General Guidelines for the Working of the Banking Committees

SAMA has updated the General Guidelines for the Working of the Banks Committees with a view of enhancing the efficiency and effectiveness of all Committees. The update has incorporated the main recommendations of the Banks’ Chairmans Committee Report dated 11 April 2012 on work done by the Banks’ Special Committee. SAMA had circulated to all banks the revised draft of General Guidelines in May 2014 and received the banks’ comments thereon. These comments have now been taken into consideration in revising the Guidelines.

SAMA would like the Chairman of the Managing Directors Committee to forward these guidelines to the Chairmen of all banking committees for their further distribution and use by the members of the various committees, and ensure the implementation of these guidelines by 31 March 2015.

1. Background

In the 1980’s, the Saudi Banking market was facing rapid changes and many challenges that required banks to share their experiences. For this purpose, SAMA encouraged Saudi banks to establish Bank Committees for providing a mechanism whereby the banks could assemble, deliberate and discuss common issues and concerns. The first Managing Directors Committee met in 1987 and other Committees followed. At these committee meetings, representatives of the banks could share their experiences, provide their bank’s point of view for resolving common problems, as well as providing inputs to SAMA for framing supervision policy. Accordingly, over the years, the Banks have decided to establish a number of such Committees. Each Committee is headed by a Chairman, who in turn is aided by a Vice Chairman and a Secretary, and at times is supported by Sub-committees and where needed by outside Consultants.

2. Mandate

The mandate of a Committee should be based on the specific purposes of the Committee. Also, the mandate should be reviewed annually and updated if needed.

3. Purpose of the Committee

▪ Issues discussed must focus on areas of common interest for growth of the banking system and for enhancing controls, efficiency and supervision. ▪ Committee members are expected to identify, analyze, discuss issues and come up with recommendations pertaining to their respective functions i.e. Treasury, Credit, Operations, Fraud, etc. ▪ Discussions must be conducted in an organized and structured manner to ensure all viewpoints are aired and objectives of the Committee are achieved.

4. SAMA’s Role and Responsibility (Agreed by SAMA)

▪ SAMA nominates senior officers as observers to attend Committee meetings. ▪ SAMA responds to issues raised and proposals put forward by banks at its own discretion within a reasonable span of time. These proposals normally reflect the position of all Committee members and have the support of the bank's CEO. ▪ SAMA representatives ensure that banks are appraised of SAMA policies, directives and viewpoints on various initiatives being undertaken. Where possible SAMA representatives put forward the constraints and concerns of SAMA and other Government bodies. Their effort is aimed at enabling the Committees to work in a proactive and efficient manner. ▪ All meetings are conducted with full knowledge of SAMA and the minutes of Committee meetings, are taken by the Secretary of a Committee and shared with SAMA representatives at the draft stage. After clearance and vetting by a SAMA representative (who may suggest changes taking into account SAMA confidentiality and sensitivity concerns), the minutes are distributed to all members. ▪ The SAMA representative should prepare for the meeting collecting information from all relevant departments in SAMA to respond to requests from the Committee and also share relevant new circulars issued by SAMA with the Committee. ▪ The SAMA representative should be the point of contact between SAMA and a bank Committee.

5. Bank’s Role and Responsibility

a- Each bank should select and nominate its representatives with proper background related to a Committee’s mandate. These individuals are responsible for the following:

▪ To bring to the attention of the Committee relevant issues and concerns of their banks which require support from, and/or views of, other banks. ▪ To bring to the attention of their bank’s relevant management, the deliberations at such meetings of various matters identified in the agenda and bring any responses thereto from their management to the Committee which may be of interest to the Committee as a whole. ▪ To participate in the work carried out by working groups and subcommittees. ▪ The members should be able to obtain the necessary resources to support commitments for projects and plans initiated by banking committees. ▪ Each member of the Committee must provide to the relevant senior managers of the banks, a report about the work of his/her Committee and his/her participation in its work.

b- A clear process for nominating back up (replacement) for bank’s representative.

6. Committee Structure, Composition and Membership

▪ Each Committee should be headed by a Chairman, and in his/her absence an acting Vice Chairman, and a Secretary. ▪ The Composition of the Committee shall draw upon the skills and expertise of its members to carry out its mandate and work. Professional competency and commitment are a pre-requisite for Committee membership. ▪ Formal documented procedures need to be discussed and agreed and minutes for nomination/ appointment of Chairman and Vice Chairman for each Committee must be maintained. ▪ The Banks should nominate their representatives from senior managers who have the relevant experience and expertise.

