Requirements for ATM Receipts Initiative

No: 43067037 Date(g): 6/3/2022 | Date(h): 3/8/1443 Status: In-Force Based on the powers granted to the Saudi Central Bank under its Law issued by Royal Decree No. (M/36) dated 11/4/1442 AH, and the Banking Control Law issued by Royal Decree No. (M/5) dated 22/2/1386 H, and referring to the ATM Service Level Agreement (Version 2) issued under Central Bank Circular No. (41932/227) dated 15/3/1441 H, and in continuation of the efforts made to develop the payment system infrastructure in the Kingdom.

Attached is the Requirements for ATM Receipts Initiative issued by Saudi Payments, which banks are required to implement on ATMs. The initiative aims to reduce customer requests for paper receipts in ATM transactions by standardizing the workflow across all machines to ensure the following:

- Preserving the environment and the overall appearance.

- Standardizing the user experience across all ATMs.

- The importance of maintaining data privacy for cardholders.

- Reducing costs for service providers.

Accordingly, the Central Bank emphasizes that all banks operating in the Kingdom and members of the Saudi Payments Network must comply with the provisions of the attached initiative. Coordination in this regard can be made with specialists at Saudi Payments via email (onboarding@saudipayments.com).

For your information and action accordingly, effective from 30/06/2022 G.

1. Introduction

In line with SAMA’s and Saudi Payments’ vision to make continuous improvements in payment infrastructure of the Kingdom, ATM Receipts initiative aims to minimize Cardholders’ dependency on paper receipts for ATM transactions.

The sole objectives of this initiative are to:

√ Enable cost efficiency for Acquirers

√ Maximize customer data privacy and protection

√ Save environment and go green!

1.1 Purpose of Document

The purpose of this document is to assign rules and requirements related to ATM Receipts to external stakeholders who play significant roles in the success of this change. This document is intended to govern the responsibilities of mada Members from multiple aspects for the purpose of ensuring the quality of the solution.

1.2 Scope of Document

This document covers the rules and requirements for ATM Receipts initiative. It also contains detailed workflows of the new enhancements on ATM screens. This document, however, does not contain certification procedures nor terms and conditions.

1.3 Audience of Document

The intended audience of this document is mada Members who are familiar with the basic guidelines of ATM functionalities, and who must comply with these rules at all times.

2. Overview

ATM Receipts is an enhancement initiative that drives the market to minimize dependency on receipts for the four (4) most commonly performed transactions on ATMs.

This initiative focusses on improving and unifying the screen workflow across all ATMs (off-us and on-us) in an attempt to unify user experience and reduce demand on receipts as a result. However, paper receipts shall still be available and provided to Cardholders whenever requested.

