Book traversal links for Implementing Regulation of the Finance Companies Control Law

Implementing Regulation of the Finance Companies Control Law

No: 2/MFC Date(g): 24/2/2013 | Date(h): 14/4/1434 Part One: Definitions and General Provisions

Article 1

The following words and phrases, wherever they appear, in this Regulation shall have the corresponding meanings, unless the context otherwise indicates:

Law: the Finance Companies Control Law.

Finance Laws: the Real Estate Finance Law, the Finance Lease Law and the Law Finance Companies Control Law.

Regulation: the Implementing Regulation of the Finance Companies Control Law.

SAMA: Saudi Central Bank*.

Governor: the Governor of Saudi Central Bank.

Finance Company: a joint stock company licensed to carry out Finance activity.

Borrower: a person receiving Finance.

Consumer: a person to whom Finance Company’s services are directed.

License: a license issued by SAMA to a company to carry out Finance activity.

“Finance Activity” or “Finance Activities”: one or more types of Finance listed in Article 10 of the Law or any other Finance activities approved by SAMA pursuant to Article 10 of the Law.

Finance: extending credit under contracts for the activities set out in the Law and the Regulation.

Finance Agreement: a Finance Company extends credit for the activities set out in the Law and the Regulation.

Installment: the Total Amount Payable by the Borrower distributed over the term of the Finance Agreement, minus non-recurring expenditures, expenses and costs such as fees, commissions and administrative services fees.

Term Cost: the term cost to the Borrower under the Finance Agreement as a fixed annual or variable annual percentage applied to the Amount of Finance obtained by the Borrower.

Total Cost of Finance: all the costs to be paid by the Borrower under a Finance Agreement other than the Amount of Finance, including Term Cost, fees, commissions, administrative services fees, insurance, and any charges required to obtain Finance excluding any expenses the Borrower can avoid such as costs or fees payable by the Borrower due to his breach of any of his obligations contained in the Finance Agreement.

Amount of Finance: the ceiling or the total amounts made available to the Borrower under a Finance Agreement.

Total Amount Payable by the Borrower: the Amount of Finance and the Total Cost of Finance.

Annual Percentage Rate: the discount rate calculated in accordance with the provisions of Article 81 of this Regulation.

Board: the board of directors of the Finance Company.

Senior Management: the managing director, chief executive officer, general manager, their deputies, the chief financial officer and directors of major departments, in addition to the officers in charge of risk management, internal audit and compliance functions in the Finance company.

Exposure: the value of an asset that is subject to any credit risks, such as default risk or downgrade risk.

Large Exposure: the exposure of one Borrower by (5%) or more of the paid capital and reserves of the Finance Company.

Qualifying Interest: (5%) or more of the shares or the voting rights related to shares in the Finance Company whether held directly or indirectly either by one person or by several persons acting in concert.

* The "Saudi Arabian Monetary Agency" was replaced By the "Saudi Central Bank" in accordance with The Saudi Central Bank Law No. (M/36), dated 11/04/1442H, corresponding to 26/11/2020G.

Article 2

SAMA shall organize the Finance sector and supervise the business of the Finance Companies in accordance with the Law and the Regulation as the following:

1. License to practice one or more of the Finance activities in accordance with the Finance laws and its regulations. 2. Taking all actions necessary for maintaining the integrity and stability of the Finance sector and fairness of its transactions; 3. Taking all actions necessary for encouraging legitimate and fair competition among Finance Companies; 4. Issuing rules and instructions required to organize the Finance sector. 5. Taking all suitable means for the development of the Finance sector, Saudization, and enhancement of its employees’ efficiency through regulating the obligations of the Finance Companies in training of human resources, improving their skills and enriching the employees’ knowledge in Finance Industry. Article 3

1. Any legal person engaging in one or more of the Finance Activities specified in Article 10 of the Law, or any other Finance Activity approved by SAMA in accordance with Article 10 of the Law, shall be subject to the provisions of this Regulation. 2. Notwithstanding the provision of paragraph 1 of this Article, consumer microfinance companies are subject to the rules issued by SAMA in this regard. This article has been amended in accordance with His Excellency the Governor's Decision No. 85/M SH T dated 26/5/1441H.

Part Two: Finance Companies Licensing

Article 4

No one is allowed to carry out any finance activity without obtaining a license from SAMA in accordance with the Law and the Regulation or other applicable laws.

This Article has been amended in accordance with His Excellency the Governor's Decision No. 66/M SH T, dated 09/07/1439H.

Article 5

The finance of a natural or a legal person regarding the goods of their institution or services to their consumers will be subject to the controls and instructions issued by SAMA.

This Article has been amended in accordance with His Excellency the Governor's Decision No. 78/M SH T, dated 05/12/1440H.

Article 6

The Finance Company shall not practice any activities, which it has not been licensed for under the Finance Laws and their regulations.

Article 7

Founding shareholders of the Finance Company, or their representatives, shall apply to SAMA for a License. The application shall specify the activities for which a License is requested, and includes the following:

1. Completed application form required by SAMA; 2. Draft articles of association and by-laws of the Finance Company; 3. Description of the organizational structure of the Finance Company showing all necessary departments and functions and their main tasks; 4. List of all founding shareholders setting out the number and percentage of shares that each founding shareholder will own; 5. Fit and proper requirements form for founding shareholders signed by each founding shareholder; 6. Fit and proper requirements form for Board members signed by each candidate for Board membership; 7. Feasibility study identifying target market, services to be provided, business model, and strategy of the Finance Company in addition to a five- year business plan sets out at least the following: a. Finance Activities, for which a license is requested, products and a marketing plan; b. Credit granting policies and procedures; c. Estimated financial statements, projected annual revenue, expenses and financial margins and targeted growth rates, taking into account the requirements of capital adequacy and liquidity assessments of the SAMA; d. Projected start-up costs and funding thereof; e. Projected ongoing financing of operations; f. Branch offices to be established; g. Plan and programs of monitoring and managing risks and compliance; h. Recruitment and training plan, including the projected number of employees and percentage of Saudi nationals at each department and each organizational level, and the training and qualification programs for employees. 8. An irrevocable bank guarantee issued in favour of SAMA by one of the local banks for an amount equivalent to the required minimum capital for the Finance Activity or Activities, requested to be licensed, in accordance with the model set by the SAMA. Such bank guarantee is renewable automatically until the required capital is paid up in full. This guarantee shall be released upon the request of the founding shareholders in the following cases: a. Paying up the capital in cash. b. Withdrawing the license application. c. Refusing the license application by SAMA. 9. Drafts of proposed agreements and contracts with third parties, including agreements and contracts with related parties and external service providers; and 10. Any other documents or information that SAMA may request. Article 8

Subject to the provisions of the Companies Law, the minimum paid up capital of the Finance Company is as follows:

1. For Finance Company carrying out real estate Finance Activity: (200,000,000) two hundred million Saudi riyals. 2. For Finance Company carrying out one Finance Activity or more other than real estate Finance: (100,000,000) one hundred million Saudi riyals. 3. For Finance Company carrying out only microfinance activity: (10,000,000) ten million Saudi riyals. 4. For Finance Company carrying out only small and medium enterprise finance activity: (50,000,000) fifty million Saudi riyals.

