Part Eighteen: Consumer Protection in Finance Services

Article 78

Finance Agreements must be drawn up on paper or electronically between the Finance Company and the Borrower and each contracting party must receive a copy of the Finance Agreement. The Finance Agreement must include at least the following data and information:

1. Names of the parties of Finance Agreement, No of ID or Iqama or Borrower’s CR, as the case may be, their official addresses, means of contact including mobile numbers and e-mails, if available. 2. Type of Finance; 3. Term of the Finance Agreement; 4. Amount of Finance; 5. Conditions to drawdown the Amount of Finance if available; 6. The description of price determination formula in Finance Agreements with variable Term Cost in order to enable the consumer to understand the Term Cost, and distribute the cost on the fulfillment period; 7. Term Cost, the conditions governing the application of the Term Cost and any index or reference rate applicable to the initially agreed Term Cost, as well as the periods, conditions and procedures for changing the Term Cost; 8. Annual Percentage Rate; 9. Total Amount Payable by the Borrower, calculated at the time of concluding the Finance Agreement; the assumptions used in order to calculate that amount must be mentioned; 10. The amount of Installments payable by the Borrower and their number and duration, and the method of distributing them on the remaining amounts, in case of fixed Term Cost. Three examples of Installments amount in consideration to the preliminary Term Cost and two higher and lower costs in case of variable Term Cost. 11. Fees, commissions and costs of administrative services; 12. Periods of fees payments or money that needs to be repaid without the payment of the Amount of Finance and the conditions of the payment; 13. Implications of the delayed Installments payment; 14. Documentation fees, if necessary, 15. Necessary guaranty and insurance; 16. Account number for depositing Finance Installments and the name of the bank. 17. Right of withdrawal procedures, if available, and its conditions and the financial obligations of its practice; 18. The procedures of early repayment and indemnity procedures for the Finance Company, if applicable, and the method for determining such indemnity; 19. Procedures for dealing with collaterals in case of decreasing, if available, 20. Procedure to be followed in exercising the right of termination of the Finance Agreement; 21. The Borrower’s permission to insert his information in the credit record; 22. Any data or information stipulated by SAMA. Article 79

The Finance Agreement shall bear on its forefront a summary containing the basic information of the Finance product and the main provisions of the Finance Agreement in a clear language for the Borrower, in accordance with the model determined by SAMA and documenting the receipt of this summary by the Borrower in the Finance file.

Article 80

If permitted by Finance Agreement, the Finance Company must inform the Borrower in writing of any change in the Term Cost before the change enters into force in the duration of no less than two months, if the Finance Agreement allows such change. Company must also inform the Borrower, via the official addresses agreed upon on the Finance Agreement, of the amount of Installments to be paid under the new Term Cost and the details concerning the number of Installments or their duration if changed.

Article 81

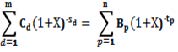

1. The Annual Percentage Rate is the discount rate at which the present value of all Installments and other payments that are due on the Borrower, representing the Total Amount Payable by the Borrower, equals the present value of the payments of the Amount of Finance available to the Borrower, calculated on the date on which the Amount of Finance or the date the first payment is available to the Borrower,. Calculated by the following equation:

m is the last payment of the Amount of Finance to be received by the Borrower. d is the payment to be received by the Borrower from the Amount of Finance. Cd is the payment value of (d) to be received by the Borrower from the Amount of Finance. Sd the period between the date on which the Amount of Finance or the first payment is available to the Borrower and the date of payment (d), calculated in years and parts of the year, and so that this period of first payment received by the Borrower from the Amount of Finance is zero (s1=0) n is the last payment payable by the Borrower. p is the payment payable by the Borrower. Bp is the payment value (p) payable by the Borrower. Tp the period between the date on which the Amount of Finance or the first payment is available to the Borrower and the date of the payment (p) to be received from the Borrower, calculated in years and parts of the year. X is the Annual Percentage Rate.

