Book traversal links for Rules Regulating Consumer Microfinance Companies

Rules Regulating Consumer Microfinance Companies

No: MSHT/82 Date(g): 10/12/2019 | Date(h): 13/4/1441 Status: In-Force Chapter One Definitions and General Provisions

Article 1

1. The following terms and phrases, wherever mentioned herein, shall have the same meanings stated in the Finance Companies Control Law.

2. For the purpose of applying the provisions of these Rules, the following terms and phrases, wherever mentioned herein, shall have the meanings assigned thereto, unless the context otherwise requires:

Consumer Microfinance: extending consumer credit as per controls stated in Article (50) of these Rules.

Consumer Microfinance Company: a joint stock company licensed by SAMA to practice consumer microfinance activity.

Article 2

1. Without prejudice to the provisions of the Finance Companies Control Law, the objective of these Rules is to establish licensing provisions for consumer microfinance companies and regulate their activities.

2. These Rules shall be applicable to consumer microfinance companies, licensed pursuant to the provisions of the Law and these Rules.

Chapter Two Licensing Provisions

Article 3

The founding members or shareholders of a Consumer Microfinance Company, or their representatives, shall submit the license request to SAMA, attached with the following:

1. completed application form required by SAMA;

2. draft articles of association and by-laws of the Consumer Microfinance Company;

3. description of the organizational structure of the Consumer Microfinance Company showing all necessary departments and functions and their main tasks;

4. the Fit and Proper forms for founding shareholders, signed by each founding shareholder;

5. the Fit and Proper Form for Board members, signed by every candidate for board membership;

6. an irrevocable bank guarantee issued in favor of SAMA by one of the local banks for an amount equivalent to the required minimum capital. Such bank guarantee is renewable automatically until the required capital is paid up in full. This guarantee shall be released upon the request of the founding shareholders in the following cases:

a. paying up the capital in cash;

b. withdrawing the license application; or

c. refusing the license application by SAMA.

7. any other documents or information required by SAMA.

Article 4

1. The minimum paid-up capital for a Consumer Microfinance Company shall be (20,000,000) twenty million riyals.

2. Notwithstanding the provision of subsection (1) of this article, the minimum paid-up capital for a Consumer Microfinance Company that carries out the activity using Financial technology shall be (10,000,000) ten million riyals.

3. SAMA may stipulate higher or lower minimum capital based on the prevailing market conditions, or if it deems that the proposed business model or the geographical scope requires so. The capital shall be paid in full at the establishment of the consumer microfinance company.

Article 5

1. SAMA shall charge a fee of (20,000) twenty thousand riyals for issuing, amending, or renewing a license to practice consumer microfinance activity.

2. Notwithstanding the provision of subsection (1) of this article, the fee for issuing, amending, or renewing a license to practice consumer microfinance activity using financial technology shall be (10,000) ten thousand riyals.

Article 6

1. Each founding shareholder must comply with the Sharia and legal competence requirements, and the fit and proper requirements stipulated by SAMA, in particular the following:

a. The founding shareholder must have the sufficient financial solvency and shall not have breached any financial obligations towards his/her creditors nor there is an indication that he cannot continuously comply with his financial obligations towards his/her creditors.

b. The founding shareholder must not have violated any of the provisions or regulations of the Capital Market Law, the Banking Control Law, the Cooperative Insurance Companies Control Law, Finance Laws, or any other laws or regulations inside or outside Saudi Arabia.

c. The founding shareholder must not have declared bankruptcy or entered into a general settlement with any creditor.

d. The founding shareholder must not have been sentenced of a breach of trust offense, unless rehabilitated and at least 10 years have passed since the last sanction for this crime has been completed and on the condition of obtaining a non-objection letter from SAMA.

e. The founding shareholder have not requested to withdraw license application to carry out finance activity in the last two years.

f. The founding shareholder must not have a previous application to carry out finance activity refused by SAMA during the last five years.

2. A non-objection letter from SAMA is required before acquiring (5%) or more of the consumer microfinance company's capital or voting rights.

Article 7

All Board members shall comply with the requirements of professional eligibility and fit and proper requirements stipulated by SAMA, in particular the following:

1. He/she must not be a Board member in another Consumer Microfinance Company exercising the same activity.

2. He/she must not combine work in supervising or auditing the Consumer Microfinance Company with being a member in the Board of the company.

3. He/she must not have been dismissed from an executive leadership function in financial facility as disciplinary measure.