SAMA may stipulate higher or lower minimum capital based on the prevailing market conditions, or if, as deemed by SAMA, the proposed business model of the Finance Company, scope and nature of proposed activities, or their geographic reach so requires, taking into consideration the magnitude and the nature of risks associated with such activities. The capital must be paid up in full at the establishment of the Finance Company.

This article has been amended in accordance with His Excellency the Governor's Decision No. (126/M SH T) dated 8/6/1444H.

Article 9

1. Microfinance activity is limited to Financing the production activates of small business owners, crafts people and the like, provided that the finance amount shall not exceed the limit set by SAMA.* 2. The licensed Finance Company practicing microfinance shall comply with SAMA requirements, permissions and rules regarding this Finance Activity. * This paragraph has been amended in accordance with His Excellency the Governor's Decision No. 85/M SH T dated 26/5/1441H.

Article 10

1. Each founding shareholder must comply with the Sharia and legal competence requirements, and the fit and proper requirements stipulated by SAMA. In particular the following: a. He must not have been convicted of a violation of any of the provisions of a criminal law, the Banking Control Law, the Capital Market Law, the Co-operative Insurance Companies Control Law or its regulations, the Finance Laws or its regulations, or any other laws or regulations inside or outside the Kingdom of Saudi Arabia; b. He must not have been declared bankruptcy or entered into a general settlement with any creditor; c. He must not have been sentenced of a breach of trust offence, unless rehabilitated and at least 10 years have passed since the last sanction for this crime has been completed and on the condition of obtaining a non-objecting letter from SAMA; d. Have not requested to withdraw license application to carry out Finance Activity in the last two years; e. He must not have a previous application to carry out Finance Activity refused by SAMA during the last five years; and f. He must have the sufficient financial solvency and shall not have breached any financial obligations towards his creditors nor there is an indication that he cannot continuously comply with his financial obligations towards his creditors. 2. In case of a founding shareholder or an owner of the Qualifying Interest committing a prejudice to the Sharia or legal competence, or solvency stipulated by SAMA; SAMA may at any time band them from the right to vote on the decisions of the Finance Company or require receiving a written non-objection before practicing this right in order to preserve the integrity of the performance of the Finance Company, apply the principles of governance and protect the interests of stakeholders of the Finance Company. 3. A written non-objecting letter from SAMA is required prior to the acquisition of any shares in a Finance Company that is not publically traded in the Saudi Stock Exchange “Tadawul”, or the acquisition of a Qualifying Interest in a Finance Company that is publically traded in the Saudi Stock Exchange “Tadawul”, and the acquirer of such shares shall be subject to the provisions of this Article in both cases. 4. If the founding shareholder or that who intends to acquire shares in the Finance Company is an entity, the provisions of this Article shall apply on any who owns (5%) or more of the capital or of the right to vote in that entity. Article 11

All Board members shall comply with the requirements of professional eligibility and fit and proper requirements stipulated by SAMA. In particular the following:

1. He must not be a Board member in another Finance Company; 2. He must not combine work in supervising Finance Companies or auditing their financials and membership in a Board of the Finance Company; 3. He must not have been dismissed from an executive leadership function in financial facility as disciplinary measure; 4. He must not have been convicted of a violation of any of the provisions of a criminal law, the Banking Control Law, the Capital Market Law, the Co-operative Insurance Companies Control Law or its regulations, the Finance Laws or its regulations, or any other laws or regulations inside or outside the Kingdom of Saudi Arabia; 5. He must not have been previously declared bankruptcy, or entered into a general settlement with any creditor; 6. He must not have been sentenced of a breach of trust offence, unless rehabilitated and at least 10 years have passed since the sanction for this crime has been completed and on condition that he receives a non-objecting letter from SAMA; and 7. He must have the sufficient financial solvency and shall not have breached any financial obligations towards his creditors nor there is an indication that he cannot continuously comply with his financial obligations towards his creditors. Article 12

Any candidate for a Senior Management position in the Finance Company must comply with the requirements of professional eligibility and fit and proper requirements stipulated by SAMA. In particular the following:

1. He must be permanently resident in the Kingdom of Saudi Arabia; 2. He must be professionally qualified and must have at least five years of relevant experience. SAMA has the right to assess the candidate's completion of such period of experience.* 3. He must not have been dismissed from a previous job as disciplinary measure; 4. Not have been convicted of a violation of any of the provisions of a criminal law, the Banking Control Law, the Capital Market Law, the Cooperative Insurance Companies Control Law or its regulations, the Finance Laws or its regulations, or any other laws or regulations inside or outside the Kingdom of Saudi Arabia; 5. He must not have been declared bankruptcy or entered into a general settlement with any creditor; 6. He must not have been sentenced of a breach of any trust offence, unless rehabilitated and at least 10 years have passed since the sanction for this offence has been completed and on condition that he receives a non-objecting letter from SAMA; and 7. He must have the sufficient financial solvency, and shall not have breached any financial obligations towards his creditors nor there is an indication that he cannot continuously comply with his financial obligations towards his creditors. * This paragraph has been amended in accordance with His Excellency the Governor's Decision No. 72/M SH T, dated 20/06/1440H.

Article 13

1. The license application must comply with the requirements set out in the Law and this Regulation. The founding shareholders of the Finance Company must provide SAMA with any additional information or documents that SAMA may require within 30 days from the date of request; 2. In case of failing to meet the 30 days period requirement specified in Paragraph 1 of this Article, SAMA may refuse the license application; 3. SAMA will issue a written notice to the applicant after the completing all the requirements stipulated in the Law and the Regulation and 4. Within (60) days from the day on which SAMA has accepted the license application as being complete, SAMA will either grant a preliminary approval or refuse to grant a License, giving its reasons in case of a refusal. The preliminary approval does not constitute a License or approval to practice the Finance Activity. Article 14

Founding shareholders must establish the Finance Company as a joint stock company within six months of the granting of the preliminary approval and provide SAMA with copies of the Finance Company’s commercial registration and by-laws, reflecting the licensed activities in accordance with the preliminary approval. The preliminary approval will expire after six months of the preliminary approval. Unless a non-objection letter has been obtained from SAMA to extend its duration for a maximum of six months.