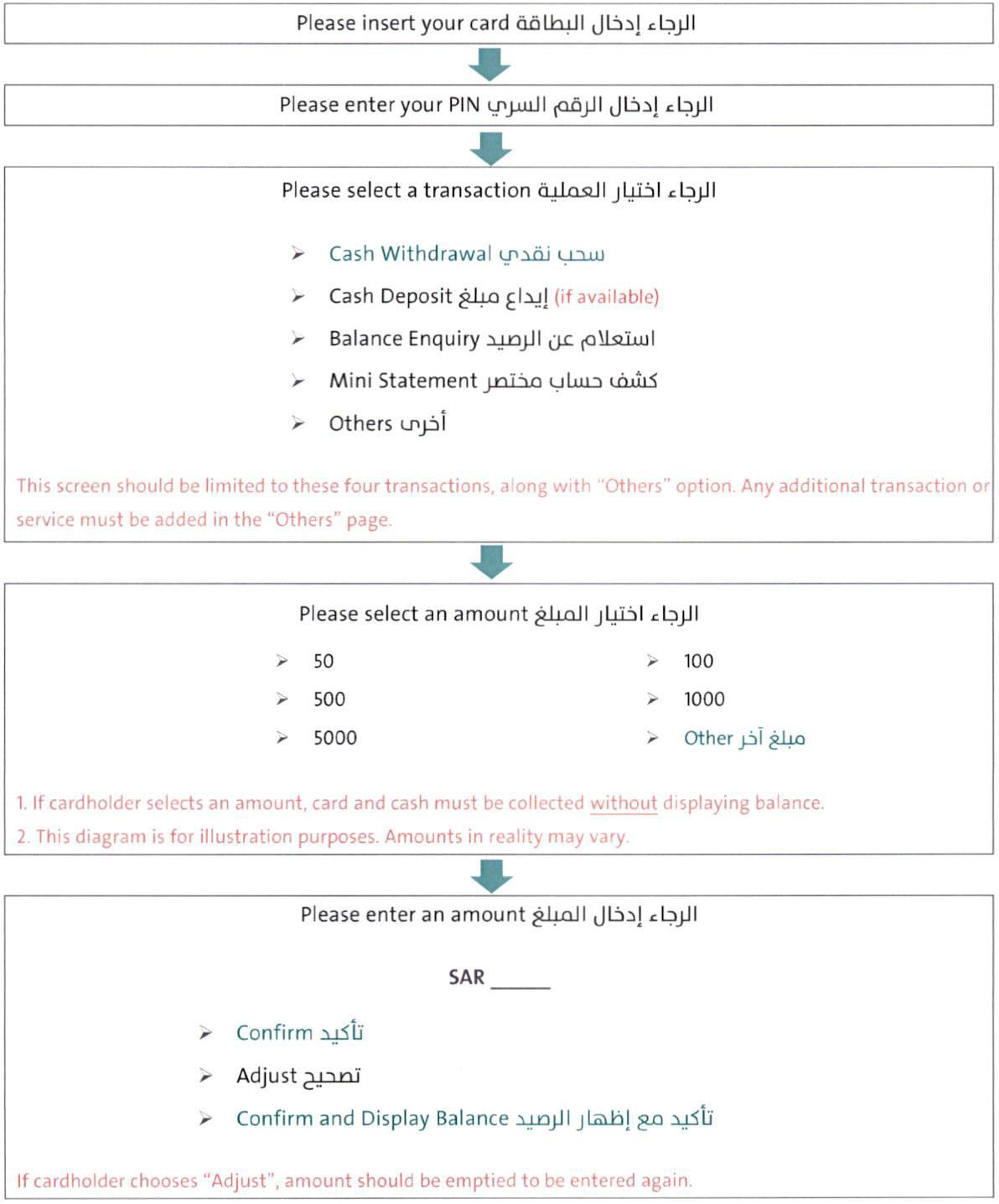

Currently, the Home page on ATMs-after inserting the card and entering the PIN-displays the four major transactions (Cash Withdrawal, Balance Inquiry, Mini Statement, and Cash Deposit if available). As part of this initiative, the Home page will be limited to whatever is available of those four transactions and must be fixed and unified across all ATMs (including on-us and off-us). In addition to the four transactions, the Home page also provides an 'Others’ option which opens up to any other transaction(s) and/or service(s) (i.e. PIN Change, Transfer...etc.).

The new enhancement on ATM screen flow runs into two streams: (1) Cash Withdrawal transaction stream, and (2) *Non-cash transactions stream. Each of which has its own mechanism to achieve the same goal of receipt reduction.

*Non-cash transactions include (1) Balance Enquiry, (2) Mini Statement, and (3) Cash Deposit -which is currently available for on-us only.

