5. Workout Plan

5.1 Preparing for the Workout Process

As the first step after receiving a new NPL, the workout team should ensure collection of all relevant and necessary information on the borrower’s loan and financial details to enable the selection of an appropriate workout plan. The Corporate/MSME team should ensure that the file is transferred with all necessary documentation and a case update summary is attached. In the best-case scenario, the bank should aim at achieving a consensual solution that satisfies the interests of both parties and results in a successful restructuring. Adopting such perspective implies not only a self-assessment of the bank’s options and legal position but also an analysis of the existing options and situation for the borrower. A comprehensive approach requires a thorough preparation process on both sides, which, if done properly, will maximize the chances of achieving a successful and mutually beneficial solution. All workout exercises should adhere to principles of restructuring outlined in Appendix 3 of this document and abide by Section 5 of the “Rules on the Management of Problem Loans”.

On the bank’s side, a thorough preparation includes:

i. Gathering all relevant information available on the borrower;

ii. Perform a thorough review of the borrower’s historical financials, business viability, business plan and forecast loan service capacity.

iii. Accurately assessing the value of the collateral securing the loan; and

iv. Conducting a detailed analysis of the bank’s legal position.

These aspects are further explained in the sections below.

5.1.1 Gathering of Information About the Borrower

All borrowers and guarantors should be informed promptly (within 5 business days) that responsibility for their relationship has been transferred to the Workout Unit. This notification should be in writing and contain a complete and accurate description of all legal obligations outstanding with the bank, the amounts and dates of all past due amounts together with any fees or penalties which have been assessed. The Workout Unit should intimate the borrower with any violations and loan covenants or agreements observed at the time of information collection.

The borrower should be requested to submit the following information, preferably in electronic format:

i. Information on all loans and other obligations (including guarantees) outstanding.

ii. Detailed contact information (mail, telephone, e-mail), including representatives, if applicable.

iii. Detailed latest financial statements of the company (balance sheet, income statement, cash flow statement, explanatory notes). MSME’s and financially less-sophisticated enterprises may submit only aggregate financial figures.

iv. Updated business plan and the proposal for repayment/restructuring of loan obligations.

v. Individual entrepreneurs (for example sole proprietors), should also submit information about the household. The two additional parameters for determining the loan servicing ability of such borrowers are: (i) the borrower’s family composition (number of children, number of earners in the family) to determine justified expenses; and (ii) total net earnings.

Updated financial information, together with a detailed listing of all guarantees outstanding, if any, should be also collected from the guarantors (natural or legal persons) of loans. In addition, the bank should exercise all legal efforts to acquire additional information from other sources to form an accurate, adequate, and complete view of the borrower’s loan servicing capability.

During the file review, the Workout Unit should pay close attention to identifying any other significant creditors. These may include other banks and financial institutions, Zakat/Tax authority, utilities, trade creditors and loans to shareholders, related parties, or employees.

For any missing key information identified during the file review, the Workout Unit should develop a corrective action plan to ensure collection of these documents with the help of the business team. Some of this information should be requested promptly from the borrower or third party sources such as Credit Bureaus.

5.1.2 Identifying Non-cooperative Borrowers:

The Workout Unit should define non-cooperative borrowers and carefully document their non-compliance. Useful criteria to be used to identify these borrowers are:

i. Borrowers who default on their loans while having the ability to pay (“strategic defaulters") in hopes of receiving unwarranted concessions from the bank.

ii. Failure to respond either orally or in writing to two consecutive requests from the bank for a meeting or financial information within 15 calendar days of each request.

iii. Borrowers who deny access to their premises and/or books and records.

iv. Borrowers who do not engage constructively with the bank, including those that are generally unresponsive, consistently fail to keep promises, and/or reject restructuring proposals out of hand.

Non-cooperative borrowers are more likely to be transferred to the legal team as it would be difficult to reach a consensual restructuring solution if the Borrowers are not willing to cooperate with the Banks.

However, banks would have to maintain an appropriate audit trail, documenting the rationale for classifying a borrower as “non-cooperative"

5.1.3 Determining the Bank’s Legal Rights and Remedies

The banks having reviewed and understood the borrower’s business plan, but before initiating restructuring negotiations with a borrower, must prepare for these negotiations and have a very clear understanding of its bargaining position from a legal standpoint.

The Workout Unit should perform a thorough review of all documents relating to the borrower, with special emphasis on the loan agreement and the security package that was formalized when the transaction took place. An accurate assessment of the bank's rights will have a critical impact on determining the resolution strategy to be adopted.

The following are general indicators that a Workout Unit could pay attention to when reviewing the documentation:

i. Whether the parties to the loan were adequately described in the loan documentation;

ii. Whether all key documents were signed by the duly authorized persons under Saudi governing law;

iii. Whether the bank is in possession of all original documents;

iv. Whether the collateral has been duly perfected, including registration at the applicable registry

v. Whether the loan documentation included non-compliance with certain financial indicators as ‘events of default’, and whether these indicators have been breached;

vi. Historical financial position, driver of historical underperformance and to what extent this is expected to drive forecast performance:

a) Current market challenges and outlook: The Banks should form a view on how this has impacted the borrower’s historically and how is it expected to impact its forecast performance and ability to repay the loan;

b) The capabilities of the borrower’s Management team and whether they are capable of turning around the business;

c) Strategy and turnaround initiatives: Does the borrower have a clear strategy or plan to turnaround the business? Has this plan been clearly documented and communicated to banks?

d) Business plan and financial projections: How is the borrower expected to perform of the medium to long-term? What are the borrower's cash flow projections, which should provide an indication of his loan service capacity going forward? What is the level of sustainable versus unsustainable loan;

e) Alignment with credit terms: To what extent are all of the above aligned with existing credit terms and repayment plan;

vii. Whether the loan documentation included a cross-default clause and whether there are other loans that may be considered breached and/or accelerated as a result of the breach of one single loan;

viii. Whether there was an obligation on the bank to notify the borrower or potential guarantors of major changes in the documentation or the terms of the loan, like changes in legislation, currency, interest rates, etc.

If the borrower is not fully equipped to provide such information or if the banks would like to independently review such information, they can seek to appoint a financial advisor to perform an independent business review and clarify the above.

Once the Banks have formed a good understanding of the above, it is expected to assist them in identifying sustainable and commercial restructuring options that could align the banks' interest with that of the borrower and maximize recovery. Such options should be continuously evaluated as the WU engage in restructuring discussions and gather further information.

5.1.4 Ensuring Collateral’s Validity

The workout team should ensure that the collateral taken at the time of loan agreement/origination was formalized and is still valid and enforceable. The banks should complete timely validation of legal documents to evade probable disputes or delay at the time of negotiating restructuring proposal. Furthermore, the banks should establish procedures around periodic (e.g. yearly basis) valuation and monitoring of acquired collateral

The Bank is required to perform detailed collateral analysis for all the accounts referred to WU. The workout team should perform this analysis as detailed out in section 7 of the “Rules on Management of Problem Loans"

5.1.5 Financial Viability Analysis

Banks need to conduct a thorough financial and business viability analysis of its borrowers especially MSME NPL borrowers to determine their ability to repay their obligations. In addition, it is important to obtain sufficient insight into the business plan and projected cash flows available with the borrower for loan service. This will entail determining the borrower’s forecasted loan service capacity and assessment needs to be performed by the banks to align this with the restructured credit terms.