Article 15

1. Once the company has completed the establishment requirements and the applicants have provided proof indicating full payment of the capital, and any additional initial funding as set out in the business plan has been provided to the Finance Company and that the company has taken all necessary measures to start carrying out the planned Finance Activities, including the establishment of all necessary personnel, systems, equipment and functions, SAMA will grant the License. 2. SAMA may take all necessary actions, such as on-site supervision, inspection, meeting their officials and viewing their systems, procedures and records, to verify that the requirements set out in Paragraph 1 of this Article have been met. Article 16

SAMA will determine in the License the Finance Activity or Activities for which it is granted. SAMA may restrict the License to certain geographic area or specific types of Borrowers or impose other conditions.

This article has been respectively amended in accordance with His Excellency the Governor's Decision No. 72/M SH T, dated 20/06/1440H, and His Excellency the Governor's Decision No. 113/M SH T dated 10/08/1443H.

Article 17

The License shall be granted for a term of five years and may be renewed by SAMA based on a request by the Finance Company in accordance with the requirements of this Regulation. The renewal application must be submitted to SAMA at least six months prior to the expiry of the License in accordance with the model stipulated by SAMA, including the following:

1. an updated strategy and five-year business plan that sets out at least the following: A. A marketing plan taking into account existing and planned products; B. Credit policies and procedures; C. Projected financial statements, annual revenue and expenses, financial margins and targeted growth rates, against the performance of the Finance Company over the past five years, taking into account any modifications to the company’s strategy and business plan; D. Projected liquidity and capital adequacy ratios against the levels of liquidity and capital solvency ratios of the past five years, taking into account any modifications to the Company’s strategy and business plan; E. Projected ongoing Finance operations; F. Branch offices to be established; G. Report on risks suffered by the Finance Company through the past five years, and how to manage and deal with it, including the risks of non-compliance and cases of violation of laws, regulations, or, instructions and future plan and programs of the company to manage risks and compliance. H. Current number of employees and the percentage of Saudi nationals thereof at each department and each organizational level. I. Recruitment and training plan, including training and qualification programs for employees. 2. The financial charges required for renewing the License; 3. Any other documents and information that SAMA may request. Article 18

The Finance Company must not cease any of its activities for more than three consecutive months unless SAMA has granted its prior written approval, and without prejudice to the Company’s obligations towards its creditors, shareholders or the integrity of the financial system.

Article 19

The Finance Company may apply for an amendment of the License for addition or deletion of some Finance Activities or amendment of any term or limitation thereof. Amendment application must be based on reasonable justifications and accompanied by any documents, information or studies required by SAMA.

Article 20

1. SAMA may revoke the License upon the request of the Finance Company, taking into account the rights of the creditors and Borrowers and the integrity of the financial system. 2. SAMA may revoke the License if the Finance Company has submitted false information or failed to disclose material information that should have been provided for licensing purposes. 3. If the License is revoked, the Finance Company must be liquidated. SAMA may appoint a liquidator. Article 21

The Finance Company must cease its Finance Activities with immediate effect if the License is suspended according to Article 29 of the Law, and may not practice any of these activities unless a non-objection letter has been obtained from SAMA thereupon.

Article 22

1. SAMA may charge the following: a. (200,000) two hundred thousand Saudi riyals for issuing the License; b. (100,000) one hundred thousand Saudi riyals for renewing the License; and c. (50,000) fifty thousand Saudi riyals for amending the License. 2. Notwithstanding the provision of Paragraph 1 of this Article, the financial fees for issuing the license to practice microfinance activity, renew it or amended it is (10.000) Ten Thousand Saudi Riyals. Article 23

The Finance Company shall obtain from SAMA a non-objection letter prior to the launch of any financial products or amendment of any existing products directed to individuals or beneficiaries of microfinance.

This article has been amended in accordance with His Excellency the Governor's Decision No. 72/M SH T, dated 20/06/1440H.

Part Three: Capital Adequacy and Liquidity

Article 24

The Finance Company shall comply with the levels of capital adequacy and liquidity required in accordance with the rules, requirements and criteria stipulated by SAMA.

Article 25

The Finance Company shall provide SAMA with precautionary data at specific times according to the models, controls and instructions determined by SAMA.

Article 26

The Finance Company shall obtain a non-objecting letter from SAMA prior to the approval of any distribution of profits, any other distributions, the recommendation of it or announcing it, after making sure of the following:

1. The distribution does not cause capital adequacy, or liquidity to drop below the required levels; 2. The distributions of the fiscal year must not exceed the actual net profit for the previous fiscal year; and 3. Any other conditions set by SAMA. Part Four: Ownership and Assets

Article 27

1. No acquisition of assets other than those necessary to manage its business shall be executed by the Finance Company unless it has obtained a non-objection letter from SAMA; 2. The Finance Company may not execute any partial or total liquidation of its business or of the Finance Company itself without a non-objecting letter from SAMA. Part Five : Corporate Governance

Article 28

The Finance Company must comply with corporate governance rules determined by SAMA.

Article 29

The Finance Company shall develop an internal corporate governance rules and implement a specific regulation for corporate governance and provide SAMA with a copy of the regulation after its approval by the Board. The corporate governance code shall at least address the following:

1. The description of the organizational structure, including all departments and functions and their tasks and responsibilities; 2. Independence and separation of duties; 3. Roles of the Board, its committees, and the composition and duties of each. 4. Remuneration and compensation policies; 5. Conflict of interest controls; 6. Integrity and transparency controls; 7. Compliance with applicable laws and regulations; 8. Methods for securing confidentiality of information; 9. Fair dealing; and 10. Protection of Company’s assets. Article 30

The Board must form specialized committees to expand the scope of work in the areas requiring special expertise, including at least an audit committee and a risk management and credit committee, and shall grant those committees the necessary powers to perform their work and monitor their performance.

Part Six: Internal Organizing

Article 31

The Finance Company must establish appropriate written organizational policies, that includes work manuals and workflow procedures. Those policies must be kept up to date on a regular basis and they must be communicated to the concerned staff in a suitable and timely manner. The organizational policies must include rules for at least the following:

1. The organizational and operational structure, decision making and responsibilities; 2. Credit granting and operations; 3. Financial management and accounting; 4. Marketing and sales; 5. Information technology and security; 6. Customer service and collection; 7. Identifying, assessing, treating, monitoring and disclosing risks; 8. Internal supervision system; 9. Internal audit; 10. Committing to the related laws, regulations and instructions ; 11. Assigning tasks to external service providers; and 12. Salaries, bonuses and incentives, including the salaries of members of Senior Management and staff and their motivation and remuneration of the Board and its committees. Article 32

It is prohibited in the Finance Company to combine an executive function such as financing or hedging and oversight function such as internal auditing or accounting tasks. A separation of functions must be adopted in a manner that ensures the application of the generally accepted policies, procedures, and technical standards, to protect the Finance Company’s assets and funds, and avoid fraud and embezzlement.