4. He/she must not have been convicted of violating provisions of any penal law or any provisions or regulations of the Capital Market Law, the Banking Control Law, the Cooperative Insurance Companies Control Law, Finance Laws, or any other laws or regulations inside or outside Saudi Arabia.

5. He/she must not have been sentenced of a breach of trust offense, unless rehabilitated and at least 10 years have passed since the sanction for this crime has been completed and on condition that he/she receives a non-objection letter from SAMA.

6. He/she must have the sufficient financial solvency and shall not have breached any financial obligations towards his/her creditors nor there is an indication that he/she cannot continuously comply with his/her financial obligations towards his/her creditors.

Article 8

Any candidate for a Senior Management position must comply with the requirements of professional eligibility and fit and proper requirements stipulated by SAMA, in particular the following:

1. The candidate must be professionally qualified and must have at least two years of relevant experience. SAMA has the right to assess the candidate's completion of such period of experience.

2. The candidate must not have been dismissed from a previous job as disciplinary measure.

3. Not have been convicted of a violation of any of the provisions of a criminal law, the Banking Control Law, the Capital Market Law, the Co-operative Insurance Companies Control Law or its regulations, the Finance Laws or its regulations, or any other laws or regulations inside or outside the Kingdom of Saudi Arabia.

4. The candidate must not have declared bankruptcy or entered into a general settlement with any creditor.

5. The candidate must not have been sentenced of a breach of trust offense, unless rehabilitated and at least 10 years have passed since the sanction for this offense has been completed and on condition that he receives a non-objection letter from SAMA.

6. The candidate must have the sufficient financial solvency, and shall not have breached any financial obligations towards his/her creditors nor there is an indication that he/she cannot continuously comply with his/her financial obligations towards his/her creditors.

Article 9

1. The license application must comply with the requirements set out in the Law and these Rules. The founding shareholders of the Consumer Microfinance Company must provide SAMA with any additional information or documents that SAMA may require within (15) working days from the date of request.

2. In case of failing to meet the 15 working day period requirement specified in paragraph (1) of this Article, SAMA may refuse the license application.

3. SAMA will issue a written notice to the applicant after the completion of all the requirements set forth in the Law and these Rules.

4. Within (60) days from the day on which SAMA has accepted the license application as being complete, SAMA will either grant a preliminary approval or refuse to grant a License, giving its reasons in case of a refusal. The preliminary approval does not constitute a license or approval to practice the finance activity.

Article 10

1. Founding shareholders must establish the Consumer Microfinance Company as a joint stock company within six months of the granting of the preliminary approval and provide SAMA with copies of the Consumer Finance Company’s commercial registration and by-laws. The preliminary approval will expire after six months unless a non-objection letter has been obtained from SAMA to extend its duration for a maximum of six months.

2. SAMA will issue a decision to grant the license to the company following the company’s fulfillment of the requirements set forth in paragraph (1) of this Article. SAMA may take any necessary actions, such as making a licensing visit to the company headquarters, meeting its executives, and reviewing its regulations, procedures, and records to verify that the specified requirements have been met.

3. SAMA may restrict the License to a certain geographic area or specific types of borrowers or otherwise. The Consumer Microfinance Company is prohibited from engaging in any unlicensed activity or activities that violate the License conditions.

Article 11

The license shall be granted for a term of five years and SAMA may renew it upon the request of the company. The company shall submit the renewal request to SAMA at least six months prior to the expiration of the license using the form set by SAMA.

Article 12

Without prejudice to the provisions of the Finance Companies Control Law and other relevant instructions, a Consumer Microfinance Company may request to amend any condition or limitation in the license, provided that such request is based on reasonable justifications. Any documents, information or studies required by SAMA shall be attached to the request. If the amendment results in adding a new activity or amending the licensed activity, the relevant requirements of such activity shall be met in accordance with the Finance Companies Control Law and its Implementing Regulations, and the Rules of such activity.

Article 13

1. SAMA may revoke the license upon the request of the Consumer Microfinance Company, taking into account the rights of the creditors and borrowers and the integrity of the financial system.

2. SAMA may revoke the license if the Consumer Microfinance Company has submitted false information or failed to disclose material information that should have been provided for licensing purposes.

Chapter Three Supervision on Consumer Microfinance Companies

Article 14

Consumer Microfinance Company shall provide SAMA with precautionary data at the specified times as per the forms, controls and instructions set by SAMA.

