Book traversal links for Collateralized Transactions

Collateralized Transactions

| No: 44047144 | Date(g): 27/12/2022 | Date(h): 4/6/1444 | Status: In-Force |

General requirements

| 9.25 | Before capital relief is granted in respect of any form of collateral, the standards set out below in paragraphs 9.26 ,9.31 must be met, irrespective of whether the simple or the comprehensive approach is used. Banks that lend securities or post collateral must calculate capital requirements for both of the following: (i) the credit risk or market risk of the securities, if this remains with the bank; and (ii) the counterparty credit risk arising from the risk that the borrower of the securities may default. | |||

| 9.26 | The legal mechanism by which collateral is pledged or transferred must ensure that the bank has the right to liquidate or take legal possession of it, in a timely manner, in the event of the default, insolvency or bankruptcy (or one or more otherwise-defined credit events set out in the transaction documentation) of the counterparty (and, where applicable, of the custodian holding the collateral). Additionally, banks must take all steps necessary to fulfil those requirements under the law applicable to the bank’s interest in the collateral for obtaining and maintaining an enforceable security interest, e.g. by registering it with a registrar, or for exercising a right to net or set off in relation to the title transfer of the collateral. | |||

| 9.27 | Banks must have clear and robust procedures for the timely liquidation of collateral to ensure that any legal conditions required for declaring the default of the counterparty and liquidating the collateral are observed, and that collateral can be liquidated promptly. | |||

| 9.28 | Banks must ensure that sufficient resources are devoted to the orderly operation of margin agreements with OTC derivative and securities-financing counterparties, as measured by the timeliness and accuracy of its outgoing margin calls and response time to incoming margin calls. Banks must have collateral risk management policies in place to control, monitor and report: | |||

| (1) | The risk to which margin agreements expose them (such as the volatility and liquidity of the securities exchanged as collateral); | |||

| (2) | The concentration risk to particular types of collateral; | |||

| (3) | The reuse of collateral (both cash and non-cash) including the potential liquidity shortfalls resulting from the reuse of collateral received from counterparties; and | |||

| (4) | The surrender of rights on collateral posted to counterparties. | |||

| 9.29 | Where the collateral is held by a custodian, banks must take reasonable steps to ensure that the custodian segregates the collateral from its own assets. | |||

| 9.30 | A capital requirement must be applied on both sides of a transaction. For example, both repos and reverse repos will be subject to capital requirements. Likewise, both sides of a securities lending and borrowing transaction will be subject to explicit capital charges, as will the posting of securities in connection with derivatives exposures or with any other borrowing transaction. | |||

| 9.31 | Where a bank, acting as an agent, arranges a repo-style transaction (i.e. repurchase / reverse repurchase and securities lending/borrowing transactions) between a customer and a third party and provides a guarantee to the customer that the third party will perform on its obligations, then the risk to the bank is the same as if the bank had entered into the transaction as a principal. In such circumstances, a bank must calculate capital requirements as if it were itself the principal. | |||

| The simple approach: general requirements | ||||

| 9.32 | Under the simple approach, the risk weight of the counterparty is replaced by the risk weight of the collateral instrument collateralizing or partially collateralizing the exposure. | |||

| 9.33 | For collateral to be recognized in the simple approach, it must be pledged for at least the life of the exposure and it must be marked to market and revalued with a minimum frequency of six months. Those portions of exposures collateralized by the market value of recognized collateral receive the risk weight applicable to the collateral instrument. The risk weight on the collateralized portion is subject to a floor of 20% except under the conditions specified in paragraphs 9.36 to 9.39. The remainder of the exposure must be assigned the risk weight appropriate to the counterparty. Maturity mismatches are not allowed under the simple approach (see paragraphs 9.10 to 9.11). | |||

| The simple approach: eligible financial collateral | ||||

| 9.34 | The following collateral instruments are eligible for recognition in the simple approach: | |||

| (1) | Cash (as well as certificates of deposit or comparable instruments issued by the lending bank) on deposit with the bank that is incurring the counterparty exposure41 42. | |||