Article 33

1. The Finance Company’s technical facilities and related systems must be adequate according to industry standards for the Finance Company’s operational needs, the nature of its activities, and risk situation. 2. Information technology systems and the related processes must be designed in a manner that ensures data integrity, availability, authenticity and confidentiality. Information technology systems and the related processes must be assessed on a regular basis in accordance to the general accepted technical standards and tested before they are used for the first time and after any changes have been made. 3. The Finance Company must establish a business continuity plan for emergency cases that ensures an alternative solution to re-operate in an appropriate period of time. Article 34

All business documents, records and files must be kept in an orderly, transparent and safe manner by the Finance Company. They must be kept up to date and completed and retained for at least ten years from the date of termination of the client’s relationship.

Article 35

The Finance Company must have sufficient and eligible staff regarding knowledge and experience in order to fulfill its operational needs, business activities and risks situation. The remuneration and incentives of staff must be fair and aligned with the Finance Company’s risk management strategy and must not create conflicting interests.

Article 36

1. At least (50%) of all employees of the Finance Company must be Saudi nationals when the Finance Company starts operations. The (50%) minimum applies to all departments and organizational levels. 2. The percentage of Saudi nationals of total human resources shall be annually increased by (5%) of all employees until (75%) has been reached. SAMA may determine the minimum required annual increase thereafter. 3. Recruitment of non-Saudis in the Finance Company shall be limited to jobs that require expertise not available in the Saudi labor market. In all cases, the Finance Company must obtain a non-objection letter from SAMA before appointing any non-Saudi employee in supervision departments provided that the Company has proved the lack of Saudis for the vacant position.* * This paragraph has been amended in accordance with His Excellency the Governor's Decision No. 72/M SH T, dated 20/06/1440H.

Part Seven: Outsourcing

Article 37

1. The Board must issue a written policy regulating outsourcing. It must be updated annually. This policy shall include in particular the following: a. Terms of reference and responsibilities of the Board and Senior Management; b. Eligibility criteria for outsourcing provider; c. Risk identification criteria and risk hedging measures; d. Rules for the continuous monitoring and controlling of outsourced operations; e. Criteria to identify conflicts of interest, if any, rules and procedures which ensure safeguarding the interests of the Finance Company and not putting the interest of the other party over the company's interest; and f. Procedures to protect information and maintain confidentiality and privacy. 2. SAMA, the Finance Company, and the external auditor must have the authority to obtain any information or documents related to the work of the outsourcing provider or be examined in the offices of the outsource provider. 3. The Finance Company must verify the outsourcing provider’s compliance with the applicable laws, regulations, and instructions. The Finance Company remains responsible in case of the outsourcing provider’s non-compliance with the applicable laws, regulations and instructions in any operations and tasks that are assigned to him. 4. The Finance Company must obtain a non-objecting letter from SAMA prior to any outsourcing arrangement that, in case of disruption or other default, may have an impact on the Finance Company’s activities, reputation or financial situation, or if the tasks assigned included transferring, processing or saving the data and information of the Borrowers. In this case, the outsourcing provider may not subcontract these tasks to another provider. Part Eight: Risk Management

Article 38

The Finance Company must:

1. Establish a clear written business strategy and a written risk management policy approved and updated annually by the Board. The risk management policy should take into account all relevant types of risks and how to deal with them, taking into consideration all business activities, including operations and tasks that have been outsourced. The risk management policy must include analysis for at least the following risks: a. Credit risks; b. Market risks; c. Term Cost rate risks; d. Incompatibility of assets with liabilities risks; e. Exchange rate risks; f. Liquidity risks; g. Operational risk; h. Country risks; i. Legal risks; j. Reputation risks; k. Technology risks. 2. Establish appropriate procedures to identify, assess, manage, monitor and communicate risks. These processes must be included in a comprehensive risk management framework that ensures the following: a. Early and comprehensive identification of risks; b. Assessment of correlations between risks; and c. Immediate coordination with Senior Management, the Board, risk and credit management committee and the responsible staff, and where appropriate, the internal audit department. 3. Establish a risk management function directly reporting to the risk and credit management committee. Risk and credit management committee must raise their views about risk management reporting to the Board. Article 39

The Finance Company must prepare a quarterly risk report for discussion by the risk and credit management committee and the Board after review by Senior Management. The report must include as a minimum the following:

1. A comprehensive overview of the risk development and performance of financial positions that incur market price risks, as well as any instances in which the limits have been exceeded; 2. Changes to assumptions or parameters which form the basis of risk assessment procedures; 3. The performance of the Finance portfolio by activity, risk class and size and collateral category; 4. The extent of limits granted and external credit lines; Large Exposures as defined in Article 55 of this Regulation and other significant Exposures, such as default Finance, must be listed and commented on; 5. Analysis of the conditions in which the Finance Company exceeded the limits and the reasons thereof, the scale and development of new business, and Finance Company’s risk provisioning; and 6. Any major Finance decisions which deviate from the strategies or policies of the Finance Company. Article 40

The Finance Company must submit to SAMA the report referred to in Article (Thirty-Nine) of this Regulation, after being discussed and approved by credit and risk management committee and the Board, along with the decisions made in this regard.

Part Nine: Compliance

Article 41

The Finance Company must comply with applicable laws, regulations and instructions. It must also take the necessary measures and procedures to avoid breaching its provisions.

Article 42

The Finance Company must:

1. Establish an independent department or a compliance function and assign a head of compliance reporting directly to the audit committee, and the audit committee must raise their views about compliance reports to the Board; 2. Develop a written compliance policy approved by the Board, which sets out the rights, obligations and responsibilities of the compliance department, as well as compliance programs and related processes of the compliance function. The audit committee must ensure the implementation of the compliance policy, evaluate its effectiveness, update it and propose the necessary amendments to it on an annual basis; and 3. Take the necessary procedures to ensure that the compliance policy referred to in Paragraph 2 of this Article is adhered to. Article 43

1. Based on the recommendation of the audit committee, a head of compliance shall be appointed by the Board, after obtaining a non-objecting letter from SAMA thereupon. 2. The head of compliance acts independently, regarding his tasks and he may not practice any other administrative responsibilities. Article 44

The head of compliance must submit a compliance report to the audit committee and thereafter to the Board for review on quarterly basis at least. The compliance report must identify the main compliance-related risks facing the Finance Company, analyze existing processes and procedures and assess their viability and, suggest any amendments or changes thereto.

Article 45

The compliance department must have staff and resources commensurate with the business model and size of the Finance Company. Compliance employees must report solely to the head of compliance.