Article 15

1. A Consumer Microfinance Company must provide SAMA with its audited annual financial statements, auditor’s report and the Board report within (45) forty five working days from the end of the Gregorian year.

2. A Consumer Microfinance Company must provide SAMA with its quarterly financial statements and auditor’s report within (20) twenty working days from the end of each Gregorian quarter.

3. A Consumer Microfinance Company shall immediately report to SAMA any losses exceeding (15%) of the paid-up capital.

4. SAMA may amend the periods mentioned in this Article when it deems necessary.

Article 16

A Consumer Microfinance Company shall obtain a non-objection letter from SAMA prior to approving any dividend distribution, and such distribution shall not lead to a decrease in the level of capital adequacy and liquidity in accordance with the rules, requirements and criteria set by SAMA.

Article 17

1. No acquisition of assets other than those necessary to manage its business shall be executed by the Consumer Microfinance Company unless it has obtained a non-objection letter from SAMA.

2. A Consumer Microfinance Company may not execute any partial or total liquidation of its business or of the Company itself without obtaining a non-objecting letter from SAMA.

Article 18

A Consumer Microfinance Company must not obtain non-banking credit facilities or the like unless it has obtained a non-objection letter from SAMA.

Article 19

1. The Consumer Microfinance Company must apply international accounting standards in the preparation of their accounts and financial statements

2. The Consumer Microfinance Company must make provisions for contingent losses and risks in accordance with International Financial Reporting Standards. SAMA may require that the Company to make an additional provision or more for contingent losses and risks.

3. Subject to the international accounting standards, a Consumer Microfinance Company must define criteria for assets value reduction, provisioning standards and regularly verify their implementation.

Article 20

1. Prior to appointing an external auditor, a Consumer Microfinance Company shall obtain a non-objection letter from SAMA. SAMA may require the company to appoint another auditor whenever the size and nature of its business require so.

2. SAMA may require the Consumer Microfinance Company to replace its external auditor or may appoint another external auditor at the expense of the company in any of the following cases:

a. when necessary due to the size and nature of its business;

b. the external auditor has committed a breach of professional obligations; if there is a reason to believe that the external auditor has a conflict of interest; or

c. when necessary for the protection of the finance sector or governance considerations and the protection of shareholder’s interest.

3. The external auditor must report to SAMA immediately all facts of which he/she obtains knowledge in the course of an audit and which:

a. justify the reservation in the audit report or the abstention from giving an opinion;

b. jeopardize the existence of the consumer microfinance company;

c. seriously impair the company’s development;

d. indicate an evidence that the executives violate any of the applicable laws, regulations or instructions in Saudi Arabia or the by-laws of the company; or

e. terminate the agreement before it ends with the reasons thereupon.

4. SAMA may require the external auditor to explain his/her report or to reveal other facts that may have come to his/her attention during the audit, which indicates any violation of the laws, the regulations, the instructions or the by-laws of a Consumer Microfinance Company.

Article 21

1. The Consumer Microfinance Company, its Board members, and employees must provide all information and documentation concerning the Company, its business, its shareholders, and its personnel, that SAMA may request at any time.

2. SAMA has the right to inspect the records and accounts of the Consumer Microfinance Company, through SAMA’s personnel or by auditors appointed by SAMA, provided that the inspection shall be at the Company’s premises.

3. The Consumer Microfinance Company and its employees shall facilitate the task of whom SAMA appoints for inspection and cooperate with them particularly as follows:

a. providing the inspector with the company’s records, accounts and documents he/she deems necessary to perform his/her task;

b. providing information and explanations as required by the inspector; and

c. disclosing any violations or irregularities in the Company’s operations to the inspector at the beginning of his/her mission

4. The Consumer Microfinance Company shall adhere to the recommendations and instructions given by SAMA to address the observations of inspection visits.

5. The Consumer Microfinance Company and any of its employees may not hide or attempt to hide any information or irregularities or fail to provide any clarifications requested by the appointed inspector or neglect to provide any requested information and documents on time.

6. SAMA’s employees in charge of the supervision, control, and inspection shall not be vulnerable to any claims as a result of performing their duties.

Article 22

1. Every violation of the provisions of the Law and the Regulation or the noncompliance to any of the rules or circulars issued by SAMA is a violation related to the professional irregularity referred to in Article (29) of the Law.

