Effective from Dec 19 2012 - Dec 18 2012

To view other versions open the versions tab on the right

6.1 Counterparty Credit Risk

As mentioned, Counterparty Credit Risk under Basel II only measured Default Risk which could be calculated by using the following 3 methods, where SAMA adopted the # 3 Current Exposure Method.

1. Internal Model Method

2. Standardized Approach

3. Current Exposure Method (CEM)

In this regard, SAMA had permitted only the Current Exposures Method under Basel II. For Basel III purposes as in Basel II banks are to use the more simple CEM.

Further, Basel III introduced the concept of Current Value Adjustment (CVA) as an additional Counterparty Risk, which again can be determined by using the Internal Model Method (IMM) or the Standardized Method.

It should also be emphasized that Basel III introduced incremental risk or additional risk through the concept of the Credit Value Adjustment which measure the counterparty risk prior to default. Consequently, total risk is an aggregate of these two.

The main revision to Internal Models Method to measure default risk exposure is to using the Effective EPE with stressed parameters.

In this regard, the Default risk capital charge is the greater of:

• Portfolio level capital charge based on effective EPE (not including CVA charge using current market data) and the portfolio level capital charge based on effective EPE under stress calibration.

B. Credit Value Adjustment

Capitalization of the risk of CVA losses

The major element of CVA include the following:

• Applies to IMM and non IMM banks

• Huge mark-to-market losses incurred during financial crisis

• BCBS introduced a ‘’bond equivalent of the counterparty exposure’’ approach which aims to better capture CVA losses

• In addition to default risk, additional capital charge introduced for CCR for OTC derivatives

• Transactions with SFTs and CCPs excluded from CVA capital charge unless these are material, where the materiality threshold for SFT’s will be defined by SAMA and if warranted, bank will be advised accordingly.

• Banks with IMM approval and Specific Interest Rate Risk VaR model approval for bonds will use ‘’Advanced CVA risk capital charge’’

• All other banks will calculate CVA capital charge based on ‘’Standardized CVA risk capital charge’’ methodology

• Under Basel II, Banks in KSA are mandated by SAMA to use ‘’CEM’’ methodology for both Standardized & IRB Approach. However, for Basel III they can utilize IMM as well.

• Under the Standardized Approach, Banks would be required to develop enhanced system’s capability to apply this formula

• Maturity: Mi is the notional weighted average maturity (FAQ- For CVA purposes, the 5-year cap of the effective maturity will not be applied). This applies to all transactions with the counterparty, not only to index CDS- Maturity will be capped at the longest contractual remaining maturity in the netting set.

A. Counterparty credit risk using Internal Models

This section is only applicable for those banks that have been given regulatory approval by SAMA to use the IMM Approach to calculate counterparty credit risk. Alternatively, Banks should use Standardized Approach 6.1.B on page 30. Also, for further clarifications, please refer to SAMA Circular # BCS 24331 dated 4 September 2012 entitled "Basel III Definition of Capital FAQs (p.7).

6.1.A Internal Model Method (IMM)

Default Risk Exposures Calculation

Internal Model (EPE)

25(i). To determine the default risk capital charge for counterparty credit risk as defined in paragraph 105, banks must use the greater of the portfolio-level capital charge (not including the CVA charge in paragraphs 97-104) based on Effective EPE using current market data and the portfolio-level capital charge based on Effective EPE using a stress calibration. The stress calibration should be a single consistent stress calibration for the whole portfolio of counterparties. The greater of Effective EPE using current market data and the stress calibration should not be applied on a counterparty by counterparty basis, but on a total portfolio level.

61. When the Effective EPE model is calibrated using historic market data, the bank must employ current market data to compute current exposures and at least three years of historical data must be used to estimate parameters of the model. Alternatively, market implied data may be used to estimate parameters of the model. In all cases, the data must be updated quarterly or more frequently if market conditions warrant. To calculate the Effective EPE using a stress calibration, the bank must also calibrate Effective EPE using three years of data that include a period of stress to the credit default spreads of a bank’s counterparties or calibrate Effective EPE using market implied data from a suitable period of stress. The following process will be used to assess the adequacy of the stress calibration:

• The bank must demonstrate, at least quarterly, that the stress period coincides with a period of increased CDS or other credit spreads – such as loan or corporate bond spreads – for a representative selection of the bank’s counterparties with traded credit spreads. In situations where the bank does not have adequate credit spread data for a counterparty, the bank should map each counterparty to specific credit spread data based on region, internal rating and business types.

