Effective from Dec 19 2012 - Dec 18 2012

To view other versions open the versions tab on the right

6. Enhanced Risk Coverage

In addition to raising the quality and level of the capital base, the Basel III framework recognized the need to ensure that all material risks are captured in the capital framework. Failure to capture major on- and off-balance sheet risks, as well as derivative related exposures, was a key factor that amplified the crisis. This section outlines enhancement to Risk Coverage under the Basel III framework as given below.

A. Counterparty Credit Risk

• Revised metric to better address counterparty credit risk, credit valuation adjustments and wrong-way risks

• Introduction of Asset Value correlation (AVC) for Financial Institutions

• Collateralized counterparties and increased margin period of risk

• Central Counterparties (CCPs)

• Enhanced counterparty credit risk management requirements

B. Addressing Reliance on external credit ratings and minimizing cliff effects

• Standardized Inferred rating treatment for long-term exposure

• Incentive to avoid getting exposures rated

• Incorporation of IOSCO’s Code of Conduct Fundamentals for Credit Rating Agencies

• ‘’Cliff effects’’ arising from guarantees and credit derivatives- ‘’CRM’’

• Unsolicited ratings and recognition of ECAI’s

6.1 Counterparty Credit Risk

As mentioned, Counterparty Credit Risk under Basel II only measured Default Risk which could be calculated by using the following 3 methods, where SAMA adopted the # 3 Current Exposure Method.

1. Internal Model Method

2. Standardized Approach

3. Current Exposure Method (CEM)

In this regard, SAMA had permitted only the Current Exposures Method under Basel II. For Basel III purposes as in Basel II banks are to use the more simple CEM.

Further, Basel III introduced the concept of Current Value Adjustment (CVA) as an additional Counterparty Risk, which again can be determined by using the Internal Model Method (IMM) or the Standardized Method.

It should also be emphasized that Basel III introduced incremental risk or additional risk through the concept of the Credit Value Adjustment which measure the counterparty risk prior to default. Consequently, total risk is an aggregate of these two.

The main revision to Internal Models Method to measure default risk exposure is to using the Effective EPE with stressed parameters.

In this regard, the Default risk capital charge is the greater of:

• Portfolio level capital charge based on effective EPE (not including CVA charge using current market data) and the portfolio level capital charge based on effective EPE under stress calibration.

B. Credit Value Adjustment

Capitalization of the risk of CVA losses

The major element of CVA include the following:

• Applies to IMM and non IMM banks

• Huge mark-to-market losses incurred during financial crisis

• BCBS introduced a ‘’bond equivalent of the counterparty exposure’’ approach which aims to better capture CVA losses

• In addition to default risk, additional capital charge introduced for CCR for OTC derivatives

• Transactions with SFTs and CCPs excluded from CVA capital charge unless these are material, where the materiality threshold for SFT’s will be defined by SAMA and if warranted, bank will be advised accordingly.

• Banks with IMM approval and Specific Interest Rate Risk VaR model approval for bonds will use ‘’Advanced CVA risk capital charge’’

• All other banks will calculate CVA capital charge based on ‘’Standardized CVA risk capital charge’’ methodology

• Under Basel II, Banks in KSA are mandated by SAMA to use ‘’CEM’’ methodology for both Standardized & IRB Approach. However, for Basel III they can utilize IMM as well.

• Under the Standardized Approach, Banks would be required to develop enhanced system’s capability to apply this formula

• Maturity: Mi is the notional weighted average maturity (FAQ- For CVA purposes, the 5-year cap of the effective maturity will not be applied). This applies to all transactions with the counterparty, not only to index CDS- Maturity will be capped at the longest contractual remaining maturity in the netting set.

A. Counterparty credit risk using Internal Models

This section is only applicable for those banks that have been given regulatory approval by SAMA to use the IMM Approach to calculate counterparty credit risk. Alternatively, Banks should use Standardized Approach 6.1.B on page 30. Also, for further clarifications, please refer to SAMA Circular # BCS 24331 dated 4 September 2012 entitled "Basel III Definition of Capital FAQs (p.7).

6.1.A Internal Model Method (IMM)

Default Risk Exposures Calculation

Internal Model (EPE)

25(i). To determine the default risk capital charge for counterparty credit risk as defined in paragraph 105, banks must use the greater of the portfolio-level capital charge (not including the CVA charge in paragraphs 97-104) based on Effective EPE using current market data and the portfolio-level capital charge based on Effective EPE using a stress calibration. The stress calibration should be a single consistent stress calibration for the whole portfolio of counterparties. The greater of Effective EPE using current market data and the stress calibration should not be applied on a counterparty by counterparty basis, but on a total portfolio level.

61. When the Effective EPE model is calibrated using historic market data, the bank must employ current market data to compute current exposures and at least three years of historical data must be used to estimate parameters of the model. Alternatively, market implied data may be used to estimate parameters of the model. In all cases, the data must be updated quarterly or more frequently if market conditions warrant. To calculate the Effective EPE using a stress calibration, the bank must also calibrate Effective EPE using three years of data that include a period of stress to the credit default spreads of a bank’s counterparties or calibrate Effective EPE using market implied data from a suitable period of stress. The following process will be used to assess the adequacy of the stress calibration:

• The bank must demonstrate, at least quarterly, that the stress period coincides with a period of increased CDS or other credit spreads – such as loan or corporate bond spreads – for a representative selection of the bank’s counterparties with traded credit spreads. In situations where the bank does not have adequate credit spread data for a counterparty, the bank should map each counterparty to specific credit spread data based on region, internal rating and business types.

• The exposure model for all counterparties must use data, either historic or implied, that include the data from the stressed credit period, and must use such data in a manner consistent with the method used for the calibration of the Effective EPE model to current data.

• To evaluate the effectiveness of its stress calibration for Effective EPE, the bank must create several benchmark portfolios that are vulnerable to the same main risk factors to which the bank is exposed. The exposure to these benchmark portfolios shall be calculated using (a) current positions at current market prices, stressed volatilities, stressed correlations and other relevant stressed exposure model inputs from the 3-year stress period and (b) current positions at end of stress period market prices, stressed volatilities, stressed correlations and other relevant stressed exposure model inputs from the 3-year stress period. Supervisors may adjust the stress calibration if the exposures of these benchmark portfolios deviate substantially.