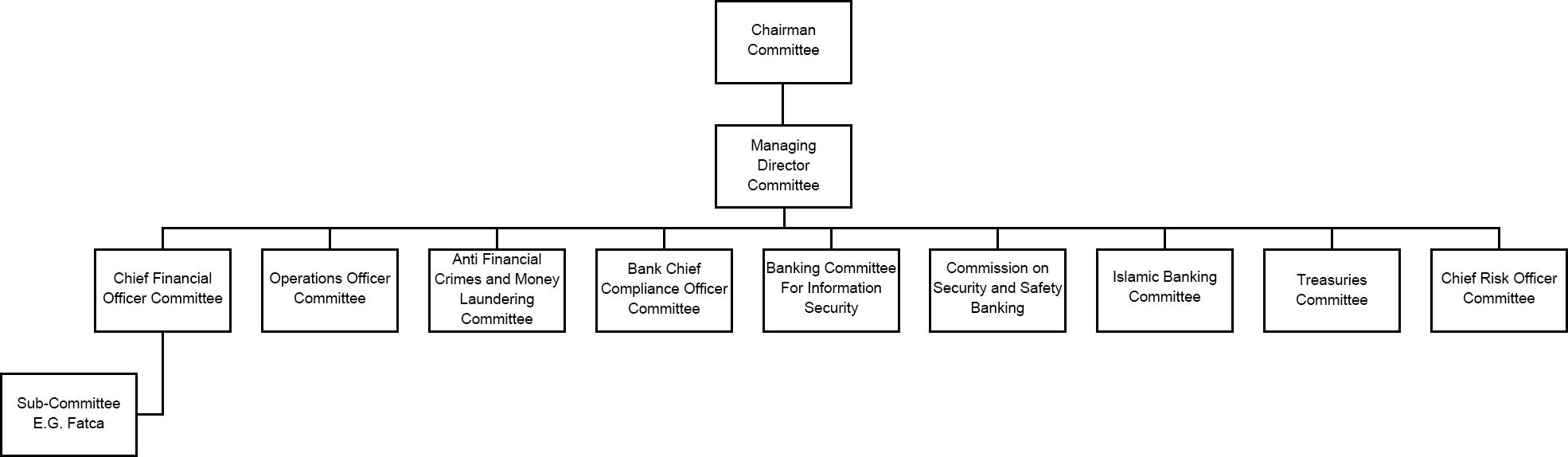

6.1 Reporting Lines

The reporting lines are, for example, as the following:

6.2 Governance Structure

▪ Each Sub-Committee is established by the Managing Directors’ Committee with consultation with SAMA. ▪ The Chairman of each (Sub-) Committee should report to the higher Committee. ▪ The Chairman of each (Sub-) Committee should update the higher Committee on its work including any important issues to be raised to SAMA.

7. Committee Officials

7.1 The Chairman

The chairman of a committee determines its effectiveness and success because he/she normally sets its tone, agenda and style. His/her responsibilities include but are not restricted to the following.

1. Overall planning of meetings including timings, venues, agenda items, etc. 2. Ensure that the minutes of the meetings should be reviewed by SAMA representative before distribution. 3. Liaising with SAMA officials, for the follow-ups on outstanding agenda items and for improving the functioning of the Committee. 4. Maintaining an independent, professional and effective style and attitude in the forum and among the members of the Committee. 5. Determining strategies and priorities of the Committee and in implementing new proposals amongst the banks. 6. Soliciting and developing new initiatives in order to activate and improve the mandate of the Committee. 7. Developing and improving the terms of reference document of the Committee for making this Committee more effective, efficient and independent at the end of each year. 8. Determining at Committee level if external consultants are necessary in providing input to a proposal. Final approval for such appointments are to be provided by SAMA.

7.2 Vice Chairman

The Vice Chairman shall assist in any way the chairman requires for discharging his/ her role and responsibilities and as above. He/she will be there to officiate during the absence or early departure of the Chairman.

The Vice Chairman of the Committee is the Chairman for the following year , unless SAMA has a different view.

7.3 The Secretary

The secretary's main responsibility would be to take notes and maintain minutes of the meetings. The minutes must normally be prepared in a reasonable span of time and submitted to SAMA's key representatives for their approval. SAMA representative approves the minutes in normal circumstances within one week after the receipt and authorizes their final distribution.

