated by a collection of short securitisation exposures, then the securitisation exposures may be offset.

(2) Furthermore, when a long securitisation exposure can be replicated by a collection of short securitisation exposures with different securitised portfolios, then the securitisation exposure with the “mixed” securitisation portfolio may be offset by the combination of replicating securitisation exposures.

(3) After the decomposition, the offsetting rules would apply as in any other case. As in the case of default risk (non-securitisations), long and short securitisation exposures should be determined from the perspective of long or short the underlying credit, eg the bank making losses on a long securitisation exposure in the event of a default in the securitised portfolio.

Calculation of default risk capital requirement for securitisations (non-CTP)

8.31 For default risk of securitisations (non-CTP), the buckets are defined as follows:

(1) Corporates (excluding small and medium enterprises) – this bucket takes into account all regions.

(2) Other buckets – these are defined along two dimensions:

(a) Asset classes: the 11 asset classes are defined as asset-backed commercial paper; auto Loans/Leases; residential mortgage-backed securities (MBS); credit cards; commercial MBS; collateralised loan obligations; collateralised debt obligation (CDO)-squared; small and medium enterprises; student loans, other retail; and other wholesale.

(b) Regions: the four regions are defined as Asia, Europe, North America and all other.

8.32 To assign a securitisation exposure to a bucket, banks must rely on a classification that is commonly used in the market for grouping securitisation exposures by type and region of underlying.

(1) The bank must assign each securitisation exposure to one and only one of the buckets above and it must assign all securitisations with the same type and region of underlying to the same bucket.

(2) Any securitisation exposure that a bank cannot assign to a type or region of underlying in this fashion must be assigned to the “other bucket”.

8.33 The capital requirement for default risk of securitisations (non-CTP) is determined using a similar approach to that for non-securitisations. The DRC requirement within a bucket is calculated as follows:

(1) The hedge benefit discount HBR, as defined in [8.23], is applied to net short securitisation exposures in that bucket.

(2) The capital requirement is calculated as in [8.25].

8.34 For calculating the weighted net JTD, the risk weights of securitisation exposures are defined by the tranche instead of the credit quality. The risk weight for securitisations (non-CTP) is applied as follows:

(1) The default risk weights for securitisation exposures are based on the corresponding risk weights for banking book instruments, as set out in 18 to 22 of Minimum Capital Requirements for Credit Risk with the following modification: the maturity component in the banking book securitisation framework is set to zero (ie a one-year maturity is assumed) to avoid doublecounting of risks in the maturity adjustment (of the banking book approach) since migration risk in the trading book will be captured in the credit spread capital requirement. (2) Following the corresponding treatment in the banking book, the hierarchy of approaches in determining the risk weights should be applied at the underlying pool level.

(3) The capital requirement under the standardised approach for an individual cash securitisation position can be capped at the fair value of the transaction.

8.35 No hedging is recognised between different buckets. Therefore, the total capital requirement for default risk securitisations must be calculated as a simple sum of the bucket-level capital requirements.

Default Risk Capital Requirement for Securitisations (CTP)

Gross jump-to-default risk positions (gross JTD)

8.36 For the computation of gross JTD on securitisations (CTP), the same approach must be followed as for default risk-securitisations (non-CTP) as described in [8.27].

8.37 The gross JTD for non-securitisations (CTP) (ie single-name and index hedges) positions is defined as their market value.

8.38 Nth-to-default products should be treated as tranched products with attachment and detachment points defined below, where “Total names” is the total number of names in the underlying basket or pool:

(1) Attachment point = (N – 1) / Total names

(2) Detachment point = N / Total names

Net jump-to-default risk positions (net JTD)

8.39 Exposures that are otherwise identical except for maturity may be offset. The same concept of long and short positions from a perspective of loss or gain in the event of a default as set out in [8.10] and offsetting rules for non-securitisations including scaling down positions of less than one year as set out in [8.15] to [8.18] apply to JTD risk positions for securitisations (non-CTP).

(1) For index products, for the exact same index family (eg CDX.NA.IG), series (eg series 18) and tranche (eg 0–3%), securitisation exposures should be offset (netted) across maturities (subject to the offsetting allowance as described above).

(2) Long and short exposures that are perfect replications through decomposition may be offset as follows. When the offsetting involves decomposing single name equivalent exposures, decomposition using a valuation model would be allowed in certain cases as follows. Such decomposition is the sensitivity of the security’s value to the default of the underlying single name obligor. Decomposition with a valuation model is defined as follows: a single name equivalent constituent of a securitisation (eg tranched position) is the difference between the unconditional value of the securitisation and the conditional value of the securitisation assuming that the single name defaults, with zero recovery, where the value is determined by a valuation model. In such cases, the decomposition into single-name equivalent exposures must account for the effect of marginal defaults of the single names in the securitisation, where in particular the sum of the decomposed single name amounts must be consistent with the undecomposed value of the securitisation. Further, such decomposition is restricted to vanilla securitisations (eg vanilla CDOs, index tranches or bespokes); while the decomposition of exotic securitisations (eg CDO squared) is prohibited.