Calculation of Credit Value Adjustment (CVA)

The Concept

Credit Value Adjustments (CVA) under Basel III is an incremental credit risk capital charge prior to default. Under Basel II and Basel II.5 counterparty credit risk methodology only calculated capital requirements for default risk. However, Basel III brings in the capital charge with regard to the deterioration of a counterparty risk prior to default. Consequently, the CVA is in addition or as an incremental risk to default risk. SAMA's methodology uses the Current Exposure Method (CEM) for Default Risk which is one of the four methods prescribed under Basel II Annex # 41. Consequently, capital requirements for counterparty risk is the aggregate of CEM and CVA calculations.

Specific Aspects of CVA under IMM Approach

Capitalization of the risk of CVA losses

99. To implement the bond equivalent approach, the following new section VIII will be added to Annex 4 of the Basel II framework.1 The new paragraphs (97 to 105) are to be inserted after paragraph 96 in Annex 4.1

VIII. Treatment of mark-to-market counterparty risk losses (CVA capital charge)

- CVA Risk Capital Charge

97. In addition to the default risk capital requirements for counterparty credit risk determined based on the standardized or internal ratings- based (IRB) approaches for credit risk, a bank must add a capital charge to cover the risk of mark-to-market losses on the expected counterparty risk (such losses being known as credit value adjustments, CVA) to OTC derivatives. The CVA capital charge will be calculated in the manner set forth below depending on the bank’s approved method of calculating capital charges for counterparty credit risk and specific interest rate risk. A bank is not required to include in this capital charge (i) transactions with a central counterparty (CCP); and (ii) securities financing transactions (SFT), unless their supervisor determines that the bank’s CVA loss exposures arising from SFT transactions are material.

A. Banks with IMM approval and Specific Interest Rate Risk VaR model2 approval for bonds: Advanced CVA risk capital charge

98. Banks with IMM approval for counterparty credit risk and approval to use the market risk internal models approach for the specific interest-rate risk of bonds must calculate this additional capital charge by modeling the impact of changes in the counterparties’ credit spreads on the CVAs of all OTC derivative counterparties, together with eligible CVA hedges according to new paragraphs 102 and 103, using the bank’s VaR model for bonds. This VaR model is restricted to changes in the counterparties’ credit spreads and does not model the sensitivity of CVA to changes in other market factors, such as changes in the value of the reference asset, commodity, currency or interest rate of a derivative. Regardless of the accounting valuation method a bank uses for determining CVA, the CVA capital charge calculation must be based on the following formula for the CVA of each counterparty:

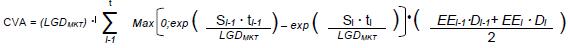

Where:

• ti is the time of the i-th revaluation time bucket, starting from t0=0.

• tT is the longest contractual maturity across the netting sets with the counterparty.

• si is the credit spread of the counterparty at tenor ti, used to calculate the CVA of the counterparty. Whenever the CDS spread of the counterparty is available, this must be used. Whenever such a CDS spread is not available, the bank must use a proxy spread that is appropriate based on the rating, industry and region of the counterparty.

• LGDMKT is the loss given default of the counterparty and should be based on the spread of a market instrument of the counterparty (or where a counterparty instrument is not available, based on the proxy spread that is appropriate based on the rating, industry and region of the counterparty). It should be noted that this LGDMKT, which inputs into the calculation of the CVA risk capital charge, is different from the LGD that is determined for the IRB and CCR default risk charge, as this LGDMKT is a market assessment rather than an internal estimate.

• The first factor within the sum represents an approximation of the market implied marginal probability of a default occurring between times ti-1 and ti. Market implied default probability (also known as risk neutral probability) represents the market price of buying protection against a default and is in general different from the real-world likelihood of a default.

• EEi is the expected exposure to the counterparty at revaluation time ti, as defined in paragraph 30 (regulatory expected exposure), where exposures of different netting sets for such counterparty are added, and where the longest maturity of each netting set is given by the longest contractual maturity inside the netting set. For banks using the short cut method (paragraph 41 of Annex 4)1 for margined trades, the paragraph 99 should be applied.

• Di is the default risk-free discount factor at time ti, where D0 = 1.

99. The formula in paragraph 98 must be the basis for all inputs into the bank’s approved VaR model for bonds when calculating the CVA risk capital charge for a counterparty. For example, if this approved VaR model is based on full repricing, then the formula must be used directly. If the bank’s approved VaR model is based on credit spread sensitivities for specific tenors, the bank must base each credit spread sensitivity on the following formula:3

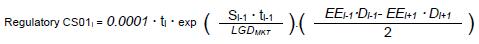

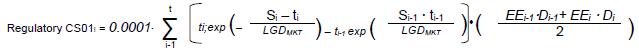

If the bank’s approved VaR model uses credit spread sensitivities to parallel shifts in credit spreads (Regulatory CS01), then the bank must use the following formula:4

If the bank’s approved VaR model uses second-order sensitivities to shifts in credit spreads (spread gamma), the gammas must be calculated based on the formula in paragraph 98.

Banks using the short cut method for collateralized OTC derivatives (paragraph 41 in Appendix 4), must compute the CVA risk capital charge according to paragraph 98, by assuming a constant EE (expected exposure) profile, where EE is set equal to the effective expected positive exposure of the shortcut method for a maturity equal to the maximum of (i) half of the longest maturity occurring in the netting set and (ii) the notional weighted average maturity of all transactions inside the netting set.

Banks with IMM approval for the majority of their businesses, but which use CEM (Current Exposure Method) or SM (Standardized Method) for certain smaller portfolios, and which have approval to use the market risk internal models approach for the specific interest rate risk of bonds, will include these non-IMM netting sets into the CVA risk capital charge, according to paragraph 98, unless the national supervisor decides that paragraph 104 should apply for these portfolios. Non-IMM netting sets are included into the advanced CVA risk capital charge by assuming a constant EE profile, where EE is set equal to the EAD as computed under CEM or SM for a maturity equal to the maximum of (i) half of the longest maturity occurring in the netting set and (ii) the notional weighted average maturity of all transactions inside the netting set. The same approach applies where the IMM model does not produce an expected exposure profile.

For exposures to certain counterparties, the bank's approved market risk VaR model may not reflect the risk of credit spread changes appropriately, because the bank's market risk VaR model does not appropriately reflect the specific risk of debt instruments issued by the counterparty. For such exposures, the bank is not allowed to use the advanced CVA risk charge. Instead, for these exposures the bank must determine the CVA risk charge by application of the standardized method in paragraph 104. Only exposures to counterparties for which the bank has supervisory approval for modeling the specific risk of debt instruments are to be included into the advanced CVA risk charge.

