19. Securitization: Standardized Approach

No: 44047144 Date(g): 27/12/2022 | Date(h): 4/6/1444 Status: In-Force Standardized Approach (SEC-SA)

19.1 To calculate capital requirements for a securitization exposure to a standardized approach (SA) pool using the securitization standardized approach (SEC-SA), a bank would use a supervisory formula and the following bank-supplied inputs: the SA capital charge had the underlying exposures not been securitized (KSA); the ratio of delinquent underlying exposures to total underlying exposures in the securitization pool (W); the tranche attachment point (A); and the tranche detachment point (D). The inputs A and D are defined in paragraphs 22.14 and 22.15 respectively. Where the only difference between exposures to a transaction is related to maturity, A and D will be the same. KSA and W are defined in 19.2 to 19.4 and 19.6.

19.2 KSA is defined as the weighted-average capital charge of the entire portfolio of underlying exposures, calculated using the risk-weighted asset amounts in chapter 7 in relation to the sum of the exposure amounts of underlying exposures, multiplied by 8%. This calculation should reflect the effects of any credit risk mitigant that is applied to the underlying exposures (either individually or to the entire pool), and hence benefits all of the securitization exposures. KSA is expressed as a decimal between zero and one (that is, a weighted-average risk weight of 100% means that KSA would equal 0.08).

19.3 For structures involving a special purpose entity (SPE), all of the SPE’s exposures related to the securitization are to be treated as exposures in the pool. Exposures related to the securitization that should be treated as exposures in the pool include assets in which the SPE may have invested, comprising reserve accounts, cash collateral accounts and claims against counterparties resulting from interest swaps or currency swaps.105 Notwithstanding, the bank can exclude the SPE’s exposures from the pool for capital calculation purposes if the bank can demonstrate to SAMA that the risk does not affect its particular securitization exposure or that the risk is immaterial - for example, because it has been mitigated.106

19.4 In the case of funded synthetic securitizations, any proceeds of the issuances of credit-linked notes or other funded obligations of the SPE that serve as collateral for the repayment of the securitization exposure in question, and for which the bank cannot demonstrate to SAMA that they are immaterial, have to be included in the calculation of KSA if the default risk of the collateral is subject to the tranched loss allocation.107

19.5 In cases where a bank has set aside a specific provision or has a non- refundable purchase price discount on an exposure in the pool, KSA must be calculated using the gross amount of the exposure without the specific provision and/or non- refundable purchase price discount.

19.6 The variable W equals the ratio of the sum of the nominal amount of delinquent underlying exposures (as defined in paragraph 20.7 below) to the nominal amount of underlying exposures.

19.7 Delinquent underlying exposures are underlying exposures that are 90 days or more past due, subject to bankruptcy or insolvency proceedings, in the process of foreclosure, held as real estate owned, or in default, where default is defined within the securitization deal documents.

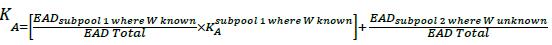

19.8 The inputs KSA and W are used as inputs to calculate KA, as follows:

KA = (1 - W) x KSA + 0.5W

19.9 In case a bank does not know the delinquency status, as defined above, for no more than 5% of underlying exposures in the pool, the bank may still use the SEC-SA by adjusting its calculation of KA as follows:

19.10 If the bank does not know the delinquency status for more than 5%, the securitization exposure must be risk weighted at 1250%.

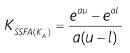

19.11 Capital requirements are calculated under the SEC-SA as follows, where KSSFA(KA) is the capital requirement per unit of the securitization exposure and the variables a, u, and l are defined as:

(1) a = - (1/(p * KA))

(2) u = D- KA

(3) l = max (4 - KA; 0)

19.12 The supervisory parameter p in the context of the SEC-SA is set equal to 1 for a securitization exposure that is not a resecuritization exposure.