2. Every violation that endanger the shareholders of the Consumer Microfinance Company or their creditors as referred to in Article (29) of the Law, is as follows:

a. There is a material adverse change in the business, or in the financial or legal or administrative situation of the Consumer Microfinance Company that might endangers its existence or its ability to pay its debts as they fall due.

b. The Consumer Microfinance Company incurs a loss amounting to one- half of its paid up capital.

c. The Consumer Microfinance Company incurs a loss amounting to more than (10%) of its paid-up capital in each of at least four consecutive fiscal years.

Article 23

The Consumer Microfinance Company must reimburse all costs of a third party appointed by SAMA as a consequence of procedures taken under this Chapter.

Chapter Four Corporate Governance

Article 24

The Consumer Microfinance Company must comply with corporate governance rules determined by SAMA.

Article 25

The Consumer Microfinance Company shall develop written internal governance rules and regulations, approved by the Board. Such regulations should include at least the following:

1. the description of the organizational structure, including all departments and functions and their tasks and responsibilities;

2. independence and separation of duties;

3. roles of the Board, its committees, and the composition and duties of each of them;

4. remuneration and compensation policies;

5. conflict of interest controls;

6. integrity and transparency controls;

7. compliance with applicable laws and regulations;

8. methods for securing confidentiality of information;

9. fair dealings; and

10. controls for protection of company assets.

Article 26

The Board shall form specialized committees to expand the scope of work in the areas requiring special expertise, including at least an audit committee, and shall specify their powers and monitor their performance.

Article 27

1. A Consumer Microfinance Company must obtain a non-objection letter from SAMA before appointing any person in the following positions and functions:

a.

Membership of Board and its committees.

b. Managing Director, Chief Executive Officers, General Manager, their designees, Financial Manager and directors of key departments, or their designees.

c. Directors of control functions, such as internal audit, risk management and compliance or their designees.

2. A Consumer Microfinance Company shall inform SAMA immediately when any of its senior management members retires or gets his/her mandates terminated.

Chapter Five Internal Organization

Article 28

A Consumer Microfinance Company must establish appropriate written organizational policies that includes work manuals and workflow procedures. Those policies must be kept up to date on a regular basis and they must be communicated to the concerned staff in a suitable and timely manner. The organizational policies must include rules for at least the following:

1. the organizational and operational structure, decision making and responsibilities;

2. credit granting and operations;

3. financial management and accounting;

4. marketing and sales;

5. information technology and security;

6. customer service and collection;

7. risk management, assessment, treatment, control and disclosure;

8. internal supervision system;

9. internal audit;

10. committing to the related laws, regulations and instructions;

11. outsourcing; and

12. salaries, bonuses and incentives, including the salaries of members of Senior Management and staff and their motivation and remuneration of the Board and its committees.

Article 29

It is prohibited in the Consumer Microfinance Company to combine an executive function such as financing or operation and oversight function such as internal audit or compliance tasks. A separation of functions must be adopted in a manner that ensures the application of the generally accepted policies, procedures, and technical standards, to protect the company’s assets and funds, and avoid fraud and embezzlement.

Article 30

1. A Consumer Microfinance Company’s technical equipment and related systems must be adequate according to industry standards for the company’s operational needs, nature of activity and risk situation.

2. Information technology systems and the related processes must be designed in a manner that ensures data integrity, availability, authenticity and confidentiality. Information technology systems and the related processes must be assessed on a regular basis in accordance to the generally accepted technical standards and tested before they are used for the first time and after any changes have been made.

3. A Consumer Microfinance Company must establish a business continuity plan for emergencies that includes alternative solutions to restore its operations within an appropriate time.

Article 31

A Consumer Microfinance Company shall have sufficient and qualified human resources in terms of knowledge and expertise to meet its operational needs, business activities and risk situation. The remuneration and incentives of staff must be fair, in line with its risk management strategy, and must not create a conflict of interest.

Article 32

1. At least 50% of all employees must be Saudi nationals when a Consumer Microfinance Company starts operations. The percentage applies to all departments and organizational levels.

2. The percentage of Saudi nationals of total human resources shall be annually increased by (5%) of all employees until (75%) has been reached. SAMA may determine the minimum required annual increase thereafter.

3. Recruitment of non-Saudis in the Consumer Microfinance Company shall be limited to jobs that require expertise not available in the Saudi labor market. In all cases, the Consumer Microfinance Company must obtain a non-objection letter from SAMA before appointing any non-Saudi employee in supervision departments provided that the company has proved the lack of Saudis for the vacant position.