• The exposure model for all counterparties must use data, either historic or implied, that include the data from the stressed credit period, and must use such data in a manner consistent with the method used for the calibration of the Effective EPE model to current data.

• To evaluate the effectiveness of its stress calibration for Effective EPE, the bank must create several benchmark portfolios that are vulnerable to the same main risk factors to which the bank is exposed. The exposure to these benchmark portfolios shall be calculated using (a) current positions at current market prices, stressed volatilities, stressed correlations and other relevant stressed exposure model inputs from the 3-year stress period and (b) current positions at end of stress period market prices, stressed volatilities, stressed correlations and other relevant stressed exposure model inputs from the 3-year stress period. Supervisors may adjust the stress calibration if the exposures of these benchmark portfolios deviate substantially.

Calculation of Credit Value Adjustment (CVA)

The Concept

Credit Value Adjustments (CVA) under Basel III is an incremental credit risk capital charge prior to default. Under Basel II and Basel II.5 counterparty credit risk methodology only calculated capital requirements for default risk. However, Basel III brings in the capital charge with regard to the deterioration of a counterparty risk prior to default. Consequently, the CVA is in addition or as an incremental risk to default risk. SAMA's methodology uses the Current Exposure Method (CEM) for Default Risk which is one of the four methods prescribed under Basel II Annex # 41. Consequently, capital requirements for counterparty risk is the aggregate of CEM and CVA calculations.

Specific Aspects of CVA under IMM Approach

Capitalization of the risk of CVA losses

99. To implement the bond equivalent approach, the following new section VIII will be added to Annex 4 of the Basel II framework.1 The new paragraphs (97 to 105) are to be inserted after paragraph 96 in Annex 4.1

VIII. Treatment of mark-to-market counterparty risk losses (CVA capital charge)

- CVA Risk Capital Charge

97. In addition to the default risk capital requirements for counterparty credit risk determined based on the standardized or internal ratings- based (IRB) approaches for credit risk, a bank must add a capital charge to cover the risk of mark-to-market losses on the expected counterparty risk (such losses being known as credit value adjustments, CVA) to OTC derivatives. The CVA capital charge will be calculated in the manner set forth below depending on the bank’s approved method of calculating capital charges for counterparty credit risk and specific interest rate risk. A bank is not required to include in this capital charge (i) transactions with a central counterparty (CCP); and (ii) securities financing transactions (SFT), unless their supervisor determines that the bank’s CVA loss exposures arising from SFT transactions are material.

A. Banks with IMM approval and Specific Interest Rate Risk VaR model2 approval for bonds: Advanced CVA risk capital charge

98. Banks with IMM approval for counterparty credit risk and approval to use the market risk internal models approach for the specific interest-rate risk of bonds must calculate this additional capital charge by modeling the impact of changes in the counterparties’ credit spreads on the CVAs of all OTC derivative counterparties, together with eligible CVA hedges according to new paragraphs 102 and 103, using the bank’s VaR model for bonds. This VaR model is restricted to changes in the counterparties’ credit spreads and does not model the sensitivity of CVA to changes in other market factors, such as changes in the value of the reference asset, commodity, currency or interest rate of a derivative. Regardless of the accounting valuation method a bank uses for determining CVA, the CVA capital charge calculation must be based on the following formula for the CVA of each counterparty:

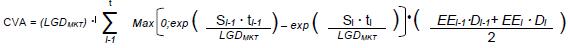

Where:

• ti is the time of the i-th revaluation time bucket, starting from t0=0.

• tT is the longest contractual maturity across the netting sets with the counterparty.

• si is the credit spread of the counterparty at tenor ti, used to calculate the CVA of the counterparty. Whenever the CDS spread of the counterparty is available, this must be used. Whenever such a CDS spread is not available, the bank must use a proxy spread that is appropriate based on the rating, industry and region of the counterparty.

• LGDMKT is the loss given default of the counterparty and should be based on the spread of a market instrument of the counterparty (or where a counterparty instrument is not available, based on the proxy spread that is appropriate based on the rating, industry and region of the counterparty). It should be noted that this LGDMKT, which inputs into the calculation of the CVA risk capital charge, is different from the LGD that is determined for the IRB and CCR default risk charge, as this LGDMKT is a market assessment rather than an internal estimate.

• The first factor within the sum represents an approximation of the market implied marginal probability of a default occurring between times ti-1 and ti. Market implied default probability (also known as risk neutral probability) represents the market price of buying protection against a default and is in general different from the real-world likelihood of a default.