3. New ATM Screen Workflows

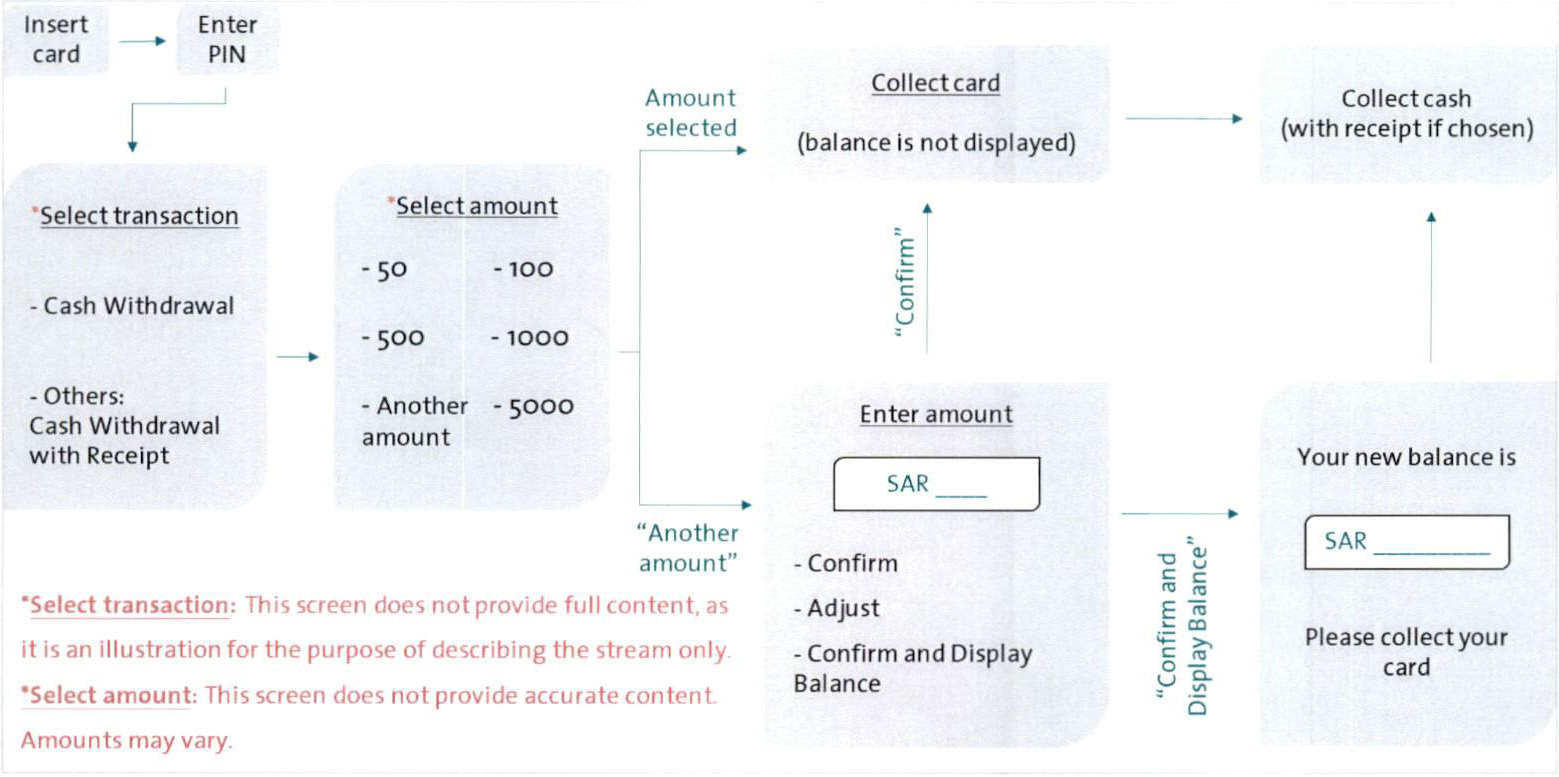

3.1 Cash Withdrawal Transaction Stream

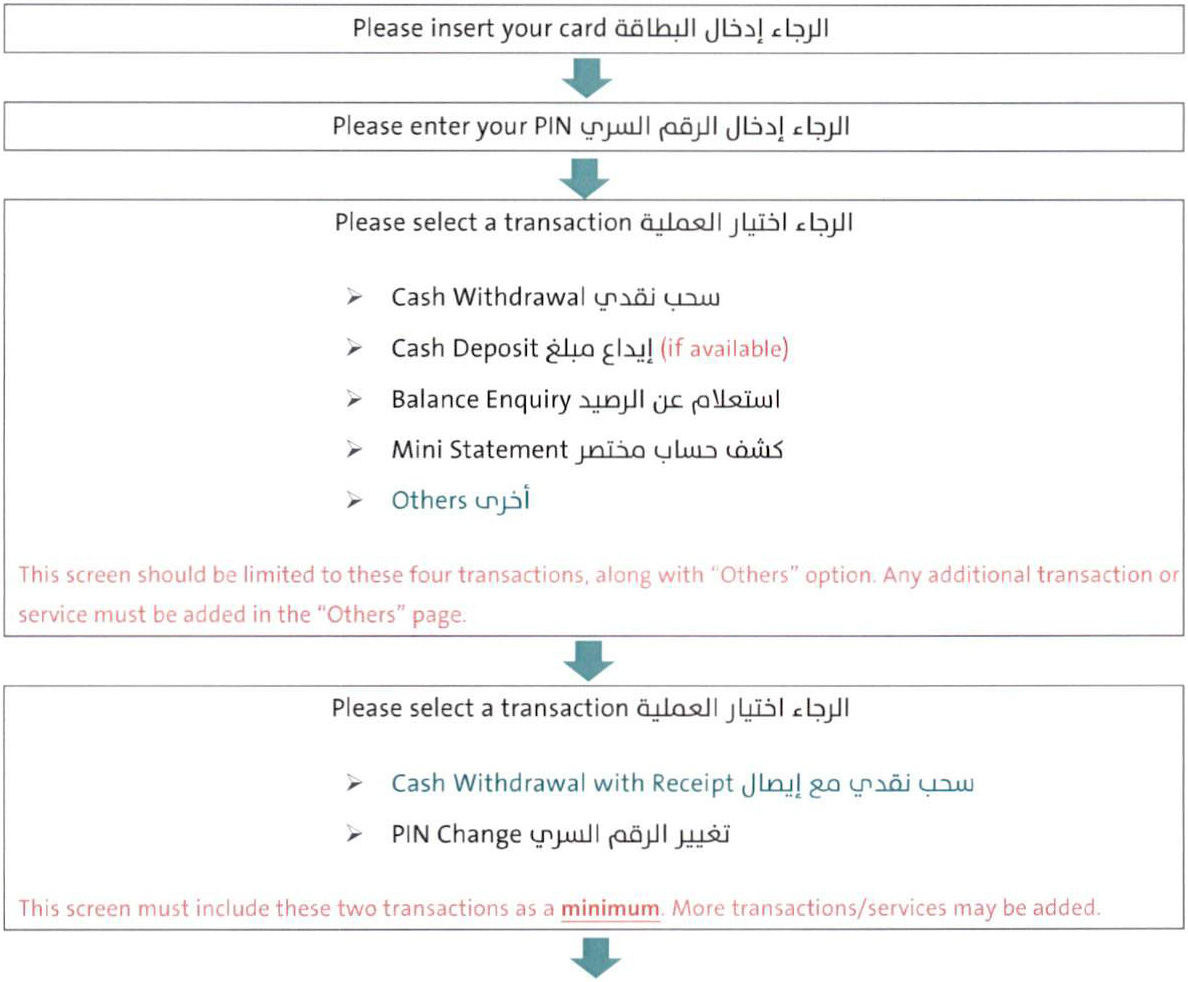

Since Cash Withdrawal is the top transaction in terms of initiation and receipt requests, there will be two separate transactions for Cash Withdrawal:

(1) The first transaction is “Cash Withdrawal" which is presented within the Home page on the ATM. This transaction should not provide a receipt upon completion.

(2) The second transaction is "Cash Withdrawal with Receipt” which will be added inside the 'Others' page from the Home page. This transaction should provide a receipt upon completion.

