6.1.A Internal Model Method (IMM)

| الرقم: 341000015689 | التاريخ (م): 2012/12/19 | التاريخ (هـ): 1434/2/6 | الحالة: In-Force |

Default Risk Exposures Calculation

Internal Model (EPE)

| 25(i). | To determine the default risk capital charge for counterparty credit risk as defined in paragraph 105, banks must use the greater of the portfolio-level capital charge (not including the CVA charge in paragraphs 97-104) based on Effective EPE using current market data and the portfolio-level capital charge based on Effective EPE using a stress calibration. The stress calibration should be a single consistent stress calibration for the whole portfolio of counterparties. The greater of Effective EPE using current market data and the stress calibration should not be applied on a counterparty by counterparty basis, but on a total portfolio level. |

| 61. | When the Effective EPE model is calibrated using historic market data, the bank must employ current market data to compute current exposures and at least three years of historical data must be used to estimate parameters of the model. Alternatively, market implied data may be used to estimate parameters of the model. In all cases, the data must be updated quarterly or more frequently if market conditions warrant. To calculate the Effective EPE using a stress calibration, the bank must also calibrate Effective EPE using three years of data that include a period of stress to the credit default spreads of a bank’s counterparties or calibrate Effective EPE using market implied data from a suitable period of stress. The following process will be used to assess the adequacy of the stress calibration: |

| • | The bank must demonstrate, at least quarterly, that the stress period coincides with a period of increased CDS or other credit spreads – such as loan or corporate bond spreads – for a representative selection of the bank’s counterparties with traded credit spreads. In situations where the bank does not have adequate credit spread data for a counterparty, the bank should map each counterparty to specific credit spread data based on region, internal rating and business types. |

| • | The exposure model for all counterparties must use data, either historic or implied, that include the data from the stressed credit period, and must use such data in a manner consistent with the method used for the calibration of the Effective EPE model to current data. |

| • | To evaluate the effectiveness of its stress calibration for Effective EPE, the bank must create several benchmark portfolios that are vulnerable to the same main risk factors to which the bank is exposed. The exposure to these benchmark portfolios shall be calculated using (a) current positions at current market prices, stressed volatilities, stressed correlations and other relevant stressed exposure model inputs from the 3-year stress period and (b) current positions at end of stress period market prices, stressed volatilities, stressed correlations and other relevant stressed exposure model inputs from the 3-year stress period. Supervisors may adjust the stress calibration if the exposures of these benchmark portfolios deviate substantially. |

Calculation of Credit Value Adjustment (CVA)

The Concept

Credit Value Adjustments (CVA) under Basel III is an incremental credit risk capital charge prior to default. Under Basel II and Basel II.5 counterparty credit risk methodology only calculated capital requirements for default risk. However, Basel III brings in the capital charge with regard to the deterioration of a counterparty risk prior to default. Consequently, the CVA is in addition or as an incremental risk to default risk. SAMA's methodology uses the Current Exposure Method (CEM) for Default Risk which is one of the four methods prescribed under Basel II Annex # 41. Consequently, capital requirements for counterparty risk is the aggregate of CEM and CVA calculations.

Specific Aspects of CVA under IMM Approach

Capitalization of the risk of CVA losses

| 99. | To implement the bond equivalent approach, the following new section VIII will be added to Annex 4 of the Basel II framework.1 The new paragraphs (97 to 105) are to be inserted after paragraph 96 in Annex 4.1 | ||

VIII. Treatment of mark-to-market counterparty risk losses (CVA capital charge)

- CVA Risk Capital Charge

| 97. | In addition to the default risk capital requirements for counterparty credit risk determined based on the standardized or internal ratings- based (IRB) approaches for credit risk, a bank must add a capital charge to cover the risk of mark-to-market losses on the expected counterparty risk (such losses being known as credit value adjustments, CVA) to OTC derivatives. The CVA capital charge will be calculated in the manner set forth below depending on the bank’s approved method of calculating capital charges for counterparty credit risk and specific interest rate risk. A bank is not required to include in this capital charge (i) transactions with a central counterparty (CCP); and (ii) securities financing transactions (SFT), unless their supervisor determines that the bank’s CVA loss exposures arising from SFT transactions are material. | |