100. The CVA risk capital charge consists of both general and specific credit spread risks, including Stressed VaR but excluding IRC (incremental risk charge). The VaR figure should be determined in accordance with the quantitative standards described in paragraph 718(Lxxvi). It is thus determined as the sum of (i) the non-stressed VaR component and (ii) the stressed VaR component.

i. When calculating the non-stressed VaR, current parameter calibrations for expected exposure must be used.

ii. When calculating the stressed VaR future counterparty EE profiles (according to the stressed exposure parameter calibrations as defined in paragraph 61 of Annex 4)1 must be used. The period of stress for the credit spread parameters should be the most severe one-year stress period contained within the three year stress period used for the exposure parameters.5

101. This additional CVA risk capital charge is the standalone market risk charge, calculated on the set of CVAs (as specified in paragraph 98) for all OTC derivatives counterparties, collateralized and uncollateralized, together with eligible CVA hedges. Within this standalone CVA risk capital charge, no offset against other instruments on the bank’s balance sheet will be permitted (except as otherwise expressly provided herein).

102. Only hedges used for the purpose of mitigating CVA risk, and managed as such, are eligible to be included in the VaR model used to calculate the above CVA capital charge or in the standardized CVA risk capital charge set forth in paragraph 104. For example, if a credit default swap (CDS) referencing an issuer is in the bank’s inventory and that issuer also happens to be an OTC counterparty but the CDS is not managed as a hedge of CVA, then such a CDS is not eligible to offset the CVA within the standalone VaR calculation of the CVA risk capital charge.

103. The only eligible hedges that can be included in the calculation of the CVA risk capital charge under paragraphs 98 or 104 are single-name CDSs, single-name contingent CDSs, other equivalent hedging instruments referencing the counterparty directly, and index CDSs. In case of index CDSs, the following restrictions apply:

• The basis between any individual counterparty spread and the spreads of index CDS hedges must be reflected in the VaR. This requirement also applies to cases where a proxy is used for the spread of a counterparty, since idiosyncratic basis still needs to be reflected in such situations. For all counterparties with no available spread, the bank must use reasonable basis time series out of a representative bucket of similar names for which a spread is available.

• If the basis is not reflected to the satisfaction of the supervisor, then the bank must reflect only 50% of the notional amount of index hedges in the VaR. Other types of counterparty risk hedges must not be reflected within the calculation of the CVA capital charge, and these other hedges must be treated as any other instrument in the bank’s inventory for regulatory capital purposes. Tranched or nthto-default CDSs are not eligible CVA hedges. Eligible hedges that are included in the CVA capital charge must be removed from the bank’s market risk capital charge calculation.

1 Annex 5 of this document.

2 “VaR model” refers to the internal model approach to market risk.

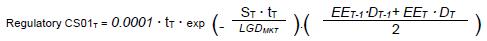

3 This derivation assumes positive marginal default probabilities before and after time bucket ti and is valid for i<T. For the final time bucket i=T, the corresponding formula is:

4 This derivation assumes positive marginal default probabilities.

5 Note that the three-times multiplier inherent in the calculation of a bond VaR and a stressed VaR will apply to these calculations.6.1.B Counterparty Credit Risk (Under the Standardized Approach)

The total capital requirements for counterparty credit risk under the Standardized Approach is also an aggregate of the 1) Default risk under SAMA Basel III calculated using the Current Exposure Method and the Incremental Risk under Basel III called the Credit Value Adjustment.

For further clarifications, please refer to SAMA Circular # BCS 24331 dated 4 September 2012 entitled "Basel III Definition of Capital FAQs (p.7).

Consequently, Bank using the Standardized Approach will calculate the Default Risk using the CEM as prescribed also under Basel II, and the CVA under the Standardized Approach as given below under Basel III.

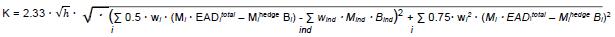

Standardized CVA risk capital charge

104. When a bank does not have the required approvals to use paragraph 98 to calculate a CVA capital charge for its counterparties, the bank must calculate a portfolio capital charge using the following formula:

Where:

• h is the one-year risk horizon (in units of a year), h = 1.

• wi is the weight applicable to counterparty ‘i’. Counterparty ‘i’ must be mapped to one of the seven weights wi based on its external rating, as shown in the table of this paragraph below. When a counterparty does not have an external rating, the bank must, subject to supervisory approval, map the internal rating of the counterparty to one of the external ratings.

• EADtotali EAD is the exposure at default of counterparty ‘i’ (summed across its netting sets), including the effect of collateral as per the existing IMM, SM or CEM rules as applicable to the calculation of counterparty risk capital charges for such counterparty by the bank. For non-IMM banks the exposure should be discounted by applying the factor (1-exp(-0.05*Mi))/(0.05*Mi). For IMM banks, no such discount should be applied as the discount factor is already included in Mi.

• Bi is the notional of purchased single name CDS hedges (summed if more than one position) referencing counterparty ‘i’, and used to hedge CVA risk. This notional amount should be discounted by applying the factor (1-exp(-0.05*Mihedge))/(0.05* Mihedge).

• Bind is the full notional of one or more index CDS of purchased protection, used to hedge CVA risk. This notional amount should be discounted by applying the factor (1-exp(-0.05*Mind))/(0.05* Mind).

• wind is the weight applicable to index hedges. The bank must map indices to one of the seven weights wi based on the average spread of index ‘ind’.

• Mi is the effective maturity of the transactions with counterparty ‘i’. For IMM banks, Mi is to be calculated as per Annex 4,1 paragraph 38 of the Basel Accord. For non-IMM banks, Mi is the notional weighted average maturity as referred to in the third bullet point of para 320. However, for this purpose, Mi should not be capped at 5 years.

• Mihedge is the maturity of the hedge instrument with notional Bi (the quantities Mihedge Bi are to be summed if these are several positions).

• Mind is the maturity of the index hedge ‘ind’. In case of more than one index hedge position, it is the notional weighted average maturity.

For any counterparty that is also a constituent of an index on which a CDS is used for hedging counterparty credit risk, the notional amount attributable to that single name (as per its reference entity weight) may, with supervisory approval, be subtracted from the index CDS notional amount and treated as a single name hedge (Bi) of the individual counterparty with maturity based on the maturity of the index.

The weights are given in this table, and are based on the external rating of the counterparty:2

Rating Weight Wi AAA 0.7% AA 0.7% A 0.8% BBB 1.0% BB 2.0% B 3.0% CCC 10.0% 1 Annex 5 of this document.