This analysis serves as the foundation for making an informed decision on the appropriate resolution approach – restructuring, sale to a third party, change of loan type (loan-to-asset or loan-to-equity swap) or legal proceedings. This analysis is required to be conducted by WU not previously involved in the loan approval process.

A. Analysis of key financial ratios

Financial ratios, calculated from data provided in the balance sheet and income statement, provide an insight into a firm’s operations and are among the most readily available and easy to use indicators for determining the borrower’s viability. In case of MSME borrowers, in the absence of availability of audited and reliable financial information banks should focus on cash-flow based analysis and should also assess the reasonableness of financial information (where this information is available).

Below are four categories of financial ratios that banks may consider for their initial financial analysis (being illustrated below for indicative purposes and should not be considered prescriptive):

i. Liquidity ratios measure how easily a company can meet its short-term obligations within a short timeframe.

a. Current ratio (total current assets/total current liabilities) measures a company’s ability to pay current liabilities by using current assets. It must be recognized that the distressed borrower’s ratios will be considerably lower. The Workout Unit should assess how the borrower can achieve a more normal ratio within a reasonable time frame.

b. Quick ratio, which includes only liquid assets (cash, readily marketable securities and accounts receivable) in the numerator, is a measure of the firm’s ability to meet its obligations without relying on inventory.

ii. Solvency or leverage ratios measure the company’s reliance on loan rather than equity to finance its operations as well as its ability to meet all its obligations and liabilities.

iii. Profitability ratios measure the company’s growth and ability to generate profits or produce sufficient cash flow to survive, rate of sales growth, gross profit margin, and net profit margin are some of the key ratios to be considered.

iv. Efficiency ratios measure management’s ability to effectively employ the company’s resources and assets. These include receivable turnover, inventory turnover, payable turnover and return on equity.

Detailed financial analysis of the borrower needs is to be performed in order to ensure completeness and avoid ignoring important underlying trends. Banks should undertake detailed analysis to understand the interrelation of these financial ratios, which can enable identification of borrower’s real problems as well as probable corrective actions to restore the company’s financial health.

The workout team should exercise prudence in his analysis and utilize reasonable caps and floors for certain ratios, as these ratios vary across borrower segments and sectors as well as economic conditions.

B. Balance sheet analysis

In addition to computing and analyzing the key ratios, the workout team should carefully review the balance sheet to develop a basic understanding of the composition of the borrower’s assets and liabilities. Primary emphasis should be placed on developing a complete understanding of all obligations outstanding to the bank and other creditors, including the purpose of the credits, their repayment terms, and current status, to determine the total debt burden of the borrower and the amount of loan that needs to be restructured.

The composition of liabilities, particularly “other liabilities" and accrued expense items should be addressed. Wages payable and taxes are two particularly problematic accounts. Both represent priority claims against the borrower's assets and must be settled if a successful restructuring or bankruptcy is to take place.

C. Cash flow analysis - defining financial viability

When financial statements are prepared on an accrual basis, cash flow analysis ties together the income statement and the balance sheet to provide a more complete picture of how cash (both sources and uses) flows through the company. Cash is the ultimate source of loan repayment.

The less cash is generated by operations, the less likely the borrower will be able to repay the loan, making it more likely that the bank will need to rely on its collateral (asset liquidation or bankruptcy) for repayment. Thus, the primary emphasis when conducting the financial analysis of the borrower should be on its forecasted cash generation capabilities. The proper analysis of cash flow involves the use of both the balance sheet and the income statement for two consecutive fiscal years to identify the sources and uses of cash within the company. Changes in working capital and fixed asset expenditures are quantified and cash needs are highlighted, providing a clear view of the many competing uses of cash within the company.

With respect to MSME borrowers, in case reliable and timely financial information is not available, cash flow based assessment is recommended. Banks should incorporate a robust and efficient internal process of cash flow estimation for these borrowers.

D. Business Plan

A comprehensive financial analysis of the non-performing borrower includes an assessment of the company’s business plan containing a detailed description of how the owners and management are going to correct existing problems. While no one can forecast the future with certainty, a candid discussion between the borrower and the bank on new business plan and financial projections is an essential part of the viability assessment exercise. It provides both the bank and the borrower an opportunity to explore how the company will operate under different scenarios and allows management to have a contingency (or corrective action) plans in place should actual results deviate significantly from the projections. The focus of the Workout Unit will be on validating the assumptions (whether realistically conservative and in line with past performance) and performing a sensitivity analysis to see how results will vary under changed assumptions. Again, the emphasis should be placed on tracing the flow of cash through the business to determine the company’s ability to pay.

E. Cash budget

Cash budget is a powerful tool, which helps the borrower to limit expenditures and preserve cash to meet upcoming obligations such as taxes. It can also compensate for the poor quality of formal financial statements in the case of micro and small enterprises.

In a workout, the ability to generate and preserve cash is the key to the company’s survival. All borrowers should be encouraged to prepare a short-term cash budget. The cash budget is similar to the cash flow analysis and differs, however, in two important respects: (i) it is forward-looking; and (ii) it breaks down the annual sources and uses by month to reveal the pattern of cash usage within the company. It also clearly identifies additional financing needs as well as the timing and amount of cash available for loan service. For smaller borrowers, a simple listing of monthly cash receipts and cash disbursements will suffice. Actual results need to be monitored monthly and corrective actions are taken immediately to ensure that the company remains on plan.

5.1.6 Business Viability Analysis

Unlike financial analysis, which is highly quantitative, the business analysis is more qualitative in nature. Its purpose is to assess the borrower's ability to survive over the longer term. It focuses not on the borrower's financial performance, but rather on the quality of its management, the nature of the products & services, facilities and the external environment in which the borrower operates (including competition).

The primary cause of a business failure that has been acknowledged is the management of the business. The most common reasons include: (i) lack of necessary management skills required to run an organization; (ii) inability or unwillingness to delegate responsibilities; (iii) lack of experienced and qualified managers in key positions; (iv) lack of skills to run the business; and (v) inadequate management systems and controls.

Product assessment focuses on the nature of the product and its longevity potential. The main considerations include services or products, product mix diversified or reliant on a single product, technical obsolescence, and demand of the product/service.

The primary focus of the assessment of the facilities (physical plant, manufacturing units, etc.) is not on their valuation but rather on their capacity and efficiency. The attempt should be made to evaluate any requirements of significant upgrades or new facility to meet demand for the product presently and in the foreseeable future. The costs for the same should then be assessed and included in the base projections.

External factors include the assessment of the general macro environment as well as overall industry and market conditions. It focuses on assessing the potential impact on the borrower of changes in the economic as well as regulatory climate; analyzing the strength of the borrower's position within the industry (market share) and its competitors; and gaining a better understanding of the borrower's market and how changes within the market might affect the company's performance.

A. Use of outside expertise to prepare business viability assessment

For large commercial or real estate loans, the business viability portion of the analysis may be performed or validated by an independent third party such as a consultant or a restructuring advisor.

i. Micro and Small Enterprises

In the case of micro and small companies and subject to the cooperation of the owner or the management, which is trustworthy and provides reliable financial and other information, the use of external consultants may not be efficient in terms of time and costs. Banks are, therefore, encouraged to build internal capacity (or engage with external service providers as necessary) to assess the business viability of this segment and enable reasonable decision making in this regard.

ii. Medium-sized companies:

Medium-sized companies should be analyzed in more detail and it may be reasonable to use a similar approach as in the case of large companies. This may require a guided and aligned coordination between the banks and the inclusion of an external consultant to prepare an independent overview of operations, particularly in the following cases.