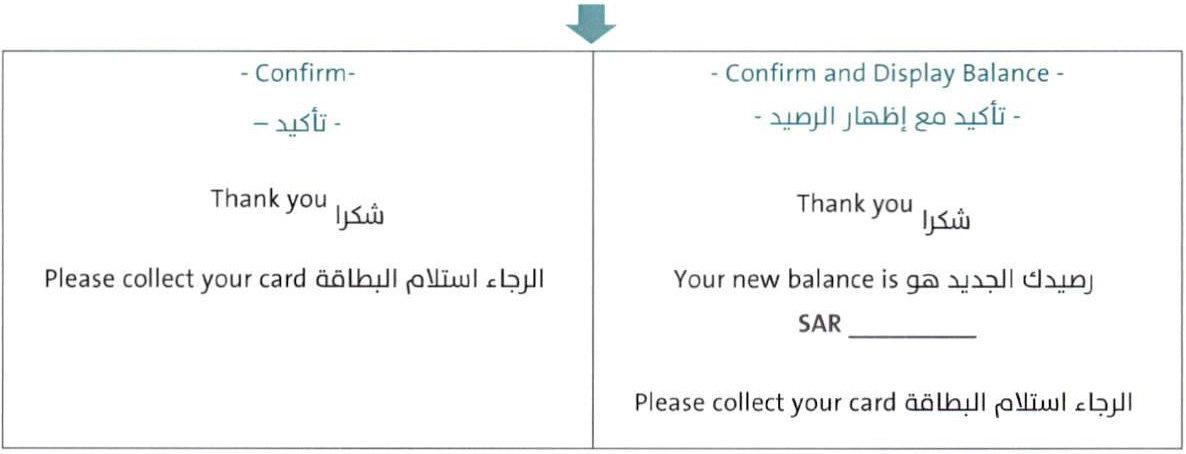

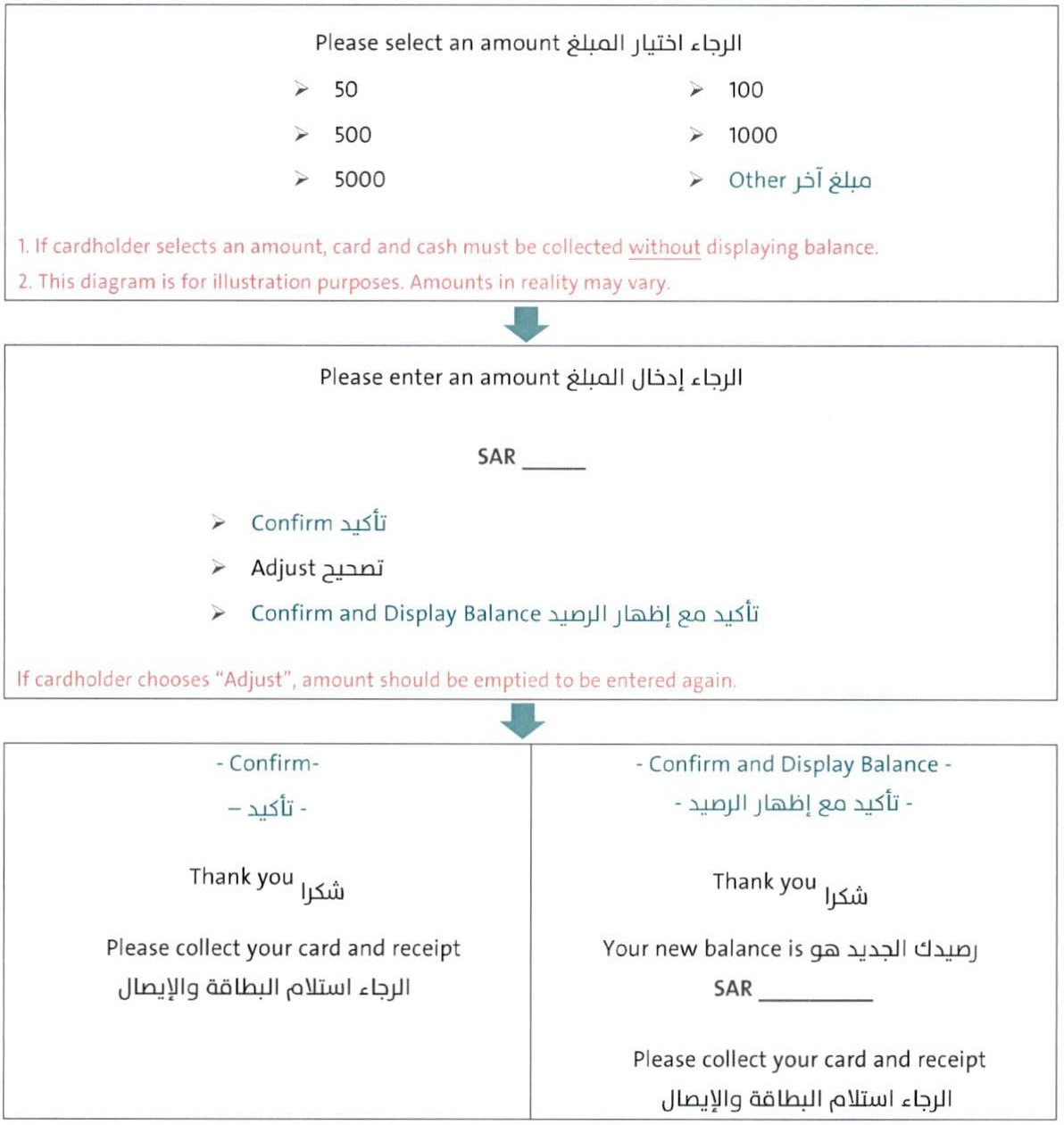

More importantly, after choosing either of the two transactions, if Cardholder selects one of the listed amounts on the screen, card and cash should be collected immediately and without displaying the account balance. However, in case Cardholder chooses "Another amount” and manually enters the amount, an option to "Confirm and Display Balance” will be given to the Cardholder in addition to the default option(s). The new workflow for Cash withdrawal transactions will be as follows:

A detailed workflow for the Cash Withdrawal transactions stream can be found in the Appendix.