Chapter Six Outsourcing

Article 33

1. The Board must issue and annually update a written policy regulating outsourcing. This policy shall include in particular the following:

a. terms of reference and responsibilities of the Board and Senior Management;

b. eligibility criteria for outsourcing provider;

c. risk identification criteria and risk hedging measures;

d. rules for continuous control and supervision over the outsourced operations;

e. criteria to identify conflict of interest as well as rules and procedures which ensure safeguarding the interests of the Consumer Microfinance Company and not putting the interest of the other party over the company's interest; and

f. procedures to protect information and maintain confidentiality and privacy.

2. SAMA, the Consumer Microfinance Company, and the external auditor must have the authority to obtain any information or documents related to the work of the outsourcing provider or be examined in the offices of the outsource provider.

3. A Consumer Microfinance Company shall verify the outsourcing provider’s compliance with relevant laws, regulations and instructions. The Consumer Microfinance Company shall be held liable if the outsourcing provider shows lack of compliance with the applicable laws, regulations and instructions in all operations and tasks assigned to it.

4. A Consumer Microfinance Company must obtain a non-objecting letter from SAMA prior to any outsourcing arrangement that, in case of disruption or other default, may affect the consumer microfinance company’s activities, reputation or financial situation, or if the tasks assigned include transferring, processing or saving the data and information of borrowers. In this case, the outsourcing provider may not subcontract these tasks to any other provider.

Article 34

A Consumer Microfinance Company shall obtain a no-objection letter from SAMA before outsourcing any finance services to a third party.

Chapter Seven Risk Management

Article 35

A Consumer Microfinance Company shall:

1. establish a clear written business strategy and a written risk management policy approved and updated annually by the board. The risk management policy should take into account all relevant types of risks and how to deal with them, taking into consideration all business activities, including outsourced operations and tasks;

2. establish appropriate procedures to identify, assess, manage, monitor and communicate risks. These processes must be included in a comprehensive risk management framework that ensures:

a. early and comprehensive identification of risks;

b. assessment of correlations between risks; and

c. immediate coordination with Senior Management, the Board, risk and credit management committee and the responsible staff, and where appropriate, the internal audit department.

3. submit the risk report to its board.

Article 36

The Consumer Microfinance Company must prepare a biannual risk report for discussion by the board or the competent committee, if any, after review by senior management. The report must include as a minimum the following:

1. a comprehensive overview of the risk development and performance of financial positions that incur market price risks as well as any instances in which the limits are exceeded;

2. changes to assumptions or parameters which form the basis of risk assessment procedures;

3. the performance of the finance portfolio by activity, risk class and size and collateral category;

4. the extent of limits granted, external credit lines and default finance, which must be listed and commented on;

5. analysis of the conditions in which the Consumer Microfinance Company exceeds the limits as well as the reasons for this, the scale and development of new business, and the company’s risk provisioning; and

6. any major finance decisions which deviate from the strategies or policies of the Consumer Microfinance Company.

Article 37

A Consumer Microfinance Company shall submit to SAMA the report referred to in Article (36) of this document, after being discussed and approved by the board or the competent committee, if any, along with the decisions made in this regard.

Chapter Eight Compliance

Article 38

A Consumer Microfinance Company must comply with applicable laws, regulations and instructions. It must also take the necessary measures and procedures to avoid breaching its provisions.

Article 39

A Consumer Microfinance Company shall:

1. establish an independent department or a compliance function and assign a head of compliance reporting directly to the audit committee, and the audit committee must raise their views about compliance reports to the board;

2. develop a written compliance policy approved by the board, which sets out the powers, obligations and responsibilities of the compliance department as well as compliance programs and related processes. The audit committee must ensure the implementation of the compliance policy, evaluate its effectiveness, update it and propose the necessary amendments to it on an annual basis; and

3. take the necessary procedures to ensure that the compliance policy referred to in paragraph (2) of this Article is adhered to.

Article 40

1. Based on the recommendation of the audit committee, a head of compliance shall be appointed by the board after obtaining a non-objecting letter from SAMA.

2. The head of compliance acts independently regarding his/her tasks, and he/she may not perform any other administrative responsibilities.

Article 41

The head of compliance must submit a compliance report to the audit committee semi-annually and then to the board for review. The compliance report must identify the main compliance-related risks facing the Consumer Microfinance Company, analyze existing processes and procedures and assess their viability, and suggest any amendments or changes.

Article 42

The compliance department must have staff and resources commensurate with the business model and size of the Consumer Microfinance Company. Compliance employees must only report solely to the head of compliance.