7.4 Membership of the Committee

The size of a Committee will be restricted to a maximum of 2 members (one at least is permanent) from each bank. Those members should be identified and known to other members. However, in Chairmans’ and Managing Directors’ Committees, each bank will be represented by one member only.

7.5 Selection and Termination of Committee Officials

The selection of the Committee Officials takes place in the last meeting in the calendar year. It may be decided by each Committee, and could be based on annual rotation or through a vote. In case of a vote, the following rules are to be applied:

▪ Each bank has 1 vote. ▪ No proxy vote are accepted. ▪ No individual can have the same office for more than 3 years. There are some exceptions to this rule. ▪ All appointments are approved by MD's Committee. Should there be an unexpected departure of any of the officials of a Committee, before their regular tenor of 1 year, the relevant bank may nominate a replacement.

Any official can be terminated under any of the following circumstances.

▪ Unanimous decision by the Committee members and SAMA's approval. ▪ SAMA's sole discretion.

8. Role of Managing Directors' Committee

▪ At the beginning of each term, the Managing Directors’ Committee should review all the submitted term of reference documents for various subcommittee before submitting them to SAMA. These documents should outline their objectives, mandates, and priorities for the coming year. ▪ Managing Directors’ Committee should monitor and evaluate the functionality and performance of the sub-committee on a continuous basis. ▪ The self-assessment of the Committee's performance and recommended action shall be submitted to SAMA by the Chairman of the Committee at the end of each year. An annual evaluation of a Committee's overall performance is useful in determining the effectiveness of its activities.

9. Meetings, Quorum, Agenda and Attendance

▪ Committee meetings will take place at least once each quarter, with a minimum of four Committee meetings per year, or more frequently, if necessary, and as decided by the members of the Committee. ▪ The Chairman and the Secretary shall be responsible for preparing the Agenda of the meeting. ▪ The Committee's Secretary is responsible for distributing the agendas and the meetings schedule. ▪ In the absence of the Chairman, the Vice Chairman shall preside over the meeting on behalf of the Chairman. ▪ Names of the Committees member in attendance shall be noted in the meeting minutes. ▪ In case of replacement of the representative of a bank, the bank should inform the Chairman or the Committee Secretary about the change within adequate time before the meeting. ▪ Where the Chairman believes that a bank is not adequately represented, he can seek SAMA’s help in rectifying the situation after providing the reasons for his views. ▪ Members should adhere to the meeting attendance and ensure active participation in the meeting. ▪ The Managing Directors’ Committee Secretary should provide SAMA with a consolidated annual schedule of planned meetings of all Sub-Committees to ensure discipline in the frequency of all meetings.

l0. Proposals and Decision-Making by the Committees

Discussions and deliberations of the Committees often serve as inputs for SAMA’s supervision and regulation. These discussions are concerned with either existing rules, regulations and practices or for contributing towards new ones. Accordingly, the proposals before being presented to SAMA are thought through and documented by the committees. Formal proposals outlining the nature of the issue, existing and international practice, an analysis of the merits and demerits of the status quo and of the proposed changes are submitted to SAMA by the chairman of each Committee or raised to the MDC's Committee for forwarding to SAMA Senior Management.

It is expected that there is a consensus on the proposals being submitted and that there has been sufficient research and analysis carried out by the committee members.

Committee decisions and proposals are normally by consensus. However in the case of dissent, a majority vote applies. No voting by proxy is permitted. In case of equal vote, the Committee is authorized to seek guidance from the higher Committee.

The banks’ proposals are further studied by SAMA internally or SAMA may at its own discretion solicit external advice and help if necessary. SAMA after study may reject any proposal.

11. Confidentiality

All deliberations, agenda items, decisions, notifications, etc. are strictly confidential unless decided otherwise. It is expected that all banks would strictly adhere to this requirement. While each bank can exercise its own professional judgment in deciding upon the nature and extent of confidentiality, agenda items should only be discussed at the Committee and sub-committee levels or within the scope of selected and responsible officers at their respective banks.

12. Committee Self-Assessment

Each year, the Committee shall conduct a self-assessment of its performance as well as taking note of the significant contributions of members.

There should be unified/ standardized templates, forms, KPIs, and procedures for all committees self-assessment process. KPIs should be linked to the objective of each committee.