Article 46

The compliance department must ensure the Finance Company’s compliance with applicable laws, regulations and circulars. It has, without limitation, the following tasks:

1. Identifying and dealing with all compliance risks and monitoring all relevant developments; 2. Analyses new procedures, policies and operations. and suggesting the procedures to address relevant compliance risks; 3. Following a risk-based compliance program and including its findings in the report referred to in Article 44 of this Regulation; 4. Collecting compliance complaints and formulates written guidance for staff, where necessary; 5. Drafting internal policies and procedures to combat financial crimes, such as money laundering and terrorism financing; 6. Monitoring compliance with all applicable anti-money laundering and anti-terrorism financing laws, regulations, and rules; 7. Promoting awareness of compliance issues and providing training for employees on compliance related matters through periodic programs; and 8. Reporting any irregularities and/or violations promptly to SAMA and the Audit Committee. Article 47

The Finance Company must develop internal policies and procedures of anti-financial crimes, specifically money laundering and financing terrorism. Therefore, the standards of (Know Your Client) should be applied and taking the necessary actions to report to the financial investigation unit of any suspected activities or processes.

Part Ten: Internal Audit

Article 48

1. The Finance Company must establish an internal audit department reporting directly to the audit committee. The internal audit department shall be independent in performing its duties, and its employees shall not be assigned any other responsibilities. 2. The internal audit department manages and assesses the internal control system and to assure the extent to which the company and employees, comply with the applicable laws, regulations, circulars and Finance Company’s policies and procedures, whether outsourced or not. The internal audit department must have full and unlimited access to information and documents. Article 49

The internal audit department shall operate according to a comprehensive audit plan, approved by the audit committee and updated on an annual basis. Major activities and operations, including those related to risk management and compliance, must be audited annually.

Article 50

1. The internal audit department must prepare and submit to audit committee a written report on its work at least quarterly. This report must include the scope of the audit, all findings and recommendations. It must also include the procedures taken by each department in respect of the findings and recommendations of the previous auditing and any related observations, especially if they have not been settled on time and the reasons for their unsettlement. 2. The internal audit department must prepare and submit to the audit committee a written general report on all audits in a fiscal l year, compared with the approved plan and stating any gaps or deviation from the plan, if any. This report shall be submitted within the first quarter following the end of the relevant fiscal year. Article 51

The Financing Company shall maintain the working documents and audit reports that, show in a transparent manner the work carried out, as well as findings and recommendations and what has been accomplished regarding these recommendations.

Part Eleven: Finance Policies and Procedures

Chapter One: Finance Policies

Article 52

1. The Finance Company shall define written Finance policies setting out rules and procedures for granting Finance, including but not limited to, classification of credit worthiness, procedures for dealing with, deteriorating credit rating and default Finance, types of accepted collaterals, methods for calculating their values, monitoring, administration and enforcement of collateral, and risk provisioning. 2. All Finance policies and all amendments to policies must be approved by the Board and submitted to SAMA by the Finance Company. Chapter Two: Exposure Limits

Article 53

Exposure includes the value of all assets that subject to any credit risks, including but not limited to, Finance Agreements; securities; and advanced payments to other entities and clients; all commitments or other obligations to grant Finance or to make a payment or deliver assets to a third party with a right of recourse against a client or another third party, equity, participating interests and assets in respect of which the Finance Company is the lessor.

Article 54

1. The aggregate finance amount offered by a Finance Company shall not exceed five times the capital and reserves for Finance Companies carrying out real estate finance activities and three times the capital and reserves for Finance Companies carrying out other finance activities, unless a non-objection letter from SAMA is obtained. 2. SAMA may increase the limit on the aggregate finance amount offered by a Finance Company to the extent it deems appropriate, taking into account the financial position of the Finance Company, its performance and the market conditions. This article has been amended in accordance with His Excellency the Governor's Decision No. 72/M SH T, dated 20/06/1440H.

Article 55

1. The aggregate of Large Exposures must not exceed the paid-up capital and reserves of the Finance Company unless the Finance Company has obtained a non-objecting letter from SAMA. 2. The Finance Company may not incur an Exposure to a Borrower of (10%) or more of its paid up capital and reserves or an Exposure to a group of Borrowers where one of them has direct or indirect control over the other members of the group of (25%) or more of its paid up capital and reserves, unless it has obtained a non-objecting letter from SAMA thereupon. Article 56

1. Any of the following is a related party for the purposes of this Regulation: a. Any member of the Board or its committee; b. Any member of Senior Management; c. Any person directly or indirectly holding or controlling (5%) or more of the capital or voting rights of the Finance Company, and any entity in which such person directly or indirectly holds or controls (5%) or more of the entity’s capital or voting rights; d. Any person directly or indirectly holds or controls (5%) or more of any class of securities that give their holders the right to a share of the profits or income of the Finance Company; e. Any entity in which the Finance Company directly or indirectly holds or controls (5%) or more of the shares or interests or voting rights; and f. Any ancestor or descendant up to the second degree, or spouse of any of the persons listed in the preceding Subparagraphs (a) through (d). 2. In accordance with Article 12 of the Law, the Finance Company may incur an Exposure to a related party only on a commercial basis and after obtaining sufficient collateral so that the Finance may not exceed (60%) of the collateral, and if the Finance is more than (500,000) five hundred thousand riyals, there must be a consensus decision of the Board to do so. 3. The Finance Company may not incur an Exposure to a related party of (10%) or more of its paid-up capital and reserves without obtaining a non-objecting letter from SAMA. In all cases, the aggregate of all Exposures to related parties must not exceed (50%) of the paid-up capital and reserves of the Finance Company. 4. The Finance Company must not incur any Exposure to a related party that either directly or indirectly holds or controls (25%) or more of the shares, interests or voting rights in the Finance Company or in which the Finance Company holds or controls directly or indirectly (25%) or more of the shares, interests or voting rights. 5. The Finance Company must not incur an Exposure to any of its employees that is not a related party in excess of four months’ salary of such employee, except through Finance programs organized by the company for its employees, approved by the Board and after obtaining a non-objecting letter from SAMA. 6. Without prejudice to the public and private rights prescribed by laws, any Board member of the Finance Company or any external auditor who receives Finance in breach of any of sections (1/b), (1/c), or (1/d) of Article 12 of the Law, shall be deemed dismissed from the date of receiving the Finance, and the Finance Agreement in this case shall be deemed void. Chapter Three: Finance Procedures

Article 57

1. The Finance Company must, upon the approval of the Consumer verify his credit record to confirm his solvency, repayment capacity and credit conduct. The confirmation of such must be documented in the Finance file. 2. The Finance Company must, upon the approval of the Borrower, register his credit information at one or more of the companies licensed to collect credit information in accordance to the relevant laws, regulations and instructions. Such information shall be updated throughout the period for dealing with the Borrower. 3. The Finance Company must decline the Finance request in case of the absence of obtaining an approval from the Consumer or Borrower, specified in paragraphs 1 and 2 of this Article. Article 58