2 The notations follow the methodology used by one institution, Standard & Poor’s. The use of Standard & Poor’s credit ratings is an example only; those of some other approved external credit assessment institutions could be used on an equivalent basis. The ratings used throughout this document, therefore, do not express any preferences or determinations on external assessment institutions by the Committee.6.1.C Further Details on CCR and CVA Aggregation

105. Calculation of the aggregate CCR and CVA risk capital charges for 6.1.A IMM and 6.1.b (Standardized Approach)

As a summary, total counterparty exposure is an aggregate of 1) Default Rate calculated either through IMM, CEM or Standardized Approach and 2) Credit Value Adjustment which again can be calculated as per the IMM or Standardized Approach or CEM.

This paragraph deals with the aggregation of the default risk capital charge and the CVA risk capital charge for potential mark-to-market losses. Note that outstanding EAD referred to in the default risk capital charges below is net of incurred CVA losses according to [new paragraph after Para 9 in Annex 4],1 which affects all items “i” below. In this paragraph, “IMM capital charge” refers to the default risk capital charge for CCR based on the RWAs obtained when multiplying the outstanding EAD of each counterparty under the IMM approach by the applicable credit risk weight (under the Standardized or IRB approach), and summing across counterparties. Equally, Current Exposures Method “(CEM) capital charge” or “SM capital charge” refer to the default risk capital charges where outstanding EADs for all counterparties in the portfolio are determined based on CEM or SM, respectively.

A. Banks with IMM approval and market-risk internal-models approval for the specific interest-rate risk of bonds The total CCR capital charge for such a bank is determined as the sum of the following components:

i. The higher of (a) its IMM capital charge based on current parameter calibrations for EAD and (b) its IMM capital charge based on stressed parameter calibrations for EAD. For IRB banks, the risk weights applied to OTC derivative exposures should be calculated with the full maturity adjustment as a function of PD and M set equal to 1 in the Basel Accord (paragraph 272), provided the bank can demonstrate to SAMA its specific VaR model applied in paragraph 98 contains effects of rating migrations. If the bank cannot demonstrate this to the satisfaction of SAMA, the full maturity adjustment function, given by the formula (1 – 1.5 x b)^-1 × (1 + (M – 2.5) × b)2 should apply.

ii. The advanced CVA risk capital charge determined pursuant to paragraphs 98 to 103.

B. Banks with IMM approval and without Specific Risk VaR approval for bonds The total CCR capital charge for such a bank is determined as the sum of the following components: i. The higher of (a) the IMM capital charge based on current parameter calibrations for EAD and (b) the IMM capital charge based on stressed parameter calibrations for EAD.

ii. The standardized CVA risk capital charge determined by paragraph 104.

C. All other banks The total CCR capital charge for such banks is determined as the sum of the following two components:

i. The sum over all counterparties of the CEM or SM based capital charge (depending on the bank’s CCR approach) with EADs determined by paragraphs 91or 69 respectively.

ii. The standardized CVA risk capital charge determined by paragraph 104.

In addition, the following paragraph will be inserted after paragraph 9 in Annex 4.1

“Outstanding EAD” for a given OTC derivative counterparty is defined as the greater of zero and the difference between the sum of EADs across all netting sets with the counterparty and the credit valuation adjustment (CVA) for that counterparty which has already been recognized by the bank as an incurred write-down (i.e. a CVA loss). This CVA loss is calculated without taking into account any offsetting debit valuation adjustments which have been deducted from capital under paragraph 75.3 RWAs for a given OTC derivative counterparty may be calculated as the applicable risk weight under the Standardized or IRB approach multiplied by the outstanding EAD of the counterparty. This reduction of EAD by incurred CVA losses does not apply to the determination of the CVA risk capital charge.

1 Annex 5 of this document.

2 Where “M” is the effective maturity and “b” is the maturity adjustment as a function of the PD, as defined in paragraph 272 of the Basel Accord.

3 The incurred CVA loss deduced from exposures to determine outstanding EAD is the CVA loss gross of all debit value adjustments (DVA) which have been separately deducted from capital. To the extent DVA has not been separately deducted from a bank’s capital, the incurred CVA loss used to determine outstanding EAD will be net of such DVA.6.2 Wrong-Way Risk

As a summary, ‘’Wrong-way risk substantially applies only to IMM banks and is typically defined as an exposure to a counterparty that is adversely correlated with the credit quality of that counterparty’’ (Transactions with counterparties such as financial guarantors). However, there are implications for the Standardized and IRB Approaches as described in p.36.

As a summary:

• 2 types of wrong way risk

• General wrong-way risk (GWWR)

• Specific wrong-way risk (SWWR)

• GWWR arises when the PD of the counterparties are positively corrected with general market risk factors

• Arises from purchase of credit protection via CDS from mono-line insurers

• Banks must identify exposures that give rise to general WWR:

■ Stress testing and scenario analysis to be conducted

■ Monitor general wrong way risk by product, by region, by industry etc.

■ Reports to be provided to Senior Management and Board on a regular basis

Implement an explicit Pillar 1 capital charge and revise Annex 41 where specific wrong-way risk (SWWR) has been identified

• Banks exposed to SWWR if future exposure to a counterparty is highly correlated with the counterparty’s PD

• Banks need to have explicit procedure for identifying, monitoring and controlling specific WWR

• Specific WWR charges applies for where there exists a legal connection between the counterparty and the underlying issuer e.g.

■ Single name credit default swaps

■ Equity derivatives referencing single counterparty

■ CDS (Credit Default Swaps): use expected loss assuming underlying in liquidation (LGD for swap = 100%)

■ Equity, bond, securities financing EAD= value of transaction under JtD (jump-to-default)

100. In specific, Paragraph 57 of Annex 41 in Basel II will be revised as follows to explain the following aforementioned summary on wrong way exposures:

57. Banks must identify exposures that give rise to a greater degree of general wrong-way risk. Stress testing and scenario analyses must be designed to identify risk factors that are positively correlated with counterparty credit worthiness. Such testing needs to address the possibility of severe shocks occurring when relationships between risk factors have changed. Banks should monitor general wrong way risk by product, by region, by industry, or by other categories that are germane to the business. Reports should be provided to senior management and the appropriate committee of the Board on a regular basis that communicate wrong way risks and the steps that are being taken to manage that risk.