| A. | Banks with IMM approval and Specific Interest Rate Risk VaR model2 approval for bonds: Advanced CVA risk capital charge | |

| 98. | Banks with IMM approval for counterparty credit risk and approval to use the market risk internal models approach for the specific interest-rate risk of bonds must calculate this additional capital charge by modeling the impact of changes in the counterparties’ credit spreads on the CVAs of all OTC derivative counterparties, together with eligible CVA hedges according to new paragraphs 102 and 103, using the bank’s VaR model for bonds. This VaR model is restricted to changes in the counterparties’ credit spreads and does not model the sensitivity of CVA to changes in other market factors, such as changes in the value of the reference asset, commodity, currency or interest rate of a derivative. Regardless of the accounting valuation method a bank uses for determining CVA, the CVA capital charge calculation must be based on the following formula for the CVA of each counterparty: | |

| Where: | ||

| • | ti is the time of the i-th revaluation time bucket, starting from t0=0. | |

| • | tT is the longest contractual maturity across the netting sets with the counterparty. | |

| • | si is the credit spread of the counterparty at tenor ti, used to calculate the CVA of the counterparty. Whenever the CDS spread of the counterparty is available, this must be used. Whenever such a CDS spread is not available, the bank must use a proxy spread that is appropriate based on the rating, industry and region of the counterparty. | |

| • | LGDMKT is the loss given default of the counterparty and should be based on the spread of a market instrument of the counterparty (or where a counterparty instrument is not available, based on the proxy spread that is appropriate based on the rating, industry and region of the counterparty). It should be noted that this LGDMKT, which inputs into the calculation of the CVA risk capital charge, is different from the LGD that is determined for the IRB and CCR default risk charge, as this LGDMKT is a market assessment rather than an internal estimate. | |

| • | The first factor within the sum represents an approximation of the market implied marginal probability of a default occurring between times ti-1 and ti. Market implied default probability (also known as risk neutral probability) represents the market price of buying protection against a default and is in general different from the real-world likelihood of a default. | |

| • | EEi is the expected exposure to the counterparty at revaluation time ti, as defined in paragraph 30 (regulatory expected exposure), where exposures of different netting sets for such counterparty are added, and where the longest maturity of each netting set is given by the longest contractual maturity inside the netting set. For banks using the short cut method (paragraph 41 of Annex 4)1 for margined trades, the paragraph 99 should be applied. | |

| • | Di is the default risk-free discount factor at time ti, where D0 = 1. | |

| 99. | The formula in paragraph 98 must be the basis for all inputs into the bank’s approved VaR model for bonds when calculating the CVA risk capital charge for a counterparty. For example, if this approved VaR model is based on full repricing, then the formula must be used directly. If the bank’s approved VaR model is based on credit spread sensitivities for specific tenors, the bank must base each credit spread sensitivity on the following formula:3 | |

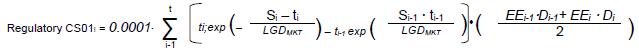

| If the bank’s approved VaR model uses credit spread sensitivities to parallel shifts in credit spreads (Regulatory CS01), then the bank must use the following formula:4 | ||

| ||

| If the bank’s approved VaR model uses second-order sensitivities to shifts in credit spreads (spread gamma), the gammas must be calculated based on the formula in paragraph 98. | ||

| Banks using the short cut method for collateralized OTC derivatives (paragraph 41 in Appendix 4), must compute the CVA risk capital charge according to paragraph 98, by assuming a constant EE (expected exposure) profile, where EE is set equal to the effective expected positive exposure of the shortcut method for a maturity equal to the maximum of (i) half of the longest maturity occurring in the netting set and (ii) the notional weighted average maturity of all transactions inside the netting set. | ||