| (2) | Gold. | |||

| (3) | Debt securities that meet the following conditions: | |||

| (a) | Debt securities rated43 by a recognized external credit assessment institution (ECAI) where these are either: | |||

| (i) | At least BB- when issued by sovereigns or public sector entities (PSEs) that are treated as sovereigns; or | |||

| (ii) | At least BBB- when issued by other entities (including banks and other prudentially regulated financial institutions); or | |||

| (iii) | At least A-3/P-3 for short-term debt instruments. | |||

| (b) | Debt securities not rated by a recognized ECAI where these are: | |||

| (i) | Issued by a bank; and | |||

| (ii) | Listed on a recognized exchange; and | |||

| (iii) | Classified as senior debt; and | |||

| (iv) | All rated issues of the same seniority by the issuing bank are rated at least BBB– or a-3/p-3 by a recognized ECAI; and | |||

| (v) | The bank holding the securities as collateral has no information to suggest that the issue justifies a rating below BBB– or A-3/P-3 (as applicable); and | |||

| (vi) | SAMA is sufficiently confident that the market liquidity of the security is adequate. | |||

| (4) | Equities (including convertible bonds) that are included in a main index. | |||

| (5) | Undertakings for Collective Investments in Transferable Securities (UCITS)and mutual funds where: | |||

| (a) | a price for the units is publicly quoted daily; and | |||

| (b) | the UCITS/mutual fund is limited to investing in the instruments listed in this paragraph.44 | |||

| 9.35 | Resecuritizations as defined in the securitization chapters 18 to 23 are not eligible financial collateral. | |||

| Simple approach: exemptions to the risk-weight floor | ||

| 9.36 | Repo-style transactions that fulfil all of the following conditions are exempted from the risk-weight floor under the simple approach: | |

| (1) | Both the exposure and the collateral are cash or a sovereign security or PSE security qualifying for a 0% risk weight under the standardized approach (chapter 0); | |

| (2) | Both the exposure and the collateral are denominated in the same currency; | |

| (3) | Either the transaction is overnight or both the exposure and the collateral are marked to market daily and are subject to daily remargining; | |

| (4) | Following a counterparty’s failure to remargin, the time that is required between the last mark-to-market before the failure to remargin and the liquidation of the collateral is considered to be no more than four business days; | |

| (5) | The transaction is settled across a settlement system proven for that type of transaction; | |

| (6) | The documentation covering the agreement is standard market documentation for repo-style transactions in the securities concerned; | |

| (7) | The transaction is governed by documentation specifying that if the counterparty fails to satisfy an obligation to deliver cash or securities or to deliver margin or otherwise defaults, then the transaction is immediately terminable; and | |

| (8) | Upon any default event, regardless of whether the counterparty is insolvent or bankrupt, the bank has the unfettered, legally enforceable right to immediately seize and liquidate the collateral for its benefit. | |

| 9.37 | Transactions with core market participants; SAMA and Saudi sovereign only. | |

| 9.38 | Repo transactions that fulfil the requirement in paragraph 9.36 receive a 10% risk weight, as an exemption to the risk weight floor described in paragraph 9.33. If the counterparty to the transaction is a core market participant, banks may apply a risk weight of 0% to the transaction. | |

| 9.39 | The 20% floor for the risk weight on a collateralized transaction does not apply and a 0% risk weight may be applied to the collateralized portion of the exposure where the exposure and the collateral are denominated in the same currency, and either: | |

| (1) | The collateral is cash on deposit as defined in paragraph 9.34(1); or | |

| (2) | The collateral is in the form of sovereign/PSE securities eligible for a 0% risk weight, and its market value has been discounted by 20%. | |

| The comprehensive approach: general requirements | ||

| 9.40 | In the comprehensive approach, when taking collateral, banks must calculate their adjusted exposure to a counterparty in order to take account of the risk mitigating effect of that collateral. Banks must use the applicable supervisory haircuts to adjust both the amount of the exposure to the counterparty and the value of any collateral received in support of that counterparty to take account of possible future fluctuations in the value of either45, as occasioned by market movements. Unless either side of the transaction is cash or a zero haircut is applied, the volatility-adjusted exposure amount is higher than the nominal exposure and the volatility-adjusted collateral value is lower than the nominal collateral value. | |