Implement an explicit Pillar 1 capital charge and revise Annex 41 where specific wrong-way risk has been identified

101. In order to implement the requirement that the EAD calculation reflect a higher EAD value for counterparties where specific wrong way risk has been identified, paragraph 423 of the Basel II text and paragraphs 29 and 58 of Annex 4 will be revised as follows:

423. Each separate legal entity to which the bank is exposed must be separately rated. A bank must have policies acceptable to its supervisor regarding the treatment of individual entities in a connected group including circumstances under which the same rating may or may not be assigned to some or all related entities. Those policies must include a process for the identification of specific wrong way risk for each legal entity to which the bank is exposed. Transactions with counterparties where specific wrong way risk has been identified need to be treated differently when calculating the EAD for such exposures (see paragraph 58, Annex 4).1

29. When using an internal model, exposure amount or EAD is calculated as the product of alpha times Effective EPE, as specified below (except for counterparties that have been identified as having explicit specific wrong way risk – see paragraph 58):

58. A bank is exposed to “specific wrong-way risk” if future exposure to a specific counterparty is highly correlated with the counterparty’s probability of default. For example, a company writing put options on its own stock creates wrong way exposures for the buyer that is specific to the counterparty. A bank must have procedures in place to identify, monitor and control cases of specific wrong way risk, beginning at the inception of a trade and continuing through the life of the trade. To calculate the CCR capital charge, the instruments for which there exists a legal connection between the counterparty and the underlying issuer, and for which specific wrong way risk has been identified, are not considered to be in the same netting set as other transactions with the counterparty. Furthermore, for single-name credit default swaps where there exists a legal connection between the counterparty and the underlying issuer, and where specific wrong way risk has been identified, EAD in respect of such swap counterparty exposure equals the full expected loss in the remaining fair value of the underlying instruments assuming the underlying issuer is in liquidation. The use of the full expected loss in remaining fair value of the underlying instrument allows the bank to recognize, in respect of such swap, the market value that has been lost already and any expected recoveries.

Application to IRB and Standardized Approach

Accordingly LGD for Advanced or Foundation IRB banks must be set to 100% for such swap transactions.2 For banks using the Standardized Approach, the risk weight to use is that of an unsecured transaction. For equity derivatives, bond options, securities financing transactions etc. referencing a single company where there exists a legal connection between the counterparty and the underlying company, and where specific wrong way risk has been identified, EAD equals the value of the transaction under the assumption of a jump-to-default of the underlying security. In as much this makes re-use of possibly existing (market risk) calculations (for IRC) that already contain an LGD assumption, the LGD must be set to 100%.

1 Annex 5 of this document.

2 Note that the recoveries may also be possible on the underlying instrument beneath such swap. The capital requirements for such underlying exposure are to be calculated under the Accord without reduction for the swap which introduces wrong way risk. Generally this means that such underlying exposure will receive the risk weight and capital treatment associated with an unsecured transaction (ie assuming such underlying exposure is an unsecured credit exposure).6.3. Asset Value Correlation (AVC) Multiplier for Large Financial Institutions

As summary, the following elements are relevant.

■ AVC is applicable under credit risk for IRB Approaches only; For banks remaining on Standardized Approach for bank asset class this will not apply

■ Financial institution’s (FIs) credit quality deteriorated in a highly corrected manner during the severe financial crisis

■ To address this Basel III introduced AVC for large financial institutions

■ A multiplier of 1.25 is applied to the correlation parameter of all exposures to large financial institutions meeting the following criteria:

• Regulated financial institutions are whose total assets are greater than or equal to US$100 billion (SR 375 billion)

• Most recent audited financial statements of the parent and consolidated Subsidiaries to be used

Unregulated financial institutions are regardless of size and includes lending, factoring, leasing, securitization etc. (FAQs unregulated financial institution can include a financial institution or leveraged fund that is not subject to prudential solvency regulation)

102. In order to implement the AVC multiplier, paragraph 272 of the Basel framework would be revised as follows: (This relates to the determination of Capital requirements under IRB Approaches.)

272. Throughout this section, PD and LGD are measured as decimals, and EAD is measured as currency (e.g. euros), except where explicitly noted otherwise. For exposures not in default, the formula for calculating risk-weighted assets is:1

Correlation (R) = 0.12 × (1 – EXP(-50 × PD)) / (1 – EXP(-50)) + 0.24 × [1 – (1 – EXP(-50 × PD)) / (1 – EXP(-50))]

Maturity adjustment (b) = (0.11852 – 0.05478 × ln (PD))^2

Capital requirement2 (K) = [LGD × N[(1 – R)^-0.5 × G(PD) + (R / (1 – R))^0.5 × G(0.999)] – PD x LGD] x (1 – 1.5 x b)^-1 × (1 + (M – 2.5) × b)

Risk-weighted assets (RWA) = K x 12.5 x EAD

The capital requirement (K) for a defaulted exposure is equal to the greater of zero and the difference between its LGD (described in paragraph 468) and the bank’s best estimate of expected loss (described in paragraph 471). The risk-weighted asset amount for the defaulted exposure is the product of K, 12.5, and the EAD.

A multiplier of 1.25 is applied to the correlation parameter described on page 37 para 102of all exposures to financial institutions meeting the following criteria.

Accordingly, the correlation R as determined by the formats in paragraph 101 will be multiplied by 1.25. This in turn would produce a higher "R" correlation and capital requirements necessary for exposure to large FI.

- Regulated financial institutions whose total assets are greater than or equal to US $100 billion (SR 375 billion). The most recent audited financial statement of the parent company and consolidated subsidiaries must be used in order to determine asset size. For the purpose of this paragraph, a regulated financial institution is defined as a parent and its subsidiaries where any substantial legal entity in the consolidated group is supervised by a regulator that imposes prudential requirements consistent with international norms. These include, but are not limited to, prudentially regulated Insurance Companies, Broker/Dealers, Banks, Thrifts and Futures Commission Merchants;

- Unregulated financial institutions, regardless of size. Unregulated financial institutions are, for the purposes of this paragraph, legal entities whose main business includes: the management of financial assets, lending, factoring, leasing, provision of credit enhancements, securitization, investments, financial custody, central counterparty services, proprietary trading and other financial services activities identified by supervisors.

1 Ln denotes the natural logarithm. N(x) denotes the cumulative distribution function for a standard normal random variable (i.e. the probability that a normal random variable with mean zero and variance of one is less than or equal to x). G(z) denotes the inverse cumulative distribution function for a standard normal random variable (ie the value of x such that N(x) = z). The normal cumulative distribution function and the inverse of the normal cumulative distribution function are, for example, available in Excel as the functions NORMSDIST and NORMSINV.