The process can be followed in case where at least one of the following conditions are met:

i. There is doubt about the reliability of financial and other information;

ii. There is doubt about the fairness and competence of the management;

iii. Activity involved of which the bank does not have sufficient internal knowhow;

iv. There is a great probability that the company will need additional financial assets.

All banks should have clear procedures regarding the level of approval authority required and the process to be followed when contracting for an independent review. The procedure guidelines at a minimum should include qualifications of the advisor, selection criteria, evaluation process and approval for these appointments. Whenever possible, Workout team should request proposals from several firms. In addition, these procedures should require that the deliverables (together with their due dates) and the pricing structure, should be clearly laid out. To expedite and further standardize the onboarding process, banks may choose to establish a list of pre-approved vendors.

B. Documenting the results of the financial and business viability analysis

The findings of the financial and business viability analysis should be documented in writing and communicated to the credit committee for review. The documentation should have sufficient detail to provide a comprehensive picture of the borrower's present financial condition and its ability to generate sustainable cash flows in the future. Banks will have its own standard format for documenting the analysis but should ensure that it incorporates, at a minimum, the below information:

i. Minutes of the meeting with the borrower with a clear identification of the reasons for the problems and the assessment of the ability to introduce radical changes into the operations;

ii. Exposure of the banks and all other creditors (related persons, in particular);

iii. The analysis of the balance sheet structure - the structure of maturity of receivables and operating liabilities, identification of assets suitable for sale and assessment of the value of this property;

iv. The analysis of the trends of the key indicators of individual categories of financial statements: EBITDA margin, net financial /EBITDA, total debt/equity, interest coverage, debt service coverage ratio (DSCR), net sales revenue/operating receivables, accounts payable/total debt, quick liquidity ratio, cash flow from operations, costs of services etc. (these ratios are indicative, banks in practice are free to utilize such ratios, which they deem appropriate).

v. 3- to 5-year projection (time period is dependent based on the tenor of the loan) of cash flows based on conservative assumptions - the plan of operations must not be a wish list but rather a critical view of the possibilities of the company's development in its branch of industry;

vi. Analysis of the necessary resources for the financing of working capital and investments (Capex);

vii. Review of all indemnities (in the case of personal guarantees also an overview and an assessment of the guarantor's property);

viii. Overview of the quality and assessment of the value of collaterals and the calculations of different scenarios (implementation of restructuring or the exit strategy).

The results of the financial analysis should be updated at least annually or more frequently in conjunction with the receipt of the borrower's financial statements. The business assessment should be updated at least every three years or whenever major changes occur in either borrower's management or the external operating environment.

Based on the financial analysis, the business plan and the understanding of the borrower’s loan service capacity, the banks should consider various restructuring solutions that can offer a sustainable restructuring and align the credit terms with the cash flow forecasts of the business. These solutions could include, but are not limited to:

i. Grace periods.

ii. Reduced interest rates or in some cases payment in kind (PIK) (PIK is the option to pay interest on debt instruments and preferred securities in kind, instead of in case.PIK interest has been designed for borrowers who wish to avoid making cash outlays during the growth phase of their business. PIK is the financial instrument that pays interest or dividends to investors of bonds, notes, or preferred stock with additional securities or equity instead of cash) interest.

iii. Assessing sustainable versus unsustainable debt.

iv. Agreeing repayment profiles around sustainable debt in line with forecast sensitized cash flows of the borrower.

v. Agreeing an asset sale plan.

vi. Agreeing a debt to equity conversion.

vii. Agreeing a debt to asset swap.

viii. Agreeing a cash sweep mechanism (it is the mandatory use of excess free cash flows to pay outstanding debt rather than distributing it to the shareholders) to benefit from any upsides to the borrower's business plan.

ix. Longer-term tenors when the business plan and financial analysis suggest that this is necessary for a more sustainable restructuring

5.2 Identifying the Workout Options

5.2.1 Purpose of Workout

Under a best-case workout scenario, the bank and the viable (or marginally viable) borrower will agree on the restructuring strategy aiming to return the defaulted borrower to a fully performing status in the shortest feasible time frame. This requires matching the borrower's sustainable repayment capacity with the correct restructuring option(s). There is no one standard (“one size fits all") approach and instead, the Workout Unit must choose from a variety of options to tailor a restructuring plan that meets the needs of specific borrower.

For the bank to consider approving a restructuring plan, the borrower must meet two essential pre-conditions: (i) borrower's projected cash flows must be sufficient to repay all or a substantial portion of its past due to obligations within a reasonable time frame: and (ii) borrower must display cooperative behavior.

Not all borrowers will be able to repay their obligations in full. However, this does not mean they should automatically be subject to legal action. Banks are advised to invoke out of court settlements for borrowers willing to cooperate with the restructuring process and are able to demonstrate that the economic loss as a result of any foreseeable restructuring is likely to be lower than seeking foreclosure. Instead, the bank should proceed with restructuring whenever it can reasonably document that the revised terms (which may include conditional loan forgiveness) will result in a greater recovery value for the bank than a legal procedure (bankruptcy or foreclosure).

In a syndicated or multi-bank scenario, wherein minority banks don't agree to a restructured/ work out solution, dissenting banks may utilize the guidelines laid down in the Bankruptcy law.

5.2.2 Workout Options

At the initial segmentation stage, the loan-to-value and viability parameters are generally used to help identify potentially viable borrowers (Refer to Chapter 3). This group of borrowers is then subject to in-depth financial analysis and business viability assessment, which narrows the number of candidates for potential restructuring even further. At this stage, the Workout Unit should have a fully informed view as to the nature and causes of the borrower's difficulties. Based on this understanding, the Workout Unit should work with the borrower on developing a realistic repayment plan designed around the borrower's projected sustainable cash flows and/or the liquidation of assets within acceptable timeframes. Understanding and knowing when to use each of the options discussed below provides a Workout Unit with the flexibility necessary to tailor appropriate restructuring proposals.

Consider personal guarantees, conversion of loans from owner(s) to equity or other subordinated form, capital increase, additional collateral, sale of excess assets, achievement of certain levels of financial indicators.