• EEi is the expected exposure to the counterparty at revaluation time ti, as defined in paragraph 30 (regulatory expected exposure), where exposures of different netting sets for such counterparty are added, and where the longest maturity of each netting set is given by the longest contractual maturity inside the netting set. For banks using the short cut method (paragraph 41 of Annex 4)1 for margined trades, the paragraph 99 should be applied.

• Di is the default risk-free discount factor at time ti, where D0 = 1.

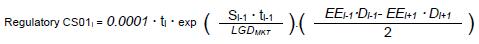

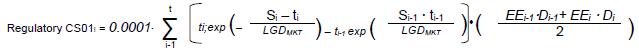

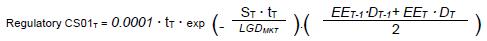

99. The formula in paragraph 98 must be the basis for all inputs into the bank’s approved VaR model for bonds when calculating the CVA risk capital charge for a counterparty. For example, if this approved VaR model is based on full repricing, then the formula must be used directly. If the bank’s approved VaR model is based on credit spread sensitivities for specific tenors, the bank must base each credit spread sensitivity on the following formula:3

If the bank’s approved VaR model uses credit spread sensitivities to parallel shifts in credit spreads (Regulatory CS01), then the bank must use the following formula:4

If the bank’s approved VaR model uses second-order sensitivities to shifts in credit spreads (spread gamma), the gammas must be calculated based on the formula in paragraph 98.

Banks using the short cut method for collateralized OTC derivatives (paragraph 41 in Appendix 4), must compute the CVA risk capital charge according to paragraph 98, by assuming a constant EE (expected exposure) profile, where EE is set equal to the effective expected positive exposure of the shortcut method for a maturity equal to the maximum of (i) half of the longest maturity occurring in the netting set and (ii) the notional weighted average maturity of all transactions inside the netting set.

Banks with IMM approval for the majority of their businesses, but which use CEM (Current Exposure Method) or SM (Standardized Method) for certain smaller portfolios, and which have approval to use the market risk internal models approach for the specific interest rate risk of bonds, will include these non-IMM netting sets into the CVA risk capital charge, according to paragraph 98, unless the national supervisor decides that paragraph 104 should apply for these portfolios. Non-IMM netting sets are included into the advanced CVA risk capital charge by assuming a constant EE profile, where EE is set equal to the EAD as computed under CEM or SM for a maturity equal to the maximum of (i) half of the longest maturity occurring in the netting set and (ii) the notional weighted average maturity of all transactions inside the netting set. The same approach applies where the IMM model does not produce an expected exposure profile.

For exposures to certain counterparties, the bank's approved market risk VaR model may not reflect the risk of credit spread changes appropriately, because the bank's market risk VaR model does not appropriately reflect the specific risk of debt instruments issued by the counterparty. For such exposures, the bank is not allowed to use the advanced CVA risk charge. Instead, for these exposures the bank must determine the CVA risk charge by application of the standardized method in paragraph 104. Only exposures to counterparties for which the bank has supervisory approval for modeling the specific risk of debt instruments are to be included into the advanced CVA risk charge.

100. The CVA risk capital charge consists of both general and specific credit spread risks, including Stressed VaR but excluding IRC (incremental risk charge). The VaR figure should be determined in accordance with the quantitative standards described in paragraph 718(Lxxvi). It is thus determined as the sum of (i) the non-stressed VaR component and (ii) the stressed VaR component.

i. When calculating the non-stressed VaR, current parameter calibrations for expected exposure must be used.

ii. When calculating the stressed VaR future counterparty EE profiles (according to the stressed exposure parameter calibrations as defined in paragraph 61 of Annex 4)1 must be used. The period of stress for the credit spread parameters should be the most severe one-year stress period contained within the three year stress period used for the exposure parameters.5

101. This additional CVA risk capital charge is the standalone market risk charge, calculated on the set of CVAs (as specified in paragraph 98) for all OTC derivatives counterparties, collateralized and uncollateralized, together with eligible CVA hedges. Within this standalone CVA risk capital charge, no offset against other instruments on the bank’s balance sheet will be permitted (except as otherwise expressly provided herein).

102. Only hedges used for the purpose of mitigating CVA risk, and managed as such, are eligible to be included in the VaR model used to calculate the above CVA capital charge or in the standardized CVA risk capital charge set forth in paragraph 104. For example, if a credit default swap (CDS) referencing an issuer is in the bank’s inventory and that issuer also happens to be an OTC counterparty but the CDS is not managed as a hedge of CVA, then such a CDS is not eligible to offset the CVA within the standalone VaR calculation of the CVA risk capital charge.