| 9.41 | The size of the haircuts that banks must use depends on the prescribed holding period for the transaction. For the purposes of chapter 9,the holding period is the period of time over which exposure or collateral values are assumed to move before the bank can close out the transaction. The supervisory prescribed minimum holding period is used as the basis for the calculation of the standard supervisory haircuts. | |

| 9.42 | The holding period, and thus the size of the individual haircuts depends on the type of instrument, type of transaction, residual maturity and the frequency of marking to market and remargining as provided in paragraphs 9.49 to 9.50. For example, repo-style transactions subject to daily marking-to-market and to daily remargining will receive a haircut based on a 5-business day holding period and secured lending transactions with daily mark-to-market and no remargining clauses will receive a haircut based on a 20-business day holding period. Haircuts must be scaled up using the square root of time formula depending on the actual frequency of remargining or marking to market. This formula is included in paragraph 9.58. | |

| 9.43 | Additionally, where the exposure and collateral are held in different currencies, banks must apply an additional haircut to the volatility-adjusted collateral amount in accordance with paragraphs 9.51 and 9.81 to 0 to take account of possible future fluctuations in exchange rates. | |

| 9.44 | The effect of master netting agreements covering securities financing transactions (SFTs) can be recognized for the calculation of capital requirements subject to the conditions and requirements in paragraphs 9.61 to 9.64 . Where SFTs are subject to a master netting agreement whether they are held in the banking book or trading book, a bank may choose not to recognize the netting effects in calculating capital. In that case, each transaction will be subject to a capital charge as if there were no master netting agreement. | |

| The comprehensive approach: eligible financial collateral | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.45 | The following collateral instruments are eligible for recognition in the comprehensive approach: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | All of the instruments listed in paragraph 9.34; | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | Equities and convertible bonds that are not included in a main index but which are listed on a recognized security exchange; | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) | UCITS/mutual funds which include the instruments in point (2). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The comprehensive approach: calculation of capital requirement | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.46 | For a collateralized transaction, the exposure amount after risk mitigation is calculated using the formula that follows, where: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | E* = the exposure value after risk mitigation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | E = current value of the exposure | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) | He = haircut appropriate to the exposure | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) | C = the current value of the collateral received | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) | Hc = haircut appropriate to the collateral | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (6) | Hfx = haircut appropriate for currency mismatch between the collateral and exposure | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.47 | In the case of maturity mismatches, the value of the collateral received (collateral amount) must be adjusted in accordance with paragraphs 9.10 to 0. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.48 | The exposure amount after risk mitigation (E*) must be multiplied by the risk weight of the counterparty to obtain the risk-weighted asset amount for the collateralized transaction. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.49 | The following supervisory haircuts in table 14 below (assuming daily mark-to- market, daily remargining and a 10 business day holding period), expressed as percentages, must be used to determine the haircuts appropriate to the collateral (Hc) and to the exposure (He): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.50 | In paragraph 9.49 : | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | “Sovereigns” includes: PSEs that are treated as sovereigns by SAMA, as well as multilateral development banks receiving a 0% risk weight. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | “Other issuers” includes: PSEs that are not treated as sovereigns by SAMA. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) | “Securitization exposures” refers to exposures that meet the definition set forth in the securitization framework. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) | “Cash in the same currency” refers to eligible cash collateral specified in paragraph 9.34(1). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.51 | The haircut for currency risk (Hfx) where exposure and collateral are denominated in different currencies is 8% (also based on a 10-business day holding period and daily mark-to-market). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.52 | For SFTs and secured lending transactions, a haircut adjustment may need to be applied in accordance with paragraphs 9.55 to 9.58. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.53 | For SFTs in which the bank lends, or posts as collateral, non-eligible instruments, the haircut to be applied on the exposure must be 30%. For transactions in which the bank borrows non-eligible instruments, credit risk mitigation may not be applied. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.54 | Where the collateral is a basket of assets, the haircut (H) on the basket must be calculated using the formula that follows, where: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | aiis the weight of the asset (as measured by units of currency) in the basket | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | Hi the haircut applicable to that asset | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The comprehensive approach: adjustment for different holding periods and non-daily mark-to-market or remargining | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.55 | For some transactions, depending on the nature and frequency of the revaluation and remargining provisions, different holding periods and thus different haircuts must be applied. The framework for collateral haircuts distinguishes between repo-style transactions (i.e. repo/reverse repos and securities lending/borrowing),” other capital markets-driven transactions” (i.e. OTC derivatives transactions and margin lending) and secured lending. In capital-market-driven transactions and repo-style transactions, the documentation contains remargining clauses; in secured lending transactions, it generally does not. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.56 | The minimum holding period for various products is summarized in table 15 below: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.57 | Regarding the minimum holding periods set out in paragraph 9.56, if a netting set includes both repo-style and other capital market transactions, the minimum holding period of ten business days must be used. Furthermore, a higher minimum holding period must be used in the following cases: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | For all netting sets where the number of trades exceeds 5,000 at any point during a quarter, a 20-business day minimum holding period for the following quarter must be used. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | For netting sets containing one or more trades involving illiquid collateral, a minimum holding period of 20 business days must be used. "Illiquid collateral" must be determined in the context of stressed market conditions and will be characterized by the absence of continuously active markets where a counterparty would, within two or fewer days, obtain multiple price quotations that would not move the market or represent a price reflecting a market discount. Examples of situations where trades are deemed illiquid for this purpose include, but are not limited to, trades that are not marked daily and trades that are subject to specific accounting treatment for valuation purposes (e.g. repo-style transactions referencing securities whose fair value is determined by models with inputs that are not observed in the market). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) | If a bank has experienced more than two margin call disputes on a particular netting set over the previous two quarters that have lasted longer than the bank's estimate of the margin period of risk (as defined in The Counterparty Credit Risk (CCR) Framework), then for the subsequent two quarters the bank must use a minimum holding period that is twice the level that would apply excluding the application of this sub-paragraph. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