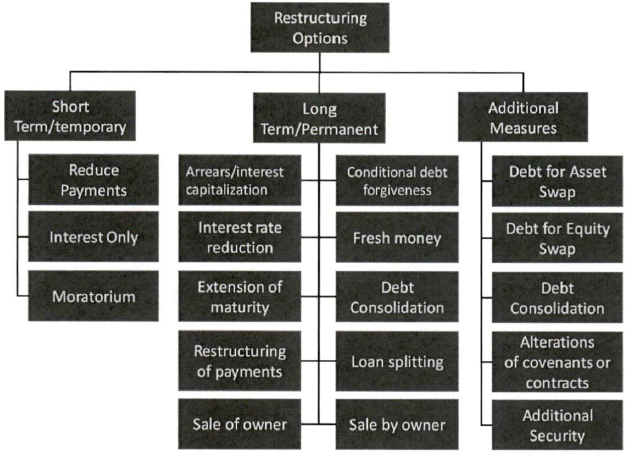

Borrower Type Workout Measure Description Viable Normal reprogramming Future cash flows sufficient for repayment of loan until a sustainable level of cash flow reached within the stipulated period (Actual timeline dependent on the profile of the borrower and tenor of the loan). Consider personal guarantees, conversion of loans from owner(s) to equity or other subordinated form, capital increase, additional collateral, sale of excess assets, achievement of certain levels of financial indicators. Marginal Extended repayment period Extended period of reprogramming (rescheduling) needed to reach a sustainable level of cash flow, i.e., with final payment in equal installments or balloon or bullet payment. Loan Splitting Loan is split into two parts: the first, representing the amount that can be repaid from sustainable cash flow) is repaid in equal installments (principal and interest) with a specified maturity date; the remaining portion is considered to be excess loan (which can be subordinated), which may be split into several parts/tranches. These may be non-interest bearing with interest payable either at maturity or from the proceeds of specific asset sales. Conditional Loan Forgiveness To be used to encourage owners to make an additional financial contribution to the company and to ensure that their interests are harmonized with those of the bank, particularly in those cases when the net present value of the company (taking into consideration all collateral and potential cash flow) is lower than the total loan. Bank may choose to: i. Partial write-off in the framework of the owner's cash equity contribution, particularly in all cases where the owner(s) have not guaranteed the loan; ii. Partial write-off in the framework of a cash capital increase from a third-party investor where they have not assumed the role of the guarantor; iii. Partial write-off in the case of a particularly successful business restructuring that materially deviates from the operating plan that served as the basis for the restructuring; iv. Partial write-off in those cases when the above-average engagement of the owner(s) (i.e. successful sale of excess assets) guarantees a higher level of repayment to the bank(s). Loans can also be written off if the collateral has no economic value, and such action ensures the continuation of the borrower's operations and the bank has confidence in the management or if the cause for the problems came from objective external factors. Loan to Equity Swaps Appropriate for medium-sized companies where the company can be sold, has established products/services, material know-how; or significant market share, etc. However, such measures should be in-line with the requirements stipulated by Banking Control Law (Issued by SAMA) under Article 10 subsection 2 and 4. Loan to Asset Swaps Can be an effective tool particularly in the case of stranded real estate projects provided that the real estate is in good condition and can be economically viable managed in the future. The transaction must not be legally disputable, considering the provisions of the bankruptcy and enforcement legislation. It may also be used for other real estate cases, equity stakes, and securities with determinable market value. Short Term restructuring Restructuring agreements with a one-year maturity may be appropriate in those cases such as micro and small borrowers, where the bank feels closer monitoring or increased pressure to perform is necessary. Loan Sale Sale of the loan is reasonable under the following conditions: • The bank does not have sufficient capacity to effectively manage the borrower; • The buyer has a positive reference; and • The buyer is a major specialist in the area of resolving non-performing loans. Non-Viable Borrowers Collateral Liquidation by owner MSME owners have strong attachments to their property. They may fail to carry out the sale within the agreed-upon time frame or have unrealistic expectations regarding the value of the property. It is recommended that the bank set short deadlines; obtain a notarized power of attorney allowing it to activate the sale procedures; and have sufficient human resources within the real estate market to expedite the sales process. Execution or Insolvency To be used when the borrower is not viable or non-cooperative, and no feasible restructuring solution can be put in place. The below figure presents the various options broken into three broad categories: (i) short term measures most appropriately used in early-stage arrears to stabilize the situation and give the borrower and the bank time to develop a longer-term strategy; (ii) longer-term/ permanent solutions, which will result in the reduction of the loan: and (iii) additional measures, which do not directly lead to repayment but strengthen the bank's collection efforts.

5.2.3 Short Term Restructuring Measures:

Short-term measures do not lead, in and of themselves, to the repayment of a borrower's obligations. Instead they are designed to provide: (i) temporary relief in response to a clearly identified short term disruption in a borrower's cash flow (e.g., event out of the borrower's control, like a sudden fall in demand due to external circumstances); or (ii) time for the creditor(s) to assess the situation and determine an appropriate course of action. They are most appropriate to use when there is a reasonable expectation that the borrower's sustainable cash flow will be strong enough to allow the resumption of its existing payment schedule at the end of the restructuring period. Evidence of such an event should be demonstrated in a formal manner (and not speculatively) via written documentation with defined evidence showing that the borrower's income will recover in the short-term or on the basis of the bank concluding that a long-term restructuring solution was not possible due to a temporary financial uncertainty of a general or borrower-specific nature. As these options envision that the borrower will be able to bring defaulted amounts of interest and/or principal current at the end of the restructuring period, they should not exceed a tenor of 24 months (12 months in the case of real estate or construction projects) and must be used in combination with longer-term solutions such as an extension of maturity, revision in terms and additional security.

Specific short-term measures to consider include:

i. Reduced payments - the company’s cash flow is sufficient to service interest and make partial principal repayments.

ii. Interest-only - the company's cash flow can only service its interest payments, and no principal repayments are made during a determined period of time.

iii. Moratorium - an agreement allowing the borrower to suspend payments of principal and/or interest for a clearly defined period. This technique is most commonly used at the beginning stages of a workout process (especially with multi-bank borrowers) to allow the bank and other creditors time to assess the viability of the business and develop a plan for moving forward. Another appropriate use is in response to natural disaster, which has temporarily interrupted the company's cash flow.

The contractual terms for any restructuring solution should ensure that the bank has the right to review the agreed restructuring measures if the situation of the borrower improves and more favorable conditions for the bank (ranging from the restructuring to the original contractual conditions) could, therefore, be enforced. The bank should also consider including strict consequences in the contractual terms for borrowers who fail to comply with the restructuring agreement (e.g. additional security).

5.2.4 Long Term/Permanent Restructuring

Longer-term/permanent options are designed to permanently reduce the borrower’s loan. Most borrowers will require a combination of options to ensure repayment. In all cases, the bank must be able to demonstrate (based on reasonable documented financial information) that the borrower's projected cash flow will be sufficient to meet the restructured payment terms.

Specific options that may be considered include:

i. Interest and Arrears capitalization - adds past due payments and/or accrued interest arrears to the outstanding principal balance for repayment under a sustainable revised repayment program. Workout Unit should always attempt to have the borrower bring past due payments and interest current at the time a loan is rescheduled. Capitalization, intended to be used selectively, is likely to be more widespread when borrowers have been in default for an extended period. This measure should be applied only once, and in an amount that does not exceed a pre-defined size relative to the overall principle as defined in the bank's Remedial/restructuring policy. The bank should also formally confirm that the borrower understands and accepts the capitalization conditions.

ii. Interest rate reduction - involves the permanent (or temporary) reduction of the interest rate (fixed or variable) to a fair and sustainable rate. This option could be considered when the evolution of interest rates has resulted in the borrower receiving finance at an exorbitant cost, compared with prevailing market conditions. However, banks should ensure that lower interest rate is sufficient to cover the relevant credit risk.

iii. Extension of maturity - extension of the maturity of the loan (i.e., of the last contractual loan installment date) allows a reduction in installment amounts by spreading the repayments over a longer period

iv. Rescheduled Payments - the existing contractual payment schedule is adjusted to a new sustainable repayment program based on a realistic assessment of the borrower's cash flows, both current and forecasted. This is usually used in combination with an extension of maturity. In addition to normal rescheduling, additional repayment options include:

a. Partial repayment - a payment is made against the credit facility (e.g., from a sale of assets) that is lower than the outstanding balance. This option is used to substantially reduce the loan at risk and to enable a sustainable repayment program for the remaining outstanding amount. This option is generally preferable, from the bank's standpoint to the balloon, bullet or step-up options described below.

b. Balloon or bullet payments - are used in the case of more marginal borrowers whose sustainable cash flow is insufficient to fully repay the loan within the rescheduled tenor. A balloon payment is a final installment substantially larger than the regularly scheduled installments. Bullet loans carry no regular installment payments. They are payable in full at the maturity date and frequently contain provisions allowing the capitalization of interest throughout the life of the loan.