| Banks with IMM approval for the majority of their businesses, but which use CEM (Current Exposure Method) or SM (Standardized Method) for certain smaller portfolios, and which have approval to use the market risk internal models approach for the specific interest rate risk of bonds, will include these non-IMM netting sets into the CVA risk capital charge, according to paragraph 98, unless the national supervisor decides that paragraph 104 should apply for these portfolios. Non-IMM netting sets are included into the advanced CVA risk capital charge by assuming a constant EE profile, where EE is set equal to the EAD as computed under CEM or SM for a maturity equal to the maximum of (i) half of the longest maturity occurring in the netting set and (ii) the notional weighted average maturity of all transactions inside the netting set. The same approach applies where the IMM model does not produce an expected exposure profile. | ||

| For exposures to certain counterparties, the bank's approved market risk VaR model may not reflect the risk of credit spread changes appropriately, because the bank's market risk VaR model does not appropriately reflect the specific risk of debt instruments issued by the counterparty. For such exposures, the bank is not allowed to use the advanced CVA risk charge. Instead, for these exposures the bank must determine the CVA risk charge by application of the standardized method in paragraph 104. Only exposures to counterparties for which the bank has supervisory approval for modeling the specific risk of debt instruments are to be included into the advanced CVA risk charge. | ||

| 100. | The CVA risk capital charge consists of both general and specific credit spread risks, including Stressed VaR but excluding IRC (incremental risk charge). The VaR figure should be determined in accordance with the quantitative standards described in paragraph 718(Lxxvi). It is thus determined as the sum of (i) the non-stressed VaR component and (ii) the stressed VaR component. | |

| i. | When calculating the non-stressed VaR, current parameter calibrations for expected exposure must be used. | |

| ii. | When calculating the stressed VaR future counterparty EE profiles (according to the stressed exposure parameter calibrations as defined in paragraph 61 of Annex 4)1 must be used. The period of stress for the credit spread parameters should be the most severe one-year stress period contained within the three year stress period used for the exposure parameters.5 | |

| 101. | This additional CVA risk capital charge is the standalone market risk charge, calculated on the set of CVAs (as specified in paragraph 98) for all OTC derivatives counterparties, collateralized and uncollateralized, together with eligible CVA hedges. Within this standalone CVA risk capital charge, no offset against other instruments on the bank’s balance sheet will be permitted (except as otherwise expressly provided herein). | |

| 102. | Only hedges used for the purpose of mitigating CVA risk, and managed as such, are eligible to be included in the VaR model used to calculate the above CVA capital charge or in the standardized CVA risk capital charge set forth in paragraph 104. For example, if a credit default swap (CDS) referencing an issuer is in the bank’s inventory and that issuer also happens to be an OTC counterparty but the CDS is not managed as a hedge of CVA, then such a CDS is not eligible to offset the CVA within the standalone VaR calculation of the CVA risk capital charge. | |

| 103. | The only eligible hedges that can be included in the calculation of the CVA risk capital charge under paragraphs 98 or 104 are single-name CDSs, single-name contingent CDSs, other equivalent hedging instruments referencing the counterparty directly, and index CDSs. In case of index CDSs, the following restrictions apply: | |

| • | The basis between any individual counterparty spread and the spreads of index CDS hedges must be reflected in the VaR. This requirement also applies to cases where a proxy is used for the spread of a counterparty, since idiosyncratic basis still needs to be reflected in such situations. For all counterparties with no available spread, the bank must use reasonable basis time series out of a representative bucket of similar names for which a spread is available. | |

| • | If the basis is not reflected to the satisfaction of the supervisor, then the bank must reflect only 50% of the notional amount of index hedges in the VaR. Other types of counterparty risk hedges must not be reflected within the calculation of the CVA capital charge, and these other hedges must be treated as any other instrument in the bank’s inventory for regulatory capital purposes. Tranched or nthto-default CDSs are not eligible CVA hedges. Eligible hedges that are included in the CVA capital charge must be removed from the bank’s market risk capital charge calculation. | |

1 Annex 5 of this document.

2 “VaR model” refers to the internal model approach to market risk.

3 This derivation assumes positive marginal default probabilities before and after time bucket ti and is valid for i<T. For the final time bucket i=T, the corresponding formula is:![]()

4 This derivation assumes positive marginal default probabilities.

5 Note that the three-times multiplier inherent in the calculation of a bond VaR and a stressed VaR will apply to these calculations.