103. The only eligible hedges that can be included in the calculation of the CVA risk capital charge under paragraphs 98 or 104 are single-name CDSs, single-name contingent CDSs, other equivalent hedging instruments referencing the counterparty directly, and index CDSs. In case of index CDSs, the following restrictions apply:

• The basis between any individual counterparty spread and the spreads of index CDS hedges must be reflected in the VaR. This requirement also applies to cases where a proxy is used for the spread of a counterparty, since idiosyncratic basis still needs to be reflected in such situations. For all counterparties with no available spread, the bank must use reasonable basis time series out of a representative bucket of similar names for which a spread is available.

• If the basis is not reflected to the satisfaction of the supervisor, then the bank must reflect only 50% of the notional amount of index hedges in the VaR. Other types of counterparty risk hedges must not be reflected within the calculation of the CVA capital charge, and these other hedges must be treated as any other instrument in the bank’s inventory for regulatory capital purposes. Tranched or nthto-default CDSs are not eligible CVA hedges. Eligible hedges that are included in the CVA capital charge must be removed from the bank’s market risk capital charge calculation.

1 Annex 5 of this document.

2 “VaR model” refers to the internal model approach to market risk.

3 This derivation assumes positive marginal default probabilities before and after time bucket ti and is valid for i<T. For the final time bucket i=T, the corresponding formula is:

4 This derivation assumes positive marginal default probabilities.

5 Note that the three-times multiplier inherent in the calculation of a bond VaR and a stressed VaR will apply to these calculations.6.1.B Counterparty Credit Risk (Under the Standardized Approach)

The total capital requirements for counterparty credit risk under the Standardized Approach is also an aggregate of the 1) Default risk under SAMA Basel III calculated using the Current Exposure Method and the Incremental Risk under Basel III called the Credit Value Adjustment.

For further clarifications, please refer to SAMA Circular # BCS 24331 dated 4 September 2012 entitled "Basel III Definition of Capital FAQs (p.7).

Consequently, Bank using the Standardized Approach will calculate the Default Risk using the CEM as prescribed also under Basel II, and the CVA under the Standardized Approach as given below under Basel III.

Standardized CVA risk capital charge

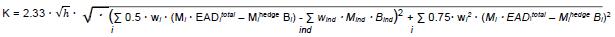

104. When a bank does not have the required approvals to use paragraph 98 to calculate a CVA capital charge for its counterparties, the bank must calculate a portfolio capital charge using the following formula:

Where:

• h is the one-year risk horizon (in units of a year), h = 1.

• wi is the weight applicable to counterparty ‘i’. Counterparty ‘i’ must be mapped to one of the seven weights wi based on its external rating, as shown in the table of this paragraph below. When a counterparty does not have an external rating, the bank must, subject to supervisory approval, map the internal rating of the counterparty to one of the external ratings.

• EADtotali EAD is the exposure at default of counterparty ‘i’ (summed across its netting sets), including the effect of collateral as per the existing IMM, SM or CEM rules as applicable to the calculation of counterparty risk capital charges for such counterparty by the bank. For non-IMM banks the exposure should be discounted by applying the factor (1-exp(-0.05*Mi))/(0.05*Mi). For IMM banks, no such discount should be applied as the discount factor is already included in Mi.

• Bi is the notional of purchased single name CDS hedges (summed if more than one position) referencing counterparty ‘i’, and used to hedge CVA risk. This notional amount should be discounted by applying the factor (1-exp(-0.05*Mihedge))/(0.05* Mihedge).

• Bind is the full notional of one or more index CDS of purchased protection, used to hedge CVA risk. This notional amount should be discounted by applying the factor (1-exp(-0.05*Mind))/(0.05* Mind).

• wind is the weight applicable to index hedges. The bank must map indices to one of the seven weights wi based on the average spread of index ‘ind’.

• Mi is the effective maturity of the transactions with counterparty ‘i’. For IMM banks, Mi is to be calculated as per Annex 4,1 paragraph 38 of the Basel Accord. For non-IMM banks, Mi is the notional weighted average maturity as referred to in the third bullet point of para 320. However, for this purpose, Mi should not be capped at 5 years.

• Mihedge is the maturity of the hedge instrument with notional Bi (the quantities Mihedge Bi are to be summed if these are several positions).

• Mind is the maturity of the index hedge ‘ind’. In case of more than one index hedge position, it is the notional weighted average maturity.

For any counterparty that is also a constituent of an index on which a CDS is used for hedging counterparty credit risk, the notional amount attributable to that single name (as per its reference entity weight) may, with supervisory approval, be subtracted from the index CDS notional amount and treated as a single name hedge (Bi) of the individual counterparty with maturity based on the maturity of the index.