These options are generally only be used/considered in exceptional circumstances, and when the bank can duly document future cash flow availability to meet the payment. Bullet loans are frequently used in conjunction with loan splitting. In this case, the unsustainable portion of the loan represented by the bullet loan should be fully provisioned and written off in accordance with bank policy.

c. Step-up payments - should be used when the bank can ensure and demonstrate that there is a good reason to expect that the borrower's future cash flow will be sufficient to meet increases (step-up) in payments.

v. Sale by owner/assisted sale - this option is used when the borrower agrees to voluntarily dispose of the secured assets to partially or fully repay the loan. It is usually combined with the partial repayment option or conditional loan forgiveness. The borrower must be monitored closely to ensure that the sale is conducted in a timely manner and the agreement should contain a covenant allowing the borrower to conduct the sale if the borrower fails to do so within the specified timeframe.

vi. Conditional loan forgiveness - involves the bank forfeiting the right to legally recover part or the whole of the amount of an outstanding loan upon the borrower's performance of certain conditions. This measure may be used when the bank agrees to a “reduced payment in full and final settlement", whereby the bank agrees to forgive all the remaining loan if the borrower repays the reduced amount of the principal balance within an agreed timeframe. This option should be used to encourage owners to make an additional financial contribution to the company and to ensure that their interests are aligned with the banks. It is particularly appropriate in those cases where the net present value of the borrower's projected repayment capacity (taking into consideration all the collateral and potential cash flow) is lower than the total loan. In these cases the bank may consider:

a) Partial write-off in return for a cash equity contribution from an owner(s), particularly in those cases where the owner(s) have not guaranteed the loan.

b) Partial write-off in the framework of a cash capital increase from a third- party investor where they have not assumed the role of guarantor.

c) Partial write-off in the case of a particularly successful business restructuring that materially deviates from the operating plan that served as the basis for the restructuring.

d) Partial write-off in those cases when the above-average engagement of the owner(s) (i.e. successful sale of excess assets) guarantees a higher level of repayment to the bank(s).

e) Loan can also be written off if: (i) the collateral has no economic value, and such action ensures the continuation of the company's operations; (ii) it is evident that the owner has invested his entire property in the business and has lost it; (iii) the borrower possesses significant “know-how", and the bank has confidence in the management; or, (iv) the problems were caused by objective external factors.

Banks should apply loan forgiveness options carefully since the possibility of forgiveness can give rise to moral hazard, weaken the payment discipline, and encourage “strategic defaults". Therefore, banks should define specific forgiveness policies and procedures to ensure strong controls are in place.

vii. Fresh money - providing new financing arrangements to support the recovery of a distressed borrower is usually not a standalone viable restructuring solution but should be combined with other measures addressing existing arrears. It should only be applied in exceptional cases and requires a thorough assessment of the borrower's ability to repay. For loans with significant amount, independent sector experts should be used to validate the viability of proposed business plans and cash flow projections.

The Banks are recommended to have strict policies prohibiting lending new monies or allowing roll-overs. There are, however, three specific situations where it may be warranted. They are: (i) the need for fresh money to be used for working capital to restart the business; (ii) advances required to protect the bank's collateral position; or, (iii) small advances to prevent large contingent exposures (guarantees) from being called.

viii. Loan splitting - is used to address collateral and cash flow shortfalls. In this option, the loan is split into two parts: (i) the portion representing the amount that can be repaid from sustainable cash flow is repaid in equal installments of principal and interest; and (ii) the remaining portion represents “excess loan" (which can be subordinated). This portion can be used in combination with payments from the sale of specific assets or bullet payments at the maturity.

5.2.5 Additional Measures

Additional measures are not considered to be viable stand-alone restructuring options as they do not result in an immediate reduction in the loan. However, when combined with one or more of the previously identified options, they can provide incentives for repayment or strengthen the bank's overall position.

i. Loan-to-asset swap - transfers a loan, or portion of a loan, into “other assets owned" where the ultimate collection of the original loan requires the sale of the asset. This technique is generally used in conjunction with conditional loan forgiveness or partial loan repayment and maturity extension options. The management and sale of real estate properties also requires specialized expertise to ensure that the bank maximizes its returns from these assets.

ii. Loan-to-equity swap - transfers the loan, or portion of the loan, into an investment. Generally used to strengthen the capital structure of large highly indebted corporate borrowers, it is seldom appropriate for MSME borrowers due to limited access to equity markets and difficulties in determining the fair value of illiquid securities. Like the loan-to-asset swap above, this option may also require the bank to allocate additional resources for managing the new investment. However, such measures should be in-line with the requirements stipulated by Banking Control Law (Issued by SAMA) under Article 10 subsection 2 and 4.

iii. Loan Consolidation - more common for small loans, entails the combination of multiple loans into a single loan or a limited number of loans. This solution should be combined with other restructuring measures addressing existing arrears. This option is particularly beneficial in situations, where combining collateral and secured cash flows provides greater overall security coverage for the entire loan than individually.

iv. Other alterations of contract/covenants - when entering a restructuring agreement, it is generally necessary to revise or modify existing contracts/covenants to meet the borrower’s current financial circumstances. Examples might include revising ratios such as minimum working capital or providing additional time for a borrower to sell excess assets.

Additional security - additional liens on unencumbered assets (e.g., pledge on a cash deposit, assignment of receivables, or a new/additional mortgage on immovable property) are generally obtained as additional security from a borrower to compensate for the higher risk loan or cure existing defaults in loan-to-value ratio covenants.

5.2.6 Utilizing New Information

If new information is obtained after deciding on the resolving approach, the bank must re-examine and refresh it. For example, if it turns out that the borrower had been misleading it with certain material information, the approach and the measures must be more conservative. On the other hand, if the borrower puts forward or presents a repayment proposal during the measures, which would considerably improve the bank's position, the bank may mitigate the measures subject to fulfillment of certain conditions or eliminate them completely. This means that there is a certain flexibility of restructuring measures for the company.

Banks generally have a choice of choosing to restructure a loan, sell the loan (note sale), or liquidate the underlying collateral either by sale by owner or legal procedures (e.g. enforcement or insolvency). These guidelines require banks to compare the value of the proposed restructuring option against the other alternatives. The analysis will be confined to comparing the value of the proposed restructuring against enforcement and bankruptcy. Choosing the optimal option, i.e., the solution that returns the highest value to the bank is not always clear-cut.

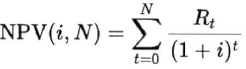

Evaluating alternative strategies based on NPV analysis

Using a simple Net Present Value (NPV) analysis is recommended in order to provide more quantitative justification for the decision.