2 If this calculation results in a negative capital charge for any individual sovereign exposure, banks should apply a zero capital charge for that exposure.6.4. Collateralized Counterparties and Margin Period of Risk

Increase the margin period of risk

As a summary the following are relevant.

• Applicable to IMM banks

• Financial crisis showed that the mandated margin period of risks for regulatory capital calculations underestimated the realized risk

• Margin period of risk increased to 20 business days for netting sets where the number of trade exceeds 5000 or that contain illiquid collateral

103. To further explain the aforementioned Summary, and in order to implement the increased margin periods of risk, the following new paragraphs 41(i) and 41 (ii) will be inserted into Annex 41 of the Basel II framework:

41(i). For transactions subject to daily re-margining and mark-to-market valuation, a supervisory floor of five business days for netting sets consisting only of repo-style transactions, and 10 business days for all other netting sets is imposed on the margin period of risk used for the purpose of modeling EAD with margin agreements. In the following cases a higher supervisory floor is imposed:

• For all netting sets where the number of trades exceeds 5,000 at any point during a quarter, a supervisory floor of 20 business days is imposed for the margin period of risk for the following quarter.

• For netting sets containing one or more trades involving either illiquid collateral, or an OTC derivative that cannot be easily replaced, a supervisory floor of 20 business days is imposed for the margin period of risk. For these purposes, “Illiquid collateral” and “OTC derivatives that cannot be easily replaced” must be determined in the context of stressed market conditions and will be characterized by the absence of continuously active markets where a counterparty would, within two or fewer days, obtain multiple price quotations that would not move the market or represent a price reflecting a market discount (in the case of collateral) or premium (in the case of an OTC derivative). Examples of situations where trades are deemed illiquid for this purpose include, but are not limited to, trades that are not marked daily and trades that are subject to specific accounting treatment for valuation purposes (eg OTC derivatives or repostyle transactions referencing securities whose fair value is determined by models with inputs that are not observed in the market).

• In addition, a bank must consider whether trades or securities it holds as collateral are concentrated in a particular counterparty and if that counterparty exited the market precipitously whether the bank would be able to replace its trades.

41 (ii). If a bank has experienced more than two margin call disputes on a particular netting set over the previous two quarters that have lasted longer than the applicable margin period of risk (before consideration of this provision), then the least double the supervisory floor for that netting set for the subsequent two quarters.

41 (iii). For re-margining with a periodicity of N-days, irrespective of the shortcut method or full IMM model, the margin period of risk should be at least equal to the supervisory floor, F, plus the N days minus one day. That is,

Margin Period of Risk = F + N - 1.

Paragraph 167 of Basel II (Adjustment for different holding periods and non daily mark-to-market or re-margining) will be replaced with the following:

167. The minimum holding period for various products is summarized in the following table.

Transaction Type Minimum holding period Condition Repo-style transaction 5 business days Daily re-margining Other capital market transactions Ten business days Daily re-margining Secured lending Twenty business days Daily revaluation

Where a bank has such a transaction or netting set which meets the criteria outlined in paragraphs 41(i) or 41 (ii) of Annex 4, the minimum holding period should be the margin period of risk that would apply under those paragraphs.

Paragraph 179 of Basel II (Use of models) will be replaced with the following:

179. The quantitative and qualitative criteria for recognition of internal market risk models for repo-style transactions and other similar transactions are in principle the same as in paragraphs 718 (LXXIV) to 718 (LXXVI). With regard to the holding period, the minimum will be 5- business days for repo-style transactions, rather than the 10-business days in paragraph 718 (LXXVI) (c). For other transactions eligible for the VaR models approach, the 10-business day holding period will be retained. The minimum holding period should be adjusted upwards for market instruments where such a holding period would be inappropriate given the liquidity of the instrument concerned. At a minimum, where a bank has a repo-style or similar transaction or netting set which meets the criteria outlined in paragraphs 41(i) or 41 (ii) of Annex 4, the minimum holding period should be the margin period of risk that would apply under those paragraphs, in combination with paragraph 41(iii).

6.4.1 Revise the Shortcut Method for Estimating Effective EPE

The following is a summary of the components.

• Applicable to IMM banks

• Amended ‘’short-cut‘’ method to take more realistic simplifying assumptions to estimate Effective EPE when a bank is unable to model margin requirements along with exposures

104. In order to elaborate on the aforementioned, Paragraph 41 of Annex 41 in Basel II will be revised as follows:

41. Shortcut method: a bank that can model EPE without margin agreements but cannot achieve the higher level of modeling sophistication to model EPE with margin agreements can use the following method for margined counterparties subject to re-margining and daily mark-to-market as described in paragraph 41 (i)2. The method is a simple approximation to Effective EPE and sets Effective EPE for a margined counterparty equal to the lesser of:

a) Effective EPE without any held or posted margining collateral, plus any collateral that has been posted to the counterparty independent of the daily valuation and margining process or current exposure (ie initial margin or independent amount); or

b) An add-on that reflects the potential increase in exposure over the margin period of risk plus the larger of

i. the current exposure net of and including all collateral currently held or posted, excluding any collateral called or in dispute; or

ii. the largest net exposure including all collateral held or posted under the margin agreement that would not trigger a collateral call. This amount should reflect all applicable thresholds, minimum transfer amounts, independent amounts and initial margins under the margin agreement.

The add-on is calculated as E[max(ΔMtM, 0)], where E[…] is the expectation (ie the average over scenarios) and ΔMtM is the possible change of the mark-to-market value of the transactions during the margin period of risk. Changes in the value of collateral need to be reflected using the supervisory haircut method or the internal estimates method, but no collateral payments are assumed during the margin period of risk. The margin period of risk is subject to the supervisory floor specified in paragraphs 41(i) to 41(iii). Backtesting should test whether realized (current) exposures are consistent with the shortcut method prediction over all margin periods within one year. If some of the trades in the netting set have a maturity of less than one year, and the netting set has higher risk factor sensitivities without these trades, this fact should be taken into account. If backtesting indicates that effective EPE is underestimated, the bank should take actions to make the method more conservative, eg by scaling up risk factor moves.

1 Annex 5 of this document.

2 Where a bank generally uses this shortcut method to measure Effective EPE, this shortcut method may be used by a bank that is a clearing member in a CCP for its transactions with the CCP and with clients, including those client transactions that result in back-to-back trades with a CCP.6.4.2 Preclude Downgrade Triggers from Being Reflected in EAD

As a summary:

• Applicable to IMM banks

• Downgrade triggers in margin agreements resulted in liquidity strains for market participants during the crisis

• Prevent the reflection in EAD of any clause in a collateral agreement that requires receipt of collateral when a counterparty’s credit quality deteriorates (downgrade triggers)

105. In order to explicitly disallow downgrade triggers in EAD, a new paragraph 41(iv) will be inserted into Annex 41 to read as follows:

41(iv). Banks using the internal models method must not capture the effect of a reduction of EAD due to any clause in a collateral agreement that requires receipt of collateral when counterparty credit quality deteriorates.