The weights are given in this table, and are based on the external rating of the counterparty:2

Rating Weight Wi AAA 0.7% AA 0.7% A 0.8% BBB 1.0% BB 2.0% B 3.0% CCC 10.0% 1 Annex 5 of this document.

2 The notations follow the methodology used by one institution, Standard & Poor’s. The use of Standard & Poor’s credit ratings is an example only; those of some other approved external credit assessment institutions could be used on an equivalent basis. The ratings used throughout this document, therefore, do not express any preferences or determinations on external assessment institutions by the Committee.6.1.C Further Details on CCR and CVA Aggregation

105. Calculation of the aggregate CCR and CVA risk capital charges for 6.1.A IMM and 6.1.b (Standardized Approach)

As a summary, total counterparty exposure is an aggregate of 1) Default Rate calculated either through IMM, CEM or Standardized Approach and 2) Credit Value Adjustment which again can be calculated as per the IMM or Standardized Approach or CEM.

This paragraph deals with the aggregation of the default risk capital charge and the CVA risk capital charge for potential mark-to-market losses. Note that outstanding EAD referred to in the default risk capital charges below is net of incurred CVA losses according to [new paragraph after Para 9 in Annex 4],1 which affects all items “i” below. In this paragraph, “IMM capital charge” refers to the default risk capital charge for CCR based on the RWAs obtained when multiplying the outstanding EAD of each counterparty under the IMM approach by the applicable credit risk weight (under the Standardized or IRB approach), and summing across counterparties. Equally, Current Exposures Method “(CEM) capital charge” or “SM capital charge” refer to the default risk capital charges where outstanding EADs for all counterparties in the portfolio are determined based on CEM or SM, respectively.

A. Banks with IMM approval and market-risk internal-models approval for the specific interest-rate risk of bonds The total CCR capital charge for such a bank is determined as the sum of the following components:

i. The higher of (a) its IMM capital charge based on current parameter calibrations for EAD and (b) its IMM capital charge based on stressed parameter calibrations for EAD. For IRB banks, the risk weights applied to OTC derivative exposures should be calculated with the full maturity adjustment as a function of PD and M set equal to 1 in the Basel Accord (paragraph 272), provided the bank can demonstrate to SAMA its specific VaR model applied in paragraph 98 contains effects of rating migrations. If the bank cannot demonstrate this to the satisfaction of SAMA, the full maturity adjustment function, given by the formula (1 – 1.5 x b)^-1 × (1 + (M – 2.5) × b)2 should apply.

ii. The advanced CVA risk capital charge determined pursuant to paragraphs 98 to 103.

B. Banks with IMM approval and without Specific Risk VaR approval for bonds The total CCR capital charge for such a bank is determined as the sum of the following components: i. The higher of (a) the IMM capital charge based on current parameter calibrations for EAD and (b) the IMM capital charge based on stressed parameter calibrations for EAD.

ii. The standardized CVA risk capital charge determined by paragraph 104.

C. All other banks The total CCR capital charge for such banks is determined as the sum of the following two components:

i. The sum over all counterparties of the CEM or SM based capital charge (depending on the bank’s CCR approach) with EADs determined by paragraphs 91or 69 respectively.

ii. The standardized CVA risk capital charge determined by paragraph 104.

In addition, the following paragraph will be inserted after paragraph 9 in Annex 4.1

“Outstanding EAD” for a given OTC derivative counterparty is defined as the greater of zero and the difference between the sum of EADs across all netting sets with the counterparty and the credit valuation adjustment (CVA) for that counterparty which has already been recognized by the bank as an incurred write-down (i.e. a CVA loss). This CVA loss is calculated without taking into account any offsetting debit valuation adjustments which have been deducted from capital under paragraph 75.3 RWAs for a given OTC derivative counterparty may be calculated as the applicable risk weight under the Standardized or IRB approach multiplied by the outstanding EAD of the counterparty. This reduction of EAD by incurred CVA losses does not apply to the determination of the CVA risk capital charge.

1 Annex 5 of this document.

2 Where “M” is the effective maturity and “b” is the maturity adjustment as a function of the PD, as defined in paragraph 272 of the Basel Accord.

3 The incurred CVA loss deduced from exposures to determine outstanding EAD is the CVA loss gross of all debit value adjustments (DVA) which have been separately deducted from capital. To the extent DVA has not been separately deducted from a bank’s capital, the incurred CVA loss used to determine outstanding EAD will be net of such DVA.