Each Committee shall report to the Managing Directors’ Committee the evaluation of its Committee performance.

13. Sub-Committees

In order to ensure that issues and proposals are thoroughly deliberated upon, the Chairman after consultation with the members of a Committee, may at his discretion, appoint a Sub-Committee. These Sub-Committees would be headed by a Chairman who would be accountable in front of the main Committee’s Chairman for the terms of reference, reporting, agendas and timelines.

14. Role of Secretary General of the Chairman’s Committee

The Secretary General of the Chairman’s Committee may also act as an observer in other Banking Committees. His objectives is to streamline the effectiveness of all Banking Committees by the following:

▪ Eliminating any duplication of effort i.e. the Agenda items of each Banking Committee must be complementary. ▪ To bring major issues to the attention of Chairmen’s Committee.

A summary of the "Guidelines for Banking Committees” is attached for easy reference.

Annex 1 Summary of Guidelines for Banking Committees

1. Each bank is required to nominate a representative(s) to each of the committees. The representative(s) should be of an appropriate seniority within the bank and should have the appropriate knowledge and skills to contribute to the proceedings of the committee. He should also be in position to make commitments on behalf of the bank and contribute to the work and decisions of the Committee according to the bank’s reporting line. 2. Each bank must be presented at the committee meetings. The bank representative(s) is responsible for communication of the proceedings of the meetings to the relevant personnel within their bank including to the Managing Director, Chief Executive Officer or the General Manager. 3. Each Committee must elect a Chairman, Vice Chairman and Secretary (committee officials). The terms of the Chairman, Vice Chairman and Secretary will normally be for one year but could be extended by a unanimous decision of the Committee. 4. Each bank has an equal obligation to act as an official of the committee. The Chairman of each committee must maintain a record of the individuals and banks appointed as committee officials, and must ensure that all banks participate fully and meets their responsibility to act as committee officials. 5. All banks must be represented in all meetings. Attendance records must be maintained. 6. SAMA will nominate staff to attend meetings as observers only. 7. In circumstances where the Chairman cannot attend the meeting the Vice Chairman will act as Chairman. 8. In circumstances where any Committee member resigns during his term, the bank must choose a replacement to serve until the end of the term. 9. Minutes must be taken at each meeting of a Committee. The minutes of each Committee meeting must be submitted to a SAMA representative in a draft form for reviewing before circulation to the full membership of the Committee. 10. Committee meetings should normally be held at the Institute of Banking, or at SAMA Head Office. Sub-committee meetings may be held at other locations or in Banks after receiving SAMA consent. 11. From time to time, sub-committees may be formed. The Chairman of the main Committee after consultation with membership may at his discretion delegate the Chair of the sub-committee to another member of the committee. The sub-committee is fully accountable to the main committee. Proposals to SAMA must be voted upon and made via the main committee. 12. Committee decisions and proposals will normally be governed by consensus. In the case of dissent, a majority vote will apply. Banks are not permitted to vote by proxy. In case of equal vote, the committee is authorized to seek guidance from the higher Committee. 13. Each Committee should prepare its terms of reference. The terms of reference should detail the scope and objectives of the Committee and identify the types of issues which the Committee intends to consider. At the beginning of each term, the Managing Directors’ Committee should review all the submitted term of reference documents for the sub-committee before submitting them to SAMA outlining their objectives, mandates, and priorities for the coming year. 14. Issues to be discussed in a Committee meeting could originate from the banks, SAMA and other stakeholders. Banks representatives may agree by consensus to raise issues as proposals to SAMA. 15. Proposals made by the committees to SAMA must be fully documented and must outline the issues, contain a detailed analysis of the merits and demerits including supporting documentation such as international best practice, and the recommendations made by the committee. Proposals requiring major changes in policies or commitment of significant resources must be channeled through the Managing Directors’ Committee to ensure their approval.

Annex 2 Basic Information on a Banking Committee

Committee Name No. Items Description 1 Mandate 2 Purpose 3 KPIs for the Year 4 SAMA Representative (only name and department) 5 Bank Representatives (name, position, and bank) 6 Chairman (Name + Bank) 7 Vice Chairman (Name + Bank) 8 Committee Secretary (Name + Bank) 9 Meeting Frequency 10 Meeting Location 11 Reporting to 12 Sub-Committee, if any. [Must be updated every year by the Chairman of a Committee.]