Article 43

The compliance department must ensure the Consumer Microfinance Company’s compliance with applicable laws, regulations and instructions. It shall particularly perform the following tasks:

1. identify and deal with all compliance risks and monitor all relevant developments;

2. analyze new procedures, policies and operations and suggest procedures to address relevant compliance risks;

3. follow a risk-based compliance program and include its findings in the report referred to in Article (41) of these Rules;

4. collect compliance-related complaints and formulate written guidance to staff, where necessary;

5. draft internal policies and procedures to combat financial crimes, such as money laundering and terrorism financing;

6. monitor compliance with anti-money laundering and anti-terrorism financing laws, regulations, and rules;

7. promote awareness of compliance issues and provide training to employees on compliance-related matters through periodic programs; and

8. immediately report to SAMA and the audit committee in case of revealing any irregularities or violations.

Article 44

A Consumer Microfinance Company, shall comply with the legal requirements mentioned in the Anti-Money Laundering Law, the Law on Terrorism Crimes and Financing, their Implementing Regulations, and the relevant instructions and guidelines as specified by SAMA, in a manner that is consistent with the nature and size of this company’s activity and risks it may be exposed to. A Consumer Microfinance Company, shall also comply with the requirements and instructions issued by SAMA on financial crimes and fraud.

Chapter Nine Internal Audit

Article 45

1. The Consumer Microfinance Company must establish an internal audit department reporting directly to the audit committee. The internal audit department shall be independent in performing its duties, and its employees shall not be assigned any other responsibilities. Tasks of this department may be outsourced.

2. The internal audit department manages and assesses the internal control system to ensure the extent to which the company and employees comply with applicable laws, regulations and instructions as well as the Consumer Microfinance Company's policies and procedures, whether outsourced or not. The internal audit department must have full and unlimited access to information and documents.

Article 46

1. The internal audit department in the Consumer Microfinance Company shall operate according to a comprehensive audit plan approved by the audit committee and updated on an annual basis.

2. Major activities and operations, including those related to risk management and compliance, must be audited at least annually.

Article 47

1. The internal audit department must prepare and submit to the audit committee a written report on its work at least semi-annually. This report must include the scope of the audit, all findings and recommendations. It must also include the procedures taken by each department in respect of the findings and recommendations of the previous auditing and any related observations, especially if they have not been settled on time and the reasons for their unsettlement.

2. The internal audit department must prepare and submit to the audit committee a written general report on all audits in a fiscal year, compared with the approved plan and stating any gaps or deviation from the plan, if any. This report shall be submitted within the first quarter following the end of the relevant fiscal year.

Article 48

The Consumer Microfinance Company shall maintain the working documents and audit reports that clearly show the work carried out as well as findings and recommendations and what has been accomplished regarding these recommendations.

Chapter Ten Finance Procedures

Article 49

1. Without prejudice to these Rules and the relevant instructions issued by SAMA, a Consumer Microfinance Company shall define written finance policies setting out rules and procedures for granting finance including, but not limited to, classification of creditworthiness.

2. A consumer microfinance company's board shall approve all finance policies and all amendments to policies and provide SAMA with a copy of these policies.

Article 50

The Consumer Microfinance Company shall not engage in any activity other than the activity of consumer microfinance. It shall practice such activity according to the following:

a. The finance shall be for purchasing goods and services for purposes of consumption, including, but not limited to, purchase of furniture, consumer goods and household products or payment of education fees and the like.

b. The finance to the borrower shall not be for commercial or professional purposes.

c. Vehicle purchase financing is excluded from consumer microfinance activity.

Article 51

A Consumer Microfinance Company shall obtain a non-objection letter from SAMA before launching any finance products or modifying any existing products.

Article 52

A Consumer Microfinance Company shall fully abide by the Responsible Lending Principles for Individual Consumers issued by SAMA.

Article 53

1. Consumer Microfinance Company must, upon the approval of the Consumer, verify the consumer’s credit record to confirm solvency, repayment capacity and credit conduct. The confirmation of such must be documented in the finance file.

2. Upon the borrower’s consent, the Consumer Microfinance Company shall register the credit information of the borrower at one or more of the companies licensed to collect credit information according to the relevant laws, regulations and instructions. Such information shall be updated throughout the period of dealing with the borrower.

3. The Consumer Microfinance Company must decline the finance request in case of the absence of consent from the consumer or borrower mentioned in paragraphs (1) and (2) of this Article.