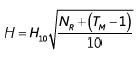

| 9.58 | When the frequency of remargining or revaluation is longer than the minimum, the minimum haircut numbers must be scaled up depending on the actual number of business days between remargining or revaluation. The 10-business day haircuts provided in paragraphs 9.49 to 9.50 are the default haircuts and these haircuts must be scaled up or down using the formula below, where: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | H = haircut | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | H10 = 10-business day haircut for instrument | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) | TM = minimum holding period for the type of transaction. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) | NR = actual number of business days between remargining for capital market transactions or revaluation for secured transactions | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The comprehensive approach: exemptions under the comprehensive approach for qualifying repo-style transactions involving core market participants | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.59 | For repo-style transactions with core market participants as defined in paragraph 9.37 and that satisfy the conditions in paragraph 9.36, a haircut of zero can be applied. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.60 | Where, under the comprehensive approach, a foreign supervisor applies a specific carve-out to repo-style transactions in securities issued by its domestic government, banks are allowed to adopt the same approach to the same transactions. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The comprehensive approach: treatment under the comprehensive approach of SFTs covered by master netting agreements | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.61 | The effects of bilateral netting agreements covering SFTs may be recognized on a counterparty-by-counterparty basis if the agreements are legally enforceable in each relevant jurisdiction upon the occurrence of an event of default and regardless of whether the counterparty is insolvent or bankrupt. In addition, netting agreements must: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | Provide the non-defaulting party the right to terminate and close out in a timely manner all transactions under the agreement upon an event of default, including in the event of insolvency or bankruptcy of the counterparty; | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | Provide for the netting of gains and losses on transactions (including the value of any collateral) terminated and closed out under it so that a single net amount is owed by one party to the other; | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) | Allow for the prompt liquidation or set-off of collateral upon the event of default; and | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) | Be, together with the rights arising from the provisions required in (1) to (3) above, legally enforceable in each relevant jurisdiction upon the occurrence of an event of default and regardless of the counterparty’s insolvency or bankruptcy. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.62 | Netting across positions in the banking and trading book may only be recognized when the netted transactions fulfil the following conditions: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | All transactions are marked to market daily46; and | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | The collateral instruments used in the transactions are recognized as eligible financial collateral in the banking book. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