The general formula to calculate net present value is:

Where i = interest rate per period

N = total number of periods

Rt= net cash flow per period t

t = period in which cash flow occurs

Net present value (NPV) is the sum of the present values (PV) of a stream of payments over a period of time. It is based on the concept of time value of money - money received in the future is less valuable than money received today. To determine NPV, the net cash flow (cash payments of principal, interest, and fees less the bank’s out-of-pocket costs for legal fees, consultants, etc.) received annually is calculated. Each of these amounts or future values (FV) is then discounted to the present by using an appropriate market-based discount rate. Alternatively, the Banks may also use original effective interest rate used for computation of provisioning under International Financial Reporting Standard (IFRS) 9 guidelines.

The sum of the PVs equals the NPV. Because of its simplicity, NPV is a useful tool to evaluate which of the possible workout options results in the maximum recovery to the bank.

For NPV analysis, the bank's standard risk-adjusted discount rate should be considered. NPV from various options should be considered including below considerations in each option:

i. Restructuring: evaluation based on estimated cash-flows for a period under negotiation for new tenor of contract. The factors to be considered are interest rate of the new term, any other expenses involved in restructuring and business plan or internal estimations of the bank.

ii. Enforcement (including legal): the parameters to be considered includes current value of the property, suitable haircuts to be applied, litigation charges and additional time to be taken to conclude these proceedings.

iii. Insolvency: cost of insolvency procedure, length of time to conclude insolvency proceedings and estimated value to be recovered.

5.3 Negotiating and Documenting Workout Plan

5.3.1 Developing the Negotiating Strategy

Restructuring plan should be viable and mutually acceptable. As every restructuring is unique, depending on borrower and the executing team, the notion of the strategy should keep, following things in mind before drafting the plan:

• Restructuring a loan, which is under stress, means introducing changes that will make underlying business viable and profitable once again and to implement changes so that it will generate enough cash flow to cover the service of loan and satisfactorily returns to shareholders. It is important to understand the underlying causes of the problem.

• The restructuring is more than just changing the terms and structure of the facility, as it focuses on sustainable business.

• Economic profitability should be priorities over accounting profitability while restructuring. The objective is to render the company viable and to ensure its continuity.

A. Better Practices for approaching negotiation in an efficient manner

i. Preparation is essential before the negotiation starts: Every negotiation requires preparation and a strategy to implement. During their preparation, the bank can propose and determine how the possible refinancing is going to be distributed, under what conditions, and subject to what limits and guarantees. Negotiating strategy and tactics should include identification of the negotiable points, possible counter-proposals from the banks, and matters kept in reserve (if possible) to be raised during the process.

a. Be Prepared - It is not possible to draw up a restructuring strategy without a reliable resolvability analysis. The bank should review all available information of the company and current state of business sector, identify the reason and nature of the distress situation.

b. Evaluate the position - Bank should evaluate its ranking in terms of security among the other creditors and stakeholders. The bank should also assess the number and value of secured claims in relation to other secured and unsecured creditors,

ii. Keep the borrower informed: For a successful negotiation, the bank should inform all the stakeholders and be involved actively in talks about the negotiation progress. Successful restructuring is a team effort. Success requires that borrowers work closely with their investment partners. In a restructuring, investors are not only shareholders but also supporting financial entities. For managers the challenge is always to be a step ahead by preparing the (eventual) next round: to be transparent, and to communicate effectively.

iii. Consistency will deliver results: At this crucial stage in a company's life, inconsistency in communication or strategy can be detrimental. Some ways to be consistent:

a) Draw up a consistent and credible action plan to improve the company's liquidity. Determine the financial needs in the short, medium and long term.

b) Be consistent in the plan: try to cover short-term needs with short-term funds, and long-term needs with long-term funds.

c) Do not equate restructuring with loan renegotiation n. Long-term needs can and must be financed by converting loan to equity, whenever the level of leverage is excessive.

d) When converting loan to equity, negotiate in detail the value of the stake held by the new shareholders or look for alternative sources of capital.

e) Finally, the success of the restructuring depends to a large extent on the company surrounding itself by qualified advisors who can offer the benefit of their experience.

iv. A restructuring process consists of reaching a private agreement in order to prevent legal proceedings. It is also possible to base the agreement on corresponding bankruptcy law, although it would have to be under judicial protection and subject to regulations that are often more rigid (creditors agreement).

B. SWOT (Strengths, weaknesses, opportunities, threats) Analysis

While negotiating the rehabilitation plan, the bank should identify and evaluate the strengths and weaknesses in the account. The strengths and weaknesses in the account should be thoroughly evaluated to assess and draft the strategy. Before initiating the negotiations with the borrower, bank should prepare a strategy to discuss and finalize the meaningful and successful plan.

The cases where the borrower is not sound to understand the restructuring, the banks should make all the efforts to educate and represent the facts in full faith and trust. If necessary, bank should involve external party for explaining the plan and reducing the resistance by the borrower in restructuring.

Bank may adopt SWOT analysis to formulate the plan. In SWOT, all internal and external factors are considered for identification of strengths and weaknesses in the account. On critical assessment of these factors, bank can build the plan into negotiating strategy. The strategy should cover the defined objectives along with needs of the borrower, reason for restructuring, root cause analysis of the problem, proposed solutions, and negotiating parameters. The strategy of the bank should be focused on incentivizing the borrower and must include fees, penalties, and interest. The structure of the new and old facility has to be clearly explained to borrower while negotiating the strategy. A good background check and through homework may reduce the last-minute surprises and enhances the chances of a successful outcome.

Although the borrower should be made aware of deadlines to complete negotiations (i.e., at the specific restructuring plan being offered will expire if not accepted within 30 days), the situation should not end up into a sub-optimal restructuring.

Despite the fact that negotiating with the borrower on restructuring may be heated at times, both parties must understand the need of the situation and work collaboratively in the interest of both the parties and to come to a consensual and mutually acceptable agreement. The negotiation should be drafted as win-win situations for both parties.

C. Use of advisor

After ascertaining the viability of business and ensuring that business plans are sustainable, both parties should come to a negotiable agreement. Depending on the complexity of structure and borrower's financial knowledge and sophistication, an external advisor may be required. Potential areas for advice are: a) drafting the entire restructuring proposal (financial and legal) and b) drafting business plans as a cornerstone for restructuring discussion with the bank.

In order to build trust of borrower in the restructuring plan, especially for less sophisticated borrowers, it is recommended to involve external advisor viz. a lawyer or a financial specialist.

The bank should organize borrower educational unit within the bank that would provide general financial counsel services to borrowers, including NPL resolution.

The bank should also consider providing independent counseling/mediation services to borrowers for finalizing the strategy.

D. Involvement of guarantor (/s)

Depending on the terms of a guarantee, a guarantor is either fully or partially liable for the loan of third party (the borrower). The guarantor, therefore, should be kept fully informed about the status of the loan and the resolution process so that the guarantor is fully prepared to meet his obligations if the bank chooses to call the guarantee. New guarantees or a re-statement of the previous ones should be obtained whenever changes are made to the loan.

This is to ensure that the guarantor cannot use as a defense against payment that changes were made, to which the guarantor would not have agreed, without prior knowledge or consent.