1. The Finance Company shall administrate levels for granting Finance shall be determined based on the type and Amount of Finance, including defining Finance types that require the approval of more than one person and the decision for acceptance or refusal of the Finance shall be subject to the powers granted for each administrative level. 2. The Finance Company must obtain a non-objecting letter from SAMA before extending any of the following: a. Finance to a foreign Borrower that is not a resident in the Kingdom. b. Finance in a currency other than the Saudi riyal. Article 59

1. The Finance Company must follow a scientific method and a written, transparent and clear standards and procedures to asses credit worthiness of the applicant for the Finance and his ability to repay, according to the best practices in this field, and the Board must approve these standards and procedures and review them at least once every two years, and updating them if necessary. The Finance Company must apply these procedures before granting Finance and it shall be documented in the Finance file. 2. Risks related to an Exposure must be evaluated and classified before the Finance decision is made. The risk classification must be reviewed at least annually. 3. The Finance Company must define procedures for the early detection of risks to signal out Finance that show signs of increased risk and develop quantitative and qualitative indicators for the early identification of risks. Article 60

1. In accordance with the policy and procedures of risk management, approved by the Finance’s Company Board, the Finance must be by collaterals 2. All collateral must be enforceable and capable of valuation in order to be acceptable. Personal guarantees must be evaluated based on the net assets and/or net earning of the guarantor.* 3. The value and legal validity of collateral must be assessed prior to the granting of the Finance. 4. If the value of the collateral is dependent to a substantial degree on the financial situation of a third party or fluctuations and conditions of the market, the collateral must be evaluated on a regular basis, and the procedures stated in the agreement to strengthen those collateral shall be taken when its value decreases. The counterparty risk of the third party must be reviewed as appropriate. 5. Decisions of the collateral and reserve risks must be made by the control function. * This paragraph has been amended in accordance with His Excellency the Governor's Decision No. 72/M SH T, dated 20/06/1440H.

Article 61

In exception to the provisions of Article 60 of this Regulation, the Finance Company may grant Finance without a collateral, if the following applies:

1. The total Amount of Finance received by the Borrower, without collateral does not exceed (100,000) one hundred thousand Saudi riyal based on the data of the Borrower’s credit record. 2. The Borrower has no history of un-settled debt, conflict or a standing credit lawsuit, insolvency, bankruptcy or liquidation through the past ten years, or checks without balance by him through the past five years, based on the data of the Borrower’s credit record. 3. The Borrower must not be a related party. Article 62

The Finance Company must make provisions for contingent losses and risks in accordance with International Financial Reporting Standards. SAMA may require that the Finance Company to make an additional provision or more for contingent losses and risks.

Article 63

1. The Finance Company must define cases in which an Exposure requires special Observation; these Exposures shall be reviewed on an ongoing basis to determine whether further actions may be required. There must be clear rules determining when a Finance must be transferred to personnel specializing in restructuring, scheduling or winding up. 2. The Finance Company must define criteria for assets value reduction, provisioning Standards including country risks provisioning, taking into account of the International Financial Reporting Standards, and ensure that these are applied consistently. Article 64

Finance risks insurance must be in accordance with the Cooperative Insurance Companies Control Law and its implementation regulation and instructions issued by SAMA.

Part Twelve: Account and Deposits

Article 65

The Finance Company must not accept term deposits or non-banking credit facilities or similar or open any type of accounts to its clients unless a non-objecting letter from SAMA is obtained.

Part Thirteen: Trading Securities

Article 66

Without prejudice to Paragraph 3 of Article 11 of the Law, the Finance Company shall not own securities such as stocks, bonds, SUKUK and derivatives except in the following cases:

1. As part of a Finance transaction where the purpose of the transaction is to grant Finance to the Borrower; 2. To invest cash in hand, through local commercial banks deposits or through debt instruments that are approved by SAMA; 3. To hedge an existing Term Cost risk Exposure; and 4. To hedge an existing currency risk Exposure. Part Fourteen: Refinancing

Article 67

1. In accordance with the provisions of Article 14 of the Law, the Finance Company may issue securities only after obtaining a non-objecting letter from SAMA. 2. The Finance Company may not dispose finance assets or rights arising therefrom in any form except in accordance with the rules issued by SAMA in this regard.* 3. The Finance Company must comply with the rules and instructions issued by SAMA in this regard. * This paragraph has been amended in accordance with His Excellency the Governor's Decision No. 72/M SH T, dated 20/06/1440H.

Article 68

The Finance Company may not be financed by a foreign lender or in a currency other than Saudi Riyal unless a non-objecting letter from SAMA is obtained.

Part Fifteen: Structural Changes

Article 69

The Finance Company must obtain a non-objecting letter from SAMA before appointing persons in the following functions and tasks:

a. Membership of the Board and its committees. b. Managing director, chief executive officer, general manager, their designees, financial manager and directors of the key departments, or their designees. c. Managers of control functions, such as internal audit, risk management and compliance, or their designees. Article 70

The Finance Company must immediately notify SAMA of:

1. Any retirement of any member of the Senior Management or revocation of such authorization; 2. Losses exceeding (15%) of the paid-up capital of the Finance Company; Part Sixteen: Accounts

Article 71

The Finance Company must apply international accounting standards in the preparation of their accounts and financial statements.

Article 72

1. The Finance Company must provide SAMA with its audited annual financial statements, auditor’s report, and the Boards report at least five business days before its publishing date. 2. The Finance Company must provide SAMA with its quarterly financial statements and auditor’s report at least five business days before its publishing date. Article 73

Without prejudice to the requirements of other laws, the Finance Company must establish a website on the World Wide Web (the Internet) and publish its annual financial statements and reports including the following:

1. Statement of financial postions; 2. Income statement; 3. Cash flows statement; and 4. Boards report. Part Seventeen: Audit and Inspection

Article 74

1. The Finance Company must obtain a prior non-objecting letter from SAMA before appointing an external auditor. SAMA has the right to require the Finance Company to appoint another auditor if the size and nature of the company’s operation so requires. 2. SAMA may require the Finance Company to replace its external auditor or may appoint another external auditor at the expense of the Finance Company in any of the following cases: a. When necessary due to the size or the nature of the business; b. The external auditor has committed a breach of professional obligations; c. There is a reason to believe that the external auditor has a conflict of interest; or d. When necessary for the protection of the Finance sector or governance considerations and the protection of shareholder’s interest. 3. The external auditor must report to SAMA immediately all facts of which he obtains knowledge in the course of an audit and which: a. Might justify the reservation in the audit report or refrain from expressing opinion; b. Jeopardize the existence of the Finance Company; c. Seriously impair the Finance Company’s development, or d. Indicate that the managers have breached any laws, regulations, instructions applicable in the Kingdom of Saudi Arabia or the by-laws of the Finance Company. e. Terminate the agreement before it ends with the reasons thereupon. 4. SAMA may require the external auditor to explain his report or to reveal other facts that may have come to his attention during the audit which indicates any violation of the laws, the regulations, the instructions or the by-laws of the Finance Company. Article 75

1.The Finance Company, its Board members, and employees must provide all information and documentation concerning the Finance Company, its business, its shareholders, and its personnel, that SAMA may request at any time.