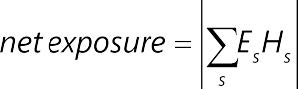

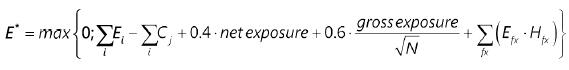

| 9.63 | The formula in paragraph 9.64 will be used to calculate the counterparty credit risk capital requirements for SFTs with netting agreements. This formula includes the current exposure, an amount for systematic exposure of the securities based on the net exposure, an amount for the idiosyncratic exposure of the securities based on the gross exposure, and an amount for currency mismatch. All other rules regarding the calculation of haircuts under the comprehensive approach stated in paragraphs 9.40 to 9.60 equivalently apply for banks using bilateral netting agreements for SFTs. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9.64 | Banks using standard supervisory haircuts for SFTs conducted under a master netting agreement must use the formula that follows to calculate their exposure amount, where: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | E* is the exposure value of the netting set after risk mitigation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | Ei is the current value of all cash and securities lent, sold with an agreement to repurchase or otherwise posted to the counterparty under the netting agreement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) | Cj is the current value of all cash and securities borrowed, purchased with an agreement to resell or otherwise held by the bank under the netting agreement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (6) | Es is the net current value of each security issuance under the netting set(always a positive value) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (7) | Hs is the haircut appropriate to ES as described in tables of paragraphs 9.49 to 9.50, as applicable | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (a) | Hs has a positive sign if the security is lent, sold with an agreement to repurchased, or transacted in manner similar to either securities lending or a repurchase agreement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (b) | Hs has a negative sign if the security is borrowed, purchased with an agreement to resell, or transacted in a manner similar to either a securities borrowing or reverse repurchase agreement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (8) | N is the number of security issues contained in the netting set (except that issuances where the value Es is less than one tenth of the value of the largest Es in the netting set are not included the count) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (9) | Efx is the absolute value of the net position in each currency fx different from the settlement currency | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (10) | Hfx is the haircut appropriate for currency mismatch of currency fx | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collateralized OTC derivatives, exchange traded derivatives and long settlement transactions | |||

| 9.65 | Under the standardized approach for Counterparty Credit Risk Framework (SA-CCR), the calculation of the counterparty credit risk charge for an individual contract will be calculated using the following formula, where: | ||

| (1) | Alpha = 1.4 | ||

| (2) | RC = the replacement cost calculated according to paragraphs 6.5 to 6.22 in The Counterparty Credit Risk (CCR) Framework. | ||

| (3) | PFE = the amount for potential future exposure calculated according to paragraphs 6.23 to 6.76 in the CCR framework. | ||

| 9.66 | As an alternative to the SA-CCR for the calculation of the counterparty credit risk charge, banks may also use the internal models method as set out in chapter 7 of the Counterparty Credit Risk (CCR) Framework, subject to SAMA’s approval. | ||

41 Cash-funded credit-linked notes issued by the bank against exposures in the banking book that fulfil the criteria for credit derivatives are treated as cash-collateralized transactions.

42 When cash on deposit, certificates of deposit or comparable instruments issued by the lending bank are held as collateral at a third- party bank in a non-custodial arrangement, if they are openly pledged/assigned to the lending bank and if the pledge/assignment is unconditional and irrevocable, the exposure amount covered by the collateral (after any necessary haircuts for currency risk) receives the risk weight of the third-party bank.

43 When debt securities that do not have an issue specific rating are issued by a rated sovereign, banks may treat the sovereign issuer rating as the rating of the debt security.

44 However, the use or potential use by a UCITS/mutual fund of derivative instruments solely to hedge investments listed in this paragraph and paragraph 9.45 shall not prevent units in that UCITS/mutual fund from being eligible financial collateral.

45 Exposure amounts may vary where, for example, securities are being lent.

46 The holding period for the haircuts depends, as in other repo-style transactions, on the frequency of margining.