E. Dealing with multi-bank borrowers

The role of the coordinator should be assumed by the bank with the largest loan, but the other banks must also be willing to accept it, should the bank with the largest expose refuse such activities for objective reasons. When appointing the coordinator and setting its powers, the banks shall strive for the following:

i. As a rule, a coordinator should be appointed within 1 month.

ii. The coordinator should be appointed for a certain period (no more than 6 months) with the possibility of renewal (3 months).

iii. During this mandate term, the coordinator may not withdraw without a grounded reason. If the banks do not renew the coordinator's mandate term 1 month prior to expiry, the restructuring process is completed.

iv. The coordinator shall be responsible for the assessment of the need to sign a Standstill Agreement, the assessment of the need to extend the coordinator's mandate, the assessment of the need for external consultant (financial or legal) and the drafting of the proposed solution for borrower restructuring.

v. In the beginning of the process, the coordinator must clearly define the goals, take care of strict compliance of the deadlines, transparent communication and information of all stakeholders and cooperation by agreement

vi. The coordinator takes care of the minutes of creditor meetings which sum up the decisions and the orientations of the process. In case individual creditors or the borrower constantly change their positions without reason, thereby jeopardizing the process, the coordinator transparently informs all creditors and the borrower and is entitled to withdraw as coordinator.

vii. If appointment of an agent is necessary after the completion of the restructuring, this role can be assumed by the coordinator unless agreed otherwise by the creditors. The coordinator takes over all further communication with the borrower, with the purpose of limiting mutual administrative activities.

It is generally agreed that a negotiated out-of-court debt restructuring is preferable to court proceedings. It tends to be both faster and less costly, hence banks are encouraged to explore the same prior to seeking legal recourse

To facilitate the process, the primary bank must familiarize themselves with the role of the coordinator and be prepared to assume the responsibilities, if necessary, when a borrower has loans from more than one bank.

Banks should strive to actively participate and cooperate in these negotiations. While banks may have genuine differences of opinion about the proper course of action to be taken with a borrower, they should state their views openly and be prepared to compromise, when warranted.

F. Bearing the costs of the workout

Formalizing a workout implies incurring multiple costs that may significantly compromise the financial position of the parties involved in the workout.

This implies that the borrower does not only assume his own costs, but also the costs and fees of auditors, lawyers and financial advisors that were engaged at creditors' request to complete the restructuring. While this is standard practice, there are certain limits to this general rule that try to prevent that the amount of these external costs become excessive:

a) The borrower is only supposed to assume those costs incurred by the whole body of creditors. This implies that creditors who wish to use their own advisers shall cover their own costs.

b) When engaging the external consultants, throughout the course of the workout process, creditors must strive to help the borrower control and manage such costs, and should not incur any costs that may not be considered reasonable.

For MSME borrowers, banks are required to streamline workout processes, review existing processes to ensure that any cost levied to the borrower is kept at manageable levels

G. Checklists for Negotiations

Best practice in the recovery of distressed business loans is based on ensuring that ample effort goes into preparing for negotiations. To prepare for negotiations bank must have a

i. Know loans and security position.

ii. Know the mindset of each negotiating borrower.

iii. Have a realistic assessment of counterparties’ other personal or psychological attributes.

iv. Know the main negotiating points critical to the success of the workout, and how each negotiating point is likely to be perceived by the borrower.

v. Determine the overall posture best to adopt in conducting the negotiations.

vi. Detail the relative merits of your chosen “posture" in terms of flexibility.

vii. Separate the counterparties and their representatives from the problems caused by differences in positions.

viii. Focus on each borrower's needs and interests rather than their stated or presumed position.

ix. Look for solutions with mutual benefits (win-win strategies).

x. Push for objectivity in judging proposals.

H. Pricing the workout

While considering the price of the workout, the banks should consider cash flow, net present value, involvement of other banks (share, interest rate), and collateral value. The pricing should also factor in the risk in the proposal i.e. the change in risk profile of the borrower and waiver/ sacrifice amount while finalizing the work out strategy.

I. Maintaining fallback strategics

Fall-back strategies are important because of the potential fluidity of any workout. The following are worth keeping in mind as strategy is being developed:

a) Workout strategies can be rendered ineffective suddenly, without warning and often as the result of revisions to what were previously believed to be immutable facts.

b) The importance of comparing options carefully during initial strategy selection - The scope for different views and approaches is ample. While occasionally some solutions will so clearly dominate all others as to not require deep discussion of alternatives, more often the best course of action is not so immediately obvious. In such cases, a thorough analysis and discussion of the strategy options will be an indispensable part of the asset recovery process. Best practice also involves formalizing the process, by holding the type of decision meeting appropriate for removing ambiguity as to what was decided and by recording the decision.

Comparisons of the various asset recovery options should involve quantification. As a minimum, each strategy option considered should be presented in terms of its internal rate of return (IRR) and/or its net present value (NPV). However, to the extent that certain aspects of risk and uncertainty play an important role yet are not always easily quantified, the framework for analysis and presentation should accommodate important qualitative considerations as well. The SWOT framework may be useful for comparing alternative workout strategies. Regardless of the framework used, it is important to ensure that all main assumptions are set in writing. Over time, assumptions that appear obvious early on are altered and rendered inapplicable. The workout specialist will appreciate having a record of the changing assumptions as the workout plan evolves.

Clear communication helps keep market participants informed, build confidence in the resolution strategy and maintain public support. Authorities gather a large amount of information in the process of assessing the NPL problem and play a strong coordination role in the resolution strategy. They are therefore best placed to explain to market participants how the NPL crisis is developing, and to propose and implement solutions. Communication is essential to build public support, given that public sector intervention will have fiscal implications, as well as an impact on borrower companies and households. Finally, communication of the resolution strategy creates a basis for a subsequent policy review, thus keeping the authorities accountable.

J. Documentation of plan

Banks must document each loan workout determination as part of the formal record. This includes documented communication with the borrower demonstrating the borrower has a renewed willingness and ability to repay the loan. Further, sufficient documentation of the ability to repay the loan must be on records for the options evaluated for assessing the borrower's ability to repay.

The bank should establish comprehensive management and internal controls over loan workout activity. This includes establishing authority levels and segregation of duties over the various types of workouts (modification, refinance, adjusting due dates, etc.). In addition, the policy needs to specify volume thresholds tied to financial performance elements such as net worth, delinquency and/or net charge off rates, etc. that trigger enhanced reporting to SAMA.

The contract and documentation should include a well-defined borrower milestone target schedule, detailing all necessary milestones to be achieved by the borrower in order to repay the loan over the course of the contract term. These milestones/targets should be credible, appropriately conservative and take account of any potential deterioration of the borrower's financial situation.

Based on the collective monitoring of the performance of different restructuring options and on the examination of potential causes and instances of re-defaults (inadequate affordability assessment, issue with the characteristics of the restructuring treatment product, change in the borrower's conditions, external macroeconomic effects etc.), banks should regularly review their restructuring policies and products.

For the cases, where the borrower has experienced an identifiable event which has caused temporary liquidity constraints. Evidence of such an event should be demonstrated in a formal manner (and not speculatively) via written documentation with defined evidence showing that the borrower's income will recover in the short-term or on the basis of the bank concluding that a long-term restructuring solution was not possible due to a temporary financial uncertainty of a general or borrower specific nature.

Greater transparency on NPLs can improve the viability of all resolution options, as well as market functioning in normal times. In cases where the ownership of the NPL passes from the originating bank to an external party, information limitations play an important role. To help overcome this problem, some standardization of asset quality data, as well as completeness of legal documentation on the ownership of these loans, would help buyers and sellers agree on pricing. In addition, co-investment strategies in securities originated from a pool of NPLs may reduce information asymmetries between buyers and sellers. This could increase transaction volumes, or facilitate sales at higher prices. A third option is the establishment of databases for realized prices of real estate transactions, given that real estate is the most widely used form of collateral. A transparent and sufficiently large database on real estate sale prices would, therefore, enhance the stability and reliability of NPL valuations, ultimately facilitating the NPL disposal process and leading to smaller price discounts. This would encourage market-based solutions for NPL disposal.

