Chapter Twelve Consumer Protection

Article 64

Finance agreements must be drawn up on paper or electronically between the Consumer Microfinance Company and the borrower and each contracting party must receive a copy of the finance agreement. The finance agreement must include at least the following data and information:

1. names of parties to the contract, ID/Iqama/commercial register number of the borrower (as the case may be), official addresses, and contact information such as mobile phone number and email address (if any);

2. type of finance;

3. term of finance contract;

4. finance amount;

5. conditions to drawdown the amount of finance if available;

6. term cost and its application conditions;

7. annual percentage rate (APR);

8. total amount payable by the borrower, calculated at the time of signing the finance contract, with the assumptions used in calculation provided;

9. the amount, number and duration of installments to be paid by the borrower and the method of distributing that amount over the remaining amounts;

10. fees, commissions, and administrative service costs;

11. terms of payment of fees or funds required without paying the finance amount as well as the conditions for such payment;

12. the consequences of delayed payment of installments;

13. required documentation fees, where applicable;

14. guarantee and insurance (if any);

15. the account number for depositing finance installments and the bank name;

16. procedures for exercising the right to withdraw (if any) and the conditions and financial obligations relating to such right;

17. procedures for early repayment and for compensation of the Consumer Microfinance Company (when necessary) and how to determine such compensation;

18. procedures for dealing with guarantees if their value is reduced (if any);

19. procedures for exercising the right to terminate the finance contract;

20. the borrower's permission to include his/her information in the credit record; and

21. any other information specified by SAMA.

Article 65

The finance agreement shall bear on its forefront a summary containing the basic information of the finance product and the main provisions of the finance agreement in a clear language for the borrower, in accordance with the model determined by SAMA and documenting the receipt of this summary by the borrower in the finance file.

Article 66

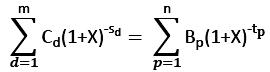

1. The Annual Percentage Rate is the discount rate at which the present value of all instalments and other payments that are due on the borrower, representing the total amount payable by the borrower, equals the present value of the payments of the amount of finance available to the borrower, calculated on the date on which the amount of finance or the date the first payment is available to the borrower, calculated by the following equation:

Where:

m is the last payment of the amount of finance to be received by the borrower;

d is the payment to be received by the borrower from the amount of finance;

Cd is the payment value of (d) to be received by the borrower from the amount of finance;

Sd the period between the date on which the amount of finance or the first payment is available to the borrower and the date of payment (d), calculated in years and parts of the year, and so that this period of first payment received by the borrower from the amount of finance is zero (s1=0);

n is the last payment payable by the borrower;

p is the payment payable by the borrower;

Bp is the payment value (p) payable by the borrower;

tp is the period between the date on which the amount of finance or the first payment is available to the Borrower and the date of the payment (p) to be received from the Borrower, calculated in years and parts of the year.; and

X is the Annual Percentage Rate (APR).

2. For the purpose of calculating the APR, the periods between the date on which the finance amount or the first finance payment is made available to the borrower and the date of every payment received or payable by the borrower shall be calculated on the basis of (12) months or (365) days a year.

3. For the purpose of calculating the APR, the total amount payable by the borrower must be specified including fees, commissions and costs that cannot be avoided by the borrower, excluding costs or fees payable by the borrower due to his/her violation of any obligations contained in the finance contract.

4. It is a must to calculate the Annual Percentage Rate, assuming validity of finance agreement for the agreed period of time and both parties commitment to their obligations according to the conditions contained in the finance agreement.

Article 67

The Consumer Microfinance Company must use the declining balance method in distributing the term cost on the maturity period, whereas the term cost is distributed proportionally between installments on the basis of the balance value of the remaining amount of finance at the beginning of the installment maturity period, and including it in the finance agreement.

Article 68

Fees, commissions and administrative service charges to be received by the Consumer Microfinance Company from the borrower shall not exceed the amount equivalent to (1%) of the finance amount.

Article 69

A borrower may accelerate the payment of the remaining finance amount at any time without bearing the term cost of the remaining period. A Consumer Microfinance Company may be compensated for the following:

a. The cost of re-investment, but not exceeding the term cost for the following three months of payments, calculated on the basis of the declining balance; and

b. Payments from the Consumer Microfinance Company to a third party due to the finance agreement of expenses stipulated therein, if they are irrecoverable expenses, for the remaining term of the finance agreement.

Article 70

1. The Consumer Microfinance Company shall indicate in all product advertisements: its name, logo, any identifying representation and contact details.

2. The advertisement shall disclose, in a manner that is clear to the consumer, the name and Annual Percentage Rate of the advertised product and shall not include other rates of the term cost.

3. A Consumer Microfinance Company is not allowed to publish an advertisement that includes a false offer, statement, or a claim expressed in terms that would directly or indirectly deceive or mislead a consumer.

4. SAMA may require any Consumer Microfinance Company that does not comply with the conditions of this Article to withdraw the advertisement within one business day of SAMA’s notice.

Article 71

The Consumer Microfinance Company shall establish a function for handling complaints, assign staff to such function, set clear procedures for receiving, documenting, reviewing, and responding to borrowers’ complaints within the period specified by SAMA, and keep such complaints in relevant records. All necessary details of borrowers’ complaints and related actions taken shall be included in the complaint records.

Article 72

1. The Consumer Microfinance Company and its employees shall maintain the confidentiality of clients’ data and transactions and shall not disclose them to other parties, except in accordance with the relevant laws and instructions.

2. Employees of the Consumer Microfinance Company shall not disclose any information about the company’s clients and transactions obtained through their work, even after leaving the company, and shall not retain any of this information after resigning.

3. The Consumer Microfinance Company shall take all necessary measures to ensure confidentiality of clients’ information and transactions.