6.4.3 Add Requirements to Improve Operational Performance of the Collateral Department

• Only applicable to IMM Banks.

To implement the requirements designed to improve the collateral department operations, two new paragraphs, 51(i) and 51(ii), will be incorporated into Annex 4 and paragraph 777(x), Part 3: The Second Pillar – Supervisory Review Process, will be revised as follows:

51(i). Banks applying the internal model method must have a collateral management unit that is responsible for calculating and making margin calls, managing margin call disputes and reporting levels of independent amounts, initial margins and variation margins accurately on a daily basis. This unit must control the integrity of the data used to make margin calls, and ensure that it is consistent and reconciled regularly with all relevant sources of data within the bank. This unit must also track the extent of reuse of collateral (both cash and non-cash) and the rights that the bank gives away to its respective counterparties for the collateral that it posts. These internal reports must indicate the categories of collateral assets that are reused, and the terms of such reuse including instrument, credit quality and maturity. The unit must also track concentration to individual collateral asset classes accepted by the banks. Senior management must allocate sufficient resources to this unit for its systems to have an appropriate level of operational performance, as measured by the timeliness and accuracy of outgoing calls and response time to incoming calls. Senior management must ensure that this unit is adequately staffed to process calls and disputes in a timely manner even under severe market crisis, and to enable the bank to limit its number of large disputes caused by trade volumes.

51(ii). The bank’s collateral management unit must produce and maintain appropriate collateral management information that is reported on a regular basis to senior management. Such internal reporting should include information on the type of collateral (both cash and non-cash) received and posted, as well as the size, aging and cause for margin call disputes. This internal reporting should also reflect trends in these figures.

777(x). The bank must conduct an independent review of the CCR management system regularly through its own internal auditing process. This review must include both the activities of the business credit and trading units and of the independent CCR control unit. A review of the overall CCR management process must take place at regular intervals (ideally not less than once a year) and must specifically address, at a minimum:

• the adequacy of the documentation of the CCR management system and process;

• the organization of the collateral management unit;

• the organization of the CCR control unit;

• the integration of CCR measures into daily risk management;

• the approval process for risk pricing models and valuation systems used by front and back-office personnel;

• the validation of any significant change in the CCR measurement process;

• the scope of counterparty credit risks captured by the risk measurement model;

• the integrity of the management information system;

• the accuracy and completeness of CCR data;

• the accurate reflection of legal terms in collateral and netting agreements into exposure measurements;

• the verification of the consistency, timeliness and reliability of data sources used to run internal models, including the independence of such data sources;

• the accuracy and appropriateness of volatility and correlation assumptions;

• the accuracy of valuation and risk transformation calculations; and

• the verification of the model’s accuracy through frequent backtesting.

Refer to Pillar 2 section of this document with regard to BCBS Basel III requirements to improve the operational performance of the collateral definition.

6.4.4 Requirements on the Controls Around the Reuse of Collateral by IMM Banks

As a summary, please note the following:

• Applicable to IMM banks

• Relates to variation margin, initial or independent margin and calls resulting from potential downgrade.

• Cash management policies for IMM banks to account liquidity risks of potential incoming margin calls

To further elaborate on the aforementioned,

107. To implement the requirements on controls regarding the reuse of collateral, a new paragraph 51(iii) will be included in Annex 41 as follows:

51(iii). A bank employing the internal models method must ensure that its cash management policies account simultaneously for the liquidity risks of potential incoming margin calls in the context of exchanges of variation margin or other margin types, such as initial or independent margin, under adverse market shocks, potential incoming calls for the return of excess collateral posted by counterparties, and calls resulting from a potential downgrade of its own public rating. The bank must ensure that the nature and horizon of collateral reuse is consistent with its liquidity needs and does not jeopardize its ability to post or return collateral in a timely manner.

6.4.5 Require Banks to Use Supervisory Haircuts when Transforming Non-Cash OTC Collateral into Cash-Equivalent

• Applicable to IMM banks

• Implementation of supervisory haircuts for non-cash OTC collateral

• Recognition in EAD calculation the effect of collateral other than cash

• Must use either haircuts that meets the standards of the financial collateral comprehensive method or standard supervisory haircuts

108. To implement the supervisory haircuts for non-cash OTC collateral, a new paragraph 61(i) would be incorporated in Annex 41 as follows:

61(i). For a bank to recognize in its EAD calculations for OTC derivatives the effect of collateral other than cash of the same currency as the exposure itself, if it is not able to model collateral jointly with the exposure then it must use either haircuts that meet the standards of the financial collateral comprehensive method with own haircut estimates or the standard supervisory haircuts.

6.4.6 Requirement for Banks to Model Non-Cash Collateral Jointly with Underlying Securities for OTC Derivatives and SFTs

The following summary is appropriate.

• Applicable to IMM banks

• Regulation ensures robustness of non-cash collateral

• Ensure the effect of collateral on changes in the market for SFTs for EAD calculation

In order to further explain this component:

109. To ensure the robustness of non-cash collateral, a new paragraph 61(ii) will be inserted in Annex 41 as follows:

61(ii). If the internal model includes the effect of collateral on changes in the market value of the netting set, the bank must model collateral other than cash of the same currency as the exposure itself jointly with the exposure in its EAD calculations for securities-financing transactions.

6.4.7 Revise Credit Risk Mitigation Section to Add a Qualitative Collateral Management Requirement

The following summary is appropriate.

• Applicable to IMM and non IMM banks

• Sufficient resources are devoted to the orderly operation of margin agreements for OTC and SFTs

• Appropriate collateral management policies to be in place

110. To ensure that sufficient resources are devoted to the orderly operation of margin agreements for OTC derivative and SFT counterparties, and that appropriate collateral management policies are in place, a new paragraph 115(i) will be inserted into the main text and will read as follows:

115(i). Banks must ensure that sufficient resources are devoted to the orderly operation of margin agreements with OTC derivative and securities-financing counterparties, as measured by the timeliness and accuracy of its outgoing calls and response time to incoming calls. Banks must have collateral management policies in place to control, monitor and report:

• the risk to which margin agreements exposes them (such as the volatility and liquidity of the securities exchanged as collateral),

• the concentration risk to particular types of collateral,

• the reuse of collateral (both cash and non-cash) including the potential liquidity shortfalls resulting from the reuse of collateral received from counterparties, and

• the surrender of rights on collateral posted to counterparties.