K. Information Access:

One of the key success factors for the successful implementation of any strategy option is adequate technical infrastructure. In this context, it is important that all cases related data is centrally stored in robust and secured IT systems. Data should be complete and up-to-date throughout the workout process. An adequate technical infrastructure should enable units to easily access all relevant data and documentation including:

i. current NPL and early arrears borrower information including automated notifications in the case of updates;

ii. loan and collateral/guarantee information linked to the borrower or connected borrowers;

iii. monitoring/documentation tools with the IT capabilities to track restructuring performance and effectiveness;

iv. status of workout activities and borrower interaction, as well as details on restructuring measures, agreed, etc.;

v. foreclosed assets (where relevant);

vi. tracked cash flows of the loan and collateral;

vii. sources of underlying information and complete underlying documentation;

viii. access to central credit registers, land registers and other relevant external data sources where technically possible.

L. External Information

As a minimum, the following information should be obtained when restructuring a non-retail loan:

i. latest audited financial statements and/or latest management accounts;

ii. Verification of variable elements of current income; assumptions used for the discounting of variable elements;

iii. overall indebtedness;

iv. business plan and/or cash-flow forecast, depending on the size of the borrower and the maturity of the loan;

v. latest independent valuation report of any mortgaged immovable properties securing the underlying facility;

vi. information on any other collateral securing the underlying loan facilities.

vii. latest valuations of any other collateral securing the underlying loan facilities;

viii. historical financial data;

ix. relevant market indicators (unemployment rate, GDP, inflation, etc.).

x. In case of MSME's access to bank statements of all accounts maintained by the borrower may also be necessary.

M. Internal Information

Banks should maintain in the credit file of the transactions the documentation needed so that a third party can replicate the individual estimations of accumulated credit losses made over time. This documentation should include, inter alia, information on the scenario used to estimate the cash flows it is expected to collect (going concern vs. gone concern scenario), the method used to determine cash flows (either a detailed cash-flow analysis or other more simplified methods), their amount and timing as well as the effective interest rate used for discounting cash-flows.

Banks should maintain all internal supporting documentation, which may be made available for review by the supervisory authority upon request. It should include:

i. the criteria used to identify loans subject to an individual assessment;

ii. rules applied when grouping loans with similar credit risk characteristics, whether significant or not, including supporting evidence that the loans have similar characteristics;

iii. detailed information regarding the inputs, calculations, and outputs in support of each of the categories of assumptions made in relation to each group of loans;

iv. rationale applied to determine the considered assumptions in the impairment calculation;

v. results of testing of the assumptions against actual loss experience;

vi. policies and procedures which set out how the bank sets, monitors and assesses the considered assumptions;

vii. findings and outcomes of collective allowances;

viii. supporting documentation for any factors considered that produce an impact on the historical loss data;

ix. detailed information on the experienced judgment applied to adjust observable data for a group of financial assets to reflect current circumstances.

N. Restructuring documentation

Important documents in any workout will be the term sheet, the loan agreement, and the security documents. Even before the banks have determined that a going concern solution is feasible and indeed preferable and the transaction starts crystallizing, they will want to start preparing documents.

The documentation will also determine the conditions of effectiveness of the restructuring. Before these have been met, the restructuring is not complete and it is theoretically possible to revert to the default and real bankruptcy.

The proposal should contain the following elements:

i. Full description of the borrower

ii. Amount(s) of the loan(s) to be restructured

iii. Restructuring fees and expenses, if any

iv. Name(s) of the bank(s)

v. Anticipated date of closing

vi. Representations and warranties

vii. Repayment schedule(s)

viii. Mandatory repayment(s), if any

ix. Cash sweep mechanism, if any

x. Interest rate(s) and applicable margin(s) if floating rate

xi. Default interest

xii. Interest payment dates

xiii. (Revised) events of default

xiv. (Additional) security

xv. List of documentation

xvi. Taxes

xvii. Governing law

O. Checklist:

i. Establish parties to be part of the workout transaction

ii. Establish what minimum terms acceptable to parties other than the borrower

iii. Prepare draft term-sheet

iv. Negotiate draft term-sheet among parties other than borrower and reach tentative agreement

v. Submit draft term-sheet to borrower

vi. Negotiate, agree, and initial term-sheet

vii. Have lawyers prepare draft legal documents for workout, including new or amendatory loan agreement and security documents, based on initialed term-sheet

viii. Negotiate, agree, and sign legal documents for workout

ix. Determine when conditions of effectiveness have been met and workout is complete.

5.3.2 Drafting the Restructuring Agreement

A typical restructuring agreement at minimum should include: Purpose, Restructuring Fees and Expenses, banksLenders, Nature and Amount of Current Principal Loan, Role of External Counsel, Signing Date of the Loan Restructuring Agreements and other Documentation, Conditions of Effectiveness, Representations and Warranties, Repayment Schedule, Mandatory Prepayments, Cash Sweep Mechanism, Interest Rates, Applicable Margin - Base, Default Interest, Interest Periods, Shareholder Loan, Emergency Working, Deferral of Principal Payment, Undertakings, Events of Default, Security, Documentation, Taxes, Withholdings, Deductions and Relevant Governing Law.

A. Determining required documentation

Every restructuring transaction is different in its own way, and these differences lead to defining the type and number of documents required to formalize the workout. Factors like the number of creditors, the size of the loan restructured and the type of collateral used in the original lending transaction determine the complexity and number of documents required to formalize a workout.

Regardless of the number of creditors and complexity of loan structure, the restructuring documentation will determine the conditions and effectiveness of the restructuring, and it is essential that all parties should agree and sign the documents before implementing the workout. Until all documents have been formalized, it is still possible that the restructuring negotiations fail and initiating the bankruptcy proceedings.

The documentation formalizing the workout should always be prepared by a legal practitioner. While the legal practitioner should be primarily responsible for elaborating this documentation, close collaboration is required with the Workout Unit in charge of negotiating the workout.

In the case of MSME workouts, the banks are encouraged to explore developing restructuring documentation, which is typically simplified in comparison with the restructuring of larger corporate borrowers. This is just a reflection of the fact that the negotiating process is simpler, and most negotiating milestones are either abridged or do not take place at all.

For further guidance on relevant agreements refer to Appendix 4.

B. Communicating with the borrower during the workout process

The bank should have detailed internal guidelines and rules regarding bank's staff communication with the borrower. Communication with borrowers should be as per the procedures outlined in the bank's code of conduct. This should include; timelines for responding to borrower's requests/complaints, identify who within the bank is responsible/authorized to issue various types of communications to the borrowers, documenting process for all communications to/from the borrowers, signing/acknowledgement protocols with timelines, approval requirements for all workout proposals, templates to be used for communication with the borrowers.

With respect to borrowers, transferred to the specialized unit, some of the basic principles are as follows:

i. Work out unit must act honestly, fairly, and professionally at all times.

ii. RM should avoid putting excessive pressure on the borrower and/or guarantor. All contacts with the borrower should take place at reasonable times) and at a mutually convenient location.