2. SAMA has the right to inspect the records and accounts of the Finance Company, through SAMA’s personnel or by auditors appointed by SAMA, provided that the inspection shall be at the Finance Company’s premises.

3.The Finance Company and its employees shall facilitate the task of whom SAMA appoints for inspection and cooperate with them particularly as follows: a. Provide the inspector with the Finance Company’s records, accounts, and documents that he deems necessary to perform his task; b. Provide information and explanations as required by the inspector. c. Disclose any violations or irregularities in the Finance Company’s operations to the inspector at the beginning of his mission. d. Adhere to the recommendations and instructions given by SAMA to the Finance Company to address the uncovered observations through the inspection’s rounds. 4. The Finance Company and any of its employees may not hide or attempt to hide any information or irregularities or fail to provide any clarifications requested by the appointed inspector or neglect to provide him with requested information and documents on time. 5. SAMA’s employees in charge of the supervision, control, and inspection shall not be vulnerable to any claims as a result of performing their duties. Article 76

1. Every violation of the provisions of the Law and the Regulation or the non-compliance to any of the rules or circulars issued by SAMA is a violation related to the professional irregularity referred to in Article 29 of the Law; 2. every violation that endanger the shareholders of the Finance Company or their creditors as referred to in Article 29 of the Law, is as follows: A. There is a material adverse change in the business, or in the financial or legal or administrative situation of the Finance Company that might endangers its existence or its ability to pay its debts as they fall due; B. The Finance Company incurs a loss amounting to one-half of its paid- up capital; C. The Finance Company incurs a loss amounting to more than (10%) of its paid-up capital in each of at least four consecutive fiscal years; or Article 77

The Finance Company must reimburse all costs of a third party appointed by SAMA as a consequence of procedures taken under this Part.

Part Eighteen: Consumer Protection in Finance Services

Article 78

Finance Agreements must be drawn up on paper or electronically between the Finance Company and the Borrower and each contracting party must receive a copy of the Finance Agreement. The Finance Agreement must include at least the following data and information:

1. Names of the parties of Finance Agreement, No of ID or Iqama or Borrower’s CR, as the case may be, their official addresses, means of contact including mobile numbers and e-mails, if available. 2. Type of Finance; 3. Term of the Finance Agreement; 4. Amount of Finance; 5. Conditions to drawdown the Amount of Finance if available; 6. The description of price determination formula in Finance Agreements with variable Term Cost in order to enable the consumer to understand the Term Cost, and distribute the cost on the fulfillment period; 7. Term Cost, the conditions governing the application of the Term Cost and any index or reference rate applicable to the initially agreed Term Cost, as well as the periods, conditions and procedures for changing the Term Cost; 8. Annual Percentage Rate; 9. Total Amount Payable by the Borrower, calculated at the time of concluding the Finance Agreement; the assumptions used in order to calculate that amount must be mentioned; 10. The amount of Installments payable by the Borrower and their number and duration, and the method of distributing them on the remaining amounts, in case of fixed Term Cost. Three examples of Installments amount in consideration to the preliminary Term Cost and two higher and lower costs in case of variable Term Cost. 11. Fees, commissions and costs of administrative services; 12. Periods of fees payments or money that needs to be repaid without the payment of the Amount of Finance and the conditions of the payment; 13. Implications of the delayed Installments payment; 14. Documentation fees, if necessary, 15. Necessary guaranty and insurance; 16. Account number for depositing Finance Installments and the name of the bank. 17. Right of withdrawal procedures, if available, and its conditions and the financial obligations of its practice; 18. The procedures of early repayment and indemnity procedures for the Finance Company, if applicable, and the method for determining such indemnity; 19. Procedures for dealing with collaterals in case of decreasing, if available, 20. Procedure to be followed in exercising the right of termination of the Finance Agreement; 21. The Borrower’s permission to insert his information in the credit record; 22. Any data or information stipulated by SAMA. Article 79

The Finance Agreement shall bear on its forefront a summary containing the basic information of the Finance product and the main provisions of the Finance Agreement in a clear language for the Borrower, in accordance with the model determined by SAMA and documenting the receipt of this summary by the Borrower in the Finance file.

Article 80

If permitted by Finance Agreement, the Finance Company must inform the Borrower in writing of any change in the Term Cost before the change enters into force in the duration of no less than two months, if the Finance Agreement allows such change. Company must also inform the Borrower, via the official addresses agreed upon on the Finance Agreement, of the amount of Installments to be paid under the new Term Cost and the details concerning the number of Installments or their duration if changed.

Article 81

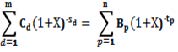

1. The Annual Percentage Rate is the discount rate at which the present value of all Installments and other payments that are due on the Borrower, representing the Total Amount Payable by the Borrower, equals the present value of the payments of the Amount of Finance available to the Borrower, calculated on the date on which the Amount of Finance or the date the first payment is available to the Borrower,. Calculated by the following equation:

m is the last payment of the Amount of Finance to be received by the Borrower. d is the payment to be received by the Borrower from the Amount of Finance. Cd is the payment value of (d) to be received by the Borrower from the Amount of Finance. Sd the period between the date on which the Amount of Finance or the first payment is available to the Borrower and the date of payment (d), calculated in years and parts of the year, and so that this period of first payment received by the Borrower from the Amount of Finance is zero (s1=0) n is the last payment payable by the Borrower. p is the payment payable by the Borrower. Bp is the payment value (p) payable by the Borrower. Tp the period between the date on which the Amount of Finance or the first payment is available to the Borrower and the date of the payment (p) to be received from the Borrower, calculated in years and parts of the year. X is the Annual Percentage Rate.