(3) Moreover, for long and short positions in index tranches, and indices (non- tranched), if the exposures are to the exact same series of the index, then offsetting is allowed by replication and decomposition. For instance, a long securitisation exposure in a 10–15% tranche vs combined short securitisation exposures in 10–12% and 12–15% tranches on the same index/series can be offset against each other. Similarly, long securitisation exposures in the various tranches that, when combined perfectly, replicate a position in the index series (non-tranched) can be offset against a short securitisation exposure in the index series if all the positions are to the exact same index and series (eg CDX.NA.IG series 18). Long and short positions in indices and single-name constituents in the index may also be offset by decomposition. For instance, single-name long securitisation exposures that perfectly replicate an index may be offset against a short securitisation exposure in the index. When a perfect replication is not possible, then offsetting is not allowed except as indicated in the next sentence. Where the long and short securitisation exposures are otherwise equivalent except for a residual component, the net amount must show the residual exposure. For instance, a long securitisation exposure in an index of 125 names, and short securitisation exposures of the appropriate replicating amounts in 124 of the names, would result in a net long securitisation exposure in the missing 125th name of the index.

(4) Different tranches of the same index or series may not be offset (netted), different series of the same index may not be offset, and different index families may not be offset.

Calculation of default risk capital requirement for securitisations (CTP)

8.40 For default risk of securitisations (CTP), each index is defined as a bucket of its own. A non- exhaustive list of indices include: CDX North America IG, iTraxx Europe IG, CDX HY, iTraxx XO, LCDX (loan index), iTraxx LevX (loan index), Asia Corp, Latin America Corp, Other Regions Corp, Major Sovereign (G7 and Western Europe) and Other Sovereign.

8.41 Bespoke securitisation exposures should be allocated to the index bucket of the index they are a bespoke tranche of. For instance, the bespoke tranche 5% - 8% of a given index should be allocated to the bucket of that index.

8.42 The default risk weights for securitisations applied to tranches are based on the corresponding risk weights for the banking book instruments, as set out in 18 to 22 of SAMA Minimum Capital Requirements for Credit Risk, with the following modification: the maturity component in the banking book securitisation framework is set to zero, ie a one-year maturity is assumed to avoid double-counting of risks in the maturity adjustment (of the banking book approach) since migration risk in the trading book will be captured in the credit spread capital requirement..

8.43 For the non-tranched products, the same risk weights for non-securitisations as set out in [8.24] apply. For the tranched products, banks must derive the risk weight using the banking book treatment as set out in [8.42].

8.44 Within a bucket (ie for each index) at an index level, the capital requirement for default risk of securitisations (CTP) is determined in a similar approach to that for non-securitisations.

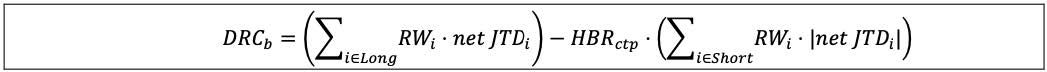

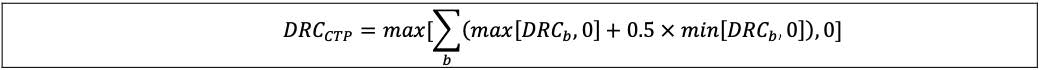

(1) The hedge benefit ratio (HBR), as defined in [8.23], is modified and applied to net short positions in that bucket as in the formula below, where the subscript ctp for the term HBRctp indicates that the HBR is determined using the combined long and short positions across all indices in the CTP (ie not only the long and short positions of the bucket by itself). The summation of risk-weighted amounts in the formula spans all exposures relating to the index (ie index tranche, bespoke, non-tranche index or single name).

(2) A deviation from the approach for non-securitisations is that no floor at zero applies at the bucket level, and consequently, the DRC requirement at the index level (DRCb) can be negative.

8.45 The total DRC requirement for securitisations (CTP) is calculated by aggregating bucket level capital amounts as follows. For instance, if the DRC requirement for the index CDX North America IG is +100 and the DRC requirement for the index Major Sovereign (G7 and Western Europe) is - 100, the total DRC requirement for the CTP is 100 - 0.5 × 100 = 50.37

37 The procedure for the DRCb and DRCctp terms accounts for the basis risk in cross index hedges, as the hedge benefit from cross-index short positions is discounted twice, first by the hedge benefit ratio HBR in DRCb, and again by the term 0.5 in the DRCCtp equation.