The total capital requirements for counterparty credit risk under the Standardized Approach is also an aggregate of the 1) Default risk under SAMA Basel III calculated using the Current Exposure Method and the Incremental Risk under Basel III called the Credit Value Adjustment.

|

For further clarifications, please refer to SAMA Circular # BCS 24331 dated 4 September 2012 entitled "Basel III Definition of Capital FAQs (p.7).

|

Consequently, Bank using the Standardized Approach will calculate the Default Risk using the CEM as prescribed also under Basel II, and the CVA under the Standardized Approach as given below under Basel III.

|

Standardized CVA risk capital charge

|

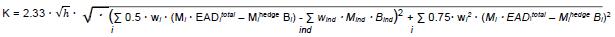

| 104. | When a bank does not have the required approvals to use paragraph 98 to calculate a CVA capital charge for its counterparties, the bank must calculate a portfolio capital charge using the following formula:

|

|

Where:

|

| | • | h is the one-year risk horizon (in units of a year), h = 1.

|

| | • | wi is the weight applicable to counterparty ‘i’. Counterparty ‘i’ must be mapped to one of the seven weights wi based on its external rating, as shown in the table of this paragraph below. When a counterparty does not have an external rating, the bank must, subject to supervisory approval, map the internal rating of the counterparty to one of the external ratings.

|

| | • | EADtotali EAD is the exposure at default of counterparty ‘i’ (summed across its netting sets), including the effect of collateral as per the existing IMM, SM or CEM rules as applicable to the calculation of counterparty risk capital charges for such counterparty by the bank. For non-IMM banks the exposure should be discounted by applying the factor (1-exp(-0.05*Mi))/(0.05*Mi). For IMM banks, no such discount should be applied as the discount factor is already included in Mi.

|

| | • | Bi is the notional of purchased single name CDS hedges (summed if more than one position) referencing counterparty ‘i’, and used to hedge CVA risk. This notional amount should be discounted by applying the factor (1-exp(-0.05*Mihedge))/(0.05* Mihedge).

|

| | • | Bind is the full notional of one or more index CDS of purchased protection, used to hedge CVA risk. This notional amount should be discounted by applying the factor (1-exp(-0.05*Mind))/(0.05* Mind).

|

| | • | wind is the weight applicable to index hedges. The bank must map indices to one of the seven weights wi based on the average spread of index ‘ind’.

|

| | • | Mi is the effective maturity of the transactions with counterparty ‘i’. For IMM banks, Mi is to be calculated as per Annex 4,1 paragraph 38 of the Basel Accord. For non-IMM banks, Mi is the notional weighted average maturity as referred to in the third bullet point of para 320. However, for this purpose, Mi should not be capped at 5 years.

|

| | • | Mihedge is the maturity of the hedge instrument with notional Bi (the quantities Mihedge Bi are to be summed if these are several positions).

|

| | • | Mind is the maturity of the index hedge ‘ind’. In case of more than one index hedge position, it is the notional weighted average maturity.

|

For any counterparty that is also a constituent of an index on which a CDS is used for hedging counterparty credit risk, the notional amount attributable to that single name (as per its reference entity weight) may, with supervisory approval, be subtracted from the index CDS notional amount and treated as a single name hedge (Bi) of the individual counterparty with maturity based on the maturity of the index.

|

The weights are given in this table, and are based on the external rating of the counterparty:2

|

| Rating | Weight Wi | | AAA | 0.7% | | AA | 0.7% | | A | 0.8% | | BBB | 1.0% | | BB | 2.0% | | B | 3.0% | | CCC | 10.0% |

|