Article 54

A Consumer Microfinance Company shall not:

a. provide finance to a foreign borrower not residing in Saudi Arabia; or

b. provide finance in a currency other than the Saudi riyal.

Article 55

1. A Consumer Microfinance Company shall adopt clear, transparent and documented scientific methods, criteria and procedures to evaluate the creditworthiness of the finance applicant and his/her ability to repay. These methods, criteria, and procedures shall be in accordance with the best practices in this area. The board of directors of the company shall adopt, revise at least once every three years, and update when necessary these criteria and procedures. The company shall apply these procedures and document them in the finance file prior to granting finance.

2. A Consumer Microfinance Company shall set procedures for early risk detection in order to identify the finance with clear evidence of increased risk. It shall also develop quantitative and qualitative indicators for early risk detection.

Article 56

A Consumer Microfinance Company may provide unsecured finance in line with the risk management policy and procedures approved by its board of directors.

Article 57

1. The total amount of finance granted to a borrower by a Consumer Microfinance Company must not exceed (SAR 50,000) fifty thousand riyals.

2. Notwithstanding the provision of subsection (1) of this article, the total amount of finance granted to a borrower by a Consumer Microfinance Company that carries out its activity using financial technology must not exceed (SAR 25,000) twenty-five thousand riyals.

3. SAMA may adjust this amount according to the market conditions or geographical scope of the company.

Article 58

A Consumer Microfinance Company must make provisions for contingent losses and risks in accordance with International Financial Reporting Standards. SAMA may require that the company to make an additional provision or more for contingent losses and risks.

Article 59

The Consumer Microfinance Company must define cases in which an exposure requires special observation; these exposures shall be reviewed on an ongoing basis to determine whether further actions may be required. There must be clear rules determining when a finance must be transferred to personnel specializing in restructuring, scheduling or winding up.

Article 60

Insurance on finance risks shall be in accordance with the Cooperative Insurance Companies Control Law and its Implementing Regulations as well as instructions issued by SAMA.

Chapter Eleven Exposure Limits

Article 61

Exposure includes the value of all assets that subject to any credit risks, including but not limited to, finance agreements; securities; and advanced payments to other entities and clients; all commitments or other obligations to grant finance or to make a payment or deliver assets to a third party with a right of recourse against a client or another third party, equity, participating interests and assets in respect of which the Consumer Microfinance Company is the lessor.

Article 62

A Consumer Microfinance Company shall assess and rate risks related to each exposure before making any finance decision and review the risk rating at least once every two years.

Article 63

1. The aggregate finance amount provided by a Consumer Microfinance Company shall not exceed double the company’s amount of capital and reserves unless a non-objection letter from SAMA is obtained.

2. SAMA may increase the limit on the aggregate finance amount offered by a Consumer Microfinance Company to the extent it deems appropriate, taking into account the financial position of the company, its performance and the market conditions.

Chapter Twelve Consumer Protection

Article 64

Finance agreements must be drawn up on paper or electronically between the Consumer Microfinance Company and the borrower and each contracting party must receive a copy of the finance agreement. The finance agreement must include at least the following data and information:

1. names of parties to the contract, ID/Iqama/commercial register number of the borrower (as the case may be), official addresses, and contact information such as mobile phone number and email address (if any);

2. type of finance;

3. term of finance contract;

4. finance amount;

5. conditions to drawdown the amount of finance if available;

6. term cost and its application conditions;

7. annual percentage rate (APR);

8. total amount payable by the borrower, calculated at the time of signing the finance contract, with the assumptions used in calculation provided;

9. the amount, number and duration of installments to be paid by the borrower and the method of distributing that amount over the remaining amounts;

10. fees, commissions, and administrative service costs;

11. terms of payment of fees or funds required without paying the finance amount as well as the conditions for such payment;

12. the consequences of delayed payment of installments;

13. required documentation fees, where applicable;

14. guarantee and insurance (if any);

15. the account number for depositing finance installments and the bank name;

16. procedures for exercising the right to withdraw (if any) and the conditions and financial obligations relating to such right;

17. procedures for early repayment and for compensation of the Consumer Microfinance Company (when necessary) and how to determine such compensation;

18. procedures for dealing with guarantees if their value is reduced (if any);

19. procedures for exercising the right to terminate the finance contract;

20. the borrower's permission to include his/her information in the credit record; and

21. any other information specified by SAMA.