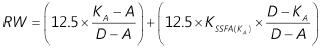

19.13 The risk weight assigned to a securitization exposure when applying the SEC-SA would be calculated as follows:

(1) When D for a securitization exposure is less than or equal to KA, the exposure must be assigned a risk weight of 1250%.

(2) When A for a securitization exposure is greater than or equal to KA, the risk weight of the exposure, expressed as a percentage, would equal KSSFA(KA) times 12.5

(3) When A is less than KA and D is greater than KA, the applicable risk weight is a weighted average of 1250% and 12.5 times KSSFA(KA) according to the following formula:

19.14 The risk weight for market risk hedges such as currency or interest rate swaps will be inferred from a securitization exposure that is pari passu to the swaps or, if such an exposure does not exist, from the next subordinated tranche.

19.15 The resulting risk weight is subject to a floor risk weight of 15%. Moreover, when a bank applies the SEC-SA to an unrated junior exposure in a transaction where the more senior tranches (exposures) are rated and therefore no rating can be inferred for the junior exposure, the resulting risk weight under SEC-SA for the junior unrated exposure shall not be lower than the risk weight for the next more senior rated exposure.

105 In particular, in the case of swaps other than credit derivatives, the numerator of KSA must include the positive current market value times the risk weight of the swap provider times 8%. In contrast, the denominator should not take into account such a swap, as such a swap would not provide a credit enhancement to any tranche.

106 Certain best market practices can eliminate or at least significantly reduce the potential risk from a default of a swap provider. Examples of such features could be cash collateralization of the market value in combination with an agreement of prompt additional payments in case of an increase of the market value of the swap and minimum credit quality of the swap provider with the obligation to post collateral or present an alternative swap provider without any costs for the SPE in the event of a credit deterioration on the part of the original swap provider. If SAMA are satisfied with these risk mitigants and accept that the contribution of these exposures to the risk of the holder of a securitization exposure is insignificant, SAMA may allow the bank to exclude these exposures from the KSA calculation.

107 As in the case of swaps other than credit derivatives, the numerator of KSA (i.e. weighted-average capital charge of the entire portfolio of underlying exposures) must include the exposure amount of the collateral times its risk weight times 8%, but the denominator should be calculated without recognition of the collateral.Resecuritisation Exposures

19.16 For resecuritization exposures, banks must apply the SEC-SA specified in 19.1 to 19.15, with the following adjustments:

(1) The capital requirement of the underlying securitization exposures is calculated using the securitization framework;

(2) Delinquencies (W) are set to zero for any exposure to a securitization tranche in the underlying pool; and

(3) The supervisory parameter p is set equal to 1.5, rather than 1 as for securitization exposures.

19.17 If the underlying portfolio of a resecuritization consists in a pool of exposures to securitization tranches and to other assets, one should separate the exposures to securitization tranches from exposures to assets that are not securitizations. The KA parameter should be calculated for each subset individually, applying separate W parameters; these calculated in accordance with 19.6 and 19.7 in the subsets where the exposures are to assets that are not securitization tranches, and set to zero where the exposures are to securitization tranches. The KA for the resecuritization exposure is then obtained as the nominal exposure weighted- average of the KA’s for each subset considered.

19.18 The resulting risk weight is subject to a floor risk weight of 100%.

19.19 The caps described in 18.50 to 18.55 cannot be applied to resecuritization exposures.

Alternative Capital Treatment for Term STC Securitizations and Short- Term STC Securitizations Meeting the STC Criteria for Capital Purposes

19.20 Securitization transactions that are assessed as simple, transparent and comparable (STC)-compliant for capital purposes as defined in 18.67 can be subject to capital requirements under the securitization framework, taking into account that, when the SEC-SA is used, 19.21 and 19.22 are applicable instead of 19.12 and 19.15 respectively.

19.21 The supervisory parameter p in the context of the SEC-SA is set equal to 0.5 for an exposure to an STC securitization.

19.22 The resulting risk weight is subject to a floor risk weight of 10% for senior tranches, and 15% for non-senior tranches.