6.4.8 Revise Text to Establish Standard Supervisory Haircuts for Securitization Collateral

The following summary is appropriate.

• Applicable to IMM and non IMM banks

• Re-securitization no more an eligible collateral

• Under Basel II framework, the standardized haircuts currently treat corporate debt and securitizations collateral in the same manner

• Collateral haircuts for securitization exposures are doubled due to stressed volatilities

111. To implement the supervisory haircuts for securitization collateral, a new paragraph 145(i) will be inserted into the Basel text and paragraph 151 will be revised as follows:

145(i). Re-securitizations (as defined in the securitization framework), irrespective of any credit ratings, are not eligible financial collateral. This prohibition applies whether the bank is using the supervisory haircuts method, the own estimates of haircuts method, the repo VaR method or the internal model method.

151. These are the standardized supervisory haircuts (assuming daily mark-to-market, daily re-margining and a 10-business day holding period), expressed as percentages:

Issue rating for debt

securitiesResidual

MaturitySovereigns Other

IssuersSecuritization

ExposuresAAA to AA-/A-1 <1 year 0.5 1 2 >1 year <5 years 2 4 8 > 5 years 4 8 16 A+ to BBB-/ <1 year 1 2 4 A-2/A-3/P-3 and >1 year <5 years 3 6 12 unrated bank securities > 5 years 6 12 24 BB+ to BB- All 15 Not eligible Not eligible main index equities 15 other equities 25 UCITS/mutual funds Highest haircut applicable to any security in

Fund

Cash in the same currency 0 (The footnotes associated with the table are not included. However, securitization exposures would be defined as those exposures that meet the definition set forth in the securitization framework.) 6.5 Treatment of Highly Leveraged Counterparties (HLC)

The following summary is appropriate.

• Applicable to IMM and non IMM banks (IRB Approach)

• New rule stipulates that PD for a highly leveraged counterparty (hedge funds) should be based on a period of stressed volatilities

• While, the definition of highly-leveraged counterparties is aimed at hedge funds or any other equivalently highly-leveraged counterparties that are financial entities, SAMA will in due course provide a clear definition of HLC's for IRB purposes.

112. The Committee believes it is appropriate to add a qualitative requirement indicating that the PD estimates for highly leveraged counterparties should reflect the performance of their assets based on a stressed period and, thus, is introducing a new paragraph after 415 of the framework to read as follows:

415(i). PD estimates for borrowers that are highly leveraged or for borrowers whose assets are predominantly traded assets must reflect the performance of the underlying assets based on periods of stressed volatilities.

6.6 Central Counterparties to be Implemented

The following represents a summary of the additional capital requirements to central counterparties.

• International regulators intention to move to CCPs to clear OTC trades

• No local CCP’s is in KSA- banks will be at disadvantage

For further clarifications also refer to SAMA Circular # BCS 25092 dated 21/11/1433 (Hijri) entitled "BCBS Finalized Document Entitled "Capital Requirements for Bank Exposures to Central Counterparties".

Definition of CCP

‘’is a clearing house that interposes itself between counterparties to contracts traded on or more financial markets, becoming the buyer to every seller and the seller to every buyer and thereby ensuring the future performance of open contracts’’

• In 2009, the G20’s ambition of moving standardized over-the-counter (OTC) derivatives from a bilaterally cleared to a centrally cleared model by the end of 2012 reducing systemic risks in global banking

• Capitalizing exposures to CCPs builds on the new CPSS-IOSCO Principles for Financial Market Infrastructures (PFMIs)

Key features of Interim rules published by BCBS July, 2012

As part of the reform process BCBS released interim rules for the risk weighting of exposures to CCP’s (Document entitled: Capital requirements for bank exposures to central counterparties July, 2012)

The decision to publish the rules on an interim basis suggests that Basel Committee will monitor and make further changes if necessary

Exposures to Qualifying CCPs

Trade exposures:

Where a bank acts as a clearing member of a CCP, a risk weight of 2% must be applied to the bank’s trade exposure to the CCP in respect of OTC derivatives, exchange-traded derivative transactions and SFT’s.

Where a clearing member offers clearing services to clients 2% risk weight also applies when the clearing member is obligated to reimburse the clients for any losses suffered due to changes in the value of transactions in the event CCP defaults.

(‘’A qualifying CCP is a CCP that meets the new ‘’Principles for Financial Market Infrastructures’’ published by Payment and Settlement Systems and International Organization of Securities Commission’’)

Clearing member exposures to clients

‘’A clearing member is a member of or a direct participant in a CCP that is entitled to enter into transactions with the CCP’’

• Clearing member will always calculate its exposure (including potential CVA risk exposure) to clients as bilateral trades

• To recognize shorter close-out period for cleared transactions clearing members can capitalize the exposure to their clients applying a margin of period of risk of at least 5 days in case if they adopt the IMM or multiply the EAD by a scalar of no less than 0.71 if they adopt either the CEM or the Standardized Method

Client exposure

‘’A client is a party to a transaction with a CCP through either a clearing member acting as a financial intermediary or a clearing member guaranteeing the performance of the client to the CCP’’

• Where a bank is a client of a clearing member and enters into a transaction with the clearing member acting as financial intermediary the client’s exposures to the clearing member may receive the same treatment as defined for clearing member exposures to CCPs subject to meeting two conditions as defined in Para 114 (a) and (b) of Basel Document for central counterparties

Basel III imposed a capital charge on a bank’s exposures to a CCPs default funds

‘’CCP default funds consist of contributions made by clearing members which are designed to protect the relevant CCP from losses caused by the default of a clearing member’’

• Whenever a bank is required to capitalize for exposures arising from default fund contributions to a ‘’Qualifying CCP’’

• Clearing member banks may apply one of the following approaches:

Method 1: Risk sensitive approach

Risk sensitive formula considers size and quality of a qualifying CCP’s financial resources

Method 2: Simplified method

Clearing member banks: Default fund exposures will be subject to a 1250% risk weight subject to an overall cap of 20% of the total trade exposures to the relevant CCP

Exposures to Non-Qualifying CCPs

• Banks must apply the Standardized Approach for credit risk in the main framework according to the category of the counterparty to their trade exposures

• Banks must also apply a risk weight of 1250% to their default fund contributions to a non-qualifying CCP