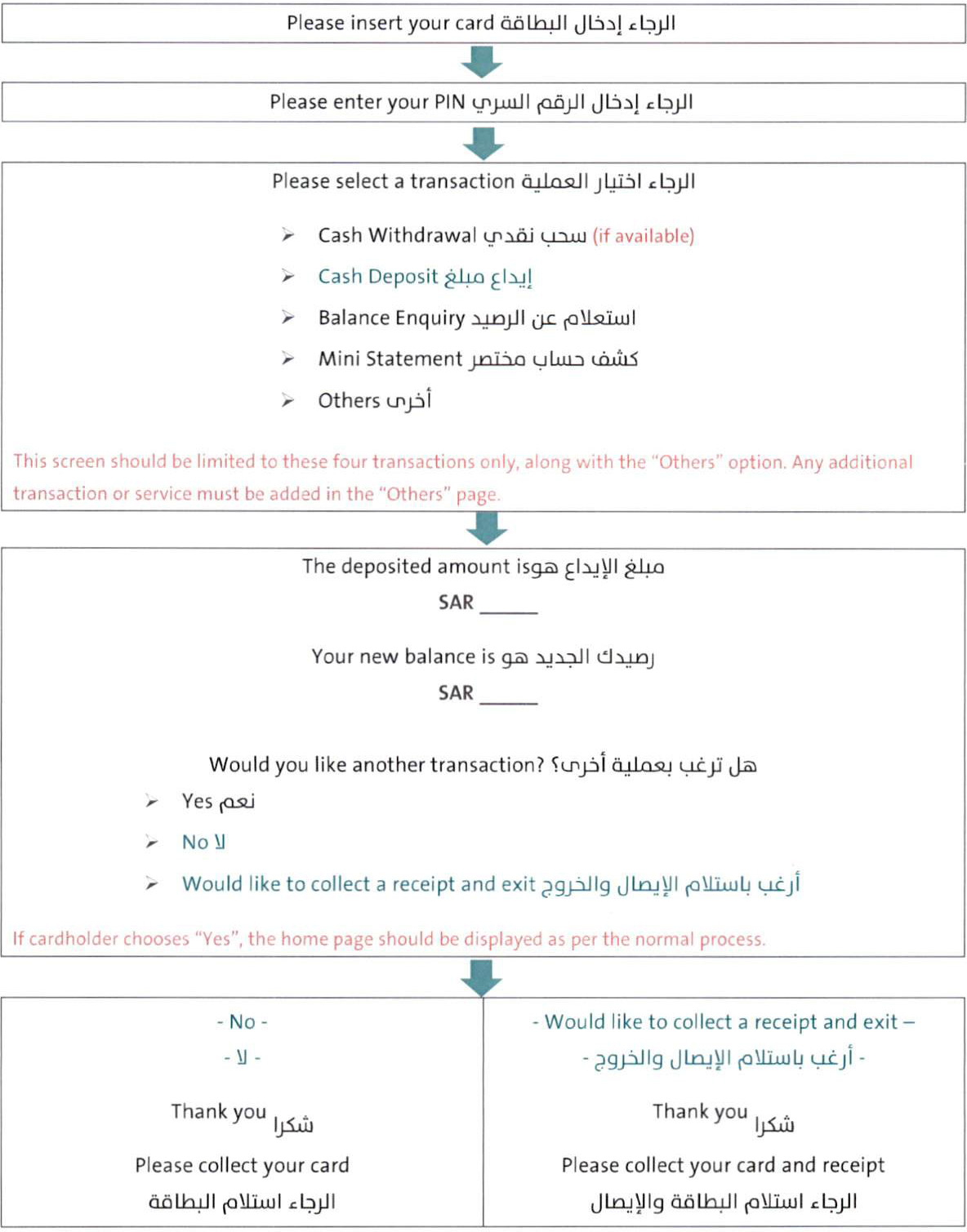

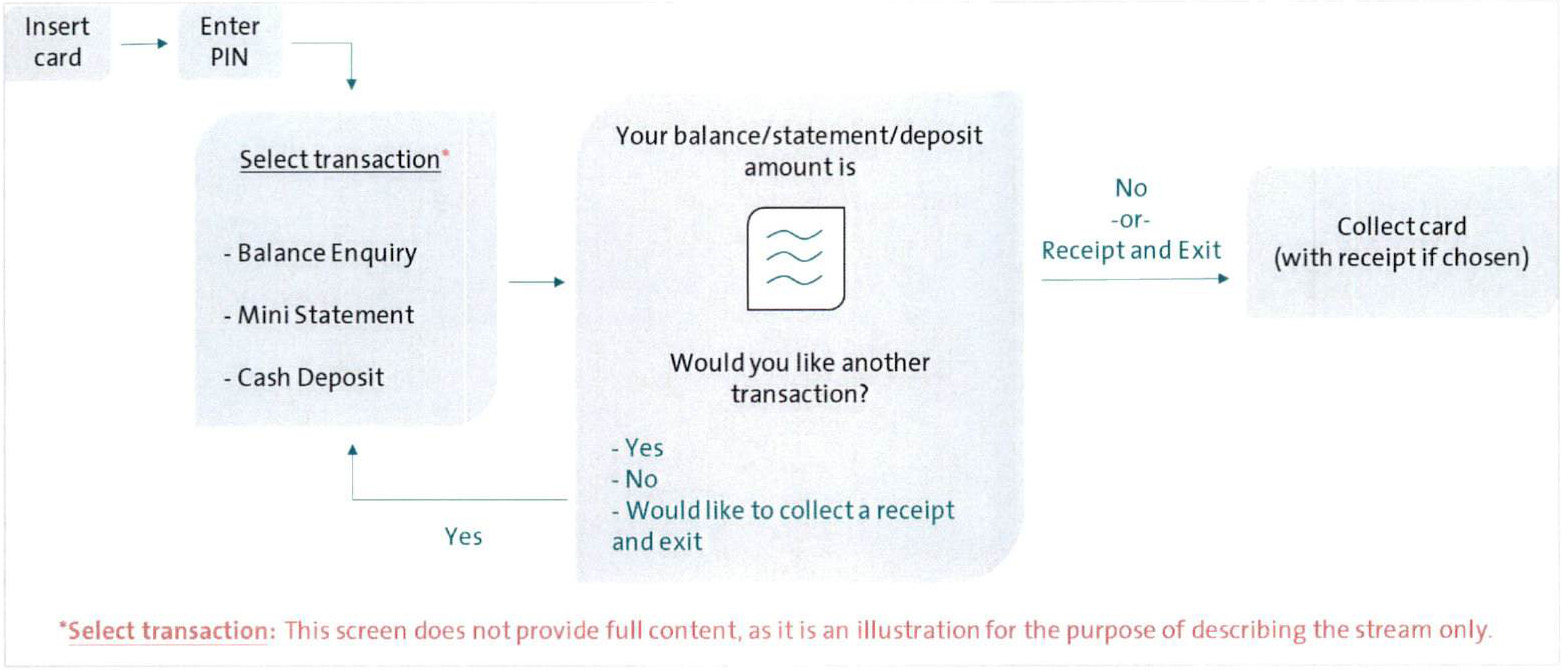

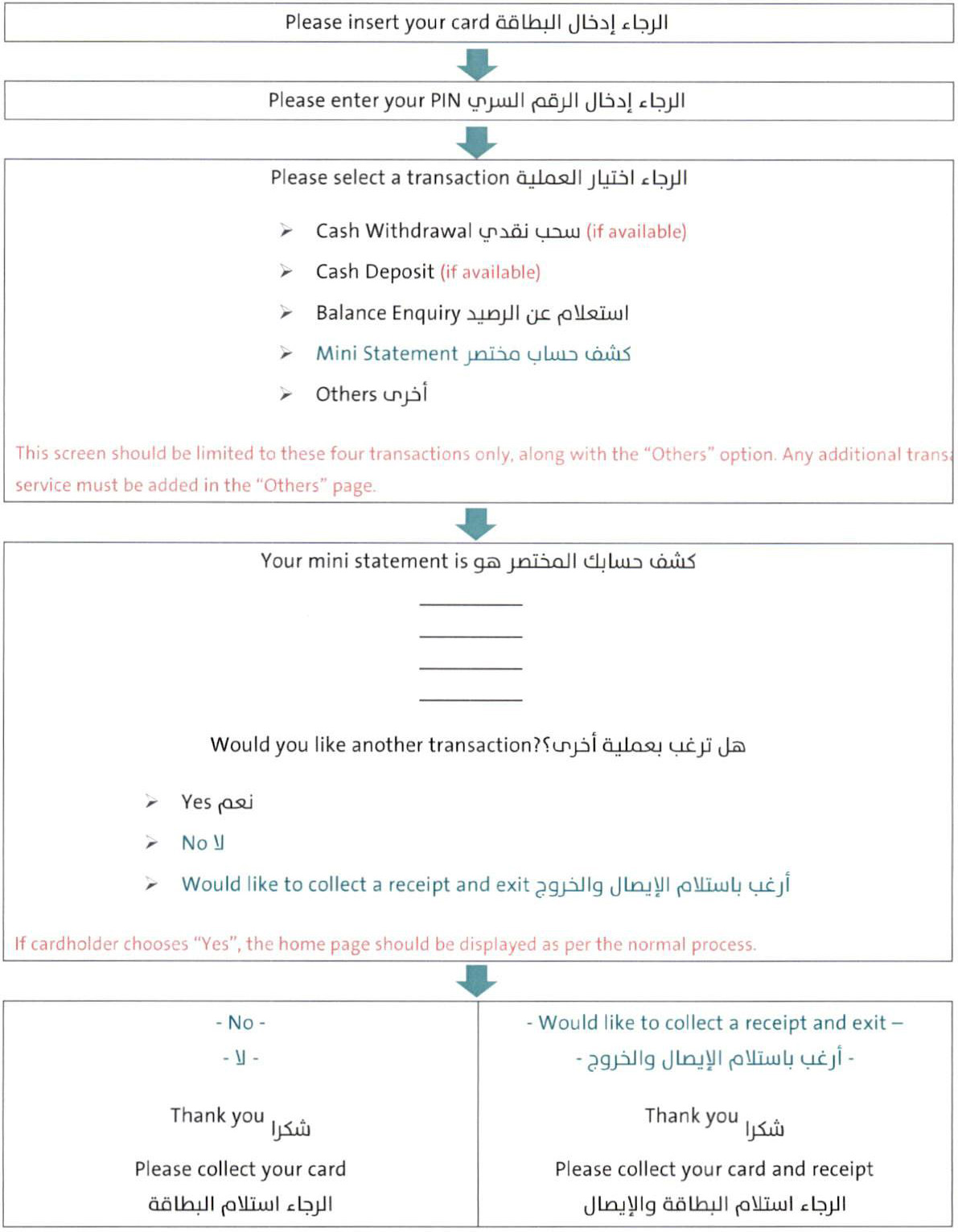

3.2 Non-Cash Transactions Stream

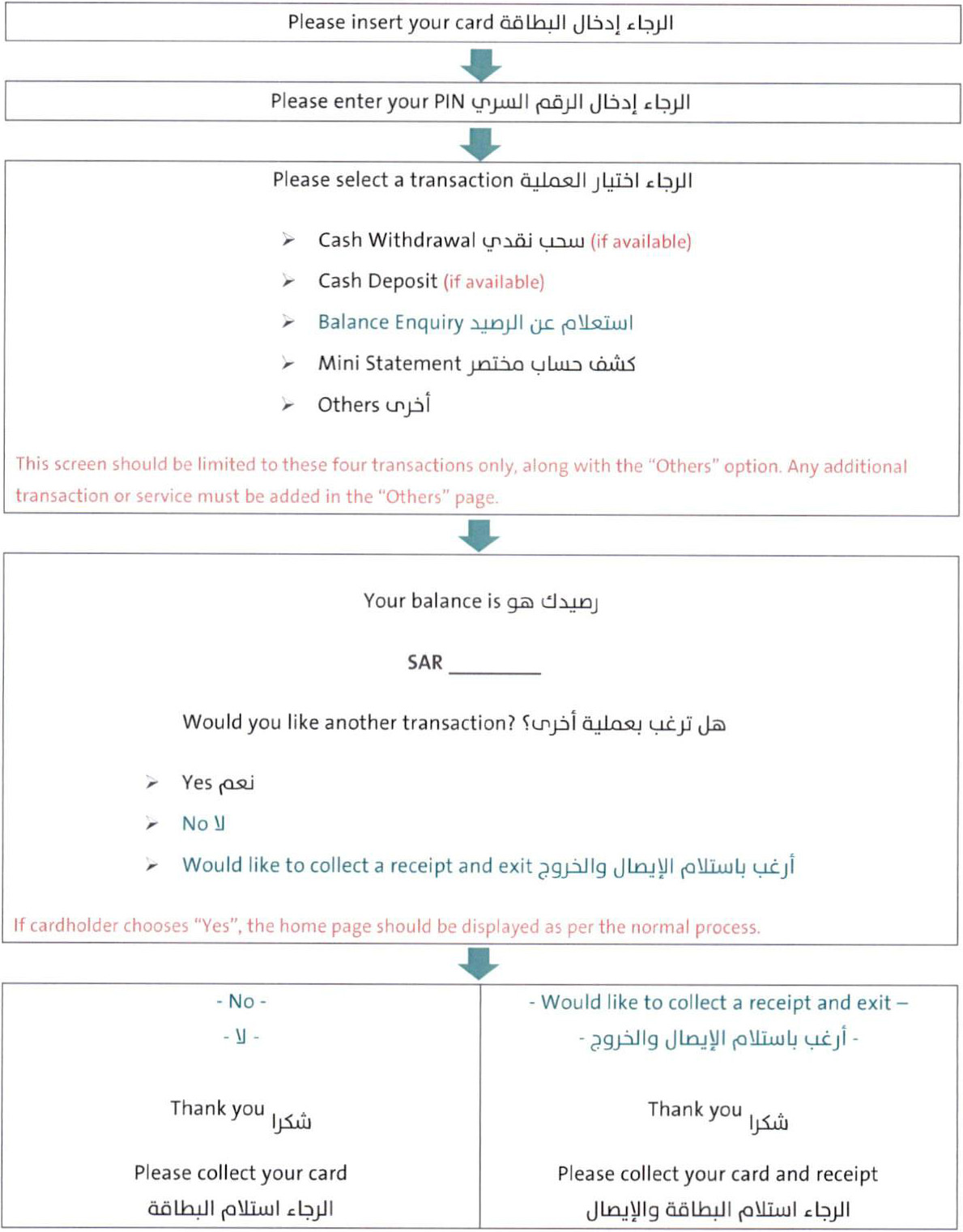

As mentioned earlier, non-cash transactions include Balance Enquiry, Mini Statement, and Cash Deposit. There will be two changes (or additions) to enhance the screen flow and reduce receipt demand for this stream:

First, upon choosing Balance Enquiry or Mini Statement, the account balance or mini statement, respectively, will be shown on the screen. And upon choosing Cash Deposit, the deposited amount as well as the new balance will be shown on the screen.

Second, at the end of either of the three transactions, a receipt will not be automatically printed. However, an option to "collect a receipt and exit’’ will be given to the Cardholder in addition to the default option(s) - if chosen, the process should be ended and the card should be collected along with the receipt. The new workflow for the non-cash transactions will be as follows:

A detailed workflow for the non-cash transactions stream can be found in the Appendix.

4. Appendix

4.1 Workflows for Cash Withdrawal Transactions Stream

4.1.1 Workflow for Cash Withdrawal (without Receipt)

4.1.2 Workflow for Cash Withdrawal with Receipt

4.2 Workflows for Non-Cash Transactions Stream

4.2.1 Workflow for Balance Enquiry

4.2.2 Workflow for Mini Statement

4.2.3 Workflow for Cash Deposit