2. For the purpose of calculating the Annual Percentage Rate, the periods between the date on which the Amount of Finance or the first payment is available to the Borrower and the date of every payment received or payable by the borrower shall be calculated on the basis of (12) months or (365) days a year. 3. For the purpose of calculating the Annual Percentage Rate, the Total Amount Payable by the Borrower must be specified including fees, commissions and costs that cannot be avoid by the Borrower, with the elimination of costs or fees payable by the Borrower due to his breach to any of his obligations contained in the Finance Agreement. 4. It is a must to calculate the Annual Percentage Rate, assuming validity of Finance Agreement for the agreed period of time and both parties commitment to their obligations according to the conditions contained in the Finance Agreement. 5. In accordance with Paragraph 10 of Article 78 of this Regulation, in the case of Finance Agreement containing clauses allowing variations in the Term Cost and fees contained in the Annual Percentage Rate which cannot be calculated, the Annual Percentage Rate must be calculated on the assumption that the Term Cost and other charges remain fixed in relation to the initial Term Cost and remain applicable until the end of the Finance Agreement. 6. The Annual Percentage Rate must be calculated and expressed in percentage points as a decimal fraction, with the fractional portion rounded to two digits and the basic half point or more rounded to full point. Article 82

The Finance Company must use the declining balance method in distributing the Term Cost on the maturity period, whereas the Term Cost is distributed proportionally between Installments on the basis of the balance value of the remaining Amount of Finance at the beginning of the Installment maturity period, and including it in the Finance Agreement.

Article 83

All fees, commissions and administrative services charges to be recovered from the Borrower by the Finance Company shall not exceed the equivalent of (1%) of the Amount of Finance or (5,000) Five thousand Saudi riyals whichever is less,

Article 84

1. The Borrower may accelerate the payment of the rest of the Amount of Finance, at any time, and he may not pay the Term Cost of the remaining period. The Finance Company may be compensated for the following: a. The cost of re-investment, but not exceeding the Term Cost for the following three months of payments, calculated on the basis of the declining balance; and b. Payments from the Finance Company to a third party due to the Finance Agreement of expenses stipulated therein, if they are irrecoverable expenses, for the remaining term of the Finance Agreement. 2. An exception to the provisions of Paragraph 1 of this Article, the real estate Finance Agreement may stipulate a period of time which early payment is prohibited, provided that it does not exceed two years from the date of concluding the real estate Finance Agreement. Article 85

1. In the event of the Finance Company assigns its rights to a third party or the Finance Agreement itself, to a third party or issuance of securities against the rights arising out of the Finance Agreement, the Borrower is entitled to use against the assignee any defense available to him against the original Finance Company. 2. The Finance Company shall receive a non-objecting letter from SAMA, before assigning the services related to the Finance to another party. Article 86

1. The Finance Company shall indicate in all product advertisements: its name, logo, any identifying representation and contact details. 2. The advertisement shall disclose, in a manner that is clear to the Consumer, the name and Annual Percentage Rate of the advertised product and shall not include other rates of the Term Cost. 3. The Finance Company may not do any of the following: a. Provide an advertisement that includes a false offer, statement, or a false claim expressed in terms that would directly or indirectly deceive or mislead the Consumer. b. Provide an advertisement that includes the unlawful use of a logo, a distinctive mark, or a counterfeit mark. 4. SAMA may oblige any Finance Company that does not abide by the provisions of this Article to withdraw the advertisement within one working day of SAMA’s notice. Article 87

The Finance Company shall establish a function and designate staff to address complaints, and put in place clear procedures for receiving, documenting, studying, and responding to Borrowers’ complaints within a period not exceeding (10) business days from the date of receiving the complaint. All necessary details of Borrowers’ complaints and actions taken thereon shall be entered in a complaints registry.

Article 88

1. The Finance Company and its employees shall maintain the confidentiality Of clients’ data and transactions, and may not disclose or expose them to other parties, except in accordance with the related laws and instructions. 2. The Finance Company employees are prohibited from disclosing any information about the Company’s clients and transactions obtained through their work, even after leaving the Finance Company. It is also prohibited to hold any of this information after resigning. 3. The Finance Company shall take all necessary measures to ensure confidentiality of the clients’ information and transactions. Part Nineteen: Finance Support Activities

Article 89

No one other than licensed Finance Companies shall carry out a Finance support activity or more, such as marketing Finance products or collecting the debts of the Finance Company, except after obtaining a license in accordance with the rules issued by SAMA in this regard.

Article 90

The Finance Company shall not contract or otherwise deal with providers of Finance support activities without receiving SAMA’s non-objection letter.

This article has been amended in accordance with His Excellency the Governor's Decision No. 85/M SH T dated 26/5/1441H.

Part Twenty: Control, Investigation and Prosecution Procedures

Article 91

1. The provisions of this part shall apply to violations and cases of public rights arising out of implementation of the Law and the Regulation. 2. Criminal Procedures, the Bureau of Investigation and Public Prosecution and the general rules applicable in the Kingdom of Saudi Arabia. Article 92

SAMA’s employee that is in charge of control, investigation and prosecution procedures shall:

1. Be a Saudi national; 2. Be of a good conduct; 3. Have not been sentenced of a breach of trust offence or a crime involving moral turpitude, unless rehabilitated. 4. Hold a bachelor degree; 5. Have passed the professional examination approved by SAMA . Article 93

1. Control, investigation and prosecution personnel shall receive notices, collect information, and control necessary evidences for investigation and point accusation. 2. Control, investigation and prosecution personnel may seek assistance from criminal investigation employee if necessary. 3. Control, investigation and prosecution personnel may benefit from specialists either as individuals or companies when conducting their survey, examination, seizing materials connected with violations. The duty of such individuals and companies shall be confined to showing places and materials that requires search and capturing during investigation 4. The Governor shall issue the rules, procedures and permissions for the work of the staff of control, investigation and prosecution. Article 94

The control, investigation and prosecution staff, law enforcement personnel, experts and specialists assisting them shall not disclose the confidential information, which they come across in the course of their work even after quitting the service.

Article 95

Criminal lawsuit shall be referred to the Committee for Settlement of Finance Violations and Disputes by the Governor or his deputy.

Article 96

SAMA shall refer crimes and violations that are not within its jurisdiction to the body concerned with investigation and prosecution.

Article 97

SAMA may exempt Finance Companies from some of the provisions in this Regulation without prejudice to the provisions of the Law and as required by the conditions of the sector.

This Article has been added pursuant to His Excellency the Governor's Decision No. 66/M SH T, dated 09/07/1439H.

Article 98

Article 99

Companies and establishments engaging in finance activities in the Kingdom of Saudi Arabia prior to the Law’s entry into force must provide SAMA, within the first nine months of the period prescribed in Article (36) of the Law, with their plan to correct their situation according to the Law or a plan to exit the market.

Article 100

A committee, or more, will be formed by a decision of the Governor to be responsible for presenting the proposals and recommendations necessary to develop the finance sector.

Article 101

The necessary rules and instructions for the implementation of regulatory and supervisory requirements of the finance sector shall be issued by a decision of the Governor.

Article 102

This Regulation comes into effect as of the date of its publication on the official gazette.