2. For the purpose of calculating the Annual Percentage Rate, the periods between the date on which the Amount of Finance or the first payment is available to the Borrower and the date of every payment received or payable by the borrower shall be calculated on the basis of (12) months or (365) days a year. 3. For the purpose of calculating the Annual Percentage Rate, the Total Amount Payable by the Borrower must be specified including fees, commissions and costs that cannot be avoid by the Borrower, with the elimination of costs or fees payable by the Borrower due to his breach to any of his obligations contained in the Finance Agreement. 4. It is a must to calculate the Annual Percentage Rate, assuming validity of Finance Agreement for the agreed period of time and both parties commitment to their obligations according to the conditions contained in the Finance Agreement. 5. In accordance with Paragraph 10 of Article 78 of this Regulation, in the case of Finance Agreement containing clauses allowing variations in the Term Cost and fees contained in the Annual Percentage Rate which cannot be calculated, the Annual Percentage Rate must be calculated on the assumption that the Term Cost and other charges remain fixed in relation to the initial Term Cost and remain applicable until the end of the Finance Agreement. 6. The Annual Percentage Rate must be calculated and expressed in percentage points as a decimal fraction, with the fractional portion rounded to two digits and the basic half point or more rounded to full point. Article 82

The Finance Company must use the declining balance method in distributing the Term Cost on the maturity period, whereas the Term Cost is distributed proportionally between Installments on the basis of the balance value of the remaining Amount of Finance at the beginning of the Installment maturity period, and including it in the Finance Agreement.

Article 83

All fees, commissions and administrative services charges to be recovered from the Borrower by the Finance Company shall not exceed the equivalent of (1%) of the Amount of Finance or (5,000) Five thousand Saudi riyals whichever is less,

Article 84

1. The Borrower may accelerate the payment of the rest of the Amount of Finance, at any time, and he may not pay the Term Cost of the remaining period. The Finance Company may be compensated for the following: a. The cost of re-investment, but not exceeding the Term Cost for the following three months of payments, calculated on the basis of the declining balance; and b. Payments from the Finance Company to a third party due to the Finance Agreement of expenses stipulated therein, if they are irrecoverable expenses, for the remaining term of the Finance Agreement. 2. An exception to the provisions of Paragraph 1 of this Article, the real estate Finance Agreement may stipulate a period of time which early payment is prohibited, provided that it does not exceed two years from the date of concluding the real estate Finance Agreement. Article 85

1. In the event of the Finance Company assigns its rights to a third party or the Finance Agreement itself, to a third party or issuance of securities against the rights arising out of the Finance Agreement, the Borrower is entitled to use against the assignee any defense available to him against the original Finance Company. 2. The Finance Company shall receive a non-objecting letter from SAMA, before assigning the services related to the Finance to another party. Article 86

1. The Finance Company shall indicate in all product advertisements: its name, logo, any identifying representation and contact details. 2. The advertisement shall disclose, in a manner that is clear to the Consumer, the name and Annual Percentage Rate of the advertised product and shall not include other rates of the Term Cost. 3. The Finance Company may not do any of the following: a. Provide an advertisement that includes a false offer, statement, or a false claim expressed in terms that would directly or indirectly deceive or mislead the Consumer. b. Provide an advertisement that includes the unlawful use of a logo, a distinctive mark, or a counterfeit mark. 4. SAMA may oblige any Finance Company that does not abide by the provisions of this Article to withdraw the advertisement within one working day of SAMA’s notice. Article 87

The Finance Company shall establish a function and designate staff to address complaints, and put in place clear procedures for receiving, documenting, studying, and responding to Borrowers’ complaints within a period not exceeding (10) business days from the date of receiving the complaint. All necessary details of Borrowers’ complaints and actions taken thereon shall be entered in a complaints registry.

Article 88

1. The Finance Company and its employees shall maintain the confidentiality Of clients’ data and transactions, and may not disclose or expose them to other parties, except in accordance with the related laws and instructions. 2. The Finance Company employees are prohibited from disclosing any information about the Company’s clients and transactions obtained through their work, even after leaving the Finance Company. It is also prohibited to hold any of this information after resigning. 3. The Finance Company shall take all necessary measures to ensure confidentiality of the clients’ information and transactions.