Article 65

The finance agreement shall bear on its forefront a summary containing the basic information of the finance product and the main provisions of the finance agreement in a clear language for the borrower, in accordance with the model determined by SAMA and documenting the receipt of this summary by the borrower in the finance file.

Article 66

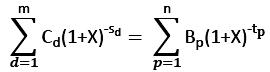

1. The Annual Percentage Rate is the discount rate at which the present value of all instalments and other payments that are due on the borrower, representing the total amount payable by the borrower, equals the present value of the payments of the amount of finance available to the borrower, calculated on the date on which the amount of finance or the date the first payment is available to the borrower, calculated by the following equation:

Where:

m is the last payment of the amount of finance to be received by the borrower;

d is the payment to be received by the borrower from the amount of finance;

Cd is the payment value of (d) to be received by the borrower from the amount of finance;

Sd the period between the date on which the amount of finance or the first payment is available to the borrower and the date of payment (d), calculated in years and parts of the year, and so that this period of first payment received by the borrower from the amount of finance is zero (s1=0);

n is the last payment payable by the borrower;

p is the payment payable by the borrower;

Bp is the payment value (p) payable by the borrower;

tp is the period between the date on which the amount of finance or the first payment is available to the Borrower and the date of the payment (p) to be received from the Borrower, calculated in years and parts of the year.; and

X is the Annual Percentage Rate (APR).

2. For the purpose of calculating the APR, the periods between the date on which the finance amount or the first finance payment is made available to the borrower and the date of every payment received or payable by the borrower shall be calculated on the basis of (12) months or (365) days a year.

3. For the purpose of calculating the APR, the total amount payable by the borrower must be specified including fees, commissions and costs that cannot be avoided by the borrower, excluding costs or fees payable by the borrower due to his/her violation of any obligations contained in the finance contract.

4. It is a must to calculate the Annual Percentage Rate, assuming validity of finance agreement for the agreed period of time and both parties commitment to their obligations according to the conditions contained in the finance agreement.

Article 67

The Consumer Microfinance Company must use the declining balance method in distributing the term cost on the maturity period, whereas the term cost is distributed proportionally between installments on the basis of the balance value of the remaining amount of finance at the beginning of the installment maturity period, and including it in the finance agreement.

Article 68

Fees, commissions and administrative service charges to be received by the Consumer Microfinance Company from the borrower shall not exceed the amount equivalent to (1%) of the finance amount.

Article 69

A borrower may accelerate the payment of the remaining finance amount at any time without bearing the term cost of the remaining period. A Consumer Microfinance Company may be compensated for the following:

a. The cost of re-investment, but not exceeding the term cost for the following three months of payments, calculated on the basis of the declining balance; and

b. Payments from the Consumer Microfinance Company to a third party due to the finance agreement of expenses stipulated therein, if they are irrecoverable expenses, for the remaining term of the finance agreement.

Article 70

1. The Consumer Microfinance Company shall indicate in all product advertisements: its name, logo, any identifying representation and contact details.

2. The advertisement shall disclose, in a manner that is clear to the consumer, the name and Annual Percentage Rate of the advertised product and shall not include other rates of the term cost.

3. A Consumer Microfinance Company is not allowed to publish an advertisement that includes a false offer, statement, or a claim expressed in terms that would directly or indirectly deceive or mislead a consumer.

4. SAMA may require any Consumer Microfinance Company that does not comply with the conditions of this Article to withdraw the advertisement within one business day of SAMA’s notice.

Article 71

The Consumer Microfinance Company shall establish a function for handling complaints, assign staff to such function, set clear procedures for receiving, documenting, reviewing, and responding to borrowers’ complaints within the period specified by SAMA, and keep such complaints in relevant records. All necessary details of borrowers’ complaints and related actions taken shall be included in the complaint records.

Article 72

1. The Consumer Microfinance Company and its employees shall maintain the confidentiality of clients’ data and transactions and shall not disclose them to other parties, except in accordance with the relevant laws and instructions.

2. Employees of the Consumer Microfinance Company shall not disclose any information about the company’s clients and transactions obtained through their work, even after leaving the company, and shall not retain any of this information after resigning.

3. The Consumer Microfinance Company shall take all necessary measures to ensure confidentiality of clients’ information and transactions.

Chapter Thirteen Concluding Provisions

Article 73

Without prejudice to the provisions of the Law, SAMA may exempt consumer microfinance companies from some of the provisions of these Rules as required by the conditions of the sector.

Article 74

These Rules comes into effect as of the date of their publication on SAMA’s website.